Your company has already entered into a leasing agreement and you have questions about how to reflect leasing in accounting? In this article you can find the necessary information and examples of accounting entries for various leasing transactions.

If you are just planning to enter into a leasing transaction and are looking for financing options, you can fill out an application on our website and receive offers from dozens of lessors. Using the site is free, you enter into an agreement directly with the leasing company, which will offer the most favorable conditions.

Accounting for transactions under a leasing agreement is regulated by Order of the Ministry of Finance of the Russian Federation No. 15 dated February 17, 1997.

Leasing transactions depend on whose balance sheet the leased property is reflected in: the lessor or the lessee. The party on whose balance sheet the leased property is accounted for must be indicated in the leasing agreement.

Transfer of advance payment to the lessor

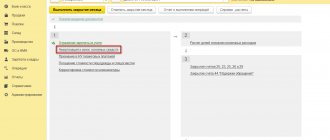

Complete the transfer of the advance to the lessor with the document Debit from the current account, transaction type Payment to the supplier in the Bank and cash desk section – Bank – Bank statements – Debit from the current account.

Postings

Registration of SF for advance payment from supplier

The Lessee may deduct VAT from the advance payment to the Lessor if:

- correctly executed SF;

- agreement providing for prepayment;

- documents for transfer of advance payment.

You can register an invoice issued for an advance from the document Write-off from current account by clicking the Create based and selecting Invoice received .

Invoice document is automatically filled in with the data from the document Write-off from the current account .

- The transaction type code is “Advances issued.”

Entry into leasing in 1C 8.3: balance holder - lessee

At the time of transfer of property for leasing, the Lessor does not issue an invoice to the Lessee and does not present the VAT amount. Consequently, at the time of transfer of property for leasing, the Lessee does not have the right to deduct VAT from the cost of the leased property.

The Lessee's right to deduct VAT arises when:

- The lessor issues an invoice for lease payments;

- The lessor issues an invoice for the redemption price at the time of redemption of the property.

Document the receipt of leased property on the balance sheet of the lessee with the document Receipt into leasing from the section Fixed assets and intangible assets – Receipt of fixed assets – Receipt into leasing.

In accounting , the leased property recorded on the balance sheet by the Lessee is recognized by him as a fixed asset. Its initial cost is formed depending on the contract (clause 8 of PBU 6/01, Order of the Ministry of Finance of the Russian Federation dated February 17, 1997 N 15):

- from the sum of all leasing payments and the redemption price, i.e. the full cost of the contract, including VAT, if there is only one contract and includes the terms of redemption and the redemption price;

- from the amount of all leasing payments without the redemption price, i.e. the full cost of the contract, including VAT, if there is a separate purchase and sale agreement for the redemption value of the leased asset.

Postings

The document generates transactions:

- Dt 08.04.1 Kt 76.07.1 - lease liabilities in the amount of the cost of the asset taken onto the balance sheet;

- Dt 76.07.9 Kt 76.07.1 - rental obligations in the amount of VAT 18%.

Attention! Due to the increase in the VAT rate to 20% in 2021, VAT obligations will change!

Results

Transactions for leasing a car will depend on what conditions are specified in the contract.

Both LD and LP may have different blocks of transactions depending on whose balance sheet the car is accounted for, how the redemption price is paid, and also on what happens to the car at the end of the contract: it becomes the property of LP or is returned to LP . You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Reflection of the leased asset as part of the operating system

Acceptance of the leased asset for accounting on the balance sheet of the lessee is carried out in 1C 8.3 with the document Acceptance for accounting of fixed assets, type of operation Equipment from the section Fixed assets and intangible assets - Receipt of fixed assets - Acceptance for accounting of fixed assets.

Tab Fixed assets .

Accounting tab :

- Account — 01.03;

- Depreciation (depreciation) account — 02.03.

In accounting, the useful life of an item of fixed assets is determined by the organization independently when accepting the item for accounting (clause 20 of PBU 6/01).

Tax accounting tab .

The rules for forming the initial cost of leased property in BU and NU are different!

In the NU, despite the fact that ownership of the leased property does not pass until its redemption, it is recognized as depreciable property, and its value is determined as the sum of all the Lessor’s expenses for its acquisition (clause 1 of Article 257 of the Tax Code of the Russian Federation). The value of leased property for tax accounting is taken from the Lessor’s certificate of its book value.

The useful life of depreciable property in tax accounting is determined by the party on whose balance sheet it is taken into account (clause 10 of Article 258 of the Tax Code of the Russian Federation) in accordance with the depreciation group, based on the classification of fixed assets approved by the Government of the Russian Federation (clause 2 of Article 259.1 of the Tax Code of the Russian Federation ). Currently, to determine the depreciation group, it is necessary to use OKOF OK 013-2014 (SNS 2008), adopted and put into effect by Order of Rosstandart dated December 12, 2014 N 2018-st.

Postings

The document generates transactions:

- Dt 01.03 Kt 08.04.1 - the initial cost in the accounting system was formed (1,553,400);

- Dt 01.03 Kt 08.04.1 - the initial cost was formed in NU (1,020,000);

- Dt 01.K Kt 08.04.1 - the difference in the cost of fixed assets between accounting and tax accounting in NU is taken into account.

The purpose of account 01.K is to account for the non-depreciable part of the cost of fixed assets in the tax accounting system, i.e., the difference between the cost of leased property in tax and accounting.

Accounting for leasing when reflecting property on the lessor’s balance sheet

Leasing transactions correspond to the payment schedule located at the link.

If the leasing agreement provides for the reflection of the leased asset on the lessor’s balance sheet, the lessee reflects the leased property on off-balance sheet account 001 “Leased fixed assets”.

The accrual of leasing payments is reflected in the credit of account 76 “Settlements with various debtors and creditors” in correspondence with cost accounts: 20, 23, 25, 26, 29 – when accounting for leasing payments on property that is used in production activities, 44 – on property used in the activities of a trade organization, 91.2 - for property that is used for non-production purposes. Further, for simplicity, in the leasing accounting examples, only entries for the 20th account will be given.

Calculation of monthly lease payment

1-12 leasing payment (from 02/01/2016 to 01/31/2017) is 68,440 rubles. (incl. VAT 18%), including:

- offset of the advance payment - 29,500 rubles.

- payable - RUB 38,940.

The amount of the leasing payment is 68,440 rubles. The lessor issues a monthly invoice.

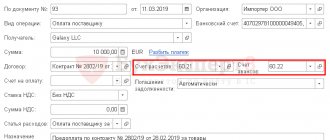

Accrue the monthly lease payment using the document Receipt (act, invoice) transaction type Leasing services from the section Purchases – Purchases – Receipt (acts, invoices) – button Receipt – Leasing services.

Postings

An example of calculating a leasing agreement

The total amount of the leasing agreement is RUB 751,500.00, including VAT 20% - RUB 125,250.00. Initial payment (advance payment) - 150,000.00 rubles, including VAT 20% - 25,000.00 rubles. Leasing term - 2 years (24 months + the last month the redemption price is paid), redemption price - 1,500.00 rubles, including VAT 20% - 250 rubles. The monthly payment is (751,500.00 - 1,500 − 150,000.00) / 24 = 25,000.00 rubles, including 20% VAT - 4,166.67 rubles.

Read about what the redemption value of a leased asset is here..

It is worth noting that there is no single standard for a leasing agreement, so the advance payment can also be counted as the first monthly lease payment or towards several monthly lease payments. These conditions must be clearly stated in the leasing agreement.

See also “Car leasing agreement for legal entities”.

In the future, we will use the conditions from this example to describe accounting entries.

Registration of SF supplier

To register an incoming invoice, indicate its number and date at the bottom of the Receipt document form (act, invoice) , click the Register .

The Invoice document received is automatically filled in with the data from the Receipt document (act, invoice) .

- Operation type code : “Receipt of goods, works, services.”

VAT restoration when crediting an advance payment to a supplier

The amount of VAT offset on the advance payment is subject to restoration (clause 3, clause 3, article 170 of the Tax Code of the Russian Federation).

VAT recovery when crediting an advance payment to a supplier is carried out using the document Generating sales ledger entries at the end of the month or quarter. The document is available from the section Operations – Period closure – Regular VAT operations.

In our example, it is subject to restoration from the offset advance - 29,500 rubles.

- VAT at the rate of 18/118% - 4,500 rubles.

See also: Under a leasing agreement, a change in the contract amount was sent due to an increase in VAT, how can I make the changes correctly?

Postings

Postings for current lease payments

Dt 60 – Kt 51 – 236,000 (advance payment (down payment) under the leasing agreement has been paid)

It is necessary to take into account that the advance payment under the leasing agreement can be charged as expenses (offset of the advance payment) not immediately, but throughout the entire agreement. In the above payment schedule, the advance payment under the contract is offset evenly (RUB 6,555.56 each) over 36 months.

Dt 20 – Kt 76 – 29,276.27 (accrued leasing payment No. 1 – 34,546 minus VAT – 5,269.73)

Dt 19 – Kt 76 – 5,269.73 (VAT charged on lease payment No. 1)

Dt 20 – Kt 60 – 5,555.56 (part of the advance payment under the leasing agreement is credited – 6,555.56 minus VAT 1,000)

Dt 19 – Kt 60 – 1,000 (VAT charged against advance payment)

Dt 68 – Kt 19 – 6,269.73 (VAT submitted to the budget)

Dt 76 – Kt 51 – 34,546 (leasing payment No. 1 listed)

The commission that is paid at the beginning of the leasing transaction (commission for concluding the transaction) is charged in accounting to the same expense accounts as current leasing payments.

Recognition of expenses in accounting and accounting records

Recognition of expenses in accounting and accounting at the end of the month is carried out by routine operations in the Month Closing assistant, section Operations – Period Closing – Month Closing.

Depreciation calculation

Depreciation deductions are made by the party to the leasing agreement on whose balance sheet the leased asset is located (clause 2 of Article 31 of Law No. 164-FZ of October 29, 1998).

Depreciation is accrued in the generally established manner (clause 17 of PBU 6/01), with the straight-line method - based on the useful life of the asset.

For tax accounting purposes, the lessee charges depreciation in the general manner.

In NU, the amount of monthly depreciation is included in expenses that reduce the tax base (clause 3 of Article 272 of the Tax Code of the Russian Federation).

Postings

The essence of leasing

A leasing agreement is concluded between two interested parties. The subject of the contract is buildings, equipment, cars and other types of property. The lessee can become the legal owner of the leased property by purchasing it.

For the subject of leasing, you need to draw up a transfer and acceptance certificate. Depreciation is calculated by the party whose property is recorded on its balance sheet.

Submit electronic reports via the Internet. The Kontur.Extern service gives you 3 months free of charge!

Try it

Recognition of leasing payments in NU

The expenses that reduce the tax base when leasing property include:

- depreciation;

- the difference between leasing payments and depreciation, which is included in other expenses (clause 10, clause 1, article 264 of the Tax Code of the Russian Federation) on the last day of the month (clause 3, clause 7, article 272 of the Tax Code of the Russian Federation).

Recognition of expenses on leasing payments is carried out by the regulatory operation Recognition of leasing payments in the NU .

Postings

The document generates the posting:

- Dt Kt 01.K - write-off of leasing payments to NU expenses at the expense of the non-depreciable part of the cost of the leased property.

In subsequent years, leasing payments are accrued and recognized as expenses according to the same scheme as for the first year, with the exception of the offset of advance payments.

An example of accounting for leasing when reflecting property on the lessee’s balance sheet

Leasing transactions correspond to the payment schedule for property leasing located at the link

The lessee received a passenger car under a leasing agreement, payment schedule parameters:

- leasing agreement term – 3 years (36 months)

- the total amount of payments under the leasing agreement is 1,479,655.10 rubles, incl. VAT – 225,710.10 rubles

- advance payment (down payment) – 20%, 236,000 rubles, incl. VAT – 36,000 rubles

- car cost – 1,180,000 rubles, incl. VAT – 180,000 rubles

The expected period of use of the leased property is four years (48 months). The car belongs to the third depreciation group (property with a useful life of 3 to 5 years). Depreciation is calculated using the straight-line method.

Let's determine the amount of monthly depreciation in accounting. Because the cost of the property (including the leasing company's remuneration) is equal to 1,253,945 rubles (1,479,655.10 - 225,710.10), monthly depreciation will be 1,253,945: 48 = 26,123.85 rubles.

A passenger car belongs to the third depreciation group, therefore, a period of 48 months can be established in tax accounting. The monthly depreciation rate is 2.0833% (1: 48 months x 100%), the monthly depreciation amount is 1,000,000 x 2.0833% = 20,833.33 rubles.

In accordance with paragraph 10 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation, the amount of the lease payment recognized monthly as an expense for profit tax purposes is 8,442.94 rubles (34,546 (lease payment) - 5,269.73 (VAT as part of the lease payment) – 20,833.33 (monthly depreciation in tax accounting)).

Expenses under the leasing agreement are formed monthly in accounting due to depreciation (26,123.85 rubles), in tax accounting - due to depreciation (20,833.33 rubles) and leasing payment (8,442.94 rubles), a total of 29,276 ,27 rubles.

Because in accounting, the amount of expenses over 36 months (the term of the leasing agreement) is less than in tax accounting, this leads to the emergence of taxable temporary differences and deferred tax liabilities.

During the term of the leasing agreement, the lessee has a monthly taxable temporary difference in the amount of 3,152.42 rubles (29,276.27 - 26,123.85) and a corresponding deferred tax liability arises in the amount of 630.48 rubles (3,152.42 x 20% ).

Separately, it is necessary to say about accounting for the advance payment (down payment under the contract) . The following situations are possible:

1. When transferring property for leasing, the lessor provides an invoice for the full amount of the advance (in the given schedule of leasing payments - for 236,000 rubles). In this case, the entire amount of the advance payment minus VAT in tax accounting is recognized as an expense for profit tax purposes.

I would like to note that under the leasing agreement, services are provided throughout the entire contract and the fiscal authorities have no reason to assess compliance with the criteria of paragraph 4, paragraph 2 of Article 40 of the Tax Code of the Russian Federation on the comparability of leasing payments, because individual payments cannot be considered as separate transactions, and the price under a leasing agreement must be analyzed in aggregate for all payments in the agreement.

2. The advance payment under the leasing agreement is offset in equal payments throughout the entire leasing term. In this case, the offset portion of the advance payment is recognized as an expense in tax accounting for profit tax purposes.

In the given example of a leasing payment schedule, it is assumed that an advance invoice is issued to the lessee when the property is leased, i.e. In tax accounting, when transferring property into leasing, expenses in the amount of 200,000 rubles are reflected (the advance payment, which is a leasing payment, is not deducted, since in the first month when transferring property into leasing, it is not yet accrued). At the same time, a taxable temporary difference in the amount of 200,000 rubles and a corresponding deferred tax liability in the amount of 40,000 rubles (200,000 rubles x 20%) arise.

At the end of the leasing agreement, the lessee will continue to accrue monthly depreciation in accounting in the amount of 26,123.85 rubles. There will be no expenses in tax accounting. This will lead to a monthly decrease in deferred tax liabilities in the amount of 5,224.77 rubles (26,123.85 rubles x 20%).

Thus, based on the results of the agreement, the total amount of deferred tax liabilities will be equal to zero:

40,000 (deferred tax liability for the advance payment) + 22,697 (630.48 x 36 – deferred tax liability for current lease payments) – 62,697 (5,224.77 x 12 – reduction of deferred tax liabilities for 12 months of depreciation in the accounting accounting after the end of the leasing agreement).

Change of agreement to 2% VAT in 2019

In connection with the increase in the VAT rate to 20% from 2021, the Lessor and the Lessee signed an additional agreement to the agreement for an increase of 2%:

- the balance of lease obligations in terms of VAT - in the amount of RUB 4,164.50.

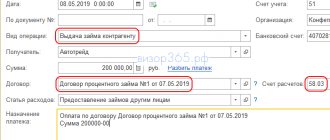

Continue accounting for leasing transactions in 1C 8.3 for the lessee after 01/01/2019 after creating the manual Transaction , where you reflect the amount of the increase in the cost of the contract under the additional agreement. Create a document from the section Operations – Accounting – Operations entered manually – Create button – Operation.

See also: Under a leasing agreement, can we transfer the invoice deduction to 2021?

Accounting of leasing operations for lessees

The sometimes arising need to purchase expensive property for the economic activities of an organization confronts the management of the enterprise with a difficult choice.

Not every company can afford one-time large expenses. Accordingly, organizations are beginning to consider the possibility of attracting financing for the acquisition of property.

One of these possibilities is the conclusion of a financial lease agreement, that is, a leasing agreement.

Legal relations under leasing agreements are regulated by the provisions of the federal law “On financial lease “leasing” of October 29, 1998. No. 164-FZ and Ch. and the provisions of the Civil Code (Articles 665-670).

Despite the similarity of the essence of leasing with a loan, accounting for leasing transactions is very different from accounting for borrowed obligations.

Leasing payments completely reduce the tax base for income tax, without any restrictions. VAT is paid and refunded on leasing transactions. At the same time, the debt under the leasing agreement is not reflected in the liability side of the balance sheet as part of borrowed funds and does not worsen its performance.