When calculating VAT when importing goods into Russia from countries participating in the Customs Union, you must be guided by the Treaty on the Eurasian Economic Union and Appendix 18 to the Treaty on the Eurasian Economic Union.

And on the official website of the Federal Tax Service of Russia in the “Customs Union” section you can view all international treaties, other regulations, information materials and samples of documents related to the activities of the Customs Union (letter of the Federal Tax Service of Russia dated July 9, 2010 No. ШС-37-3/ 6330).

VAT rates for the import of goods and services

For taxation of goods or services imported from abroad, standard tax rates are applied - 0%, 10%, 18%. To correctly use the required percentage during customs clearance and VAT calculations, follow the proposed algorithm:

- identify the product code according to the Unified Customs Tariff of the Customs Union ;

- compare the code with the lists of goods taken into account at a 10% rate ;

- in the absence of the required code in the specified lists approved by the Government of the Russian Federation, a rate of 18% .

The specificity of the calculation and payment of “import” VAT is the fact that the required calculations must be made before the item of trade leaves the customs post. Payment of VAT is made directly to the customs authority, as part of the mandatory payments for clearance.

The importer independently determines the tax base, product code and the amount of VAT required to be paid. If a problematic situation arises when customs applies a higher tax rate than the one calculated by the declarant, the importer can appeal to a higher customs authority.

The importer is given 15 days from the date the cargo crossed the Russian border to pay VAT when drawing up a customs declaration. Each day of delay in remitting tax will “cost” the buyer 1/300 of the key rate, multiplied by the full value of the cargo according to the declaration.

INVOICE

INVOICE (Invoice) - issued by the Seller or Sender.

The main document confirming the value of the declared cargo. May contain the following:

- Document number and date;

- Name of the Seller, Sender, Buyer and Consignee;

- Contract number and date;

- Vehicle number or type of transport;

- Delivery conditions;

- Terms of payment;

- Shipping Name;

- HS code of cargo;

- Country of origin of the cargo;

- Weight of a single package and total weight of the cargo;

- Number of packages, if possible, labeling information;

- Cost and total value of the cargo;

- Cargo packaging;

- Other information necessary for reliable declaration of cargo.

VAT on imports from EAEU countries

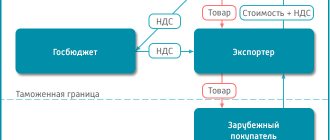

In case of mutual trade with the former union states, VAT on imported goods or services is calculated according to an elementary scheme, and the payment of the budget fee is made to the treasury account of the territorial tax inspectorate.

The object for VAT taxation in the case of imports from the EAEU powers is determined as the cost of the purchased commodity mass, increased by the amount of excise duty (if necessary). The moment of formation of the tax base is determined by the calendar date when the imported goods are recorded in warehouse accounting. The amount of VAT is determined by simply multiplying the cost of purchased commodity products and the required tax tariff.

At the close of the quarter in which import transactions involving the movement of goods from the EAEU were carried out, the Russian importing company (IP) is obliged to submit a VAT declaration to the fiscal authority. The document must be submitted by the 20th day (inclusive) of the month following the reporting period.

Important: the “import” VAT declaration is submitted in the form of a “paper” document. Electronic reporting is used only by those taxpayers whose staff exceeds 100 people.

Simultaneously with submitting the VAT return, the importer is obliged to pay tax according to the banking parameters of “his” tax department. The payment order applies a separate BCC for VAT when importing from neighboring countries.

Accounting entries

Let's look at the accounting entries when working with import VAT:

| Operation | Debit | Credit |

| We reflect the price of the product | 60 | 51 |

| We pay for the goods | 60 | 51 |

| We charge VAT for payment to the Federal Tax Service | 19 | 68 (sub-account “VAT calculations”) |

| Paid VAT | 68 | 51 |

In order to consider in more detail the process of accounting entries, as well as everything related to the import of VAT from Kyrgyzstan, one of the EAEU member countries, you can use the Treaty on the EAEU and Appendix %18 to it. Also on the official website of the tax service there is a section “Customs Union”, where other application documentation is located.

VAT on imports from countries outside the EAEU

When importing goods/services into Russian territory from countries outside the Eurasian Union, the importer is required to pay not only mandatory duties, but also VAT at customs. The procedure for calculating and paying taxes is regulated not only by the Tax Code of the Russian Federation, but also by the Customs Code.

Keep in mind: VAT at customs is paid not at the end of the reporting period, but before the completion of the procedure for releasing the goods from the customs post.

The formula by which the importer calculates the amount of VAT payable is as follows:

VAT = (TSt + VTP + A) x St

where: Tst – the value of the goods indicated in the customs declaration; ICT – the amount of import customs duty; A – excise tax (if necessary); St – VAT rate (%, 10%, 18%).

You need to know: if the imported goods are not subject to customs duties and excise taxes, then the amount of VAT is determined by multiplying the customs value by the desired tax rate.

To avoid conflicts with the customs service due to incorrect calculation of tax, it is advisable for the importer to calculate VAT separately for each group of goods.

Introductory information

As in the case of the export of goods from Russia to the countries of the EAEU, the taxation of reverse transactions is regulated by the norms of international legislation, which takes precedence over the rules of the Tax Code (Article of the Tax Code of the Russian Federation).

The fundamental documents that regulate the payment of taxes when purchasing goods in Belarus, Kazakhstan, Armenia or Kyrgyzstan will be the “Treaty on the Eurasian Economic Union” (signed in Astana on May 29, 2014; hereinafter referred to as the Treaty on the EAEU) and the “Protocol on the procedure for collecting indirect taxes and a mechanism for monitoring their payment when exporting and importing goods, performing work, providing services,” which is Appendix No. 18 to the said Agreement (hereinafter referred to as the Protocol). Please note: the rules established by these documents apply not only to goods purchased for resale, but also to any other property purchased in the EAEU countries (for example, fixed assets or low-value property). This directly follows from the definition of the term “goods” given in paragraph 2 of the Protocol. However, the rules apply only when the imported goods are purchased from a foreign supplier. If goods are imported under an agreement concluded with another Russian organization, VAT is not paid on such goods in the Russian Federation (letter of the Ministry of Finance of Russia dated February 26, 2016 No. 03-07-13/1/10895).

VAT on import of services

Receiving services from a foreign counterparty does not require documentation at the customs post. A legal entity or individual acting as a buyer is a tax agent and must withhold the amount of VAT from the supplier and transfer it to the federal budget.

The documentary basis for payment is a contract, in which it is necessary to state the condition that the amount of VAT is included in the total cost of the service provided. If there is no such clause in the contract, then the importer will be required to pay VAT in excess of the contract amount, at his own expense.

If the work and services performed by the foreign partner are subject to Art. 149 of the Tax Code of the Russian Federation and are not subject to VAT, the importer is relieved of the duties of a tax agent - he must neither calculate nor transfer tax to the budget. However, he retains the obligation to submit a VAT return with completed section 7 to the tax authority at the place of his registration.

Taxes in Armenia

The tax system in the Republic of Armenia is regulated by Law No. 3R 107 “On Taxes” dated May 12, 1997.

Taxes in Armenia are classified into state and local.

You can find out about the standard of living in Armenia on our website.

State tax payments

State tax payments are:

- Profit payment.

- Income tax.

- Excise duty.

- VAT.

Let's look at each of the tax payments in more detail.

Profit tax payment

Income tax is regulated by Law No. 3R 155 “On Income Tax”. It is paid by legal entities.

The object of taxation is the profit received by a legal entity as a result of commercial activities. In this case, the place where the profit is made does not matter.

If the taxpayer has registered an organization outside the Republic of Armenia and regularly receives income from the company, then he is obliged to pay this payment.

The tax rate is 20%.

Income tax

Income tax payment is regulated by Law No. 3R 246 “On Income Tax”. It is paid by legal entities to the state from income received from labor activities (salaries). The rate of this payment is progressive and directly depends on the salary level of the Armenian.

If the income of an Armenian citizen is below 120 thousand drams (the dram is the national currency of Armenia), then he is obliged to contribute 15% of his profit. For wages from 120 to 320 thousand drams, the rate is 18 thousand drams. An additional 25% of the amount exceeding 120 thousand drams is paid.

With an income of 320 thousand drams, the tax rate is 68 thousand drams. Additionally, the Armenian is obliged to contribute 30% of the amount exceeding 320 thousand drams to the state budget.

Income tax in different countries of the world

Foreigners working in the country are additionally charged the following fees:

- Insurance compensation in the amount of 5% of annual income.

- Other payments (dividends, royalties) in the amount of 15%.

Excise tax

The excise tax is regulated by Law No. 3R 79 “On Excise Tax”. This is an indirect payment paid exclusively from transactions with various groups of goods subject to excise duty.

Excise goods include alcoholic beverages, tobacco products and petroleum products. There is no single rate. It depends on the type of product.

List of excise rates based on product:

- Beer (for 1 l) - 70 drams.

- Wine (per 1 l) - 100.

- Champagne (per 1 liter) - 180.

- Vermouth (per 1 l) - 500.

- Cider (per 1 l) - 180.

- Alcohol (per 1 liter) - 600.

- Cognac (per 1 l) - 300.

- Alcohol tinctures (per 1 l) - 1500.

- Tobacco (per 1 kg) - 1500.

- Petroleum products (per 1 ton) - 27,000.

- Diesel fuel (per 1 ton) - 11,500.

- Oil gas (per 1 ton) - 1000.

What is necessary to obtain Armenian citizenship can be found here.

VAT

VAT is regulated by Law No. 3R 118 “On Value Added Tax”. This type of payment is paid in the following situations:

- Import of goods into the territory of the Republic of Armenia.

- Production of goods.

- Sales of services within the country.

It is paid by legal entities and private entrepreneurs.

The standard fee rate is 20%.

People are exempt from paying this fee in the following situations:

- Payment for tuition at any educational institution in Armenia.

- Sales of stationery products necessary for the educational process (pens, notebooks, etc.).

- Conducting research work.

- Implementation:

- Agricultural products.

- Printed products.

- Lottery tickets.

- Precious stones.

- Carrying out insurance operations.

Local tax payments

Local tax payments include:

- Payment on property.

- Land.

- Hotel.

- Payment for a vehicle parking space.

Let's look at each of them in more detail.

Payment on property

This type of tax is direct. It is paid by owners of real and movable property, in particular real estate and various vehicles.

There is no single rate. It is progressive, that is, it directly depends on the estimated value of the property. The rate for vehicles is calculated based on the power of the vehicle.

If the assessed value of the property is below three million drams, then the owner is not subject to tax.

For real estate prices ranging from three to 10 million, the tax is 100 drams. An additional 0.1% is paid from the amount that exceeds three million drams.

If the property price is from 10 to 20 million drams, the rate increases to 7100 drams. An additional 0.2% of the amount that exceeds 10 million drams is paid.

If the property price is from 20 to 30 million, the rate increases to 27,100 drams. An additional 0.4% of the amount that exceeds 20 million drams is paid.

With a property value of 30 to 40 million drams, the rate is 67,100 drams. Additionally, the owner pays 0.6% of the amount that exceeds 30 million drams.

For real estate values of 40 million and above, the fee is 127,100 drams. Additionally, the owner pays 0.8% of the amount that exceeds 40 million drams.

Table. Rates for vehicles

| Criteria | Horsepower | Price for each horsepower (indicated in drams) |

| Facility for up to 10 people | up to 120 | 200 |

| Facility for up to 10 people | from 120 to 250 | 400 |

| Facility for up to 10 people | over 250 | 500 |

| Facility with a capacity of over 10 people | up to 200 | 100 |

| Facility with a capacity of over 10 people | over 200 | 200 |

Land tax

This type of tax payment is direct. It is paid by land owners. There is no flat rate. It depends on the cadastral price of the land plot and its location.

For plots located in populated areas, a rate of 1% applies.

For plots located outside the populated area, the rate is 0.5%.

You can find out about salaries in Armenia and available vacancies on our website.

Paying taxes

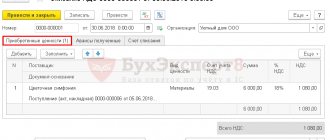

An application for payment of indirect taxes is a document confirming tax payments made. This application must be submitted to the tax office at the place of registration before the 20th.

In 2021, there is also a new service for filing papers electronically.

Source: https://VisaSam.ru/emigration/pereezdsng/nalogi-v-armenii.html

Right to tax deduction for VAT

According to the generally established rule, taxpayers who have paid VAT at the customs post have the opportunity to declare a deduction in the declaration for the amount of tax paid. The provision of a deduction is guaranteed if the following criteria are met:

- imported goods will be used on Russian territory in transactions subject to VAT;

- imported products will be resold in the future;

- a tax deduction can be claimed by a Russian company only in the quarter when the goods are registered;

- receipt of imported goods is confirmed by an invoice, contract or customs declaration;

- payment of VAT is certified by primary documents received at customs.

If the importer is a business entity exempt from VAT or operating under a special regime, then the tax deduction is not applied. The VAT paid at customs will be taken into account in the nominal price of the goods upon receipt and subsequent sale.

Information about received imported goods/services is subject to entry into the purchase book indicating the amount of VAT. The prerequisite for registering the fact of purchase is payment of tax and an import statement certified by the tax authority.

Documents to confirm the right to deduct VAT

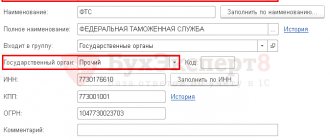

The initial documents allowing the importer to claim VAT deduction are:

- foreign trade contract with a foreign supplier;

- invoice for payment from the supplier (invoice);

- customs declaration - customs declaration (copy);

- bank statements, certified duplicates of payment orders.

All documents justifying the application for a VAT tax deduction when importing goods should be kept for at least four years.

Tax deduction for prepayment

In most cases, for foreign trade deliveries, prepayment is practiced. When transferring an advance payment for the upcoming receipt of goods, the buyer pays VAT on the advance payment amount.

In order to avoid duplicate taxation, VAT on advances made can be declared as a tax deduction during customs clearance of goods delivery and payment of the final amount of VAT.

Many Russian companies prefer not to deal with customs clearance of imported goods themselves, but delegate this procedure to intermediaries. If VAT at customs was paid by a third party, but at the expense of the importer and on his behalf, then the amount paid can be recorded as a tax deduction.

Sanitary, Veterinary, Phytosanitary certificates

Sanitary, Veterinary, Phytosanitary certificates (by type of cargo under control) - issued by the competent authorities of the country of export, sometimes certified by authorized representatives of the Russian Federation in the exporter’s country. These documents are Quarantine certificates to confirm the absence of various diseases for a number of goods of plant or animal origin. They are controlled by border veterinary and phytosanitary control services. They are necessary for import into the territory of the Russian Federation, the procedure for passing veterinary or phytosanitary border control, Russian certification and cargo declaration.

IMPORTANT:

- so that the form of these certificates complies with the currently valid agreement and requirements for cargo between the Exporter’s country and the Russian Federation. The established form of these documents has an English and, in most cases, a Russian translation;

- correct indication of the final recipient and place of unloading.