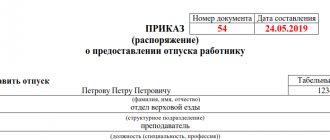

Form T-60 is standard and in official language is called a note-calculation on granting leave to an employee. The T-60 calculation note is filled out immediately before granting an employee of the organization the next paid leave. This document includes all the necessary information used to calculate vacation pay, and it is on the basis of it that the employee receives the vacation funds due to him by law before going on vacation.

Attention! Vacation pay must be issued to an employee at least three days before the start of the vacation. If this condition is violated, the employee of the organization has the legal right to refuse to go on vacation. In addition, this may entail administrative penalties from regulatory authorities and fines.

Documents serving as the basis for drawing up a settlement note

A vacation schedule drawn up in advance in the organization, an order from the company’s management to provide planned vacation to a particular employee, a payroll and cash settlements serve as documentary justification for drawing up a settlement note.

Before sending an employee on a planned vacation, the enterprise's personnel specialist must send him a notice of vacation, but no later than two weeks before it starts.

In turn, the future vacationer must put his signature under it, which will indicate that he agrees with the period and conditions of the annual planned paid leave.

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Note-calculation on granting leave to an employee. Form N T-60", as well as ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |

Filling the front side of T-60

- This part of the document includes data on the full name of the organization in which the employee works with a mandatory indication of its organizational and legal status (CJSC, LLC, individual entrepreneur).

- Then, just below, enter the serial number of the document to be filled out for internal document flow and information relating to the employee personally: his full name, position, structural unit to which he belongs, as well as the personnel number assigned to him when hired.

- In the next line, it is necessary to indicate the period for which leave is granted (the employee’s length of service at the place of work) and the exact number of days of leave (according to the calendar) with a clear indication of the start and end dates of the leave.

- If an employee does not go on a planned paid vacation, but takes additional or educational leave, then this must be entered in the appropriate column with a mandatory indication of the number of calendar vacation days, as well as a link to the document that served as the basis for its provision (management order, etc. )

- At the end of the sheet there must be a signature of the official who filled out the document - in this case, a HR specialist.

Formula for calculating vacation pay

If a worker plans to take a vacation period in accordance with the approved schedule, he may be paid the following types of monetary compensation.

- wages that were not paid in the current period;

- material assistance, if such is secured by internal regulations;

- bonus payments if performance indicators meet the requirements;

- compensation for temporary disability in case of illness before vacation;

- payment for the period of rest, the amount of which is calculated according to the approved rules.

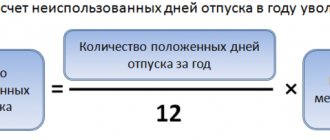

Calculation of vacation funds is carried out as follows.

- Average earnings per day are calculated.

- The resulting figure is multiplied by the number of days for vacation.

- Next, income tax is deducted from the entire amount - personal income tax and other deductions.

- The final result is entered on the form and entered in the appropriate line (written in words using numbers).

Filling out the reverse side of the T-60 form

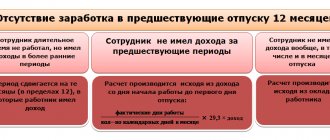

This section in the calculation note in form T-60 is the main one and includes all information regarding vacation pay due to the employee for the billing period.

The basis is information on income for the last 12 months of work at the enterprise. Opposite each specified month is written the amount accrued to the employee for this period. Then the total number of days for which vacation is calculated is entered and the average daily wage is calculated. View vacation pay calculations with examples.

The “Accrued” table includes all calculated accruals to the vacationer. In column number 8 (amount for vacation), you need to enter the result of multiplying the average daily earnings by the number of planned vacation days.

If there are any additional accruals due to the employee, they also need to be entered in the appropriate columns of the document. The total amount is entered in column 15, from which you then need to subtract the amount of income tax withheld and enter the resulting total in column 23 of this calculation.

The resulting amount will be the one that needs to be paid to the employee as vacation pay. This figure must be entered into the document both in numerical terms and necessarily in words. The accountant who made the calculations must put his signature at the bottom of the sheet with a transcript.

Thus, a calculation note in form T-60 is an internal document of the organization and is subject to mandatory accounting; its completion must fully reflect all information relating to the employee, including his personal data, as well as payments made to him in the reporting period . Based on this information, a detailed calculation of the vacation pay that the employee will receive when going on vacation is made.

Content and structure

A note regarding the provision of annual leave to an employee is drawn up in the presence of an issued Order of the manager. It is a two-sided unified form and requires certain drafting standards.

Form T-60 was legalized by Resolution of the State Statistics Committee of the Russian Federation No. 1 of 01/05/2004 and was mandatory for use in all organizations, institutions, and enterprises. But from January 1, 2013, the procedure for maintaining and processing primary documentation for labor accounting and payment was simplified. Therefore, it became possible to use not only standard forms, but also independently developed forms with all the required details. The only requirement is the presence of an Order and local acts reflecting the adoption of such a decision.

The document contains two working fields. The front part reflects basic information regarding the company and employee. Its source is the Leader's Order. On the reverse side the calculation of compensation is given and the final amounts are recorded. Both parts are executed separately by the relevant authorized persons.

How to make the calculation correctly?

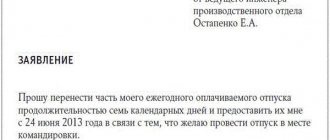

The duration of leave is 28 days, but the employee may have extended or additional annual leave. And here the factors are in addition to working conditions, for example, not a standardized working day , the internal policy of the organization.

One of the parts of the vacation necessarily corresponds to 14 days of the calendar, the others can be of the size according to the wishes of the employee.

The amount to be paid must be deductible for personal income tax , and the taxation of income at a rate of 13% should be taken into account, taking into account all tax deductions due to the employee.

In some cases, company owners are forced to take out loans to stay afloat. The founders and the director are responsible for the organization's debts. Read about what subsidiary liability is in this material.

When calculating vacation pay, a “conditional” number of calendar days is taken , which corresponds to 29.4 days in a full month worked.

If the month is not fully worked, then this conditional number is divided by the actual number of calendar days in the month and multiplied by the number worked.

An example of calculating vacation pay.

Types of paid leave

According to the Labor Code of the Russian Federation, different paid holidays are allocated. Let us present in the form of a table what types of vacations there are:

| Type of paid leave | Vacation period and to whom it is granted |

| Annual paid vacation | Is 28 calendar days. Extended leave is provided to: minors, disabled people, civil servants, prosecutors, court employees, teaching staff, candidates of science and rescue workers. |

| Annual additional leave | Provided to employees who work in extreme conditions, in harmful or dangerous work, as well as to employees who do not have a standardized work schedule. |

| Study leave | Provided to those employees who have brought the appropriate certificate from the educational institution. The duration of this leave depends on the form of study and course. |

| Maternity leave | Presented to a woman on the basis of a sick leave certificate, which she provides from a medical institution, which is given for 30 weeks. The duration of rest is 70 days before childbirth and 70 days after, in severe cases it increases to 86 days, and for the birth of twins to 110 days. |

| Holiday to care for the child | Provided at the request of the woman herself based on an application. Her income for this period will be the amount of state social insurance benefits. During this period, the woman retains her job and position. |

Related documents

- Personal account (svt). Form N T-54a

- Personal account. Form N T-54

- Payslip. Form N T-51

- Payroll. Form N T-49

- Timesheets for recording working hours and calculating wages. Form N T-12

- Time sheet. Form N T-13

- Staffing schedule. Form N T-3

- Certificate of commissioning of a temporary (non-title) structure (Unified Form N KS-8)

- Certificate of acceptance of the completed construction of the facility by the acceptance committee (Standard interindustry form N KS-14)

- General work log (Standard intersectoral form N KS-6)

- Act on cleaning the pile (trench, vegetable storage) (Unified form N MX-17)

- Act on the consumption of goods by batch (Unified form N MX-11)

- Act on the consumption of goods by batch (Unified form N MX-12)

- Act on the depreciation of inventory items (Unified form N MX-15)

- Weight sheet (Unified form N MX-9)

- Logbook for incoming cargo (Unified form N MX-4)

- Invoice for the transfer of finished products to storage locations (Unified Form N MX-18)

- Forwarder's report (Unified form N MX-21)

- Party card (Unified form N MX-10)

- Act on the return of funds to buyers (clients) for unused cash registers (Unified Form N KM-3)

How long before vacation should you write a note?

The Labor Code of the Russian Federation does not determine the exact timing for issuing a note-calculation for vacation. The law requires company management to warn its employees about the start of vacation at least 14 days before it starts.

The rules also define the obligation for the administration to make payments to an employee going on vacation no less than 3 days before leaving. The new rules stipulate that if a person working at an enterprise applies for leave and immediately leaves for this period, then the money must be paid within three days from the date of receipt of the application.

Attention! Based on this, it is advisable to draw up a settlement note in the period from 2 weeks to 3 days before the start of your vacation. Their final determination is carried out at each enterprise individually, taking into account the peculiarities of its work.

Specific deadlines can be fixed at an enterprise in its local acts, for example, in the Regulations on Vacations.

You may be interested in:Certificate of average earnings for the employment center: how to fill it out correctly

Comment on the rating

Thank you, your rating has been taken into account. You can also leave a comment on your rating.

Is the sample document useful?

If the document “Note-calculation on granting leave to an employee.

Form N T-60" was useful for you, we ask you to leave a review about it. Remember just 2 words:

Contract-Lawyer

And add Contract-Yurist.Ru to your bookmarks (Ctrl+D).

You will still need it!

How long before the vacation is it issued?

The Labor Code does not clearly indicate how many days before the start of the vacation this document must be drawn up.

However, the law specifies that the employee must be notified of the start of his vacation no less than 14 days before it begins. In addition, vacation payment must be made no later than 72 hours before the start of the vacation.

The law also states that if an employee applies for annual paid leave and immediately leaves, then the payment must be made within 3 days from the moment the employee submits the application.

Attention: therefore, based on these dates, it is best to issue a note between 2 weeks and 3 days before your vacation.

And the exact date is determined by each enterprise independently, and most often depends on the employee responsible for this action. It is allowed that the exact day of registration of the form is indicated in the internal local acts of the business entity. For example, this can be done in the Vacation Regulations.

conclusions

A note-calculation is a unified form of primary accounting documentation and in its absence it is not possible to record vacation payments as expenses.

also be calculated and filled out correctly , otherwise the inspector may deregister this form if there are errors.

For information on granting regular vacations and calculating vacation pay, watch this video:

Dear readers! We constantly write relevant and interesting materials to our news portal FBM.ru, subscribe to our news in Yandex News!