Payment

The Tax Code of the Russian Federation regulates the lists and procedures for collecting excise taxes from manufacturers (or in some

The article presents possible options for filling out an advance invoice in 1C using the example of receiving a non-cash

Accounts receivable is one of the most significant indicators of financial statements. The write-off of accounts receivable is preceded by a large

Frequent amendments made to legislation sometimes lead to the emergence of many issues, including especially

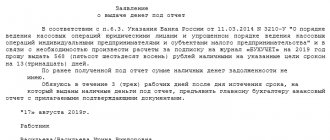

The organization carries out most of its payments through a legal entity's bank account. But often when

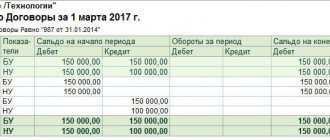

The word “balance” has its roots in the Latin phrase “bis lanz,” which literally means “two scales,”

Tax holidays have existed since 2015. At first it was assumed that they would operate for only three

Increase in the minimum wage from January 1, 2021: was it or not? Minimum wage is the minimum

Organizational property tax is one of the mandatory OSNO taxes for legal entities

Income or income minus expenses? This is the question that every entrepreneur asks himself when choosing