Payment

All fixed assets of the enterprise gradually decrease in value, transferring it to manufactured products or

After the expected abolition of UTII, the patent taxation system will remain the only one where tax calculation does not depend

The amount of profit received must be reflected in accounting and tax returns. Often data from

What has changed From January 1, 2021, the list of non-taxable personal income tax income includes: Type

A current account is a necessary tool for any modern business. Not only do they pass through r/s

Article 88 of the Tax Code of the Russian Federation defines a desk tax audit as an audit of the tax law

Adjustment invoice (ACF) refers to tax primary documents. The scope of its application, as well as the primary

The tax burden is one of the main indicators by which a certain minimum payment is calculated

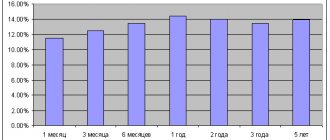

How to get maximum income on a deposit After a certain amount of money is earned, it

Time sheets serve as the basis for calculating salaries for employees. This document contains