Work in the North

Persons working in the North have the right to receive state guarantees and compensation, which are established by the Labor Code of the Russian Federation, other federal laws and other legal acts of the Russian Federation (Article 313 of the Labor Code of the Russian Federation).

One of these guarantees is compensation for travel to and from the vacation destination. This right is established by Article 325 of the Labor Code of the Russian Federation. Employers located in regions of the Far North and areas equivalent to regions of the Far North are required to provide this guarantee to employees.

What to do if supporting documents are not provided

To compensate for transportation costs, it is necessary to provide supporting documents: railway and air tickets, taxi receipts, certificates of work performed by the transport organization. When paying compensation for the use of personal transport, an agreement on its purpose must be concluded or a rental agreement must be provided. If there are no supporting documents, then:

- An organization will not be able to include transportation costs in expenses when calculating income tax, because they must not only be justified, but also documented.

- If, nevertheless, the organization pays compensation, then the regulatory authorities will consider it part of the salary and will oblige the employee to pay personal income tax, and the organization to pay insurance premiums.

Paying for travel on vacation

There are no specific rules for northerners paying for travel on vacation. Therefore, companies determine them independently.

The amount, conditions and procedure for compensation of expenses for payment of travel costs and baggage transportation to the place of use of the vacation and back must be specified in collective or labor agreements or in local regulations.

Please note: 2 years are counted in total from the date of commencement of work in the Far North and equivalent areas for all employers.

Expenses for paying the cost of travel to the place of vacation are not compensated if the employee is:

- on maternity leave;

- on parental leave until the child reaches the age of 3 years;

- on leave without pay;

- on annual paid leave followed by dismissal.

Compensation for using a personal vehicle for business purposes

If an employee uses a personal car to travel on behalf of the company, the employer is obliged to compensate him for the cost of fuel and depreciation of the car. For this purpose, payment of compensation may be provided for in the employment contract. But it should be remembered that compensation can be included in expenses when calculating income tax only within the limits of the following standards:

- 1200 rub. per month - with an engine of 2000 cm³ or less;

- 1500 rub. - with an engine volume of more than 2000 cm³.

The amount of compensation paid can be stipulated by order of the manager.

Sample order on the amount of compensation for the use of personal vehicles

Another option is to enter into a vehicle rental agreement. This method will allow you to reflect the entire amount of employee expenses on a vehicle in tax accounting. For compensation to be valid, the employee must confirm that he is the owner of the car.

Travel from home to work in a personal vehicle is not eligible for compensation.

What about personal income tax?

For “northerners”, such payment for travel to the vacation destination and back is compensation provided for by law. Therefore, personal income tax does not need to be withheld from the entire amount of compensation for travel expenses.

However, this opinion is not shared by all officials of the Russian Ministry of Finance.

There is also such an opinion. Vacation is time when an employee is free from performing work duties and which he can use at his own discretion. That is, if an employee does not perform work duties during vacation, then he does not bear the costs associated with their performance. It turns out that the cost of travel to the place of rest and back during the vacation period of workers, paid by the employing organization, is not in its content a compensation payment and is subject to personal income tax in the general manner.

And the courts believe that compensation for travel expenses falls under paragraph 3 of Article 217 of the Tax Code of the Russian Federation and is not subject to personal income tax. But today there are no such provisions in the list of income exempt from taxation.

The amount of travel compensation for a new employee is not subject to personal income tax.

Amounts of compensation to an employee for expenses associated with moving to work in another area are not subject to personal income tax in the amounts established by agreement of the parties to the employment contract

09/22/2017 Author: Expert of the Legal Consulting Service GARANT auditor Ovchinnikova Svetlana

In a commercial organization, to attract young promising employees, a Regulation on payment is being developed lifts for young specialists arriving at their place of work from other cities. In accordance with the Regulations, a young specialist is recognized as a specialist who is getting a job for the first time; his age is not older than 28 years. When issuing allowances, an additional agreement to the employment contract is concluded with the employee with the condition of working in the organization for at least 5 years; in case of dismissal at his own request, the employee is obliged to return the amount of paid allowances. 2 payment options are being considered:

1. A newly hired young specialist, upon personal application and after concluding an additional agreement, receives an advance in the amount of 100 thousand rubles. Within a month, the obligation arises to provide a report with the attachment of primary documents confirming payment of actual expenses. In this case, expenses may be associated with reimbursement of expenses for travel documents, rental housing, purchase of necessary items and furniture for arrangement in a new place (including furniture, dishes, household appliances). In case of voluntary dismissal before the expiration of 5 years, the employee becomes obligated to return the amounts received in full.

2. A newly hired young specialist, upon personal application and after concluding an additional agreement, receives 100 thousand rubles. — one-time compensation in connection with moving to another location. With this option, the employee does not have the obligation to confirm actual expenses. In case of voluntary dismissal before the expiration of 5 years, the employee becomes obligated to return the amounts received in full.

What is the taxation procedure in these situations in terms of accepting such expenses for profit tax purposes, personal income tax and insurance premiums? What are the tax risks arising from such payments?

Having considered the issue, we came to the following conclusion:

1. Taking into account judicial practice, the amount of compensation for travel and accommodation of a newly hired specialist, as well as compensation for the cost of renting housing may not be subject to personal income tax.

According to the current official position, the amount of compensation for travel and accommodation for newly hired specialists who have moved from other cities should be subject to personal income tax.

The amount of compensation to an employee for rental housing expenses, according to the Russian Ministry of Finance, is subject to personal income tax (even if reimbursement of such expenses is provided for in the employment contract).

2. We have not found any official explanations or judicial practice on the issue of taxation of the costs under consideration by insurance premiums in the light of the norms of Chapter 34 of the Tax Code of the Russian Federation.

If we adhere to the position that the organization’s expenses for reimbursement of the costs in question should be considered as compensation (guarantees) provided for in Art. 169 of the Labor Code of the Russian Federation, these payments are not subject to insurance premiums on the basis of paragraphs. 2 p. 1 art. 422 of the Tax Code of the Russian Federation.

However, taking into account the official position on the previous paragraph, it is impossible to exclude the possibility of tax risks if insurance premiums are not applied to the expected payments to newly hired young specialists (for any option of formalizing the relationship).

3. In the situation under consideration, it seems to us that the more “risk-free” option for profit tax purposes is to take into account the amounts of compensation to new employees for relocation and settlement expenses under clause 25 of Art. 255 Tax Code of the Russian Federation.

An organization's expenses for paying compensation for rental housing can be taken into account for profit tax purposes as other expenses associated with production and (or) sales (clause 49, clause 1, article 264 of the Tax Code of the Russian Federation), subject to the general requirements of clause 1 Art. 252 of the Tax Code of the Russian Federation.

Rationale for the conclusion:

The concept of lifting is not defined by labor and tax legislation.

According to Art. 169 of the Labor Code of the Russian Federation, when an employee moves, by prior agreement with the employer, to work in another area, the employer is obliged to reimburse the employee:

— expenses for moving the employee, his family members and transporting property (except for cases where the employer provides the employee with appropriate means of transportation);

- expenses for settling into a new place of residence.

Commercial organizations establish the procedure and amount of reimbursement to employees for expenses when moving to work in another area by a collective agreement or local regulation, or by agreement of the parties to the employment contract.

According to the Ministry of Finance of Russia (see, for example, letters dated July 20, 2007 N 03-04-06-01/255, dated May 22, 2007 N 03-04-06-01/152, dated January 17, 2006 N 03-03-04 /1/30), for tax purposes, lifting should be understood as the types of compensation established by Art. 169 Labor Code of the Russian Federation.

At the same time, some judges note that when applying the provisions of Art. 169 of the Labor Code of the Russian Federation, it is necessary to take into account that the provisions of this article apply in the case when an employee, in agreement with the employer, moves from one place of work where he performed his job duties to another place of work with the same employer (see, for example, the appeal ruling of the IC in civil cases of the Transbaikal Regional Court dated May 25, 2016 in case No. 33-2283/2016).

At the same time, we note that Rostrud specialists, in responses to private inquiries, indicate that the provisions of Art. 169 of the Labor Code of the Russian Federation are also applied when concluding an employment contract with an employer located in another area.

Based on Art. 57 of the Labor Code of the Russian Federation, an employment contract may provide for additional conditions that do not worsen the employee’s position in comparison with established labor legislation and other regulatory legal acts containing labor law norms, a collective agreement, agreements, and local regulations.

In this situation, the organization plans to pay newly hired employees the following funds:

- as compensation for actual (documented) expenses for travel to a new place of work, for renting housing, for settling into a new place of residence;

- or as compensation for the employee’s expenses associated with moving to a new place of residence and settling down there in a certain amount without documentary evidence of the fact of incurring expenses.

Personal income tax

For personal income tax purposes, the concept of “income” is defined in accordance with the provisions of paragraph 1 of Art. 41 of the Tax Code of the Russian Federation, according to which income is recognized as economic benefit in monetary or in-kind form, taken into account if it is possible to evaluate it and to the extent that such benefit can be assessed, and determined in accordance with Chapter 23 of the Tax Code of the Russian Federation.

As a general rule, income received by an individual from sources in the Russian Federation in kind or in cash is recognized as an object of personal income tax taxation (Articles 208-210 of the Tax Code of the Russian Federation). As follows from the provisions of paragraph 1 of Art. 208 of the Tax Code of the Russian Federation, income from sources in the Russian Federation includes any income received by the taxpayer as a result of his activities in the Russian Federation.

At the same time, Art. 217 of the Tax Code of the Russian Federation establishes a list of income that is not subject to taxation.

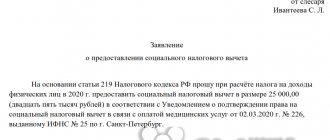

So, in accordance with paragraph 3 of Art. 217 of the Tax Code of the Russian Federation are not subject to taxation (exempt from personal income tax) all types of compensation payments established by the current legislation of the Russian Federation, legislative acts of constituent entities of the Russian Federation, decisions of representative bodies of local self-government (within the limits of legally established norms), related, in particular, to the performance of labor duties by the taxpayer ( including moving to work in another area).

According to the explanations of specialists from the Ministry of Finance of Russia, amounts reimbursed to an employee for expenses associated with moving to work in another area (travel and accommodation expenses) are not subject to personal income tax in the amounts established by agreement of the parties to the employment contract. Such clarifications are given, for example, in relation to situations where:

- the employer transfers some of the employees from one separate division to another separate division located in another city (letters of the Ministry of Finance of Russia dated May 15, 2013 N 03-03-06/1/16789, dated December 17, 2008 N 03-03-06/1/ 688);

- the employee is sent to permanent work abroad (letter of the Ministry of Finance of Russia dated April 18, 2007 N 03-04-06-01/123);

- the employer attracts new employees of other organizations from other regions of Russia (letters of the Ministry of Finance of Russia dated December 17, 2008 N 03-03-06/1/688, dated May 26, 2008 N 03-04-06-01/140, dated May 30, 2007 N 03-04-06-01/165).

From the above letters it follows that the Russian Ministry of Finance allowed the possibility of applying clause 3 of Art. 217 of the Tax Code of the Russian Federation when paying reimbursement of expenses provided for in Art. 169 of the Labor Code of the Russian Federation, both in cases of transfer of existing employees to work in another area, and in cases of attracting new nonresident workers.

However, later the position of the Russian Ministry of Finance changed. Thus, in the letter dated July 14, 2009 N 03-03-06/2/140 it is explained that the provisions of Art. 169 of the Labor Code of the Russian Federation are applied in the case when an employee, in agreement with the employer, moves from one place of work where he performed his job duties to another place of work. At the time of moving to work in another locality, an individual must be in an employment relationship with the same employer, by agreement with which he is moving from one place of work with this employer to another place of work located in another locality. In the case of hiring a new employee and paying for travel to his place of work specified in the employment contract, as well as expenses for settling into a new place of residence, the provisions of Art. 169 of the Labor Code of the Russian Federation is unfounded. In this regard, amounts paid by the organization for these employee expenses are subject to personal income tax in the prescribed manner.

In relatively recent letters from the Ministry of Finance of Russia dated 08/05/2014 N 03-04-06/38542, dated 06/30/2014 N 03-04-06/31385, a similar point of view is expressed.

Since the new employer reimburses the employee for his expenses for moving to a new place of work, Art. 169 of the Labor Code of the Russian Federation is not provided for; this payment is not subject to clause 3 of Art. 217 Tax Code of the Russian Federation. In this case, the method of payment (reimbursement) by the employer for such expenses does not matter.

Thus, at the moment, representatives of the financial department believe that in the case where the costs of moving and settling an employee are compensated by a new employer, such compensation is not considered made on the basis of Art. 169 of the Labor Code of the Russian Federation (in particular, the Trans-Baikal Regional Court agreed with this, as we have already mentioned above).

In addition, officials draw attention to the fact that the amount of reimbursement of an employee’s expenses for settling into a new place of residence and the cost of travel for the employee and his family members (carriage of luggage) are exempt from personal income tax if there are appropriate supporting documents, provided that such reimbursement is made in accordance with Art. 169 of the Labor Code of the Russian Federation (letters of the Ministry of Finance of Russia dated March 17, 2017 N 03-04-06/15550, dated November 3, 2016 N 03-04-06/64782, dated November 18, 2014 N 03-04-06/58173).

At the same time, there are court decisions that do not support the official point of view.

Thus, in the decision of the Thirteenth Arbitration Court of Appeal dated November 1, 2011 No. 13AP-16522/11, the tax inspectorate’s argument about the impossibility of applying the provisions of Art. 169 of the Labor Code of the Russian Federation and clause 3 of Art. 217 of the Tax Code of the Russian Federation due to the fact that before moving to the location of the company the employees were not in an employment relationship with the organization, the court rejected it. The court came to the conclusion that the company fulfilled all the provisions provided for in Art. 169 of the Labor Code of the Russian Federation conditions, namely: a preliminary agreement has been reached with employees on reimbursement of disputed expenses, employment contracts stipulate the specific amounts of this reimbursement, and the reimbursement itself was made during the period when the employees were in an employment relationship with the company. The Federal Tax Service's reference to the fact that none of the employees documented that the funds received were used specifically for arrangement at a new place of residence was also rejected by the judges, since the current legislation does not provide for the need for employees to submit reports on the expenditure of disputed compensation.

A similar conclusion is contained in the resolution of the Ninth Arbitration Court of Appeal dated 04/19/2011 N 09AP-6466/11. In particular, the court indicated that, on the basis of Art. 169 of the Labor Code of the Russian Federation, an employee is reimbursed for the costs of settling into a new place of residence in all cases when, in order to fulfill his work duties, he has to change his previous place of residence.

A decision was made in favor of the taxpayer in the resolution of the Federal Antimonopoly Service of the Far Eastern District dated February 22, 2012 N F03-417/12 in case N A51-9827/2011.

At the same time, for example, in the resolution of the Federal Antimonopoly Service of the Far Eastern District dated April 20, 2005 N F03-A73/05-2/461, the court indicated that reimbursement of expenses for moving to a place of work is recognized as compensation in the presence of an employment relationship.

With regard to reimbursement of expenses for rental housing, it should be noted that Art. 169 of the Labor Code of the Russian Federation does not provide for this type of compensation.

In this regard, the Ministry of Finance of Russia has repeatedly indicated that the amount of reimbursement by the organization of expenses for hiring housing for employees who moved to work in another area does not fall under clause 3 of Art. 217 of the Tax Code of the Russian Federation (this norm provides for exemption from taxation of compensation amounts only in relation to relocation). Therefore, the amounts in question are subject to personal income tax (even if reimbursement of such expenses is provided for in the employment contract). See letters of the Ministry of Finance of Russia dated 03/17/2017 N 03-04-06/15550, dated 06/14/2016 N 03-03-06/1/34531, dated 12/07/2015 N 03-04-06/71288, dated 09/19/2014 N 03-04-06/46997, dated 05/15/2013 N 03-03-06/1/16789, dated 02/13/2012 N 03-04-06/6-35, dated 07/13/2009 N 03-04-06-01 /165, dated 06/11/2008 N 03-04-06-02/57, dated 01/25/2008 N 03-04-06-01/22.

At the same time, the judges take the opposite point of view, considering that the rental of living quarters for employees from another locality is an integral part of the arrangement at a new place of residence, and therefore, payment for rent falls under the concept of compensation provided for in Art. 169 of the Labor Code of the Russian Federation, and is not subject to personal income tax (see, for example, resolutions of the AS of the North-Western District dated 08/28/2014 N F07-6326/14, FAS of the East Siberian District dated 09/11/2013 N F02-4189/13 in case N A19- 2330/2013, Fourth Arbitration Court of Appeal dated July 3, 2013 N 04AP-2233/13, FAS Volga District dated November 15, 2011 N F06-9891/11, FAS Moscow dated March 21, 2011 N KA-A40/1449-11, dated 06.09 .2007 N KA-A40/9054-07, FAS Volga-Vyatka District dated June 24, 2008 N A43-28282/2007-37-943).

The Presidium of the Supreme Court of the Russian Federation in paragraph 3 of the Review dated October 21, 2015 summarized the judicial practice on this issue and came to the conclusion that the receipt by an individual of benefits in the form of goods (work, services) paid for him and property rights is not subject to personal income tax if the provision of such benefits is determined, first of all, by the interest of the person transferring (paying for) them, and not by the goal of primarily satisfying the personal needs of the citizen. The mere fact that as a result of providing a citizen with the benefits paid for him, the personal needs of the individual are satisfied to a certain extent, is not sufficient to conclude that taxable income in kind has arisen.

Thus, taking into account judicial practice, the amount of compensation for travel and accommodation for newly hired specialists, as well as compensation for expenses for renting housing, may not be subject to personal income tax on the basis of Art. 169 of the Tax Code of the Russian Federation and clause 3 of Art. 217 Tax Code of the Russian Federation.

However, following such a legal approach is likely to cause disagreements with inspectors. In this case, the organization must be prepared to defend its position in court.

We also believe that the absence of documents confirming the fact that the employee has incurred reimbursable expenses in the second option of payment of compensation increases the risks of additional claims from inspectors (as we mentioned above, the Russian Ministry of Finance insists on the availability of these documents).

For your information:

If an employee is dismissed before the expiration of the established period and such employee returns to the organization the entire amount of money received, the employee will have income in the form of material benefits from savings on interest for the use of borrowed (credit) funds, provided for in paragraphs. 1 clause 1 art. 212 of the Tax Code of the Russian Federation (letter of the Ministry of Finance of Russia dated December 17, 2008 N 03-03-06/1/688).

Insurance premiums

Since 01.01.2017, relations related to the calculation and payment of insurance premiums are regulated by the provisions of Chapter 34 of the Tax Code of the Russian Federation (Clause 8, Article 2, Part 1, Article 5 of the Federal Law of 07/03/2016 N 243-FZ).

The object of taxation with insurance contributions for organizations are payments and other remuneration in favor of individuals subject to compulsory social insurance in accordance with federal laws on specific types of compulsory social insurance, in particular, within the framework of labor relations (clause 1 of Article 420 of the Tax Code of the Russian Federation).

The base for calculating insurance premiums is determined at the end of each calendar month as the amount of payments and other remunerations provided for in paragraph 1 of Art. 420 of the Tax Code of the Russian Federation and accrued separately in relation to each individual from the beginning of the billing period on an accrual basis, with the exception of the amounts specified in Art. 422 of the Tax Code of the Russian Federation (clause 1 of Article 421 of the Tax Code of the Russian Federation).

According to paragraphs. 2 p. 1 art. 422 of the Tax Code of the Russian Federation are not subject to insurance premiums for all types of compensation payments established by the legislation of the Russian Federation, legislative acts of the constituent entities of the Russian Federation, decisions of representative bodies of local self-government (within the limits of the norms established in accordance with the legislation of the Russian Federation), related, in particular, to the performance of labor duties by an individual , including in connection with moving to work in another area.

Note that a similar rule is provided for in paragraphs. 2 p. 1 art. 20.2 of the Federal Law of July 24, 1998 N 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases.”

Unfortunately, we were not able to find any official explanations regarding the imposition of insurance premiums on the amount of compensation to a newly hired employee for his travel expenses to a new place of work (location of the organization) and for settling into a new place.

If we adhere to the position that the organization’s expenses for reimbursement of the costs in question should be considered as compensation (guarantees) provided for in Art. 169 of the Labor Code of the Russian Federation, these payments are not subject to insurance premiums on the basis of paragraphs. 2 p. 1 art. 422 of the Tax Code of the Russian Federation.

An argument in this situation can, in our opinion, be the fact that the expenses of a newly hired employee for relocation and arrangement are subject to reimbursement already during the validity period of the employment contract concluded with him, in turn, reimbursement of such amounts is provided for in an additional agreement to the employment contract.

However, we cannot exclude the possibility that tax authorities will take a different point of view on this issue.

The employer’s obligation to pay housing rental compensation to newly hired non-residents (as we noted above) is not directly established by Art. 169 Labor Code of the Russian Federation. Since such compensation is not mentioned among the amounts not subject to insurance contributions, we believe that there are direct grounds for applying the provisions of Art. 422 of the Tax Code of the Russian Federation does not apply to the amounts of these compensations.

On the issue of taxation of insurance premiums on the amounts reimbursed by an organization for the costs of hiring housing for employees, representatives of official bodies (during the period of validity of the Federal Law of July 24, 2009 N 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Fund Insurance" (hereinafter referred to as Law N 212-FZ)) explained that such payments are subject to insurance premiums, since they are of an incentive nature and are not designated as not subject to insurance premiums in Art. 9 of Law N 212-FZ (see, for example, letters of the Ministry of Labor of Russia dated May 19, 2016 N 17-3/B-199, Social Insurance Fund of the Russian Federation dated November 17, 2011 N 14-03-11/08-13985, paragraph 3 of the letter Ministry of Health and Social Development of Russia dated 05.08.2010 N 2519-19)*(2).

At the same time, court decisions that considered disputes relating to the period of validity of Law N 212-FZ show that judges do not share the official point of view.

For example, in the ruling of the RF Armed Forces dated 02.26.2016 N 310-KG15-20212, in the IC rulings on economic disputes of the RF Armed Forces dated 09.22.2015 N 304-KG15-5000, dated 09.16.2015 N 304-KG15-5008 it is stated that established on on the basis of a local act of the organization, the disputed compensation payments are of a social nature and, despite the fact that they were made in connection with the existence of labor relations, do not have signs of wages in the sense of Art. 129 of the Labor Code of the Russian Federation, since they are not remuneration (remuneration for labor), do not relate to incentive payments, do not depend on the qualifications of the employee, the complexity, quality, quantity and conditions of the work performed by this employee. These payments are not made as part of an employment relationship. The fact of the existence of an employment relationship between the employer and his employees does not in itself indicate that all payments accrued to employees represent payment for their labor. Thus, the disputed payments fall within the scope of paragraphs. “and” clause 2, part 1, art. 9 of Law N 212-FZ and are not subject to inclusion in the base subject to insurance contributions.

See additionally the decisions of the Eighth Arbitration Court of Appeal dated July 5, 2016 N 08AP-6318/16, AS of the Volga-Vyatka District dated September 30, 2014 N F01-3938/14 in case N A43-23628/2013, the Twelfth Arbitration Court of Appeal dated September 17, 2014 N 12AP-8012/14.

With regard to the application of the norms of Chapter 34 of the Tax Code of the Russian Federation, due to their short validity, law enforcement practice has not yet been formed.

Taking into account the above, we believe that if in the case under consideration insurance premiums are not imposed on payments to newly hired young specialists (for any option of formalizing the relationship), there is a possibility of tax risks arising.

An organization can exercise the right of a taxpayer and apply on this issue to the Ministry of Finance of Russia or the tax authority at the place of its registration for appropriate written explanations.

Based on paragraph 1 of Art. 34.2 of the Tax Code of the Russian Federation, the financial body authorized to give explanations on the application of the legislation of the Russian Federation on insurance premiums, since 01.01.2017, is the Ministry of Finance of Russia. In turn, payers of insurance premiums have the right to contact the Ministry of Finance of Russia or the tax authority at the place of their registration for personal written explanations on the application of the legislation of the Russian Federation on taxes and fees (subparagraphs 1, 2, paragraph 1, paragraph 3 of Art. 21 of the Tax Code of the Russian Federation).

Income tax

According to paragraph 1 of Art. 252 of the Tax Code of the Russian Federation, for the purpose of taxation of profits, the taxpayer has the right to reduce the income received by the amount of expenses incurred (with the exception of expenses specified in Article 270 of the Tax Code of the Russian Federation), provided that such expenses are economically justified, documented and incurred to carry out activities aimed at generating income .

In accordance with paragraph 2 of Art. 252 of the Tax Code of the Russian Federation, expenses, depending on their nature, as well as the conditions for implementation and areas of activity of the taxpayer, are divided into expenses associated with production and sales (Article 253 of the Tax Code of the Russian Federation), and non-operating expenses (Article 265 of the Tax Code of the Russian Federation).

By virtue of paragraphs. 5 p. 1 art. 264 of the Tax Code of the Russian Federation, other expenses associated with production and sales include the taxpayer’s expenses in the form of amounts of paid allowances within the limits established in accordance with the legislation of the Russian Federation.

As already mentioned, allowances, according to the Russian Ministry of Finance, are the amounts of expenses reimbursed to employees in the manner provided for in Art. 169 Labor Code of the Russian Federation.

It is in this meaning that this concept was interpreted in the letter of the Ministry of Finance of Russia dated December 17, 2008 N 03-03-06/1/688, in which, with reference to paragraphs. 5 p. 1 art. 264 of the Tax Code of the Russian Federation states that the costs of reimbursing expenses to employees associated with their move to work in another area, for tax purposes of the organization’s profit, can be taken into account as part of other expenses associated with production and sales, within the limits determined by the parties to the employment contract, and provided that these expenses comply with the provisions of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation. Please note that this letter also addressed newly hired employees.

Subsequently (as we have already noted) the Russian Ministry of Finance applied the provisions of Art. 169 of the Labor Code of the Russian Federation in relation to reimbursement of expenses for moving a newly hired employee to a new place of work was considered unfounded. Currently, the Ministry of Finance of Russia in its letters, speaking about the possibility of taking into account amounts of paid allowances for profit tax purposes, emphasizes that these amounts should be provided for in Art. 169 of the Labor Code of the Russian Federation (see, for example, letter of the Ministry of Finance of Russia dated November 3, 2016 N 03-04-06/64782).

At the same time, taking into account the provisions of Art. 255 of the Tax Code of the Russian Federation as a whole, employees of the financial department considered it possible to take into account, for the purposes of Chapter 25 of the Tax Code of the Russian Federation, expenses associated with the relocation of newly hired employees on the basis of the norm of paragraph 25 of Art. 255 Tax Code of the Russian Federation.

Such clarifications are presented, in particular, in letters of the Ministry of Finance of Russia dated November 23, 2011 N 03-03-06/1/773, dated July 23, 2009 N 03-03-05/138, dated July 14, 2009 N 03-03-06/ 2/140.

Let us recall that by virtue of clause 25 of Art. 255 of the Tax Code of the Russian Federation, for tax purposes, “other types of expenses incurred in favor of the employee, stipulated by the employment contract and (or) collective agreement” are taken into account.

Accordingly, it can be assumed that the tax authorities will be guided by precisely this position of the financial department.

Therefore, in the situation under consideration, we think it is more “risk-free” for profit tax purposes to take into account the amounts of compensation to new employees in the organization’s expenses under clause 25 of Art. 255 Tax Code of the Russian Federation.

At the same time, the absence of confirmation of the employee’s expenses in the second option of paying a lump sum compensation provides the tax authority with the opportunity to classify these expenses as not supported by documents. In other words, the presence in the additional agreement to the employment contract only of the phrase “one-time compensation in connection with moving to another location” does not reveal what was actually compensated.

Regarding the issue of accounting for the costs of reimbursing an employee’s expenses for renting residential premises, we report the following.

In a number of letters, the Ministry of Finance of Russia noted that compensation for an employee’s expenses for hiring residential premises cannot be taken into account for corporate profit tax purposes as part of other expenses related to production and (or) sales, since the employee’s expenses related to meeting his social and economic needs , cannot be considered as carried out within the framework of the activities of the organization itself. These payments can only be made as part of the remuneration system adopted in the organization (payment in kind). See letters of the Ministry of Finance of Russia dated November 21, 2016 N 03-03-06/1/68362, dated November 14, 2016 N 03-03-06/1/66710, dated December 7, 2015 N 03-03-06/1/71238.

And in the letter of the Ministry of Finance of Russia dated June 14, 2016 N 03-03-06/1/34531, officials, referring to clause 29 of Art. 270 of the Tax Code of the Russian Federation, came to the conclusion that the amount of reimbursement by an organization of expenses for renting an apartment for an employee who moved to work in another area is of a social nature and such expenses cannot be taken into account when calculating the tax base for corporate income tax, regardless of whether these are provided for expenses due to employment contracts or not.

Chapter 25 of the Tax Code of the Russian Federation does not contain a closed list of specific expenses of the taxpayer that can be taken into account when calculating the tax base for income tax (see also the definition of the Constitutional Court of the Russian Federation dated June 4, 2007 N 320-O-P).

The organization's expenses for the payment of such compensation can be taken into account for profit tax purposes as other expenses associated with production and (or) sales (clause 49, clause 1, article 264 of the Tax Code of the Russian Federation), subject to the general requirements of clause 1, art. 252 of the Tax Code of the Russian Federation, namely economic justification, documentary evidence of such costs and their incurrence within the framework of activities aimed at generating income.

We believe that, subject to proper documentary confirmation of the requirements of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation in relation to compensation for an employee for renting housing in the locality where he performs his labor function, can be considered fulfilled if the attraction of out-of-town workers is associated with the lack of qualified specialists among local residents, which can be confirmed by a certificate from the employment service institution, documentary evidence of placement by the employer vacancies in local media, etc.

At the same time, the possibility of tax risks arising when recognizing in tax accounting the costs of reimbursing employees for rental housing costs cannot be excluded.

GUARANTEE

Post:

Comments

Documents confirming travel expenses

In order for expenses to be compensated and taken into account, it is necessary to confirm not only their validity. Each fact of travel must be documented.

The easiest thing to do is with travel expenses. The employee must provide all travel tickets, receipts, checks, electronic tickets or other documents that can confirm the fact of payment for travel.

If an organization has its own bus that transports employees, then fuel costs are subject to accounting based on waybills and established fuel consumption standards. The purchase of gasoline, spare parts for repairs and other similar expenses associated with the transportation of employees are confirmed by primary accounting documents.

If transportation services are provided by a transport organization, then a certificate of completion of work or a contract for transportation is required.

How to write an application for reimbursement of travel expenses

To receive compensation, the employee writes a statement justifying the need for payment. Supporting documents (receipts from gas stations, tickets, statements, etc.) are attached to the application. When traveling on business, money is issued in advance, and supporting documents should be attached to the advance report.

Typically, an application for travel compensation is made in writing. There is no unified form. Write your full name in the header of the document. and the position of the manager, indicate the name of the organization. Then your own full name, position in the company.

In the text of the application, describe in detail the circumstances that are the basis for payment: with dates, references to regulations or legislative acts. Sign the application, indicate the date of preparation and submit it to the accounting department for review.

Application for reimbursement of transportation costs

About the author of the article

Natalya Evdokimova Accountant-expert, practical experience - more than 15 years.

Author of articles in online media on accounting, taxes, and personnel issues.

Travel expenses as part of remuneration and as a necessity

First of all, it should be noted that employee travel costs can be of two types:

- Those that are prescribed in the internal regulations of the organization and enshrined in the employment contract. With this approach, travel costs are included in wages and are part of it. Such expenses include the cost of traveling on public transport, in the form of financial assistance to a strictly limited circle of employees

- The delivery of employees to their place of work can be organized by the employer himself. Let's give a simple example. The work shop is located in a hard-to-reach place outside the city, public transport does not go there, and the nearest stop is very far from the place of work. In connection with this, the employer purchased a bus and transports workers to their place of work. If the employer does not have his own transport, then you can enter into an agreement with a company that will carry out such transportation

In the case when compensation for travel is included in the salary, it is a full part of income and the amount should be subject to salary taxes.

Taxes

Payment for travel is not subject to income tax and contributions (letter of the Ministry of Finance No. 03-04-05/46903 dated 06/07/18, letter of the Social Insurance Fund No. 02-03-16/08-526P dated 02/04/10) . “Travel” amounts are not subject to VAT (Article 149 of the Tax Code of the Russian Federation, clauses 2-7), with the exception of taxis, including minibuses. This should be kept in mind when setting a fixed amount for travel for an employee.

They can be included in income tax expenses, like others related to production and sales (Article 264 of the Tax Code of the Russian Federation, paragraphs 1-49), subject to documentary substantiation.

Those working for the simplified tax system cannot reduce costs by fare amounts, since Art. 346.16 clause 1 they are not directly named. The Ministry of Finance and the Federal Tax Service have given such explanations more than once. This point of view, however, can be argued if we consider payment for travel as a payment related to the employee’s working hours (subclause 6 of clause 1 of this article), and focus on this in the employment contract, LNA of the company.

Examples of compensating terms in a collective agreement

Example #1. Recommended clauses for an employment contract

- The employer reimburses members of the work collective and persons married to them, as well as children under 18 years of age, the amount of travel to and from the place of rest, as well as the amount of transportation of 30 kg of luggage based on documented actual costs, but not more than than 50 thousand rubles for the whole family once a year.

- Advance compensation payment is 25 thousand rubles and is made 3 days before departure on vacation.

- In order to comply with paragraph 1 of this provision, the employee is paid an additional amount up to the amount that finally compensates the actual costs incurred for the purchase of tickets to the vacation spot and payment of luggage receipts, but not more than 25 thousand rubles, if the actual cost of travel for a family on vacation and return from vacation cost him more than 50 thousand rubles.

- The additional payment period is 5 days from the date of confirmation of travel costs, but no more than 6 calendar months after the last vacation.

- If you apply for final compensation later than specified in paragraph 4 of this provision, no additional payment will be made.

- If the confirmed costs of travel to and from vacation are less than the amount of the advance payment issued on account, their compensation, then the excess amount received must be returned within 30 days.

- If controversial issues arise when paying compensation, the employee should contact the primary trade union organization for resolution of the conflict situation.

- To receive compensation for family members, the employee must confirm the fact of their residence with him and family ties with the following documents:

- an extract from a financial and personal account;

- copies of marriage and/or birth certificates of the child/children.

As can be seen from this example, the employer tried to be as specific as possible about the procedure for paying compensation for travel to and from the vacation spot in order to minimize possible disputes with employees in the future.

Example #2. Consequences of not including compensation clauses

The employer ignored labor legislation and did not include provisions on compensation for vacation travel in the collective agreement with employees, deciding that this measure was mandatory only for government agencies located on the territory of KSiPM.

The company's trade union decided to defend the rights of workers and went to court.

The court pointed out to the employer the obligation to comply with the existing norms of labor law and ordered the workers to reimburse travel expenses for arriving on vacation and returning home.

Features of calculating compensation for pensioners in the Far North regions

Pensioners in the northern regions who do not work, when applying for compensation, must choose one of two ways to provide it:

- apply for the purchase of tickets for him to travel to a vacation spot that was offered to him by social security authorities, presenting for this purpose any document that officially states where and when the vacation is planned. The application can be left at the pension fund or at the MFC at your place of residence;

- the second way is to present already purchased tickets with a request to return the funds spent on them.

Briefly

- Payment for travel on public transport for employees is carried out at the expense of the company: by purchasing travel cards, issuing money on account, or paying a fixed amount.

- All expenses must be economically justified, recorded in the employment contract, LNA, and supported by documents. In accounting entries, standard accounts 70, 71, 73 are used in correspondence with the cost accounts of the corresponding departments.

- Travel cards purchased by the organization are received through account 50/3. Amounts are not subject to personal income tax, contributions, or VAT (except for taxis). They are included in profit expenses under the OSNO, and organizations using the simplified tax system can include travel costs in the calculation only if they prove that they are part of the remuneration.

- The use of account 70 and other accounting accents indicating that the payment is part of wages and not compensation can lead to additional assessment of personal income tax and contributions.

Payment amounts

The law has not established specific amounts of compensation payments. Amounts are determined on an individual basis.

The amounts of payments are fixed by orders, regulations or resolutions in the organization. Without this they are impossible.

The norms for compensation for travel are prescribed:

- in the employment contract with the employee;

- in the vehicle operating agreement;

- in a collective agreement;

- in certain regulations and standards, for example, in the regulations on the posting of an employee.