- Name. Let's say we purchased a domain in the “ru” zone. So we’ll enter: “Domain in the “ru” zone.”

- For tax accounting purposes, we will indicate “Other”.

- Type of asset in the balance sheet: “Other current inventories.”

- Field "Amount": is indicated for informational purposes only. The write-off amount is calculated according to the algorithm indicated below and based on the remaining amount to be written off according to accounting data. We will indicate here the domain purchase amount – 2600 rubles. in a year.

- In the write-off parameters, we will indicate the frequency. For example, “By month”.

- Let the cost account be 26.

- Cost item – “Other expenses”.

- All that remains is to indicate the period for which the expenses should be completely written off. Let's say we plan to launch and make our website popular in 4 months. We will indicate the start date and end date of the write-off, respectively.

Get 267 video lessons on 1C for free:

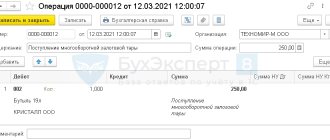

Now you can click the “Record and close” button and proceed to registering the accounting of future expenses:

Registration of deferred expenses in 1C 8.3

We prepare the document “Receipt of goods and .

Go to the “Purchases” menu, then click the “Receipt of goods and services” link. Click the “Receipt” button and select “Receipt of services”.

We fill out the header of the document as usual upon admission (described more than once). There shouldn't be any questions here.

Let's move on to filling out the tabular part. Let's add a new line, select an item, indicate the quantity and amount.

The column “Accounts” is of interest. In it you need to delete what the program offers by default and click the account selection button. In the window that opens, indicate:

Tax accounting is set up in the same way.

Here is an example of setting up accounting accounts:

Example of a completed document:

Let's look at the accounting entries that the 1C program generated for us:

We make sure that the expenses are credited to account 97.21 and will be recorded there until they are completely written off. You can always view the balance to be written off by creating a balance sheet for the account.

Write-off of deferred expenses in transactions when closing the month

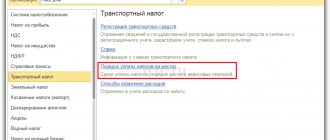

Write-off of such expenses is carried out by the routine operation “Closing the month“:

If you did everything as described above (your data may differ from mine, but the principle should be the same as I described), then the following calculation result should be obtained in the postings for the BPO:

See also our video about reflecting RBP in 1C:

Unfortunately, we are physically unable to provide free consultations to everyone, but our team will be happy to provide services for the implementation and maintenance of 1C. You can find out more about our services on the 1C Services page or just call +7 (499) 350 29 00. We work in Moscow and the region.

programmist1s.ru

How to reflect voluntary health insurance accounting in 1C 8.3?

MariaAFG, this is the situation.

Excerpt. For accounting purposes, insurance premiums under a voluntary insurance agreement for employees, provided for in an employment or collective agreement, are recognized as an expense of the organization for ordinary activities (clauses 5, 8 of PBU 10/99 “Expenses of the organization,” approved by order of the Ministry of Finance of Russia dated May 6. 1999 No. 33n, hereinafter referred to as PBU 10/99).

It turns out that, unlike tax accounting, in which expenses for voluntary health insurance are normalized (6% of the payroll), in accounting such expenses are recognized without restrictions. If differences arise, they should be reflected in accounting in accordance with PBU 18/02.

Due to the fact that the standard for voluntary medical insurance is calculated on an accrual basis, a deductible temporary difference

(clause 11 of PBU 18/02), because at the end of the year, such a difference may disappear. However, if the difference still remains, it becomes permanent (clause 4 of PBU 18/02).

In accounting, expenses for voluntary health insurance for employees are included in expenses during the period to which they relate. The posting in accounting is as follows.. By debit - expense accounts (20, 26, 44), if VHI concerns your employees - then decide for yourself. If the organization transferred insurance premiums for persons who are not in an employment relationship with it, then this In this case, expenses are recognized as other for the organization and reflected in the debit of account 91.02 “Other expenses” (clause 11 of PBU 10/99).

To reflect transactions on voluntary medical insurance of employees under CT, account 76.01 “Payments (contributions) for voluntary insurance of employees” is used.

In the “1C: Accounting 8” program, to account for the costs of voluntary medical insurance for employees, you can do it nicely and use subaccount 76.01.2 “Payments (contributions) for voluntary insurance in case of death and injury to health.” The “Future Expenses” reference book is used as analytics. Then VHI amounts will be written off automatically at the end of the month as expenses.

Well, the fact of transferring money under the VHI agreement to the insurance company in the statement will be reflected by debiting from the current account with the posting of Dt. 76.01.2 - Kt. 51

www.buhonline.ru

On civil liability insurance at hazardous production facilities

Wiring:

- D20(26) K76-1 – insurance premium charged to expenses

When the contract is not concluded on the first day of the month, it is necessary to calculate the amount of expenses in accordance with the number of days remaining until the end of the month. When the contract is terminated before the end of its validity period, then part of the premium is returned from the insurance company:

- D51 K76-1 – part of the insurance premium received

In this case, you need to write off the policy:

How to reflect property insurance in accounting The most common forms of insurance are insurance against the risk of loss or damage to specific property. After concluding a property insurance contract, an insurance policy is issued.

Attention

As an additional justification, an analogy with prepaid rent can be given: the tenant recognizes expenses in the form of rent as the service is received, the amounts transferred before that are considered as funds in the calculations. However, the rental service is clear: the tenant constantly consumes it, that is, uses the landlord’s property. With insurance the situation is different: and, it would seem, it is not consumed in the same traditional sense constantly and continuously during the term of the contract.

However, this is true: the insurer’s assumption of the insured’s risks constitutes a service. Consequently, it is consumed in the same way continuously during the term of the contract, regardless of the occurrence of insured events.

Accounting for transactions under MTPL and CASCO agreements in 1C:Accounting 8

After purchasing a car, the organization must first enter into a compulsory civil liability insurance agreement (MTPL), since liability insurance for car owners is mandatory (clauses 1, 2, article 4 of the Federal Law of April 25, 2002 No. 40-FZ “On compulsory civil liability insurance of vehicle owners funds"), and the received MTPL policy is necessary for registering a vehicle with the traffic police, its technical inspection and operation (clause 2 of article 19, clause 3 of article 16 of the Federal Law of December 10, 1995 No. 196-FZ “On Road Traffic Safety” ; clauses 1, 3 of Article 32 of the Federal Law of April 25, 2002 No. 40-FZ).

Payments under compulsory motor liability insurance may not fully cover the damage that may be caused to a car during an accident (traffic accident). In addition, only the injured party is compensated for losses. Therefore, organizations, in addition to compulsory motor liability insurance, enter into voluntary property insurance contracts for the vehicle itself against theft and possible damage as a result of an accident, illegal actions of third parties and damage due to other risks. In auto insurance practice, such contracts are called CASCO contracts (from the Spanish casco - “hull”, “hull”).

OSAGO and CASCO agreements are usually concluded for one year and come into force from the moment the policy is paid for. In accounting, the costs of purchasing MTPL and CASCO policies are recognized as expenses for ordinary activities (clause 5 of PBU 10/99).

At the same time, according to the interpretation of P112 “On the participation of an organization in insurance contracts as an insured”, adopted by the Accounting Development Fund “National non-state accounting regulator “Accounting Methodological Center”” (see https://bmcenter.ru/Files/P112), the purchase of a policy does not result in the occurrence of future expenses in the accounting records of the insured organization.

Payment for the policy by the policyholder is accounted for as an advance payment for services (advances for services), which is recognized as an expense of the organization as insurance services are consumed, i.e., as the insurance period expires. The specified prepayment is reflected in the account for settlements with insurers. Before the expiration of the paid insurance period, the corresponding amounts are reflected in the balance sheet depending on their materiality under an independent item or are included in the aggregate item “Other current assets” or “Other non-current assets” (if paid for a period of more than a year).

To account for settlements with insurers for prepayment amounts in the interpretation of P112, it is recommended to use account 76 “Settlements with various debtors and creditors” subaccount 76-1 “Settlements for property and personal insurance”.

Costs for CASCO insurance are recognized when taxing profits in the amount of actual costs (subclause 1, clause 1, clause 3, article 263 of the Tax Code of the Russian Federation).

At the same time, insurance premiums under MTPL and CASCO contracts are recognized evenly during the term of the contract - in proportion to the number of calendar days in the reporting period (clause 6 of Article 262 of the Tax Code of the Russian Federation). The costs of paying premiums are included in other expenses associated with production and (or) sales (clauses 2 and 3 of Article 263 of the Tax Code of the Russian Federation).

To account for prepayment amounts under MTPL and CASCO contracts in 1C: Accounting 8, subaccount 76.01.9 “Payments (contributions) for other types of insurance” is intended. Analytical accounting for Subconto 2 in subaccount 76.01.9 is carried out according to items of expenses of future periods, which allows automatic write-off of the amounts recorded in this subaccount according to certain rules, in particular, evenly - in proportion to the number of calendar days in the reporting period.

In connection with the purchase of a car, the organization insured its civil liability on October 1, 2012, and also issued a CASCO agreement. The cost of the MTPL policy was 6,000 rubles, CASCO - 60,000 rubles.

The insurance period under MTPL and CASCO contracts is from October 1, 2012 to September 30, 2013.

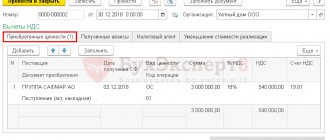

1) The transfer of the insurance premium is reflected in the documents Write-off from the current account for the type of transaction Other write-off:

from 01.10.2012 - for the amount of insurance premiums under compulsory motor liability insurance and the first payment under the CASCO agreement;

The description of the deferred items in the reference book Deferred Expenses indicates (Fig. 1):

Civil liability insurance for accounting entries

Example An industrial organization has concluded with an insurance organization that has the appropriate license a civil liability insurance contract for damage to life, health or property of third parties and the environment in the event of an accident at a hazardous production facility (a site where a permanently installed tower crane is used). The contract period is from February 1, 2006 to January 31, 2007. Sum insured - 1,000,000 rubles, insurance rate - 0.5%, insurance premium - 5,000 rubles. The organization paid the one-time insurance premium within the period established in the insurance contract. The transactions indicated in the table are recorded in accounting. Table Contents of transactions Debit Credit Amount, rub.

Info

Indeed, termination of an insurance contract before its expiration is provided for by law (Art.

958 of the Civil Code of the Russian Federation). Thus, the contract is terminated early if, after its entry into force, the possibility of the occurrence of an insured event has ceased and the existence of the insured risk ceased due to circumstances other than the insured event, for example as a result of: - destruction of the insured property for reasons other than the occurrence of the insured event; - termination in in accordance with the established procedure for entrepreneurial activity by a person who has insured the entrepreneurial risk or the risk of civil liability associated with this activity. In this case, the insurer has the right to a portion of the insurance premium in proportion to the time during which the insurance was in force.

Regulations on the composition of costs for the production and sale of products (works, services), included in the cost of products (works, services), and on the procedure for the formation of financial results taken into account when taxing profits, approved by Decree of the Government of the Russian Federation dated 05.08.1992 N 552, in the amount 1% of revenue. However, arbitration practice is not in favor of the tax authorities. In the decisions of the FAS of the East Siberian District dated 03/02/2005 in case No. A33-13049/04-С6-Ф02-572/05-С1, the FAS of the Volga District dated 09/22/2005 in case No. A49-656/2005-75A/17, FAS Volga-Vyatka District dated August 26, 2006 in case No. A43-34874/2005-38-630, dated January 27, 2006 in case No. A43-21719/2005-16-672, these types of insurance are recognized as mandatory in relation to each specific taxpayer.

Therefore, there is another type of voluntary auto insurance - DSAGO. For any type of insurance, a contract is concluded.

Accounting for the costs of purchasing an OSAGO and CASCO policy

Enterprises in their economic life can use various vehicles, in particular cars.

In tax accounting, the cost of an MTPL policy is taken into account when taxing profits within the limits of insurance tariffs (Clause 1, Article 263 of the Tax Code of the Russian Federation).

We will consider the procedure for accounting for the costs of purchasing MTPL and CASCO policies in 1C: Accounting 8 using the following example.

The amount of insurance premiums for compulsory motor liability insurance was transferred on October 1, 2012.

The CASCO agreement provides for payment of the insurance premium in two stages: until October 2, 2012 and until April 1, 2013. Payment of contributions for the first 6 months was made on October 1, 2012.

dated March 30, 2013 - for the amount of the second payment under the CASCO agreement.

In the Payment Decoding section of the document Write-off from the current account form, the following is indicated:

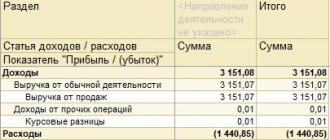

2) The monthly inclusion of paid insurance premiums in the expenses of the current period in terms of the insurer’s services consumed is carried out when performing the routine operation of closing the month Write-off of future expenses.

To document the amounts included in expenses, it is recommended to create and print out on paper a Statement of Calculation for the transaction (Fig. 2), compiled separately “according to accounting data” and “according to tax accounting data.”

○ Advice from a lawyer:

✔ Accounting for the costs of insuring a leased car.

Quite often, organizations that own a car under a leasing agreement have problems with tax and accounting transactions for obtaining compulsory motor liability insurance and CASCO policies. To avoid problems, car lawyers recommend turning to the essence of the leasing agreement itself. The norms of civil legislation (namely part 3 of article 421, part 1 of article 1005 and part 2 of article 1008 of the Civil Code of the Russian Federation) are applicable to the transaction in question to the extent that the lessor becomes an agent through whose actions the vehicle is insured against in its own name, but at the expense of the lessee. Therefore, the insurance premium (if it is documented) is reflected according to the general rules, as if this amount was paid directly to the insurer.

✔ Expenses under the simplified taxation system.

Preferential taxation in a certain way influences the need to reflect the transactions considered. The simplified system comes in two types, which differ by object: either “income minus expenses” or “income”. In the first case, the funds spent for concluding MTPL and CASCO contracts must be taken into account along with the expenses incurred at the time of direct payment of the insurance premium. However, if the contract is terminated, its part, returned taking into account the actual duration of the insurance, is counted along with other income as a general rule. If the organization has chosen the simplified tax system for the object “income,” then neither the payment of the insurance premium nor the return of part of it is taken into account in any of the articles.

Published by: Vadim Kalyuzhny , specialist of the TopYurist.RU portal

Accounting for repair costs and damage compensation in case of an accident

During operation, the organization's vehicle may be damaged in an accident. Damage caused to the car in this case can be compensated:

At the same time, under both the MTPL agreement and the CASCO agreement, the insurance company can compensate the amount of damage by means of a monetary payment or, against this payment, organize and partially or fully pay for repairs at a car repair organization chosen by it or the injured party.

When an insurance company pays compensation in monetary terms, it is recognized in accounting as other income (clause 7 of PBU 9/99), and for profit tax purposes it is taken into account as non-operating income (clause 3 of Article 250 of the Tax Code of the Russian Federation). The date of its receipt is considered to be the date of recognition by the insurance company of the amount of compensation for damage (subclause 4, clause 1, article 271 of the Tax Code of the Russian Federation).

The amounts of insurance compensation received upon the occurrence of an insured event are not related to payment for goods, works, services sold, therefore they are not included in the VAT base (letter of the Ministry of Finance of Russia dated December 24, 2010 No. 03-04-05/3-744 and the Federal Tax Service of Russia dated December 29, 2006 No. 14-2-05/ [email protected] ).

We will consider accounting for compensation of damages in cash in “1C: Accounting 8” using the following example.

The organization owns a car. The CASCO agreement with the insurance company was not concluded:

— 12/01/2012 — the organization’s car was involved in an accident. The driver of the other car was found to be at fault;

- 12/14/2012 - the insurance organization of the person responsible for the accident accepted the payment of compensation in the amount of 29,500 rubles;

— December 20, 2012 — the amount of damages in the amount of RUB 29,500. credited to the organization's bank account.

1) On the date the insurance company recognizes the culprit of the accident as the amount of compensation for damage, the document Operation (accounting and tax accounting) with posting is entered

Debit 76.01.1 “Calculations for property and personal insurance” Credit 91.01 “Other income”

For tax accounting purposes, the amount of compensation is indicated in the resources Amount NU Dt and Amount NU Kt (Fig. 3).

Analytics for account 76.01.1 - insurance company and basis for calculations (application for compensation of losses). Analytics for account 91.01 - an item for accounting for income and expenses for insured events with the type Other non-operating income (expenses).

2) Receipt of the amount of compensation for damage to the organization’s account is registered with the document Receipt to the current account for the type of transaction Other settlements with counterparties. In the Settlement account field, account 76.01.1 is indicated.

Repair costs are recognized in the general manner provided for in Article 260 of the Tax Code of the Russian Federation, as expenses for the repair of fixed assets.

They are reflected in the implementation period in the amount of actual costs (letter of the Ministry of Finance of Russia dated March 31, 2009 No. 03-03-06/2/70).

VAT deduction on goods, works and services purchased to repair a damaged car is made on a general basis, regardless of the fact that the cost of repair work is compensated by an insurance organization (letters of the Ministry of Finance of Russia dated July 29, 2010 No. 03-07-11/321 and dated April 15. 2010 No. 03-07-08/115).

Let's look at accounting for the cost of car repairs after an accident in 1C: Accounting 8 using an example.

The organization's car, used for management purposes, was involved in an accident on December 1, 2012.

On December 20, 2012, the insurance company of the person responsible for the accident received an amount of compensation for damage in the amount of 29,500 rubles to the bank account.

The car was repaired on December 24, 2012 by the Autoservice organization, for which a transfer and acceptance certificate of the work performed was drawn up. The cost of repairs amounted to 23,600 rubles, including VAT of 3,600 rubles. The contractor has issued an invoice for the work performed. On December 26, 2012, the organization paid the contractor for the car repair work in the amount of 23,600 rubles, including VAT of 3,600 rubles.

1) On the date of the acceptance certificate of completed car repair work, the document Receipt of goods and services is entered for the Purchase, commission operation.

On the Services tab, the tabular section indicates the work performed, its cost, invoices and analytical features of accounting and tax accounting (Fig. 4).

On the Invoice tab, specify the details of the invoice received from the contractor, and select the Reflect VAT deduction in the book checkbox.

2) The transfer of payment to the contractor for work performed is reflected in the documents Payment order (to prepare a payment order to the bank) and Write-off from the current account for the Payment to supplier transaction (to reflect the transfer on the accounting accounts).

If the insurance company compensating for the damage itself organizes and pays for the repair of the damaged car to pay compensation, the organization that owns the damaged car does not recognize in accounting and tax accounting either income in the form of insurance compensation (it does not receive it) or expenses in the form of the cost of repairs (paid by the insurer).

How to carry out an insurance policy in 1 second

1.

- If you need to call a document form to print, this can be done by clicking on the “Accounting certificate” button.

- Save the document.

- The remaining fields are filled in as shown in Fig. 2.

- Save the document and post it.

- From the “Bank and Cash Desk” menu, select the creation of a new document - “Receipt of funds to the organization’s current account.”

- Transaction type – “Other receipts”.

- The fields of the document are filled in as follows. In the “Credit account” field the account 76.01.1 is indicated. In the “Agreements” field, select a document that is used as the basis for registering the receipt of funds to the company’s account.

In order to reflect the transfer of the amount of insurance compensation to the account of the company (the injured party), it is necessary to generate a new document - “Receipt of funds to the organization’s current account.”

This is done as follows (see Fig. 2).

In Fig.

Accounting for expenses and compensation when liquidating a car after an accident

As a result of an accident, the fact of total or constructive loss of the vehicle may be recorded. Constructive loss is said to occur when the cost of restoring the vehicle exceeds 75 percent of the insured value under the CASCO agreement. Constructive loss is equivalent to the complete loss of property.

If an organization waives its rights to a car, payment of compensation in the event of its total or constructive loss is made in the amount of the full insured amount minus depreciation of the car for the period of validity of the contract that elapsed before the insured event (Clause 5 of Article 10 of the Law of the Russian Federation of November 27, 1992 No. 4015 -1 “On the organization of insurance business in the Russian Federation”).

In “1C: Accounting 8”, calculations for insurance compensation for the total or constructive loss of a car are reflected in the same way as the accounting for calculations for funds for car repairs discussed above (see Example 2).

A car that cannot be restored is written off from accounting and tax records on the basis of an act on the write-off of motor vehicles. The fact of write-off is also noted on the fixed assets inventory card. To stop paying transport tax, the vehicle being written off must be deregistered with the traffic police.

In accounting, the write-off of a car is reflected in the following entries:

Debit 01.09 “Retirement of fixed assets” Credit 01.01 “Fixed assets in the organization” - the book value of the retiring car was transferred to a separate subaccount; Debit 02.01 “Depreciation of fixed assets accounted for on account 01” Credit 01.09 “Disposal of fixed assets” - accumulated depreciation on a retiring car was transferred to a separate subaccount; Debit 91.02 “Other expenses” Credit 01.09 “Disposal of fixed assets” - the residual value of the disposed car is written off as other expenses.

In tax accounting, the residual value and expenses associated with the decommissioning of a vehicle that cannot be restored are included in non-operating expenses (subclause 8, clause 1, article 265 of the Tax Code of the Russian Federation).

In “1C: Accounting 8”, the write-off of a car from accounting and tax records as a result of total or constructive loss is reflected in the document Write-off of OS (Fig. 5). As an analytical indicator, account 91.02 indicates the item of other income and expenses with the type Income (expenses) associated with the liquidation of fixed assets.

Postings for payment of car insurance

The organization must keep this type of agreement for 5 years. Sometimes, to conclude a contract, it is necessary to undergo a technical inspection and obtain a diagnostic card. The costs of passing a technical inspection are reflected by posting:

- D20 (26) K60 – costs for technical inspection were expensed

The receipt of the policy must be taken into account in an off-balance sheet account, for example account 13 “OSAGO, DSAGO, CASCO policies”, posting:

Calculations for car insurance in the organization’s accounting must be reflected in account 76-1 “Calculations for property and personal insurance.”

Accounting for expenses and compensation in case of theft (theft) of a car

If the car was insured against theft (theft), then in the event of an insured event, the insurance company must pay the organization insurance compensation in the amount established by the CASCO agreement, but not exceeding the actual (insurable) value of the property (Article 947 of the Tax Code of the Russian Federation).

Insurance compensation in accounting is recognized as other income (clause 7 of PBU 9/99), and for profit tax purposes it is taken into account as non-operating income (clause 3 of Article 250 of the Tax Code of the Russian Federation). The date of its receipt is considered to be the date of recognition by the insurance company of the amount of compensation for damage (subclause 4, clause 1, article 271 of the Tax Code of the Russian Federation).

In “1C: Accounting 8”, calculations for insurance compensation in case of theft (theft) of a car are reflected in the same way as the above-discussed accounting for calculations for funds for car repairs after an accident (see Example 2).

A stolen (stolen) car is subject to write-off from accounting (clause 29 of PBU 6/01), as in the case of an accident, on the basis of a vehicle write-off act. This can be done in the reporting period when the theft occurred based on the inventory, as well as a copy of the resolution to initiate a criminal case. In this case, the residual value, as in the case of an accident, is included in the other expenses of the organization.

For profit tax purposes, the residual value of a stolen (stolen) car is recognized as non-operating expenses, but provided that it was not possible to identify the culprit (subclause 5, clause 2, article 265 of the Tax Code of the Russian Federation).

Thus, the residual value of the car is taken into account as part of the expenses of the reporting (tax) period in which a decision was made to suspend the criminal case on the fact of theft (theft).

To bring accounting and tax accounting closer together, it is recommended to reflect the residual value of the car before assigning it to other expenses as a shortage on account 94 “Losses and shortages from damage to valuables” and, after the suspension of the criminal case, write off as a debit to account 91.02 “Other expenses”.

We will consider writing off a stolen (stolen) car from the register and recognizing expenses in 1C: Accounting 8 using an example.

The organization owns a car used for management purposes:

— 05.11.2012 — theft of a car was committed;

— On November 12, 2012, a copy of the resolution to initiate a criminal case on the fact of theft was received. On the same day, based on the results of the inventory, a decision was made to write off the car from the register. The residual value of the car in accounting and tax accounting, taking into account depreciation for November 2012, is 190,950.00 rubles;

— 12/20/2012 — a copy of the decision to suspend the criminal case on the fact of theft and a positive decision of the insurance company on payment of insurance compensation was received.

Let's consider the reflection of these events in the organization's accounting.

1) The deregistration of a vehicle based on the results of the inventory is reflected using the document Write-off of fixed assets. The form of the document indicates Expense Account - 94 “Shortages and losses from damage to valuables”, Reason - “Theft (theft)”.

2) The write-off of the residual value of account 94 to account 91.02 “Other expenses” is reflected in the document Operation (accounting and tax accounting) (Fig. 6). In the transaction debit analytics, the item of other income and expenses is indicated with the type Income (expenses) associated with the liquidation of fixed assets and a fixed asset item written off from accounting.

Bad request

AttentionThe insurance company satisfied the request for compensation and transferred 117 thousand rubles to the account of the Sewing Factory organization, fulfilling its obligations to the injured party. The management decided to repair the car involved in the accident on its own by contacting an authorized service center. How to account for the debt of an insurance company in 1C Accounting? In order to take into account the accrual of the amount of insurance payment under MTPL in 1C Accounting, you should create a new document “Operation” (see Fig. 1). This is done in the following order.

- From the operations menu, go to the “Accounting” subsection and select “Create a new document”.

- The selected document type is “Operation”.

- The fields of the document are filled in as follows.

Accounting for unused insurance premium under MTPL and CASCO contracts

MTPL and CASCO agreements can be terminated early. For example, in the event of total or constructive loss of a car in an accident, theft (theft) of a car or its sale before the expiration of the contract. In these cases, under the MTPL agreement, the insurance company is obliged to return part of the unused insurance premium (clause 34 of the Rules for compulsory civil liability insurance of vehicle owners, approved by Decree of the Government of the Russian Federation of May 7, 2003 No. 263).

In accounting, the returned part of the insurance premium is reflected as a return of the prepayment in the debit of account 51 “Current accounts” and the credit of account 76.01.9 “Payments (contributions) for other types of insurance.”

For profit tax purposes, the returned amount of the insurance premium is also not taken into account as expenses (letter of the Ministry of Finance of Russia dated March 18, 2010 No. 03-03-06/3/6).

In “1C: Accounting 8”, the crediting of part of the unused insurance premium to the current account is registered with the document Receipt to the current account for the Other receipt operation (Fig. 7). The loan account analytics indicates the insurance company and the item of deferred expenses for which the prepayment of insurance premiums under the compulsory motor liability insurance agreement was taken into account.

Under the MTPL agreement, the insurance company does not fully return the amount of the insurance premium for the unexpired period of the insurance agreement. She deducts from it 23% of the amount of the insurance premium, of which 20% is to cover the costs of the insurance company in connection with the conclusion of the contract, and the insurance company sends 3% to the reserve of compensation payments.

The non-refundable part of the insurance premium in accounting is written off from account 76.01.9 in correspondence with account 91.02. For tax purposes, this amount is taken into account as part of non-operating expenses (letters of the Ministry of Finance of Russia dated March 18, 2010 No. 03-03-06/3/6, dated March 15, 2010 No. 03-03-06/1/133).

In “1C: Accounting 8”, the non-refundable part of the insurance premium is written off from account 76.01.9 using the document Operation (accounting and tax accounting) (Fig. 8). In the debit account analytics, the item of other income and expenses is indicated with the type Other non-operating income (expenses). The loan account analytics indicates the insurance company and the item of deferred expenses for which the prepayment of insurance premiums under the compulsory motor liability insurance agreement was taken into account.

Unlike the MTPL agreement, the procedure for early termination of the CASCO agreement is established by the agreement itself or the rules of the insurance company attached to it. The same documents also regulate the rules for returning the unspent portion of the insurance premium. Most insurance companies refund premiums under a CASCO agreement, but with significant restrictions and in exceptional cases.

If the CASCO agreement provides for the return of part of the premium, then in tax and accounting it is reflected in the same way as the MTPL agreement (see Fig. 7).

The non-refundable part of the insurance premium under the CASCO agreement is written off from account 76.01.9 by analogy with the OSAGO agreement. For profit tax purposes, this amount can be taken into account by analogy with the possibility of accounting for these expenses under a compulsory motor liability insurance agreement (see Fig. 8).

If an organization believes that this option is associated with tax risks, it can take into account the non-refundable part of the insurance premium as part of non-taxable expenses, fixing a constant difference (Fig. 9).

In order to be able to use standard reports to analyze the composition of expenses not taken into account for tax purposes, you should additionally enter an entry in the debit of account HE.03 “Non-operating expenses not taken into account for tax purposes.”

buh.ru

See also:

- Internal Revenue Service fines for individual entrepreneurs Sanctions for late submission of reports to the tax office Organizations and individual entrepreneurs must submit reports to the tax authorities of the Russian Federation. The composition of the reporting and the timing of its submission depend, in particular, [...]

- Sample report on dismissal from the police department Office work Leave for combat veterans The Government of the Russian Federation provides various benefits to combat veterans, including additional leave. Not every person […]

- On state pension provision in the Russian Federation law Federal Law “On state pension provision in the Russian Federation” dated December 15, 2001 N 166-FZ Article 7 (as amended on March 7, 2018) Article 7. Conditions for assigning pensions to the federal […]

- I have not received a tax payment notice. What should I do if I have not received a tax payment notice? Citizens pay land and transport taxes, property tax on individuals on the basis of a tax notice. Also […]

- Requirements for collateral agreements How to register the right of claim under a deposit agreement as collateral? A pledge of receivables under a bank account (deposit) agreement can be used as collateral provided by the bank […]

- Notary St. Petersburg Avtovo Notaries near Avtovo metro station in St. Petersburg - list with addresses Notary Kolpakov Vladimir Veniaminovich City/District: Krasnoselsky Address: St. Petersburg, Leninsky Prospect, 100, bldg. 3, off. 4 […]