Issues discussed in the material:

- What is personnel records in an organization and why is it needed?

- HR documents

- Who can be entrusted with maintaining personnel records in an organization?

- How to set up HR records in an organization from scratch: step-by-step instructions

- What errors may occur when maintaining personnel records in an organization?

- What other errors can a GIT inspector detect when checking the organization of work on personnel records?

- Who is responsible for violations in the personnel records system in the organization

- Why should you entrust personnel accounting and personnel records to a consulting company?

Personnel records in an organization allow you to reliably reflect information that not only demonstrates the transparent activities of the company, but also helps it function fully. This work involves the preparation of a huge number of different documents - from personal files of employees to the creation of labor discipline rules, so maintaining personnel records is simply impossible to ignore.

Undoubtedly, maintaining such a volume of documentation requires regulation, the standards of which are established at the legislative level. However, just knowing how personnel records should be maintained in an organization is not enough. And therefore we will tell you where to start in order to avoid mistakes that can lead to large fines.

What is personnel records in an organization and why is it needed?

Personnel records are a set of measures aimed at regulating the labor relationship between employer and employee. An organization's personnel are its main value and main resource. Therefore, it is very important to be able to build an effective personnel records system in an enterprise. To do this, you need to understand the current legislation and have certain competencies.

Properly selected HR personnel will allow the company to minimize the possibility of errors and serve as a guarantee of protecting the rights of its team.

Personnel accounting is a mandatory component of the activities of any organization.

The responsibilities of HR department employees include:

- hiring workers;

- dismissal of employees;

- registration of horizontal (transfer between departments) and vertical (career growth) movements;

- travel arrangements;

- sick leave records;

- filling out time sheets;

- vacation registration;

- filling out personal cards of employees, etc.

Personnel records in a budgetary organization include:

- military registration;

- regulation of labor relations;

- development, implementation and registration of personnel documentation (hiring orders, employee incentives, etc.);

- labor organization and other issues.

All company documentation must be prepared in accordance with applicable regulations. This rule applies to both unified documents and local ones (developed by the organization itself).

Correct construction of personnel records allows you to solve most of the company’s problems and tasks related to personnel.

Reports

To simplify the work of HR officers, the 1C:ZUP program provides a large number of built-in reports that can be easily customized to individual needs.

Fig.21 Reports

Main areas of personnel reporting:

- Personal information of employees and family compositions;

- Reporting on education, certifications and qualifications;

- Reporting intended for military registration and enlistment offices;

- Information on vacation balances and spending;

- Number of employees and personnel movements of workers;

- Filling out the staffing table and its structure.

Automated reports help HR employees avoid wasting time consolidating information, conducting quick analysis, and not doubting the accuracy of the data.

Implementation of 1C:ZUP

Implementation for the company’s business model: personnel accounting, payroll calculation, analysis and personnel management

Learn more

Automation of personnel records

Planning of personnel requirements, payroll, staffing, personnel records and office work

Learn more

HR documents

There are mandatory and optional documentation included in personnel records in an organization. The documents required for use are determined by the Labor Code of the Russian Federation.

These include:

- employment order (T-1);

- contract (agreement) with an employee (TD-1);

- work book (mandatory use is established by Decree of the Government of the Russian Federation No. 225 “On work books” dated April 16, 2003);

- employee personal card (T-2);

- translation documents (T-5);

- order for registration of leave (T-6);

- vacation schedule (T-7);

- staffing (T-3);

- time sheet (T-12);

- dismissal order (T-8).

All the documents listed above have a unified form. The rest of the personnel documentation is developed by the organization itself.

Optional documents include:

- collective agreement;

- inner order rules;

- wage regulations;

- provisions on personal data of employees;

- labor protection regulations;

- bonus provisions.

However, labor legislation protects hired personnel, therefore the use of local regulations in an organization that infringe on the rights of employees is unacceptable. This point is regulated by Article 8 of the Labor Code of the Russian Federation.

Accounting documents are developed by employees of the enterprise's personnel service. After this, the head of the company checks and approves them. Next, employees familiarize themselves with the document under the personal signature of each.

Top 3 articles that will be useful to every manager:

- How to choose a tax system to save on payments

- How to minimize taxes and not interest the tax authorities

- How to create an electronic signature quickly and easily

The preparation of some personnel documents is optional in cases where the information that should be reflected in them is already included in other personnel documents. For example, there is no need to draw up a job description if all the employee’s functions are specified in the employment contract. The same is true with regard to wages. It is optional in the case where all essential payment conditions are contained in the contract with the employee.

The need to create one or another personnel records document is determined by the specifics of the organization’s activities and the functionality of a particular employee. Thus, a shift schedule is necessary only for those companies whose employees perform their functions in shifts. Regulations on trade secrets, documents regulating access (and its termination) to it and responsibility for its disclosure must be drawn up at high-secrecy facilities. An agreement on full financial responsibility is signed with an employee whose responsibilities include ensuring the safety of material assets.

Personnel accounting. Why does business need HR records?

Tasks of personnel document flow

HR records management allows you to effectively solve several problems at once:

— document labor relations, formalize personnel procedures at a specific employer;

— build a coherent personnel management system that meets the strategic objectives of management;

— regulate the relationship between employee and employer;

— create an organizational and legal basis for labor activity for both employees and the employer;

— resolve labor disputes.

Who can be entrusted with maintaining personnel records in an organization?

Personnel records in a company can be organized in several ways. They all have their advantages and disadvantages. Let's look at them in more detail.

| Method of organizing personnel records | Advantages | Flaws |

| Hiring a full-time HR specialist |

|

|

| Involvement of a third-party specialist (upon recommendation) |

|

|

| Delegation of accounting to an accountant or secretary |

|

|

| Delegation of personnel records to a third party |

|

|

Partial HR outsourcing for large companies

Representatives of large businesses should consider the possibility of partial outsourcing, when office work is completely outsourced to external specialists, and management is handled by their own employees.

This solution will allow the HR department to focus entirely on employees. After all, working with paperwork takes a lot of time, and if an organization decides to outsource the entire routine part of HR management, then the HR department can focus directly on people. This will significantly increase employee loyalty, which means the company will work much more efficiently.

How to set up HR records in an organization from scratch: step-by-step instructions

A manager can always organize accounting in an organization, even if there is no experience. To do this, you just need to act in accordance with a certain algorithm. Personnel accounting in an organization from scratch looks step by step as follows.

Step 1: Learn the basics of HR.

In addition to the latest edition of the Labor Code of the Russian Federation, it is necessary to study regulations in the field of labor law and comments to them. These documents already contain most of the answers to questions in the field of labor relations. Insufficient knowledge of labor legislation entails mistakes when working with personnel, and, consequently, bringing the organization to administrative responsibility.

Step 2: Find out what computer programs you can use.

To make work easier, specialized programs can be used to maintain personnel records in an organization. They allow you to minimize routine operations and optimize work with documents. Processes such as recording actual time worked, creating vacation schedules, and drawing up orders and instructions are automated.

Results

Correct and timely personnel records allow management to make the company more efficient. Currently, there are many software tools that help optimize the time for drawing up personnel documentation and achieve accuracy in reflecting personnel records .

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What errors may occur when maintaining personnel records in an organization?

If regulatory authorities discover violations in the field of personnel records, the organization is held accountable (administrative or criminal).

The following are typical violations.

1. Mistakes when working with personal files

A personal file for an employee is opened at the moment he is hired for a position and is maintained until dismissal.

When filling out personal files, the following errors occur:

- lack of necessary documents;

- violation of the order of documents;

- lack of personal files as such;

- reconciliation is not carried out in a timely manner;

- filling out an employee questionnaire instead of a personal record sheet;

- entering unnecessary documents;

- non-compliance by HR employees with the procedure for transferring personal files to third parties (companies).

If the personal files of employees are formed properly, this makes working with them much easier. Properly organized storage allows you to ensure the integrity of documents and quick access to them.

2. Errors when drawing up an employment contract

In the event of labor disputes, mistakes made by the employer when concluding or terminating contracts with employees can have quite serious consequences for the company.

Errors may be:

- signing one copy of the contract;

- the employment contract has not been registered or the registration date has not been entered;

- no signature on employment contracts;

- mandatory information and/or conditions are missing;

- no employment contract has been concluded;

- one of the copies of the employment contract was not given to the employee or there is no receipt mark;

- the duration of the contract has not been determined;

- the conditions for completing the probationary period (if any) are not specified;

- the employee’s salary, the date of its payment, the method of payment, the working hours and the duration of leave are not indicated.

Will HR EDI become mandatory in 2021?

The introduction of electronic work books can be considered the first stage of the process of automation of regulated personnel records, which is gaining momentum every year. The high degree of government involvement in increasing the pace of automation will force business to take part in this process, no matter - in 2020 or 2021, but it will still have to be done.

The important thing is that today there are IT solutions that comply with current legislation and can quickly adapt to any changes in the outside world. They enable a business not only to join the process of transition to EDI without losses, but also to benefit from it - to reduce costs and speed up processes many times over, which will ultimately have a beneficial effect on the rate of growth and development of the entire business as a whole.

What other errors can a GIT inspector detect when checking the organization of work on personnel records?

The State Labor Inspectorate periodically conducts on-site inspections. The organization is given ten days to prepare.

Errors that are most often detected during testing are shown in the table.

| Error | How to fix |

| The internal labor regulations do not contain information about the employer's responsibility. | The detection rate of such an error during a routine check is 90%. It can be corrected by issuing new PVTR, which will contain a chapter on the disciplinary and financial responsibility of the manager. |

| Workers are not familiar with the LA directly related to their work activities. |

|

| The documents do not contain information about wage indexation. | Development of additional agreements to employment contracts. |

| Ignoring the opinions of trade unions when developing aircraft. | Creating a new document. |

| The PVTR does not specify a second day off and/or paydays. | |

| Lack of information in the employment contract about the employee’s salary, regional coefficient, percentage bonus for workers in the Far North. | |

| The employment contract does not specify SOUT. | If a special assessment of working conditions has been made, this must be reflected in the contract. Otherwise, it is worth adding the phrase “Working conditions will be determined by the SOUT, it will be carried out within the time limits established by law.” |

| The working time sheet is filled out incorrectly: there is no information about working overtime and holidays, the length of the working day is incorrectly indicated, there is no information about absenteeism and tardiness. | Create a correction sheet and enter the correct information into it. |

| Incorrectly drawn up vacation schedule: the transfer is not reflected, the fact that the employee familiarized himself with the order 2 weeks before the vacation is not recorded, preferential categories are not taken into account, the vacation is incorrectly divided (one part must last at least 14 days). | Creating a new schedule, generating vacation notices (must be signed by employees). |

| Lack of occupational safety instructions for employees working on PCs | Employers often forget that when working at a computer for more than four hours, it is necessary to comply with labor safety rules. Appropriate instructions must be developed, and employees must be familiarized with them under signature. |

Shortcomings in the documentation associated with incomplete completion of fields or the absence of a mandatory signature are very annoying. Therefore, it is necessary to carefully check all the papers and enter the necessary information even before the visit of the State Tax Inspectorate, who apply separate sanctions for each violation (three errors - three fines).

Office work

Record keeping includes proper maintenance of documentation related to the reception, movement and release of personnel.

It is mandatory to maintain personal files that are created for each employee of the enterprise. It includes a personal personnel record card, an application for admission, a copy of the passport, copies of educational documents, a certificate of medical examination, a copy of a military ID (if any) and other documents that are generated during the employee’s work activities . Another very important task is filling out work books.

In addition to all of the above, other documents can be developed that are directly related to the specifics of the enterprise, ensuring the correctness of work in the field of personnel accounting.

Who is responsible for violations in the personnel records system in the organization

The State Labor Inspectorate is the body that monitors the correct maintenance of personnel records in organizations. If State Labor Inspectorate employees discover violations, they have the right to hold the employer accountable for non-compliance with labor laws.

Based on the norms of Article 419 of the Labor Code of the Russian Federation, the following types of liability can be distinguished:

- Administrative responsibility

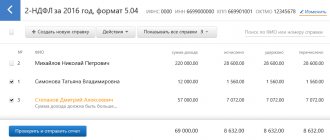

Penalties for officials and companies are regulated by Articles 5.7, 5.27–5.34, 5.39 of the Code of the Russian Federation on Administrative Offenses. As a rule, employers are brought to this type of liability in the absence of any necessary personnel document or refusal to provide it at the request of an employee (organization).Let’s say Petrenko V.A. intends to take out a loan, and he needs a copy of his work record book, as well as a 2-NDFL certificate. He turned to his employer with a request to give him a copy of his work record book and received a negative response. In this situation, Petrenko V.A. has the right to contact the State Tax Inspectorate and report the employer’s unlawful actions. The inspection, in accordance with Article 5.39 of the Code of the Russian Federation on Administrative Offences, will hold the organization's officials accountable and impose a fine in the amount of 1,000 to 3,000 rubles.

- Civil liability

Defined by articles 15, 151 and 59 of the chapter of the Civil Code of the Russian Federation.Let's look at an example. Korpenko Yu. S. was injured at work. According to Article 1085 of the Civil Code of the Russian Federation, the employer must pay him for the time he is on sick leave and compensate for the costs of treatment and recovery.

- Criminal liability

Provided for in Articles 143, 145,145.1,146, 147,215, 216, 217 of the Criminal Code of the Russian Federation.Personnel documentation may also be required by Federal Tax Service employees. Failure to provide it entails punishment under Article 126 of the Tax Code of the Russian Federation.

Types of personnel policies

Types of personnel policies:

a) according to the level of awareness of the rules and regulations that underlie personnel activities:

1) Passive, when the management of the enterprise does not have a clear idea of actions regarding personnel management and all personnel work comes down to eliminating negative consequences. This policy is characterized by the lack of a forecast of personnel needs, tools for assessing labor and personnel, and as a result, management in this case is often forced to act in an emergency response to any conflict situations, without analyzing the causes and possible consequences of these situations.

2) Reactive. In this case, management exercises control over the symptoms of a negative state in personnel work, the causes and situation of the development of the crisis and takes timely measures to localize the crisis, aimed at understanding the reasons that led to the crisis in personnel work.

3) Preventive, i.e. This policy is aimed at preventing the occurrence of any difficulties in working with personnel and is used when the management of the enterprise has justified forecasts of the development of the situation. Enterprise development programs contain short- and medium-term forecasts of personnel requirements and formulate tasks for personnel development.

4) Active. We can talk about the existence of this personnel policy when the management of the enterprise has not only a forecast of the development of the situation, but also the means of influencing this situation, and the personnel service is able to develop anti-crisis personnel programs, conduct regular monitoring of the situation and adjust the implementation of the program.

b) according to the degree of openness of the organization to the external environment when forming personnel:

1) An open personnel policy is characterized by the fact that the organization is transparent to potential employees at any structural level. This policy can be used by new organizations that are pursuing an aggressive policy of conquering the market, focused on rapid growth and reaching the forefront in their industry.

2) A closed personnel policy is characterized by the fact that the organization is focused on including new employees only from the lowest official level, and vacant positions at the highest level are filled by employees who have been working in the organization for some time. This policy is typical for companies focused on creating a certain corporate atmosphere, as well as operating in conditions of shortage of human resources.

Read also: Personnel strategy and personnel policy of enterprises

The main element of personnel policy is personnel records management - a branch of activity that regulates labor relations. Personnel documentation records information about the presence and movement of personnel and is an integral responsibility of any employer, regardless of the scale of its activities and legal form. Conducting personnel records allows the employer not only to document labor relations and formalize human resources, but also to solve many other problems, thereby protecting himself from negative consequences when resolving labor disputes in court, where personnel documentation is intended to act as written evidence. Thus, personnel records management is a tool that allows you to clearly regulate the relationship between employer and employee, the rights and obligations of the parties to labor relations, document uniform principles of corporate relations, and build a well-functioning, stable personnel management system.

[flat_ab id=”5"]

About HR audit

A personnel audit is an assessment of the performance of the personnel department, its part or the responsible person, as well as checking documents for their compliance with legal requirements.

At different stages of the organization’s functioning, it may be necessary to conduct a personnel audit (for example, when a change in personnel specialist is expected). In general, the audit performs the following tasks:

- minimizes the amount of all existing documentation;

- reduces the costs of document management;

- monitors compliance with legal regulations;

- helps improve the rate of passing inspections by the State Labor Inspectorate (GIT);

- minimizes material losses in case of labor disputes.

In certain situations, there is a need to conduct a personnel audit

The manager decides independently whether or not to resort to the services of organizations operating in this area. But many people prefer to cope on their own, because this allows them to maintain confidentiality. If you decide to conduct an audit yourself, you will have to:

- Issue an order to conduct an inspection, and also take care of the appointment of executors. Be sure to clearly define the objectives of the audit and the time frame within which it will be carried out.

- After issuing the order, determine the stages of conducting a personnel audit. First, it is determined whether all the documents required by law are available. The second stage involves conducting an examination, the purpose of which is to determine the compliance of all documentation with legal standards.

Often organizations do not use standardized forms of documentation, but their own (if this does not contradict the law). In this case, these forms are approved by order. Based on the results of the audit, a report on the results of the inspection is drawn up. It includes information about detected errors and suggests measures to eliminate them. You should also characterize the state of personnel records and what risks exist in a given organization or individual entrepreneur.