Transport tax is a tax for owning a vehicle. The following types of transport are subject to taxation:

- Cars

- Motorcycles

- Buses

- Snowmobiles

- Boats, yachts, motor boats, jet skis

- Airplanes, helicopters

While the vehicle is registered, the owner is charged tax, regardless of its use. The obligation to pay this tax lies with both individuals and legal entities.

The vehicle tax calculator will help you quickly calculate the tax amount for your car, motorcycle, motor boat or other vehicle.

What is transport tax?

Transport tax is a tax levied on vehicle owners. Transport means are: cars, motorcycles, scooters, buses, airplanes, helicopters, motor ships, yachts, sailing ships, boats, snowmobiles, motor sleighs, jet skis, motor boats and other water and air vehicles.

Not all vehicles are subject to taxation. For example, the following exceptions exist: - rowing boats, as well as motor boats with an engine power of no more than 5 horsepower - vehicles that are wanted, subject to confirmation of the fact of their theft (theft) by a document issued by an authorized body. The full list of exceptions is indicated in Article 358 of the Tax Code of the Russian Federation.

Payers of transport tax are both individuals and legal entities.

When to pay

According to clause 1 of Article 363 of the Tax Code of the Russian Federation, tax is payable:

- taxpayers - individuals no later than December 1 of the year following the expired tax period;

- taxpayers - organizations within the time limits established by the laws of the constituent entities of the Russian Federation.

From 01/01/2021, a new version of this article will be in effect, according to which the tax will be payable by taxpayer organizations no later than March 1 of the year following the expired tax period. Advance tax payments will be subject to payment by taxpayer organizations no later than the last day of the month following the expired reporting period.

How to calculate the tax amount?

The amount of transport tax is calculated based on the following parameters: — Tax rate

The tax rate is established by the laws of the constituent entities of the Russian Federation per one horsepower of engine power.

Depends on power, gross capacity, vehicle category and year of manufacture of the vehicle. Tax rates can be increased or decreased by the laws of the constituent entities of the Russian Federation by no more than 10 times the rate specified in the Tax Code of the Russian Federation. — Tax base

This parameter is set depending on the type of vehicle.

For cars, motorcycles and other vehicles with an engine, this is the engine power in horsepower - Ownership period

The number of complete months of ownership of the vehicle during the year.

— Increasing coefficient

For passenger cars with an average cost of 3 million rubles. a multiplying factor is applied. The list of such cars is available on the website of the Ministry of Industry and Trade of the Russian Federation.

Increasing coefficients for expensive cars

For cars whose cost is above 3 million rubles, increasing coefficients are provided:

| Average car cost | Vehicle age | Coefficient |

| From 3,000,000 to 5,000,000 rubles. | up to 3 years | 1,1 |

| From 5,000,000 to 10,000,000 rubles. | up to 5 years | 2 |

| From 10,000,000 to 15,000,000 rubles. | up to 10 years | 3 |

| More than 15,000,000 rub. | up to 15 years | 3 |

Who is entitled to transport tax benefits?

At the federal level, the following categories of citizens are exempt from paying transport tax:

- Heroes of the Soviet Union, heroes of the Russian Federation, citizens awarded Orders of Glory of three degrees - for one vehicle;

- veterans of the Great Patriotic War, disabled people of the Great Patriotic War - for one vehicle;

- combat veterans, disabled combat veterans - for one vehicle;

- disabled people of groups I and II - for one vehicle;

- former minor prisoners of concentration camps, ghettos, and other places of forced detention created by the Nazis and their allies during the Second World War - for one vehicle;

- one of the parents (adoptive parents), guardian, trustee of a disabled child - for one vehicle;

- owners of passenger cars with an engine power of up to 70 horsepower (up to 51.49 kilowatts) inclusive - for one such vehicle;

- one of the parents (adoptive parents) in a large family - for one vehicle;

- owners of vehicles belonging to other preferential categories.

In addition to the federal list of preferential categories of citizens, there are regional benefits. For example, in some regions of the Russian Federation, pensioners pay only 50% of transport tax, or are completely exempt from it. The situation varies greatly depending on the region. For example, in Moscow there are no benefits for pensioners, and in St. Petersburg pensioners are completely exempt from paying transport tax for a domestically produced car with an engine power of up to 150 horsepower.

You can find out the availability of regional benefits on the tax service website, in the “electronic services” section. On this page you must select a subject of the Russian Federation, municipality (city), type of tax and year. After this, you will receive complete information about all types of transport tax benefits for individuals.

It is important to know that the tax authority does not have the right to provide a transport tax benefit based solely on age information. Benefits are of a declarative nature, as a result of which it is necessary to submit to the Federal Tax Service the taxpayer’s application in the prescribed form, which indicates the basis for providing the benefit (reaching retirement age).

Rules and deadlines for paying taxes for individuals

To pay the tax and sleep peacefully, the car owner can use two methods:

- Wait for a postal notification from the tax office, where the data on the vehicle will be entered and the tax amount will be indicated.

- Register on the website of the Federal Tax Service and receive information about taxes through your personal account. You can pay the tax immediately using a credit card from any bank.

The deadline for payment of transport tax for last year expires on December 1 of the current year , after this date the fiscal authorities have the right to apply penalties to the defaulter.

How to calculate the number of complete months of car ownership?

If a vehicle is delivered or deregistered during the year, then the transport tax is calculated with a certain coefficient. This coefficient is defined as the ratio of the number of complete months during which a given vehicle was registered to the number of calendar months in a year (12).

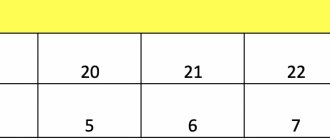

The procedure for determining the number of full months of car ownership is calculated in accordance with paragraph 3 of Art. 362 of the Tax Code of the Russian Federation. Month of registration

It is considered complete if the vehicle

is registered

before the 15th day inclusive.

The month of deregistration is considered complete if the car is deregistered

after the 15th day. For example, if a car was registered after the 15th, then this month is not complete and is not taken into account when calculating the car tax.

Calculation examples

To make it easier for you to make calculations related to transport taxes yourself, we will give you a few examples.

Imagine that you own a car with an engine power of 140 horsepower. Let us assume that the rate relevant for the subject of the country in which the vehicle was registered is 3.5. You are the sole owner of the car. The period of ownership of the object is a calendar year.

The formula will look like this: 140 * 3.5 = 490. The final value will be the very amount of tax collection that the state expects you to receive.

If, at the time of determining the tax amount, the vehicle had not been in your possession for a full year, but only for seven months, the formula would have been as follows: 140 * 3.5 * (7:12) = 140 * 3.5 * 0.58 = 284 units of Russian currency.

Now let’s imagine that the cost of your car classifies it as a “luxury” vehicle, amounting to three and a half million rubles. Moreover, only four months have passed since its release. Then the calculation would look like this: 140 * 3.5 * 1.5 = 735 Russian rubles.

If your car was owned for only two months, and its price was 6 million Russian rubles, while the engine power was the same 140 “horses,” the calculation would be made as follows: 140 * (2:12) * 3, 5*2 = 166 rubles 6 kopecks.

Now let's consider the situation with a car with more power, and apply the general tax rate to it. Let's imagine that you own a car with an engine power of 270 horsepower, and the ownership period is a full 12 months. Then the value is calculated as follows: 270 * 15 = 4 thousand 50 Russian rubles.

If the car had been owned for 7 months less, the formula would have taken the form: 270 * 15 * 0.42 = 1 thousand 701 Russian rubles.

When a car with the required power is owned for a whole year, and its cost reaches 4 million, while only two and a half year periods have passed since the year of its production, the tax amount is calculated as follows: 270 * 15 * 1.1 = 4 thousand 455 rubles .

If the cost of the same car is raised to 12 million, provided that you have owned it for only six months, you need to calculate the tax according to the presented ratio: 170 * 15 * 0.5 * 3 = 6 thousand 75 rubles.

Above, you were presented with examples of calculating the amount of tax collection on cars. Now let's look at several problems in which the vehicle will be a motorcycle. Let's take the general tax rate.

You are the proud owner of a motorcycle, the ownership period of which is a full year. The power of the unit is 40 horsepower. The calculation formula is very simple: 40 * 5 = 200 units of Russian currency. If the period of ownership of the “iron horse” was only nine months, then the ratio of this period to a full year must be added to the required formula, that is, in fact, it must be multiplied by 0.75 (9:12). The result will be an amount equal to 150 rubles.

Note! The price of a motor vehicle is not a basis for changing the rate by adding an increasing factor to it.

Now let's try to give an example of calculating the transport tax for a bus. Let's imagine that the engine power of such a car is 300 horsepower. Let's take the rates from the general category. Let's assume you own this bus for a full year. Then the calculation will look like this: 300*10= 3 thousand Russian rubles.

If the period of ownership of the bus was only 8 months, then we add to the formula the ratio of this period to a full year, that is, 0.67 (8:12), multiply the indicators among themselves and get a value equal to 2 thousand 10 rubles.

As in the case of motorized transport, the price at which the bus was purchased is not the basis for changing the rate established by the Tax Code or other legislative act

Video - Calculation of transport tax

Minimum tax and citizens exempt from paying it

Despite the fact that paying tax is the responsibility of every citizen, there are situations when payment must be made in a minimal amount or not at all.

Let's consider each case in more detail. The minimum tax is calculated in relation to the following vehicles:

- motorcycles up to 150 hp – 15 rubles;

- buses up to 200 hp - 5 rubles;

- passenger cars up to 100 hp – 15 rubles;

- yachts and boats with engine capacity up to 5 hp. - 10 rubles.

There is no tax levied on individual vehicles this year. The list of such vehicles includes:

- water vehicles up to 5 hp;

- passenger cars up to 100 hp, used for the movement of citizens with health restrictions;

- Vehicles purchased with the participation of social security;

- vehicles officially registered as industrial or agricultural machinery.

If the vehicle is wanted, then no payment will be charged. The procedure for making payments is regulated by the state and controlled by tax authorities.

What is the object of taxation

Object

taxation are:

- cars;

- motorcycles;

- self-propelled machines and vehicles on pneumatic and caterpillar tracks;

- snowmobiles and motor sleighs;

- air transport (planes and helicopters);

- marine vehicles (motor ships, boats, yachts and jet skis).

But there are exceptions

, which include:

- passenger cars with engine power up to 100 horsepower (purchased through the social security department);

- cars equipped for disabled people;

- tractors, self-propelled combines and special vehicles for transporting milk, poultry, which are used for agriculture (for individual entrepreneurs);

- fishing vessels (for individual entrepreneurs).

Tax is not calculated for these vehicles

.