Legal basis

How vacation pay will be paid in 2019-2020 will become clear when they consider the bill proposed by the Ministry of Labor, which has not yet even been submitted to the State Duma of the Russian Federation for consideration.

Currently, the payment date is determined strictly according to the norms of the Labor Code of the Russian Federation. It is necessary to refer to Art. 136 of this codified act. The last paragraph of the article contains a brief formulated rule, which raises so many questions in practice: the employer is obliged to issue vacation pay to the employee no later than three days in advance.

It would seem that this principle is formulated as clearly as it is defined in Art. 22 of the Tax Code of the Russian Federation, deadlines for transferring personal income tax from vacation pay: no later than the last day of the month of their transfer. However, this is not entirely true; in practice, various situations arise, which we will discuss in more detail later.

Step-by-step instruction

On May 21, according to the vacation schedule, an order was issued to grant regular annual leave to Elena Viktorovna Avdeeva for the period from 06/07/2021 to 06/17/2018 for a period of 10 calendar days.

On June 4, the accountant calculated and paid vacation pay to the employee.

On July 2 (postponed from June 30) personal income tax was paid on vacation pay to Avdeeva E.V.

Step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Accrual of vacation pay | |||||||

| June 04 | 26 | 70 | 13 083 | 13 083 | 13 083 | Accrual of vacation pay | Vacation |

| 70 | 68.01 | 1 701 | 1 701 | Withholding personal income tax | |||

| Payment of vacation pay to a bank card | |||||||

| June 04 | — | — | 11 382 | Formation of payment statement | Statement to the bank - According to the salary project | ||

| 70 | 51 | 11 382 | 11 382 | Vacation pay | Write-off from current account - Transfer of wages according to statements | ||

| Payment of personal income tax to the budget | |||||||

| July 02 | 68.01 | 51 | 1 701 | Payment of personal income tax to the budget | Debiting from a current account – Tax payment | ||

Features of vacation payments

Transferring vacation pay is an operation similar to calculating salary receipt. Payment occurs in stages:

- The accountant calculates the amount of vacation payments.

- The employee is notified of this, as well as how much he is entitled to. The notification comes in writing.

- Money in a predetermined amount is transferred to the person’s salary card. In addition, he can receive them in cash through the cash register. It all depends on the form of remuneration chosen by the organization.

Vacation pay is a citizen's income. Therefore, officially working citizens are responsible for paying taxes to the state budget. And this fee is included in the amount of vacation pay, calculated at a rate of 13%. The amount of the mandatory fee is withheld from the company employee when issuing money. In addition to taxes, do not forget about the contributions that are transferred by the employer to extra-budgetary funds.

The legislator does not set the exact date when you need to apply for leave. If, for example, this is done 3 days in advance, the employer will not have time to calculate vacation pay. Therefore, it is better to write it a week before the intended vacation. At many enterprises, the application is written in 2 weeks.

General accrual algorithm

Every employer is required by law to pay statutory holiday pay strictly in the prescribed amount. If this rule is not followed, the company or individual entrepreneur will be assessed a certain fine. Calculating the amount of holiday pay required by law is relatively simple. It is carried out as follows:

- The estimated time period is determined. By default, its standard value is 12 full months preceding the start of vacation or dismissal. If such a billing period is slightly different, you will need to set the year and month yourself;

- Time periods that are not used to calculate compensation are excluded. A detailed list of days is presented in the official government decree;

- In conclusion, the personnel employee multiplies the total number of days by the average daily earnings established in the organization. After this, personal income tax is calculated, the amount of which is subtracted from the final amount.

The amount received after calculations must be transferred to the employee within the period established by modern legislation.

The process of crediting vacation pay is carried out using the usual method - card, cash at the cash desk. The payment of the required amount is reflected in the accounting report. Failure to comply with this rule will automatically result in the appointment of an official desk audit. This situation, in turn, will lead to rather unpleasant consequences for the employer. These may include fines and other equally serious sanctions.

What amounts should be included in the calculation?

When calculating average earnings for a working year, it includes those payments that are approved by the organization. Such payments include: salary at the approved rate; compensation for overtime work; premium; other payments for labor performance. But there are payments that can be issued along with the salary, but will not be taken into account when calculating vacation pay. These are: travel payment; compensation for food and the use of personal transport; sick leave; other non-labor or social benefits.

Free legal consultation

Free legal consultation We will answer your question in 5 minutes!

Ask a Question

We will answer your question in 5 minutes!

Ask a Question

When is it paid?

Every employee who is authorized to calculate and accrue funds is required to know when vacation pay is paid? The legislation has established a certain period for this - three days before the start of the holiday.

This is also important to know:

What is study leave and how to apply for it

But this issue also has its own nuances. For example, what to do if the accrual date falls on a weekend and the accounting department is closed. In this situation, the money must be transferred on the last working day before the weekend. The same applies to holidays. According to the law, none of the holidays, especially long ones, can interfere with the payment of vacation pay.

Therefore, if vacation starts on Monday, when are vacation pay paid? Funds can be transferred on Friday. In addition, tax is also charged on vacation pay. This fact should not be forgotten when calculating funds.

Another fact that cannot but concern employees is whether vacation pay is paid along with their salary or not? The law does not provide for such a rule. Not a single legislative act speaks of this as an obligation, which means that the employer should not pay both wages and vacation pay at the same time. The employee must receive vacation pay three days before the rest, and the salary must be accrued on time.

3 working days or calendar days

No changes have been made to this rule. Thus, the payment period for vacation pay in 2021, as in all previous years, is three days. However, the practical application of this rule has long been a matter of debate. It is not clear from the text of the article whether the payment period for vacation pay is 3 working or calendar days, and whether the payment day is included in the specified period. No separate methodological instructions were given in this regard, however, explanations from the Ministry of Labor did follow, although they were quite contradictory; there is also no uniform judicial practice on this issue.

Terms and procedure for calculating vacation pay according to the Labor Code of the Russian Federation

To calculate vacation, the following indicators are taken into account:

- The number of working days of a person. This is the billing period and its duration.

- The amount of wages for the billing period.

- Rate for 1 working day (average).

- Total payment amount.

The main indicator in calculating vacation is the billing period. It determines the number of days that employees are paid when they go on vacation.

If a person has worked for a company for at least a year, then his pay period is 12 months. All calendar days are counted, from the 1st to the 30th or 31st of a specific month. In addition, an indicator of the employee's salary is required. It is considered the total income received by him during the billing period. How is vacation pay paid correctly? If a person works at an enterprise and regularly receives a salary, then it will be multiplied by 12 (the sum of the months of the year). From this we get the amount of earnings for the year. But such a calculation occurs if a person has worked at the enterprise for more than a year.

The average income that a person receives in 1 day is also a component of the calculation.

Important

It is logical that a person may not work at the enterprise for 12 months, but he is still entitled to vacation. In this situation, a different calculation algorithm is used, since each case is individual.

Regardless of the calculation, an employee of an enterprise has the right to vacation. It must be provided by the employer every year. Rest is paid. This system should not be confused with other leaves, which are regulated by other articles of the Labor Code of the Russian Federation, and can be provided by agreement between the employer and his employee. How are vacation pay paid? Three days before going on vacation according to the previously written schedule.

Number of vacation days in 2021

The minimum duration of annual paid leave is 28 calendar days (Part 1 of Article 115 of the Labor Code of the Russian Federation).

From the recent letter of the Ministry of Labor dated September 24, 2019 No. 14-2/OOG-6958, we can conclude that an employee must take 14 days off in a row for the current working year. Let me explain.

The Labor Code of the Russian Federation allows the annual paid leave to be divided into parts by agreement of the parties (Part 1 of Article 125 of the Labor Code). In this case, one of the parts must be at least 14 calendar days.

According to the Ministry of Labor, at least 14 calendar days should be part of the annual paid leave for the current working year. If an employee takes seven days for the last year and seven for the current year, the requirement of Part 1 of Article 125 of the Labor Code will not be met.

This is also important to know:

How compensation is made for unused vacation upon dismissal

For example, an employee has accumulated seven unused calendar days of vacation for the last working year. He plans to add them to the vacation for the current working year. In this situation, the duration of one part of the vacation in the current year must be at least 21 calendar days (14 + 7). Then there will be no complaints against the company. That is, the employee must take at least 14 days off in a row for the current working year.

If the vacation coincides with a holiday

Employers often have a question: how to correctly calculate vacation pay if the period chosen by the employee falls on holidays or transfer days?

According to Art. 120 of the Labor Code of the Russian Federation, non-working holidays are not included in the number of calendar days of vacation, but transfer days no longer fall under this rule. Transfer days are, in fact, weekends that coincide with holidays. It is the weekends that are transferred, so they are included in the duration of the vacation and are paid in the general manner.

Example 1. An employee goes on vacation for two weeks from June 4 to June 17. Payment is due within 13 days, as this period falls on an official public holiday - June 12th. June 12 in 2018 falls on a Tuesday; Monday, June 11 was also a day off, but this was due to the postponement of Saturday, June 9, which was a working day this year. Therefore, only one day is excluded.

Example 2. An employee goes on short-term leave from October 29 to November 4. Only six days of vacation are subject to payment, since November 4 is a non-working holiday. In this case, the employee will have a rest until November 5 inclusive, because the day off from Sunday, November 4, is postponed to November 5.

When are vacation pay transferred?

Finding out this period is necessary in order to plan a budget and calculate funds for vacation and other expenses.

The payment will be accrued after the employer’s order is submitted to the accounting department in form T-6.

How many days in advance

To find out how long before the start of the vacation vacation pay is transferred, you need to refer to the norms of the Labor Code of the Russian Federation - Art. 136. The last paragraph contains information that vacation pay is paid no later than three days before the start of the vacation.

Internal regulations may provide for a different period, but it should not be less than the period specified in the law.

Upon dismissal

If an employee quits and did not use his vacation, then the money should be calculated in the following way:

- The coefficient is 2.33 (for a vacation of 28 days) multiplied by the number of months worked in a year.

- The resulting value is the vacation time that must be paid. If an employee leaves in the first half of the month, then this amount will be rounded down; if in the second half, then up.

- The calculated vacation period is multiplied by the employee’s average daily earnings.

Vacation pay must be paid along with the settlement. The employer must issue it on the last working day.

Payment of vacation pay according to the Labor Code of the Russian Federation must be made within the time limits established by law.

When going on maternity leave

You can receive basic paid leave payments only after leaving maternity leave and only if the woman decides to use the right to basic leave.

Material aid

One should distinguish from vacation pay financial assistance, which can be paid both by the employer and by other organizations - public associations and trade unions.

Its size is regulated by local regulations and depends on the decision of the organization’s governing bodies.

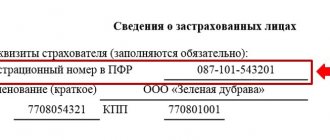

Reflection in reporting 6-NDFL

Tax amounts are calculated by tax agents on the date of actual receipt of income on an accrual basis from the beginning of the tax period. The dates for receiving income depend on the type of income; for vacation pay, this is the date of actual payment of vacation pay to the employee.

In 1C, this date is the date of the document of actual payment transfer: it will be reflected on page 100 of Section 2 of form 6-NDFL. In our example, this is the date of the document Write-off from the current account , specified in the Date .

In Form 6-NDFL, the accrual and payment of annual leave is reflected in:

Section 1 “Generalized indicators”:

- line 020 - 13,083 , amount of accrued income;

- pp. 040 - 1 701 , amount of calculated tax.

- pp. 070 - 1 701 , amount of tax withheld.

Section 2 “Dates and amounts of income actually received and withheld personal income tax”: PDF

- page 100 - 06/04/2018 , date of actual receipt of income;

- page 110 - 06/04/2018 , tax withholding date.

- page 120 - 07/02/2018 , tax payment deadline.

- pp. 130 - 13,083 , the amount of income actually received.

- pp. 140 - 1,701 , amount of tax withheld.

Responsibility for violation of payments

Sending employees on vacation is the direct responsibility of the employer. This is recorded in Chapter 19 of the Labor Code. The document specifies the procedure for its provision, maintenance and payment. The types of additional leave for this or that category of citizens or under different working conditions are indicated.

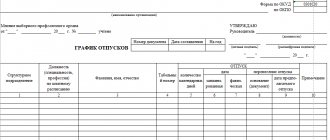

The employer is obliged to maintain a vacation schedule, which takes into account all staff rest days, and also monitor the timely transfer of money and calculation of vacation pay. Any violation is very strictly punished by supervisory authorities in the form of fines from 60 thousand rubles and above to the suspension of the organization’s activities for 90 days.

The fact of a violation can be recorded both during a routine inspection of the company by government agencies, and when an employee applies. First of all, the availability and validity of the schedule, the correctness of the submitted application and its dates, the presence of a signed order and information about the transfer of vacation money are checked. If any document is drawn up incorrectly, as a result of which the employee does not receive vacation pay on time or in full, this is a reason for imposing a fine.

Payments upon dismissal

For unused vacation days when an employee is dismissed for any reason, including at the initiative of the organization for labor offenses, monetary compensation is paid for the remaining days of rest.

From the first day of work, a person accumulates days of rest. In the process of work, he must use them, but this does not always work out. Sometimes, due to large volumes of work or simply the employee’s lack of desire to rest, the right to vacation is not used. Sometimes the employer himself does not allow his subordinates to rest, which is a direct reason for contacting the authorities.

In any case, vacation days accumulate and do not expire after a certain amount of time. Article 127 of the Labor Code of the Russian Federation enshrines a person’s right upon dismissal to receive compensation for vacation days not taken off, or to use it one last time before leaving. The employer cannot prevent this.

This is also important to know:

How to file a complaint to an employer for non-payment of wages: sample and examples

Vacation compensation is paid along with the calculation of wages on the day of dismissal automatically, and no statements need to be written. The calculation is based on the holiday pay formula. By agreement with the manager, you can take vacation instead of the work required by law upon dismissal.

In this case, a standard application is written, and vacation pay is paid according to the general scheme. Any discrepancy with the specified procedure and obstacle of the company management is a gross violation of the employee’s rights and can be punished by government authorities in the form of fines and removal from office.

Changes in vacation pay payment terms from July 1, 2021

Free legal consultation We will answer your question in 5 minutes!

Call: 8 800 511-39-66

In such a situation, in the employment contract, the director of the company makes reference to a specific provision of the collective agreement. When paying an employee his salary, the accountant indicates the following information on the pay slip:

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

- the main part of the salary, which is accrued for a specific month;

- the size and basis of the deductions, if any;

- monetary compensation, vacation pay, severance pay, etc.

Deadlines for payment of advance payments in 2021 From October 3, 2021, the changes provided for by 272-FZ came into force. Some amendments to the law also apply to advance payments.

The employer prescribes salary accrual periods here. He can also prescribe the issuance periods, describe them in another act, and leave a link to the document in the contract;

- Rules of routine. The head of the company must indicate the periods for calculating wages in the rules of the schedule, and in other documents leave a reference to this provision. The fact is that the rules of the schedule are followed by all employees, and the employment contract is followed only by a specific employee. The company may not have a collective agreement;

- Collective agreement. In this document, the head of the enterprise indicates the point in which the periods for accrual of salary are entered.

However, the legislation does not indicate whether this should be 3 full days or whether rest can begin on the third day after payment of vacation pay. It is also not indicated which days we are talking about: working days or calendar days. Three days can be interpreted in different ways.

In the situation that became the basis for the decision of the Perm Regional Court, the State Labor Inspectorate came to the organization with an unscheduled inspection of compliance with labor legislation and other regulatory legal acts containing labor law norms. The inspectors found a violation in the timing of payment of vacation pay.

They indicated that after payment of vacation pay, at least 3 full calendar days must pass before the start of the vacation. If this requirement is not met, the employee's rights are violated.

In the inspection report, GIT inspectors classified all situations where employees received vacation pay 3 days in advance as violations of deadlines, taking into account the day of going on vacation itself.

You can get a vacation after working a full six months. But this is a vacation “in advance”. Then leave will be granted every 11 months. At the end of each calendar year, a vacation schedule is drawn up, according to which all employees “walk” in the next calendar year.

Vacation can be divided into several parts, but one of them should not be less than 14 calendar days. Then you can “split” your vacation into at least 1 calendar day.

The procedure for “leaving” for a well-deserved work holiday is as follows:

- the HR department notifies the employee in writing 2 weeks before the scheduled leave date;

- the employee writes a leave application;

- the employer signs the application and an order is issued based on it;

- the employee receives “vacation pay” - compensation for the fact that he does not work on these days.

Vacation pay is paid based on the employee’s average earnings for 1 working day in the previous working year. To do this, you need to know the billing period - that is, the start and end date of the working year. For example, an employee goes on vacation in 2021 on July 8, and he got a job on March 23, 2021. The calculation period for vacation pay in 2021 is from March 23, 2021 to March 22, 2019.

To calculate average earnings, it is necessary to add up all labor payments to the employee and divide by the number of days he actually worked in the last working year. The result is the average employee's earnings per 1 working day. This number must be multiplied by the number of days of rest.

Method 2: in fact

For the last month, accruals are taken on the day the vacation pay is calculated, and at the end of the month they make an additional payment. It is clear that this method is suitable for employees whose salaries can be calculated for a specific day. For example, these could be piece workers or employees working on a specific schedule.

Let's change the conditions of the previous example. Let’s say an employee works on a 2-by-2 schedule, and his salary is set at 3,000 rubles. per shift. On the date of calculation of vacation pay (07/26/2020), he will work 14 shifts out of 16 in July. Then the accountant will take into account the amount of 42,000 rubles. (3000 × 14). When the month ends, vacation pay will need to be paid, taking into account an additional 6,000 rubles. earnings.

Additional questions

If the last of three days before the issuance of vacation pay coincides with a weekend

As mentioned above, vacation pay must be issued no less than three days before the first day of vacation. The deadline for paying vacation pay in 2020 remains the same; no changes regarding statutory standards have been adopted.

If the third day is a weekend or non-working day, the payment must be made taking this into account, that is, 4 or 5 days in advance. If the payment is made not through a cash register, but by non-cash transfer to a bank card, you need to take into account the working hours of banks. You may have to make the transfer earlier than 3 days before the start date of your vacation.

This is also important to know:

How to calculate compensation for delayed wages

For example, an employee is scheduled to go on vacation starting May 10, 2017. His vacation pay must be paid no later than May 7. Considering that May 7 is Sunday, and May 6 is Saturday, the day the benefit is issued is shifted. Even if the accounting department works on Saturdays and makes a transfer to the card, the bank is not working, which means the employee will not receive the money. Therefore, payment of vacation pay must be made no later than May 4-5, 2021.

Why vacation pay is less than salary

An unpleasant fact: vacation pay is often less than salary.

Salary for days worked is calculated simply: the salary is divided by the number of working days in the month and multiplied by the number of days worked. For example, in August of this year there are 23 working days, and in May - 20. One working day in May will cost more than in August.

Average daily earnings - the basis of vacation pay - are calculated on calendar days, not working days. Therefore, the SDZ is usually less than the cost of a working day.

When vacation falls only on working days - for example, Monday, Tuesday and Wednesday - then for these three days the person receives three SDZ. And three working days are deducted from his salary, which, as a rule, are more expensive.

Vacation pay can be unpleasantly small:

- if the employee was on maternity leave, on sick leave, on a business trip, on vacation, or participated in blood donation days;

- when there was a salary increase during the year;

- there were no bonuses during the year (or there were, but not for work, but incentive payments in honor of an anniversary, for example);

- there are holidays in the month.

The vacation application was submitted less than 3 days before the expected vacation date

Most likely, such leave will not be issued: the employer will not have time to make calculations and pay vacation pay.

Although the Labor Code of the Russian Federation does not regulate the time for submitting an application for vacation, given that vacation pay must be paid 3 days before its start, the application must be submitted at least 4 days in advance. Otherwise, the employer simply will not have enough time to complete the registration and payment within the period established by law.

It is worth noting that in most cases it is not necessary to apply for annual paid leave. The fact is that enterprises draw up a vacation schedule, of which the employee is notified in advance, against signature.

When the deadline established by the schedule approaches, the director issues an order to grant vacation, and the accounting department calculates vacation pay based on it. The employee, having read the order, puts his signature on it as a sign of consent.

If an employee requires paid leave, but not at the time established by the vacation schedule, he must write an application at least 4-14 days before the expected date of departure.

When should government employees be paid vacation pay?

How many days are paid vacation pay before civil servants go on vacation? In accordance with paragraph 10 of Art. 46 of the Law “On the State Civil Service” dated July 27, 2004 No. 79-FZ, the employer of a civil servant is obliged to transfer vacation pay to him 10 calendar days before the vacation.

Moreover, in this case, the norms enshrined in Law No. 79-FZ take precedence over those approved in the provisions of the Labor Code of the Russian Federation (Article 73 of Law No. 79-FZ). The norms of the Labor Code of the Russian Federation within the framework of labor relations with the participation of civil servants are applied if norms similar in focus are not contained in the specified federal law.

If a government employee's holiday pay is delayed, his employer may also be subject to penalties similar to those established for private employers. At the same time, “percentage” sanctions are applied specifically according to the Labor Code of the Russian Federation, since Law No. 79-FZ does not have alternative norms to them.

Documenting

Leave is provided to the employee in accordance with the approved schedule. Extraordinary release from work is also acceptable. The employee’s right to the first vacation arises six months after being hired at the enterprise.

But some employees, by law, can take a leave of absence from work before the expiration of this period. In such cases, the subordinate must submit an application to management for consideration. An order is issued based on this document. It is drawn up on standard form T-6 or T-6a.

The order is drawn up by the personnel officer or secretary. The order can be issued in free form or on a standard form. Based on it, marks are made in the employee’s personal card, personal account, and vacation pay is calculated. A note-calculation is drawn up to grant the employee exemption from work.