Your company has already entered into a leasing agreement and you have questions about how to reflect leasing in accounting? In this article you can find the necessary information and examples of accounting entries for various leasing transactions.

If you are just planning to enter into a leasing transaction and are looking for financing options, you can fill out an application on our website and receive offers from dozens of lessors. Using the site is free, you enter into an agreement directly with the leasing company, which will offer the most favorable conditions.

Accounting for transactions under a leasing agreement is regulated by Order of the Ministry of Finance of the Russian Federation No. 15 dated February 17, 1997.

Leasing transactions depend on whose balance sheet the leased property is reflected in: the lessor or the lessee. The party on whose balance sheet the leased property is accounted for must be indicated in the leasing agreement.

Accounting for leasing when reflecting property on the lessor’s balance sheet

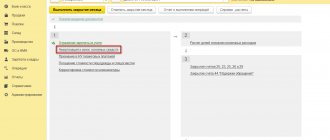

Leasing transactions correspond to the payment schedule located at the link.

If the leasing agreement provides for the reflection of the leased asset on the lessor’s balance sheet, the lessee reflects the leased property on off-balance sheet account 001 “Leased fixed assets”.

The accrual of leasing payments is reflected in the credit of account 76 “Settlements with various debtors and creditors” in correspondence with cost accounts: 20, 23, 25, 26, 29 – when accounting for leasing payments on property that is used in production activities, 44 – on property used in the activities of a trade organization, 91.2 - for property that is used for non-production purposes. Further, for simplicity, in the leasing accounting examples, only entries for the 20th account will be given.

***

Leasing accounting is one of the most complex operations in accounting due to the abundance of possible situations and nuances in financial lease agreements. For example, in addition to the cases described, property transferred under a leasing agreement may be non-redeemable, that is, returnable, and can also be purchased ahead of schedule. The article examines the main cases of leasing: accounting of property both on the balance sheet of the lessor and on the balance sheet of the lessee. Possible options for paying the redemption price are described - separately at the end of the leasing agreement or as part of monthly lease payments. An analysis of the transactions for both sides of the transaction is given.

Even more information can be found in the “Accounting” section.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Postings for current lease payments

Dt 60 – Kt 51 – 236,000 (advance payment (down payment) under the leasing agreement has been paid)

It is necessary to take into account that the advance payment under the leasing agreement can be charged as expenses (offset of the advance payment) not immediately, but throughout the entire agreement. In the above payment schedule, the advance payment under the contract is offset evenly (RUB 6,555.56 each) over 36 months.

Dt 20 – Kt 76 – 29,276.27 (accrued leasing payment No. 1 – 34,546 minus VAT – 5,269.73)

Dt 19 – Kt 76 – 5,269.73 (VAT charged on lease payment No. 1)

Dt 20 – Kt 60 – 5,555.56 (part of the advance payment under the leasing agreement is credited – 6,555.56 minus VAT 1,000)

Dt 19 – Kt 60 – 1,000 (VAT charged against advance payment)

Dt 68 – Kt 19 – 6,269.73 (VAT submitted to the budget)

Dt 76 – Kt 51 – 34,546 (leasing payment No. 1 listed)

The commission that is paid at the beginning of the leasing transaction (commission for concluding the transaction) is charged in accounting to the same expense accounts as current leasing payments.

Postings for the redemption of the leased asset

If there is a buyout price in the leasing agreement (this amount is not included in the leasing payment schedule, for example, let’s take it equal to 1,180 rubles including VAT), the following entries are made in accounting:

Dt 08 – Kt 76 – 1,000 (reflects the costs of purchasing the leased asset when transferring ownership to the lessee)

Dt 19 – Kt 76 – 180 (VAT is charged when purchasing the leased asset)

Dt 68 – Kt 19 – 180 (VAT submitted to the budget)

Dt 76 – Kt 51 – 1,180 (the amount of redemption of the leased asset has been paid)

Dt 01 – Kt 08 – 1,000 (the leased asset is accepted for accounting as part of own fixed assets)

What is leasing?

Leasing (from English to lease - to rent out) is a financial service close to lending. There are three parties involved in a leasing relationship:

- Lessor is a legal or natural person who acquires property and then leases it to the lessee.

- A lessee is a legal or natural person who accepts property for temporary possession and use, and for this regularly pays money to the lessor.

- Seller is a legal or natural person who sells property to the lessor. The seller can become a lessee himself: sell his own property and immediately lease it. This is called leaseback, which is used when there is a lack of working capital of the company and is reminiscent of issuing a secured loan. Leaseback costs are usually less than loan payments, and it also helps you save on taxes and depreciation.

Property, or leased item , is any thing that does not lose its properties during careful use. For example, plants and factories, buildings, equipment, transport. The subject of leasing cannot be land plots and other natural objects.

The term of the leasing agreement may be equal to the useful life of the property. Then, at the end of the contract, the residual value of the property is close to zero, and it can pass to the lessee without additional payments. This type of leasing is called a finance lease. If the term of the leasing agreement is less than the useful life of the property, then at the end of the contract the property is returned to the lessor or purchased by the lessee at its residual value. This type of leasing is called an operating lease.

Accounting for leasing when reflecting property on the lessee’s balance sheet

If, under the terms of the leasing agreement, the property is taken into account on the lessee’s balance sheet, upon receipt of the leased asset in the lessee’s accounting, the value of the property minus VAT is reflected in the debit of account 08 “Investments in non-current assets” in correspondence with the credit of account 76 “Settlements with various debtors and creditors”.

When a leased asset is accepted for accounting as part of fixed assets, its value is written off from credit 08 of account to debit 01 of account “Fixed Assets”.

The accrual of leasing payments is reflected in the debit of account 76, subaccount, for example, “Settlements with the lessor” in correspondence with account 76, subaccount, for example, “Settlements for leasing payments”.

Depreciation on the leased asset is calculated by the lessee. The amount of depreciation of the leased asset is recognized as an expense for ordinary activities and is reflected in the debit of account 20 “Main production” in correspondence with the credit of account 02 “Depreciation of fixed assets, subaccount for depreciation of leased property.

Regulatory framework and definition of leasing

Let's look at how to make transactions when leasing , but first let's determine what laws govern this operation. Leasing is a financial lease and is described in paragraph 6 of Chapter. 34 of the Civil Code of the Russian Federation, and is also regulated by the Law “On Financial Leases” dated October 29, 1998 No. 164-FZ. Accounting for leasing transactions is carried out in accordance with the order of the Ministry of Finance of Russia “On the reflection in accounting of transactions under a leasing agreement” dated February 17, 1997 No. 15.

ATTENTION! Order of the Ministry of Finance dated 02/17/1997 No. 15 loses force as of 01/01/2022. Starting from this period, leasing accounting transactions must be taken into account in accordance with FAS 25/2018 “Lease Accounting”, approved. by order of the Ministry of Finance dated October 16, 2018. The standard can be applied earlier by registering this fact in the enterprise’s accounting policies.

The transition to FSB 25/2018 is not an easy process; prepare for it in advance with the help of a ready-made solution from ConsultantPlus. Free trial access to the system will allow you to familiarize yourself with the material even for those who do not yet have K+.

To briefly describe the essence of leasing, one party to the transaction (the lessor) buys property from an agreed seller for the second party to the transaction (the lessee) and receives money for this service, transferring the property into the possession of the lessee for a certain period. After this period, the property can be purchased by the lessee.

The specified property is in the possession of the lessor and is recorded on its balance sheet. However, the terms of the leasing agreement may provide for accounting of the leased property on the balance sheet of the other party to the transaction, that is, the lessee.

Tax accounting of leasing when reflecting property on the lessee’s balance sheet

In the tax accounting of the lessee, leased property is recognized as depreciable property.

The initial cost of the leased asset is determined as the amount of the lessor's expenses for its acquisition.

For profit tax purposes, the monthly depreciation amount is determined based on the product of the original cost of the leased asset and the depreciation rate, which is determined based on the useful life of the leased property (taking into account the classification of fixed assets included in depreciation groups). In this case, the lessee has the right to apply a coefficient of up to 3 to the depreciation rate. The specific size of the increasing coefficient is determined by the lessee in the range from 1 to 3. This coefficient does not apply to leased property belonging to the first to third depreciation groups.

Leasing payments minus the amount of depreciation on leased property are expenses associated with production and sales.

Types of leasing payments

The size, frequency and method of payment of leasing payments are regulated by the terms of the agreement.

There are three ways to calculate lease payments:

- Fixed from the total amount. Leasing payments are accrued monthly in equal amounts;

- Less advance payment. The amount of leasing payments is also calculated in equal shares, but only from the difference between the fixed total amount and the advance received.

- Based on the amount of minimum payments. This amount is specified in the contract and consists of: depreciation, fees for the use of leased property, commissions and others.

An example of accounting for leasing when reflecting property on the lessee’s balance sheet

Leasing transactions correspond to the payment schedule for property leasing located at the link

The lessee received a passenger car under a leasing agreement, payment schedule parameters:

- leasing agreement term – 3 years (36 months)

- the total amount of payments under the leasing agreement is 1,479,655.10 rubles, incl. VAT – 225,710.10 rubles

- advance payment (down payment) – 20%, 236,000 rubles, incl. VAT – 36,000 rubles

- car cost – 1,180,000 rubles, incl. VAT – 180,000 rubles

The expected period of use of the leased property is four years (48 months). The car belongs to the third depreciation group (property with a useful life of 3 to 5 years). Depreciation is calculated using the straight-line method.

Let's determine the amount of monthly depreciation in accounting. Because the cost of the property (including the leasing company's remuneration) is equal to 1,253,945 rubles (1,479,655.10 - 225,710.10), monthly depreciation will be 1,253,945: 48 = 26,123.85 rubles.

A passenger car belongs to the third depreciation group, therefore, a period of 48 months can be established in tax accounting. The monthly depreciation rate is 2.0833% (1: 48 months x 100%), the monthly depreciation amount is 1,000,000 x 2.0833% = 20,833.33 rubles.

In accordance with paragraph 10 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation, the amount of the lease payment recognized monthly as an expense for profit tax purposes is 8,442.94 rubles (34,546 (lease payment) - 5,269.73 (VAT as part of the lease payment) – 20,833.33 (monthly depreciation in tax accounting)).

Expenses under the leasing agreement are formed monthly in accounting due to depreciation (26,123.85 rubles), in tax accounting - due to depreciation (20,833.33 rubles) and leasing payment (8,442.94 rubles), a total of 29,276 ,27 rubles.

Because in accounting, the amount of expenses over 36 months (the term of the leasing agreement) is less than in tax accounting, this leads to the emergence of taxable temporary differences and deferred tax liabilities.

During the term of the leasing agreement, the lessee has a monthly taxable temporary difference in the amount of 3,152.42 rubles (29,276.27 - 26,123.85) and a corresponding deferred tax liability arises in the amount of 630.48 rubles (3,152.42 x 20% ).

Separately, it is necessary to say about accounting for the advance payment (down payment under the contract) . The following situations are possible:

1. When transferring property for leasing, the lessor provides an invoice for the full amount of the advance (in the given schedule of leasing payments - for 236,000 rubles). In this case, the entire amount of the advance payment minus VAT in tax accounting is recognized as an expense for profit tax purposes.

I would like to note that under the leasing agreement, services are provided throughout the entire contract and the fiscal authorities have no reason to assess compliance with the criteria of paragraph 4, paragraph 2 of Article 40 of the Tax Code of the Russian Federation on the comparability of leasing payments, because individual payments cannot be considered as separate transactions, and the price under a leasing agreement must be analyzed in aggregate for all payments in the agreement.

2. The advance payment under the leasing agreement is offset in equal payments throughout the entire leasing term. In this case, the offset portion of the advance payment is recognized as an expense in tax accounting for profit tax purposes.

In the given example of a leasing payment schedule, it is assumed that an advance invoice is issued to the lessee when the property is leased, i.e. In tax accounting, when transferring property into leasing, expenses in the amount of 200,000 rubles are reflected (the advance payment, which is a leasing payment, is not deducted, since in the first month when transferring property into leasing, it is not yet accrued). At the same time, a taxable temporary difference in the amount of 200,000 rubles and a corresponding deferred tax liability in the amount of 40,000 rubles (200,000 rubles x 20%) arise.

At the end of the leasing agreement, the lessee will continue to accrue monthly depreciation in accounting in the amount of 26,123.85 rubles. There will be no expenses in tax accounting. This will lead to a monthly decrease in deferred tax liabilities in the amount of 5,224.77 rubles (26,123.85 rubles x 20%).

Thus, based on the results of the agreement, the total amount of deferred tax liabilities will be equal to zero:

40,000 (deferred tax liability for the advance payment) + 22,697 (630.48 x 36 – deferred tax liability for current lease payments) – 62,697 (5,224.77 x 12 – reduction of deferred tax liabilities for 12 months of depreciation in the accounting accounting after the end of the leasing agreement).

Documenting

The transfer of property for leasing can be formalized by an acceptance certificate in any form or using the unified forms No. OS-1, No. OS-1a, No. OS-1b, approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7. Deciding which forms will be applied in the organization, fix it in the accounting policy.

This procedure follows from the provisions of parts 1 and 4 of Article 9 of the Law of December 6, 2011 No. 402-FZ, paragraph 4 of PBU 1/2008 and paragraph 1 of Article 655 of the Civil Code of the Russian Federation.

Postings upon receipt of the leased asset

Dt 60 – Kt 51 – 236,000 (advance paid under the leasing agreement)

Dt 08 – Kt 76 (Settlements with the lessor) – 1,253,945 (debt under the leasing agreement is reflected without VAT)

Dt 19 – Kt 76 (Settlements with the lessor) - 225,710.10 (VAT reflected under the leasing agreement)

Dt 01 – Kt 08 – 1 253 945 (a car received under a leasing agreement is accepted for registration)

Dt 76 – Kt 60 – 236,000 (advance paid at the conclusion of the leasing agreement is credited)

Dt 68 (Income tax) – Kt 77 – 40,000 (deferred tax liability reflected)

Dt 68 (VAT) – Kt 19 – 36,000 (VAT submitted on advance payment)

Postings for current lease payments

Dt 20 – Kt 02 – 26,123.85 (depreciation on the car has been calculated)

Dt 76 (Settlements with the lessor) - Kt 76 (Settlements for lease payments) - 34,546 (leasing debt reduced by the amount of the lease payment)

Dt 76 “Calculations for leasing payments” – Kt 51 – 34,546 (leasing payment transferred)

Dt 68 (VAT) – Kt 19 – 5,269.73 (VAT is presented on the current lease payment)

Dt 68 (Income tax) – Kt 77 – 630.48 (deferred tax liability reflected)

Postings within 12 months after the end of the leasing agreement

Dt 20 – Kt 02 (Depreciation of own fixed assets) – 26,123.85 (depreciation accrued on the car)

Dt 77 – Kt 68 (Income tax) – 5,224.77 (reflected decrease in deferred tax liability)

There is also a method in which the initial cost of the leased asset in accounting is equal to the cost of purchasing a car from the lessor, i.e. coincides with the value in tax accounting. In this case, on account 76, when the property is accepted for accounting, only the debt for the value of the property is reflected.

Leasing payments are accrued monthly on credit 20 of account in correspondence with account 76 in the amount of the difference between accrued depreciation and the amount of the monthly lease payment.

Selecting the most reasonable option for reflecting leased property on the balance sheet of the lessor or lessee, as well as agreeing with the leasing company on the optimal scheme for reflecting leasing payments, is a very complex task that requires good knowledge of the specifics of accounting for leasing operations and the peculiarities of the wording in the leasing agreement and primary documents.

Features of car accounting in leasing

Let's say an organization has leased a car and it is on the balance sheet of the lessee - the transactions in this case are similar to those given above. Also, if the lessor is the balance holder of the leased car, there will be no changes in the postings. That is, a leased car is taken into account for accounting purposes in the same way as other property. The only issue that is added is the payment of transport tax, as well as compulsory MTPL and CASCO insurance.

As a general rule, payment of transport tax is carried out by the person in whose name the car is registered. In the case of a car transferred under a leasing agreement, the condition for paying transport tax is specified in the leasing agreement. The postings are made by the transport tax payer, according to the leasing agreement, regardless of whose balance sheet the leased property is on.

As for the payment of mandatory insurance payments, everything here also depends on the terms of the contract. Most often, payments for compulsory motor liability insurance and comprehensive insurance are included in leasing payments evenly for the entire term of the leasing agreement. But there may be a situation where the lessee pays these payments separately annually or quarterly, independently or through the lessor.