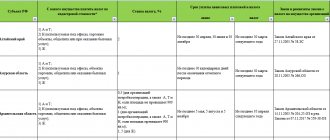

- When applying to the courts of the Russian Federation To arbitration courts

- To courts of general jurisdiction, to magistrates (with the exception of the Supreme Court of the Russian Federation)

- To the Supreme Court of the Russian Federation

- To the Constitutional Court of the Russian Federation

- To the constitutional (statutory) court of a constituent entity of the Russian Federation

- For registration of a legal entity, individuals as individual entrepreneurs, changes to constituent documents, liquidation of a legal entity and other legally significant actions

- For state registration of rights, restrictions (encumbrances) of rights to real estate and transactions with it

- For issuing a permit for harmful physical effects on atmospheric air

- For issuing a license or permit in the field of arms trafficking

BCC for payment of state duty in 2021

- 4.

- 1.

- 3.

- 2.

- 5.

- 6.

The annual change of budget classification codes requires regular monitoring of updates, therefore the article presents the corresponding BCC number for paying state duties in various situations. To resolve certain financial issues, it is necessary to pay a state tax to various structures, and most often to the tax office.

Timely payment of the state duty, the BCC of which is indicated in field “104” of the payment order, guarantees the avoidance of fines. State duty is a legal amount that a person pays for applying to government agencies.

Citizens of the Russian Federation and legal entities pay state fees in the following cases: when registering a company, law, applying to the courts, etc.

Budget classification codes are defined by the Ministry of Finance in. Not all types of ciphers are available in free online versions of regulatory frameworks authorized by authorities. Thus, the KBK for paying state duties can only be found in the paid version, but the official website of the tax authorities provides free information. Below are tables with current codes ratified by the legislation of the Russian Federation.

When applying to a court, an individual or legal entity chooses the court to which to turn for help.

Depending on the claim, the citizen selects the type of institution:

- Arbitration: bankruptcy, business affairs, work conflicts, appeal of regulatory and non-regulatory acts.

KBK - 182 1 0800 110;

- Constitutional: civil cases, family, land, property, challenging decisions of local governments.

KBK - 182 1 0800 110;

- The constitutional (statutory) resolves disputes similar to the constitutional one, with the difference that the statutory one is oriented towards municipal acts and charters.

KBK -182 1 0800 110;

- Court of general jurisdiction: cassation, appeal, district, city, military courts resolving relevant issues.

KBK - 182 1 0800 110;

Official budget classification codes when making changes to the company's constituent documents

- changing the legal address of the company;

- change of general director or chief accountant;

- increase or decrease in the size of the company's authorized capital;

- separation of part of a company or one legal entity;

- death of the founder;

- participant input/output;

- change of company owner;

- hereditary disputes;

- reorganization of the company.

All these amounts correspond to the actual amounts approved by the Russian government in 2021 - 2021. When paying a fee in a non-state bank, you will have to pay a percentage of the financial institution's commission. This means that the amount may differ from that presented in the official table.

Kbk state duty awarded by the court

Hello, in this article we will try to answer the question "".

You can also consult with lawyers online for free directly on the website.

The section contains all the responses of government bodies, which are posted on the “Open Dialogue” portal of the Electronic Government of the Republic of Kazakhstan.

Everyone knows how prices have risen and how taxes have risen.

Suddenly this also affected divorce proceedings, so now you simply cannot afford to get a divorce in 2021?

The state fee is charged regardless of the method of divorce. A receipt for payment of the fee is a required document attached to the divorce petition. Contents: Checkpoint - reason code for setting.

This is an individual nine-digit number assigned to the bank by the Federal Tax Service. The code is assigned simultaneously with the TIN when registering the bank as a taxpayer. The state fee to a court of general jurisdiction must be paid at the time the initiator of the proceedings submits an application (if the plaintiff does not belong to a preferential group of citizens).

These funds are classified as legal costs. Details for payment can be found on the information board of that court.

This data is also available on the websites of judicial authorities, and most of them even have special services that will help you calculate the fee and generate a receipt. Calculation of the state fee in court can be done by visiting the website of the judicial authority where they plan to file a claim. Most courts post convenient calculators on their official Internet pages to determine the cost of state fees.

Bank details are a necessary condition for making transfers to accounts.

These should not be confused with account details, but they are also important. In 2015, Sberbank of Russia OJSC was renamed into Sberbank of Russia PJSC at the direction of the Central Bank, but this did not affect its details.

Next, we will consider the components of the details and their meaning.

Through the registry office when submitting an application unilaterally (if the second spouse is recognized as incompetent, dead or missing, if he is sentenced to serve a prison sentence).

Republican State Institution “Department of State Revenue for the District named after.

Payment order for payment of state duty - sample 2021 - 2021

> > > August 26, 2021 All story materials Payment order for state duty - sample 2021-2021 can help in paying this fee.

What is state duty? Who should pay it and why?

What are the features of filling out a payment form for state duty?

We will consider the answers to these and other questions in the material below.

We have also prepared for you a sample of filling out a payment form for payment of state duty and will provide it below. Documents and forms will help you: Ask on our forum how to correctly transfer money to various “official” structures. For example, you can clarify how to fill out a payment form to pay a fine. State duty is a federal tax established by the Tax Code of the Russian Federation (Chapter 25.3 of the Tax Code of the Russian Federation).

It is paid in case of contacting various bodies (state, municipal, etc.) for the commission of certain legally significant actions.

The type of BCC you indicate in the payment depends on what action is required.

For convenience, we will present the main types of actions for which a duty is paid in a table and immediately present the BCC for payment. Legally significant action Amount of state duty (for 2021–2021) BCC for state duty

- State registration of individual entrepreneurs.

- Liquidation of individual entrepreneurs

- State registration of a legal entity.

- Liquidation of an organization, etc.

- Amendments to the constituent documents.

4,000 rub. 800 rub. 800 rub. 800 rub. 160 rub.

182 1 0800 110

- State registration of rights to real estate, their restrictions (encumbrances) and transactions with it, with some exceptions

22,000 rub. - for organizations. 2,000 rub.

— for “physicists” 321 1 0800 110

- Registration of vehicles and issuance of documents for them

From 350 to 1,600 rubles.

188 1 0800 110 Court fees, including:

- At

- When applying to arbitration courts.

Online magazine for accountants

Here are the main amounts of the state duty, which in 2018 are applied when applying to the arbitration courts of the Russian Federation and the Supreme Court of the Russian Federation (in cases considered in accordance with the Arbitration Procedural Code of the Russian Federation): For the price of the claim: · up to 100,000 rubles - 4% of the price of the claim, but not less than 2,000; · from 100,001 rubles to 200,000 - 4,000 + 3% of the amount exceeding 100,000 rubles; · from 200,001 rubles to 1,000,000 rubles - 7,000 rubles + 2% of the amount exceeding 200,000 rubles; · from 1,000,001 rubles to 2,000,000 rubles - 23,000 + 1% of the amount exceeding 1,000,000 rubles; · over 2,000,000 rubles - 33,000 + 0.5% of the amount exceeding 2,000,000 rubles, but not more than 200,000 rubles.

Kbk state duty awarded by the court

What does the state duty awarded by the court mean?

This means that if the defendant loses the case, then the state fee paid by the plaintiff will be recovered from him in favor of the plaintiff. As before, the state duty for individuals and organizations may differ. For example, if an application to recognize a non-normative legal act as invalid is filed by an individual, then the fee will be rubles.

The company will have to pay 10 times more - rubles sub. The fee can be paid through a bank account.

VIDEO ON THE TOPIC: Statement of claim.

The amount of the state fee to the court. Quick and clear calculation of the Kbk state fee for filing a claim Added: February 28 at 7 Admin The plaintiff pays the state fee to the court when filing claims, statements and complaints. After this, enter the value of the claim; note that not all claims are subject to valuation.

In this case, the original document confirming payment of the state duty must be attached to the documents submitted to the court.

You can calculate the exact amount using a calculator.

The calculator will show the amount of state duty that will need to be paid. First, it is necessary to determine what the cost of the claim is, whether the payer can take advantage of benefits, whether a statement of claim or an application is being filed in a special proceeding for the issuance of a court order.

In addition, we will indicate the jurisdiction of civil cases - a justice of the peace or a district city court.

The amount received using the state duty calculator must be paid through a bank in the region where the claim will be filed. The presented calculator is used: The amount of the state duty to the court did not change this year. When filing claims, starting from January 1 of the year, the state duty must be paid at the specified rates.

The state fee, in the event of a positive decision in the case, can be recovered from the defendant, like other legal expenses.

State duty The state duty to court is a fee established by law that the payer must pay when going to court. The provisions of the procedural codes establish the procedure for the collection and distribution of legal costs, including the state fee paid when filing a claim.

KBK for state duties

When applying to the arbitration courts of the KBK Name of payment 182 1 0800 110 Amount of payment (recalculations, arrears and debt for the corresponding payment, incl.

on canceled) When applying to courts of general jurisdiction, to magistrates (with the exception of the Supreme Court of the Russian Federation) KBK Name of payment 182 1 0800 110 Payment amount (recalculations, arrears and debt on the corresponding payment, including on canceled) When applying to Supreme Court of the Russian Federation KBK Name of payment 182 1 0800 110 Payment amount (recalculations, arrears and debt on the corresponding payment, incl.

according to the cancelled) When applying to the Constitutional Court of the Russian Federation KBK Name of payment 182 1 0800 110 Amount of payment (recalculations, arrears and debt on the corresponding payment, incl.

We recommend reading: Sample report on violation of internal labor regulations

according to the canceled) When applying to the constitutional (statutory) court of a constituent entity of the Russian Federation 182 1 0800 110 Amount of payment (recalculations, arrears and debt for the corresponding payment, incl.

according to the cancelled) State duty for registration of a legal entity, individuals as individual entrepreneurs, changes in constituent documents, liquidation of a legal entity and other legally significant actions of the KBK Name of payment 182 1 0800 110 Payment amount (recalculations, arrears and debt on the corresponding payment, incl. part as cancelled) State duty for registration of a legal entity, individuals as individual entrepreneurs, changes to constituent documents, liquidation of a legal entity and other legally significant actions (when applying through multifunctional centers) KBK Name of payment 182 1 0800 110 Payment amount (recalculations, arrears and debt on the corresponding payment, including the canceled State duty for the right to use the names “Russia”, “Russian Federation” and words formed on their basis in the names of legal entities

Collegium of Advocates

Please note that the correct budget classification codes for independently filling out a receipt for payment of state duty are indicated in brackets. The rest of the text must be entered in the “Purpose of payment” field.

The system in which data on all commercial and non-profit organizations, as well as peasant farms, is registered is the Unified State Register of Legal Entities. It contains information about the authorized capital, founders, addresses and activities of each company. Since information may lose its relevance, it is legally established to notify regulatory authorities, namely the Federal Tax Service, about this. In some cases, a state fee is provided for making changes to the Unified State Register of Legal Entities of a set amount.

State duty awarded by the Kbk Court 2021

The amount of state duty for civil cases.

What is a state duty awarded by a court? A state duty is a mandatory monetary fee that you will have to pay when going to court. The duty is paid in the amounts established by the Tax Code.

Based on the financial status of the payer, the judge has the right to exempt him from paying state duty, reduce its amount, and also defer or installment payment.

Dear readers! WATCH THE VIDEO ON THE TOPIC: Registration of individual entrepreneurs and LLCs through the MFC - without paying state duty Kbk state duty awarded by the court 2021 For individuals, the state duty has a fixed value, established at the state level. To calculate the state duty, you can use a variety of online calculators: the developers claim that they are regularly updated due to changes in the Tax Code.

In the case of filing an application document with a request to issue enforcement documentation intended for the enforcement of a decision issued by an arbitration court, the cost will reach rubles.

The cost of the state fee when submitting an application document, which will subsequently be considered by an arbitration court, will cost only rubles. Of course, the arbitration court's decision is not always to the taste of the plaintiffs. For such cases, it is possible to cancel it by submitting an appropriate application, the cost of which will cost in rubles.

For filing an appeal you will have to pay half the cost of the state fee. In case of loss of a verdict, court decision and other documentation allowing the issuance of a copy of the required document, payment is made for each sheet of the document. The cost of one page will be 4 rubles, but it should be remembered that the minimum cost of issuing a copy of a document should be 40 rubles.

The receipt period ranges from 15 to 40 days, although by law it should not exceed 1 month.

Date of change

Within 7 working days from the date of submission of documents to the tax authority, changes occur in the Unified State Register of Legal Entities.

Copies of documents are certified by a notary if documents for registration of changes are sent by mail.

The deadline for submitting documents is the day the documents were sent, even if they arrive much later.

By the way, you can check whether the Federal Tax Service received the amendment documents sent by mail using the new service on tax.ru (just enter your OGRN).

ipipip.ru

What is a state duty awarded by a court?

Contents 01/05/2021 What is a state duty awarded by a court is indicated in the articles of the Tax Code of the Russian Federation (Chapter 25.3).

This is a mandatory deduction of a fixed amount ordered by the competent judge hearing the dispute.

In its order, the court indicates the amount of the fee, the timing of its payment, as well as the person in respect of whom the amount is awarded.

Enforcement control falls on the shoulders of the Federal Bailiff Service of the Russian Federation.

According to Article 333.16 of the Tax Code of the Russian Federation, state duty is a mandatory deduction made by individuals and legal entities submitting a request to state or municipal authorities, judicial organizations, and officials for the execution of legal actions.

In practice, grounds for demanding payment arise in cases where the judge grants the plaintiff’s request. According to the provisions of the Code on Enforcement Proceedings, the statement of claim is accepted only after the plaintiff has paid the state fee.

If, as a result of resolving the conflict, the claim is fully satisfied, then the state fee is compensated by the defendant.

The difficulty lies in the fact that some types of claims are considered without the participation of the defendant - writ proceedings. After the decision enters into legal force, the judge prepares a court order to collect state fees from the defendant. The cost of the order is 200 rubles (for individuals), 4000 for organizations.

The original order is sent to the FSSP for further collection of funds.

Along with the notification, the competent bailiff sends the debtor a copy of the court order. The contents of the document indicate within the framework of which enforcement proceedings the money is collected. This will allow the citizen to become familiar with the legality of the grounds for claiming funds. The further procedure will be as follows: Personal appeal to the FSSP.

This is necessary in order to confirm that the writ of execution was sent by the FSSP service and is not the result of the work of fraudsters.

How to check the success of a payment

If the transfer was received by the organization, the “Completed” status will appear in your personal account. In addition, the system will offer to print a receipt confirming the payment. If there is no printer nearby, just save the receipt on your computer. Users of the mobile banking application can send the received check to their email for subsequent withdrawal on paper.

Usually sending and making payments through your personal account takes a few minutes. If you use an ATM, you will need to wait about 10 minutes for the transaction to be processed. Very rarely there are delays (1-12 hours). If a citizen paid the state fee from a bank branch, such a transfer can be processed in 2-3 days.

Kbk state duty to court 2021

Moscow, indicating the Federal Tax Service Inspectorate at the location of the court (in this case, Federal Tax Service Inspectorate No. 26);

- KBK - 182 1 0800 110;

- OKTMO - at the location of the court;

- basis of payment (field 106) - TP;

- in fields 107 “Tax period”, 108 “Document number” and 109 “Document date” will enter 0;

If you want to find out how to solve your particular problem, contact a consultant: The concept and purpose of the BCC is enshrined in Article 18 of the Budget Code of the Russian Federation. According to the code, the use of a code system allows you to group income and expenses of budgets of all levels.

When contacting state authorities, self-government or any officials with a request for any action that is significant from the point of view of the law, an individual or legal entity must pay a special fee - a state duty. Unfortunately, in 2021, these fees have increased significantly for almost all types of services.

- vehicle registration, etc.

- registration of an individual entrepreneur or organization;

- consideration of disputes in courts of various instances;

- registration of an extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs;

- liquidation of the organization;

- drawing up a pricing agreement and making changes to it;

- making changes to registration documentation;

Moscow, indicating the Federal Tax Service Inspectorate at the location of the court (in this case, Federal Tax Service Inspectorate No. 26);

If you want to find out how to solve your particular problem, contact a consultant: The concept and purpose of the BCC is enshrined in Article 18 of the Budget Code of the Russian Federation. According to the code, the use of a code system allows you to group income and expenses of budgets of all levels.

Payment of interest accrued in case of violation of the repayment deadline and interest accrued on the amount of excessively collected state duty for the re-issuance of a certificate of registration with the tax authority (payment of interest accrued on the amount of excessively collected (paid) payments, as well as in case of violation of the terms for their return ) State duty for state registration of a legal entity, individuals as individual entrepreneurs, changes made to the constituent documents of a legal entity, for state registration of liquidation of a legal entity and other legally significant actions (other receipts)

Content

From July 1, 2021, organizations in the Unified State Register of Legal Entities will be marked with unreliable data. If such a mark remains for more than 6 months, the organization will be liquidated (clause 2 of article 2 of the Law of December 28, 2016 No. 488-FZ).

From September 1, 2014 (and in 2015), the names of organizations must be changed when changes are made to them (the period is not regulated).

-OJSC is subject to renaming into a public joint-stock company (PJSC);

-CJSC is subject to renaming into JSC;

-LLC remains unchanged.

If your passport data changes, you must notify the Federal Tax Service within three days.

. It is necessary to make changes to the Unified State Register of Legal Entities.

It is no longer necessary to notify the Federal Tax Service about a change in the manager’s passport data; the Federal Migration Service notifies the Federal Tax Service of these changes in the manner of interdepartmental interaction. But this may take time. If you need to make changes urgently, you will have to do it yourself. The Federal Tax Service must be notified of a change in the name of the manager within 3 days.

The fine for late notification of the Federal Tax Service about changes is 5,000 rubles.

You may need both forms. Only one is possible. Depends on the situation.

Kbk State Duty Awarded by the Court 2021

News Tools Forum Barometer. Login Register. Login for registered:. Forgot your password? Login via:. Return of the writ of execution to the claimant after the initiation of enforcement proceedings [Law “On Enforcement Proceedings”] [Chapter 5] [Article 46] 1.

State duty awarded by the court In this text you will find information on how to correctly document the costs of paying state duty in accounting, what entries need to be made and what accounts the costs will be charged to. Payment order for payment of state duty - sample 2021 - 2021 For individuals, the state duty has a fixed value, established at the state level. To calculate the state duty, you can use a variety of online calculators: the developers claim that they are regularly updated due to changes in the Tax Code.

In the case of filing an application document with a request to issue enforcement documentation intended for the enforcement of a decision issued by an arbitration court, the cost will reach rubles.

We recommend reading: Murmansk portal where to check your housing and communal services debt

The cost of the state fee when submitting an application document, which will subsequently be considered by an arbitration court, will cost only rubles. Of course, the arbitration court's decision is not always to the taste of the plaintiffs.

For such cases, it is possible to cancel it by submitting an appropriate application, the cost of which will cost in rubles. For filing an appeal you will have to pay half the cost of the state fee. In case of loss of a verdict, court decision and other documentation allowing the issuance of a copy of the required document, payment is made for each sheet of the document.

The cost of one page will be 4 rubles, but it should be remembered that the minimum cost of issuing a copy of a document should be 40 rubles. The receipt period ranges from 15 to 40 days, although by law it should not exceed 1 month. The fees for obtaining such a passport are higher than for a book passport.

BCC for state duty in 2021 (table)

State duty is a fee levied on applications to state bodies, local government bodies, other bodies and (or) officials who are authorized in accordance with the legislative acts of the Russian Federation, legislative acts of the constituent entities of the Russian Federation and normative legal acts of local government bodies, for the commission of in relation to these persons, legally significant actions provided for in this chapter, with the exception of actions performed by consular offices of the Russian Federation.

Below is the BCC for payment of state duty in 2021: BCC STATE DUTIES For state registration: – legal entity (organization); – an individual as an individual entrepreneur; – changes made to the constituent documents of the organization; – liquidation of a legal entity (organization); — other legally significant actions. 182 1 0800 110 For cases considered in arbitration courts 182 1 0800 110 For cases considered by the Constitutional Court of the Russian Federation 182 1 0800 110 For cases considered by the constitutional (statutory) courts of constituent entities of the Russian Federation 182 1 0800 110 For cases considered by the Supreme Court of the Russian Federation 182 1 0800 110 For cases considered in courts of general jurisdiction, by justices of the peace (except for the Supreme Court of the Russian Federation) 182 1 0800 110 For the right to use the names “Russia”, “Russian Federation” and words and phrases formed on their basis in the names of legal entities 182 1 0800 110 For the re-issuance of a certificate of registration with the tax authority 182 1 08 07310 01 1000 110 For performing actions related to licensing and certification in cases where such certification is provided for by the legislation of the Russian Federation 182 1 08 07081 01 0300 110 Other state fees registration, as well as performing other legally significant actions 182 1 08 07200 01 0039 110 Below are the most common types of duties

Unified State Register of Legal Entities

The state system displays basic data about all legal entities. Partial information is reflected in the organization’s Charter, which every economic entity in Russia is required to have. This information includes key aspects of the work of any organization:

In addition to the announced information, the register records information that is not reflected in the statutory documents. For example, instructions about the director of the enterprise and the chief accountant and their personal data, registration with extra-budgetary funds, as well as activity codes received from Rosstat.

KBK for payment of state duty

18390 State Fee KBK For state registration of: – legal entity (organization); – an individual as an individual entrepreneur; – changes made to the constituent documents of the organization; – liquidation of a legal entity (organization); — other legally significant actions. 182 1 0800 110 For cases considered in arbitration courts 182 1 0800 110 For cases considered by the Constitutional Court of the Russian Federation 182 1 08 02010 01 1000 110 For cases considered by constitutional (statutory) courts of constituent entities of the Russian Federation 182 1 0800 110 For cases considered by the Supreme Court RF 182 1 0800 110 In cases heard in courts of general jurisdiction, by magistrates (with the exception of the Supreme Court of the Russian Federation) 182 1 0800 110 For the right to use the names “Russia”, “Russian Federation” and words and phrases formed on their basis in the names of legal entities persons 182 1 0800 110 For re-issuing a certificate of registration with the tax authority 182 1 08 07310 01 1000 110 For performing actions related to licensing and certification in cases where such certification is provided for by the legislation of the Russian Federation 182 1 08 07081 01 0300 110 Other fees for state registration, as well as performing other legally significant actions 182 1 08 07200 01 0039 110 FILES Applying to state authorities, self-government or any officials with a request for any action significant from the point of view of law, an individual or legal entity you need to pay a special fee - state duty.

Unfortunately, in 2021, these fees have increased significantly for almost all types of services.

For an entrepreneur, a state fee is needed to pay for the following government actions: registration of an individual entrepreneur or organization; making changes to registration documentation; liquidation of the organization; registration of an extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs; drawing up a pricing agreement and making changes to it;

Your lawyer

In addition, to reduce the risks of raider takeovers and other fraudulent activities, the procedure for registering and issuing the necessary documents, and the procedure for submitting them to the tax office, change periodically. Before taking any action, it is necessary to clarify the existing process and the required package of documents.

The electronic resource “Check yourself and your counterparty”, specially created on the website www.nalog.ru, helps the user to very easily and quickly obtain brief information about the legal entity contained in the Unified State Register of Legal Entities. The information is uploaded as a separate pdf file. You just need to enter the initial data in the search field: either TIN, or OGRN, or name. To study the full version of an extract about a specific company, you need to make a request to the Federal Tax Service of the Russian Federation and wait 5 days. On the 6th day you can receive the requested document.

Kbk State Duty Awarded by the Court 2021

News Tools Forum Barometer. Login Register. Login for registered:.

Forgot your password? VIDEO ON THE TOPIC: How to find details for paying state fees in 2 minutes? Budget classification codes (BCC) - State duty Institutions are often faced with the need to pay state duty. If the state fee was paid in cash, then the accounting department must have documents confirming that the fee was paid from the funds of the institution.

In addition to the payment document for payment of the state duty, it is necessary to attach documents that confirm the authority of the representative of the institution. This may be a power of attorney and a cash order for issuing money on account for transferring the collection. When transferring state duties non-cash, documents confirming the occurrence of a monetary obligation are not required.

In accounting, non-cash payment of state duty is reflected on the account. Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please use the online consultant form on the right or call the numbers provided on the website.

It's fast and free! In the judicial authorities, the state duty awarded by the court is immediately calculated and assigned; what it is and how to pay it can also be found out on site or on the official website.

News Tools Forum Barometer. Login Register. Login for registered:.

Forgot your password? Login via:. Previously, you entered through. Password recovery. Submit Registration.

Budget classification codes KBK - State Duty.

State duty for cases considered in arbitration courts. Tax 1 08 01 State duty on cases considered by the Constitutional Court of the Russian Federation. Send an application Extern. State duty on cases considered by the constitutional statutory courts of the constituent entities of the Russian Federation.

State duty on cases considered by the Supreme Court of the Russian Federation.

State fee for state registration:

GP size upon registration

The size of the GP is permanent and equal to eight hundred rubles if a private individual decides to register himself as an individual entrepreneur. The remaining sizes of the GP associated with registration, changes or termination of the existence of an individual entrepreneur can be viewed in the table.

| GPU size | IP action |

| RUR 800.00 | During registration |

| RUB 160.00 | For registration of termination of activities as an individual entrepreneur |

| 200/400 rub. | For providing information from the Unified State Register of Individual Entrepreneurs/urgent provision |