The UTII declaration for the 3rd quarter of 2021 has been changed, the new template recommended by tax authorities is given in the Federal Tax Service letter dated July 25, 2018 No. SD-4-3/ [email protected] , and later approved by Order of the Federal Tax Service of Russia dated June 26, 2018 No. MMV-7- 3/ [email protected] (registered with the Ministry of Justice on September 24). The adjustments were necessary so that taxpayers had the opportunity to reflect in their reporting the use of deductions on cash registers: with the transition to online cash registers, entrepreneurs using UTII and the patent taxation system are allowed to reduce the tax by the amount of the cost of purchased cash register equipment. The maximum benefit amount is 18,000 rubles. for each unit of CCP.

When to report

The UTII declaration must be submitted to the Federal Tax Service no later than the 20th day of the month following the expired quarter. This is provided for in paragraph 3 of Article 346.32 of the Tax Code of the Russian Federation.

If the deadline for submitting the declaration falls on a weekend, it is postponed to the next Monday (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). In April 2018, such transfers will not be necessary. After all, the deadline for submitting the UTII declaration for the 1st quarter of 2021 is April 20, 2021 (Friday).

If you fail to submit your UTII declaration for the 1st quarter of 2021 or submit the document late, the company or individual entrepreneur may be fined. The amount of the fine is 5% of the amount of tax that is payable on the basis of the declaration. In this case, the total amount of the fine cannot be more than 30% of the tax amount and less than 1000 rubles. (Article 119 of the Tax Code of the Russian Federation).

Filling out the UTII declaration: general recommendations

When preparing a report, all cost parameters must be rounded to the nearest ruble. Each page must be numbered. If filling out a document manually, you can only use black, blue, and violet ink. Mistakes made cannot be crossed out or covered up with corrective means. Only one character can be entered into one cell. Text elements are formatted in capital block letters. If some cells are left blank, dashes are placed in them.

New declaration form

For the first quarter of 2021, organizations and individual entrepreneurs on UTII must submit a declaration according to the “imputation” of the new form. The electronic declaration form required for submitting the UTII declaration electronically has also changed. There is also a new procedure for filling out the declaration.

The amendments are due to the fact that from January 1, 2021, entrepreneurs have the right to reduce UTII by the cost of online cash registers. The maximum amount of such a deduction is 18,000 rubles. for each cash register (Federal Law of November 27, 2021 No. 349-FZ). Accordingly, special lines are provided to reflect this deduction.

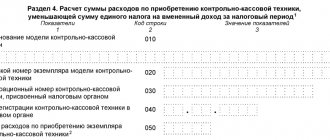

Also in the new UTII declaration form, a new section 4 has appeared, “Calculation of the amount of expenses for the acquisition of cash register equipment, which reduces the amount of the single tax on imputed income for the tax period.”

Let us remind you that the costs of purchasing a cash register online include:

- purchasing a device;

- fiscal accumulator;

- software;

- payment for related work and services (for example, setting up a cash register, etc.).

For UTII you do not need to contact the Federal Tax Service for a deduction via the online cash register. It is enough to declare it in the declaration. Due to this possibility, her form has been adjusted. For more information, see “Amendments to UTII from 2021.”

UTII declaration for the 3rd quarter: example of filling

For example, individual entrepreneur Andrey Ivanovich Ivasov works in Krasnoperekopsk (Republic of Crimea) on UTII terms, his field of activity is the provision of veterinary services. Based on the results of the 3rd quarter of 2018, the following indicators are available:

- basic profitability – 7,500 rubles;

- K1 – 1.868;

- – 0,6;

- the number of personnel, including the individual entrepreneur himself, was 5 people in July, 6 people in August, 7 people in September;

- insurance premiums were transferred in the amount of 48,000 rubles;

- An online cash register was purchased for 10,400 rubles, the equipment was registered with the Federal Tax Service.

The UTII declaration for the quarter begins with filling out the Cover Page. The adjustment number for the primary report is “0”, the tax period corresponds to the 3rd quarter (coded “23”), the reporting year is 2021. The report is submitted at the place of business activity, therefore in the column “code at the place of registration” the code “320” is entered . Next, the full name is deciphered. entrepreneur, indicating his contact phone number, the number of pages in the declaration and the volume of attachments.

The UTII 2021 declaration is filled out of order - section 1 (amount of tax payable) will be completed last. First, section 2 provides calculation data that allows us to calculate the final amount of tax liabilities payable to the budget. The individual entrepreneur provides veterinary services - in field 010 of section 2 the activity code “02” is entered. Next is the address information.

At the next stage the following actions are performed:

- Section 2 contains the initial data for calculating the tax amount - basic yield and current coefficient rates.

- The values of the physical indicator are entered monthly with the calculation of the monthly tax amounts (lines 070-090). In the first month, the average number of personnel was 5 people - this is reflected in column 070. The tax base for the first month was equal to 42,030 rubles. (7500 x 5 x 1.868 x 0.6). Similar calculations are made for each month of the quarter under consideration, taking into account changes in numbers.

- Then the UTII declaration for individual entrepreneurs records the total amount of taxable amounts for the quarter in the line 100 - 151,308 rubles. (monthly calculation results from the previous paragraph are added together).

- The tax rate is entered in column 105, and the amount of tax liability for UTII is displayed in field 110 (Q3 2018).

- For individual entrepreneurs, the declaration allows you to adjust the resulting result by the insurance premiums paid in the 3rd quarter and the deduction for the cash register. The tax reduction is reflected in Section 3. First, enter the amount of insurance premiums by which the tax amount can be reduced. An individual entrepreneur with employees can deduct no more than half of the amount of the tax liability, therefore line 020 does not indicate the entire amount of the listed deductions, but only 11,348 rubles. (22696 / 2).

- Also, the entrepreneur’s UTII declaration for the 3rd quarter will contain data on deductions at the cash register. For the purchase of equipment in the current period, an individual entrepreneur can declare no more than 11,348 rubles. (the balance of the tax after adjusting it for insurance premiums). But the actual expenses for the cash register amounted to 10,400 rubles, which means that column 040 includes the entire amount that can be deducted - 10,400 rubles. This amount is also given in Section 4, along with the details of the cash register and the date of its registration with the Federal Tax Service.

- Filling out the UTII declaration is completed by displaying in column 050 of section 3 the amount of tax payable - 948 rubles. (22,696 – 11,348 – 10,400). The final data is transferred to section 1.

How to fill out the new section 4

Here's how to fill out the new section 4 as part of the new UTII declaration form in 2021:

- on line 010 – name of the cash register equipment model;

- on line 020 – serial number of cash register equipment;

- on line 030 – registration number of cash register equipment assigned by the tax authority;

- on line 040 – the date of registration of cash register equipment with the tax authority;

- on line 050 - the amount of expenses incurred for the purchase of cash register equipment cannot exceed 18,000 rubles;

- If there are insufficient lines with codes 010, 020, 030, 040, 050, the required number of sheets in Section 4 of the Declaration must be filled out.

Read also

19.07.2016

UTII declaration form - Excel and Pdf

It is more convenient to fill out forms in pdf: unlike Excel, data is entered line by line. For example, you can copy the Taxpayer Identification Number (TIN) and paste it into the required field without filling out each number in a separate box.

PDF forms are available for filling out in Adobe Reader (the program is available on the website www.adobe.com)

ᐈ Form without deduction for online cash registers, valid from the 1st quarter of 2017 to the 3rd quarter of 2021 inclusive (KND 1152016)

(the fields in the form can be filled in).

.

ᐈ Form for deduction for online cash registers, valid in the 3rd quarter of 2018.

Form according to KND 1152016: (fields in the form can be filled in).

.

Basic rules applied when filling out the declaration

When filling out reports, you must consider the following:

- It is most convenient to start filling out the report from section No. 2, then section No. 3, and lastly fill out section No. 1.

- If there is no data to fill in, then a dash is placed in the field.

- Filling out the fields begins with the left cell; the remaining empty cells are marked with a dash.

- Text fields are filled in capital letters.

- The values of cost and physical indicators must be indicated in whole numbers, applying the rounding rule. The values of the coefficients K1 and K2 are rounded to the 3rd decimal place.

- If the form is filled out by hand, blue, purple and black ink is used. If filled out on a computer, use Courier New font with a height of 16-18 points.

- Error correction and double-sided printing are not permitted.

- It is not necessary to staple or staple the declaration.

- Penalties and penalties for tax are not indicated in the declaration.

Which UTII declaration should be submitted for the third quarter of 2018?

At the end of July, the Federal Tax Service presented a recommended declaration form, which also provides a separate section for calculating the deduction for purchased and registered cash registers. The recommended form can be used starting with reporting for the third quarter of 2018.

The form can be taken from the letter of the Federal Tax Service dated July 25, 2018 No. SD-4-3 / [email protected] In order to receive a deduction, an individual entrepreneur on UTII must indicate the following information in the recommended declaration form:

- serial number of the KKT model;

- CCP registration number assigned by the tax authority;

- date of registration of the cash register with the tax authority;

- the amount of expenses for purchasing a copy of the cash register;

- name of the CCP model.

What to do if there was an error in the declaration?

If for some reason a mistake was made in the declaration and it was you who noticed it, then you need to do the following:

- Make a new calculation and pay the difference to the budget

- File a correct corrective tax return. To do this, you need to indicate the correction number on the title page, for example, “1–”

bukhproffi

Important! It is necessary to correct errors in the declaration in this way, and not vice versa. In this case, the tax office does not charge fines and penalties for late payments.

You might be interested in:

Form P-4 NZ in statistics: sample filling

Tax return form for UTII, valid at the end of 2021: completion, sample

On what form will the UTII report for the 4th quarter of 2021 be generated? For the last tax period for 2021, the UTII declaration form must be taken from the order of the Federal Tax Service of Russia dated June 26, 2018 No. ММВ-7-3/ [email protected] Download it from the link below for free:

What are the rules for filling out the UTII report for the 4th quarter of 2020? They are also contained as a separate appendix in Order No. ММВ-7-3/ [email protected] You can read them in more detail here.

For an example of how a report for the last tax period for the year can be drawn up - a sample UTII declaration for the 4th quarter of 2020 - see ConsultantPlus, having received free demo access to the K+ system:

Formula for calculating UTII in 2021

Calculation of UTII in 2021 is made according to the formula:

UTII = VD * NS, where:

TS - tax rate equal to 15%; VD - imputed income, which is calculated by the formula: VD = BD * FP * K1 * K2

calculation of UTII in 2021 for LLCs, for entrepreneurs - below on the page.

free calculation!

Register in the online document printing service MoySklad, where you can: completely free of charge:

- calculation of UTII

- Fill out and print the UTII form online (it’s very convenient)

The calculated tax amount can be reduced by paid insurance premiums:

- entrepreneurs without employees - 100% of insurance premiums paid for themselves;

- Individual entrepreneurs with hired employees - within 50%;

- organizations - up to 50%.

Download the UTII declaration 2021: form and filling procedure

Next, we will analyze in detail the calculation of UTII for individual entrepreneurs in 2021.

Calculation of UTII in 2021 for individual entrepreneurs. Example: retail

Let's take for example a women's clothing store with an area of 10 square meters. m, which is located in a large shopping center. Let's see how the calculation of UTII depends on the area of the trading floor.

It turns out:

- BD = 1800 rubles per sq.m (according to Article 346.29 of the Tax Code of the Russian Federation - retail trade through fixed-line network facilities with trading floors);

- FP = 10 (hall area);

- K1 = 1.868 (constant indicator);

- K2 = 1 (this coefficient is set by local authorities; it may differ in different regions).

Formula for calculating UTII in 2021: BD * FP * K1 * K2 * NS (15%). Thus we get:

UTII = 1800*10*1.868*1*15% = 5,043.6 rubles.

The resulting figure is the size of UTII for just 1 month. The UTII declaration for individual entrepreneurs in 2021 is submitted every quarter, which means we multiply the result by 3. The final total: 15,130.8 rubles.

Section 2 of the declaration

It must be filled out separately:

- for each type of activity,

- for each location of a specific type of business activity (for each OKTMO).

In our example, IP Kuleshova N.A. carries out only one type of activity in a single hairdressing salon, so she only needs to complete one Section 2.

Procedure for filling out this section:

| Section line number 2 | What to indicate? | Where to get the data? |

| 010 | Code of the type of activity performed (for households) | Appendix No. 5 to the Procedure for filling out the declaration |

| 020 | Full address of the hairdressing salon (place of business) | The code of the subject of the Russian Federation must be taken from Appendix No. 6 to the Procedure for filling out the declaration |

| 030 | OKTMO code of the place of activity | OK 033-2013 All-Russian classifier of municipal territories |

How to fill out the remaining lines of Section 2 according to the example data is shown in the example:

Column 3 (on pages 070-090) for this example does not contain numerical values (dashes are inserted), since individual entrepreneur N.A. Kuleshova was not registered/deregistered with the tax authority in the reporting quarter. If this happened in one of the months of the quarter, in column 3 we would indicate the number of calendar days from the date of registration to the end of the month in which the individual entrepreneur (or company) registered as a UTII payer. In this case, when calculating UTII, the number of calendar days of actual activity in the month the taxpayer is registered will be taken into account.

Order dated June 26, 2018 No. ММВ-7-3/ [email protected]

In accordance with paragraph 4 of Article 31 and paragraph 7 of Article 80 of Part One of the Tax Code of the Russian Federation (Collection of Legislation of the Russian Federation, 1998, N 31, Art. 3824; 2021, N 27 (Part 1), Art. 4176; 2021, N 9, Art. 1291), in order to implement the provisions of Chapter 26.3 “Taxation system in the form of a single tax on imputed income for certain types of activities” of part two of the Tax Code of the Russian Federation (Collected Legislation of the Russian Federation, 2000, No. 32, Art. 3340; 2002 , N 30, Article 3021; 2018, N 18, Article 2575), as well as on the basis of subclause 5.9.36 of clause 5 of the Regulations on the Federal Tax Service, approved by Decree of the Government of the Russian Federation of September 30, 2004 N 506 (Collection of Legislation of the Russian Federation , 2004, N 40, Art. 3961; 2021, N 40, Art. 5847), I order:

1. Approve:

- tax return form for a single tax on imputed income for certain types of activities in accordance with Appendix No. 1 to this order;

- format for submitting a tax return for a single tax on imputed income for certain types of activities in electronic form in accordance with Appendix No. 2 to this order;

- the procedure for filling out a tax return for a single tax on imputed income for certain types of activities in accordance with Appendix No. 3 to this order.

2. To recognize as invalid:

Order of the Federal Tax Service dated 07/04/2014 N ММВ-7-3/ [email protected] “On approval of the tax return form for the single tax on imputed income for certain types of activities, the procedure for filling it out, as well as the format for submitting the tax return for the single tax on imputed income imputed income for certain types of activities in electronic form" (registered by the Ministry of Justice of the Russian Federation on September 1, 2014, registration number 33922);

- order of the Federal Tax Service dated December 22, 2015 N ММВ-7-3/ [email protected] “On amendments to the annexes to the order of the Federal Tax Service dated 07/04/2014 N ММВ-7-3/ [email protected] ” (registered by the Ministry of Justice Russian Federation 01/27/2016, registration number 40825);

- order of the Federal Tax Service dated 10/19/2016 N ММВ-7-3/ [email protected] “On amendments to the annexes to the order of the Federal Tax Service dated 07/04/2014 N ММВ-7-3/ [email protected] ” (registered by the Ministry of Justice Russian Federation 06.12.2016, registration number 44598).

3. The heads (acting heads) of the departments of the Federal Tax Service for the constituent entities of the Russian Federation should bring this order to the attention of lower tax authorities and ensure its application.

4. Entrust control over the implementation of this order to the deputy head of the Federal Tax Service, who coordinates methodological support for the work of tax authorities on tax issues when applying special tax regimes.

Head of the Federal Tax Service M.V. Mishustin

Where to submit the declaration?

Filing reports for LLCs and individual entrepreneurs has a number of features that must be taken into account:

- Activities are carried out at the place of registration of the individual entrepreneur or the legal address of the LLC - in this case, reporting must be submitted to the tax office where they are registered .

- The activity is not carried out at the place of registration of the individual entrepreneur or the legal address of the organization - it is necessary to submit UTII declarations to the tax authority at the actual place of business .

- If it is impossible to unambiguously determine the place of business activity (for example, transportation of passengers and cargo, delivery market trade), in this case individual entrepreneurs submit declarations to the Federal Tax Service at their place of residence, and organizations at their location (legal address)

Section 1 of the declaration

This section is usually filled out last and reflects the taxpayer’s obligations to the budget for UTII tax:

The accuracy of the information specified in Section 1 must be confirmed by the signature of the taxpayer. In other sections of the declaration, a signature is not required (with the exception of the signature placed on the Title Page).

Results

The duration of the tax period for UTII is set equal to a quarter. Therefore, reports are compiled quarterly based on data from a specific quarter. The end of the last tax period (fourth quarter) coincides with the end of the calendar year.

For the 4th quarter report for 2021, the UTII declaration form uses a familiar one. Therefore, you should not worry about how to fill out the UTII report for 2020 (fourth quarter) - it will not be difficult to do.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated June 26, 2018 No. ММВ-7-3/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Where can the imputed person get the codes to fill out the declaration?

The main necessary codes are deciphered in the appendices to the Procedure for filling out the UTII declaration:

- Appendix No. 1 (tax period codes) - for the declaration for the 4th quarter, this is a combination of numbers “24” (for those continuing to work) or “56” (in case of reorganization/liquidation of a company or individual entrepreneur);

- Appendix No. 2 (codes of forms of reorganization or liquidation) - selected from a series of numbers from 0 to 6 depending on the type of reorganization (transformation, merger, division, etc.);

- Appendix No. 3 (codes for the place of submission of the declaration to tax authorities) - there are 3 types of codes: for individual entrepreneurs (320 - at the place of activity, 120 - at the place of residence), for Russian companies (214 - for companies that are not the largest taxpayers) and for foreign firms (245, 331);

- Appendix No. 4 (method of submitting the declaration) - from 8 codes (from 01 to 05 and from 08 to 10), select the one that corresponds to the method of sending the declaration to the tax authorities (on paper in person or by mail, using a barcode, etc.);

- Appendix No. 5 (codes for types of UTII activities) - you must select from 22 codes the one required by type of activity (01 - provision of household services, 02 - provision of veterinary services, etc.);

- Appendix No. 6 (codes of constituent entities of the Russian Federation) - select the desired region from 99 codes (01 - Adygea, 02 - Bashkortostan, etc.).

Find out more about the different codes from the materials posted on our website:

- “Tax deduction codes for personal income tax – table”;

- “What do disability codes mean on a sick leave certificate?”.