All information about individual entrepreneurs is contained in the state register - Unified State Register of Individual Entrepreneurs. First, the data you provided when registering your business goes there. If they change, the information in the Unified State Register of Individual Entrepreneurs is updated. Let's figure out how this happens and what needs to be reported to the state.

Submit reports in three clicks

Elba - online accounting for individual entrepreneurs and LLCs. The service will prepare reports, calculate taxes and free up time for useful things.

Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months

In what cases is it necessary to make changes to the registry documents?

So, let's take it in order. When information about your last name, place of registration, series and passport number changes, it is not necessary to inform your tax inspector about this. An exchange of updated data has been established between the tax authority and the Federal Migration Service. Therefore, in the Unified State Register of Individual Entrepreneurs, a new surname and place of residence appears automatically , without your petition (according to the norms of RF Law No. 129-FZ, Chapter II, Article 5, Clause 4).

Of course, when changing the type of business activity, it is necessary to make amendments to the register of individual entrepreneurs. To do this, it is not necessary to use the services of a lawyer who will draw up the documents for you, but will ask for Bank of Russia tickets in return. It is quite possible to update information for the tax office on your own, especially since it is not at all difficult.

Change of full name - Sheet A

Sample of filling out form P24001: sheet A.

- XLS, 260 KB

- Generate application P24001 automatically

Sheet A is filled out only by entrepreneurs with foreign citizenship and stateless persons who have changed their full name or discovered an error in their last name according to the Unified State Register of Individual Entrepreneurs extract. The data on sheet A must be entered in Russian and Latin alphabet.

When changing your last name, a foreign citizen will need to obtain a new identity card and a new temporary residence permit or residence permit.

In addition to sheet A, you will need to fill out sheets D and D, entering the details of the new passport and place of stay in Russia.

Sample of filling out form P24001

Download the current form P24001 (links to files at the top of the page). Using Adobe Reader or any other program that can work with PDF files, open it and start studying. Then you need to print it out to fill out manually, or you can fill it out directly in the file and print out the finished document, which you only have to sign. The second option is easier to complete by downloading the application in .xls format and editing the document using Excel.

Note! The tax office accepts applications filled out only with a pen and black ink (this is if you chose to fill it out manually). Forms with blue, purple and other color spectrum entries will not be accepted!

Enter information in as legible handwriting as possible - in block capital letters. If you are an advanced PC user, try filling out the form using the editor. Tax authorities advise doing this using the Courier New 18 font.

You must sign a printed document with all the information manually in the presence of the inspector who will accept your application for consideration.

Below, in real photographs of the application for making changes to the individual entrepreneur in the Unified State Register of Entrepreneurs, a sample of filling out form P24001 is presented. Only those pages that need to be filled out by an individual entrepreneur - a citizen of the Russian Federation - are presented. All other sheets, accordingly, must be filled out by a citizen of another state and/or having a place of residence other than the Russian Federation.

Stage 1

We enter OGRNIP (number of the certificate of registration of an individual as an individual entrepreneur). All cells in this field must be completed. Next - full name in block letters, in black ink. And Taxpayer Identification Number. We remember the basic postulate of manually filling out such documents: one cell - one character.

Stage 2

We fill out Sheet E, page 1 when the data of OKVED codes into the Unified State Register of Individual Remember, the OKVED code must contain a minimum of 4 digits, a maximum of 6. There is no need to put dots - they are already on the form.

Stage 3

Sheet E. Page 2. To be filled in if these OKVED codes are EXCLUDED The filling requirements are similar. Don't forget to number the page at the top.

Stage 4

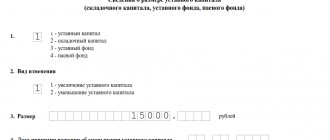

Enter your full name in block letters in black ink and below the corresponding number:

- — if documents confirming changes in the Unified State Register of Individual Entrepreneurs or a refusal to do so are issued personally to the applicant;

- - a person acting on the basis of a power of attorney;

- - send to postal address.

Please fill out the “phone” field below. You can specify both a mobile number and a landline number. We don't sign! This is done in the presence of an official at the tax authority.

If you do, there will be claims and the application may be refused!

Actions after making changes

After the inspection makes changes about an individual entrepreneur in the Unified State Register of Entrepreneurs, sometimes additional actions may be necessary. For example, these:

Change the seal

You need to order a new seal if any of the details indicated on it have changed. Usually this is your full name or address. Do not delay changing the seal, because many clients and potential partners check information about individual entrepreneurs in the Unified State Register of Entrepreneurs, and its discrepancy with the seal details can cause mistrust.

Re-register the cash register

If your full name or registration address has changed (and along with it the address where the cash register will be installed), the cash register must be re-registered using the new data. To do this, you can contact any inspection. The online cash register will be linked to the business address that you indicate in your registration address.

Notify the bank

If you change your last name, first name or patronymic, you must notify the bank that maintains your account. Otherwise, problems may arise when conducting transactions for which you present documents. You also need to report a change in your registration address, even if your actual address of residence does not change: in some cases, notifications are sent exactly to the registration address.

Notify partners and clients

First of all, counterparties need to be informed about changes in the data that you indicate in contracts, acts, invoices and other documents: full name, passport details, etc. To notify partners, you can send an email with new data.

Please note: you are not required to report changes to individual entrepreneur data to other government agencies

(FSS, PFR, Rosstat, etc.). The Federal Tax Service will independently notify all necessary departments.

Nuances of entering code data

When filling in the numbers in the cells of the main activity code, keep in mind that there is only one. There are some nuances when filling out additional codes:

- the tax office will not accept a double-sided printed application from you - this is prohibited by law;

- if you only need one sheet of the form to fill out, you don’t have to print and number the blank pages of sheet E;

- record line by line from left to right;

- When adding codes in the cells of additional activities, do not enter existing ones.

So, to add new codes:

- We select the necessary digital codes with encoded information about the types of your activities according to OKVED.

- We enter them in the appropriate block of the application (sheet E page 1).

To exclude codes that have expired, in your case:

- We select individual entrepreneur activity codes from the Unified State Register of Individual Entrepreneurs (USRIP) extract.

- We enter them in the corresponding block on page 2 of sheet E.

If there is a need to leave the previous activity code, then enter it as additional on Art. 1 sheet E. in cells intended for additional codes.

Important point! From July 11, 2021, updated codes for state registration of legal entities and individual entrepreneurs were introduced.

Change of citizenship - Sheet B

Example of filling out application P24001: sheet B.

- XLS, 260 KB

- Generate application P24001 automatically

Sheet B is intended only for foreigners and stateless individual entrepreneurs who have changed, lost or acquired citizenship. The status is indicated as follows:

- Code “1” - citizen of Russia,

- Code “2” - foreign national,

- Code “3” – stateless person.

You also need to indicate the code of the state whose citizenship you received according to the All-Russian Classifier.

Applying in person

When submitting documents in person to register new types of economic activity, you must present a passport. In this case, there is no need to certify the application with the help of a notary (according to Federal Law No. 129-FZ, Chapter III, Article 9, Clause 1.2). On sheet G of the form, in the presence of a tax officer, you need to manually fill in your full name and sign.

Important! You will not need to re-pay the state fee for changing individual entrepreneur data in the state register. If your inspector forgot about this, you should always remember this so as not to overpay extra money.

Change of passport - Sheet G

Example of filling out form P24001: sheet G.

- XLS, 260 KB

- Generate application P24001 automatically

Sheet D is filled out only by foreign citizens who have changed their identity card. You must enter data on the page in strict accordance with the original document. Leave fields that are not on your ID blank. For example, the field “unit code” is usually not indicated in foreign passports.

We send application P24001 by mail

There are often situations when a businessman cannot personally appear to the inspector to enter new data into the register: long business trips, vacations and other important reasons.

Remote sending is possible. In this case, it is necessary to perform notarized confirmation of the signature on the application.

No problem! The completed form can be sent by mail. Although to do this you will still have to visit a notary office. Agree that it is better to pay this specialist for services than, for example, to change a ticket for an expensive airline flight abroad. The notary will sign and seal Form P24001, certifying the authenticity of the copy of your passport.

Change of place of residence in the Russian Federation - Sheet B

Sample of filling out form P24001: sheet B.

- XLS, 260 KB

- Generate an application using form P24001 automatically

Sheet B is filled out by foreign entrepreneurs and stateless persons who have changed their address in the territory of the Russian Federation. The data in sheet B must be transferred from the registration document to the new address. There is no point in submitting Form P24001 until you have received a new document, since it is easy to make mistakes in the spelling of the address, for example, an incorrect abbreviation.

When changing the address, you must also fill out sheet D, which reflects the details of the new document for temporary stay in the Russian Federation or residence permit.

How long will it take to wait for updates to documents?

The inspector undertakes to issue a receipt form for receipt of your documents. It is important not to lose this paper, because with its help you can track the progress of document readiness by using a special online tool on the official website of the Federal Tax Service.

According to the law, in a week (taking into account five working days and two weekends) you can come for a ready-made Unified State Register of Individual Entrepreneurs (USRIP) sheet. It will be issued upon presentation of your passport and that same receipt. As you can see, nothing complicated. Within just a few days, literally in two visits to the tax office, you will receive the necessary document without the help of a lawyer. Study your rights and save your time so as not to waste time standing in line for meaningless consultations with tax officials.

Individual entrepreneurs and employees, when changing their registration, independently re-register with the Social Insurance Fund and the Pension Fund of Russia

For employees under an employment contract, you pay contributions to the Social Insurance Fund at your place of registration. If you have moved to another district or city and now belong to the new Social Insurance Fund, you need to register with it yourself. To do this, within 15 working days after changing your address, submit an application and a copy of your passport with a note about your new registration to the old Social Insurance Fund.

A similar story with the Pension Fund: your agreement on electronic document management was concluded with the old branch. If you don't change anything, you will submit the report to the wrong place and get fined. Therefore, contact the new Pension Fund branch to renew or update the agreement. They will tell you which form to use.

Application form for re-registration in the Social Insurance Fund

How can I apply to change the information of an individual entrepreneur?

Documents are allowed to be submitted in four ways:

- In person at the MFC or the Federal Tax Service. To submit, you need a passport and a package of documents.

- Through a representative. In addition to the package of documents, the representative must provide a notarized power of attorney. A power of attorney can be issued for the delivery and receipt of documents.

- By mail. To send, you will need to have the application notarized and also attach a copy of your passport. The documents should be placed in an envelope, an inventory of the contents should be made and sent in the form of a letter with a declared value.

- Send electronically through the Postal Agent program.

Choosing new OKVED

To select the desired code, it is better to use OKVED in electronic form with the ability to search by keywords. It is necessary to indicate the words that correspond to the new type of activity (for example, “rent,” “welding,” “sidewalk,” etc.) and read the description of the groups where they were found.

The classifier is built on the principle: “from the general to the specific.” Therefore, you need to “climb” the grouping higher to codes containing four, three, and then two digits, and study the explanations for them (for example, from code 01.11.31 go first to code 01.11, and then to codes 01.1 and 01). It is quite possible that after studying the “upstream” codes you will understand that the “downstream” code is not suitable for you. Carefully read the explanations for all groups that the new code is included in. Typically, it first describes what activities are covered by the grouping, and then provides exceptions.

If a suitable code is found, then one more question needs to be resolved: enter a “lower” code into the Unified State Register of Entrepreneurs, or “go up” in the grouping above and indicate a code that includes a larger number of possible operations?

IMPORTANT. Include “superior” codes containing four digits in the Unified State Register of Individual Entrepreneurs. This will expand the list of operations that an individual entrepreneur has the right to engage in, and therefore will reduce the risk of claims from tax authorities.

If a keyword search does not produce results, you will have to select a code based on the general logic of constructing the classifier. First you need to select a section (they are designated in Latin letters in OKVED), and within it - the most suitable grouping. And already in this grouping, find codes corresponding to “other types of activities not included in other groups.” Usually they are at the very end of the group.

Select OKVED codes for free in a special web service

For example, this is exactly what individual entrepreneurs who are engaged in intermediary activities (agents, commission agents) will have to do. There is no special code for them in OKVED. Therefore, when carrying out such activities, code 82.99 “Activities for the provision of other support services for business, not included in other groups” is applied.

Before entering the found code into the Unified State Register of Individual Entrepreneurs, you need to analyze how this will affect the amount of tax liabilities of the individual entrepreneur. The fact is that the use of some OKVED codes entails the loss of the right to UTII, PSN, a reduced single tax rate under the simplified tax system or reduced insurance premium rates.

If an individual entrepreneur has hired employees, you also need to check which class of professional risk the activity belongs to under the new code. It is quite possible that the new OKVED will lead to an increase in the insurance premium rate for injuries.

Fill out and submit 4‑FSS online for free using the current form

Reasons for changing data in the Unified State Register of Individual Entrepreneurs:

- errors were identified in the process of registering an individual entrepreneur;

- change of place of residence (registration) of the individual;

- change of type of activity (increase in areas of activity, their replacement or exclusion);

- changes in passport data or other registration documents of an individual entrepreneur.

Read further - the form of the certificate of completion of work. Detailed sample.

In the news (link) documents for calculating wages.

Sample form P13001! https://urist.club/other/terminy-i-opredeleniya/forma-r13001.html