Time sheets serve as the basis for calculating salaries for employees. This document contains information about the presence of employees at their workplaces or their absence, indicating the reason. To fill out, you can use the unified form T-13 or form T-12. As part of this article, we will look in detail at the features of filling out the T-13 time sheet, and we will give an example of filling out a working time sheet using the T-13 form as an example. In addition, you can use both forms below.

A time sheet is a table in which attendance and absence from work are taken into account for each employee of an enterprise. The total number of days and hours worked for the month is displayed. In addition, codes for the reasons for absence from work are indicated.

Normative base

Resolution of the State Statistics Committee of the Russian Federation dated 01/05/2004 N 1 “On approval of unified forms of primary accounting documentation for recording labor and its payment”

Order of the Ministry of Finance of Russia dated 03/30/2015 N 52n “On approval of forms of primary accounting documents and accounting registers used by public authorities ( state bodies), local government bodies, management bodies of state extra-budgetary funds, state (municipal) institutions, and Guidelines for their application"

Order of the Federal Tax Service of Russia dated September 10, 2015 N ММВ-7-11/ “On approval of codes for types of income and deductions”

Which form of control sheet to choose?

Of the available accounting forms, enterprises can use unified forms approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1.

Accounting schedule form in form T-12 (if accounting is done manually)

Accounting sheet form in form T-13 (if accounting is carried out automatically)

Order of the Ministry of Finance of Russia dated March 30, 2015 No. 52n approved the working time sheet - form 0504421 (a sample of 2021 is presented below), which is required for:

- bodies of state power and local self-government;

- off-budget funds;

- state and municipal institutions.

Work time schedule form according to form 0504421

The law does not specify which of the company’s employees should be responsible for monitoring working hours. Therefore, the manager can appoint any subordinate responsible for this work. But usually such responsibilities are assigned to personnel department employees and department heads.

A correctly compiled timesheet allows you to determine:

- how many days during the month the employee worked (was on vacation, on sick leave);

- whether he observed labor discipline (lateness, absence).

Based on this data, salaries, various types of compensation and payments are subsequently calculated. If internal documents stipulate penalties for regular violation of labor discipline, correctly filling out the work time sheet 0504421 (sample of completion below), T-12 or T-13 will help you find out which of the employees should be held accountable.

Where to get requirements for form design

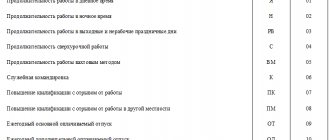

Before showing a sample of filling out a time sheet (form 0504421 new), we will explain what information needs to be entered there. All necessary special designations are contained on the first page of the T-12 form. They are also relevant for T-13, and form 0504421 has its own designations.

The company decides independently which symbols - letters or numbers - to use. This is an unimportant point. But there are two ways to write data in a timesheet:

- attendance or absence is noted every day - continuous filling;

- indicate only “deviations” - lateness, no-shows, work on weekends, downtime. This method is also used for cumulative recording of working time.

conclusions

A report card is a mandatory document that must be filled out at any enterprise. After all, it is on the basis of this document that the following processes are carried out:

- Monitoring the work of all specialists at the enterprise;

- Monitoring timely attendance at working hours;

- Control of hours worked, taking into account the possibility of correct calculation of wages.

In other words, a time sheet is a document through which the manager receives all the necessary data about the responsibility of employees and their compliance with the terms of the employment agreement, as well as the staffing table. And accountants, on the basis of this document, have the opportunity to correctly calculate wages in order to follow all the norms of labor legislation.

The legislator does not establish strict requirements for drawing up a form for proper recording of working time, but determines the need for this recording. There are two developed forms, all the nuances of which we discussed with you above; in fact, you just have to study this information in order to learn how to draw up a document yourself. It should also be noted that there are specialized programs that allow you to carry out the process of recording working hours in a simplified mode; to study the nuances and features of such programs, we invite you to watch this video.

Step-by-step instructions for filling out the T-12 report card

Let’s assume that in an organization, time recording is done manually and separately from accounting for payroll payments to personnel. Our organization is commercial, and the manager gravitates towards State Statistics Committee forms. We will show you how to fill out the first part of the unified T-12 form.

Block 1

We fill out the first page of the report card, which contains general information about the organization itself, the reporting period, as well as alphabetic and digital symbol codes.

Step 1. Enter information about the full name of the organization.

Step 2. Enter the name of the department or division of the organization. If the organization does not have structural divisions, leave the field blank.

Step 3. Enter the corresponding eight-digit code.

Step 4. We enter information about the period for which the schedule was drawn up.

Step 5. Assign a serial number and indicate the date of compilation.

Block 2

We fill out the second page (we recommend doing this in accordance with the staffing schedule). Theoretically, this page is filled out during the reporting period, however, situations may arise directly in the process of work that will not be entirely correct to immediately reflect in the chart.

For example, employee K. did not come to work today and did not notify his manager about his absence. In fact, he is absent from work, but the reason for his absence is unknown, and the letter code NN must be entered in the report card (failure to appear for unknown reasons, until the circumstances are clarified). Suppose that tomorrow he comes out and explains the reason for his absence, therefore, changes will be made to the schedule, and the NN code will be replaced with another one, depending on the reason for the absence.

Or it may happen that the employee comes to work just before submitting the schedule to the accounting department, so it is recommended to keep actual records either in pencil or in a separate document, which can be redone ten times before the final entry of information directly into T-12.

Step 6. Assign the first serial number.

Step 7. Write down the last name, initials and position of the specific employee.

Step 8. Enter the personnel number (can be found in the appointment order or in the employee’s personal card T-2).

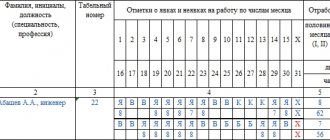

Step 9. We enter the relevant information into the attendance and absence columns by day of the month, and this information is reflected in two columns:

- in the top column the corresponding code is indicated (alphabetic or numeric, depending on what you like);

- The duration is indicated in the bottom column.

The example shows the procedure for maintaining a timesheet for an organization during a five-day period. How to fill out a timesheet correctly with a six-day work schedule? Everything is the same, but there will only be one day off, not two.

Step 10. We count for each column how many days and hours worked in the first half of the month.

Step 11. We count how much was worked in the second half of the month.

Step 12. We count the total number of days and hours worked per month.

Step 13. Enter the number of days of absence or no-shows, including the breakdown in the appropriate columns. If there were no such days, we leave empty cells.

Step 14. Enter the number of weekends and holidays.

Step 15. We check the obtained figures with the production calendar to ensure that the number of days off and working hours correspond. If something doesn’t match, we look for the error or prepare to explain the reasons to management.

Step 16. We sign it ourselves, with the head of the structural unit (if any), with the personnel service employee (if the personnel service employee and the person responsible for filling out the schedule are the same person, we sign both) and take it to the accounting department, where Based on the schedule data, employees will be paid wages.

Completed sample accounting schedule

Accounting methods

Regardless of operating modes, the enterprise may use one of the methods for recording working time:

- full registration;

- registration of deviations.

If the length of the working day is unchanged, it is easier to record only deviations (overtime or absence).

If there is a need for summarized time tracking with constant deviations from the norm due to the nature of the work, the “continuous” method is used. This will prevent individual employees from overworking and take into account the intensity of staff involvement throughout the year in subsequent working time schedules. For example, the security service works according to the schedule “from eight to eight”; with such a schedule, the report card of security guard V.V. Prokhorov, who started the morning shift from August 1, 2021, will note:

- — “I” 12 (work from 8 a.m. to 8 p.m.);

- — “I/N” 2/2 (2 regular hours from 20 to 22, then 2 night hours from 22 to 24);

- — “I/N” 1/7 (7 night hours from 00 to 7 am, then 1 regular hour from 7 to 8);

- - "On a weekend);

- - “I” 12 and so on.

To avoid overtime, the administration can hire replacement personnel or calculate staffing levels in such a way that, with an annual working time fund, each employee has the opportunity to fully rest and use regular vacations.

Instructions for filling out form T-13

There are several differences between the T-12 and T-13 report cards, but in general they are identical and are filled out according to the general rules. T-12 is allowed to be kept only for recording hours worked, without section 2 “Calculation with personnel for wages”. If an enterprise uses Form T-13, then it must be filled out in full, including additional lines for payroll.

What to write in this part? To maintain it, you will need a list of digital codes for types of remuneration approved by Order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/. It is large because it includes all possible types of income of citizens. But for the accounting sheet you only need a few codes, and they are presented in the table.

| Revenue code | Name of income |

| 2000 | salary |

| 2012 | vacation pay |

| 2300 | temporary disability benefit |

Maintaining Form T-13 is similar to the procedure for making entries in T-12. First, fill out the header of the form, then enter information about the employees, indicate data on hours worked and days off during the month. That is, the first 15 steps of the instructions must be repeated. For absences during the reporting period, additional entries are made in columns 10-13, indicating generalized data.

Columns 7-9 are given to indicate:

- code of payment type (income);

- correspondent account;

- days due for payment.

When all the necessary information is indicated, we sign the document (last step).

Completed example of form T-13

The example shows that for each employee you can specify 8 different types of payment codes at once. For this, columns 7-9 are repeated.

As for the corresponding account, it can be indicated only once - above columns 7-9, if it is the same for everyone. But if you always enter it in column 8, they won’t consider it an error either.

Features due to coronavirus

Due to the situation with COVID-19 and the second wave, it is recommended to transfer employees to remote work again. If the employee does not mind, then an additional agreement must be concluded.

If the organization has employees over 65 years of age, then it is recommended to separately isolate such employees in order to preserve their life and health. During the isolation period, employees must retain their earnings. If everything is more or less clear with the issues of isolation, then the question of what to put on the report card for workers over 65 years of age who are in quarantine does not have a single answer. The editors believe that during this period it is necessary to approve additional code specifically for this situation. If developing a new code is not an option, then you can use code OB or 27 - additional days off (paid), but such a code is not entirely correct.

For people who have switched to remote work, use the code “I” if they work, and “B” if they take a weekend break. If they went on paid leave or at their own expense, then use a different code that corresponds to the situation.

How to keep track of working hours for state-owned enterprises

Time sheet 52n (filling sample 0504421), approved by the Ministry of Finance, is externally similar to T-12 and T-13, but without a section reflecting settlements with personnel. The document is drawn up according to the rules prescribed in the Order.

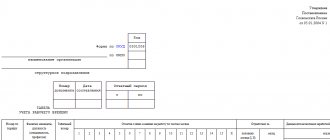

First, enter the information in the header part of the form:

- reporting period;

- name of the institution;

- type of report card - primary or corrective (the latter is submitted if errors are identified);

- date of formation of information;

- OKPO code;

- adjustment number - 0 (zero), if the primary time sheet, and then in order - 1, 2, 3, etc.

The content (tabular) part can be maintained in 2 ways, indicating:

- cases of deviations from the normal use of working time;

- actual hours worked.

In the first case, only those employees who had deviations from the schedule approved by the organization are recorded in the timesheet. The hours of deviations are written in the upper half of the line, and the symbols and hours of work at night are written in the lower half of the line. If one employee had two types of deviations per day, then his name is recorded twice. In this case, the lower part of the line is written in the form of a fraction, where the numerator is a symbol of the type of deviation, and the denominator is hours of work.

Officials have developed their own list of symbols for the form, but it can be supplemented with other symbols. You can see the list of approved signs below.

If the organization decides to reflect the actual costs of working time, then the hours are also written down at the top of the line, and a letter designation is placed at the bottom. Absences are marked with separate symbols, depending on the reasons for absence.

A few examples of what a timesheet might look like using different methods of recording data. Let's say Petrov's employee A.A. from September 10 to September 13, 2021, she was on a business trip, her colleague Ivanova T.A. I was on vacation from September 19 to 30. Employee Sidorov V.A., who works 12 hours in a shift schedule (2/2), was granted leave at his own expense twice in September - on September 7 and 23. If you fill out the timesheet only in case of deviations, it will look like this:

If an organization records actual working hours, then with the same initial data the time sheet looks different:

The last thing left to do is sign and submit it to the accounting department.

An example of filling out a time sheet, form 0504421 (new)

What is it needed for?

Is it possible for an enterprise to do without a time sheet? Why consider time at all?

The Labor Code of the Russian Federation in Article 91 provides a definition of working time, that is, that which each employee spent on work, according to the employment contract.

Since the duration of work and rest is regulated by law, the employer has an obligation to record and document working time in the form prescribed by law.

Any system of remuneration for temporary workers implies earnings proportional to the time worked. In order to determine the correspondence between the standard and actually spent time, a special accounting register is required.

In addition to this function, the time sheet also performs other key tasks:

- for all personnel without exception, the time sheet displays information about attendance and reasons for the absence of employees at the enterprise;

- on the basis of this document, the length of service and the nature of the work performed by profession and category are determined;

- contains data on the work schedule and its deviations from normal duration for each specific worker;

- confirms the organization’s labor costs to the tax authorities;

- functions as a source of analytical data. For example, it is possible to analyze compliance with guarantees for workers regarding the exercise of their right to rest.

The time sheet is based on primary observation and is the first in the chain of a number of organizational and administrative documents of the enterprise. It is used both as evidence of the organization’s labor costs and as evidence of the presence of any employee at the workplace.

What programs are used to keep timesheets?

To fill out timesheets automatically, you must either buy a program (but you will still have to enter information into it manually), or install a set of software and hardware that will automatically collect, store and process information about the presence of workers on site, their hours arrival and departure, periods of work and rest of employees, etc.

Such systems have functions for analyzing the information they receive, and therefore are very convenient and save a lot of time for personnel officers and accountants. Employers are also delighted, because at any moment they can see where Petrov’s employee is, what he’s doing, when he left yesterday, etc. However, in addition to all their advantages, these systems have one significant drawback - the implementation of such programs is very expensive.

Important before generating a document

It is very important to pay attention to the following points before you complete the report:

- the production calendar must be adjusted according to regional changes;

- all monthly vacation and sick pay must already be accrued;

- but the work time, which is reflected in the Payroll document, does not affect the formation of the timesheet in any way.

To use the program with current reference books, make sure that you have a valid 1C:ITS agreement.

If you have any difficulties when creating a Timesheet in 1C, please contact our specialists for help by phone.