Setting up product accounting in 1C Accounting

In the functionality settings (section “Main” – Settings – Functionality) on the “Production” tab there should be a “Production” checkbox:

In addition, you need to fill out the accounting policy correctly: in the form for setting it up on the “Costs” tab, indicate production as a type of activity, the costs of which are accounted for on account 20 (Main production):

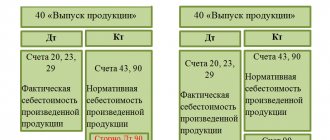

Here you can also set up product accounting. By default, the program takes into account manufactured products at their planned cost in accounting account 43 (Finished products), then during period closure, the actual cost is automatically calculated and the amount is adjusted.

If an accountant wants to use accounting account 40 (Release of finished products), then in the accounting policy form you should click the “Advanced” button on the “Costs” tab and put o. Then the manufactured products will be accounted for at the planned cost on account 40, and then, when closing the period, the program will calculate the actual cost and take it into account at account 43.

Adjustment of production output

When a company applies planned prices to account for products based on the results of a calendar month, after carrying out operations to close it and determining all costs, a cost adjustment document is generated, which determines the actual cost of manufactured products.

The importance of correct and correct reflection in the accounting of all aspects of production cannot be overestimated; 1C solutions are easily adapted to the specific operating conditions of various manufacturing companies, promptly reflecting all changes in current legislation.

Finished products in 1C with examples

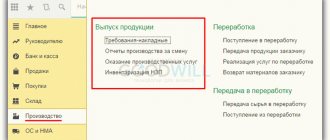

Standard documents in 1C 8.3 for reflecting production operations are available in the “Production” section (see the “Product Release” subsection).

Product output is reflected in the “Shift Production Report”. Despite the name, this program object is not a report, but a standard document.

It is first necessary to enter the manufactured products into the “Nomenclature” directory, indicating the type of nomenclature for them – Products. If an organization uses different nomenclature groups to record its activities, you must also fill out the “Nomenclature group” field (by selecting an item from the directory).

An example of accounting for finished products in 1C without account 40

Example 1. A furniture factory produced “Director” tables and “Clerk” tables. The accounting policy prescribes accounting for manufactured products on account 43, without account 40.

1. Product release. In order to reflect output, we will create a standard document “Production Report for a Shift”. In the “header” details we will indicate the warehouse (if the organization maintains warehouse records) and the cost account. On the “Products” tab, in the rows of the table, we indicate the manufactured products and manually enter their planned price. By default, the accounting account is filled in - 43.

Document 1C will generate accounting entries for accounts Dt 43 Kt 20 for the amount of the planned cost of production.

2. Sales of finished products. Registered in the program in a standard way using the standard “Implementation” document.

3. Closing the month and adjusting the cost. At the end of the period (month), we will perform routine automatic processing “Closing the month” in the program. It will calculate the cost of production based on the amount of actual costs posted to the debit of account 20 for the item group of products (if item groups are not used, costs are calculated as a whole for account 20). Costs usually include the cost of raw materials, wages of production workers, etc. Then the program will adjust the cost of production. To view the postings of this operation, you need to click on the link “Closing accounts 20, 23, 25, 26” in the month closing form and select “Show postings”:

We see that in 1C an accounting entry has been generated that adjusts the cost of production: Dt 43 Kt 20. At the same time, the amount of the entry can be negative, depending on which cost is greater - planned or actual.

If the manufactured products were sold, then during the closing of the period the program also adjusts the cost of its write-off, creating a debit entry in accounting account 90.02 “Cost of sales”:

The program allows you to generate convenient analytical reports and calculations “Calculation of cost” and “Cost of manufactured products”. They are also available in the month closing form (after the closing has been completed) using the link “Closing accounts 20, 23, 25, 26”.

The “Cost Cost Calculation” reflects the costs incurred for each unit of production:

Another calculation certificate - “Cost of manufactured products” - shows the value of the actual cost, the planned one, as well as the deviation of the “fact” from the “plan”:

Cost adjustment

Actually, this function is performed together with the write-off of the costs of the main production described above, due to the need to calculate the cost of multi-stage production.

Thus, in fact, the cost price is calculated by type of product range and subsequent adjustment of all turnover in the accounting accounts for this type of item:

- for finished products - turnover on accounts 40 “Product Output”, 43 “Finished Products” and 45 “Goods Shipped”;

- for semi-finished products - turnover on accounts 40 “Product output”, 21 “Semi-finished products of own production” and 45 “Shipped goods”.

Example (continued)

The balance of double-glazed windows in the finished product warehouse as of May 1, 2003 is 23 sets worth RUB 74,980.23. During the month, the debit turnover on the account is 43 - 50 sets in the amount of 170,000 rubles. (at planned cost - 3,400 rubles per set), credit turnover - 65 sets in the amount of 217,174.25 rubles. (moving average estimate taking into account the planned cost), including 55 sets written off for sale (RUB 184,574.15), and 10 sets shipped to customers without transfer of ownership (Debit 45 Credit 43 - RUB 32,600.10). After calculating and adjusting the cost of finished products, in addition to the entry for adjusting the debit turnover of account 43 (the previously given entry in the amount of 1,456.25 rubles), all turnover on the credit of account 43 is also adjusted, taking into account the weighted average actual cost of production. The weighted average cost of 1 set of double-glazed windows for May 2003 will be: (74,980.23 + 171,456.25) / (23 + 50) = 3,375.842 rubles. Actual cost of sold double-glazed windows: 55 x 3,375.842 = 185,671.32. Consequently, the entry is formed: Debit 90.2.1 Credit 43

- RUB 1,097.17.

Actual cost of double-glazed windows shipped without transfer of ownership: 10 x 3,375.842 = 33,758.42 rubles.

When adjusting, an entry is generated: Debit 45 Credit 43 - 1,158.32 rubles.

A similar algorithm is used to adjust turnover for account 45, only there the weighted average actual cost is determined for each counterparty and agreement separately.

It should be taken into account that the rolling estimate of the average cost, at which finished products and semi-finished products are written off during the month using the relevant documents, is “sensitive” to the order in which these documents are processed, if the actual cost of the balance on account 43 (or 21) differs from the planned cost. However, the procedure for calculating and adjusting the cost of products and semi-finished products smoothes out all differences, so there is no need to retransmit documents on the movement of products within a month.

Example of product accounting with a score of 40

Example 2. A furniture factory produced “Director” tables and “Clerk” tables. The accounting policy of the enterprise prescribes the use of accounting account 40 “Release of finished products”.

In the program, you need to configure the use of account 40 in the accounting policy (see the beginning of the article).

The output of finished products is reflected in the “Shift Production Report” in exactly the same way as in the first example. After the document is completed, accounting entries are made Dt 43 Kt 40 for the amount of the planned cost of production:

Sales of products are registered with the standard “Sales” document.

During the routine closing of the month, the program calculates the actual cost of manufactured products and generates adjusting accounting entries Dt 40 Kt 20.01 and Dt 43 Kt 40.

Based on materials from: programmist1s.ru

Program 1C: Accounting in version 8.3, to reflect the results of work during a production shift, provides for the document “Production Report for the Shift”. It is also used to reflect the services provided by departments among themselves within the enterprise. The report is accessed through the “Production” - “Product Release” section.

Issue postings

The document “Product Release” entails the preparation of entries for the release of finished products to the warehouse (Dt.43 Kt.20.01) and for the write-off of materials for production (Dt.20.01 Kt. 10.01).

Fig. 35 Postings for product release

From it you can create printed forms of the following documents: “Invoice for transfer of finished products” (M-18), “Requirement-invoice” (M-11), “Services to own departments”.

Fig.36 Formation of a document for printing

This document is the basis for creating two documents reflecting transactions:

- “Request-invoice” – for the movement of materials within the organization, for example, write-off from a warehouse to a production workshop;

- “Sales of processing services” – for the production of products from customer-supplied raw materials and the preparation of the corresponding report.

Fig. 37 Creating transaction documents

Features of filling out the “Shift Production Report”

The document has the “Production” and “Services” tabs, which are filled out depending on the field of activity of the enterprise. This document shows the production of a specific material, the place and time of its production, as well as a list of materials required for its production.

Taking into account the fact that for 1C the distribution of costs occurs on the basis of existing item groups, therefore, an incorrect choice of group can cause incorrect documents for closing accounts at the end of the month.

Activating the “Write off materials” checkbox allows the user to access the list of materials used in the production process of goods. You can see them in the “Materials” tab. If the checkbox is not selected, this tab is not shown. The tab is filled in automatically using the “Fill” button by selecting the required specification.

The presented figure demonstrates the presence of an error; in particular, one of the lines does not have the “Cost Item” field filled in. You can eliminate the inaccuracy from the document itself by making manual adjustments. If you specify an article in the nomenclature card, then it will be reflected automatically.

Returnable waste is reflected through the tab of the same name.

If you use the “FIFO” method of writing off inventories, the additional column “Capitalization Document” is activated for the “Materials” tab, and “Batch” is indicated for transactions in the analytics.

If necessary, batch accounting can be disabled through “Directories and accounting settings” - “Inventories”.

Manual adjustment of routine transaction entries

In some cases, an accountant has to deal with a situation where adjustments to routine operations require manual corrections. For example, in the process of calculating depreciation, a division is not specified in the document, although it is present in all previously entered documents. The system deficiency can be eliminated through manual adjustments. At the same time, the process itself does not pose any danger to the correctness of the entries made or the reflection of amounts.

The transition to the postings of a scheduled operation is carried out by following the link with its name.

“Production report for a shift” and cost calculation

To access the cost of production, you must first carry out month-end closing operations. After this, it will be possible to generate a balance sheet for account 20.01. Next, through the “Selections” section, the required product group is established, after which the program will display all the costs, allowing you to estimate the cost of production.

In the case under consideration, all reflected costs are included in the item “Material costs of main production”. In other cases, it is possible, for example, that the article “Costs of the quality department” may appear, requiring inclusion in the cost of finished products.

To do this, you will need to go to the “Report on production per shift”, where in the “Services” tab, reflect it indicating the department, account and cost item, item group.

By going to the “Materials” tab, the materials used in organizing quality control are reflected. In this case, the product group remains unchanged, that is, it corresponds to the product, but the cost item changes - “QD expenses”.

At the end of the month, closing is performed with the formation of the balance sheet of account 20, indicating the item group “Chocolate Paste”.

Accordingly, a new item appeared in the cost structure.

Thus, the “Production Report for a Shift” allows you to organize a full accounting of manufactured products, but also to collect data on direct costs, providing the ability to accurately calculate the cost of goods and services.

2017-04-25T12:44:19+00:00

What kind of beast is this? “ Adjustment of nomenclature

"? Beginner accountants often ask me this question because they don’t understand where this adjustment comes from, how it is calculated and whether it is necessary.

Let's figure this out once and for all using the example of 1C: Accounting 8.3, edition 3.0.

Firstly, the adjustment occurs “by itself” at the close of the month

.

Secondly, it occurs most often for organizations that write off inventories at average cost

().

And that's why.

If we carefully read paragraph 18 of PBU 5/01 on the approval of accounting regulations, we will see the following there:

The assessment of inventories at average cost is carried out for each group of inventories by dividing the total cost of the group of inventories by their quantity, consisting respectively of the cost price and the amount of balance at the beginning of the month and the inventory received during the given month.

The same in the form of a formula:

Average cost

of a group of inventories = (

Cost at the beginning

of the month +

Received cost

during the month) / (

Quantity at the beginning

of the month +

Received quantity

during the month)

This means that the average cost should be calculated for the month as a whole.

.

Let's look at an example:

- 01.01.2014

We bought 4 bricks for 250 rubles. - 05.01.2014

They sold 3 bricks for 500 rubles. - 10.01.2014

We bought 2 bricks for 200 rubles.

Let's calculate the average cost

bricks for January:

- Cost at the beginning

of the month = 0 rubles. - Received cost

during the month = 4 * 250 + 2 * 200 = 1400 rubles. - Quantity at the beginning

of the month = 0 pieces. - Quantity received

during the month = 4 + 2 = 6 pieces.

Total, according to the formula:

Average cost for January

= 1400 / 6 = 233.333 rubles.

But as of 01/05/2014, when we sell 3 bricks, we still do not know about subsequent receipts during the month, so we write off the cost without taking into account subsequent receipts:

Average cost as of 01/05

= 4 * 250 / 4 = 250 rubles.

Thus, on 01/05 we will write off our brick by 250

rubles per piece, but at the end of the month it turns out that it was necessary to write off

233,333

rubles (cheaper bricks arrived on January 10).

So there was a difference of (250 - 233.333) = 16.666 rubles per piece, which needs to be adjusted at the end of the month.

The adjustment amount for 3 bricks sold will be 3 * 16.666 = 50 rubles

.

Let's check this example in the 1C: Accounting 8.3 program (edition 3.0).

They were capitalized at 250 rubles apiece.

We make a write-off dated 01/05/2014

They also wrote off 250 rubles apiece.

We are making receipts from 01/10/2014

They have already been received at 200 rubles apiece.

Finally, we close the month for January

Left-click on the “Adjustment of item cost” item and select the “Show transactions” command:

Here is our adjustment of 50 rubles.

We're great, that's all

By the way, for new lessons...

Is it possible to make adjustments with FIFO?

Yes, it's possible. And now I will show with an example when it can arise.

So, we are on FIFO (first in first out), which means goods are written off in the order they arrive at the warehouse.

Let's look at an example:

- 01.01.2014

We bought 1 brick for 100 rubles. - 03.01.2014

We bought 1 brick for 150 rubles. - 06.01.2014

Sold 1 brick. At the same time, the cost of 100 rubles was written off (after all, we are on FIFO). - 10.01.2014

Additional expenses were received in the form of 20 rubles for the receipt of bricks dated 01/01/2014. We formalized them in 1C with the document “Receipt of additional. expenses." - 31.01.2014

We closed the month and it adjusted the write-off on 01/06/2014 by 20 rubles, since in fact the cost of the bricks received on 01/01/2014 turned out to be not 100 rubles, as we thought at the time of write-off, but 120 rubles (+20 rubles of additional expenses that we entered 10 as the number).

Sincerely, Vladimir Milkin (teacher

In step-by-step instructions, we will look at how in 1C Accounting 8.3 accounting for finished products and costs for them is carried out.

Before you start accounting for finished products, you need to make some preliminary settings. First of all, let's expand the functionality of the program. This can be done by clicking on the hyperlink of the same name in the “Main” section.

In the window that opens, on the “Production” tab, you need to check the box, as shown in the figure below. Otherwise, the production and release processes will not be taken into account in the program.

You most likely noticed that in our picture the “Production” flag is checked, but is not editable. This happened because the program already has documents within this functionality. To view a list of them, follow the “Production” hyperlink below.

The program generated a report for us with a list of all documents in the program that relate to production processes and product output. It is their existence that will not allow this functionality to be disabled.

The next important setting is to take into account deviations from the planned cost. When the flag is set, these deviations will be reflected in the 40th count. At the end of the month, an adjustment will be made by a special assistant to close it, and the products released will be assigned to account 43.

If you do not use such an add-on, the product release will be immediately attributed to account 43. Next, we will look at accounting reflection for both program setup options.

Write-off of main production costs

The amount of costs to be written off in the current month is determined as the difference between the debit balance of account 20 “Main production” and the balance of work in progress at the end of the month. The balances of work in progress at the end of the month are determined based on inventory data and are entered by the user into the document “Work in Process” (menu “Documents - Regular”). This document does not create any entries (entries) in accounting, but its data is used in the future by the “Month Closing” document.

After this, the costs to be written off (the positive difference between the debit balance of account 20 “Main production” and the balance of work in progress) for a specific type of item and division include:

- to the debit of account 40 “Product Output” for the corresponding type of item, if we are talking about the costs of producing finished products or semi-finished products (which, like finished products, are accepted for accounting within a month by the documents “Transfer of finished products to the warehouse”);

- to the debit of account 90 “Sales”, subaccount 90.2 “Cost of sales”, also according to the corresponding type of item - for work performed and services rendered.

The algorithm for writing off costs from account 20 “Main production” in the part attributable to the production of finished products and semi-finished products depends on setting the constant “Method of accounting for finished products and semi-finished products” (menu “Operations - Constants”), which can take one of two values:

- at planned cost;

- at actual cost.

By default, the value is set to “At actual cost”, since this is the method of accounting for finished products and semi-finished products that corresponds to the norm of paragraph 5 of PBU 5/01 “Accounting for inventories”, approved by Order of the Ministry of Finance of Russia dated 06/09/2001 No. 44n.

Another value (“At planned cost”) is left as a reserve for cases if the configuration will be used to restore accounting records for 2001 (when PBU 5/01 was not yet in effect, and according to clause 59 of the Regulations on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n, finished products were allowed to be reflected in the balance sheet either at actual or at planned production costs.At the same time, in 2001, the new Chart of Accounts approved by the order could already be used Ministry of Finance of Russia dated October 31, 2000 No. 94n).

If an organization for certain types of activities is a payer of the single tax on imputed income (UTII), then when writing off the cost of work (services), a distribution occurs between the subaccounts of account 90.2 “Cost of sales” - 90.2.1 “Cost of sales not subject to UTII” and 90.2. 2 “Cost of sales subject to UTII.” The distribution criterion is the share of revenue from activities subject to a single tax on imputed income in the total revenue.

Let's consider closing account 20 “Main production” if finished products and semi-finished products are reflected at actual cost.

Example

Pandora LLC is engaged in the production of building materials and at the same time provides household services to the population. Activities providing household services are subject to UTII. In May 2003, finished products were produced - 610 sq.m. floor coverings (production costs amounted to 58,629 rubles) and 50 sets of double-glazed windows (costs amounted to 171,456.25 rubles). Expenses for the provision of household services to the population were incurred in the amount of RUB 25,654. Let's consider closing account 20 “Main production” in Pandora LLC for May 2003:

As a result, taking into account the calculation, the following entries will be made:

Debit 40/Floor coverings Credit 20 - RUB 58,629; Debit 40/Glass units Credit 20 - RUB 171,456.25; Debit 90.2.2/Household services Credit 20 - 25,654 rubles;

If you look directly at the debit entries of account 43 generated by the document, then for finished products and semi-finished products they are formed by the difference between the actual and planned cost of the corresponding products, since during the month it is not possible to keep records other than at the planned cost.

That is, if in the above example the planned cost of flooring was 61,000 rubles. (100 rubles per 1 sq. m.), and double-glazed windows - 170,000 rubles. (3,400 rubles per set), then when calculating the actual cost of products, the following records will be generated:

Debit 43/Floor coverings (item) Credit 40/Floor coverings (item type) - 2,371.00 (reversing entry); Debit 43/Glazed windows Credit 40/Glass windows - 1,456.25 rubles;

Thus, when writing off the costs of main production, several points can be highlighted:

1. For complex production, where the results of some stages (processes, redistributions) are used as semi-finished products for others, the calculation of the cost of finished products and semi-finished products is carried out sequentially: first, the cost of semi-finished products is calculated at the first stage of production, then at the next, etc. Calculation order determined automatically.

2. If production has a closed cycle (that is, for example, the results of the first process are used as a semi-finished product in the second, and by-products of the second, on the contrary, in the first), then the cost calculation is not automatically performed, and a corresponding warning is issued.

3. If several product items belong to one type of product, then the actual production costs are distributed in proportion to the planned cost of these products. The planned cost of finished products and semi-finished products is reflected in the credit of account 40 in the subaccount “Accounting (planned) cost”.

4. To obtain correct data, it is not recommended to change the planned cost of products and semi-finished products more than once a year, although technically it is possible to change the planned cost of a specific product or semi-finished product at any time. For more information about the method of accounting for finished products at actual cost, see paragraphs 199 - 207 of the Guidelines for accounting of material and industrial inventories, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

5. Although the use of account 40 when accounting for finished products (and especially semi-finished products) at actual cost is not necessary, it is technically convenient, since during the month the accounting price (planned cost) is still used to reflect operations on the movement of manufactured products.

SOE accounting operations

Taking into account deviations from the planned cost

To reflect in the program the release of the GP produced by our organization, use the document “”. You can find it in the “Production” section.

First, we indicate all the document header data. In our example, the organization Confetprom LLC produced a certain product that was placed in the main warehouse. By default the accounting account will be 20.01.

On the “Products” tab, a list of state enterprises for which you want to reflect the release is indicated. In this example, we produced one thousand kilograms of Assorted sweets and five hundred kilograms of Cherry in Cognac. The document indicates planned prices, accounting account 43, product group and specification. The program fills in some of this data on its own.

If the finished product has a specification, then the “Materials” tab can also be filled in automatically, which greatly simplifies the work.

Please note that our candies are set to the “Products” nomenclature type, since they are a state-of-the-art product we produce.

In the situation we are considering, deviations from the planned cost are not taken into account. This is reflected in the accounting policies by the absence of the flag of the same name.

In this case, when conducting a production report for a shift, the “Assorted” and “Cherry in Cognac” candies will immediately be reflected on account 43, as shown in the image below. With this setting of accounting policy 40, the account for production output will not be used.

The sale of GP is reflected in the document “Sales (acts, invoices)”.

Closing the month

Let's move on to the end of October 2021, since that is when the release of our chocolates was reflected.

In the routine operation to close accounts 20, 23, 25, 26, an adjustment was made to the output of products, namely our produced candies. As you can see in the image below, the adjustment was reflected immediately in account 43.

You can immediately generate from processing the month end. In our example, only the “Assorted” and “Cherry in Cognac” candies were included.

From this assistant you can generate other useful certificates and calculations.

Without taking into account deviations from the planned cost

Now let’s go back to the accounting policy of Confetprom LLC and set the flag in the item “Deviations from the planned cost are taken into account.” Now, when releasing a GP, score 40 will be used.

Let's check this by rerunning the previously created shift production report. In the formed movements, we see that the candies “Assorted” and “Cherry in Cognac” passed instead of Kt 20.01 to Kt 40.

At the end of the month, when closing accounts 20, 23, 25, 26, the generated movements when using the setting for the need to take into account deviations from the planned cost will differ from the previous example. Adjusting output will first create movements from 20.01 to 40 counts and only after that from 40 to 43 counts.

Accounting for production costs in the 1C: Accounting 8 program is carried out in the context of item groups (types of activity). They must first be entered in the directory “Nomenclature Groups”:

Menu: Enterprise – Products (materials, products, services)

Direct production costs are recorded in accounts 20 “Main production” and 23 “Auxiliary production”. This includes everything that can be attributed to specific types of manufactured products (semi-finished products, production services): raw materials written off for production, depreciation of capital equipment, wages and payroll taxes of production workers, as well as some services.

During the month, direct costs are reflected in the program using documents such as “Request invoice”, “Receipt of goods”, “Advance report” (tab “Other”), “Payroll”, as well as routine operations “Depreciation and depreciation of fixed assets” funds”, “Calculation of taxes (contributions) from the payroll” and some others. You should pay attention to the correct indication of the nomenclature group both in documents and in the methods of reflecting depreciation expenses and reflecting wages in accounting.

Accounting adjustments

Changes that reduce the cost of shipped goods/services must be documented: an additional agreement must be drawn up to the previously concluded agreement, which will record all aspects of the new agreements.

A decrease in the cost of delivery is reflected in the seller’s accounting by reversal entries:

| Content | D/t | K/t |

| REVERSE the amount of goods/services to be returned | 41 | 62 |

| REVERSAL of VAT on returned goods and materials | 19 | 62 |

| REVERSE of VAT accepted for deduction on return | 68 | 19 |

Example

On January 12, 2021, under the agreement, Afina LLC shipped 150 sets of metal products to Hephaestus LLC in the amount of 324,000 rubles. (including VAT 20% - 54,000 rubles). The price of one set without VAT is 1800 rubles, its cost is 1000 rubles. The buyer paid for the goods in full, but upon receipt at the warehouse, he discovered 10 sets that did not meet the requirements of his production, in the amount of 21,600 rubles. in view of VAT.

LLC "Gefest" notified the seller about sending a claim and an additional agreement to the contract to reduce the cost of the goods, return them and transfer funds for them. Afina LLC agreed with the demands put forward, signing the document and returning 21,600 rubles to the buyer’s account.

Postings for adjusting sales downward from the seller

Postings in supplier accounting (Athena LLC):

Content D/t K/t Sum Sales revenue 62 90/1 324000 VAT charged 90/3 68 54000 Payment received from Gefest LLC 51 62 324000 The cost of 150 sets was written off 90/2 43 150000 Implementation adjustments: Reflected decrease in STORNO sales 43 62 21600 VAT on the cost of returned goods STORNO 19 62 3600 VAT previously accepted for deduction has been reversed 68 19 3600 Refund to buyer 62 51 21600 Adjustment of sales downward: postings to the buyer

Postings to Hephaestus LLC will be as follows:

Content D/t K/t Sum Posting of goods 41 60 270000 VAT on purchased goods and materials 19 60 54000 Payment for delivery 60 51 324000 VAT is accepted for deduction 68 19 54000 Adjustment according to additional agreement: Other income accrued 76 91/1 18000 VAT on returned goods has been restored 76 68 3600 A refund 51 76 21600

Examples of direct production costs

The “Requirement-invoice” document (menu or “Production” tab) reflects the write-off of materials for production. The cost account and analytics are listed on the Cost Account tab. When posting the document, posting Dt 20.01 Kt 10 will be generated, with the corresponding analytics for account 20 (division, item group, cost item):

Method of reflecting depreciation expenses (menu or tab “OS” or “Intangible assets”). If you choose this method when accepting a fixed asset for accounting (accepting intangible assets for accounting, transferring work clothes into operation), then depreciation for this fixed asset (depreciation of intangible assets, repayment of the cost of work clothes) will be assigned to the specified account and cost analytics. In this case, the posting Dt 20.01 Kt 02.01 will be generated:

Method of reflecting wages in accounting (menu or “Salary” tab). If you specify this method in the accrual, the employee’s salary and payroll taxes will be charged to the appropriate account and cost analytics. In this case, when accruing salary, the posting Dt 20.01 Kt 70 will be generated:

At the end of the month, direct expenses collected on accounts 20 and 23 are distributed between manufactured products and work in progress by item groups (types of activity). Distribution occurs through routine month-end closing operations.

In addition, there are general production and general business expenses, which are accounted for in accounts 25 and 26, respectively.

General production expenses during the month are charged to account 25. To reflect them, the same documents can be used as to reflect direct costs. At the end of the month, costs collected on account 25 are distributed to account 20 by item groups (types of activity), within a specific division, in accordance with the distribution base, using routine operations.

General business expenses during the month are charged to account 26. To reflect them, the same documents can be used as to reflect direct costs. At the end of the month, expenses collected on account 26 can be written off in two ways. They can be distributed to account 20 according to item groups (types of activity) of the entire enterprise, in accordance with the selected distribution base. Or, if the “direct costing” method is used, general business expenses are written off directly to account 90.08 “Administrative expenses” in proportion to sales revenue.

Cost accounting is set up in the form of the organization’s accounting policy (menu or “Enterprise” tab).

On the “Production” tab, the methods for distributing general and general production expenses are indicated using the “Set distribution methods...” button. In the form that opens, you need to indicate for each account the distribution base, which can be the volume of output, the planned cost of production, wages, material costs, revenue, direct costs, and individual items of direct costs. If necessary, you can detail the methods of distribution by departments and cost items.

Here you can configure the use of the “direct costing” method and the distribution of production costs for services:

On the “Product Output” tab, you select the method of accounting for the output of finished products (semi-finished products, production services) - with or without using account 40. Here you must also specify the definition of the sequence of redistributions for closing accounts, which is important for multi-distribution production. It is recommended to select automatic detection. If production is accounted for at planned cost using account 40, then automatic calculation of the sequence of redistributions is impossible. In this case, you need to select the manual method, and then manually set the order of divisions for closing accounts (using the button).

Automatic determination of the sequence of processing steps is set:

A manual determination of the sequence of repartitions has been set, the order of divisions has been established:

Setting up accounting policies

For proper accounting, it is important to set the correct settings in the “Main-Accounting Policy” menu.

Fig. 1 Main - Accounting policies

We see that account 26 “General business expenses” is preset as the main account for cost accounting.

Fig.2 Accounting policy

It should be replaced with 20.01 “Main production”. After checking the box in the “Product Output” line, you can choose to include general business expenses in the cost of sales or attribute them to the cost of production .

Fig.3 Product output

Their difference is that in the first case, at the end of the month, all expenses from the credit of account 26 are written off to the debit of account 90 “Sales”, subaccount 2 “Cost of sales”. With this option, an incomplete production cost of products is formed in the system, and the cost of products sold increases.

If the second method is chosen, the expenses accumulated on account 26 are written off to the debit of account 20 and distributed by type of product produced according to the selected indicator. Methods for allocating indirect costs can be selected below by clicking on the appropriate line in this section.

Fig.4 Methods for allocating indirect costs

Here you can set several cost allocation alternatives.

Fig.5 Creating a cost distribution method

Clicking on “Create” will open the following window:

Fig.6 Window for creating a cost distribution method

Here you can select the period from which this distribution method is introduced (must correspond to the accounting policy of the enterprise), the account and cost item, as well as the distribution base. Since we are considering the issue of distributing general production and general business expenses, when you click the “Expense Account” button, a window opens with a choice of these two accounts.

Fig.7 Expense account

We select account 25 “General production expenses”. The next line for selecting cost items is much broader.

Fig.8 General production expenses

You can select cost items such as depreciation, wages for workers employed at production sites, write-off of materials, etc. For the example, we chose “Payment”. Next, we decide on the choice of distribution base.

Fig.9 Distribution base

The list of distribution base options is presented in a pop-up window: volume and planned production cost, labor compensation, material costs, etc., or select the option without distribution. When choosing the option to include general business expenses in the cost of production, a check mark is placed in the line “In the cost of products, works, services.”

Fig. 10 Checkbox In the cost of products, works, services

Methods for posting indirect expenses can also be established in a similar way to general expenses.

Fig. 11 Methods for posting indirect costs

Here you can also select direct cost account 20.01 “Main production” or 23 “Auxiliary production”.

In the 1C system, if necessary, you can take into account the cost according to the plan, for which the corresponding checkbox is checked.

Fig. 12 Taking into account planned cost

Production and sale of finished products

The output of products (semi-finished products, production services to its own divisions) is reflected in the program by the document “Production report for the shift” (menu or tab “Production”). The manufactured products are accounted for at the planned cost, the document generates the posting Dt 43 Kt 20 (or, if the use of account 40 is specified, the posting Dt 43 Kt 40). It is necessary to correctly indicate the product group for the released product.

Document “Production report for the shift” and the result of its implementation (account 40 is not used):

To correctly calculate the cost in the program, it is necessary to observe the principle of matching income and expenses in the context of product groups (types of activity). That is, if there are costs for a product group, they must correspond to the output and income for this product group.

Sales of finished products are reflected in the document “Sales of goods and services”, with a revenue entry being generated: Dt 62 Kt 90.01, and a posting for writing off the cost of goods sold: Dt 90.02 Kt 43. Analytics of accounts 90.01 and 90.02 – item groups (types of activity).

Closing the month in 1C - solving monthly problems (Enterprise Accounting 3.0)

we think.

anisa8310 (8) ok now, thanks, I’ll tell you the result, it means that this is where the “dog is buried” anisa8310 (8) found expense account 90.01.1 in the sales documents!! damn... Thanks, I’ll fix it now, I’ll show it to the boobs, let them think for themselves.. further anisa8310 has now rechecked the docks and am doing a group recheck of the docks anisa8310 everything is fine, thanksClosing the period and calculating the actual cost

Closing cost accounts and calculating the actual cost of manufactured products (semi-finished products) is carried out at the end of the month through routine operations. Previously, routine operations must be carried out to calculate depreciation of fixed assets and intangible assets, repay the cost of workwear, write off deferred expenses, calculate wages and payroll taxes.

You can use the routine processing “Month Closing”:

In this case, the program itself will “determine” which routine operations are necessary and carry out them in the correct sequence. Execution occurs by clicking the “Perform month closing” button:

When carrying out the routine operation “Closing accounts 20, 23, 25, 26”, several stages are performed: distribution of indirect costs (according to the established “Distribution Methods”), calculation of direct costs for each product and for each division, cost adjustment.

Let us give an example of the operation “Closing accounts 20, 23, 25, 26” (the organization uses the “direct costing” method). There are entries for closing account 26 (not all are visible in the figure), adjusting product output, and adjusting the cost of goods sold. (Adjustment amounts can also be negative if the actual cost is less than planned).

After closing cost accounts, you can generate calculation certificates (available from the “Month Closing” processing) or through:

Menu: Reports – Help calculations

Help-calculation “Calculation”:

Help calculation “Product cost”:

Account 43 in accounting. Features of use

To reflect the receipt of finished products (GP) of own production, Dt 43 is used. When writing off finished products (consumption, defects, shipment, transfer, etc.), entries are made according to Kt 43.

Acceptance of GP for accounting can be carried out in several ways. Here are some of them:

| Debit | Credit | Description | Document |

| 43 | 20, 23, 29 | Receipt of GP from production to the enterprise warehouse (main/auxiliary/service production). | Purchase Invoice |

| 43 | 76 | Receipt of a state enterprise as part of an enterprise | Transfer and Acceptance Certificate |

| 43 | 80 | GP accepted as a contribution to the authorized capital | Minutes of the board's decision |

| 43 | 98 | GP is taken into account as a discount provided to the buyer | Packing list |

Write-off of the cost of GP from the balance sheet can be reflected by the following entries:

| Debit | Credit | Description | Document |

| 45 | 43 | GP transferred to third parties | Transfer and Acceptance Certificate |

| 80 | 43 | GP transferred under a simple partnership agreement | Transfer and Acceptance Certificate |

| 44 | 43 | GP was spent for commercial purposes | Expense report |

| 94 | 43 | GP written off due to identified shortage | Commission report, Inventory sheet |

| 97 | 43 | The cost of the GP used in performing the work is reflected in deferred expenses. | Work contract |

Unfinished production

If production expenses were incurred during the period, but there was no output (semi-finished products, production services), or it was incomplete, then account 20 is not closed, the value of work in progress (WIP) remains on it and is transferred to the next month. Accounting for work in progress can be configured in the form of the organization’s accounting policy, on the “WIP” tab. The default method is usually “In the absence of release, consider direct expenses as WIP expenses”:

If, in the accounting policy, the WIP accounting method “Using the WIP Inventory” document is selected, then if there is work in progress, it will be necessary to enter the “WIP Inventory” document before closing the month. Here you manually indicate the amounts of work in progress for each item group:

When adjustments are needed

It is necessary to reduce the cost of supplies for various reasons, for example:

- the buyer has identified misgrading, non-compliance of the goods or work performed with the initially stated requirements;

- there were errors in the implementation documents;

- in order to be more interested in promoting the product, the seller provides a bonus (reducing the cost of the product) to the buyer.

If such changes are established before the expiration of 5 calendar days from the date of shipment, then the invoice (IF) will be issued taking into account these transformations and no adjustments will be required. After a five-day period, the seller is obliged to issue an adjustment tax return, since changes in the sales amount affect VAT.