All fixed assets of the enterprise gradually decrease in value, transferring it to manufactured products or services provided. This process is called depreciation . Amounts by which the value of fixed assets is reduced - depreciable amounts - are subject to strict accounting, since they are written off. This is the most important part of an organization's financial policy.

This process cannot occur arbitrarily; depreciation write-offs are clearly stipulated in tax legislation (Article 259 of the Tax Code of the Russian Federation). Methods for calculating depreciation amounts and the specifics of their application are discussed below.

Methods for calculating depreciation

Accounting has four options for calculating depreciation. You can learn more about the methods for calculating depreciation in PBU 6/01.

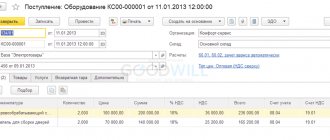

Depreciation should be calculated from the month following the month in which the asset was registered. Let’s say the computer was capitalized in October 2018, the accountant will begin calculating depreciation from November 1, 2018.

Depreciation calculation methods:

- Linear.

- Reducing balance method.

- A method of writing off cost based on the sum of the numbers of years of useful life.

- The method of writing off the cost is proportional to the volume of products (works).

Please note that the listed methods relate to depreciation of fixed assets in accounting. In tax accounting, there are only two ways to calculate depreciation charges - linear and non-linear.

Submit electronic reports via the Internet. Kontur.Extern gives you 3 months free!

Try it

Linear method

Most often, practicing accountants use this method. It is very simple and clear.

To find out the amount of monthly depreciation, you should find the product of the original cost of the asset and the depreciation rate.

Depreciation rate = 1/SPI (months) x 100%.

Example. Funtik LLC registered a Samsung computer. The initial cost is 49,320 rubles. SPI - 5 years (60 months).

The depreciation rate for a Samsung computer = 1/60 * 100% = 1.67.

Monthly depreciation = 49,320 x 1.67% = 823.64 rubles.

Due to rounding, the amount of depreciation in the first months will differ from the amount of depreciation in the last month (the total amount of depreciation for the entire period should not be more than the original cost).

In practice, it is customary to calculate depreciation in a simpler and more accurate way.

Monthly depreciation = 49,320: 60 = 822 rubles.

Submit electronic reports via the Internet. Kontur.Extern gives you 3 months free!

Try it

Reducing balance method

To find out the required amount, you will need the residual value of the fixed assets at the beginning of the year, SPI. Companies also have the right to use an acceleration factor from 1 to 3.

Example. Funtik LLC uses OS in production, the residual value of which as of 01/01/2018 is 49,320 rubles (the same amount is the initial cost). SPI - 60 months. The coefficient is set at 1.3.

2018

49,320: 60 x 1.3 = 1068.60 rubles per month

The amount of depreciation for 2021 will be 12,823.20 rubles (1068.60 x 12).

2019

Residual value as of 01/01/2019 = 49,320 - 12,823.20 = 36,496.80 rubles.

36,496.80: 60 x 1.3 = 790.76 rubles per month.

Depreciation in subsequent years is also calculated in this way. The residual value of the operating system is always taken as a basis. Thus, every year depreciation charges decrease.

Submit electronic reports via the Internet. Kontur.Extern gives you 3 months free!

Try it

Method of writing off cost based on the sum of the numbers of years of useful life

The calculation is based on the initial cost and the sum of the number of years remaining until the end of the investment project.

Example. Funtik LLC uses OS in production, the initial cost of which is 49,320 rubles. SPI - 48 months (4 years). Depreciation is accrued from 01/01/2017.

First, let's determine depreciation rates.

2017 = 4 / (1 + 2 + 3 + 4) x 100% = 40%.

2018 = 3 / (1 + 2 + 3 + 4) x 100% = 30%.

2019 = 2 / (1 + 2 + 3 + 4) x 100% = 20%.

2020 = 1 / (1 + 2 + 3 + 4) x 100% = 10%.

This method allows you to write off most of the cost of the OS in the early years.

The amount of depreciation is determined by multiplying the original amount by the calculated rate.

Depreciation amount for 2021 = 49,320 x 40% = 19,728 rubles.

Monthly depreciation in 2021 = 19,728: 12 = 1,644 rubles.

The method of writing off the cost in proportion to the volume of products (works)

With this method, quantitative indicators of production (pieces, kilograms, etc.), the initial cost and the planned productivity of the operating system are taken as a basis.

Example . Pound LLC produces spare parts on the A458 machine. The machine was purchased in April 2021 and immediately put into operation. The initial cost of the A458 machine is 589,000 rubles. Over the entire period of use, it is planned to produce 350,000 units of products on this machine. In May, the machine produced 4,200 parts, in June - 3,100 units.

Depreciation in May = 589,000: 350,000 x 4,200 = 7,068 rubles.

Depreciation in June = 589,000: 350,000 x 3,100 = 5,216.86 rubles.

Submit electronic reports via the Internet. Kontur.Extern gives you 3 months free!

Try it

What is it - definition

To understand the concept of depreciation rate, you need to understand the mechanism and significance of the depreciation process.

The depreciation procedure is an important process because:

- directs cash flows to the reproduction of fixed assets;

- divides large investments by periods.

The norm is expressed as a percentage and shows what share of the costs of acquiring a fixed asset should be transferred to expenses and invested in the cost of products, goods, and work during the year.

In other words, the norm is the part of the cost of fixed assets that the organization recognizes as expenses in the reporting year.

Depreciation rate of fixed assets: concept and structure

During the production process, fixed assets are depreciated, gradually transferring their value to the produced goods, and depreciation is a monthly process of covering the wear and tear that inevitably arises.

The concept of “depreciation rate” is the percentage established by the legislator to cover the price of the worn-out part of the OS. With its help, it is easy to determine the total amount of deductions for the year. Consequently, the depreciation rate is the ratio of the amount of annual depreciation to the cost of the fixed asset or the inverse value of the SPI of the fixed asset object.

This indicator is not a fixed value. The depreciation rate is measured as a percentage. It is established and periodically changed at the legislative level. At the same time, the accepted standards for OS groups are the same for all organizations, industries, characteristics of activities and forms of ownership. By normalizing depreciation deductions, the state regulates the rate of reproduction in different industries, and by analyzing this indicator, it calculates the rate of depreciation and the rate of restoration of the object.

Until 1990, accounting practice was to charge depreciation for complete restoration and overhaul. Since 1991, adjustments have been made, in particular:

- Resolution of the USSR Council of Ministers No. 1072 of October 22, 1990 established new unified standards for depreciation charges, which have significant differences from previous regulations for certain groups of fixed assets. True, it is worth considering that this document should be applied taking into account the provisions of Chapter 25 of the Tax Code of the Russian Federation “Income Tax” and the regulations of the Government of the Russian Federation dated 01.01.02;

- Deductions for major repairs have been abolished. Repair work is carried out at the expense of the cost of the product or a separate repair fund;

- In order to encourage the company to renew its assets, the use of accelerated depreciation has been introduced for the active share of production, for example, transport, machinery and equipment. Accelerated depreciation stimulates the transfer of the cost of fixed assets to production costs. Therefore, we can say that the amount of the depreciation rate depends on the policy pursued by the state.

What is and is not subject to depreciation

Depreciable fixed assets are property that belongs to a businessman as a property, their use brings him profit, is designed to last more than 12 months and initially costs more than 40 thousand rubles. Such property can be both tangible assets and intellectual property.

Those funds that, over time, leave unchanged not only their original condition, but also their value, are not depreciated Rather, the value may change, but this process is not associated with wear and tear due to use, and therefore cannot be considered depreciation. These include:

- land;

- bosom;

- water resources;

- other environmental management facilities;

- raw materials;

- released goods;

- Construction in progress;

- securities, etc.

When do differences arise according to PBU 18/02?

A question that worries many accountants. But it is reasonable to approach it taking into account the benefits of taxation on property and profits.

For clarity, we have compiled the following table.

| Cost of objects | Expenses in accounting | Expenses in tax accounting | |

| Including the cost of property at one time in expenses | Gradual inclusion of property value in expenses | ||

| ≤ 40,000 rub. | Objects are not accounted for as inventories, but are depreciated as part of fixed assets | There are differences according to PBU 18/02 | There are no differences according to PBU 18/02 |

| > 40,000 rub. ≤ 100,000 rub. | Depreciation of fixed assets | There are differences according to PBU 18/02 | There are no differences according to PBU 18/02 |

| > 100,000 rub. | Depreciation of fixed assets | Impossible | There are no differences according to PBU 18/02 |

IMPORTANT! The choice in favor of not reflecting differences according to PBU 18/02 does not always entail a reduction in the complexity of accounting. From the point of view of tax reduction, it is often more profitable for an organization to use the right to a one-time attribution of the cost of objects to expenses in both accounting and tax accounting.

Accounting upon disposal, liquidation

When equipment is disposed of due to external sales, accrual stops from the next month. Features of maintaining credentials:

- A sub-account is additionally opened to account 01 to account for retired equipment

- Internal wiring Dt 01/v Kt 01 carries information about the object.

- The amount of accrued depreciation is reflected on loan 01/в.

- Accounting for disposal data is carried out using account 91.

When liquidating failed, obsolete equipment, income and expenses associated with the operation are taken into account as non-operating expenses. Enterprises must document the validity of liquidation due to the impossibility of further operation of the equipment.

The operation is formalized by act OS-4, which serves as the basis for attributing to expenses the residual value of equipment that is not fully depreciated. Expenses are accounted for on the date of completion of liquidation.

Results

When deciding how depreciation of fixed assets will be calculated in 2018-2019, the organization has the right to choose: reducing the labor intensity of accounting or the absence of differences according to PBU 18/02.

At the same time, it is reasonable to make a decision also from the point of view of reducing tax expenses. This, in particular, is facilitated by the use of the right to immediately attribute the cost of objects to expenses. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Changing the order of depreciation during modernization, repair or conservation

During the operation of equipment, the need for repairs and reconstruction (modernization) often arises. The result of the work in some cases changes the amount of depreciation charges for equipment.

| Position | Repair | Reconstruction (modernization) |

| Purpose of the work | Replacement of failed spare parts | Changing settings or updating an object |

| Result of the work | Doesn't change the cost | Changes the cost or period of use |

| Depreciation | The order does not change | The deduction rate is recalculated as the period of use within the group increases |

If after the work the period of use does not change, the rate of deductions remains the same. The amount of deductions is made taking into account the cost of modernization.

Conservation of equipment involves the temporary withdrawal of objects from circulation - cessation of use in activities. A common reason is the seasonal use of equipment. Features of calculating depreciation during conservation:

- If the period of temporary withdrawal from circulation is less than 3 months, the depreciation procedure does not change.

- If the storage period is more than 3 months, depreciation is suspended.

- The operation is resumed after reactivation.

Subsequently, depreciation is charged until the cost is fully repaid. The break does not affect the deduction amount.

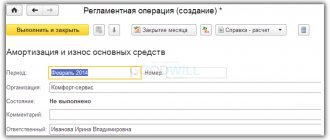

How to do depreciation accounting

Depreciation of fixed assets is calculated using account 02 “Depreciation of fixed assets”. The accrued amounts are credited to the specified account. At the same time, in the debit correspondence there are cost accounts reflecting the costs of operating the depreciable asset

Thus, the accounting entry for depreciation charges will look like this: Dt 20, 23, 25, 26, 44 Kt 02.

If the fixed assets are leased and the lease does not relate to the main activity of the business entity, then the depreciation entry is reflected as follows: Dt 91.2 Kt 02.

The accrued amount is not reflected in the balance sheet, but participates in the calculation of the indicator for line 1150 “Fixed assets”, forming the residual value of the fixed assets.

Depreciation of intangible assets is reflected in account 05 “Depreciation of intangible assets” also in correspondence with cost accounts: Dt 20, 23, 25, 26, 44 Kt 05.

The accrued amounts are not shown in the balance sheet, but take part in the calculation of the indicator for line 1110 “Intangible assets”.

conclusions

Depreciation rate is a concept used in both accounting and tax accounting. The indicator is always expressed as a percentage and shows what share of the cost of the fixed asset will need to be transferred to the organization’s expenses for a certain period of time (year, month).

For accounting purposes, this value is always calculated on an annual basis, after which the annual amount of depreciation is determined and then divided into 12 parts.

For tax accounting purposes, the rate is determined monthly. Moreover, for the linear method it needs to be calculated, but for the non-linear method, just look at the tax code, where all the values are written down depending on the depreciation group.

Useful life (USL)

The organization determines the useful life of an item of fixed assets independently based on:

- the expected life of the facility in accordance with its expected productivity or capacity;

- expected physical wear and tear, depending on the operating mode (number of shifts), natural conditions and the influence of an aggressive environment, the repair system;

- regulatory and other restrictions on the use of this object (for example, rental period).

If, as a result of reconstruction or modernization, the initially adopted standard indicators for the use of a fixed asset object have improved, then the organization can revise its useful life.