The organization carries out most of its payments through a legal entity's bank account. But often, if it is necessary to make payments for the needs of the organization, funds are issued on account to the employee. The article describes the accounting of settlements with accountable persons.

Registration of the issuance of money on account The procedure for issuing cash is established by Directive of the Bank of Russia No. 3210-U. In clause 6.3, to carry out this procedure it is necessary:

- have an administrative document of a legal entity (IP) or a written statement from an employee;

- issue a cash expense order (RKO) in the KO-2 form.

We offer a sample of filling out the application in accordance with the requirements of the Procedure.

Money is issued for a limited period, after which the employee must provide an advance report (hereinafter referred to as AO) with documents confirming expenses. There are no such time limits. As a rule, it is established in a local act.

Let's give an example of an order.

The issuance of accountable amounts can be made to the employee’s bank card and to the organization’s corporate card (Letters No. 02-03-10/37209, No. 03-11-11/42288), which must be provided for by a local act.

The basis for the transfer is also the employee’s application, which contains, in addition to the mandatory information (clause 6.3 of the Procedure), bank card details.

Important: in the payment order in the line “Purpose of payment” you must write: the transferred funds are accountable (“Advance for business needs”).

Rules for issuing imprest amounts

Accountable amounts can be issued to any employee of the organization, provided that he has no debts on previous advances.

The basis for issuing money is a written statement from the employee, which indicates the timing, amount and purpose. The application must be signed by the manager. In recent years, non-cash payments to employees have been gaining popularity in state and municipal institutions. Therefore, money against the report can not only be given to the employee in cash through the cash register, but also transferred to the institution’s debit cash desk or to the employee’s bank card (letter of the Ministry of Finance of Russia dated August 25, 2014 No. 03-11-11/42288). The specific procedure for settlements with accountable persons is regulated by internal regulations on the issuance of cash and strict reporting forms.

It should be remembered that you can issue/transfer to an employee only the amount that is indicated in the application and approved by the head of the institution. Money is allocated for strictly defined purposes and provided for by the same statement.

When issuing or transferring accountable funds to a card, an accountant must keep track of two important points:

- Since the employee purchases goods (pays for services) in the interests of the institution, these transactions should be considered transactions between legal entities. This means that it is necessary to comply with the amount of cash payments between legal entities. Currently the upper limit is set at RUB 100,000. (Instruction of the Central Bank of the Russian Federation No. 3073-U).

- If, in the interests of the institution, an employee pays for goods/work/services from one counterparty, he must comply with the annual limit on the total amount of such purchases (Federal Law dated 04/05/13 No. 44-FZ). In this case, the payment method does not matter.

Supporting documents

In addition to the advance report, the employee must attach documents confirming expenses: sales and cash receipts, tickets, boarding passes, BSO receipts, waybills, route maps, etc.

All attached documents must be original. If the original is lost, then another supporting document can confirm expenses for income tax purposes, for example, a carrier’s certificate in case of loss of a boarding pass (Letter of the Ministry of Finance of the Russian Federation dated February 27, 2012 N 03-03-07/6, Letter of the Ministry of Finance of the Russian Federation dated January 13, 2012 N 03-03-06/1/11) or duplicate.

A duplicate of a document is a repeated copy of the original document (paragraph 22, paragraph 3.1, paragraph 3 of GOST R 7.0.8-2013, approved by Order of Rosstandart dated October 17, 2013 N 1185-st).

Cash receipts

A cash receipt will be considered properly executed if it is drawn up not only in accordance with the requirements of Federal Law 402-FZ, but has all the details specified in Art. 4.7 of Federal Law No. 54-FZ of May 22, 2003 “On the use of cash register equipment when making cash payments and (or) settlements using electronic means of payment” (hereinafter referred to as Federal Law No. 54-FZ).

A cash receipt received by the buyer in electronic form and printed on paper by him is equivalent to a cash receipt printed by a cash register, provided that the information specified in such a cash receipt is identical to the cash receipt sent to the buyer in electronic form (clause 4 of article 1.2 of the Federal Law N 54-FZ).

In 2021 (from July 1 to September 1), due to the lack of a sufficient number of fiscal drives on sale, the Federal Tax Service of the Russian Federation explained that if it is impossible to use a cash register that meets the requirements of the law, organizations and individual entrepreneurs are required to issue the buyer on paper confirmation of the fact of settlement between the organization (IP) and the buyer (Letters dated June 26, 2017 N 03-01-15/40115, dated June 14, 2017 N 03-01-15/36887). Can the document issued confirm the buyer's expenses for a given period?

If a check is issued in violation of the law, the tax office will most likely challenge the costs of such a document taken into account when calculating income tax. At the same time, in the absence of distortion of information about the fact of economic life, as well as when the conditions of paragraph 2 of Art. 54.1 of the Tax Code of the Russian Federation, the taxpayer has the right to reduce the tax base for income tax. This argument, if necessary, can be presented to controllers or in court.

VAT presented by the seller in the cash register receipt cannot be deducted. VAT can be written off only for expenses that do not reduce the taxable base (Letter of the Ministry of Finance of the Russian Federation dated January 24, 2017 N 03-07-11/3094).

The department's arguments are as follows:

- VAT can be deducted only on an invoice. Exception - clause 3, 6-8 art. 171 Tax Code of the Russian Federation. The Code does not provide for the specifics of deducting VAT on retail purchases.

- VAT cannot be accepted as expenses for income tax purposes, since clause 2 of Art. 170 of the Tax Code of the Russian Federation does not provide for the possibility of taking into account VAT presented without an invoice in the cost of goods (work, services).

Organizations that are ready to argue with tax authorities in court can use the arguments of the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated May 13, 2008 N 17718/07. It states that if, during retail sales, the seller issued the buyer a cash register receipt in the established form, he fulfilled the obligation to issue an invoice (Clause 7 of Article 168 of the Tax Code of the Russian Federation). This means that a check can replace an invoice for the purpose of calculating VAT.

Cash withdrawal or transfer to card

In accounting, the issuance/transfer of funds for reporting is reflected by the following entries:

In accounting, the issuance/transfer of funds for reporting is reflected by the following entries:

| Debit | Credit | Description |

| 0 208XX 560 “Increase in accounts receivable of accountable persons” | 0 20134 610 “Retirement of funds from the institution’s cash desk” | Funds in rubles were issued for reporting to an employee of the institution in cash or transferred to his personal bank card |

| 0 20111 610 “Retirement of institution funds from personal accounts with the treasury authority” (for budgetary and autonomous institutions) | ||

| 0 20121 610 “Disposal of funds from an institution to a credit institution” (for autonomous institutions that have an account with a credit institution) | ||

| 1 30405 XXX “Settlements for payments from the budget with the financial authority” (for government institutions) |

The transfer of accountable amounts to an institution's debit card is taken into account slightly differently. In essence, this is a transfer by an institution of funds between its accounts, which means that the accounts receivable of the accountable person will arise only when he pays for goods, work, and services. In accounting, these changes are recorded only after money is written off from the debit card account.

An institution can use its own debit card to issue funds to employees on account. In this case, it must submit two documents to the Federal Treasury authority at the place of service (or other financial authority of the corresponding budget). The first is an application to receive cash transferred to the card (f. 0531243) (clause 11 of Rules No. 10n). This must be done no later than the day before receiving funds.

The second document is a breakdown of the amounts of unused funds (deposited through an ATM or cash point) (f. 0531251). The transcript, signed by the manager and chief accountant, is sent to the treasury on the day the funds are deposited (clause 42 of Rules No. 10n). The institution submits the same transcript in order to return funds to the accounts of the Federal Treasury if they were only partially spent or were not used at all.

In general, an institution can both receive and deposit cash into a debit card account through ATMs or special dispensers. For this kind of settlements between institutions and the Federal Treasury, account 21003 “Settlements with the financial authority for cash” is defined (clause 230 of the Instructions for the Application of the Unified Chart of Accounts).

The table shows accounting records that reflect these transactions and documents:

| Debit | Credit | Description |

| 0 210 03 560 | 0 201 11 610 | Funds are debited from the institution's personal account to the institution's debit card |

| 0 201 34 510 | 0 210 03 660 | The institution's cash desk received funds cashed through an ATM or bank cash desk from a debit bank card opened for account 40116 |

| 0 208 26 830 | 0 201 34 610 | An amount of cash was issued from the cash register to pay for other work and services. |

| 0 201 23 660 | 0 201 34 610 | Removal of funds from the institution's cash desk when depositing cash using bank cards through an ATM (cash dispensing point, electronic terminal or other device) |

| 0 210 03 560 | 0 201 23 660 | Funds are credited to the institution's account through an ATM using a debit bank card opened for the account |

| 0 201 11 510 | 0 210 03 660 | The unclaimed amount was returned from the institution’s account to the accounts of the Federal Treasury |

Debit and credit of account 71: what to reflect

| What we reflect on the debit of account 71 | What do we indicate in the credit of accounting account 71 |

| 71 debit account is the amount that was provided to the company employee in advance for specific expenses. That is, this is the money that the employee received as an account. For example, a cashier dispenses cash from a cash register. The balance of account 50 “Cash” decreases - the turnover to the credit account is reflected. 50. And at the same time the debit turnover on the account is reflected. 71 - the employee received accountable funds. Before the subordinate provides an advance report, he will be credited with an advance - a debit balance on the account. 71. Or a debit balance is formed if the employee reported less than the amount received in advance. The remainder should be returned to the organization's cash desk. | In the credit of the account we reflect the expenses of the accountable person, supported by documents. That is, the employee submitted an advance report, and the manager checked and approved it. Then the accountant accepts the transactions for accounting and accrues expenses according to the report. The expenditure of funds is reflected in the credit of accounting account 71. At the same time, the debit balance of the account decreases. The result of the operation may be the loan balance if the reporting employee spent his money on company expenses. The company must repay this debt. That is, pay the amount of the credit balance to the accountable person. |

Report for sub-report

The employee must report for the funds issued in a strictly defined manner. First of all, pay attention to the deadline: the report is submitted to the accounting department no later than three working days from the moment the employee returns to work or from the end of the period for which the money was allocated.

An employee can submit a report in one of two options:

- advance report in form 0504049 with attached primary documents (tickets, checks, etc.);

- statement or cash order - if accountable funds were allocated for payments to individuals (salaries, fees, etc.).

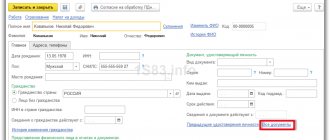

On the front side of the advance report, the employee fills out information about himself: full name, personnel number, position, structural unit. On the reverse side, in columns 1 to 6, in separate entries, based on primary documents, he enters data on the funds spent: amount, expense item, date and number of the supporting document. Primary documents must be attached to the expense report and numbered in the same order as the entries in the report.

The accountant or manager accepts the report. Each institution establishes its own procedure and timing for reviewing the report as part of its internal accounting policy; legislation does not regulate this point.

Having received the advance report from the employee, the accountant checks whether it is filled out correctly and whether all documents are attached. Data on expenses that the institution accepts for accounting are entered in columns 7–10. Opposite each amount is the analytical account number.

The accountant reflects the expenses accepted by the institution for accounting as follows:

| Debit | Credit | Description |

| 0 10500 340 “Increase in the cost of inventories” | 0 208XX 660 “Reduction of accounts receivable of accountable persons” | Expenses accepted by the institution for accounting using funds issued on account |

| 0 10600 000 “Investments in non-financial assets” | 0 208XX 660 “Reduction of accounts receivable of accountable persons” | |

| 0 30200 000 “Settlements for accepted obligations” | 0 208XX 660 “Reduction of accounts receivable of accountable persons” | |

| 0 40120 000 “Expenditures of the current financial year” | 0 208XX 660 “Reduction of accounts receivable of accountable persons” | |

| 0 10900 000 “Costs for the production of finished products, performance of work, services” | 0 208XX 660 “Reduction of accounts receivable of accountable persons” |

A situation may arise when the employee did not spend all the funds or, on the contrary, invested his own. In the advance report, he enters these amounts in the Remaining/Overexpenditure column. In accounting, this will be reflected as a debt of the reporting person or institution. The overexpenditure is recorded and reimbursed to the employee in the same manner as the advance payment, and to return the balance, the accountant creates a record using one of the options:

| Debit | Credit | Description |

| 0 20134 510 “Receipts of funds to the institution’s cash desk” | 0 208XX 660 “Reduction of accounts receivable of accountable persons” | Accountable funds were returned to the institution's cash desk |

| 0 20111 510 “Receipts of funds from the institution from personal accounts in the treasury body” (for budgetary and autonomous institutions) | 0 208XX 660 “Reduction of accounts receivable of accountable persons” | Accountable funds were returned to the institution’s personal account |

| 0 20121 510 “Receipts of funds from an institution in a credit institution” (for autonomous institutions that have an account in a credit institution) | 0 208XX 660 “Reduction of accounts receivable of accountable persons” | Accountable funds were returned to the institution’s personal account |

| 1 30405 000 “Settlements for payments from the budget with the financial authority” (for government institutions) | 0 208XX 660 “Reduction of accounts receivable of accountable persons” | Accountable funds were returned to the institution’s personal account |

Characteristics of account 71

71 accounting accounts are considered active-passive accounts. This means that account balances can have both a debit and a credit balance at the end of the reporting period. This means that at the end of the month the debt may be registered with the employee. For example, a subordinate has just received an advance and has not yet had time to report.

The debt may also be attributed to the company. For example, if an employee spent his own funds to provide for business needs or on a business trip. Overexpenditure is reflected in accounting after the employee has provided an advance report and documented his expenses.

How to take into account debt and collect it from accountable persons

The accountant may have difficulties taking into account accountable amounts if the employee did not submit a report on time for the money spent or did not return the remaining funds from payment for goods/services/work to the institution's cash desk.

If an employee is forced to return accountable amounts, the institution can recover them based on the order of the manager (Article 243 of the Labor Code of the Russian Federation). The time to make a decision is one month after the end of the period established for the return of the advance payment and submission of the report. Please note: the employee must familiarize himself with the order and give his consent to the collection in writing, otherwise the issue of returning the imputed amounts will be resolved in court.

The maximum allowable amount of deduction should be observed (Article 138 of the Labor Code of the Russian Federation) - no more than 20% of wages minus personal income tax.

In accounting, debt collection entries will look like this:

| Debit | Credit | Description |

| 0 30403 830 “Reduction of accounts payable for deductions from wage payments” | 0 20800 660 “Reduction of accounts receivable of accountable persons” | Reflected deduction from wages |

If at any stage the procedure is violated, the issue of return of funds by the accountable person is resolved through the court. The court may decide not in favor of the institution, then the penalty will be considered unfounded. In this case, the accountant writes off the amount as unrealistic for debt collection based on the certificate (f. 0504833).

These transactions in accounting will look like this:

| Debit | Credit | Description |

| 0 40120 273 “Extraordinary expenses for operations with assets” or 0 20930 560 “Increase in accounts receivable for damage to compensate for the costs of the state, state (municipal) institutions” | 0 20800 000 “Settlements with accountable persons” | The debt of an accountable person has been written off based on a court decision |

| ZB 04 “Debt of insolvent debtors” | Reflected on the balance sheet by a simultaneous operation |

The write-off date will be the date of the court order. If the litigation continues or the debtor repays the amount, the debt must be written off from the off-balance sheet account.

To record such situations, the Funds and Settlements Accounting Card (f. 0504051) is used. The data in it is presented by debtor and by type of payment.

Reportable debts in a simplified balance sheet

Debt on accountable amounts must also be reflected in the simplified balance sheet. The same rules and approaches apply as described above for a regular balance.

The only clarification is that in the simplified balance sheet, the lines where accountable debt falls are called slightly differently:

Let us remind you that clause 4 of Art. 6 of the Law of December 6, 2011 No. 402-FZ “On Accounting”. Small enterprises, non-profit organizations, and participants in the Skolkovo project have the right to draw up a simplified balance sheet using the form from Appendix 5 to Order No. 66n of the Ministry of Finance of Russia dated July 2, 2010.

Accounting for accountable amounts using specific examples

To purchase stationery, the secretary of the Prokopyevskaya Village Hospital, A. I. Altufeva, was given 3,500 rubles from the cash register. The funds are allocated from the institution’s own income. The purchased stationery will be used in the activities of the institution, not subject to VAT. The total purchase price is RUB 2,900. (including VAT - 442 rubles 37 kopecks), costs for courier delivery of stationery - 200 rubles. (including VAT - 30 rubles 50 kopecks).

Operations for the purchase of stationery will be reflected in the institution’s accounting records:

| Debit | Credit | Amount, rubles | Contents of operation |

| 2 208 34 560 | 2 201 34 610 | 3 500 | Funds were issued against the report for the purchase of stationery |

| 2 106 34 340 | 2 208 34 660 | 2 900 | Costs for purchasing stationery are taken into account |

| 2 106 34 340 | 2 208 34 660 | 200 | The cost of courier delivery of office supplies to the institution is written off as an increase in their cost (including “input” VAT) |

| 2 105 36 340 | 2 106 34 340 | 3 100 (2 900 + 200) | Purchased stationery items are included in materials |

| 2 109 80 272 | 2 105 36 440 | 3 100 | The cost of stationery put into operation has been written off |

| 2 201 34 510 | 2 208 34 660 | 400 | Accountable funds were returned to the institution's cash desk |

Accounting entries for account 71

Let's look at how to correctly make transactions for 71 accounts. Here are typical transactions and correspondence of accounts. Let us indicate which documents to draw up during the operation.

| Operation | Debit | Credit | Foundation documents |

| Money issued in cash report | 71 | 50 | A cashier's report and an expense order were drawn up |

| Funds are credited to the bank card account | 71 | 51 | Bank statement, payment order for transfer |

| Funds are credited to the report on the organization’s corporate card | 71 | 55 | Bank statement from special company accounts |

| The purchase of fixed assets is reflected in the advance report | 08 | 71 | Certificate of acceptance of works and services |

| Materials and raw materials purchased by the accountable person were capitalized | 10 | 71 | Invoices, sales receipts, transportation documents, acceptance certificate |

| The amount of expenses according to the advance report for production and economic needs is reflected | 20, 26, 44 | 71 | Advance report, invoices |

| Return to the cash desk of funds unspent by the accountable person | 50 | 71 | Cashier's report, receipt order |

| Debt accrued for amounts not returned on time by the accountable person | 73 | 71 | Advance report |

Now let's look at examples of posting entries for various situations.

How to test yourself to avoid mistakes

When working with accountable amounts, accountants make several standard mistakes:

- allow the limit for cash payments to be exceeded;

- issue funds on account or reimburse expenses without appropriate documentary evidence;

- accept an advance report that is not filled out completely or with irregularities;

- incorrectly withholds debt from an employee from his salary

- and many others.

Violations in the accounting of accountable funds are most often detected during an inventory, which a state (municipal) institution is obliged to conduct on a regular basis (Order of the Ministry of Finance of Russia dated June 13, 1995 No. 49). In employee reports, the inventory commission checks whether the purposes for using funds and reporting deadlines are met. In addition, the commission must carefully consider all cases of debt, check the correctness of execution and the validity of the amounts.

To avoid disputes with employees, litigation and complaints from regulatory authorities, the accountant must regularly check this area of accounting, including:

- compare the amounts in primary documents with the amounts in the report, and the report data with entries in the journal of settlements with accountable persons;

- track transactions for the issuance and return of funds using the journal of transactions with accountable persons (f. 0504071) and the journal of transactions on the “Cash” account (f. 0504071);

- check whether transactions with accountable persons are entered correctly in accounting from the point of view of budget classification, etc.

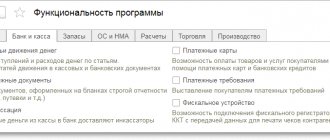

Modern accounting automation tools can be a good help in working with accountable amounts (these include, among others, the Kontur-Accounting Budget program). Programs help the accountant monitor basic parameters, check the compliance of amounts, track cash flow, etc.

Results

Accounting for settlements of funds issued to an accountable person is based primarily on the correct and timely documentation of all transactions. Such operations include issuing money for expenses, reporting by the accountable person, returning unspent amounts, and recording expenses incurred.

Sources:

- Tax Code of the Russian Federation

- Labor Code

- Directive of the Bank of Russia dated March 11, 2014 N 3210-U

- Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Changes from July 1, 2021

On July 1, certain provisions of Federal Law dated July 3, 2018 No. 192-FZ came into force. In cash receipts and BSOs generated when making payments between organizations and (or) individual entrepreneurs using cash and (or) with the presentation of electronic means of payment, additional details have appeared:

- name of the buyer (client);

- INN of the buyer (client);

- information about the country of origin of the goods (when making payments for the goods);

- excise tax amount (if applicable);

- registration number of the customs declaration - when making payments for goods) (if applicable).

Thus, from July 1, 2021, when an accountant purchases valuables by proxy on behalf of the company, not as an individual, the seller must stamp the name and TIN of the buyer on the check. And this will have a significant impact on taxation practices.

Tax risks of documentary reporting errors

If there are errors in the documents of accountable persons or supporting documents are not attached to the advance report, various types of risks may arise, including tax ones:

| Type of violation in reporting documents | Emerging risks |

| Documents confirming expenses are not attached to the advance report |

In “profitable” expenses, it is permissible to take into account accountable expenses if the supporting documents are drawn up in accordance with the legislation of the Russian Federation, and from them it is possible to establish what expenses were incurred (clause 1 of Article 252 of the Tax Code of the Russian Federation, letters of the Ministry of Finance dated January 28, 2020 No. 03-03- 06/3/4915, dated 01/28/2020 No. 03-03-06/1/4913, dated 03/21/2019 No. 03-03-06/1/19017, dated 03/20/2019 No. 03-03-06/1/18478 )

In the absence of documentary evidence of expenses, employees may receive income in kind (Article 211 of the Tax Code of the Russian Federation). Such amounts are not exempt from personal income tax (Letter of the Ministry of Finance dated May 14, 2018 No. 03-03-06/1/31933) |

| Accountable funds were issued without filing applications. Material assets purchased with money issued on account are not related to the company’s activities and are not registered | Fine 40,000 rubles. (Part 1 of Article 15.1 of the Code of Administrative Offenses of the Russian Federation) for violation of Art. 2 and 5 of the Law of May 22, 2003 No. 54-FZ “On the use of cash register equipment...” (Resolution of the Ninth Arbitration Court of Appeal dated October 3, 2017 No. A40-62347/2017) |

| Payment of part of wages under the guise of travel expenses | Additional accrual of insurance premiums on amounts paid (Resolution of the Fifteenth Arbitration Court of Appeal dated December 14, 2017 No. A32-36856/2016) |

| The advance report was not submitted on time, accountable funds were not withheld from the salary of the accountable person | Funds issued for reporting, for which the employee did not report within the established time frame, are recognized as his debt to the employer and are subject to deduction from wages (Article 137 of the Labor Code of the Russian Federation). If deduction is not made, insurance premiums must be charged for the amount of the unreturned report, as for payments in within the framework of labor relations (Articles 420, 421 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance dated 01.02.2018 No. 03-04-06/5808, Letter of the Ministry of Labor dated 12.12.2014 N 17-3 / B-609) |

In addition to tax risks, other negative consequences are possible. For example, if inventory items purchased with accountable money without supporting documents are not capitalized, a claim may be brought against the accountable person for causing damage to the company (Resolution of the Administrative District of the North Caucasus District dated October 5, 2017 No. A32-12049/2015).

What to do if the deadline for submitting an advance report is missed?

In this case, the provisions of Art. 137 Labor Code of the Russian Federation. The employer who issued the accountable amounts has the right, no later than one month from the end of the established period, to decide to withhold amounts for which an advance report has not been received from the employee’s salary of the corresponding accountable amount, provided that the employee does not dispute the grounds and amounts of the withholding. The “safest” course of action in this case is to take a statement from the employee (“I ask you to withhold this amount from my salary...”).

If an employee disputes the amount and basis of deductions, the situation becomes more complicated. For example, he may claim that he lost receipts, or that from his point of view the expense was economically feasible, which the employer does not agree with.

If after a month the situation has not been resolved, then the dispute is considered by a judicial authority or, upon expiration of the period, the employer recognizes this money as employee income.