Concluding commercial transactions through agents is a fairly common practice in modern business. Accounting for agency fees reflects the provisions of the concluded civil contract with the agent. The structure of accounting entries must be built in such a way as to take into account all its nuances. In the article we will look at the most important correspondence accounts and give practical examples of accounting for payments to company agents.

Learn more about agent fees .

Agency agreement: types and rules

The essence of an agency (intermediary) agreement comes down to the presence between the 2 parties to the transaction (seller and buyer) of a third party (intermediary), whose role can be:

- commission agent;

- agent;

- attorney.

For a sample agreement, see the material “Agency Agreement - Sample Completion for Legal Entities.”

The activity of an intermediary is to carry out legally significant actions on its own behalf or on behalf of the guarantor (principal, principal, principal), leading to the consequences of these actions for the guarantor.

Despite the fact that in the Civil Code of the Russian Federation (Chapter 52) the agency agreement is distinguished as an independent type, it, in fact, combines two types of agreements:

- orders (Chapter 49), when the agent acts on behalf of the guarantor and the rights/obligations under the transaction arise directly from the guarantor;

- commission (Chapter 51), when an agent acts on his own behalf and he also acquires rights/obligations under the transaction.

The following features of agency agreements are important for accounting:

- income and expenses from intermediary transactions arise from the guarantor;

- the income of the intermediary becomes the agency fee paid to him by the guarantor;

- The money and property of the guarantor received by the intermediary in connection with the order assigned to him are only means for executing the order and are not reflected in the income/expenses of the intermediary;

- the intermediary's costs associated with the execution of the agency agreement and reimbursed to him by the guarantor do not constitute the income/expenses of the intermediary;

- the volumes of functions performed by the intermediary and the reimbursable costs incurred by him, confirmed by documents, are reflected in the intermediary’s report, which is the primary accounting document for the guarantor and is considered accepted if he has no objections to it.

Ready-made solutions from ConsultantPlus will help you check the agency agreement for risks:

Get free access to K+ and go to the Ready-made solution for the principal.

And this link will take you to the Ready Agent Solution if you have access to K+. If you don't have it, you can get trial access for free.

There are two main schemes of actions passing through an intermediary:

- sales;

- purchases.

When concluding agency agreements, accounting should be organized using postings through account 76 with details of the types of calculations for analytics. The intermediary’s income, depending on the accounting policy, can be generated either on account 90 or 91.

See also “How to correctly make entries under an agency agreement.”

Principal's counterparties

The terms of the contract may provide for the participation of an agent in settlements between the principal and buyers or suppliers. The cash flow in this case does not generate income or expenses for the agent, but transits through account 76 “Settlements with various debtors and creditors.” In addition, the principal’s assets may be transferred to him for subsequent sale to the buyer, or the agent may accept from suppliers assets purchased on behalf of the principal. In this case, ownership of the assets does not pass to the agent, and if there are documents on the transfer of assets to him (acts, TTN, etc.), he reflects the assets in off-balance sheet accounts 004 “Goods accepted for commission” or 002 “Inventory accepted for commission” for safekeeping."

Accounting for sales through an agent

Acting on behalf of the guarantor, the agent essentially provides him with the service of finding a buyer. Documents for the buyer are drawn up by the actual seller, and he also generates income/costs for the transaction:

- the implementation is shown: Dt 62 Kt 90;

- VAT is charged under an agency agreement on sales: Dt 90 Kt 68;

- the agent's services and expenses reimbursed to him are taken into account: Dt 20 (26, 44) Kt 76;

- is allocated and accepted for deduction of VAT on the agent’s services and expenses reimbursed to him:

- Dt 19 Kt 76;

- Dt 68 Kt 19;

For information about the procedure for settlements with an agent, see the article “Procedure for payment of remuneration under an agency agreement.”

- the total amount of costs, which also includes the guarantor’s own expenses, reduces the income from sales: Dt 90 Kt 20 (23, 25, 26, 41, 43, 44).

In this case, the agent has in his records:

- income from services rendered will be reflected: Dt 76 Kt 90;

- VAT will be charged: Dt 90 Kt 68;

- Reimbursable costs for the provision of services will be taken into account: Dt 76 Kt 60;

- money will be received from the guarantor for the service and reimbursement of costs: Dt 51 Kt 76.

To learn about when an agent’s services are not subject to VAT, read the article “Which intermediary services are not subject to VAT .

When an agent acts on his own behalf, he draws up documents for the buyer himself and all payments go through him. However, the goods received for sale remain the property of the guarantor. The funds received from the buyer are also the funds of the guarantor. The agent, as a rule, withholds the remuneration intended for him from the amount received from the buyer before transferring it to the guarantor.

For such agency agreements, accounting is organized according to the following rules:

- The receipt of goods intended for sale by the agent will be reflected in the balance sheet by the entry: Dt 004;

- the shipment will be shown to them at the full sales price in the correspondence of the account of settlements with the buyer with the account of accounting for settlements with the guarantor: Dt 62 Kt 76;

- at the same time the goods will be written off from the off-balance account: Kt 004;

- money received from the buyer is taken into account in the usual manner (including advances): Dt 51 Kt 62.

Moreover, the obligation to charge VAT on advances received from the buyer falls on the guarantor.

Read how to correctly reissue invoices under an agency agreement here.

Through postings to account 76, the intermediary’s income and the amount intended for transfer to the guarantor are formed:

- The intermediary's remuneration is taken into account: Dt 76 Kt 90;

- VAT is charged on remuneration: Dt 90 Kt 68;

- the intermediary's expenses reimbursed by the guarantor are reflected: Dt 76 Kt 60;

- the total amount of debt to the guarantor is transferred to him: Dt 76 Kt 51.

The guarantor's entries for sales and cost accounting will be the same as when selling on his behalf, with the only difference being that the amount of shipment will correspond to that indicated in the documents drawn up in the name of the buyer by the intermediary, the entry for payment to the intermediary will disappear and additional accounting entries will appear shipment and payment from the buyer:

- the goods were transferred for sale to the intermediary: Dt 45 Kt 41 (43);

- at the time of sale of the transferred goods: Dt 90 Kt 45;

- receipt of money to the guarantor from the intermediary (minus his remuneration and reimbursable expenses): Dt 51 Kt 62;

- accounting in the funds due from the buyer for the amounts of remuneration and reimbursable expenses withheld by the intermediary: Dt 76 Kt 62.

For information on the rules for issuing invoices for sales involving an intermediary, read the material “How to issue invoices when selling goods through an intermediary?”

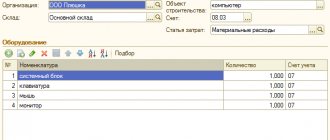

Practical registration of commission transactions

Let's look at an example of processing transactions under a commission agreement. The company LLC "Content" instructed, within the framework of an agency agreement, to sell goods in the amount of 125,000 rubles with a remuneration of 10% of turnover. The costs of the transaction are covered by the principal from the amounts of remuneration received under the agreement. To simplify the reflection of transactions in the example, a breakdown by subaccount of account 76 is not made. The following transactions are recorded in the commission agent's accounting:

- Dt 04 – 125,000 rubles – the warehouse of Transit LLC received goods from Content LLC.

- Kt 04 – 125,000 rubles – consignment goods were shipped to the buyer.

- Dt 62/3 Kt 76 – 125,000 rubles – the buyer’s debt to the agent is reflected.

- Dt26 Kt 70, (69, 10 and other cost accounts) – 5,000 rubles – transaction costs are taken into account.

- Dt51 Kt62/3 – 125,000 rubles – the buyer’s debt is repaid.

- Dt76Kt 90/1 – 12,500 rubles – remuneration accrued.

- Dt76 Kt 51 –112,500 rubles – funds were transferred to the principal minus remuneration.

- Dt90/2 Kt 26 – 5,000 rubles – expenses written off from the commission agent’s remuneration funds.

Based on the results of the operation, the financial result is determined. The commission agent's remuneration is subject to VAT taxation.

Accounting for purchases through an agent

If the agent acts on behalf of the buyer, he actually provides him with the service of finding a supplier. The seller will issue the documents directly to the guarantor, and the buyer will incur the costs of the intermediary’s services:

- goods (work, services) received: Dt 10 (20, 23, 25, 26, 41, 44) Kt 60;

- allocated and accepted for deduction of VAT on purchases:

- Dt 19 Kt 60;

- Dt 68 Kt 19;

- Dt 19 Kt 76;

- Dt 68 Kt 19;

In such a situation, the agent’s entries for recording income will be the same as when he was involved in sales on behalf of the guarantor.

An agent acting on his own behalf during procurement will receive purchase documents issued in his own name. However, neither the purchased goods nor the funds that he will receive from the guarantor to pay for the purchase will be his property.

The goods purchased by the agent for the guarantor will be reflected on the balance sheet: Dt 002.

In the balance sheet, the purchase will be shown to them at the full cost of the purchase in correspondence between the account for settlements with the supplier and the account for accounting for settlements with the guarantor: Dt 76 Kt 60.

Money received from the guarantor and transferred to the supplier will be included in the following entries:

- Dt 51 Kt 76;

- Dt 60 Kt 51.

When the goods are transferred to the guarantor, they will be written off from the off-balance sheet account: Kt 002.

The intermediary's remuneration and the amounts to be reimbursed to him by the guarantor will be formed as follows:

- The intermediary's remuneration is taken into account: Dt 76 Kt 90;

- VAT is charged on remuneration: Dt 90 Kt 68;

- the intermediary's expenses reimbursed by the guarantor are reflected: Dt 76 Kt 60;

- funds are received from the guarantor to pay for remuneration and reimbursable expenses (if they were not initially received in an amount greater than what had to be paid to the supplier): Dt 51 Kt 76.

The guarantor's purchase and cost accounting transactions will be the same as when purchasing on his behalf, with the only difference being that the purchase amount will correspond to that indicated in the documents drawn up in the name of the intermediary by the seller, and settlements for the purchase will not be made directly with the supplier, but through an intermediary:

- goods (work, services) received: Dt 10 (20, 23, 25, 26, 41, 44) Kt 76;

- allocated and accepted for deduction of VAT on purchases:

- Dt 19 Kt 76;

- Dt 68 Kt 19.

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Agency Agreement for the Purchase and Sale of Products”, as well as ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |

Agency agreement with a foreign company - features of VAT payment

When a Russian organization enters into an agency agreement with a foreign company, it will have to pay VAT if intermediary services are provided on the territory of the Russian Federation. There is a separate letter from the Ministry of Finance of the Russian Federation dated December 2, 2011 No. 03-07-08/339 on this matter.

The essence of the explanations from the financial department is as follows: intermediary services under such agreements are considered to be provided in the place where the company providing them operates. In the above case, services are provided by a Russian organization in our country, and it is here that VAT should be applied at a 20 percent rate.

Author of the document

| Contract-Yurist.Ru offline Status: Legal company rating460 84 / 6 Private message Order a consultation | number of consultations: |

| noted as the best: | 5 |

| answers to documents: | |

| documents posted: | 927 |

| positive feedback: | |

| negative reviews: |

Results

Accounting for agency agreements has its own specifics and differs depending on whether the intermediary is involved in the calculations or not. Funds and property received by the intermediary in connection with the execution of the order are not taken into account by him in the balance sheet and do not become his income.

Sources: Civil Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Nuances with payments

The remuneration is calculated based on the amount of sales secured by the agent. He is entitled to a share of the income. The amount of payments depends on the conditions of the company. Successful agents are offered bonuses in various forms and increased payments.

The law requires payment to be made no later than a week after the report is considered accepted, unless otherwise provided by laws and company rules.

If the amount of payments is not clear from the contract, the court has the right to recover the amount that is paid in the same area under similar circumstances.

If the agent is a citizen who does not have the status of an individual entrepreneur, contributions to the budget are made by the company paying the remuneration. If the employee is an entrepreneur, payments become his responsibility.

Comment on the rating

Thank you, your rating has been taken into account. You can also leave a comment on your rating.

Is the sample document useful?

If the document “Agency Agreement for the Purchase and Sale of Products” was useful to you, we ask you to leave a review about it.

Remember just 2 words:

Contract-Lawyer

And add Contract-Yurist.Ru to your bookmarks (Ctrl+D).

You will still need it!