Hi all!

Today the topic of our conversation will be of a slightly accounting nature: we will talk about the property structure of the enterprise. Surely many people know that assets are premises, factories, ships and everything that a company has. However, not everyone is aware of how they are reflected in the balance sheet. How can they be assessed?

How do they differ from liabilities and how do they relate to each other? What is the difference between current and non-current? And this is only a small part of the current issues, which I will try to analyze and explain simply and clearly, as they often say, “for dummies.”

What are assets and liabilities

Assets are property owned by a company at the reporting date. Using this property, the company carries out its activities and tries to make a profit (the left side of the balance sheet).

Liabilities are the economic means through which the company's assets are formed (the right side of the balance sheet).

Difference between liabilities and assets

To explain the difference and establish the correct cause-and-effect relationship, I will give a small example.

A company buys a machine for its activities for 100 rubles. Now the machine is the property of the company and is reflected on the left side of the balance sheet with a valuation of 100 rubles. At the same time, in order to buy equipment, the company took out a loan of 100 rubles. This is a liability and is reflected in the corresponding place on the right side of the balance sheet.

Are own shares an asset or a liability?

To answer this question, you should use the following accounting logic.

The issue of shares or other securities is the raising of funds with which it is possible to purchase property involved in the activities of the organization. This means that this is a source of funds; accordingly, own shares are a liability and are reflected as the company’s capital on the right side of the balance sheet.

Interaction of assets and liabilities

Liabilities are the sources from which the company’s property is formed. Therefore, in accounting there is an absolute rule that states that “LIABILITIES = ASSETS.”

Let me give you a couple more easy examples.

The company has funds contributed by its founders, i.e. capital (this is a liability) in the amount of 100 rubles. She buys a building (asset) worth 50 rubles with them. In this case, the balance will look like this: Liabilities = 100 rubles. Assets = 50 rub. Building and 50 rubles. - These are available funds.

Next, the company decided to purchase goods worth 100 rubles, but it did not have enough money, so it took out a loan of 50 rubles. The balance has changed: now the organization’s liabilities include 100 rubles. equity and 50 borrowed funds.

On the left side of the company’s balance sheet, a building purchased for 50 rubles remained, and goods worth 100 rubles appeared. The company has no free cash left. But the balance has not changed: 150 rubles. = 150 rub.

Assets and liabilities in financial statements

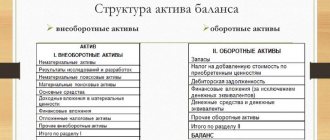

All information about the structure of the company is contained in such a type of reporting as the balance sheet. It is not filled out in free form, but has certain rules and structure.

Assets include two forms:

- non-current;

- negotiable.

Liabilities are divided into:

- equity;

- Short-term liabilities;

- long term duties.

Assets and liabilities according to Kiyosaki

Robert Kiyosaki is the bestselling author of Rich Dad Poor Dad. He offers his own system of grading property elements. His books have sold millions of copies, and his lectures attract (or have attracted) huge numbers of listeners.

Therefore, people often come across this information and begin to think that in accounting and when reading reports they can use the method he proposed. However, it is not.

Its definition rules do not apply to accounting; their meaning is as follows:

- an asset is anything that generates income;

- a liability is something that requires investment.

And the main idea is to increase the number of the former and reduce the number of the latter.

Definition of active accounts

To group enterprise funds and their sources that are homogeneous in content, appropriate registers are used.

They are called accounts; the movement of each type of material assets, settlements, and capital is represented in them for a certain time period.

https://www.youtube.com/watch?v=https:tv.youtube.com

Accounting accounts serve to summarize information about a specific type of asset (source) for a certain period of time; on their basis, all existing accounting registers are filled in (revolving balance or memorial, chess sheet, balance sheet with appendices).

Recording of business transactions to the appropriate account is made on the basis of the primary document.

Their processing consists of generating a total (balance) or closing the register.

After this, information from the accounts is transferred to the balance sheet, subject to its basic rule - the correspondence of the values of the active part and liabilities.

Active accounts are accounting accounts designed to record the status, movement and changes of business assets by type.

Active accounts display information about the funds (in monetary equivalent) that the organization has at its disposal; these can be bank accounts, property in the warehouse and in operation.

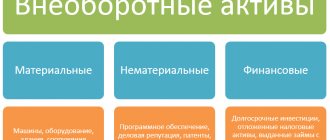

Kinds

The organization's resources are divided into two large groups: non-current and current. The main factors when assigning property to a certain group are the following:

- Duration of use or sale. For non-current assets, the useful life generally exceeds 12 months. For negotiables the situation is the opposite and is limited to a circulation period of 12 months.

- Liquidity. This is a measure of how quickly a property can be converted into cash. The industrial building has low liquidity and is classified as a non-current asset. Money has the highest liquidity and is strictly classified as current assets.

Liabilities are divided into three large groups:

- Equity. For example, own funds invested by the founders or money raised from the issue of shares, etc.

- Long term duties. The repayment period is more than 1 year.

- Short term. Repayment period is less than 1 year.

What are the net assets of an enterprise

In simple terms, NAV (from English netassets) is the difference between the total assets and liabilities of the company. Otherwise, it is property that is covered within the company's equity.

Alarm bell if this value is in the negative zone. Then the value of debts exceeds the sum of all assets.

CA and legislation

By law, if this indicator falls below a certain level, the company does not have the right to pay dividends for the reporting period.

The minimum acceptable threshold is determined as the size of the authorized capital and reserve fund. Preferred shares are also accounted for as the difference between their par value and liquidation value.

Calculation formula

The formula for calculating the NA is as follows:

Types of assets and what they include

It's time to look a little deeper at the structure of the balance sheet.

Non-current include the following subsections on the balance sheet:

- intangible assets;

- Finnish investments (more than a year);

- fixed assets;

- deferred tax liabilities.

The negotiables form the following sections:

- stocks;

- receivable;

- Finnish investments (less than a year);

- cash and equivalents.

This is an incomplete list; it may still be supplemented by some articles depending on the specifics of the activity, etc.

How are the assets and liabilities of the balance sheet formed?

Here I will briefly outline the main relationships when forming a balance:

- Assets = Liabilities = (equity + liabilities).

- Assets – liabilities = equity.

These accounting rules must always be followed.

Active account scheme

| Debit | Credit |

| Opening balance - balance (availability) of economic assets at the beginning of the reporting period | |

| Debit turnover - the amount of business transactions that cause an increase in business assets during the reporting period | Loan turnover - the amount of business transactions causing a decrease in business assets during the reporting period |

| Final balance - the balance of business assets at the end of the reporting period |

Net assets of an enterprise: calculation and interpretation

Essentially, netassets shows how much the property used by the enterprise can realistically be valued at. First of all, this is necessary to analyze and identify the risks of bankruptcy of the company.

Formula for calculation

NA are calculated based on balance sheet data and include the following indicators:

Calculation example

I will give the calculation of the NAV using the example of a real company. For this I chose the Kuzbass Fuel Company. The organization is engaged in the extraction and sale of thermal coal. The reporting is based on Russian standards (RAS) for 2021 and does not include consolidated data for the entire group.

The company has no deferred income and no debt from the founders. Therefore the calculation looks like this:

40,029,277 thousand rubles. (total assets) – 16,679,715 thousand rubles. (long-term liabilities) – 7,506,614 thousand rubles. (short-term liabilities) = 15,842,948 thousand rubles.

Balance sheet codes and lines

The calculation of the NAV according to the balance sheet lines looks like this:

(Assets, line 1600) – (liabilities, lines 1400 and 1500) + (DBP, line 1530) – (debt of the founders, as part of line 1170).

Diagnostics of business efficiency using the net asset method

The main thing you need to pay attention to when analyzing the NA is that their value is not in the negative zone. This situation indicates the following trends in the enterprise:

- the activity systematically brings losses;

- the company is unable to pay its obligations.

In this case, the organization may face bankruptcy. Firm managers should monitor netassets performance and try to take actions to improve them.

Valuation of assets on the balance sheet

For evaluation, various analytical ratios or multipliers are used, which are useful in their own way and can clearly present the financial characteristics of the company’s balance sheet. Next I will talk about some of them.

Cost and average value of total assets

The aggregate indicator combines the cost of non-current and current assets as of a certain date. It is listed under line 1600.

Average value is an amount calculated as an average between data within one period. Typically this is one year.

Those. (amount at the beginning of the period + amount at the end) / 2.

Real assets ratio

Assets that are involved in the production cycle are subject to such analysis. This could be fixed assets, products, etc.

The coefficient shows how many real assets (core) there are in the overall structure. Therefore, it is generally accepted that the normal indicator should be above 0.5 points. This would mean that more than half of them are directly involved in the business activities of the company.

If the coefficient is lower, this means that most of them are non-core for the organization and some problems may be associated with this.

Asset immobilization ratio

The ratio shows the degree of efficiency in using the company's property resources. It is considered quite simple. To do this, non-current assets must be divided into current assets.

It is believed that the lower this ratio, the better the financial condition of the enterprise.

Permanent Balance Index Ratio

This multiplier shows how much non-current assets are covered by equity capital. It is generally accepted that the indicator should be below one, then the financial condition of the organization can be called stable.

If this limit is seriously exceeded, the company is considered to be overly indebted and experiencing financial difficulties.

What types of accounting accounts are there?

3) Statement of balances of placed and attracted funds.

— client (reflect settlement and monetary relationships with its clients);

— intrabank (used for settlements, income, expenses, results of the bank’s activities)

Synthetic accounting

https://www.youtube.com/watch?v=ytcreatorsru

is general in nature. Synthetic accounting data serves both as a means for analyzing the activities of the bank itself, and can be used to analyze the activities of individual enterprises and organizations and industry analysis.

Synthetic accounting problem

— checking the correctness of analytical accounting. Synthetic accounting is carried out on second-order accounts provided for by the current chart of accounts. The relationship between synthetic and analytical accounting is expressed in the fact that personal (analytical) accounts are opened in the context of second-order accounts (synthetic accounts).

1) Turnover sheet (includes opening balances, turnover, ending balances for each synthetic account).