Source/official document: Resolution of the Board of the Pension Fund of the Russian Federation dated 02/01/2016 No. 83p Where to submit: Pension Fund Frequency of submission: monthly Must be submitted by: the fifteenth day of each month Penalty for late submission: in the amount of 500 rubles for each employee.

Document name: New form SZV-M Format: xls Size: 24 kb

Print Preview Bookmark

Save to yourself:

Pass SZV-M online and correctly

Almost a year ago, on April 1, 2021, a law was issued that obliges all entrepreneurs to submit reports on all employees with pension insurance. This law was created specifically for pensioners; it allows for control of pension payments to pensioners working in various organizations.

This law is federal from December 29, 2015 No. 385-FZ, which stands for information about insured persons who are submitted to the pension fund.

New form SZV-M from 2021: approved or not

In 2021, policyholders (organizations and individual entrepreneurs) will need to submit a report in the SZV-M form to the territorial divisions of the Pension Fund. The deadlines for submitting SZV-M reports have changed. See “SZV-M in 2017: new deadlines for submitting initial, corrective and updated reports.”

The SZV-M report form is individual (personalized) accounting information. In 2021, the Pension Fund retained the right to approve the new form and format of SZV-M reports. This is stated in paragraph 2 of Article 8 of the Federal Law of April 1, 1996 No. 27-FZ “On individual (personalized) accounting in the compulsory pension insurance system.”

Thus, the Pension Fund of Russia could take advantage of this right and approve the new SZV-M form, used from 2021. Now let’s look at the official website of the Pension Fund of Russia in the section “Draft regulatory legal acts of the Pension Fund of Russia”. In this section, the Pension Fund publishes documents that need to be approved. However, this section does not contain any information that the new SZV-M report form is planned for use from 2021. Accordingly, we can say that there will be no new form of SZV-M from 2021. There were no plans to approve the new form.

Insured persons, information on which should be reflected in the SZV-M

Insured persons are considered to be individuals who are subject to the legislation of the Russian Federation on compulsory pension insurance. These are the following categories of Russian citizens:

- individuals working under employment contracts;

- individuals who have entered into civil agreements for the performance of work or provision of services (civil agreements);

- individuals who have entered into copyright contracts;

- authors of works receiving income in the form of remuneration under agreements on the alienation of the exclusive right to works of literature and art, licensing agreements on granting the right to use works of science, literature, art.

Not only Russian citizens are considered insured, but also foreigners or stateless persons permanently or temporarily residing and temporarily staying in the Russian Federation. Such persons are required to obtain an insurance certificate (SNILS) from the Pension Fund of Russia.

New report from 2021: is it necessary?

It is worth noting that all insurance premiums (except for contributions for injuries) from 2021 will come under the control of the Federal Tax Service. However, the Pension Fund of Russia will continue to fully control individual personalized accounting and accept appropriate reporting. See “Control bodies for the payment of insurance premiums from 2021”.

At the same time, there have been no changes in the legislation on personalized accounting since 2017 that would require approval of the new SZV-M form from 2021. In 2021, as before, the report must show (clause 2.2 of Article 11 of Federal Law No. 27-FZ dated 04/01/1996):

- SNILS;

- FULL NAME.;

- TIN (if the policyholder has data on the TIN of the insured person).

The current form SZV-M “Information about insured persons”, approved by Resolution of the Pension Fund of the Russian Federation Board dated 02/01/2016 No. 83p, allows you to reflect the specified information in it. Accordingly, there was no need to approve the new SZV-M form from 2021.

Zero form: does the Pension Fund’s position change?

Do I need to submit a zero SZV-M report for July 2021? Interesting question!

| Position 1 | Position 2 |

| There cannot be a zero SZV-M in principle. If not a single person is included in the July form, then submitting such an empty SZV-M loses all meaning. No one needs blank forms because they do not contain the necessary information. | The PFR branch in the Altai Territory on August 1, 2017 said this: even when there are no employees, the policyholder still submits the SZV-M. But without a list of insured persons. |

Where to download the new SZV-M form

Starting from 2021, those who submit monthly Pension Fund reports in electronic form will not need to download the new SZV-M form. After all, personalized reporting forms are already included in the accounting programs that are used to fill out reporting.

If the organization reports “on paper,” then you can download the form for filling out the SZV-M in 2021 on our website in a convenient Excel format. See “Form “information about insured persons” (SZV-M)”. However, it is worth saying that for many accountants this form should have been preserved since 2016.

Note that in 2021, if SZV-M includes 25 or more “physicists” in a month, then the policyholder (organization or individual entrepreneur) is obliged to submit reports via the Internet as an electronic document signed with an enhanced qualified electronic signature. If there are less than 25 people in the report, then the submission of a “paper” report is allowed (paragraph 3, paragraph 2, article 8 of the Federal Law of April 1, 1996 No. 27-FZ).

How to fill out the SZV-M report

The SZV-M form includes four sections. Each of them contains instructions for filling out. The form is given below:

Form SZV-M

Let's take a closer look at how each of these sections is filled out:

At the beginning of the form you must indicate two codes: OKUD and OKPO.

- Details of the insurer. This section provides information about the employer who uses hired labor, namely:

- The number that was assigned to the employer upon registration in the Pension Fund;

- Abbreviated company name;

- TIN and checkpoint of the company (for businessmen only TIN).

- Reporting period – refers to the period for which reporting is generated. It is indicated by a digital code. January – 01, February – 02 and so on.

- Form type – this section implies indication of the type of report to be submitted. There are three such types:

- Outcome – is entered if reporting for the reporting month is submitted for the first time;

- Additional – indicated if the submitted report is an addition to a previously submitted report;

- Cancel – indicated if it is necessary to cancel information submitted earlier. A list of insured workers who were included in the original report in error is provided along with the reversal report.

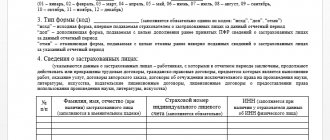

- Information about insured employees. Here is a list of persons with whom employment contracts were concluded, continued to operate or were terminated in the month of the report. This section is presented in table form. It includes the following items:

- Serial number of the line;

- Last name, first name and patronymic (the latter - if available) in full, in the nominative case;

- SNILS of the employee;

- TIN (if available).

At the end, you must indicate the position of the head of the company and his full name. Also, he must put his personal signature. It is necessary to indicate the date of formation of the document, as well as affix the company stamp of the company.

Sample SZV—

M is given below:

Sample filling SZV-M

New format SZV-M from 2021

The SZV-M report format is needed for the purpose of submitting reports to the territorial bodies of the Pension Fund of Russia in electronic form. It was approved by order No. 432r dated August 31, 2016. See “The Pension Fund of Russia approved the new format of the SZV-M report.”

At the same time, given that the new form of the SZV-M report for 2021 was not approved, the Pension Fund did not need to develop and approve a new report format. That is, in 2021 the previous format will apply.

Frequency and deadline

In fact, you can create a report quite quickly, since the form is quite small. The report must be submitted monthly by the fifteenth day of each month . Accordingly, the law came into effect on April 1, 2021, and the first report had to be submitted by May 10 of this year.

If the report is not submitted by the appointed deadline, then an administrative fine of 500 rubles per employee . Thus, if the company has a large staff, for example, 100 employees, then the fine will be 50 thousand rubles, a rather large amount.

Who to include

It is important to understand that as part of the SZV-M form for July 2021, inspectors from the Pension Fund of the Russian Federation should see information about all individuals who performed work on the basis of employment agreements from July 1 to July 31. And it doesn't matter:

- whether the company (IP) actually carried out activities in July;

- were there any accruals and payments to the “physicists” in July?

If individuals perform work (provide services) under civil law contracts, then do not get confused. In 2021, a clarification was issued (PFR letter No. LCH-08-19/10581 dated July 27, 2016) that data on such employees must be included while simultaneously meeting the following conditions:

- The performers were paid remuneration;

- Contributions are calculated on the amount of the reward.

However, as of mid-2021, the PFR authorities believe this: if in July 2021 you did not pay remuneration under a civil law contract and, accordingly, did not accrue contributions for it, then in the SZV-M form for July 2021, all such freelancers should also be turned on.

To understand whether or not to include a specific insured person in the SZV-M, you must proceed from the following:

- What type of contract has been concluded?

- Was the agreement valid in the reporting month (if at least 1 day, then it must be included in the SZV-M).

- It does not matter in the reporting period - July 2021 - the presence of facts of accrual and payment of salary (remuneration) under this agreement, as well as the accrual of contributions.

Common mistakes when filling out a form

| Type of error | It should be | Correction procedure |

| There is no information about the insured person. | It should be! The form must reflect all employees with whom an employment contract and a GPC agreement were concluded, even for 1 day. Information is also submitted if there have been no accruals and payments to the employee at the Pension Fund. | A supplementary calculation is submitted, which indicates those employees who were not reflected in the outgoing form. |

| There is an extra worker on uniform. | The presence of extra employees is equivalent to false information. The form cannot contain information if the employee received payments for the reporting period (for example, compensation) if they were fired in previous periods. | A cancellation form is provided, listing only the excess employees. |

| The employee's TIN was entered incorrectly. | Although the absence of the TIN itself will not be an error, nevertheless, if it is indicated, it must be correct. | At the same time, the following are provided: a canceling report for an employee with an incorrect TIN and, along with it, a supplementary report in which information on him is corrected. |

| Forgot to include employees. | Information must be provided for all employees, both those hired at the end of the month and those dismissed at the beginning. | A supplementary form is provided to include the missing employees. |

| Invalid SNILS specified. | Please check the information you are sending before sending, otherwise you may receive a fine. | If the report is not accepted, it must be corrected and submitted again as an outgoing report. If only correct information is accepted, corrections are provided to employees with errors in a supplementary form. |

| The reporting period is incorrect. | Make sure you fill it out correctly before submitting your reports. | You must resubmit the form with the status outgoing, indicating the correct reporting period. |

Clarifying the form: how to do it

You need to clarify the SZV-M form for July 2021 if there are errors in the primary report (with the “original” type, code “ISHD”). For example, an incorrect SNILS or TIN is indicated. But the catch is that the law does not clearly state by what date policyholders can file amendment reports.

Also see “Varieties of the SZV-M form.”

Thus, some territorial divisions of the Pension Fund of the Russian Federation believe that policyholders must submit information supplementing or canceling SZV-M no later than the main deadline. If later, there will be a fine: 500 rubles for each “physicist”.

The Pension Fund of the Russian Federation will not impose a fine if updated or corrected individual information is submitted within 5 working days from the date of receipt from the fund of a notice to eliminate discrepancies (clause 39 of Order of the Ministry of Labor of Russia dated December 21, 2016 No. 766n).

It turns out that before the deadline for submitting the SZV-M for June 2017 (i.e., before 08/15/2017 inclusive), it is advisable to have time to submit not only the original form, but also a corrective version of the July information. If, of course, it is required. The main thing is to identify the error before the Pension Fund does it.

For more information about clarifying reports, see “How to clarify the SZV-M report in 2021.”

Read also

04.05.2017

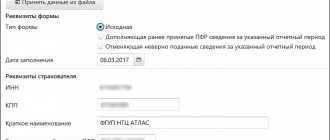

Section 3. Form type (code)

In this section, you should note one of three codes that indicate the type of form being presented:

- “iskhd” - initial;

- “additional” - complementary;

- “cancel” - canceling.

The original form is the form that the policyholder submits for the first time during the reporting period. For example, if he submits the initial report for April 2021, then in section 3 he needs to enter the code “source”:

As can be seen from the explanations given in the SZV-M form, the code “additional” should be entered if the policyholder decided to supplement the information that was previously accepted by the Pension Fund of the Russian Federation. For example, if for some reason the employer did not indicate in the initial report information about an employee who was registered during the reporting period, then it is necessary to supplement the already submitted reports with information about this employee. To do this, you need to fill out the form with the code “additional”. As for the “cancel” code, it is entered into the SZV-M form, which is submitted to cancel previously submitted information. For example, a cancellation form must be submitted if the policyholder in the original form indicated an employee who was fired before the start of the reporting period.

Please note that the procedure for filling out forms with the codes “add” and “cancel” is not specified anywhere. In this regard, accountants may have questions about how exactly they should prepare supplementary and canceling SZV-M reports. Let's give a few examples.

- The policyholder submitted form SZV-M, in which he entered information about employees dismissed before the start of the reporting period. Do I need to cancel the entire original report (provide the same information as in the original report, but indicate the form code “cancel”) or is it sufficient to list only those individuals who were “superfluous” in the original form in the cancellation form?

- The insured decided to supplement the original report with information about employees that were not included in the original report. In this case, should only new people be listed on the form with the code “additional”, or should all insured persons be listed (including those indicated on the original form)?

- The insured intends to clarify the TIN of one of the employees, since there was an error in the original report. Do I need to first cancel previously submitted information (submit the form with the code “cancel”), and then submit a supplementary form? Or is it enough to submit only the form with the code “additional”?

Elena Kulakova, an expert at the “Kontur.Otchet PF” service (she writes on the Online Accounting forum under the nickname KEGa) confirms that there are no clear answers to these questions. In her opinion, the following should be done:

- in the supplementary form it is necessary to list only those individuals in respect of whom errors were made in the original form, as well as those insured persons whose information was not included in the original form;

- in the cancellation form, you should indicate only those individuals whose information needs to be completely removed from the initial data uploaded to the Pension Fund database.

SZV-M if there are no employees

If an individual entrepreneur does not have hired employees and is not registered as an employer, then he does not need to submit this report. All other categories of business entities are required to submit this form, and it must contain at least one line. The concept of zero reporting SZV-M does not exist!

Even if the company does not operate and submits blank reports, including RSV-1, the form in question must contain one line for the director himself, who is usually also the only founder. It makes no difference whether any accruals were made on it in a given period or not. If the report is not submitted within the established time frame, the company will be subject to an appropriate minimum fine.

Also, it does not appear to be peasant farms, where, in addition to the head, members of his family work.

Who is serving?

All individual entrepreneurs who have at least one employee under an employment or civil contract.

Organizations (LLC) must always submit such a report, and it cannot be zero. SZV-M must have at least one person - a director.

If the organization has not concluded an employment contract with anyone and no one is paid remuneration, then SZV-M still needs to be submitted (Letter of the Ministry of Labor No. 17-4/10/в-1846 dated 03/16/2018)! Although before March 16, 2018, there was no such tough position.

A separate division submits form SZV-M if it has a separate balance sheet and current account. It enters the TIN of the parent organization into the form, but its own checkpoint.

Monthly reporting to the Pension Fund from 2021 to 2017

Since 2016 and in 2021, all individual entrepreneurs who are employers and organizations submit a new report to the Pension Fund of Russia every month - SZV-M.

New monthly reporting to the Pension Fund was introduced in order to track working pensioners and not index their pensions.

Reporting form to the Pension Fund SZV-M

You can read in detail about the SZV-M form in Resolution of the Pension Fund of the Russian Federation dated 01.02.2016 No. 83p “On approval of the form “Information about insured persons”.

Deadline for submitting SZV-M to the Pension Fund of Russia

In 2021, the new form must be submitted monthly, in the month following the reporting month, by the 15th. In 2021, SZV-M was surrendered by the 10th of every month. As a standard, if the deadline for submission falls on a weekend or non-working day, then it can be submitted on the next next working day.

Contents of the SZV-M form

What is in the SZV-M form:

- details of the policyholder;

- type of form (cancelling, initial, supplementary);

- reporting period (for which month);

- Full name, SNILS and TIN of employees.

As a result, the head of the company (or entrepreneur) must sign this document and put a stamp (if any), after which the document is handed over.

Form SZV-M

- Download form SZV-M in *.doc

- Download form SZV-M in *.pdf

Kontur.Accounting expert Natalya Potapkina.

Send electronic reports to the Pension Fund of the Russian Federation from Kontur.Accounting, a convenient online service for calculating salaries and sending reports. The service is suitable for comfortable collaboration between an accountant and a director.

Try free for 5 days

Webinar on the topic: Monthly reporting to the Pension Fund of Russia

You can download the presentation or on the webinar topic on the page: https://www.b-kontur.ru/webinars/1044.

In this article we will tell you how to calculate, take into account and pay insurance premiums to organizations on OSNO.

The 6-NDFL control ratios are the equality of the row values within the form and the coincidence of the values with other reporting forms (2-NDFL and DAM). Let's talk about the indicators that need to be compared with each other before passing the 6-NDFL.

An employer can provide financial assistance to an employee in connection with maternity, retirement, vacation and in other cases. How to reflect financial assistance in 6-personal income tax - we will consider below.