Structure of the enterprise's equity capital

Equity capital can be defined as a complex of sources of financing the company’s activities in the amount of funds provided by its owners, as well as those generated in the process of core activities. It includes:

- authorized capital and its analogues;

- additional;

- spare;

- repurchased shares;

- profit after distribution.

The number of interpretations of the term “equity capital” is quite significant, but the greatest practical value from the point of view of accounting procedures is to consider it as a set of elements from the above list. A similar approach is given in paragraph 66 of Order No. 34n of the Ministry of Finance of the Russian Federation dated July 29, 1998, which regulates the procedure for preparing financial statements. Based on the above, the methodology for accounting for equity capital can be presented in the form of accounting for each component separately.

Return on equity

Return on equity reflects the efficiency of the business, the degree of return from the work of the money in circulation. To put it simply, profitability gives an idea of how much profit each ruble of a company's capital brings in. This indicator reflects the success of maintaining the return on capital at a normal level. The better this indicator, the more attractive the company will be to investors.

The return on equity ratio can be determined using this formula:

PE / SK * 100.

The formula uses these values:

- PE – net profit.

- SK – own capital.

To clarify the calculation result, it is recommended to use the average annual value of equity capital.

Profitability can also be determined based on reporting documentation. In particular, you will need values from the balance sheet and income statement lines. The formula for calculations will be:

Line 2400 / line 1300 * 100.

What profitability will be optimal? Usually a ratio of 10-12% is considered normal. However, it is relevant for developed countries. If there is high inflation in the state, then the normal value will be 20%. A negative sign is a negative indicator.

The authorized capital as an integral element of the company's capital

The basis of a company's own funds can be called the company's authorized capital. The main tasks solved by the company with its help are:

- implementation of primary investments - purchase of fixed assets, intangible assets, materials, raw materials, goods, etc.;

- creating a kind of safety net that guarantees the fulfillment of the company’s obligations under contracts, including credit agreements;

- the opportunity for the owners of the company to influence the way the business is conducted through shares in ownership.

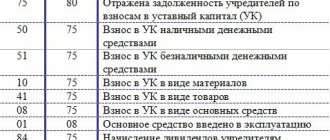

To record all movements of the authorized capital in the registers, account 80 “Authorized capital” is used, which was put into effect by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n. It is classified as passive, an increase in its size is reflected as a credit, and a decrease as a debit. Quite often it is used in conjunction with an account for accounting for settlements with founders (75).

Features of accounting for capital and profit (loss) in partnerships and cooperatives

In business partnerships, the contributed capital is accounted for as equity capital. A separate analytical account is opened for each participant (depositor), in which the amount of contribution made by him in the form of cash or other property is taken into account. The contributed property is usually valued at market prices agreed upon by the participants.

When a member of the partnership retires, he is paid part of the value of the property in proportion to his share in the share capital.

The profit received is distributed among all members of the partnership - usually in proportion to their shares in the share capital. Losses are distributed in the same way, but only among the full participants of the partnership.

If there are losses and, as a result, the net value of the property decreases to a level below the share capital, the profit then received is not distributed until the net value of the property exceeds the share capital.

To summarize information about the state and movement of share capital, account 80 “Authorized capital” is used.

Settlements with participants on contributions to the share capital are reflected in the debit of account 75 “Settlements with founders” and the credit of account 80 “Authorized capital”. Cash and other types of property received from deposits are reflected in the debit of cash accounts and the corresponding property accounts from the credit of account 75. The amount of share capital, as already noted, is determined by the constituent documents. However, it is not a fixed value and can change. At the end of the year, the balance in account 99 “Profits and losses” is written off to account 80 “Authorized capital” and distributed among the members of the partnership in proportion to their share in the share capital.

A participant in a general partnership may, with the consent of the remaining members of the partnership, transfer his share or part of the share in the share capital to another person who becomes a participant in the partnership. For such operations, the amount of share capital does not change. Changes are reflected only in analytical accounts for accounting of share capital. Upon liquidation of a partnership, its property is distributed among the participants as follows:

- if the property is sold at a profit, then it is distributed among the participants in excess of their contribution to the share capital in proportion to their shares in the share capital. Limited partners are paid only the amount of their contribution to the share capital, if this condition is provided for in the memorandum of association;

- if the property is sold at a loss, then the share capital is reduced by the amount of the loss in proportion to the shares of participants and investors.

If losses exceed the amount of the share capital, the participants of the partnership (except for limited partners) bear joint liability for the obligations of the partnership with all their property. If some participants of the partnership cannot pay their share of the debt, then it is distributed among the other participants by agreement between them.

Accounting for mutual funds in cooperatives. The cooperative's mutual fund is formed through mandatory contributions from members of the cooperative (in the form of cash and property), transferring part of the profit received to the mutual fund, and including in it the profit capitalized into the property of this organization.

For the amount of contributions of members of the cooperative to the mutual fund, account 75 “Settlements with founders” is debited and account 80 “Authorized capital” is credited. Received contributions are reflected in the debit of the cash and other property accounts from the credit of account 75.

The cooperative's profits are distributed in accordance with its charter. Part of it is sent to a mutual fund, the other part is distributed among the members of the cooperative (usually in proportion to their share contributions or the earnings of the members of the cooperative).

The transfer of part of the profit to a mutual fund is reflected in the debit of account 99 “Profits and losses” and the credit of account 80.

The members of the cooperative must cover the resulting losses within three months from the date of approval of the annual balance sheet through additional contributions - otherwise the cooperative may be liquidated in court at the request of creditors.

Members of a consumer cooperative bear subsidiary liability for its obligations to the extent of the unpaid portion of the additional contribution of each member of the cooperative.

Retired members of the cooperative have the right to receive their share from the mutual fund. In addition, the mutual fund is reduced by covering losses not covered by insurance and reserve funds.

Operations to reduce a mutual fund are reflected in the debit of account 80 and the credit of accounts for accounting for settlements with members of the cooperative and account 99 “Profits and losses”.

Analytical accounting of a mutual fund is carried out using the personal accounts of members of the cooperative.

How is analytical accounting of authorized capital carried out?

When accounting for equity , quite often they use various sub-accounts for account 80. So, you can open:

- subaccount 01 - to reflect the amounts of movement of funds of the authorized capital;

- subaccount 02 - for recording information about the cost of subscribed shares;

- subaccount 03 - for accumulating data on funds provided as owner contributions.

It is also possible to open sub-accounts for account 75 if necessary. Settlements with the founders to increase the authorized capital can be shown using account 75.01, for example: Dt 75.01 Kt 80.01.

How to reflect on the accounts the increase in the volume of authorized capital

As options for replenishing the authorized capital, in addition to directly depositing money, investment of various types of property and property rights at an agreed value can be used.

When material assets in any form act as a contribution, they are reflected in the accounting accounts by posting Dt 10, 08, 41 Kt 75.01.

One of the sources for increasing the size of the authorized capital is to attract funds from third-party investors, by placing securities or concluding agreements on investing fixed amounts. Such transactions are recorded in accounting using the entry Dt 75.01 Kt 80.

Often, the profit remaining after distribution is used as a source for replenishing the authorized capital. Then you need to reflect this operation in the registers as follows: Dt 84 Kt 80.

What are the company's own funds?

The enterprise's own funds include all assets, including financial assets, the equivalent value of movable and immovable property, unsold materials, products and other assets that are at the full disposal of the owner. Credit funds and funds raised from investors do not belong to this category, since they are targeted and raised when issuing certain obligations.

Composition of own funds

At the same time, the distribution and use of own funds is carried out within the framework of decisions made by the owner - the director of the company, the founding board, depending on whether we are talking about an LLC or OJSC, or an organization with a different form of government. Own funds also include assets that are the authorized capital of the company indicated in the accounting documentation.

Basically, the generation of own funds is carried out based on the use of the following sources:

- Initial investments of the founders - the authorized capital of the organization

- The profit from a company's operations that remains after all due fees and charges have been paid. Profit for past reporting periods since the founding of the company is taken into account, but not for the current one

- Contributions and infusions made on a non-refundable basis to the enterprise fund

Net profit is the main catalyst for the volume of equity capital. If the organization develops successfully, these indicators regularly increase.

Reducing the size of the authorized capital - accounting entries

In business practice, there are often cases when the size of the authorized capital is reduced. The reasons for this may be, for example, the sale of shares of one of the owners. For such facts, the entry Dt 80 Kt 75 is used in the accounting registers for the amount of reduction in the authorized capital upon the withdrawal of participants.

Posting to the debit of account 75 can occur in correspondence with account 91 or 51 in a situation where it is planned to exclude some material assets or property from the authorized capital.

Other reserves of the enterprise

In addition to those listed above, there may be other reserves of the enterprise that are fully owned by it. The main criteria relating assets to the enterprise’s own funds are:

- Assets acquired with own funds from the authorized capital, reserve fund or company profits

- Assets not purchased with funds from targeted loans received from investors and necessary for further depreciation during project implementation

- Assets that are not leased property of other organizations (real estate, special equipment, vehicle fleet, equipment)

In other words, if the funds of third parties were used to obtain any asset or the assets were received for temporary use, the equivalent of their financial value does not apply to the enterprise’s own funds.

Own funds are mentioned in the reporting as a separate column and refer to passive assets, the distribution of which is made within the interests of the company.

Top

Write your question in the form below

Structure of accounts to reflect the movement of additional capital in the accounts

The following cases are legally approved, upon the occurrence of which there is a movement of funds associated with a change in additional capital:

- revision of the valuation of non-current and intangible assets;

- excess of the market value of shares over their par value;

- additional budget allocations from budgetary institutions.

Another case of growth of additional capital may be a revaluation of the authorized capital recorded in the constituent documents in foreign currency. For example, if it is fully or partially issued in euros and there is a significant jump in the exchange rate, the entire resulting increase must be attributed to additional capital.

In accounting, account 83 is used to account for additional capital.

It is allowed to open the following sub-accounts for it:

- 01 - to reflect the amounts of revaluation of non-current assets accounted for as additional capital;

- 02 - the amount of income received as the difference between the market and par value of shares;

- 03 - for other cases that could lead to a change in the amount of additional capital.

However, in Form No. 1 of the financial statements, the amounts for each of the specified options for the formation of an additional fund must be reflected separately. It must be remembered that virtually all of them, one way or another, fall into one account 83. This feature of accounting for the additional fund must be considered separately and kept in mind when preparing reporting forms.

Accounting for additional capital in the structure of own capital: main accounts and subaccounts

This component of the insurance system reflects the increase in the value of non-current assets due to the revaluation of fixed assets, emission procedures, or, for example, due to an increase in the price of assets due to market reasons (in particular, if the assets are represented by real estate, which has increased in price). It can be noted that non-profit organizations can consider various allocations from the budget as additional capital.

Additional capital can be considered an increase in the value of the authorized capital due to changes in exchange rates. For example, if the authorized capital is denominated in dollars and it has become much more expensive, then its revaluation may be accompanied by the subsequent allocation of the increased amount in rubles as additional capital.

The main synthetic account on which additional capital is kept is 83.

A number of additional subaccounts can be opened for him:

- 83.01, which is used in entries recording an increase in additional capital due to the revaluation of fixed assets;

- 83.02, which is used in entries recording an increase in additional capital due to emission procedures;

- 83.03, which is used in other scenarios for increasing additional capital.

It is noteworthy that in the structure of the balance sheet form, approved in the Russian Federation by law (by order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n), separate accounting of indicators for additional capital, as well as those corresponding to the revaluation of non-current assets, is assumed, despite the fact that in order to reflect transactions on both The components of the company's capital use 1 and the same synthetic account - 83. We will look at this aspect in more detail a little later.

Let us give examples of entries that can be used when accounting for additional capital.

Double entry procedure for additional capital

So, an increase in the amount of additional capital is recorded in accounting by the following entries:

- Dt 01 Kt 83 - increase in the value of fixed assets as a result of revaluation.

- In the event of the formation of amounts as a result of the placement of securities, several entries must be made at once:

- Dt 51 Kt 75.01 - for the par value of the issued shares upon their sale;

- Dt 75.01 Kt 83 - increase in the volume of additional capital due to an increase in the value of securities.

In addition to the above situations, as a result of which the volume of additional capital increases, there may be cases when its size decreases. When they occur, the following account entries are created:

- Dt 83 Kt 01 - in case of a “reverse” decrease in the value of non-current assets after revaluation;

- Dt 83 Kt 80 - transfer of amounts of additional capital to the authorized capital;

- Dt 83 Kt 75 - a reflection of the amounts distributed among the founders upon liquidation of the company.

Composition of the organization's equity capital

Clause 66 of the Regulations on Accounting and Accounting Reports in the Russian Federation lists the sources of the organization’s funds, which are accounted for as part of equity capital [8]. These are authorized (share), additional and reserve capital, retained earnings and other reserves.

Note that, according to other rules, the amount of equity capital is determined to calculate the amount of interest on controlled debt recognized in tax expenses. This is the sum of the line indicator 1300 “Total for section. III" balance sheet and the amount of the borrower's tax debt (clause 2 of Article 269 of the Tax Code of the Russian Federation).

Authorized capital is the totality in monetary terms of the contributions of the founders (owners) to property (the cost of fixed assets, intangible assets, working capital and cash) when creating an enterprise to ensure its activities in the amounts determined by the constituent documents [7].

The additional capital of an organization represents part of its own capital and is the common property of all participants in the organization, not divided into shares. It reflects changes in equity due to facts of economic life that do not affect the financial result of the organization.

Additional capital is an independent object of accounting and is reflected separately in the accounting (financial) statements. The allocation of additional capital as a separate accounting object is due to the fact that it is possible to change the size of the authorized capital only after state registration. Therefore, all entries that change the amount of equity capital are reflected not in account 80 “Authorized capital”, but in an additional account to it (account 83 “Additional capital”).

An organization’s additional capital can be formed through:

- increase in the value of non-current assets as a result of revaluation (taking into account the revaluation of accrued depreciation) (clause 15 of the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01, clause 21 of the Accounting Regulations “Accounting for Intangible Assets” (PBU 14/2007 ));

- share premium of a joint-stock company, received from the excess of the cost of placing shares over their nominal value, and additional issue of shares (clause 68 of the Regulations on accounting and financial reporting in the Russian Federation) [8];

- the excess of the value of the participant’s contribution to the authorized capital of the limited liability company (LLC) over the nominal value of the share paid by the participant or additional contributions to the property of the LLC (Article 27 of the Federal Law of 02/08/1998 N 14-FZ “On Limited Liability Companies”);

- the amount of positive exchange rate differences arising during the formation of the authorized capital in foreign currency (clause 14 of the Accounting Regulations “Accounting for assets and liabilities, the value of which is expressed in foreign currency” (PBU 3/2006));

- amounts of value added tax transferred by the founders on property contributed as a contribution to the authorized capital (Letter of the Ministry of Finance of Russia dated October 30, 2006 No. 07-05-06/262).

Reserve capital is a so-called reserve financial source, which is created as a guarantee of uninterrupted operation of the enterprise and respect for the interests of third parties. The presence of such a financial source gives the latter confidence that the enterprise will pay off its obligations. The greater the reserve capital, the greater the amount of losses that can be compensated and the greater freedom of maneuver the enterprise management receives in overcoming losses. In this case, as a rule, reserves are created to finance expenses that may not necessarily be incurred, but only with a certain degree of probability. Of course, it is desirable for the organization that these situations do not arise and that the costs do not occur.

Regardless of the organizational and legal form of ownership, reserve capital (reserve fund) is formed through annual deductions from profits until it reaches the amount determined by the charter. Reserve capital must be created in joint-stock companies (Article 35 of the Federal Law of December 26, 1995 No. 208-FZ “On Joint-Stock Companies”). Organizations of other organizational and legal forms can create reserve capital if its creation is provided for by the company’s charter [5].

Retained earnings are the accumulated income of an organization from the moment of its creation minus taxes to the budget and the diversion of funds from profits for other purposes (dividends, reserve capital, etc.), which the organization earned in the previous and present periods. In terms of its economic content, retained earnings are one of the forms of reserve of the organization's own financial resources. This is the part of the profit that was used to finance the organization's activities.

According to the authors, future income should also be included in equity capital. The fact is that deferred income is the organization’s income that has actually already been received, but according to the principle of temporal certainty of the facts of economic activity, they relate to future reporting periods.

From an accounting point of view, i.e. priority of economic content over the legal form of economic facts, these receipts are income and should be considered as part of own funds. Despite the fact that from 01/01/2011 clause 81 of the Regulations on accounting and financial reporting in the Russian Federation became invalid, this type of liability has not lost its significance.

Other reserves include reserves that are created in the organization in connection with upcoming large expenses included in the cost of production and distribution costs.

Until January 1, 2011, reserves for future expenses fell into this category. From January 1, 2011, clause 72, which regulated the accrual of reserves for future expenses, was excluded from the Regulations on Accounting and Financial Reporting in the Russian Federation. At the same time, on the basis of the Accounting Regulations “Estimated Liabilities, Contingent Liabilities and Contingent Assets” (PBU 8/2010), organizations have the right to recognize reserves for future expenses only in connection with estimated liabilities.

An estimated liability is an obligation of an organization with an uncertain amount and (or) deadline, which may arise in the economic life of the organization as a result of various factors (legislation and other regulatory legal acts, court decisions, contracts, as a result of the actions of the organization, which, due to established past practice or statements by the organization indicate to others that the organization accepts certain responsibilities and, as a result, such persons have a reasonable expectation that the organization will fulfill such responsibilities).

Let us note that the attempt to call estimated liabilities “reserves for future expenses” seems unsuccessful for two reasons. Firstly, in terms of economic content, composition and recognition rules, estimated liabilities differ from the items recorded on account 97 “Deferred expenses”. Chart of accounts for accounting financial and economic activities of organizations [7]. Secondly, when an estimated liability is recognized, an expense item immediately appears in the income statement or the original cost of an asset element increases, which is expensed as depreciation is calculated. In addition, the reserve for future expenses cannot be considered as capital.

The question of whether valuation reserves belong to equity capital is currently debatable. This category includes reserves (according to Russian terminology) reflected in accounts that regulate/clarify the valuation of assets subject to decline in value: accounts receivable (account 63 “Provisions for doubtful debts”), financial assets (account 59 “Provisions for impairment of financial investments” ), materials, goods, finished products, work in progress (account 14 “Reserves for reduction in the value of material assets”).

These categories are neither assets nor liabilities nor equity. They are generally not independently presented in the balance sheet; their purpose is to clarify the valuation of the relevant assets.

The organization's own capital includes funds of targeted financing, the expenditure of which is limited by certain conditions.

If these conditions are met, the funds received become the organization’s own; if not, they require repayment and are classified as accounts payable. Such funds include: state assistance and funds provided in a similar manner by other persons in the form of subventions, subsidies, non-repayable loans, provision of various resources to the organization, financing of various events.

State assistance is direct economic actions aimed at increasing economic benefits for the organization, in the form of subventions and subsidies, non-repayable loans, and financing of individual events.

Subventions and subsidies are expressed in the transfer of assets to an organization or the repayment of its accounts payable in exchange for the fulfillment of certain conditions.

Non-repayable loans are loans from which an organization is exempt from repayment if a number of conditions are met.

Financing of individual activities represents the covering by government or other bodies of expenses of the organization that it would not have incurred if it had not received this assistance.

Two main components can be distinguished as part of equity capital: invested capital, i.e. capital invested by the owners in the organization, and accumulated capital - capital created in the organization in excess of what was initially advanced by the owners.

Information about the capital of the organization is mandatory reflected in the financial statements. This allows users of the statements to form an opinion about the financial position of the organization.

Composition of the reserve fund and features of its accounting

The reserve fund is created as a guarantor of the fulfillment of the company’s contractual obligations, as well as to compensate for possible losses of the company. As a rule, these are the main tasks that are supposed to be solved with its help, and they are reflected in the constituent documents of the organization. The basis for creating a fund is profit after distribution and investment by company participants (owners).

To account for reserve capital, passive account 82 is used. In the course of the company’s activities, the following accounting entries are generated using it:

- Dt 84 Kt 82 - for the amount of contributions to the reserve fund from profit;

- Dt 75 Kt 82 - when replenishing the fund through financial “infusions” of the owners.

In circumstances requiring the use of resources accumulated in it, the following entries are made:

- Dt 82 Kt 84 - coverage of losses;

- Dt 82 Kt 66 - allocation of amounts to repay the company's bonds and repurchase shares in the absence of other funds.

Reserve capital account

Formation of Reserve Capital is:

- the obligation of the joint-stock company (clause 1 of article 35 of the Federal Law of December 26, 1995 N 208-FZ);

- the right of an LLC, which is enshrined in the Charter (Clause 1, Article 30 of the Federal Law of 02/08/1998 N 14-FZ).

Reserve capital is formed to cover the company's losses, as well as to repurchase its shares (shares) in the absence of other funds.

An account summarizing information on the formation and movement of reserve capital – 82 “Reserve capital”.

In 1C account 82 has two subaccounts:

| Code | Name | Subconto 1 | Subconto 2 | Subconto 3 |

| 82.01 | Reserves formed in accordance with legislation | |||

| 82.02 | Reserves formed in accordance with the constituent documents |

Subcontos are not provided for this 1C account.

Unused profit as an element of replenishment of own funds

The next component that needs to be addressed when considering the accounting procedure for equity capital is retained earnings. Its level is largely an indicator of the company's performance. In the event of negative consequences of work, this indicator may take the form of an uncovered loss.

To reflect the volume of profit received after distribution of profits, passive account 84 is used. It is used by the company only at the end of the year, and is not used the rest of the time. In fact, the balance formed on the debit or credit of account 99 at the end of the period when preparing annual reports is transferred to it. Upon receipt of a positive final financial result, a posting is made Dt 99 Kt 84, if the result is negative, the entry will be: Dt 84 Kt 99.

Equity turnover

Equity capital turnover reflects the intensity of use of one's funds and business activity. It is an indicator of the productivity of a firm's resource management. It indicates the number of revolutions needed to pay invoices. Turnover indicates these aspects of the company’s activities:

- The degree of effectiveness of the product sales system.

- Subject's dependence on borrowed funds.

- Finance activity.

Turnover is determined by this formula:

Line 2110 / 0.5 * (line 1300 at the beginning of the period + line 1300 at the end of the period).

It is recommended to analyze the indicator over time. If it increases, this indicates an increase in the efficiency of product sales.

Retained earnings are the main source of additional financing for activities

The issue of reflecting entries in accounting accounts regarding the use of retained earnings as a source of financing for various areas of the company’s work requires more detailed study.

In particular, retained earnings can be used to pay dividends to company participants: Dt 84 Kt 75.

In addition, under favorable conditions, it can be used to pay additional remuneration to employees, such as a year-end bonus or a one-time bonus. In this case, the entry Dt 84 Kt 70 is made.

In addition, another area in which the company's profit after distribution can be used is to cover losses incurred in previous periods. However, the difficulty here lies in the need to use the same account - 84 - to reflect such operations. This problem is solved by introducing separate analytical sub-accounts. Let's say 84.01 - “Profit to be distributed”, 84.02 - “Loss to be covered”. Then the loss coverage for the reporting year will look like this: Dt 84.01 Kt 84.02.

Accounting for retained earnings and uncovered losses

To summarize information about the presence and movement of amounts of retained earnings or uncovered losses, organizations use active-passive account 84 “Retained earnings (uncovered loss).”

The amount of net profit of the reporting year is written off with the final turnover of December to the credit of account 84 from account 99 “Profits and losses” (account 99 is debited).

Profit is distributed based on the decision of the general meeting of shareholders in a joint stock company, a meeting of participants in a limited liability company or other competent body.

Net profit can be used to pay dividends, create and replenish reserve capital, and cover losses of previous years.

For the amount of accrued income, the founders are debited to account 84 “Retained earnings (uncovered loss)” and credited to accounts 70 “Settlements with personnel for wages” (employees of the organization) and 75 “Settlements with founders” (third-party participants).

Contributions to reserve capital are reflected in the debit of account 84 and the credit of account 82 “Reserve capital”.

The direction of net profit to cover the loss of the previous year is reflected in the debit and credit of account 84.

The amount of the net loss of the reporting year is written off with the final turnover of December to the debit of account 84 “Retained earnings (uncovered loss)” from the credit of account 99 “Profits and losses”.

Losses of the reporting year are written off from the credit of account 84 “Retained earnings (uncovered loss)” of the year to the debit of the accounts:

- 82 “Reserve capital” - when written off from reserve capital funds;

- 75 “Settlements with founders” - when repaying losses through targeted contributions from the founders of organizations;

- 80 “Authorized capital” - when bringing the amount of the authorized capital to the value of the organization’s net assets and other accounts.

It should be noted that the new Chart of Accounts does not provide for the opening of 84 sub-accounts for accounting for savings funds, social sphere and consumption funds.

The balances of savings and consumption funds should be added to retained earnings.

It is advisable to join the remainder of the social sector fund:

- in the part formed from profit after payment of income tax - to retained earnings (account 84);

- in terms of additional valuation of social sphere objects - to account 83 “Additional capital”;

- in terms of objects received free of charge - to account 98 “Deferred income”;

- in terms of objects and funds received during privatization - to account 83 “Additional capital”.

Analytical accounting for account 84 “Retained earnings (uncovered loss)” should ensure the formation of information on the areas of use of funds. At the same time, funds of retained earnings used as financial support for the production development of the organization or other similar measures for the creation and acquisition of new property and not yet used can be divided in analytical accounting.

Peculiarities of accounting for the repurchase of owners' shares in capital

A separate element included in the company’s own funds are operations to buy out the shares of the company’s co-owners. Such facts must be reflected in the debit of account 81 in the amount of amounts actually paid and the credit of accounts corresponding to the payment option (for example, 51 - when paying through a current account, 50 - through the company's cash desk in cash): Dt 81 Kt 51, 50.

There are options that require making entries on the credit of account 81. For example, if the authorized capital is subject to reduction by the amount of the par value of the company's shares, an entry is made Dt 80 Kt 81.

Special-purpose financing

In simple terms, targeted financing refers to funds “donated” to a company, but which can only be used for a strictly defined purpose. To reveal the logic of accounting records, let us somewhat simplify the posting scheme provided for by the current chart of accounts: with the money received by the company, current accounts are debited and the “Targeted Financing” account is credited, and when the will of the “donor” is fulfilled, the asset purchased with targeted funds is capitalized and the accounts are credited Money. After which they debit the “Targeted Financing” account and credit the “Other Income and Expenses” account, turning the “gift” into their property.

If the money is not spent according to the will of the “donor,” then it must be returned.

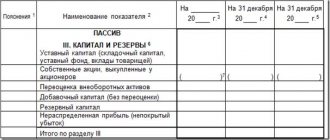

Equity as part of the balance sheet

When organizing accounting for an organization's equity capital, it is necessary to take into account the specifics of using this information in financial statements. It was noted above that all equity capital is divided into authorized, additional, reserve, retained earnings, and the amount of shares purchased from the co-owner.

It is this structure that is reflected in the third section of the balance sheet, approved by order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n. Based on the balance sheet, the company's total equity can be calculated by adding the following lines:

- 1310 - authorized capital;

- 1320 - size of purchased shares;

- 1340 and 1350 - components of additional capital;

- 1360 - reserve fund;

- 1370 - retained earnings.

Data in the balance sheet on lines 1310, 1320, 1360 and 1370 are determined based on the balances of accounts 80 (credit), 81 (debit), 82 (credit) and 84 (depending on the final financial result of the debit or credit) respectively.

Some difficulties may arise when preparing lines 1340 and 1350 in Form No. 1. The first reflects the results of the revaluation of non-current assets, the second - additional capital formed from other sources. Although the revaluation of fixed assets is by definition included in the additional fund, legislators require it to be taken into account separately in the balance sheet.

At the same time, this accounting option does not create any insoluble difficulties, since for these purposes a separate subaccount is applied to account 83 “Additional capital”. To determine the amount that needs to be entered into line 1350, you need to subtract the data from the subaccount that takes into account the results of the revaluation from the total final balance of account 83.

The total amount of equity is determined in the balance sheet on page 1300 by adding all the lines of section 3.

***

Correct accounting of an enterprise's equity capital presupposes knowledge of its structure and the features of how all its constituent elements are reflected in the accounts. When accounting, it is necessary to separately record the authorized, additional, reserve capital, the amount of repurchased shares and retained earnings. In particular, additional capital, due to the specifics of its formation from different sources, requires separate accounting for each of them. For these purposes, it is necessary to open specialized analytical sub-accounts for most accounts intended for accumulating information on changes in capital.

Retained earnings, in addition to increasing the amount of equity capital, can be used to cover losses of both current and previous periods. In this case, postings are made within one account 84, but using different subaccounts.

Of no small importance is the correct reflection of data on the state of capital in the balance sheet. For these purposes, data based on the results of the accounts of their components at the end of the period are used. In this case, additional capital is also reflected in two parts: formed through the revaluation of non-current assets and from other possible sources. Thus, knowing all the nuances listed above, a specialist will easily reflect the movement of equity capital on the accounting accounts and provide reliable information to all interested users of the statements.

Similar articles

- Own capital - what is this line on the balance sheet?

- Statement of changes in capital - sample filling

- Ways to increase net assets by founders

- The procedure for forming additional capital

- Accounting for equity

Own shares (shares)

The board of each organization can redeem and purchase its shares (stakes). In this case, the problem arises: whether to consider your shares as financial investments, that is, take them into account together with the shares of other companies that are quoted on the stock exchange. In this case, they are treated as an asset, highly liquid value. That is why they can be sold at any moment. This solution allows you to increase the solvency of the company. The second, currently accepted approach considers such shares (shares) as a counter-liability. Let's say the authorized capital is 100,000 rubles. Of the previously sold shares, the board repurchased shares at par value of 20,000 rubles. In this case, the “Own shares (shares)” account is debited and the cash accounts are credited. Thus, an amount of 20,000 rubles appears in the asset. It shows that the authorized capital is formally still equal to 100,000 rubles, but in reality, due to the counter-liability, users of the statements clearly see that the real amount of the authorized capital is 80,000 rubles. Therefore, it would be more correct to post: Credit to the cash account (black entry) and Credit to the “Own shares (shares)” account (red entry). Logically, both solutions are equivalent, but the consequences for economic work are different. In any case, the question arises here: should the repurchased shares be considered liquid funds (an asset) or a “hole” in equity capital (a liability)? In life there can be one or the other solution.