Individual entrepreneurs and organizations that are employers are required to transfer monthly insurance contributions for pension, medical and social insurance to the Federal Tax Service of the Russian Federation

. Contributions for injuries are still paid to the Social Insurance Fund.

Note

: from 2021, the procedure for paying and reporting on insurance premiums has changed, this is due to the transfer of control over insurance premiums to the Federal Tax Service of the Russian Federation and the entry into force of the new Chapter 34 of the Tax Code of the Russian Federation “Insurance Premiums”.

From payments to individuals under civil law contracts, it is necessary to transfer contributions only to pension and health insurance (contributions for accidents are not transferred in any case, and contributions for temporary disability are transferred only if such a clause is specified in the contract).

Payments to employees who are legally exempt from paying insurance premiums are listed in Art. 422 of the Tax Code of the Russian Federation.

note

that individual entrepreneurs, in addition to paying insurance premiums for employees, must additionally transfer insurance premiums to individual entrepreneurs “for themselves.”

Free tax consultation

What are insurance premiums and when did they arise?

Insurance contributions are mandatory payments for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance, collected from organizations and individuals for the purpose of financial security for the implementation of the rights of insured persons to receive insurance coverage for the corresponding type compulsory social insurance (Article 8 of the Tax Code of the Russian Federation).

Compulsory social insurance is part of the state system of social protection of the population, the specificity of which is the insurance of working citizens, carried out in accordance with federal law, against possible changes in financial and (or) social status due to reaching retirement age, disability, loss of a breadwinner, illness, injury, accident at work or occupational illness, pregnancy and childbirth, the birth of a child (children), caring for a child under the age of one and a half years and other events established by the legislation of the Russian Federation on compulsory social insurance (Article 1 of the Federal Law No. 165-FZ of July 16, 1999) .

The history of insurance premiums is quite young. The emergence of social insurance was facilitated by the development of the economy and the emergence of labor relations, as a result of which employees began to need social protection. The first mentions of social insurance go back to the 19th century, at which time the Bismar Code of Imperial Laws appeared in Germany.

In Russia, a significant leap in the development of insurance was the abolition of serfdom. At this time, the first law in this area of insurance, “On the mandatory establishment of auxiliary partnerships at state-owned mining plants,” was adopted.

To ensure more progressive economic mechanisms and to regulate pension provision, the Pension Fund was created on December 22, 1990. Even before the formation of the Pension Fund, the budget was replenished from the general wage fund of organizations.

On January 1, 1991, the Social Insurance Fund was created, designed to regulate relations in the field of social insurance of citizens.

On February 24, 1993, the Health Insurance Fund was created to finance medical care.

How are insurance premiums regulated?

- Chapter 34 of the Tax Code;

- Federal Law “On compulsory social insurance against accidents at work and occupational diseases” Federal Law No. 125-FZ dated July 24, 1998;

- Federal Law “On the Basics of Compulsory Social Insurance” No. 165-FZ dated July 16, 1999;

- Federal Law “On Compulsory Pension Insurance in the Russian Federation” No. 167-FZ dated December 15, 2001;

- Federal Law “On compulsory social insurance in case of temporary disability and in connection with maternity” Federal Law No. 255-FZ of December 29, 2006;

- Federal Law “On Compulsory Medical Insurance in the Russian Federation” Federal Law No. 326-FZ of November 29, 2010.

Who is required to pay insurance premiums

The policyholder who pays wages and other payments in favor of the insured persons is obliged to pay insurance premiums (clause 1 of Article 419 of the Tax Code). The policyholder pays insurance premiums from the organization’s funds, without deducting this amount from the employee’s salary.

In this case, the insurers include:

- organizations;

- individual entrepreneurs;

- individuals who are not individual entrepreneurs.

For example, individual entrepreneurs who have employees on their staff are required to pay insurance premiums from employee payments at generally accepted rates. Please note that in addition to insurance premiums for employees, individual entrepreneurs are required to pay insurance premiums for themselves (clause 2 of Article 419 of the Tax Code of the Russian Federation).

Changing the RSV form

The updated form for calculating insurance premiums must be used starting with reporting for 2021. That's what has changed.

- The line “Average headcount (persons)” was added to the title page. This is due to the cancellation of a separate report on the average headcount from 2021 (KND 1110018).

- In Appendix No. 5 of the filling procedure, new payer tariff codes have been added: “20” - for SMEs and “21” - for those who were exempted from paying insurance premiums for the 2nd quarter of 2021.

- A new Appendix No. 5.1 has appeared for filling out by IT companies starting with the report for the 1st quarter of 2021.

- Appendix No. 7 was supplemented with new codes for categories of insured persons.

The “My Business Professional Accountant” service will help simplify accounting. He will calculate taxes and contributions himself, generate reports, and on complex issues you will be able to receive free expert advice.

Types of insurance premiums

There are the following types of insurance premiums (Article 8 of the Tax Code of the Russian Federation):

- insurance contributions for compulsory pension insurance (OPI);

- insurance premiums for compulsory health insurance (CHI);

- insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (VNiM);

- insurance premiums for injuries (accident insurance).

These types of contributions are calculated from wages and other payments accrued for each employee.

Other payments for which insurance premiums must be calculated and paid include (Article 420 of the Tax Code of the Russian Federation):

- bonuses;

- vacation pay and compensation for unused vacation;

- financial assistance over 4000 rubles. per employee per year.

Example 1. From what amount to calculate insurance premiums. Employee of Imperia LLC Ivanov I. I. was accrued the following payments for the month:

Type of payment Amount, rub. Base taxable tax-free Wage 10000 10000 0 Prize 5000 5000 0 Material aid 7000 3000 4000 Total 22000 18000 4000 Thus, insurance premiums must be paid from the amount of 18,000 rubles, i.e. from wages, bonuses and financial assistance over 4,000 rubles.

Who pays additional contributions for employees

Some business entities are required to pay additional insurance premiums. These are the companies that hire workers:

- for hazardous working conditions (additional contribution rate - 9%);

- for difficult working conditions (contribution rate - 6%).

Moreover, if these companies conduct a special assessment, based on the results of which workplaces are assigned one or another subclass of danger or harmfulness, a differentiated tariff is established depending on the specific subclass. It can range from 2% (division 3.1 hazardous conditions) to 8% (division 4 hazardous conditions).

3. Organizations that are employers:

- for airplane and helicopter crews (rate - 14%);

- coal industry workers (rate - 6.7%).

What payments are not subject to insurance premiums?

Payments not subject to insurance premiums include (Article 422 of the Tax Code of the Russian Federation):

- state benefits (unemployment benefits, temporary disability benefits, maternity benefits);

- severance pay, if this amount does not exceed three times the employee’s average monthly earnings;

- performance of work and provision of services under a civil law contract are not subject to insurance premiums for compulsory social insurance and injuries. But contributions for compulsory health insurance and compulsory medical insurance will have to be calculated;

- one-time financial assistance in connection with an emergency, natural disaster, in connection with the death of a family member, as well as in connection with the birth of a child. Please note that in order to provide financial assistance to an employee, it is necessary to issue an order and attach supporting documents to it, otherwise the inspection authorities may attribute these amounts to taxable insurance contributions;

- financial assistance up to 4000 rubles. per employee per year;

- amounts of payments under employment contracts and civil contracts in favor of foreign citizens and stateless persons temporarily staying in the territory of the Russian Federation, if these persons are not recognized as insured in accordance with the law.

IP deductions for yourself

For individual entrepreneurs making insurance contributions for themselves, fixed amounts are provided. On OPS, if the amount of income does not exceed 300,000 rubles:

- RUB 26,545 - for 2021;

- RUB 29,354 - for 2021;

- RUB 32,448 — for 2021

If the amount of income is above the established limit, you will have to pay an additional 1% of the excess amount, but no more:

- RUB 212,360 - for 2021;

- RUB 234,832 - for 2021;

- RUB 259,584 — for 2021

Deductions for compulsory medical insurance, regardless of the amount of income, are:

- 5840 rub. - for 2021;

- 6884 rub. - for 2021;

- 8426 rub. — for 2021

As for insurance payments in case of accidents and accidents, an individual entrepreneur has the right not to make them “for himself”.

How to calculate insurance premiums. Rates. Payment deadline

Insurance premiums are calculated monthly for each employee on the last day of the month, based on the base for calculating insurance premiums. And paid no later than the 15th day of the next calendar month. That is, insurance premiums for February must be paid no later than March 15. If the 15th falls on a weekend, then insurance premiums are paid on the next working day after the weekend. For example, insurance premiums for March must be paid before April 15, but since April 15 is a non-working day, payment is postponed to April 16.

You can pay earlier, but not later. However, if you are late in payment, you still need to pay as soon as possible, since penalties will then be charged for each day of delay.

Insurance premiums are calculated based on the rate and base for calculating insurance premiums. The base for calculating insurance premiums is defined as the amount of payments and other remunerations accrued separately in relation to each individual from the beginning of the year on an accrual basis (Article 421 of the Tax Code of the Russian Federation).

The 2021 rates and maximum base for each type of contribution are set as follows (see table). How the base of insurance premiums changed (graph)

| Base for calculating insurance premiums | Pension insurance | Social insurance | Health insurance | |

| Limit value of the base for the year | 1 465 000 | 966 000 | no max size | |

| Limit value of base per month=Base/12 months | 122 083 | 80 500 | no max size | |

| Bid | 22,00% | 2,90% | 1,80% | 5,10% |

| Contribution amount =Base*Rate | 322 300 | 28 014 | 17 388 | |

| Rate if the base is exceeded | 10% | 0% | 0% | 5,10% |

Example 2. An example of calculating insurance premiums. The organization LLC "Chocolate" (general taxation system, type of activity - sale of confectionery products) pays wages to employees, we will calculate the amount of insurance premiums for December.

Option 1 – the base for calculating insurance premiums did not exceed the established limit, the salary was 20,000 rubles. OPS = 20,000 rubles * 22% = 4,400 rubles. Compulsory medical insurance = 20,000 rubles * 5.1% = 1020 rubles. VNIM = 20,000 rubles * 2.9% = 580 rubles. Injuries = 20,000 rubles * 0.2% = 40 rubles. The Social Insurance Fund may set a different coefficient; for example, we take 0.2%. It depends on your main type of activity. You can find out which coefficient applies to your organization either from the “Notice on the amount of insurance contributions for compulsory social insurance against industrial accidents and occupational diseases” or directly from the social insurance fund. Option 2 - the base for calculating insurance premiums exceeded the established limit for compulsory health insurance and VNIM, wages amounted to 200,000 rubles. In this case, insurance premiums in case of temporary disability and in connection with maternity are not accrued or paid, contributions for compulsory pension insurance are paid at a rate of 10%. OPS = 200,000 rub. * 10% = 20,000 rub. Compulsory medical insurance = 200,000 rubles * 5.1% = 10,200 rubles. Injuries = 200,000 rubles * 0.2% = 400 rubles.

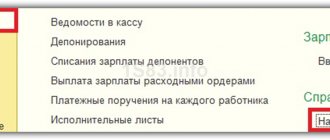

Procedure for transferring funds

Let's consider how you should transfer money for yourself and your employees so as not to violate the numerous requirements of regulatory authorities. If there are many employees, it is advisable to entrust control over payments and preparation of documents to a separate trusted person. Otherwise, there will certainly be delays, errors in calculations and, as a result, fines.

Deadlines

All contributions, without exception, are paid by the 15th of the current month. If the 15th is a holiday or day off, the period is extended until the next working day. Violation of deadlines results in a fine, so it is recommended to strictly regulate the calculation of payment amounts, reporting and transfer of funds to the state.

Where are insurance premiums paid?

Insurance premiums for compulsory medical insurance, compulsory medical insurance, and in the event of VNiM are paid to the Federal Tax Service at the location of the organization, and insurance premiums for injuries are paid to the Social Insurance Fund . If an organization has a separate division in another city, then insurance premiums must be paid at the location of its parent organization. However, if a separate unit is vested with powers, then insurance premiums are required to be paid at the location of the separate unit. In this case, insurance premiums are paid based on the size of the base for this division.

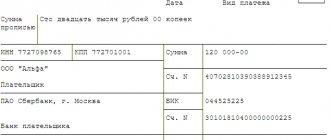

Each type of insurance premium is paid in separate payment documents. Please pay attention to the correctness of the BCC, which you indicate in the payment order; it is different for each insurance premium.

Preferential rates in 2021

This year there are even fewer firms and entrepreneurs who can pay contributions at reduced rates. Three categories did not receive an extension of benefits:

- Individual entrepreneurs and organizations that have entered into agreements on the performance of tourism and recreational work, which pay income to employees within the framework of special economic zones allocated by the Government of the Russian Federation.

- Individual entrepreneurs and organizations that have entered into agreements for the implementation of technical innovation work, which pay income to employees within special economic zones.

- Economic partnerships and societies that introduce and use the fruits of intellectual labor, if the right to them belongs to their participants or founders.

These policyholders will switch to general tariffs in 2021. See the table for who is eligible for reduced rates.

| Who is eligible for benefits | Tariff rate, % | ||

| OPS | VNiM | Compulsory medical insurance | |

| Organizations on the simplified tax system that are engaged in charitable activities | 20 | 0 | 0 |

| NPOs on the simplified tax system in the field of education, social services for citizens, science, culture and art, healthcare | 20 | 0 | 0 |

| Skolkovo organizations | 14 | 0 | 0 |

| Organizations developing and selling animation, audio or video products | 8 | 2 | 4 |

| Participants of the FEZ of Crimea and Sevastopol | 6 | 1,5 | 0,1 |

| Residents of zones with rapid development of the socio-economic sphere | 6 | 1,5 | 0,1 |

| Residents of the free port of Vladivostok | 6 | 1,5 | 0,1 |

| Residents of the SEZ in the Kaliningrad region | 6 | 1,5 | 0,1 |

How is payment of insurance premiums verified?

The correctness and timeliness of payment of contributions is carried out through desk and on-site inspections. Since 2021, control over the payment of insurance premiums is carried out by the tax authorities, with the exception of contributions for injuries, these contributions are controlled by the Social Insurance Fund. We talked about this in detail in the article “Insurance Premium Reform.”

The Social Insurance Fund also retains:

- desk audits for reimbursement of social insurance funds at the request of the employer;

- Conducting on-site audits together with tax inspectors;

- consideration of complaints based on inspection reports.

Tax authorities monitor the correctness and timeliness of payment of insurance premiums using:

- desk audit of calculations of insurance premiums;

- reconciliation of accrued and paid amounts of insurance premiums;

- conducting on-site inspections, together with the Social Insurance Fund.

What documents may be required when checking insurance premiums?

Example 3. The organization Karat LLC (general taxation system, type of activity - wholesale trade in automobile parts) received a decision to conduct an on-site inspection, the subject of which was the correctness of calculation and timely payment of insurance premiums, as well as the legality of the expenses incurred by the policyholder for the payment of insurance coverage for 2014-2017.

The following documents were required for the verification:

- labor and civil contracts;

- employment orders;

- work books;

- time sheets;

- payroll, payslips for wages;

- personal cards of employees;

- certificates of incapacity for work;

- application and order for maternity leave, calculation of the amount of benefits;

- documents confirming payment of monthly maternity benefits (copy of birth certificate, application for leave, order, calculation of the amount of benefits, certificate from the father’s place of work stating that he does not receive benefits);

- orders for financial assistance and documents confirming the basis for its payment.

Also, the tax office and the Social Insurance Fund may request other documents related to the audit being carried out. On the day the inspection was completed, a certificate of the inspection was signed.

FREQUENTLY ASKED QUESTIONS AND ANSWERS TO THEM

Question No. 1: If an organization does not provide a calculation of insurance premiums on time, what amount of fine should be expected from the tax office?

Answer: In practice, the following penalties are common for organizations for not submitting reports on time: 5,000 rubles and blocking of a bank account until the reports are submitted.

Question No. 2: According to the latest amendments to the law, transferring wages in two parts is now the direct responsibility of the employer. Is there the same obligation for calculating taxes and insurance premiums?

Answer: No, taxes and insurance premiums are not charged on the advance payment, but are calculated from the full amount of monthly earnings.

Thus, payments to insurance funds and tax authorities are made only once a month. Rate the quality of the article. Your opinion is important to us:

What responsibility does an employer bear for non-payment of insurance premiums?

In case of non-payment of insurance premiums, the employer bears tax, administrative and criminal liability.

Administrative liability for non-payment of insurance premiums - fine

Administrative liability for non-payment of insurance premiums is established only for officials of government agencies, as well as other organizations and institutions that keep budget records (Article 15.15.6 of the Code of Administrative Offenses of the Russian Federation). Administrative punishment is not directly provided for directors and other responsible persons of other organizations, although there is an opinion that they can be prosecuted under Art. 15.11 of the Code of Administrative Offenses of the Russian Federation, which establishes liability for non-payment of taxes and fees.

Tax liability for non-payment of insurance premiums - arrears, penalties, fines

They are brought to tax liability for non-payment, incomplete payment of contributions as a result of understating the base for calculating insurance premiums, and other illegal actions. This type of liability is the most common type of liability for non-payment of insurance premiums. And, as a rule, it entails simultaneously the collection of arrears (the amount of unpaid tax) from the employer and the accrual of penalties for each day of delay in payment, and also, at the same time, it is possible to impose a fine in the amount of 20% of the amount of unpaid insurance premiums, and if intentional non-payment - 40% of this amount. However, this penalty can be avoided. The Ministry of Finance clarifies the imposition of a fine for non-payment of insurance premiums in Letter No. 03-02-07/1/31912 dated May 24, 2017: “The inaction of the taxpayer, expressed solely in the failure to transfer to the budget the amount of tax specified in the tax return, does not constitute an offense, established by Article 122 of the Tax Code. In this case, penalties will be collected from the taxpayer.”

Thus, if you did not pay insurance premiums on time, but correctly reflected the accruals and submitted the calculation on time, no fine is imposed. You will only need to pay the arrears and accrued penalties. You can also avoid a fine if you incorrectly reflected the accruals, which led to an understatement of the tax base. To do this, you must first pay off the arrears and penalties that have arisen, and then submit an updated Calculation of insurance premiums. At the same time, the organization must detect the error before the tax office finds it and before it finds out that the inspectorate has ordered an on-site inspection (Article 81 of the Tax Code of the Russian Federation).

Example 4. LLC did not pay insurance premiums. The organization LLC "Ikra" (general taxation system, type of activity - wholesale trade in fish, seafood and canned fish) paid insurance premiums for March 2021 in the amount of 10,000 rubles. 05/17/2018 (instead of 04/16/2018), thereby delaying payment by 30 days. The tax office sent a demand for payment of arrears in the amount of debt - 10,000 rubles. and a penalty. In this case, the penalties will be equal to: 10,000 rubles. x 7.25% (refinancing rate in effect during the period of delay) x 1/300 x 30 days. = 72.50 rub. The employer incurred tax liability for non-payment of insurance premiums in the form of penalties. Arrears and penalties have different BCCs, so they must be paid using different payment documents.

Criminal liability for non-payment of insurance premiums - fine, arrest, imprisonment

Criminal liability is borne by employers who, as in the case of tax liability, did not pay (did not pay in full) insurance premiums, did not submit a calculation, or included knowingly false information in it, which resulted in a distortion of the tax base on a large or especially large scale . If the employer committed this crime for the first time and fully paid the fine, all amounts of arrears and penalties, then he is released from criminal liability.

This type of responsibility is quite young. The prospects for introducing criminal liability for non-payment of insurance premiums have been considered since 2013, however, the article defining this type of liability was introduced by Federal Law No. 250 - FZ only on July 29, 2021.

Criminal liability for individuals for insurance premiums (Article 198 of the Criminal Code of the Russian Federation):

- imposition of a fine from 100 to 300 thousand rubles or in the amount of wages for a period of up to 2 years;

- compulsory work for up to one year;

- arrest up to 6 months;

- imprisonment for up to one year.

If this act is committed on an especially large scale, then the individual is punished:

- a fine of 200 to 500 thousand rubles. or in the amount of wages for a period of up to 3 years;

- compulsory work for up to 3 years;

- imprisonment for up to 3 years.

Results

Insurance contributions are mandatory payments for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance, collected from organizations and individuals for the purpose of financial security for the implementation of the rights of insured persons to receive insurance coverage for the corresponding type compulsory social insurance.

These types of contributions are calculated from wages and other payments accrued for each employee monthly on the last day of the month based on the base for calculating insurance premiums. And paid no later than the 15th day of the next calendar month.

Insurance premiums for compulsory medical insurance, compulsory medical insurance, and in the event of VNIM are paid to the Federal Tax Service at the location of the organization, and insurance premiums for injuries are paid to the Social Insurance Fund.

In case of non-payment of insurance premiums, the employer bears tax, administrative and criminal liability.

Firmmaker, July 2018 (updated in January 2021) Olga Uss When using materials, reference is required