Payment

Changes In each 2-NDFL certificate, income and deduction codes must be entered. This

Taxation of movable property: history of the issue From 01/01/2015 fixed assets included in 1 and 2

Accounting for third party services Third party services are a type of activity that is not

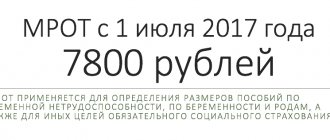

Remuneration Current as of July 1, 2017 Many personnel workers already know that with

Residents of Russia can find basic property tax benefits in Article 407 of the Tax Code

Home / Taxes Back Published: 08/18/2020 Reading time: 6 min 0 349 Last

Reflection of transactions with penalty amounts in the accounting of government institutions has its own characteristics depending on

The UTII declaration for the 3rd quarter of 2021 has been changed, the new template recommended by tax authorities is given in

Compensation by an employee for damage caused: accounting and taxation 02.12.20 The article was published in the newspaper “Pervaya

KBK 18210501011012100110 in the payment slip indicates penalties. For what tax – see the article here