| In 2014, the Ministry of Finance made numerous changes and additions to Instruction No. 157n. At the end of December, the financial department issued guidelines on how to properly implement the transition to the new provisions. In the article we will look at what you need to pay attention to when reflecting transactions related to the transition to new provisions. Let us recall that in 2014 the Ministry of Finance made numerous changes and additions to Instruction No. 157n [1]. Order of the Ministry of Finance of the Russian Federation No. 89n [2] introduced amendments at the end of August last year, but explanations from the financial department on how to properly implement the transition to the new provisions came out at the end of the year. Let's consider what you need to pay attention to when making adjustments to the accounting of the financial and economic activities of an institution when reflecting individual transactions, taking into account changes to Instruction No. 157n. |

Budget postings.

General provisions for transition

In the first paragraphs of the Methodological Recommendations [3], officials drew attention to the fact that the provisions of Order of the Ministry of Finance of the Russian Federation No. 89n are applied when forming balances as of December 31, 2014. Meanwhile, they did not rule out that in 2014 it was possible to apply changes to Instruction No. 157n at an earlier date, if this was provided for by the acts of the accounting entity establishing the organization of accounting in the institution, that is, the accounting policy of the organization. The institution had the right to decide to switch to the application of both all new provisions of Instruction No. 157n, and only certain ones:

- on the organization of accounting in the institution and the implementation of internal control over the facts of economic life;

- according to the procedure for conducting an inventory of property;

- on maintaining records of individual objects of assets, liabilities, and other accounting objects;

- on the application of the institution’s working chart of accounts and other provisions of the methodology.

In this case it was necessary to proceed from:

- conditions for conducting property inventories of assets and liabilities;

- organizational and technical readiness of institutions (no later than December 31, 2014).

As noted in paragraph 1 of the Methodological Recommendations, regardless of the date of transition to the application of the provisions of Order of the Ministry of Finance of the Russian Federation No. 89n, institutions must take into account that when the requirements established by the legislation of the Russian Federation on accounting, federal and (or) industry standards by accounting entities change, the accounting policy changes . Therefore, guided by the provisions of Art. 8 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” and Order of the Ministry of Finance of the Russian Federation No. 89n, it is necessary to make appropriate changes to your accounting policy for 2014. In particular, in:

- working chart of accounts for accounting (budget) accounting;

- analytical accounting, including in the form of additional detailing of the types of receipts and disposals (according to KOSGU) [4];

- the procedure for interaction between the accounting department (structural unit,

Photo: www.ru.123rf.com

which is entrusted with maintaining accounting (budget) accounting, centralized accounting) with officials (structural divisions of the institution) responsible for carrying out the facts of economic life and their registration with primary accounting documents;

- list and forms of accounting registers and (or) the procedure for their formation, including in the form of an electronic document;

- the procedure for recording events after the reporting date, the list of events after the reporting date, information about which is included in the indicators of the reporting period, and it is also necessary to change the date (deadline) until which primary accounting documents reflecting events after the reporting date are accepted, and the conditions of materiality the specified events when reflecting the results of the institution’s activities;

- other provisions of the accounting policy necessary for organizing and maintaining accounting (budget) records and preparing accounting (financial) statements.

Next, we would like to draw attention to two main points that should be taken into account when transitioning to the new provisions of Instruction No. 157n.

Firstly, for the accounts of the working chart of accounts of the institution, for which the names of the accounts reflected in the accounting registers have been clarified, the turnover before the date of transition to the application of the provisions of Order of the Ministry of Finance of the Russian Federation No. 89n is not adjusted (clause 1 of the Methodological Recommendations).

Secondly, primary accounting documents and accounting registers formed by the institution from January 1, 2014 until the date of transition to the application of the provisions of Order of the Ministry of Finance of the Russian Federation No. 89n are not subject to re-registration and (or) correction in connection with changes in the accounting (budget) accounting methodology ( clause 6 of the Methodological Recommendations).

Reflection of the transfer of fixed assets into materials

The procedure for correcting an error depends on the date it was discovered and on whether the accounting registers need to be corrected.

To choose a correction method, determine whether the operation logs need to be edited. Do not make changes to the transaction logs for the past month. Please reflect all clarifications in the month in which you found the error. When the commission for acceptance and disposal of non-financial assets of an institution accepts property, it mistakenly identifies fixed assets as inventory.

The institution finds such an error during inventory or it is discovered by control authorities. Let's look at examples of how an accountant can reflect the movement of property in accounting. Please note => GPC agreement with an individual insurance premiums

Registration of land plots.

Due to the fact that, according to the amendments made to Instruction No. 157n, assets that were previously recorded on off-balance sheet accounts (in particular, land plots under operational management) are accepted onto the balance sheet of institutions, and certain types of settlements on newly introduced accounts are also transferred, it is necessary to carry out an inventory. The results of the inventory must be documented in inventory sheets, the forms of which are approved by Order of the Ministry of Finance of the Russian Federation No. 173n [5].

Land plots assigned to an autonomous institution with the right of free (perpetual) use, reflected in off-balance sheet account 01 “Property received for use,” are accepted for accounting as part of non-produced assets at cadastral value. In this case, a note is made (clause 2.1 of the Methodological Recommendations):

Debit account 4 103 11 000 “Land – immovable property of the institution”

Account credit 4,401 10,180 “Other income”

At the same time, the indicator on off-balance sheet account 01 “Property received for use” is reduced and changes in the indicator in account 4,210,06,000 “Settlements with the founder” are reflected in the amount of the value of the real estate accepted for accounting.

On the off-balance sheet account 01 of the autonomous institution there was a land plot, the cadastral value of which as of December 31, 2014 was 3,650,000 rubles. (conditional cost).

The following entries were made in the accounting records of the AU on December 31, 2014:

Budget postings. Table 1

| Contents of operation | Debit | Credit | Amount, rub. |

| Until the transition date | |||

| The cadastral value of the land plot is reflected in off-balance sheet accounting | 01 | 3 650 000 | |

| As of the transition date (December 31, 2014) | |||

| The land plot under operational management has been registered | 4 103 11 000 | 4 401 10 180 | 3 650 000 |

| The land plot is written off off-balance sheet | 01 | 3 650 000 | |

| Settlements with the founder are reflected in the scope of his rights to dispose of especially valuable property | 4 401 10 172 | 4 210 06 000 | 3 650 000 |

Next, we would like to draw your attention to the fact that the AU has the right to decide to reflect the cadastral valuation of land plots, amended in accordance with the legislation of the Russian Federation for 2015, as part of transactions after the reporting date, subject to reflection on December 31, 2014.

If land plots acquired under sales contracts were previously included in the accounting of the AU, in connection with their transition to accounting at cadastral value, an accounting entry must be made for the amount of the change (reflected in the case of an increase in the book value with a plus sign, in the case of a decrease book value – with a minus sign) (clause 2.2 of the Methodological Recommendations):

Account debit 0 103 11 000 “Land – immovable property of the institution”

Account credit 0 401 10 180 “Other income”

In February 2014, the AU, using funds received from paid services, acquired a land plot worth RUB 2,350,000. (conditional price). Its cadastral value as of December 31, 2014 is 2,650,000 rubles.

The following entries were made in the accounting records of the AU:

Budget postings. Table 2

| Contents of operation | Debit | Credit | Amount, rub. |

| Until the transition date (02/28/2014) | |||

| The debt to the seller for the land plot is reflected on the basis of the purchase and sale agreement | 2 106 13 000 | 2 302 33 000 | 2 350 000 |

| Payment has been made for the land plot | 2 302 33 000 | 2 201 11 000 | 2 350 000 |

| The land plot has been registered | 2 103 11 000 | 2 106 13 000 | 2 350 000 |

| As of the transition date (December 31, 2014) | |||

| The change in the value of the land plot and its acceptance for accounting at the cadastral value (2,650,000 - 2,350,000) rubles are reflected. | 2 103 11 000 | 2 401 10 180 | 300 000 |

How to transfer property from OS to materials

It is not economically profitable to use the fixed asset in the future, and it is not possible to sell it. What should I do? The company's management has the right to decide to liquidate such an object. The reflection in tax and accounting of operations on the liquidation of fixed assets will be discussed in the article. Note! If an object whose residual value is not zero is written off, then, in the opinion of the tax authorities, the organization should restore the previously deducted part of the “input” VAT attributable to the residual value of the written-off object and pay this amount to the budget.

Write-off of workwear from the balance sheet.

Currently, by virtue of the norms set out in paragraph 385 of Instruction No. 157n, accounting of property issued by an institution for personal use to employees for the performance of their official (official) duties, in order to ensure control over its safety, intended use and movement is carried out on an off-balance sheet account 27.

As noted in paragraph 2.5 of the Methodological Recommendations, the disposal of inventories that have a standard service life, issued for personal (individual) use to employees to perform their official (official) duties [6], should be reflected in the accounting entry:

Debit of accounts 0 401 20 272 “Consumption of inventories”, 0 109 00 272 “Consumption of inventories in the cost of finished products, works, services”

Credit to account 0 105 00 000 “Inventories”, with simultaneous reflection on off-balance sheet account 27 “Material assets issued for personal use to employees (employees)”

In March 2014, AU, using a subsidy allocated for the implementation of a state task, purchased 10 sets of workwear in the amount of 6,000 rubles. The clothing was placed in the warehouse and subsequently issued to the organization's employees. The standard period for using workwear is two years.

The following entries were made in the accounting records of the AU:

Budget postings. Table 3

| Contents of operation | Debit | Credit | Amount, rub. |

| Until the transition date (02/28/2014) | |||

| Workwear was purchased from the supplier and placed in the warehouse | 4 105 35 000 (warehouse) | 4 302 34 000 | 6 000 |

| Payment for workwear has been made | 4 302 34 000 | 4 201 11 000 | 6 000 |

| Work clothes were issued to employees of the institution from the warehouse | 4,105,35,000 (employees) | 4 105 35 000 (warehouse) | 6 000 |

| As of the transition date (December 31, 2014) | |||

| Disposal of workwear from the balance sheet is reflected | 4 401 20 272 | 4,105,35,000 (employees) | 6 000 |

| The acceptance of workwear for off-balance sheet accounting is reflected at the same time | 27 (employees) | 6 000 | |

Production of fixed assets in an economic way

In the directory “Fixed assets” we create a new element with the type NFA “Capital investments” , to which the costs of its production will be written off in the future - materials, wages of workers invited from outside (under an employment contract), and other costs for the production of fixed assets .

Next, we write off materials from the warehouse to production. This is done by the document “Write-off of materials” with the type of operation “Write-off of non-material assets, works, services to the cost of accounts 106.00, 109.00” . In the program, this document can be found in the following path: Inventories → Retirement → Write-off of materials

. It is recommended to write off all costs for the production of inventories to one type of cost, so that later it will be easier to capitalize the finished product. In this case, we will write off all production costs to the cost type “Consumption of inventories” . Let’s say an organization needs to produce a basic equipment “Overalls” for a worker. An organization purchases materials for the manufacture of a fixed asset, which can be reflected in the program by the document “Purchase of materials” with the type of operation “ Receipt from supplier (10X-302)” , this document can be found in the following path: Inventory → Purchase → Purchase of materials

Reflection of the transfer of account balances.

Taking into account the changes made to Instruction No. 157n, the working chart of accounts of the autonomous institution has been supplemented with new balance sheet accounts:

Postings in the budget. Table 4

| Account number | Name |

| 205 82 | “Calculations for unidentified receipts” |

| 209 30 | "Calculations for cost compensation" |

| 209 40 | “Calculations on forced seizure amounts” |

| 209 83 | “Calculations for other income” |

| 210 11 | “Calculations for VAT on advances received” |

| 210 12 | “Calculations for VAT on purchased material assets, works, services” |

| 401 60 | “Reserves for future expenses (by type of expense)” |

| 500 90 | “Authorization for other subsequent years (outside the planning period)” |

| 502 07 | "Obligations accepted" |

| 502 09 | "Deferred obligations" |

Thus, as new accounts are introduced, it is necessary to record the transfer of balances in these accounts.

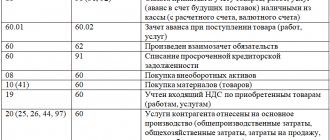

In accordance with clause 4 of the Methodological Recommendations, the transfer of account balances in terms of income calculations is carried out on the basis of a certificate (form 0504833) reflecting the following accounting entries:

Budgetary accounting entries. Table 5

| Contents of operation | Debit | Credit |

| Reflects the transfer of balances in the amount of debt for damage subject to compensation by court decision in the form of compensation for expenses associated with legal proceedings (payment of state fees, payment of legal costs)* | 0 209 30 000 | 0 205 30 000 |

| The transfer of balances in the amount of debt for compensation of damages is reflected in accordance with the legislation of the Russian Federation, including in the event of insured events* | 0 209 40 000 | 0 205 40 000 |

| Reflects the transfer of balances in the amount of debt on fines, penalties and penalties accrued for violation of the terms of contracts for the supply of goods, performance of work, provision of services* | 0 209 40 000 | 0 205 40 000 |

| The transfer of balances in the amount of debt for the sale of property is reflected due to the decision to write off non-financial assets (scrap metal, rags, waste paper, other waste and (or) objects obtained during dismantling (dismantling) of written-off, liquidated objects)* | 0 209 74 000 | 0 205 74 000 |

| Reflects the transfer of balances in the amount of debt for other income not related to the implementation of contracts, agreements, including the provision of subsidies, as well as the performance by the institution of the functions assigned to it in accordance with the legislation of the Russian Federation* | 0 209 83 000 | 0 205 80 000 |

| Reflects the transfer of balances in the amount of debt on accrued interest for the use of other people's funds due to their unlawful retention, evasion of their return, other delay in their payment or unjustified receipt or savings, as well as charges for compensation of lost benefits* | 0 209 83 000 | 0 205 80 000 |

| Reflects the transfer of balances in the amount of debt for unidentified receipts* | 0 205 81 000 | 0 205 82 000 |

| Reflects the transfer of balances in the amount of calculations for tax deductions for VAT in terms of the tax accrued upon receipt by the taxpayer of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services)* | 0 210 11 000 | 0 210 01 000 |

| Reflects the transfer of balances in terms of tax amounts presented to the taxpayer when purchasing goods (work, services) subject to deduction* | 0 210 12 000 | 0 210 01 000 |

* If, on the date of transition to the application of the provisions of Order of the Ministry of Finance of the Russian Federation No. 89n, there are credit balances for calculations in terms of the indicated income, the transfer of calculation indicators is carried out by reverse correspondence, similar to those given above.

After carrying out the inventory in the AU, account 2,210,01,000 “Calculations for VAT on purchased material assets, works, services” listed the total amount of input VAT - 25,678 rubles, which, according to tax accounting data, consisted of two amounts:

- the amount of tax accrued upon receipt by the taxpayer of payment, partial payment on account of upcoming deliveries of goods - 5,325 rubles;

- the amount of tax presented to the taxpayer upon the purchase of goods (work, services) subject to deduction - 20,353 rubles. The transfer of balances was issued with a certificate (f. 0504833).

The following entries were made in the accounting records of the AU:

Budgetary accounting entries. Table 6

| Contents of operation | Debit | Credit | Amount, rub. |

| The transfer of VAT balances on prepayment is reflected | 2 210 11 000 | 2 210 01 000 | 5 325 |

| Reflects the transfer of balances regarding input VAT when purchasing goods from suppliers | 2 210 12 000 | 2 210 01 000 | 20 353 |

In accordance with clause 4 of the Methodological Recommendations, the transfer of account balances in terms of settlements of obligations is carried out on the basis of a certificate (form 0504833) reflecting the following accounting entries:

Table 7

| Contents of operation | Debit | Credit |

| Regarding settlements of obligations | ||

| Reflects the transfer of balances in the amount of debt to the institution for advance payments under agreements, state (municipal) contracts, not returned by the counterparty in the event of their termination, including by court decision, when conducting claims work | 0 209 30 000 | 0 206 00 000 |

| Reflects the transfer of balances in the amount of debt to the institution for the listed security for applications for participation in a competition or closed auction, security for the execution of contracts, state (municipal) contracts, other collateral payments, deposits | 0 210 05 000 | 0 206 00 000 |

| The transfer of balances is reflected in the amount of debts of accountable persons not returned in a timely manner (not withheld from wages), for which claims work is being carried out as of the date of transfer, including in the case of a challenge by an individual debtor of the deductions, as well as for employees with whom employment relations have been terminated | 0 209 30 000 | 0 208 00 000 |

| Reflects the transfer of balances in the amount of debt for payments of benefits, pensions, compensations not received in a timely manner by the recipients of these payments | 0 302 00 000 | 0 304 02 000 |

| The transfer of balances in the amount of damage in the amount of debt of former employees for unworked vacation days upon their dismissal before the end of the working year for which they already received annual paid leave, identified during the inventory, is reflected* | 0 209 30 000 | 0 401 10 130 |

* With simultaneous reflection of corrective accounting entries for the corresponding settlement accounts 0 302 00 000 “Settlements for obligations”, 0 303 00 000 “Settlements for payments to budgets”.

Transfer of individual fixed assets to low value

But some of the objects, namely inventory, household supplies, tools, equipment and devices, fit the definitions of both Instructions No. 26 and Instructions No. 133, and in order to separate them, the organization could resort to additional criteria, including cost. But objects classified as equipment, which include telephones, faxes, office equipment, etc., in the author’s opinion, should be classified only as operating systems, regardless of their cost. By the way, the Ministry of Finance gave the same explanations last year. In 2013, certain property, regardless of its value, had to be counted only as part of fixed assets (for example, equipment). However, since 2014, according to clarifications from the Ministry of Finance, some objects classified as equipment (telephones, printers, faxes, etc.), under certain conditions, can be accounted for as separate items as part of working capital. How can such objects, recorded in 2013 as part of fixed assets, be transferred to inventories?

24 Dec 2021 marketur 505

Share this post

- Related Posts

- When is the sale of air tickets with subsidized benefits open?

- How to correctly calculate penalties or calculate penalties

- Photo medical certificate for replacing a driver's license

- Is it possible to build a house on agricultural land?

What to change in inventory accounting in 2021, without waiting for amendments to the instructions

Check whether all inventories are included on the balance sheet

Previously, three categories of objects were recognized as material reserves: material assets that are used in the activities of the institution, finished products and goods.

Now they also include material assets intended to provide them to certain categories of citizens and organizations: technical means of rehabilitation, medicines, medical products, etc.

Certain material assets to provide for citizens were already material reserves according to Instruction No. 157n. There was uncertainty with other inventory items, so the standard allows for differences in the composition of inventories compared to previous rules.

Thus, institutions that exercise powers to provide for citizens and organizations need to check the accounting procedure for all material assets intended for this purpose and, if necessary, transfer them to the balance sheet.

Reflect the transactions in the inter-reporting period in correspondence with account 040130000.

Use additional analytics when reflecting inventory

The reporting will need to reflect inventories according to the new analytical breakdown. It provides for four groups of inventories:

— materials;

— finished and biological products;

- goods;

— other material reserves.

Only those inventories that are used for no more than 12 months or purchased to provide for certain categories of citizens and organizations are recognized as materials. The composition of products and goods has not changed.

The Ministry of Finance projects currently do not provide for assigning a separate analytical account to each group of material reserves. There are also no plans to exclude existing analytics by type of material inventory.

To simplify the task when preparing reports, reflect inventories using your own analytical breakdown, which will correspond to the new groups.

Biological products are separated from the finished product. It is not intended to enter a special analytical account for it, so reflect it on the same account 10507. If the need arises for management needs, provide additional analytical accounting for it.

Record work in progress for services and biological products

According to the previous rules, work in progress could only be for finished products and work. For services, the cost price was regularly written off as a decrease in income.

Now the institution needs to develop and begin to apply a procedure for assessing the volume of unfinished services and the share of costs that they account for.

Work in progress is not reflected for all services of the institution. Distribute services into those for which the result is constantly transferred during the execution of the contract, and for those for which it may remain unfinished and not transferred to the customer at the reporting date.

For example, the provision of educational services may be recorded monthly. In this case, there will be no untransferred result at the reporting date. But for a short-term educational service, the result can be transferred at a time at the end of the contract. In this case, costs are reflected as part of work in progress until the date of accrual of income from the transferred result.

The standard does not specify the procedure for accounting for work in progress for biological products. Manufacturer institutions need to develop it themselves, taking into account industry recommendations. The general rules intended for finished products do not apply to biological products, since these are now different categories of inventories.