Are you switching from UTII? Connect Kontur.Accounting

45% discount in November: RUR 7,590 instead of 13,800 rub. per year of work

Easy bookkeeping

The system itself will calculate taxes and remind you of the deadlines for payments and submission of reports.

Automatic calculation of salaries, vacation pay and sick leave

Technical support 24/7, tips inside the service, reference and legal database

Sending reports via the Internet

Reports and KUDiR are generated automatically based on accounting data

Electronic document management and quick verification of counterparties

Documents, transactions, analytical reports, VAT reconciliation

In accordance with Art. 126 of the Tax Code of the Russian Federation, for the absence of a software package, the company is held accountable in the form of a fine of 300-500 rubles. Failure to comply with the rules of the UP is equivalent to gross violations of the requirements regulated by Art. 120 of the Tax Code of the Russian Federation and entail penalties in the form of penalties from 10,000 rubles.

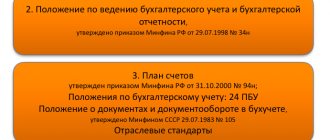

Regulatory framework governing UE: Federal Law No. 402 - Federal Law “On Accounting”, Accounting Regulations No. 34 - n, Tax Code of the Russian Federation.

Fundamental principles of UE:

- completeness - all business transactions are subject to mandatory registration;

- timeliness - facts of economic life must be recorded in the period in which they were committed;

- consistency - the data of analytical and synthetic accounting must coincide;

- rationality - costs reflected in accounting must be justified in accordance with the established procedure for the economic activity of the enterprise;

- consistency - the UE should be applied systematically from year to year;

- comparability - changes in the management program are made only from the beginning of the financial year.

Cases of changes to the UP:

- changes in the legislation of the Russian Federation;

- introduction of new ways of organizing and maintaining records;

- changes in the types of activities of an economic entity.

The organization, in parallel with the approval of the UE, develops, approves and reflects in the application the following types of documents:

- working chart of accounts of the enterprise;

- forms of primary accounting documents used by the organization;

- document flow schedule;

- accounting and tax registers;

- instructions for organizing and conducting cash transactions;

- methodology for assessing assets and liabilities;

- inventory procedure;

- rules for monitoring the facts of economic life.

Property tax

Property tax is another tax from which UTII payers are exempt. In your accounting policy, specify the order in which the cost is determined:

- OS used simultaneously in two types of activities;

- OS used for imputation;

- fixed assets subject to property tax, including fixed assets, the tax on which is calculated from the cadastral value.

To do this, include in the working chart of accounts subaccounts to account 01, which will account for various fixed assets. Depreciation is calculated on fixed assets, so also provide subaccounts for account 02.

Distribute the cost of fixed assets that are used both in the general system and in imputation according to the mechanism established in the accounting policy. Choose the indicator for calculation yourself, based on the specifics of your activity and type of property. As a rule, the same share of revenue from general mode activities in the total revenue for the quarter is applied.

Combination of simplified tax system and UTII

The simplified tax system and UTII are special tax regimes that exempt legal entities from paying corporate income tax, VAT, corporate property tax and exempt individual entrepreneurs from paying personal income tax on business income, VAT and personal property tax in relation to the entrepreneur himself.

In an organization, it is possible to combine two taxation regimes: simplified tax system and UTII. In this case, the company keeps separate records of income, expenses, property and other business transactions separately for each regime. At the same time, all information about separate accounting must be reflected in the enterprise’s UE, since the tax code does not provide clear instructions on distribution.

The simultaneous use of two special tax regimes requires additional detail for accounting and tax accounting data, and for individual entrepreneurs - the distribution of tax accounting information.

UTII will be canceled from January 1, 2021. Organizations and entrepreneurs will no longer be able to combine imputation with a simplified system. Choose an alternative tax regime with the minimum tax burden for your business - our free calculator will help you with this. If you are going to transfer all your activities from UTII to the simplified tax system or another tax regime, read the article - we have collected answers to the most popular questions about the transition from imputation. Didn't find the answer to your question? Ask it in the comments, we will definitely answer.

Results

Starting from 2021, UTII will be abolished throughout Russia.

This means that accounting policies for tax purposes for 2021 will have to be revised. Since UTII cannot exist as an independent tax system and is always combined with the simplified tax system or OSNO, taxpayers will automatically be transferred to the applicable system. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Combination of special regimes for a legal entity

Simplified accounting involves reducing accounting accounts by combining them. However, unification is impossible with separate accounting, since it does not enlarge the indicators, but, on the contrary, their specification:

- analytical income distribution;

- distribution of direct costs;

- separate accounting of expenses not related to direct ones, which, according to the accounting policy, are attributed to the financial result or distributed in proportion to the types of activities;

- distribution of personnel according to types of activities;

- division of property by type of activity;

- creation of instructions for the distribution of expenses.

This process should be described in more detail in the order on accounting policies.

The importance of detailing tax accounting will increase given that the company, along with the simplified tax system, will implement several types of activities under UTII. Organization and maintenance of tax accounting will become more complex due to:

- implementation of separate accounting of income;

- maintaining separate accounting of expenses;

- development of a distribution algorithm;

- distribution of personnel according to regimes, especially those registered under UTII, since the number of personnel units is necessary when calculating the imputed tax, it acts as an indicator of basic profitability;

- distribution of property according to regimes, especially those taken into account for UTII;

- distribution of administrative and management staff.

Accounting for input VAT

Organizations on the OSN pay VAT, while the single tax is exempt from its payment. Input VAT on UTII is included in the cost of goods, works and services, and input VAT on the general system can be deducted. When combining regimes, it is necessary to regulate the procedure for calculating VAT in the accounting policy and separate the accounting of input tax. If you do not keep separate records, you will not be able to deduct VAT and will have to cover the tax from your own funds.

Combining the two modes, distribute VAT according to the rules of clause 4 of Art. 170 Tax Code of the Russian Federation. Divide goods, works and services into three types and open sub-accounts for them on account 19:

- used on special tax purposes in taxable transactions - 19.1;

- used on UTII - 19.2;

- used in two types of activities - 19.3.

For general resources, distribute the tax using the proportional method based on quarterly indicators. Fix the procedure for determining the proportion in the accounting policy.

If you do not know in what activity the resource will be used, then you can take into account input VAT when implementing one of the options, which must be indicated in the accounting policy:

- accept VAT as a deduction, and then restore and pay to the budget that part that relates to goods used for imputation;

- take into account input VAT in the cost of goods, and then restore the part that falls on the main tax base and take it for deduction;

- divide the VAT in parts - take part for deduction, and leave part in the cost of goods. Then restore it and take part for deduction.

Combination of tax regimes for individual entrepreneurs

The simultaneous use of UTII and the simplified tax system for an individual entrepreneur is simpler than for an organization, since the individual entrepreneur is not required to keep accounting records. However, an individual entrepreneur must keep tax records separately, and he must also distribute property and employees between tax systems.

Individual entrepreneurs, when combining special regimes, in most cases choose the simplified tax system for the object of taxation “income”, since it is similar to UTII, and, therefore, such a combination is less labor-intensive.

An individual entrepreneur without employees, when combining the simplified tax system at a rate of 6% and UTII, has the right to apply a deduction to one of the taxes at the expense of the amounts of paid insurance contributions. An individual entrepreneur with employees on the simplified tax system of 6% and UTII can reduce two taxes up to 50% at the expense of insurance premiums that were paid for all personnel, including the individual entrepreneur himself, taking into account the specifics of the distribution of employees by regime.

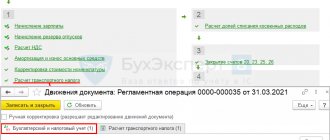

OSNO sales registration

Step 6. After all the settings are set, you can register the sale of OSNO by specifying the organization Lastochka LLC, specifying the counterparty and the agreement with the counterparty, also indicating the warehouse and setting the status of the document “Sales of goods and services” to “Sold.”

Step 7. Let's select goods for sale, making sure that they are present in the warehouse, set the VAT rate for goods to 20% (if these are new goods, then you can specify the rate in the settings when creating an item).

Step 8. In the standard sales registration option, check the “Price includes VAT” checkbox so that you can see the final price of the product. In order to see separately in the gross profit report the data on wholesale and retail sales, we will establish the wholesale division “Sales Department of commercial equipment”.

Accounting policy under a single tax and a simplified system

The importance of UE when combining simplification and imputation increases. The UP must reflect the procedure for maintaining special tax regimes, and the company must draw up this document in accordance with the following rules:

- development of regulations on separate accounting;

- selection of tax objects;

- determination of accounting methods;

- determination of accounting methods;

- choice of accounting principles;

- approval of the rules by order of the manager;

- drawing up an explanatory note if the established rules do not allow reliable information to be reflected.

In case of simultaneous use of special modes, accounting is carried out in full. In the UE, reflect the sub-accounts according to which the company will carry out accounting for each taxation regime, and also describe the methods for distributing income and expenses for each type of activity of the enterprise.

Corporate income tax

Organizations on OSNO pay income tax, that is, tax on the difference between income and expenses. Companies on the imputation are UTII, for which the actual level of income of the company does not matter.

To correctly calculate the tax base for income tax, separate income and expenses for the general system from activities on UTII. If we take into account expenses from UTII to calculate income tax, it will be significantly underestimated, and income from imputation, on the contrary, will increase the tax base.

As a rule, the amount of revenue by type of activity is clearly defined, so accounting for income separately is not difficult. You only need to assign the amounts of revenue received to subaccounts for the relevant activities. For example, account 90.1.1 - revenue from activities on the OSN and account 90.1.2 - revenue from activities on UTII. This will allow you to clearly see revenue by type of activity and exclude income from imputation from the calculation of the tax base.

Indicate in the accounting policy the document on the basis of which the revenue is calculated and refer to line 2110 of the financial results report. Otherwise, when conducting an audit, the tax office may use bank account statements and come to incorrect conclusions.

To separate expenses, you need to open subaccounts for expenses under UTII, expenses under OSN and general expenses. Distribute total expenses in proportion to revenue, as prescribed by the Tax Code of the Russian Federation (Article 274). In your tax accounting policy, specify on the basis of what income the proportion is determined and for what period the data is used.

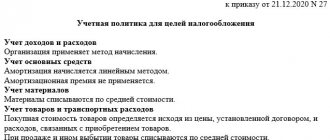

UE for tax purposes

When using UTII and the simplified tax system simultaneously, the UE for tax accounting purposes must reflect the following information:

- the fact of using the simplified tax system;

- the fact of using UTII;

- regulations on compliance with legislation, as well as on the methodology for organizing and maintaining separate accounting;

- transfer of expenses not related to a particular type of activity, which are subject to division by calculation;

- methods for distributing these costs;

- documentary reflection of separate accounting.

Insurance premiums

Separate accounting of insurance premiums is needed to calculate profits and to reduce UTII. To do this, you need to divide the staff into three groups:

- engaged in imputed activities;

- employed in general regime activities;

- engaged in both types of activities.

Companies issue orders to distribute employees by type of activity and establish their affiliation in job descriptions. Difficulties arise with insurance premiums for employees engaged in two types of activities. The number of such personnel is distributed, as a rule, based on the share of revenue of one mode in the total revenue of the company or based on the percentage of personnel involved in each type of activity. It is important to note that management personnel are prohibited from being distributed and must be counted among employees for assigned activities.

Combine modes easily in the web service for small businesses Kontur.Accounting. In the service you can select an accounting policy for combination (except for OSNO+UTII). You enter data into accounting, the system itself generates reports, calculates taxes and creates payments for online banking. For the first 14 days, use the service for free.