Stages of depreciation calculation

Depreciation methods

Optimization of equipment depreciation costs

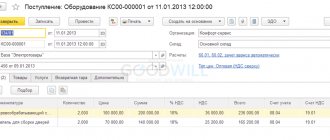

Every enterprise that acquires and accounts for fixed assets faces issues of depreciation. Many companies are interested in recognizing the cost of acquired fixed assets as expenses as soon as possible. Obviously, the faster the cost of fixed assets is transferred to cost, the faster the tax base is reduced.

In accordance with Art. 256 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation), depreciable property is property, results of intellectual activity and other objects of intellectual property that are owned by the taxpayer and are used by him to generate income (with a useful life of more than 12 months and an initial cost of more than 100 000 rub.).

Fixed assets are understood as part of the property used as means of labor for the production and sale of goods (performing work, providing services) or for managing an organization with an initial cost of more than 100,000 rubles.

The linear method of calculating depreciation of fixed assets - the essence of the technique

When choosing the linear method, depreciation is accrued every month for each fixed asset separately, depending on its useful life (clause 2 of Article 259 of the Tax Code of the Russian Federation).

The straight-line depreciation method implies that the following formula for calculating depreciation charges is used:

Am = OS × k

Where

Am – the amount of depreciation charges for the month;

k – monthly depreciation rate, expressed as a percentage;

OS is the initial or replacement cost of a depreciable fixed asset.

The depreciation rate for each fixed asset item is determined based on its useful life in months and is calculated using the formula:

k = (1/n) × 100%

where n is the number of months of useful use of the fixed asset.

This indicator is established on the basis of the Classification of fixed assets included in depreciation groups, approved by Decree of the Government of the Russian Federation dated January 1, 2002 No. 1 (hereinafter referred to as the Classification of fixed assets).

ATTENTION! The amount of depreciation calculated using the linear method is the same in accounting and tax accounting. Except in cases where bonus depreciation is applied.

ConsultantPlus experts explained how to calculate depreciation in tax accounting. Get trial access and upgrade to the Ready Solution for free.

Uniform attribution to expenses of the cost of depreciable fixed assets is the main convenience of the linear method.

Specifications

Ceiling lighting

Products that have reflective or light-absorbing properties are sold in rolls, but if desired (especially if you need tuning of a car, its wheels or a bicycle), you can cut the products into strips. Also, in cut form, such film can be sold in specialized stores. To know how a tape that can glow in the dark can be used in various areas (for the ceiling, on a bicycle or car, on walls, etc.), it is necessary to find out the technical characteristics of such non-standard products.

Photoluminescent films have the following characteristics:

- film base – PVC;

- energy charging occurs from any light source, be it a light bulb or the sun;

- the film must comply with state standards (GOST R 12.2.143, which was adopted in 2009);

Note! During operation, the light-absorbing tape is safe for animals and people, as well as the environment. But these properties are preserved only in a situation where the film is used for its intended purpose.

Calculation of depreciation using the straight-line method - example

Let us explain with a specific example how the linear depreciation method is used in practice.

On March 18, 2020, a woodworking machine for furniture production was purchased from Gamma LLC and registered as a fixed asset at an initial cost of RUB 180,000.00. The useful life of the machine was set at 72 months, because This fixed asset belongs to the 4th depreciation group according to the Classification of fixed assets.

IMPORTANT! The value of assets classified as fixed assets in tax accounting is equal to 100 thousand rubles, and in accounting accounting - 40 thousand rubles. Read about the differences between accounting and tax accounting in the material “What applies to fixed assets of an enterprise.”

Let's calculate the amount of depreciation for one month:

Am = 180,000.00 x (1/72 × 100%) = RUB 2,500.00.

Since, with a linear month, depreciation starts from the month following the month the purchased machine was accepted onto the balance sheet, then starting from 04/01/2020, for 6 years (72 months), Gamma LLC will monthly expense a depreciation amount of 2 RUB 500.00

If you have access to ConsultantPlus, check whether you have correctly calculated and reflected depreciation in your accounting. If you don't have access, get a free trial of online legal access.

Features of the tape

A tape or film that glows in the dark is completely different from the LED products we are used to. The only thing they have in common is a self-adhesive base. The main difference here is that such products accumulate light during the day, and begin to glow in the dark. All luminous products on a self-adhesive basis contain a special material that has light-absorbing or reflective properties. Glow in the dark tape has the following properties:

- accumulation of light energy. Moreover, over a short period of time, quite a significant accumulation of energy occurs;

- long service period;

- no decrease in the brightness of the glow, as well as no deterioration in the color spectrum. Such products will shine quite brightly throughout the entire period of operation;

- the cost is fully compensated by the benefits of the product.

Because of this, luminous tapes are actively used for a wide variety of purposes. They are especially often used for finishing the ceiling and decorating wheels on cars of any brand. With its help you can easily decorate even a bicycle and make it more visible in the dark.

Moreover, the installation here is extremely simple.

Tuning cars

Transition from non-linear to linear depreciation method

If a non-linear depreciation method was initially used, and later it was decided to use a linear one (the Tax Code allows changing depreciation methods, but not more than once every 5 years), then accountants may have a lot of questions in connection with such a transition.

- What useful life is used in the calculation? When switching to the straight-line depreciation method, deductions are calculated based on the remaining useful life of the asset. This period must be determined on the 1st day of the month of the tax period, when the use of the linear method begins (paragraph 2, paragraph 4, article 322 of the Tax Code of the Russian Federation).

- What value of the object should be taken as the basis for the new method of calculating depreciation? When switching to the linear depreciation method, you need to remember that part of the cost of the fixed asset has already been depreciated, so the calculation uses the residual value, which is also determined at the beginning of the tax period (clause 4 of Article 322 of the Tax Code of the Russian Federation). This is the position of officials (letter of the Federal Tax Service of Russia for Moscow dated December 1, 2009 No. 16-15/125942, letter of the Ministry of Finance of Russia dated January 28, 2010 No. 03-03-06/1/28).

- What should you do if, when switching to the straight-line depreciation method, the period of actual operation exceeded the useful life of the object, but the cost of the fixed asset was not completely written off as expenses? In such a situation, it is necessary to charge depreciation of the object until its value is written off (letter of the Ministry of Finance of Russia dated July 21, 2014 No. 03-03-RZ/35549). In this case, the useful life is determined by the taxpayer in accordance with the provisions of paragraph. 2 clause 7 art. 258 of the Tax Code of the Russian Federation and taking into account safety requirements and other factors affecting the wear and tear of the object.

conclusions

The linear method of calculating depreciation assumes that physical wear and tear of the property occurs evenly throughout the entire operational period. This mainly applies to stationary structures, which do not wear out and become obsolete as quickly as equipment.

If it is impossible to accurately determine the rate of depreciation of property, then the linear method will be the most convenient and simplest. This method is also suitable if the company purchases property for a long period of use and does not plan to quickly replace it.

Many people try to find out what profitability is in simple words in order to quickly understand its essence.

How should an order be prepared to appoint someone responsible for fire safety in an office?

Today, when the lighting market pleases us with a wide variety of light sources. An ordinary chandelier on the ceiling or LED lighting for a bicycle no longer seems original and people strive for something new and unusual. And this is where a completely non-standard material comes to the rescue - luminous tape.

This is a special product that will make even the simplest bike look completely different in the dark. Our article will tell you what you should know about this product, as well as how you can illuminate the ceiling or car (wheel tuning, etc.).

Results

The straight-line method of calculating depreciation is used in both accounting and tax accounting. The calculated amount will be the same in both cases, except in cases where bonus depreciation is applied.

Sources:

- Tax Code of the Russian Federation

- Decree of the Government of the Russian Federation dated January 1, 2002 No. 1

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Available range

Luminescent film

Today, products that can glow in the dark and be used for a wide variety of purposes (ceiling decoration, staircase lighting, car wheel tuning, bicycle decoration, etc.) come in the following types:

- luminescent or photoluminescent films and tapes. To make such a product, photoluminescent film is used, which is the main light source. Cutting is carried out automatically. In this case, it is allowed to apply a certain image to the base;

- reflective or reflective films. Such a film will reflect the light that was directed onto its surface.

Reflective film

Let's look at what photoluminescent products there are. This type of light-absorbing products today is represented by opaque and transparent varieties. They are made using an adhesive layer. Both options are used to create additional lighting for the ceiling, making the car look impressive (applied to the wheels). You can also use them to decorate a bicycle.

Term of use

The indicator is determined based on the characteristics and purpose of the object. For these purposes, a classification containing a list of OS types can be used. There they are divided into categories depending on their useful life (USL).

In many cases, objects do not meet the criteria presented in the classifier. In this case, the calculations use the predicted service life, which is determined taking into account the conditions of use and the expected wear rate.

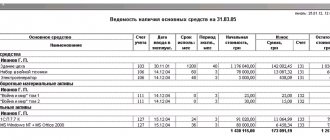

Accounting for depreciation of fixed assets

Depreciation is a monetary unit of wear and tear. That is, this is part of the cost of an asset, which is included monthly in the cost of products, services, and goods.

Through depreciation, there is a gradual transfer of the value of a fixed asset, at which it is listed in accounting, to products and goods.

Ultimately, the money spent on the acquisition of operating systems is returned to the company after receiving payment from buyers and clients for the purchased values.

This process is gradual and continues throughout the entire useful life. To account for it, the accountant makes monthly entries in specially designated accounting accounts.

As long as the fixed asset is listed on the balance sheet of the enterprise, the accountant must make monthly depreciation deductions. This procedure is carried out until complete wear and tear, write-off due to unsuitability, breakdown or transfer to other persons.

The process of depreciation accumulation is suspended only in two cases:

- The OS is under conservation, provided that its duration exceeds 3 months.

- Restoration, modernization, reconstruction of an object, if this process takes more than a year.

If a decision is made to sell an object or write it off, the accountant determines the residual value of the asset. To do this, the depreciation accrued for the entire period is written off by posting to account 01, where the residual parameter is determined.

If during the operation of equipment or another object the initial cost changes due to revaluation, then depreciation accumulations are also recalculated and the necessary entries are made.

Thus, the accountant is faced with the need to reflect entries for accounting for depreciation of fixed assets in the following cases:

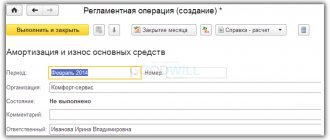

- making monthly depreciation payments;

- changes in accumulated deductions due to revaluation of the value of fixed assets (may either increase or decrease);

- write-off of a depreciable object as unnecessary (physical or moral wear and tear, breakdown, irreparable defects);

- disposal of fixed assets to third parties (sale, donation, contribution to the authorized capital of other enterprises).

How is the excess accrued amount for the previous period reflected?

If depreciation for the previous period was accrued incorrectly in an excessive amount, then the errors must be corrected. It is important in what period they were admitted - the current year or the past.

The mechanism for correcting accounting errors is prescribed in PBU 22/2010.

If the amount of depreciation has been excessively accrued, then it is necessary to reverse the excess accruals using red entries for those accounts for which incorrect entries were made.

If an error was made in the current year

Depreciation is corrected until accounts 20 or 44 are closed (depending on where savings are taken into account):

Posting reversal: Dt 20 (44) Kt 02 - for the amount of excess depreciation.

Correction after closing account 20 (or 44):

You also need to adjust account 90 to reflect expenses that are not accepted for tax accounting.

Posting reversal: Dt 90.3 Kt 20 for the overcharged amount.

If the excess accrual occurred in the year ended

Adjustments must be made to account 91 - posting: Dt 02 Kt 91.

In what cases is it used?

Linear calculation is used in relation to material and intangible objects. The duration of their operation or useful functioning should not be less than 1 year. The initial cost of property that is subject to depreciation is from 40 thousand rubles.

The presented method must be applied to buildings and structures if the service life exceeds 20 years. For objects with a different period, other options for calculating deductions may be used.

The following are not subject to depreciation:

- land;

- Natural resources;

- securities;

- capital construction projects (if it is not completed).

Such objects are not subject to wear and tear, so their cost cannot be included in the cost of manufactured products or services provided.

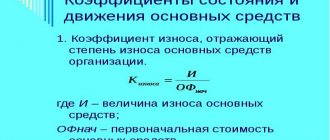

What does a high depreciation ratio mean?

Analysts identify 2 possible reasons for increased KAOS:

- the funds are really very worn out;

- depreciation is written off using an acceleration factor.

In practice, financiers use KAOS as an indicator of the risk of failures in the production process. Accordingly, if the indicator is too high, the analyst will conclude that there is a high risk of interruption of the production process and the need for repair or modernization of equipment.

But accounting assumes the possibility of using a mechanism for accelerated depreciation of fixed assets. In this case, the accounting depreciation will significantly exceed the actual one. Accordingly, the analysis should reflect relevant comments to report users.

How to calculate equipment wear

As already mentioned above, wear and tear of machines, cars and other equipment means a decrease in its consumer properties in value terms. The reasons for the decrease in balance sheet values are quite clear: this is the obsolescence of fixed assets and their physical wear and tear. Often, due to crisis phenomena, the cost of equipment can be recalculated several times downward. This is especially true for those machines that vendor companies sell in dollar terms.

Be that as it may, the desire for timely accounting for subsequent depreciation is not always the main goal of business organizers. The use of the latest technologies makes it possible to carry out restoration work, as a result of which some of the effects of wear can be eliminated.

The most difficult part of accounting calculations is the recovery of accounting data. So, if the accounting department does not have the necessary information, an integrated approach will be necessary:

- Inspection of equipment.

The unit is started, the performance of basic functions and production time are checked. Further, the equipment is classified according to databases (for example, you can view the data on the nameplate), as well as the profile of the processes being executed. Depreciation of equipment - At the next stage, it is necessary to find out whether changes were made to the design of the equipment, whether modernization, replacement of parts and service were carried out. The situation may be complicated by the fact that some responsible persons do not consider it necessary to reflect such changes in the product data sheet or technical documentation. In addition, the use of these documents does not always provide reliable information. To clarify the presence of design changes and other manipulations with the technical device of the machine, a method is used to compare temporary data corresponding to the period of major repairs and changes in design.

- It is determined what place the unit occupies in the production cycle. For this purpose, an additional classification of the unit is carried out for inclusion in the group of auxiliary or leading production tools. Assignment to the last category occurs on the basis of the issuing link. That is, if the machine directly manufactures products, it is the last in the chain, it is the main equipment.

- At this stage, the degree of physical wear and tear of units, equipment or vehicles is calculated. It is necessary to develop a system of indicators and, on its basis, characterize the capabilities of the equipment in question. Experts are often involved in such calculations; they use mathematical methods in their work. Most often, to determine the degree of wear, similar equipment that is in operation, in the production cycle, is used. If such equipment is not available in the region, a request is submitted to the vendor - an organization that acts as the official distributor of the manufacturing plant.

Where is it in demand?

Reflective and light-absorbing films have different uses. Today, light-absorbing products are considered more in demand. They are used:

- on the road surface in order to distinguish the road surface from the pedestrian sidewalk at night;

- are applied to the clothing of fire department employees, as well as road transport service employees. In addition, very often such tape is sewn into the clothes of schoolchildren and medical staff;

- as a decoration on a car. Such a film can be applied along the entire body or form a special pattern. Many car enthusiasts decorate their wheels in this way. In addition to cars, such a film is often applied to a bicycle (both its frame and wheels);

Bicycle tuning

- marking trucks in order to make them more visible at night when moving from one city to another;

- marking of roadside posts and road signs.

Note! The most extensive area of application of such products is focused on ensuring greater safety for all road users at night (both pedestrians and vehicles themselves).

This is due to the fact that at night the risk of traffic accidents increases due to insufficient visibility, and the use of lights to illuminate the road is not always possible due to a number of reasons (lack of funding, complex terrain features of the road section, etc.). d.). Today you can even find light-absorbing films in parking lots. As for pedestrians, reflective inserts on clothing (special vests, jackets or pants) make a person much more visible to passing cars. In addition to roads and transport, products of this kind are often found in housing and communal services. For example, such a film today can be applied to flights of stairs, steps, and paths between buildings. It is also actively used for illumination of industrial, warehouse and medical institutions of various profiles. In turn, reflective films have also found wide application in the field of transport and road lighting. When hit by light coming from the headlights, it begins to glow, which serves as a visual signal that there is a road sign or that the road is blocked.

Reflective film

In addition to the areas of activity described above, such products are also quite actively used at home.

How to work with property that has been used?

Organizations often operate objects that have already been used . Among them:

- Fixed assets received by an enterprise through succession when a legal entity was reorganized.

- Property received as a contribution to the authorized capital.

- Objects whose condition was not new already during the acquisition process

For such objects, depreciation is calculated in exactly the same way as for fixed assets. The only difference is that the service life is calculated slightly differently.

To determine it, we subtract from the period established by the former owners the time during which the equipment was actually used.

The main thing is to remember that the results of financial activities should not be affected by the absence or presence of these deductions at a particular enterprise. They are necessarily included in expenses for the tax period to which they relate.

It is acceptable to use non-linear methods of depreciation calculations, but it is the linear method that will be convenient, for example, for buildings or structures. And for other objects that are not directly used in production processes.

Methods for calculating depreciation of fixed assets: