Payment

Work in the North Persons working in the North have the right to receive government guarantees and

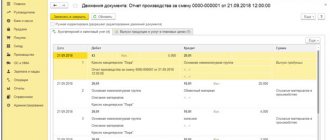

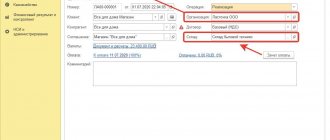

Setting up product accounting in 1C Accounting In the functionality settings (section “Main” – Settings –

We justify the need to purchase books and printed publications. First, it is important to determine to what extent books, magazines

When explanations are required During an inspection, the inspector has the right to request written explanations. Situations in

In accounting, fixed assets worth no more than 40,000 rubles can be taken into account in

The state controls all processes occurring within it. The business sector is no exception. Any

Why is the issue of collecting insurance premiums accrued by the fund relevant in 2021? From 2021

In 2014, the Ministry of Finance made numerous changes and additions to Instruction No. 157n.

Are you switching from UTII? Connect Kontur.Accounting 45% discount in November: RUR 7,590 instead of 13

To automate the preparation and execution of tax and accounting documents, you will need the latest version of the program