How is your relationship with accounting and accountants? Perhaps you, like many IT specialists, find it difficult to find a common language with them and, as a result, you regularly have work conflicts? Or do you, as a contractor, constantly feel hostility from the chief accountant, and for some reason your bills are paid last? Or maybe the conflicting demands of the company’s management and the chief accountant are perplexing you, as a software product implementation specialist, and you don’t understand what to do about it? Then this article is for you. Today I decided to talk about accounting, the accountant and his role in the organization. It is intended, first of all, for specialists involved in the implementation of ERP, CRM, accounting systems (for example, 1C) and other business automation products. And here I want to talk about the human factor and the rules of interaction with accounting.

I will also clarify that in this article we will talk specifically about business companies, but not about government organizations.

The fact is that financial flows, including approval of contracts and payment of bills in small and medium-sized businesses, are very often controlled by an accountant.

The owner (manager) of a business delegates authority to the accounting department when it comes to everything related to finance. The reasons are obvious - the manager is busy, the need for competent paperwork from the point of view of accounting and tax reporting, and, ultimately, the need to directly carry out certain actions related to paying bills. All this falls under the responsibility of the accounting department. And if you fail to find a common language with an accountant, problems are guaranteed to arise with signing documents and paying bills. In addition, when implementing any accounting system, you will definitely encounter primary accounting. You will need to understand how the work of primary documentation is organized in the company, and how interaction with accounting takes place (receiving documents for customers, payment information, etc.). And here, without the friendly help of a specialist accountant, you risk getting a lot of difficulties, misunderstandings, and, as a result, alterations and improvements. And, of course, customer dissatisfaction.

This article can also help company employees, for example, system administrators, service engineers or sales specialists, establish correct and effective relationships with accounting.

At any enterprise there are two types of accounting:

- Managerial.

Necessary for internal control and decision-making by the organization's management. Examples include personnel changes, equipment purchasing decisions, strategic business development planning, etc. - Regulated.

This type of accounting is used for reporting to the state. This includes accounting, statistical and tax accounting.

Meet the accountant

Maintaining accounting records is an obligation for organizations enshrined in law.

There are practically no privileges or exemptions from this requirement. Therefore, someone in the company must be responsible for the work of the financial department. In large companies, accounting work is performed by an entire structural unit. In small ones, one person can handle it. And some institutions even outsource accounting to third-party companies. For example, centralized accounting departments in the public sector and outsourcing companies in a commercial environment.

But regardless of who will do the accounting: a third-party company or a full-time employee, the requirements for accountants are determined by law. Who is an accountant?

An accountant is a responsible employee whose responsibilities include documenting the facts of the financial and economic activities of an organization in accordance with established standards and requirements. In essence, the employee registers the operations and facts of the company’s life in specialized forms of documents (primary documents, books, magazines). And on the basis of accounting registers it compiles reports.

Use a free accountant job description template from ConsultantPlus.

Reasons for problems interacting with accounting

- Low qualifications of accountants. Today, you can often see a chief accountant in a company who barely knows the basics of accounting. Paradoxically, this position can be held even by a person without a higher education, simply after completing accounting courses. The main reason for such management decisions is that the manager chooses an accountant “for himself.” For our businessmen, what is more important is not the qualifications of an accountant, but the ability to trust him.

- Low qualifications of the company's managers and employees. The lack of basic knowledge in the field of accounting among the management team leads to the fact that employees are not particularly keen to be trained in primary accounting. However, many employees themselves are not particularly interested in this area of knowledge. As a result, the accountant is often forced to take the preparation of the entire “primary” work into his own hands, since otherwise regular gross errors will be made when drawing up documents.

- High workload and responsibility of accountants, incommensurate with the salary. The company is developing, sales are growing, and so is the number of documents and reports. And the salaries of accountants remain at the same level. Even bonuses rarely apply to this division. Naturally, on the one hand, the accountant will play it safe to protect himself from mistakes. The interests of the company will be secondary for him. On the other hand, due to the high workload, the preparation of primary documentation and payment of bills will be postponed “to the last resort.” Reports for an accountant come first.

Specialization of positions and responsibilities of an accountant

The work responsibilities of an accountant directly depend on the structure of the enterprise in which he works. For example, in a small company you will have to keep records of all objects. In a large company, accounting positions may be specialized. Typically, specializations are divided into categories of accounting objects:

- Salary, vacation pay and benefits. This specialization is also called “payroll accountant.” For example, the responsibilities of an accountant in an LLC include calculating wages for company personnel, calculating and paying taxes and payroll fees, preparing reports to the Federal Tax Service and funds, as well as calculating disability benefits, vacation pay and other types of payments.

- Fixed assets. The employee’s tasks for accounting for fixed assets include systematically calculating depreciation, recording the receipt and disposal of fixed assets in accounting, periodically conducting inventories, reconciliations and monitoring the actual availability of property. You will also have to prepare reports to the Federal Tax Service, Rosstat and other regulatory agencies.

- Cash register. The cashier's job includes receiving and issuing cash, as well as reporting on all cash flow transactions. It is important to familiarize the cashier with the Directive of the Central Bank of Russia No. 3210-U.

- Materials and warehouse. Accounting for warehouse operations and provision of material supplies to enterprises. The work includes not only the reflection in accounting of operations on the movement of raw materials, fuel and lubricants and other materials, but also systematic monitoring of the actual availability of assets. It is necessary to exclude facts of theft and shortages.

- Settlements with counterparties. The employee’s tasks include reflecting in accounting the services and work provided by third parties. The employee is required to conduct systematic reconciliations of mutual settlements with counterparties in order to eliminate delays. Responsibilities also include working with debtors to reduce the level of accounts payable and receivable in the enterprise.

- Bank operations. The rate is introduced in large institutions. The work consists of reflecting transactions on the company's current accounts. Preparation of payment orders for settlements with the budget and counterparties, as well as reflection of inflows and outflows from banking operations.

The position of chief accountant closes the list. This is the head of the financial service, who monitors the correct reflection of business transactions by subordinates, and is responsible for the preparation of financial and tax reports. But the accounting responsibilities of an accountant can be separated, for example, assigning a separate employee to prepare tax returns and calculations.

Who does the accounting department consist of?

Here I will not consider individual divisions subordinate to accounting - the financial and HR (personnel) departments.

In terms of the problems of working with accounting, these departments cause the least number of problems. The finance department is strictly concerned with the movement of funds, and interaction with them rarely raises questions. Often developers and technical specialists do not interact with him at all.

The HR department, although it belongs to the accounting department, is, in fact, a separate department with its own accounting automation systems and other features. HR rather refers to management accounting.

The main composition of the accounting department is divided into two weighted entities:

- Chief Accountant.

- Accounting rank and file

It is impossible to consider the work of any accounting department without taking into account the chief accountant.

Moreover, it is the chief accountant who is the key figure, since he is personally responsible for correct and timely reporting to the state. All the features of the accounting department and its interaction with other departments directly depend on how the chief accountant understands his responsibility and determines the degree of personal control over document flow, including primary ones.

The rank and file of the accounting department in matters of organizing work and interaction with various specialists is involved only as subordinates and slave employees. And it doesn’t play a special role in building effective cooperation with accounting.

It would seem that the organization of work of other departments is structured in a similar way. Actually this is not true. For example, in the sales department, in addition to the manager’s responsibility for overall performance, there is also the personal responsibility of each manager for interaction with clients. At the same time, there are no such strict rules and clearly defined responsibilities of the department head. Therefore, much more initiative, different approaches to work, etc. are allowed.

It is important to understand that in medium and small businesses, two people are responsible to the state for the activities of the enterprise, reporting and payment of mandatory contributions (tax and social) - the head of the company and the chief accountant. We will talk about the manager later, but now we will focus on the chief accountant.

Professional standards

A separate regulation has been approved for the position of “accountant” - the professional standard. Unlike the classification of positions by specialization, the professional standard does not provide for a similar division. Thus, officials identified only three categories in the professional accounting standard:

- Accountant. It is allowed to assign 1 or 2 categories to the specified position.

- Chief accountant or head of the accounting service.

- Head of Accounting and Financial Reporting Department.

The current standards are established by Order of the Ministry of Labor of Russia dated February 21, 2019 No. 103n. Moreover, the requirements regarding education and necessary work experience in the position held have been significantly tightened. For example, an employee with a higher education and at least five years of experience in accounting can be appointed to the position of head of the accounting service. If the chief accountant has secondary vocational education, then the required work experience increases to seven years.

What kind of professional accountant is he?

Availability of education in a specialty is one of the key issues that an employer is interested in when selecting a new employee. The criterion is one of the most important, but it is not exhaustive. The concept of “professional qualities of an accountant” includes other elements. Conventionally, they can be listed in order of importance.

- Knowledge. The requirement is mandatory and fair. An accountant must have a solid theoretical base, be fluent in terms (fixed assets, current assets, balance sheet, posting, primary documents, reporting, etc.), and at least have minimal computer skills.

- Experience. Its presence allows an accountant to apply for higher-paying vacancies or ask for an increase. However, we should not forget that work experience is not just an entry in the work book that is shown at an interview. Practical skills must be present in reality. Having experience makes it possible to quickly adapt to another place of work, quickly delve into the process and avoid mistakes when accounting.

- Literacy. An accountant needs this skill. After all, a person in this position constantly works with documents, letters, and reports. The presence of errors in important papers will not be a plus for the operation of the enterprise.

- Knowledge of special accounting programs. This skill allows you to maintain full-fledged automated accounting at the enterprise, optimizing working time.

It can be difficult for a manager to understand the level of professional skills of an accountant during a 15-minute interview. To do this, at many enterprises the applicant is first hired for a probationary period, during which his work is secretly monitored.

Job description

The procedure for conducting accounting work must be documented. The employer specifies some tasks and general functions in the employment contract with the accountant. But besides this, the work process should be detailed in a special document - a job description.

Job description structure:

- General provisions. Disclose information about the employee, work area and location. Then the qualification requirements for the employee are listed. The standards and acts that a financier must know are indicated. It is also recorded which category of specialists a specific position belongs to.

- Responsibilities. What tasks, responsibilities and functions should a hired accountant perform?

- Rights. What powers does the employee have to perform the tasks and responsibilities assigned to him?

- Responsibility. What penalties are provided for violation of the specified requirements.

Example of a job description for a chief accountant

Let's look at the subsections of the job description in more detail.

Intellectual qualities

For high salaries, employers are looking for employees with a fairly high level of thinking. In this case, it is worth paying attention to some of the intellectual qualities of the accountant. Specialists who have them are not very common.

High efficiency and the ability to concentrate help an accountant identify priority issues from the general mass of problems and solve them as quickly as possible. A person with similar qualities can replace two or three who will take on work from the wrong end.

Developed logical thinking and an analytical mind allow an accountant to see a problem in dynamics. A specialist with such qualities does not need to spend a long time processing primary documentation or issuing invoices. Such employees are most often recommended for leadership positions.

A critical mind is useful in accounting. After all, constant changes in legislation and tax conflicts require constant analysis.

Accounting: responsibilities

The list of responsibilities of an accountant depends on the specialization of the position and the need to apply a professional standard. Let us outline the main tasks.

Responsibilities of a payroll accountant (salary):

- calculation of wages and other remuneration for labor on the basis of personnel documentation and accounting sheets;

- calculation of benefits, scholarships, vacation pay and other types of payments;

- calculation and payment of taxes, fees and contributions from wages;

- preparation of salary reports to the Federal Tax Service, Rosstat, Social Insurance Fund and Pension Fund of Russia;

- participation in audits by extra-budgetary funds and the tax service.

Responsibilities of a material table accountant (property: fixed assets, inventories, warehouse)

- reflection of receipts, movements and disposals of property assets of the enterprise;

- depreciation calculation for fixed assets;

- conducting an inventory of fixed assets and medical supplies;

- preparation of reports to regulatory authorities on property assets.

Responsibilities of a billing accountant

- accounting of settlements with counterparties;

- carrying out inventory and reconciliation of calculations;

- work with accounts payable and receivable;

- preparation of reports on the designated area.

Cashier responsibilities

- drawing up cash documents, orders;

- reflection of cash flow transactions in the cash book;

- responsibility for preparing the cashier's daily report;

- control over compliance with the cash limit, transfer of surplus to current accounts;

- strict compliance with the requirements of Directions 3210-U;

- conducting settlements with accountable persons;

- reflection of transactions on the organization's current accounts;

- Preparation of reports for the designated area.

Responsibilities of the chief accountant:

- control over the work of subordinates;

- preparation of financial statements;

- organization of internal financial control;

- participation in the planning and development of regulatory and administrative local documents for the institution;

- drawing up and adjusting accounting policies for the corresponding financial period.

What should be the personal qualities of a good accountant?

If management is satisfied with the level of professionalism of an employee, then they should pay attention to other aspects of it. After all, the personal qualities of an accountant are also very important.

Honesty and integrity of the employee come first for many managers. They are ready to turn a blind eye to other shortcomings of the accountant if they completely trust him. Catching an employee for theft, misrepresentation, or dishonesty should have only one result - immediate dismissal.

- The pedantry and scrupulousness of the accountant will guarantee his accuracy in accounting. Such specialists are always accurate in calculations, attentive to details, and comply with the necessary requirements and rules.

- Organization and discipline are very good qualities for an accountant. Such an employee is not late. Submits all reports on time. And the rest of the employees do not complain about the delay in salaries.

- Stress tolerance greatly helps an accountant cope with psychological stress during audits or conflict situations with counterparties. The presence of this quality is not critical for management, but it is useful for the employee himself.

- Responsibility is mandatory for an accountant. If there is no understanding of this, then it is worth choosing another person for the position.

- Patience. A person who gives up halfway through a job should not become an accountant. If such a specialist appears at the enterprise, then you should not be surprised by fines from the tax service and claims from dissatisfied partners for money transferred incorrectly or on time.

Rights and powers

The financier not only performs duties, but also has a number of powers and rights. For example, an accountant has the right to demand that company employees provide timely primary documents. In addition, the accountant can carry out counter-reconciliations with counterparties, inspectorates and funds to identify debts and adjust the correctness of calculations. Take part in control, audit and other verification activities.

Rights, powers and procedures for interaction with other structural divisions of the company should be specified in as much detail and clearly as possible. If we leave only general formulations, then disputes and disagreements are inevitable.

Example of wording

External manifestations of certain qualities of an accountant

Some people are quite successful at hiding their flaws. However, there are external markers that help determine the individual qualities of an accountant:

- frequent delays – irresponsibility;

- constant delays at work - inability to organize one’s activities;

- complaints about other employees - a tendency to conflict;

- a mess on the table is disorder.

If an employee has an orderly workplace, all documents are in folders, the computer is turned on, and the mobile phone is on vibrate alert, then almost certainly this employee’s accounting will be fine.

Responsibility for misconduct

This section of the job description cannot contradict the Labor Code of the Russian Federation and other regulations. That is, the employer does not have the right to introduce its own system of fines for misconduct, tardiness and other deviations from work standards.

What responsibilities should be provided:

For improper performance or failure to fulfill one’s official duties as provided for in this job description and causing moral damage - “in the manner established by the current labor legislation of the Russian Federation.”

For offenses and crimes committed in the course of their activities - “in the manner established by the current administrative, criminal and civil legislation of the Russian Federation.”

What qualities should a chief accountant have?

The right hand of the manager and the second person in the enterprise. This place in the production hierarchy is occupied by the chief accountant. A mistake in choosing this person can be very costly for the company. Therefore, the qualities of the chief accountant are assessed extremely strictly by management.

A specialist in this position must have:

- honesty;

- deep knowledge in the field of tax and accounting legislation;

- high organizational skills;

- analytical mind;

- responsibility and discipline.

The person responsible for finance must always be extremely correct both with management and with inspection and control authorities. It would be nice if he has good communication skills.

History of the formation of the profession

The history of the accounting profession dates back to Ancient Egypt: such specialists were called scribes or tax collectors. Their responsibilities included: calculating the costs of transporting goods, constructing structures and land, calculating profits in agriculture, etc.

In Ancient Greece and Ancient Rome, money accounting was carried out by bankers or managers. Only wealthy people could count on this position, who, in case of shortage, replenished the budget from personal funds. Fraud was severely punished, including confiscation of property, expulsion from the country, or exemplary death penalty. The position was occupied mainly by men.

In Europe in the Middle Ages, financial specialists were available in all sectors: estates, castles, monasteries, knightly orders, royal court, etc. hired a person who prepared financial reports for money. At this time, the position of auditor appears. Society has always spoken highly of accountants: the specialist was valued, respected, and his work was placed above science and art.

It has always been difficult to study accounting: it is a complex job that requires deep knowledge and skills, special personal qualities of a professional, etc. Who is an accountant in the 21st century: specialists in this field include an auditor, a financial director, a tax consultant, a senior cashier, etc. .d. More than 90% of modern specialists are female.

Modern accounting professions

The accountant is the second most important person after the general director (decisions on actions with funds are made by management, the activities of a financial department employee are of an executive nature). Its activities are strictly controlled by the employer and the Ministry of Taxes: negligence in the performance of official duties can lead to troubles for both the employee and the entire enterprise.

The profession of an accountant implies documentary maintenance of financial and economic accounting of an organization, which does not contradict the legislation of the Russian Federation. An organization can employ an employee or use accounting support services (hire a specialist to perform single actions (outsourcing).

Accounting is a difficult job because... any error in calculations may lead to disciplinary, administrative, financial or criminal liability. In the accounting profession, the description indicates that a person who has received an economic education can work:

- tax accounting specialist;

- auditor;

- auditor;

- banker;

- financial manager/director;

- economist;

- financier at an enterprise, etc.

A specialist in this field must be a professional in his field (perform one of many functions in an enterprise) and be familiar with all the other intricacies of accounting.

What are the advantages of the profession?

This profession has its advantages and disadvantages. The advantages include:

- stability, demand (a young specialist without work experience can find employment as a junior employee);

- career growth, constant improvement of professional level;

- the ability to perform some functions remotely while working from home;

- Both men and women can become accountants;

- Work experience, obtaining additional knowledge and skills (taking advanced training courses) can significantly increase a specialist’s salary.

An accountant is a creative profession that suits energetic, thinking people who can analyze a given situation and see possible ways to solve a problem.

Disadvantages of Accounting

A high level of income and a prestigious profession have their downside. Disadvantages of the position include:

- high responsibility: an accountant’s mistake can cause trouble for the entire enterprise;

- uneven distribution of effort, which negatively affects the health of the employee: the accountant works especially intensively at the end of each month and year (closing all current affairs, preparing the annual report, etc.).

The job responsibilities that an employee performs directly affect his salary. The subject of an accountant's work is accounting, which is possible thanks to knowledge of tax and financial legislation. This is a difficult profession that requires patience, perseverance, and the desire to constantly improve your level of professionalism.

Indicators of quality work of an accountant

No matter how careful the selection of a candidate for a position is, the fruits of an employee’s labor become visible only over time. The quality of an accountant’s work can be assessed in three areas.

- Individual indicators. These are discipline, initiative, independence, innovation, and avoidance of conflict situations.

- Maintaining internal records. This includes making mistakes in documents or their absence, failure to submit reports on time, and diligent performance of job duties.

- External interaction. Work with fiscal authorities, prosecutor's office. Ability to resolve controversial situations.

An accountant's work can be considered high-quality if it is performed quickly, correctly and in full. In order to determine this indicator, some enterprises appoint certifications, others conduct internal audits.

Stereotypes about the accounting profession

There are several persistent stereotypes about the accounting profession. Some of them are still valid, some are no longer relevant.

The most common question: “Is accounting a male or female profession?”

It is believed that mostly women go to work as accountants, since the position requires scrupulousness, perseverance and attentiveness. And men, as a rule, have problems with these qualities. Indeed, approximately 40% of companies prefer to hire women as accountants, although another 30% of companies do not care what gender the applicant is. So male accountants are also quite common. Moreover, the position of an accountant is always a rather serious start for a career in finance.

Are a bookkeeper and an accountant the same thing?

In fact, before the advent of automatic calculation systems, there were two different professions: accountant and bookkeeper. The latter were engaged in manually compiling balance sheets, making calculations, entering data into special ledgers, and then transferring them to an accountant for verification. Over time, when accountants acquired calculators, computers and the 1C: Accounting system, the profession of accountant disappeared. Well, if the word itself is used, it is as an everyday synonym.

Exactly the same confusion, by the way, arises between accountants and cashiers. What is the difference between them? It's simple. The first one does all the calculations, and the second one simply gives out money at the checkout. Although in practice, an accountant can combine both of these positions. Therefore, in many enterprises, in order to save money, there is only a related position - an accountant-cashier.

The essence of the work of accountants is to sort through pieces of paper.

Not at all necessary. Of course, any enterprise is full of reports. But all basic information is now stored in databases on the company’s servers. Well, the amount of paperwork depends greatly on how the internal document flow is organized.

An accountant sits in one place in the office for days

Again, not a prerequisite. It's not always the same. For example, there are now a lot of remote work offers for accountants. This approach is practiced by small companies with low turnover, for which it is unprofitable to inflate their staff. Well, the accountant gets the opportunity to manage several projects simultaneously while working from home. There are also accountants and auditors - they never sit in one place and constantly go on business trips.

How to get a profession?

To engage in accounting activities, you can obtain a higher or secondary specialized education in the following areas: economics, finance, banking, merchandising, trading, etc.

An accountant's education requires a university or college degree. People who do not have a certificate of completion of a higher or professional educational institution (or who have completed accounting courses) can only count on the position of assistant without further career growth.

Where to study to become an accountant?

Accounting professions are taught in colleges and universities, which are located in almost every city in Russia. The most prestigious educational institutions are located in Moscow and St. Petersburg. Training is possible on full-time, part-time and part-time basis. Studying at a college takes 3-3.5 years (receiving secondary vocational education), at a university – 4-6 years (receiving a diploma of higher education). List of institutions where you can get secondary specialized education:

- Financial College No. 35 (Moscow).

- Moscow Banking College of Economics.

- Moscow Technological College.

- St. Petersburg Polytechnic College.

- College of Management and Economics “Alexandrovsky Lyceum” (St. Petersburg).

- Economic College (St. Petersburg).

- St. Petersburg Technical College of Management and Commerce.

A higher education in economics will allow an employee to easily find a place in a large organization and move up the career ladder. A university diploma can be obtained from the following institutions:

- Moscow Finance and Law University (MFUA).

- Moscow State University named after. M.V. Lomonosov (MSU).

- Moscow Humanitarian and Economic University (MSEU).

- National Research University Higher School of Economics (HSE).

- Moscow State Institute of International Relations (MGIMO).

- Financial University under the Government of the Russian Federation.

- Russian Economic University named after. G. V. Plekhanov.

The choice of educational institution depends on the capabilities and desires of the applicant.

What subjects do I need to take to become an accountant?

Upon admission to college, applicants undergo internal entrance tests, on the basis of which students are selected.

To enter the university, you must pass the Unified State Exam in the following subjects:

- Russian language;

- mathematics;

- social studies/computer science/foreign language (the choice of subject depends on the specifics of the future job; it is advisable to find out in advance what subject is required when entering the desired university).

A foreign language (usually English) is required upon admission to the Faculty of Economics with a focus on international relations. Thus, upon graduation, a specialist will be able to work in a branch of a foreign company or a Russian organization where work is carried out with foreign partners.

Which people are not recommended to be hired as accountants?

There are categories of applicants whom experts do not recommend employing. It is not recommended to hire the following as accountants:

- friends;

- relatives;

- close people of existing employees.

It is better to hire a suitable person from outside.

If the personal qualities of an accountant are impressive, but he lacks professionalism, the right decision would be to hire such a person and train him. In this case, people try very hard and stay with the company for a long time.

Salary and career opportunities

A big advantage of this profession is the opportunity to constantly improve your qualifications. This becomes the key to dynamic salary growth and provides opportunities for career development. Ambitious accounting employees are able to occupy high positions in commercial enterprises and government agencies, and combine activities in order to increase financial wealth.

How much can accountants earn?

At the initial stage, an employee’s salary can be 15-20 thousand rubles in the regions and 20-25 thousand rubles in large cities. For experienced employees, these numbers increase at least twice. When changing positions to a higher one, indicators can change 3-4 times.

How much a specialist earns is influenced by the following factors:

- the scope of activity and profit level of a particular company;

- the employee’s position and a list of his job responsibilities;

- statistics of the region and the demand for accounting workers in it;

- willingness to take on additional work and run several companies at the same time.

In international companies, the salary of a mid-level accountant can be 80-100 thousand rubles. The deputy head of a department receives up to 130 thousand rubles, and representatives of the highest positions in the sphere can count on 180-200 thousand rubles and even more.

An ordinary accounting employee with a higher education, regular certification and accumulation of experience can count on rapid career growth. He is not limited to the post of chief accountant; ambitious employees rise to senior level auditors and financial directors. The salary for these positions depends on the level of the company and often amounts to hundreds of thousands of rubles.

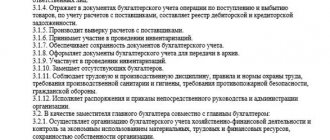

Purpose of Accounting

To prepare accounting and tax reporting, the law obliges business entities to adhere to established requirements when maintaining accounting records during the reporting period. Analyzing the goals and objectives of accounting, we can say that the most significant requirements of the legislation include the completeness and reliability of the information provided, generated in the process of work.

Thus, the tasks and purpose of accounting. accounting can be expressed in three components:

- Formation of objective and comprehensive accounting information based on primary data.

- Preventing the formation of negative results in the production and economic activities of the enterprise by analyzing the current situation and forming appropriate reserves.

- Providing reporting information on the financial activities of the company to the services and bodies established by law.

What is an accountant responsible for?

E.V. Danilova Magazine “Glavbukh”, N 11, June 2001

The accounting profession has always been necessary and important, and in recent years it has also become prestigious. The accountant is aware of all the affairs of the enterprise, since he must reflect financial and economic transactions in accounting and, by correctly taking advantage of the benefits, minimize taxes. How much will be transferred to the budget and whether the company will have to pay fines depends on its work. Therefore, many managers respect accountants and trust them.

But we should not forget that this profession is also associated with financial responsibility. For serious violations in work, both unconscious and accidental, as well as intentional, for using his official position for personal gain, an accountant can be brought not only to disciplinary and administrative, but also to criminal liability. We will tell you how and for what exactly in this article.