Save time and money

Accounting services at “My Business” from only 1,667 rubles per month

More details

PSN is another taxation system designed to simplify the lives of entrepreneurs and not burden them with taxes and reports. For an individual entrepreneur, reporting on a patent is even simpler than for other special regimes. But we can’t make you happy and say that it doesn’t exist at all; sometimes we have to pore over paperwork with a patent.

So, you have acquired or are planning to acquire a patent to conduct any activity from the list in Article 346.43 of the Tax Code of the Russian Federation. As with other modes, the reporting set will depend on whether you have employees.

Features of the use of PSN

Activities on a patent are regulated by the provisions of Chapter 26.5 of the Tax Code of the Russian Federation. Only entrepreneurs can use this special regime (Article 346.44 of the Tax Code of the Russian Federation). It appeared relatively recently: from 01/01/2013. PSN is put into effect on the territory of a constituent entity of the Russian Federation by regional legislation. The patent taxation regime can be applied only in relation to certain types of activities listed in paragraph 2 of Art. 346.43 Tax Code of the Russian Federation. Mainly these include:

- retail;

- catering;

- transportation;

- services to the population.

Using such a system, individual entrepreneurs are exempt from paying personal income tax and VAT.

Requirements for accounting and reporting

The rules for recording business transactions are enshrined in Article 346.53 of the Tax Code of the Russian Federation. Tax accounting of individual entrepreneurs on a patent comes down to recording the income actually received by the entrepreneur. Receipts are recorded throughout the entire period of validity of the patent. The accounting journal has the right to request territorial inspections as part of checking compliance with restrictions.

The form and rules for filling out the register were approved by Order of the Ministry of Finance of Russia No. 135-dated October 22, 2012. Revenue information is entered in chronological order. The lines record the serial number of the business transaction, details of the primary documents, their contents and the amount in rubles. It is permitted to maintain the register electronically. However, after the end of the reporting period, the magazine is printed on paper, the sheets are numbered and stitched.

Important! Order of the Ministry of Finance of Russia No. 135-also introduced a book of income and expenses for “simplified people”. The difference between the magazine for PSN is the absence of a section on costs. Patent holders do not document their expenses.

Entrepreneurs may not keep accounting records (clause 2 of Article 6 of Law No. 402-FZ of 12/06/11). Registration of business transactions is carried out by merchants on a voluntary basis. In this case, one should rely on the clarifications of the Ministry of Finance of the Russian Federation No. 64n dated December 21, 1998, No. PZ-3/2015 dated June 3, 2015, as well as numerous PBUs.

How to switch to PSN

To switch to the patent system, an entrepreneur must submit a corresponding application to the Federal Tax Service.

Within five days, the Federal Tax Service is obliged to issue a patent or a notice of refusal to issue with an explanation of the reasons. The cost of the patent will be calculated by the inspectorate and indicated in the document. Depending on the period for which it was issued, payment terms are established:

| Validity | Tax payment procedure |

| Less than six months | Paid in full before the end of the term |

| From six months to a year | One third is paid within 90 days from the date of receipt, the remaining amount is due before the expiration date |

You can preliminary calculate its cost using the service on the official website of the Federal Tax Service.

How to get a patent?

Before an individual entrepreneur begins to operate under a patent, he must submit an application in the form approved by order of the Federal Tax Service of Russia dated July 11, 2017 No. ММВ-7-3 / [email protected] to the tax authority at the place of business activity under the patent.

On February 18, 2020, the Federal Tax Service approved a new application form No. SD-4-3/2815 for the use of PSN. You can submit any of these forms, the Federal Tax Service inspectors will accept them.

Patent application form.

The difference between the new and previous forms is that in the KND 1150010 form (old sample) it is not possible to establish the exact number of days of work on the PSN. In the old form, you can only specify the number of full months during the year.

A new form was required to implement the amendments made to Article 346.51 of the Tax Code of the Russian Federation, which allows the acquisition of a patent not from the beginning of the month, but from any date.

For each type of activity, it is necessary to fill out a separate application, this is due to the fact that the potential income, on which the size of the cost of the patent depends, varies depending on the type of activity and on physical indicators.

Then, 10 days before the start of business activities on a patent, an application must be submitted:

- if the individual entrepreneur will operate at the place of registration of the individual entrepreneur, then the application is submitted to the tax authority at the place of registration of the individual entrepreneur;

- If an individual entrepreneur plans to carry out activities in the territory of an administrative-territorial unit where he is not registered for tax purposes, then the application must be submitted to any territorial tax authority at the place where the individual entrepreneur plans to carry out business activities.

In 2021, regional authorities are allowed to pass laws allowing the combination of several related activities in one patent. There will be no need to acquire a separate patent for each type of activity. Accordingly, one application will be submitted to work on several similar types of business activities.

A patent application can be submitted in the following ways:

- personally or through your representative with a notarized power of attorney;

- by post with a description of the contents;

- transmit in electronic format via the Internet. The application must be signed electronically.

Then, after 5 working days, the individual entrepreneur must again apply to the tax authority to obtain a patent. This deadline is not always respected by the Federal Tax Service, so it is better not to rush and contact the Federal Tax Service 10 days after submitting the application.

The patent form was approved by Order of the Federal Tax Service of the Russian Federation dated July 11, 2017 N ММВ-7-3/ [email protected] " (old form) and recommended by letter of the Federal Tax Service of the Russian Federation No. SD-4-3/2815 dated February 18, 2020 (new form).

To start working on the PSN from January 1, 2021, an application for the use of the PSN must be sent no later than December 17 (10 working days before the patent begins to be valid). However, in connection with the massive transition from UTII to PSN, the Federal Tax Service sent a letter dated 12/09/2020 No. SD-4-3/ [email protected] about extending the deadline for accepting applications for patents in December of this year. The point of the letter is that the federal tax service has demanded that local Federal Tax Service Inspectors accept applications for a patent until December 31, 2021 inclusive, without taking into account the deadline for filing the said application established by paragraph 2 of Article 346.45 of the Code,”

DOCUMENTS FOR REGISTRATION OF A PATENT FOR 2021

The legislation does not require documents confirming the right to use PSN to be attached to the application. However, as practice shows, sometimes inspectors of the Federal Tax Service are asked to provide copies of documents from which information can be obtained, for example, about the area of objects leased by an entrepreneur. Or other documents on the basis of which the value of the patent can be calculated. Therefore, be prepared that after you submit your patent application, you may receive a request for additional documents.

Having received a patent, an individual entrepreneur can engage in business activities legally.

What kind of reporting needs to be submitted to PSN

Article 346.52 of the Tax Code of the Russian Federation directly states that a tax return under the patent taxation system is not provided. Since an entrepreneur in the patent system is exempt from accounting, he does not prepare financial statements.

Thus, when applying a patent, the entrepreneur is maximally freed from communication with regulatory authorities. You only need to contact the tax office to receive it or to stop working in this mode.

When should this be done?

Individual entrepreneur on OSNO what kind of reports does he submit without employees and with them?

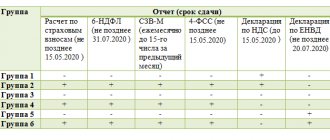

An individual entrepreneur working on a patent submits reports within the following deadlines:

- income journal: submitted once for the entire period, at the end of it;

- information on the number of staff: provided once a year until January 20;

- Certificate 2-NDFL must be submitted once a year before April 1. Information is provided to the tax office at the place of registration;

- Certificate 6-NDFL: must be submitted quarterly. In the first quarter until April 30, in the first half of the year - until July 31, 9 months before October 31, for the year - until January 31;

- 4-FSS is submitted every quarter: the report must be submitted by the 20th of the month following the reporting month;

- SZV-M: provided every month before the 15th day of the month following the reporting month;

- Insurance premiums are calculated every quarter. In the first quarter until April 30, in the second half of the year until July 31, 9 months before October 31, per year - until January 30;

- The SZV-experience report is submitted every year before March 1 of the year following the reporting year.

- Picture 3. What are the deadlines for submitting patent reports?

Individual entrepreneurs applying professional income tax (NPT, Self-employed)

To confirm their income, individual entrepreneurs using the NPA need to order a certificate in the form KND 1122036 “Certificate on the status of calculations (income) for professional income tax” in the “My Tax” application or in the taxpayer’s personal account. The certificate arrives instantly, certified by an enhanced qualified electronic signature of the tax authority. The Federal Tax Service of Russia, in letter dated September 13, 2019 N ED-4-20/18515 “On the tax on professional income,” indicated that this certificate is an official confirmation of income and an entrepreneur cannot be refused to accept such a certificate.

Report to IP statistics

Various statistical reports are submitted to the territorial office of Rosstat. The list of documents must be updated annually, since observation can be continuous, that is, mandatory for all individual entrepreneurs without exception, or selective, covering only some of the entrepreneurs. Reports in connection with continuous observation are submitted based on the results of annual activities according to f. 1-entrepreneur no later than 04/02/18 for 2021

When the observation is selective, statisticians notify those entrepreneurs who are included in the sample about which reports need to be submitted and when. To be sure that you have not missed important information, it is recommended that you check the information yourself with your Rosstat office.

What is PSN? Advantages and disadvantages

The patent system is a special type of taxation that involves payment of a tax calculated based on the annual income that can be received. The tax payment amount is calculated by the Federal Tax Service.

The decision to introduce the use of PSN on the territory of a subject of the Federation is made by the legislative bodies of that subject. They also establish:

- the amount of potential income (tax base);

- an additional list of types of business activities (not named in the Tax Code of the Russian Federation) in respect of which the PSN is applied.

The advantages of such a taxation system include:

- Simplicity of taxation: tax calculation is carried out by the Federal Tax Service, the entrepreneur only has to pay the amount specified in the patent.

- Exemption from VAT and personal income tax.

- Minimum accounting and reporting forms.

- Can be combined with any other activity.

Disadvantages include:

- Fixed tax amount. Even if the actual income turns out to be less than the estimated one, the tax amount will not be reduced.

- The tax must be paid in advance within the deadlines established by law.

- An individual entrepreneur will not be able to reduce the amount of tax on insurance premiums for himself and his employees (as on the simplified tax system).

- The need to comply with income and number of employees limits, beyond which the right to use PSN is lost.

How to fill out a declaration

When preparing the 3rd personal income tax, individual entrepreneurs enter the necessary information on the title page, in the two sections provided, and, if necessary, in the appendices and calculations to them. Step-by-step instructions for filling out 3 personal income taxes for individual entrepreneurs for 2021 begin with filling out the title page. Here are the following:

- TIN at the top (the same must be done on each page of the document).

- If a revised version is submitted, the correction number.

- Code of the category in which the taxpayer is included (for individual entrepreneurs - 720).

- Code of the tax authority related to the place of residence of the entrepreneur.

- State code (for the Russian Federation - 643).

- Full name, passport details, telephone number of the individual entrepreneur.

The entrepreneur or his representative must sign the title card.

Income received by an entrepreneur from conducting activities is reflected on sheet B (in the second section).

In paragraph 1, you need to select an activity code and indicate OKVED according to the classifier. If there are several types of activities, you need to fill out sheet B for each separately. The totals are calculated in the “Total” section on the last such sheet.

Lines 030-090 of paragraph 2 contain information for calculating the tax base. Business income and expenses taken into account when calculating professional deduction are displayed here. The list of expenses consists of material and depreciation costs, payments to individuals and other expenses, but only confirmed by documents.

Important! In the absence of documentary evidence of expenses, only 20% of the total amount of income will be included in the professional tax deduction.

Lines 110-140 of paragraph 3 summarize the income and expenses of the entrepreneur on all sheets B. Accrued and paid tax advances are also recorded here.

Paragraph 5 must be completed in case of independent adjustment of the tax and base. This happens when prices different from market prices are used when conducting transactions with related parties.

The result obtained in paragraph 3 is indicated in section 2 for calculating the tax base and the personal income tax itself. After calculating the tax to be paid, additionally paid or refunded, the figure is displayed in line 010 of section 1. Here you must also enter the KBK for crediting the tax, the territorial OKTMO code at the place of registration of the entrepreneur where personal income tax is paid.

For personal income tax, the cash method works, so advance funds are counted as income. When an advance is returned in the year in which it was received, this operation does not affect the tax base and is not reflected in the declaration. If the receipt and return of the advance occurred in different tax periods, adjustments will be required. The advance is excluded from the merchant’s income.

Important! The tax amount can be offset; this is reflected in line 122 of the second section of the document. Muscovites have the opportunity to offset the trade tax by indicating the necessary information in line 091 of the second section.

Sample

Entrepreneurs can use as an example samples of completed declarations published on various websites. The main thing is to pay attention to the publication period, since changes are regularly made to the filling procedure.

When filling out a document on a computer, you can use the only font - Courier New with letter sizes 16-18. There is no need to put dashes in empty cells. All numeric data should be right aligned.

Important! The declaration is filled out in rubles and kopecks, the tax amount is indicated in rubles, rounded according to arithmetic rules.

PDF file

Patent and reporting. Summing up, or 3 reasons for accounting

The main thing that beginner entrepreneurs need to know about PSN

Patent and reporting. Today, about 35% of Russian entrepreneurs work with PSN. In conclusion, I will say once again that after acquiring a patent, the PSN does not imply the submission of additional reports. A declaration of income for individual entrepreneurs on PSN does not exist in nature. But let me formulate it this way: it is necessary to keep tax records on PSN. And he is not required to keep accounting records.

❗But there are situations when accounting is necessary:

Firstly, to obtain a loan or attract investment in another way. Because without it, it is impossible for a bank or potential investor to assess your financial condition. Secondly, if you have hired personnel, accounting and personnel records are obviously necessary. And, thirdly, during the development of individual entrepreneurs, when there are many contractors. Consequently, the constantly growing volume of advance payments and deferments. A serious task arises for the entrepreneur himself to understand how his business is developing.

What is KUDiR?

By purchasing a patent for an activity, you are exempt from drawing up a declaration. Reporting is carried out on the basis of filling out the book for accounting of income and expenses (KUDiR). You can read this document in detail on the Federal Tax Service website.

The book contains information about the entrepreneur’s income for the tax period in which the PSN is used and must be stored for at least 4 years. Let us remind you that the book can be in electronic or paper form. In the second case, it must be stitched and numbered. The last page is stamped with information about the number of pages.

The accounting book must be kept for at least 4 years from the tax period when the PSN was applied.

Patent termination conditions

Tax legislation does not contain a definition of the right of individuals to independently refuse to apply a patent. Termination is carried out forcibly in the following cases:

- Exceeding the restrictions established by Art. 346.45 Tax Code of the Russian Federation.

- Termination of activities in which the patent system was used.

- Closing an individual entrepreneur operating using PSN.

| Condition required for maintaining PSN | Limit parameters | Add-ons |

| Entrepreneur’s income received from the sale of goods, works, services | Up to 60 million rubles received from the beginning of the calendar year, increased by the deflator index | The amount is calculated for all operations carried out using the patent |

| Number of employees hired under labor and civil law contracts | Up to 15 people, the number of which is calculated taking into account statistics | The number is determined by all types of activities of the enterprise and all modes used |

When using the simplified tax system and the special tax system at the same time, income in order to comply with the restriction is summed up under both special regimes.

Deputy Director of the Department of Tax and Customs Tariff Policy R.A. Sahakyan

Deadline for submitting individual entrepreneur reports for 2021: Rosstat

Another type of mandatory reporting for an entrepreneur is statistical. Let's look at what kind of reporting an individual entrepreneur submits to Rosstat for the year, and the deadlines for submitting it in 2021 in more detail.

In general, statistical reporting is provided by individual entrepreneurs with or without employees, and regardless of whether they are active for a particular reporting period or not.

Individual entrepreneurs submit information to Rosstat as part of continuous statistical observation, which takes place once every 5 years, as well as when included in the department’s sample (Clause 1, Article 5 of Law No. 209-FZ of July 24, 2007). Statistical reporting must be submitted within the deadlines indicated on the appropriate form.

You can determine exactly what form of statistical reporting you need to submit by using a special online service from Rosstat. To obtain information, you will need any of the available identifiers of an individual entrepreneur - TIN or OGRNIP.

The main statistical reporting of individual entrepreneurs for 2021, the deadlines for its submission are given in the table

| Name of the report, which individual entrepreneurs submit | Due in 2021 | Period |

| As part of continuous statistical monitoring of economic activity indicators for 2021 (form approved by Rosstat order No. 469 dated August 17, 2020): | ||

| 1-entrepreneur (all individual entrepreneurs are taken once every 5 years) | April 1 | For 2021 |

| Within the framework of sample statistical observations: | ||

| MP (micro) - nature (individual entrepreneurs are given the status of micro-enterprises engaged in the production of mining and manufacturing products, production and distribution of electricity, gas, steam, logging and fishing) | The 25th of January | For 2021 |

| PM-prom (taken by individual entrepreneurs - SMEs, except micro-enterprises, for the above types of activities) | January 14 | For December 2021 |

| 1-IP (month) (passed by individual entrepreneurs who are not SMEs for the above types of activities) | January 14 | For December 2021 |

| 1-manufacturer prices (passed by individual entrepreneurs engaged in forestry and logging, fishing and fish farming, mining, manufacturing, supply of electricity, gas and steam, air conditioning, water supply, sanitation, waste collection and disposal, pollution removal, publishing activities) | December 22, 2021 | For December 2021 |

| 2-TP (air) (passed by individual entrepreneurs who have stationary sources of air pollution) | January 22 | For 2021 |

| 4-OS (taken by individual entrepreneurs engaged in environmental activities) | The 25th of January | For 2021 |

| 2-TP (hunting) (rented to individual entrepreneurs who have hunting agreements or a long-term license to use game animals) | March 22 | For 2021 |

| 1-P (fish) (rented to individual entrepreneurs larger than SMEs engaged in fishing and extraction of other aquatic biological resources) | February, 15 | for January-December 2021 |

| 1-KSR (rented by individual entrepreneurs providing hotel services and other collective accommodation facilities) | 1st of February | For 2021 |

| 1-services (rented by individual entrepreneurs providing paid services to the population) | March 1 | For 2021 |

| 1-travel agency (taken by individual entrepreneurs engaged in tourism activities) | April 1 | For 2021 |

| 1-RZH (rented by individual entrepreneurs engaged in real estate transactions, including those providing intermediary services) | January 14 | For the 4th quarter of 2021 |

What is 3-NDFL for individual entrepreneurs

3-NDFL is a type of tax return. Individuals are required to submit completed reports to the nearest branch of the Federal Tax Service. The document describes all the sources from which the money was received. And also the total amount of profit for the past year.

Filling out the declaration

Tax authorities use the declaration as one of the tools to control the activities of citizens. The document can become important evidence during investigations. Especially when market participants try to hide income that requires one or another taxation. Therefore, it is necessary to draw up this document.

Note! The Tax Code has a separate article that describes types of profit that are not taxed. The amount of tax payable is calculated in the same document.

Personal income tax when switching to OSN

If the right to PSN is lost, taxes for the period of validity of the patent are paid by the individual entrepreneur under a different regime. If the entrepreneur has not declared a special regime, the general regime is applied, the main tax of which is personal income tax. You will need to take the following actions:

- Determine the amount of income from the accounting book when maintaining PSN.

- Calculate the amount of expenses incurred during the period.

- Submit a 4-NDFL declaration for the tax authority to calculate the amounts of advance payments. Payment of advance payments is made in the calendar period after the transition to the OSN.

- At the end of the year, submit a 3-NDFL declaration and pay the annual tax amount levied at the end of the tax period. Persons who do not keep track of expenses can reduce the amount of the liability by the amount of the professional tax deduction. The benefit amount is 20% of income.

Penalties for non-payment of advance payments for personal income tax coinciding with the period for maintaining the PSN are not charged. The resulting overpayment in connection with the termination of the PSN is indicated in the declaration as an amount that reduces obligations. Explanations are provided for the 3-NDFL declaration.

Reporting when combining special modes

Individual entrepreneurs are not required to keep accounting records, but if special regimes are combined, they will have to maintain separate tax records. So, for example, if an entrepreneur combines the PSN and the simplified tax system, he is obliged to maintain:

- Book of income and expenses - according to the simplified tax system;

- Income book – according to PSN.

That is, the entrepreneur will need to attribute income to one or another type of activity. If the income is clear, then questions may arise with the expenses. After all, an entrepreneur cannot always attribute a specific expense to a specific type of activity (for example, staff salaries or office rent). In this case, this type of expense is distributed in proportion to the income received from each type of activity.

In addition to paying a single tax, an entrepreneur who combines the simplified tax system and a patent must submit a declaration under the simplified tax system.

Separately, it is worth highlighting the procedure for reducing the tax on insurance premiums paid by individual entrepreneurs without employees for themselves. Individual entrepreneurs do not have the right to reduce the amount of tax under PSN by insurance premiums. But an individual entrepreneur has the right to reduce the tax according to the simplified tax system for the entire amount of insurance premiums paid for himself (Letter of the Ministry of Finance of Russia No. 03-11-11/19849 dated 04/07/2016).

Reporting procedure

Since the law does not provide for declarations on PSN, the question of how to interact with the tax inspectorate disappears. Upon expiration of the application period, the merchant has the right to submit an application again. The application form was approved by order of the Federal Tax Service of the Russian Federation No. ММВ [email protected] dated 07/11/17. It can be sent in writing or electronically.

The question of how to submit reports to entrepreneurs-employers is also not worth it. The transition to a special regime does not affect other obligations. Sending payments is permitted in person, through an authorized representative, or by mail. PSN payers are not required to use telecommunication channels. All documents are prepared on paper.