Document structure

The simplified taxation system (STS) exempts an organization from paying a number of taxes. Article 346.20 of the Tax Code of the Russian Federation provides for two options for using the simplified tax system :

- 6% – tax is calculated on the taxpayer’s total income;

- 15% – the tax base consists of income reduced by the amount of the organization’s costs.

Regardless of the chosen option of the simplified tax system (“income” or “income minus expenses”), the calculation and payment of advance payments occurs in accordance with the procedure approved in Article 346.21 of the Tax Code of the Russian Federation. At the end of the calendar year, the HOA is required to submit a declaration to the tax office , the structure of which is divided into five sections :

- title page;

- section 1.1. – to display advance payments at a rate of 6%;

- section 1.2. – to display advance payments at a rate of 15%;

- section 2.1. – to calculate the tax amount in the “income” option;

- section 2.2. – to calculate the amount of tax in the “income minus expenses” option;

- Section 3 – report on the intended use of funds.

In this case, it is not necessary to fill out all five sections: the taxpayer enters information only on the pages directly related to him.

Step-by-step instructions for filling out a declaration under the simplified tax system for 2019 (object “Income minus expenses”)

As an example, let’s look at the reporting of an LLC. The tax period is 2021, so these reports must be submitted by March 31, 2020 (March 31 in 2020 fell on a Tuesday, therefore, there are no postponements).

Step 1. Title page

The TIN and KPP are taken from the registration certificate and are written on all pages of the document (see sample certificate). In electronic form, it is enough to indicate them only once, the rest will be filled in automatically. The tax authority code is also included in the registration certificate. The remaining codes shown in the figure are the same for all LLCs. The reporting year refers to the tax period, i.e. 2021 in our case.

The name of the taxpayer is taken from the same certificate or from the charter.

IMPORTANT!

It is necessary to write both the full and short name and name in a foreign language, if they are recorded in the constituent documents.

The OKVED code is set for the main type of activity either from the charter or from statistics codes issued by Rosstat. It is customary to write the phone number in 11 digits (with an eight). If it is easier to reach you on your mobile phone, then indicate it.

Let's fill out a sample declaration.

The accuracy of the specified information has the right to certify:

- LLC director (code 1);

- in-house or outsourced accountant (code 2).

In any case, for the organization, fill in the fields Full Name, Signature and Date. If the code is 1, then dashes are placed in the lower field “Name of document”, otherwise a power of attorney is indicated.

Step 2. Section 2.1

Let us remind you that for each object of taxation, a special subsection is provided in the declaration under the simplified tax system. If the object of taxation is “Income minus expenses”, first fill out section 2.2.

In lines 210–213, on a quarterly accrual basis, we enter the income received, from which the tax base is formed. And in 220–223 there will be amounts of expenses (cumulative total) corresponding to the list from Article 346.16 of the Tax Code of the Russian Federation. As in previous cases, each line corresponds to a tax period (1st quarter, half year, 9 months, year). If a loss was incurred in the previous reporting period, it is reflected in line 230. It will reduce the tax base.

Lines 240–243 indicate the tax base for calculating the advance payment:

- Page 240 = page 210 - page 220 if > 0.

- Page 241 = page 211 - page 221 if > 0.

- Page 242 = page 212 - page 222 if > 0.

- Page 243 = page 213 - page 223 - page 230 if > 0.

If the amount of loss on line 230 is equal to the taxable base, 243 will have a value of 0.

Losses for the reporting year are reflected in lines 250–253 if the indicators in lines 210–213 are less than 220–223.

The next two blocks on the tax base and losses of the reporting year are mutually exclusive: if line 240 contains a numerical value (profit), then line 250 contains dashes (loss), and vice versa. Similarly for pairs of lines 241 and 251, 242 and 252, 243 and 253.

The values are determined by simply subtracting expenses from income for the corresponding period (the first two blocks).

Lines 260–263 indicate the tax rate of 15% or another provided for by the legislation of the constituent entity of the Russian Federation where the taxpayer’s activities are registered. Tax rates may vary depending on the region and type of activity of the organization and change throughout the year. But usually the same value is specified four times. The amounts of calculated tax are not the payments that the company actually paid to the budget. In our example, the organization paid the minimum tax twice. Lines 270–273 record the mathematical values: tax base multiplied by the rate and divided by 100.

Tax advances are calculated and reflected as follows:

- Page 270 = page 240 × page 260 / 100.

- Page 271 = page 241 × page 261 / 100.

- Page 272 = page 242 × page 262 / 100.

- Page 273 = page 243 × page 263 / 100.

Pay attention to line 280 - the minimum tax on the simplified tax system (income for the year on line 213, multiplied by 1%). Line 280 indicates the minimum tax to be paid. It is defined as pp. 213 × 1/100.

Step 3. Section 3

The third section of the tax return is intended to be filled out only by those organizations that received funds in accordance with paragraphs 1 and 2 of Art. 251 Tax Code of the Russian Federation. We are talking about targeted funding, targeted revenues and income received as part of charitable activities. Previously, companies using the simplified tax system, if they had such amounts, had to fill out sheet 7 of the income tax return. Therefore, the procedure for filling out the new section is similar to the previous requirements. This is a specific section, so it is not common among simplifiers.

The codes for column 1 “Receipt type code” are given in Appendix No. 5 to the procedure for filling out the declaration.

Start filling out section 3 by transferring funds that were not used on time (or without a period of use), but received in the previous year. For amounts for which a period of use has been established, indicate the date of their receipt in column 2, and in column 3 - their amount. If the period of funds received in the previous reporting period has not expired, then their amount is entered in column 6.

Only after this do they fill in the data on funds received in the reporting period:

- In columns 2 and 5, for funds with a specified period, the dates of receipt and use are indicated.

- Column 3 - the amount of funds received with a specified period.

- Column 6 shows the amount of unused funds that have not yet expired.

- Column 4 - funds that were fully used for their intended purpose within the prescribed period.

- In column 7 - funds used for other purposes (they are included in non-operating income at the time of actual use).

The line “Total for the report” indicates the total amounts for the corresponding columns 3, 4, 6, 7 of section 3.

Step 4. Section 1.2

- In line 010, enter the OKTMO code (check the code on the Federal Tax Service website).

- Enter the amounts of quarterly advance payments in lines 020, 040, 070.

- In line 100 - the amount of additional payment for the year.

If there were amounts to be reduced during the year, fill in 050 instead of 040, and 080 instead of 070.

Lines 110 and 120 are for special cases. If the tax for the year is less than the advance payments, fill in 110. If you need to pay extra, the minimum tax amount is 120.

Step 5. Registration and certification of the declaration

Signatures and dates are placed on the title page and in section 1.2 (below).

The presence of TIN and KPP on each page is checked. The page numbers are specified: 001 - title page, 002 - section 1.2, 003 - section 2.2.

The number of pages is indicated on the title page. There are no official instructions on how to do this, the main thing is that all familiar places are occupied. Please note that when signing a declaration under the simplified tax system by a representative, and not by the director of the company, there is at least one attachment - a power of attorney for the representative.

And lastly: only completed sections need to be sent to the tax office. And those organizations that, in accordance with the charter, operate without a seal, may not certify the report with a round seal.

We described in detail how to correctly fill out a declaration under the simplified tax system for 2021 income minus expenses. Let's move on to another example, in which the object of taxation is “Income”.

Categories of reported income

Reporting under the simplified tax system involves reflecting all income from the activities of the HOA that is subject to taxation. The Partnership as a non-profit organization receives the following types of income :

- contributions;

- rent and utility bills;

- income from economic activities;

- subsidies from the budget;

- other income.

The legislation allows not all types of income to be reflected when calculating the tax base. Thus, contributions from partnership participants for repairs and maintenance of property are considered as received as a result of the statutory activities of the HOA and are not subject to taxation. Whereas contributions from other persons are subject to accounting in the income side of the organization’s activities with subsequent payment of taxes.

ATTENTION! If the charter of the HOA does not stipulate its obligation to supply heat, electricity, etc., then funds received from residents for utilities are included in the tax base.

If agency agreements have been concluded with residents, then only the amounts of agency fees are reflected in the income portion.

Read more about the organization’s income and how it is reflected in accounting in this material.

Basic rules for entering data

There are two options for filling out the reporting document: by hand and on the computer . In the first case, use a pen with black ink and write in capital letters. When printing a computer version, double-sided printing is not allowed: the back side of each page of the form must be left blank.

If no information is indicated in the column, then a dash is placed in it. Financial calculations are rounded to the nearest ruble. The sheets are numbered consecutively.

The reporting document can be filled out online on specialized resources that will help you make the correct calculation and check for errors before sending or printing the document.

Basic requirements for filling out the report

Order of the Federal Tax Service No. ММВ-7-3/ [email protected] dated February 26, 2016 approved the rules for filling out the declaration under the simplified tax system for 2021. Amounts in this report are entered in whole rubles. Pennies are rounded up. If the document is filled out by hand, you must use blue, purple or black ink. No corrections are allowed! Each page of the report is printed on a separate sheet (two-sided printing is prohibited). Typically, when filling out a tax return, taxpayers do not pay attention to the fact that the numbers in the fields are aligned, but this is very important. If the form is filled out by hand, the numbers are entered from the first - left - field; when filling out electronically, the numbers are aligned to the right. If there are free cells left, put a dash. All text values are written in capital block letters.

The rules for filling out reports are the same for all types of property: both for legal entities and individual entrepreneurs.

To make filling out a declaration under the simplified tax system for 2021, income minus expenses, as clear as possible, we have compiled step-by-step instructions and ready-made samples. In the “Income minus expenses” examples, we used the reporting of an LLC, and for the “Income” object we will use the data of an individual entrepreneur.

Necessary preliminary calculations

Before filling out the declaration, it is necessary to sum up the income received for the past calendar year (if necessary, subtract expenses if the simplified tax system “income minus expenses” option with a rate of 15% is selected) and the advance payments made.

If the calculated tax amount exceeds the advance payments already made, the difference must be transferred by the 25th of the billing month. Otherwise, a penalty will be charged based on the results of the declaration verification.

The Tax Code (Articles 346.15 and 251) and federal legislation (Federal Law No. 185-FZ dated July 21, 2007) allow the following types of income to be ignored:

- fellowship contributions;

- donations;

- funds for major repairs from the budget;

- funds for current and major repairs from the participants of the partnership.

Check out other useful materials on our website about HOA funds and accounting reports. Read about what income and expenses are in an organization and how they are reflected in documents, as well as how the balance sheet of an HOA is compiled and submitted to the simplified tax system.

Deadlines for submitting the declaration

The dates depend on the type of taxpayer. Deadlines for reporting:

- March 31 – for legal entities;

- April 30 - for individual entrepreneurs.

If an organization or individual entrepreneur stops using the simplified tax system, then they submit a report without waiting for the end of the tax period - until the 25th day of the month following the month of deregistration as a payer of the simplified tax system. And if the right to simplified activities is lost due to violations of the requirements of Art. 346.13 of the Tax Code of the Russian Federation, then the simplified taxation system declaration is submitted before the 25th day after the end of the quarter in which business activity ceased to comply with the conditions of the Tax Code of the Russian Federation. Individual entrepreneurs have the opportunity to fill out a simplified taxation system declaration online in the taxpayer’s personal account on the Federal Tax Service website.

What to include on the title page?

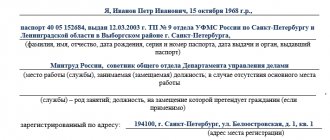

Filling out the document begins with a title page reflecting information about the declarant:

- name of the organization - it should be written as specified in the organization’s charter, for example, Homeowners Association “Capital”;

- organizational and legal form - homeowners association (OKOPF code 94);

- TIN;

- checkpoint;

- adjustment number - in the general case, 0 is indicated, but if an updated declaration is submitted (after detection of arrears, for example), then 1 will be entered;

- tax period - when submitting the annual form, indicate code 34;

- reporting year – for example, 2017;

- tax service code - can be found on the tax office website or directly at the territorial office;

- code of the type of economic activity - according to OKVED, but if there are several of them, then the declarant has the right to indicate any of them;

- reorganization form - in the standard situation remains empty, with the exception of situations when the declaration is submitted due to the reorganization of the enterprise;

- contact details - phone number.

In separate columns the number of completed pages and copies of documents in the application are indicated. Mandatory attributes are the date and signature of the declarant; for the representative, it is necessary to indicate the details of the power of attorney.

IMPORTANT! The lower right part is filled out by the inspector of the fiscal authority accepting the declaration.

Completing section 3 is a report on targeted revenues with codes for subsidies and contributions

This section displays target revenues and their expenditure in the past calendar year (contributions from members of the partnership, subsidies for major repairs):

- in column 1 indicate codes 112 for subsidies and 120 for contributions for property maintenance;

- column 2/5 is not filled out in accordance with the letter of the Federal Tax Service of Russia dated January 20, 2015 No. GD-4-3/2700;

- in column 3/6 indicate the annual amount of target receipts and their balance in the current account of the partnership;

- Column 4/7 reflects the annual amount of expenses of these funds and the unused balance, which must be included in non-operating income when calculating the tax base.

For example, this section might look like this:

| 1 | 2/5 | 3/6 | 4/7 |

| 112 | —————————— | 500000 | 500000 |

| —————————— | —————————— | —————————— |

Submission order

There are two reporting options , the choice of which depends on the preference and desire of the declarant:

- on paper during a personal visit to the tax office;

- in electronic format with a qualified digital signature.

The obligation to provide electronic reporting arises only for organizations with more than 100 employees or equated to the category of large taxpayers.

Thus, in the tax return under the simplified tax system for HOAs, only those pages and columns that directly relate to the activities of the organization and the option chosen by it must be filled out. The 2021 form can always be found on the official website of the Federal Tax Service . You can evaluate the correctness of filling out and calculations on specialized portals online.

What is 3-NDFL?

Declaration 3-NDFL is a tax return for personal income taxes. It is issued in different situations:

- to calculate the level of income subject to taxation;

- as a document confirming the creditworthiness of an individual.

3-NDFL is extremely rarely required by the bank if a consumer loan, mortgage loan or credit card is issued. An online loan application is usually accompanied by identification documents and a certificate in the form of a bank or 2-NDFL. It’s another matter if the loan is issued by an individual entrepreneur, a lawyer who conducts private practice, a notary, etc.

Unlike the 2-NDFL certificate, the 3-NDFL declaration is not limited to one or several pages. This is a multi-page document that contains a large amount of data. According to the requirements, this is at least 23 pages.

Who is obliged to fill out the 3-NDFL declaration?

This requirement applies to the following persons:

- Individual entrepreneurs.

- Notaries and lawyers, as well as other persons engaged in private practice.

- Individuals who receive income from another state one-time or on an ongoing basis.

- Individuals who received income from the sale of real estate or cars, as well as from the sale of property rights.

- Individuals who received a gift of real estate, a vehicle, shares (s), share(s), shares from other individuals.

Does not apply to cases where the property was donated from close relatives: parents or children, grandparents, grandchildren, brothers and sisters (including half-siblings).

- Individuals who receive income from renting out real estate, as well as under property rental agreements.

- Individuals who received income from winning the lottery and other gambling games (including through bookmakers and sweepstakes).

Deadline for submitting 3-NDFL

These individuals need to fill out 3-NDFL and submit a correctly completed declaration by April 30 of the year following the year in which the income was received .

Where should the 3-NDFL declaration be submitted?

To submit a tax return you must:

- Personally contact the tax office at your place of registration.

- Send the declaration by registered mail with a list of attachments (to the address of the tax office at your place of registration).

- Submit a declaration electronically (using a special computer program “Declaration”, through State Services, etc.).

One of the easiest and fastest ways is to submit 3-NDFL through State Services.