Most often, taxpayers encounter representatives of tax authorities during the reporting process. And this seemingly simple procedure sometimes confronts the taxpayer with unexpected and unpleasant problems. The most optimal way of relations with representatives of tax authorities is the exact and strict fulfillment of the requirements of the law, a correct and reasoned refusal to comply with illegal requirements. Let's consider the requirements of the current legislation of the Russian Federation regarding the presentation of tax and accounting reports.

TAX INNOVATIONS 2021

Financial statements

Accounting statements allow you to get a complete picture of the state of affairs in the organization in terms of financial and economic condition. In fact, this is a system of indicators that are recorded in special documents and talk about the company’s profits, its debts and losses, the taxes the company pays, and the assets on its balance sheet.

The main accounting documents are the balance sheet

and

income statement

.

In most cases, they are enough to understand what the economic situation of the organization is. In large companies, in addition, it is necessary to have reports on cash flows and their intended use

, as well as

changes in capital

. All information on these documents is regularly sent to the fiscal authorities, some - to the Pension Fund of the Russian Federation, the State Committee and other regulatory authorities. The deadlines for submitting financial statements are determined by law, and violation of them is subject to a fine.

Accounting reporting forms are approved at the state level; errors in them are unacceptable and are punishable by fines. If the error led to an underestimation of tax figures, the fine can reach 40 thousand, and the head of the company in this case will bear administrative responsibility.

Retention periods for LLC documents

Since February 18, 2021, the order of the Federal Archive (dated December 20, 2019 N 236) has been in force, which replaced the previous document - Order of the Ministry of Culture of the Russian Federation dated August 25, 2010 N 558. The new order partially changed the storage periods for documents of an organization, including commercial . Some of the deadlines are given in the table, but for a complete study of the issue, we recommend that you refer to the original source.

| Documentation | Shelf life |

| Registration documents, licenses and certificates of conformity, annual financial statements, annual payroll statements in the Social Insurance Fund, inventory lists of liquidation commissions | Constantly |

| Employment contracts, personal files and employee cards, books, magazines, personnel records, | 75 years old |

| GPC agreements and acts on the performance of work, provision of services by individuals, calculations of insurance premiums, information about the employee’s work activity and length of service | 50 years |

| Accounting registers, general ledger, working chart of accounts, accounting policies, audit reports on financial statements, primary documents, tax returns, invoices, agreements, agreements, contracts (with the exception of some) | 5 years |

| Books of purchases and sales, customs declarations, BSO, documents on payment of excise duty | 4 years |

Tax reporting

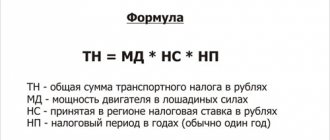

Tax reporting, unlike accounting, contains information about the taxes that the company pays. The forms and timing of these reports depend on the taxation system, the size of the enterprise, the form of ownership and a number of other points.

There are three main taxation systems - general (OSNO), simplified (USN), and the so-called “imputation” (UTII).

- Simplified system

used by small companies in which the number of employees is no more than a hundred, income does not exceed 60 million, and the size of fixed assets is less than 100 million. This system is good because it does not require accounting, reporting is simple and consists of making quarterly advance payments and annual filing of returns. The tax is 6 or 15% of income depending on the object of taxation.

- General system

noticeably more difficult. Enterprises that operate under OSNO pay VAT, property tax and income tax (companies) or personal income tax (entrepreneurs). Correct calculation of these taxes requires professional knowledge of accounting and extensive practical experience. A qualified accountant who knows the law well can significantly reduce tax payments without breaking the law.

- A single tax on imputed income

depends on the company's activities and local legal requirements.

Part of the reporting submitted at the end of the quarter is the RSV 1 form. In it, the company displays information on accrued and paid insurance premiums. This form is submitted to the pension fund and the compulsory health insurance fund no later than the middle of the second month of the quarter following the reporting one. That is, RVS 1 for the first quarter must be submitted by mid-May. Violation of deadlines is punishable by a fine. This fine is small, but such delays attract the attention of the tax authorities and may result in an unscheduled audit. For a long time, the RSV 2 form was submitted by individual entrepreneurs who do not have employees. However, this practice was stopped in 2012, and today the RSV 2 form is not submitted.

Tax reporting forms

Tax reporting is documents from which you can understand how much and what taxes have been accrued and paid. There are two main forms of reporting - tax return and advance payment calculation.

- Tax return

- this is actually a statement in which the payer talks about his income and its sources, about the expenses made during the tax period, about the tax benefits he has, about the objects of taxation and about everything else on the basis of which the tax is calculated. Tax returns are submitted for VAT, income tax, and property tax.

- Advance payment calculation

is much like a declaration. It contains similar information for the reporting period, usually a quarter. This information serves as the basis for calculating payments that will be paid in advance.

In addition to the two main documents, you must also submit Form 6-NDFL to the tax office, which contains data on income, benefits and tax deductions, as well as amounts intended to be paid as income tax. This document must take into account everyone to whom the company’s work brought income.

Personnel documents

Despite the fact that personnel document flow is gradually moving into electronic format, the organization must keep confirmation of the hiring, transfer, dismissal of employees and the amounts paid to them. For now, these data are the main basis for forming the insurance period when calculating a pension.

Therefore, the organization must ensure the storage of the following documents:

- Work books of employees, if they are kept in paper form, as well as books of accounting of forms, the books themselves and inserts for them.

- Employment contracts with each employee and additional agreements to them, if any.

- Local regulations, such as regulations on wages, bonuses, work and rest hours, and internal regulations. If the employer belongs to a micro-enterprise (less than 15 people, and annual income below 120 million rubles), then he can conclude a standard employment contract with employees, the form of which is approved by Government Decree No. 858 of August 27, 2021. The standard contract has already included standard regulations and are not required to be formalized separately.

- Regulations on the protection of personal data of employees.

- Personal cards of employees in the T-2 form.

- Staffing table in form T-3.

- Vacation schedules in form T-7.

- Timesheets for recording working hours and calculating wages (forms T-12 and T-13).

- Orders, personnel instructions and reasons for them, for example, a memorandum.

- All documents related to the calculation of salaries and other payments to employees.

- Documents on labor protection, as well as on certification or assessment of working conditions of workplaces.

- Job descriptions for each position, if the employment contract does not describe the employee’s functions.

- An agreement on full financial responsibility, if the employee’s position requires this.

- Journals and books of personnel records (employment contracts, orders, personal files, travel certificates, military records, etc.).

When are tax returns due?

The deadlines for submitting tax reports are strictly regulated. Violation of them is subject to various sanctions: from fines and penalties to administrative punishment. Different types of taxes are paid at different times, but certain limits can be distinguished.

So, according to UTII, declarations must be submitted every quarter, and before the 20th day of the month that follows the reporting quarter. Those who work under the simplified system submit advance payments once a quarter and a tax return annually. Companies and organizations must submit it before the end of March, but individual entrepreneurs have more time - their deadline ends on April 30.

The general taxation system requires an annual income tax report, for which a return is filed for each quarter (by the 28th of the following month) and at the end of the year (by March 28). In addition, it is necessary to submit a VAT report (also quarterly) and a property tax return once a year. It must fall into the hands of the tax inspector no later than March 30.

Declaration of excise taxes on alcohol

Order of the Federal Tax Service of Russia dated August 27, 2020 No. ED-7-3/ [email protected] updated the form of the declaration on excise taxes on ethyl alcohol, alcoholic and (or) excisable alcohol-containing products and grapes, as well as the procedure for filling it out and the format for submitting it in electronic form .

The amendments are related to the current provisions of Federal Law dated September 29, 2019 No. 326-FZ. In particular, from 01.01.2020, grapes used for the production of wine, sparkling wine (champagne), liqueur wine with a protected geographical indication, with a protected designation of origin (special wine), wine materials, grape must or for the production of alcoholic beverages are recognized as excisable goods. including grape processing.

Section 3 has been added to calculate the excise tax on grapes; Section 2 includes a new line 020, according to which the budget classification code should be indicated. The new excise tax declaration form will be used for reporting for December 2021.

1C:ITS

For changes to the alcohol excise tax declaration, see the “Legislative Consultations” section.

How can I submit reports?

You can submit your tax returns yourself, send them by mail, send them by email, or have a representative submit them to you. In some cases, the method of delivery is established by law. However, the main thing in filing reports is to do it on time, as well as to prepare tax documents correctly.

Errors in tax reporting are common and costly for both organizations and entrepreneurs. So, if due to an error the amount of tax was reduced, both the company and the accountant face serious fines, which can reach 20% of the underpaid tax. In all other cases, it is not so much the mistakes that are scary as the violation of deadlines for filing declarations, which, again, leads to fines and penalties.

By law, the tax office may refuse to accept returns if they are submitted in the wrong format. In practice, this leads to the fact that documents may not be accepted without a stamp, with a facsimile signature instead of a regular one, or in paper format, if the law requires reporting to be submitted electronically.

All these mistakes, blots and omissions lead to financial losses and force entrepreneurs to waste time and nerves. If you have the opportunity, it is much more profitable to entrust the submission of reports to professionals who do not make mistakes, and who are liable to you in rubles for violation of deadlines.

Legal Company Business Consulting LLC will be happy to answer all your questions about accounting outsourcing with the help of an online consultant, as well as by calling the phone numbers listed on the website.

Confirmation of legal address

The Federal Tax Service strictly ensures that the organization is actually located at the declared location. During the recent cleanup of the Unified State Register of Legal Entities, about half a million LLCs received a mark of unreliable information precisely because of the discrepancy between the actual and legal addresses. If the company does not confirm the reality of the location, it may be excluded from the state register.

Confirmation of legal address is also requested by banks when opening a current account and by counterparties when concluding contracts. Here are the documents about the location that the organization must have:

- Certificate of ownership or extract from the Unified State Register of Real Estate, if the premises belong to the LLC itself.

- Lease agreement, acceptance certificate of premises, copy of the title document, certified by the lessor, if the property is rented.

- Consent of the owner and a copy of the title document, if the LLC is registered at a home address.