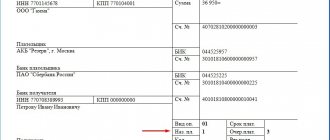

Payment

Pay taxes in a few clicks! Pay taxes, fees and submit reports without leaving your

To calculate advance payments and simplified tax system, you can use a free online calculator directly at

How is the 2021 balance sheet prepared (Word version of the current form can be found below)? Important part of the job

What is a desk tax audit? A desk audit is a control event carried out by the Federal Tax Service

From 2021, the obligation to submit calculations for land and transport taxes has been abolished. But this

During the existence of the property tax, various changes occurred with it. Mostly they concerned

What is property tax Find out everything about property tax in legislative language

Transport tax is a tax for owning a vehicle. The following types are subject to taxation

Pay taxes in a few clicks! Pay taxes, fees and submit reports without leaving your

Individual entrepreneurs and organizations that are employers are required to pay monthly payments to employees working under employment contracts