Accounting for third party services

Services of third-party organizations are a type of activity that does not have a material expression; the result of the service is sold and consumed immediately in the process of the organization’s economic activities (clause 5 of Article 38 of the Tax Code of the Russian Federation). If there is a material component, then this is work (clause 4 of Article 38 of the Tax Code of the Russian Federation):

In accounting, an organization can write off all direct expenses only for services (Letter of the Ministry of Finance of Russia dated February 22, 2007 N 03-03-06/1/114).

The primary accounting documents confirming the receipt of services from third-party organizations are:

- Service agreement;

- Certificate of services rendered, signed by the customer and the contractor;

- Invoice received.

Services provided by third parties may include:

- Communication services (discussed in example 1);

- Pre-sale preparation services (discussed in example 2);

- Cash register maintenance services (discussed in example 3);

- Housing and communal services;

- Storage services;

- Consulting services;

- Transport services;

- Training services;

- Auditing services;

- Legal services;

- Real estate services and so on.

Standard accounting entries for services received from third parties:

| Debit Account | Credit Account | Wiring Description | A document base |

| 26 | 60 (or 76.05) | Reflection of the cost of the service received (excluding VAT) | Certificate of services rendered, Invoice received |

| 19.04 | 60 (or 76.05) | The amount of VAT on the cost of the service received is reflected | |

| 68.02 | 19.04 | VAT amount accepted for deduction | |

| 60 (or 76.05) | 51 | Payment to the counterparty for services rendered | Bank statement |

| 90.02 | 26 | Write-off of the cost of services received to cost of sales |

Standard accounting entries when receiving services free of charge:

| Debit Account | Credit Account | Wiring Description | A document base |

| 91 | 60 (or 76.05) | The cost of the service received free of charge is reflected | Agreement for the provision of services free of charge |

| 60 (or 76.05) | 91 | Income from services received free of charge is reflected |

A sample contract for the provision of services free of charge can be downloaded here ˃˃˃

Payment of tax for a 3rd person - postings in 1C 8.3 Accounting

The Organization has a loan payable to a counterparty in the amount of RUB 50,000.

At the time of repayment of the loan, the Organization received a letter from the counterparty with a request to transfer the entire amount of debt to pay VAT for the 1st quarter.

On April 20, the Organization transferred the amount of debt 50,000 rubles. to the budget.

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Generating a payment order for tax payment | |||||||

| 20 April | — | — | 50 000 | Formation of a payment order | Payment order - Payment of tax for third parties | ||

| Payment of tax to the budget for a third party | |||||||

| 20 April | 66.03 | 51 | 50 000 | 50 000 | Payment of tax for a third party on account of loan debt | Debiting from a current account – Payment of tax for third parties | |

Generating a payment order for tax payment

To transfer tax, create a Payment order - for such a case, the program implements a special Operation Type : Payment of tax for third parties (Bank - Payment orders).

Fill out the document:

- The organization is your organization;

- Taxpayer is the counterparty for whom you pay the tax;

- Recipient - tax office of the counterparty;

- using the link Payment details to the budget, indicate the BCC and all payment data corresponding to the tax paid;

- Expense item - Repayment of loans and borrowings , since for our organization the loan is repaid under the contract;

- Purpose of payment - is issued automatically based on the completed data, manually specify the tax payment period.

Check that the printed form is completed. In the figures, the details of the counterparty are marked in blue, and the details of our organization are marked in red.

Payment of tax to the budget for a third party

Based on the Payment Order, issue a Debit from the current account (Bank - Payment Orders).

The document is filled out automatically according to the Payment Order .

Manually enter:

- Settlement account - an account that reflects the debt to the counterparty, against which the tax was paid (in our example - 66.03).

Postings

Control

Check the result of the operation using the Balance Sheet for the account on which the accounts payable were registered: in our example - 66.03 (Reports - Account Balance Sheet).

In the SALT we see that the debt under this loan agreement has been repaid.

Postings for services received from third parties

Let us consider in more detail how to attribute the services of third-party organizations in transactions using the example of receiving various types of services.

Example 1. Receipt of communication services

Expenses for communication services are reflected in accounting in accordance with paragraph 18 of PBU 10/99 “Expenses of the Organization”; in tax accounting they are reflected in accordance with subparagraph 25 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation.

Let’s say the supplier Svyaz LLC provides communication services to Vesna LLC. According to the contract, the cost of communication services per month is 14,750 rubles, incl. VAT 18% - 2,250 rub. Costs for services are included in the organization's expenses.

The accountant of Vesna LLC reflected the receipt of communication services from the supplier with the following entries:

| Debit Account | Credit Account | Transaction amount, rub. | Wiring Description | A document base |

| 26 | 60.01 | 12 500 | The cost of communication services in the current month is taken into account | Certificate of services rendered, Invoice received |

| 19.04 | 60.01 | 2 250 | VAT amount included | |

| 68.02 | 19.04 | 2 250 | The VAT amount is accepted for deduction | |

| 60.01 | 51 | 14 750 | Payment to the counterparty for services rendered | Bank statement |

Example 2. Purchasing pre-sales services

Expenses for pre-sale preparation are reflected in accounting in accordance with paragraph 6 of Article 226 of the Methodological Instructions, and in tax accounting are reflected in accordance with Article 265 of the Tax Code of the Russian Federation.

Let’s assume that Vesna LLC transferred its goods in the amount of 250 pieces to the counterparty for polishing. The cost of the pre-sale preparation service under the contract is 61,950 rubles, incl. VAT 18% - RUB 9,450. According to the accounting policy, service costs are classified as indirect costs.

The accountant of Vesna LLC reflected the services provided for pre-sale preparation of goods with the following entries:

| Debit Account | Credit Account | Transaction amount, rub. | Wiring Description | A document base |

| 44.01 | 60.01 | 52 500 | The cost of services provided is taken into account | Certificate of services rendered, Invoice received |

| 19.04 | 60.01 | 9 450 | VAT amount included | |

| 68.02 | 19.04 | 9 450 | The VAT amount is accepted for deduction | |

| 90.07.1 | 44.01 | 52 500 | Distribution costs are written off as financial results | Help-calculation of write-off of indirect expenses |

Example 3. Receipt of cash register maintenance services

For example, Vesna LLC purchased a cash register machine (CCM) worth RUB 10,207, incl. VAT 18% - RUB 1,557. For commissioning work, 1,062 rubles were paid, incl. VAT 18% - 162 rubles. An agreement was concluded with the KKM Technical Service Center for monthly KKM maintenance, the cost of the service is 295 rubles, incl. VAT 18% - 45 rub.

Under the conditions of the example, maintenance costs are included in the organization's expenses. The accountant of Vesna LLC reflected cash register servicing services with the following entries:

| Debit Account | Credit Account | Transaction amount, rub. | Wiring Description | A document base |

| 44.01 | 60 | 250 | The amount of expenses for KKM maintenance is taken into account | Certificate of services rendered, Invoice received |

| 19.04 | 60 | 45 | VAT amount included | |

| 68.02 | 19.04 | 45 | The VAT amount is accepted for deduction |

Methodology for reflecting the receipt of services at various VAT rates

Courses Stimul › Reference book › Useful materials › 1C:Enterprise 7.7 › Complex configuration › Complex configuration

1C:Enterprise 7.7 / Complex configuration / Complex configuration

Table of contents

Services are provided on an advance payment basis.

Receipt of services is carried out on the terms of subsequent payment.

Due to the fact that recently the operation of reflecting payment for mobile communication services, which in addition to VAT is also subject to the pension fund, has become very popular, we will consider the method of reflecting this operation in the standard configuration “Accounting + Trade + Warehouse + Salary + Cards for Ukraine”.

It should be noted that in the configuration the flag is set to allocate advances and VAT postings are made according to the “Tax invoice”.

Receipt of services is carried out on an advance payment basis

- At the first step, you should draw up an “Agreement” and an “Incoming Invoice” for the services provided, it is necessary to indicate in separate lines both the received cellular communication services (subject to VAT, we indicate the VAT rate - 20%), and the amount of contributions to the Pension Fund (which is not subject to VAT , indicate the VAT rate – Without VAT).

These documents will subsequently act as analytical sections when registering mutual settlements. The completed form of the “Incoming Invoice” document is shown in Figure 1 – “Incoming Invoice” document. Figure 1 – Document “Invoice” - In the second step, it is necessary to reflect the prepayment for the services received. To do this, you should create and fill out the “Bank Statement” document. The document should reflect in one line the transfer of the advance for the service received - “20%”, select “Counterparty”, “Agreement”, “Incoming Invoice”, indicate the amount that should be transferred as an advance for the service received. The second line should indicate the deduction to the pension fund, indicate the “VAT rate” – “Without VAT”, select “Counterparty”, “Agreement”, “Incoming account”, and you should also indicate the amount transferred to the Pension Fund. The completed form of the document is shown in Figure 2 - Document “Bank Statement”.

Figure 2 – Document “Bank Statement”After the “Bank Statement” is completed, transactions will be generated that will reflect Gross expenses in tax accounting, the amount of the advance, as well as a tax credit for the service received (Figure 3).

Figure 3 – Postings of the “Bank Statement” document

- In the third step, it is necessary to reflect the receipt of the services themselves. To do this, based on the “Incoming Invoice” document, you must enter the “Third Party Services” document. The document header will automatically contain the counterparty and the documents for the receipt of services. In the tabular part of the document, two lines will be filled in - one for receipt of services (VAT rate - 20%), and the second for transfer to the Pension Fund (VAT rate - Without VAT). The completed form of the document “Third Party Services” is shown in Figure 4. Figure 4 – Document “Third Party Services”

After completing the document “Services of third-party organizations”, entries will be generated that will reflect the repayment of the advance, tax credit, and the cost of services will also be included in the administrative costs (Figure 5).Figure 5 – Postings of the document “Third Party Services”

- In the last, fourth step, it is necessary to reflect the closure of the VAT tax credit. To do this, based on the “Bank Statement” document for which the first event occurred, you must enter two “Acquisition Ledger Entry” documents. One document (VAT rate – “20%”) for communication services and a second document (VAT rate – “Without VAT”) for transfer to the Pension Fund. When you try to enter the document “Acquisition book entry” based on the “Bank statement,” the program will prompt you to enter two documents with different rates. You must enter two documents in turn. The details in the documents will be filled in automatically based on the data specified in the “Incoming Invoice”. The documents are shown in Figure 6 and 7, respectively. Figure 6 – Document “Acquisition Book Entry” payment for services Figure 7 – Document “Acquisition Book Entry” transfer to the Pension Fund

After posting the document “Acquisition Book Entry”, a posting will be generated for only one document – payment for services. Wiring shown in Figure 8.Figure 8 – Postings of the document “Acquisition book entry” payment for services

Receipt of services is carried out on the terms of subsequent payment

- At the first step, as in the first case (receipt of services on an advance payment basis), you should draw up an “Agreement”.

- The second step is to reflect the receipt of services. To do this, based on the “Agreement” document, you must enter the “Third Party Services” document. The document header will automatically contain the counterparty and the documents for the receipt of services.

In the tabular part of the document, two lines will be filled in - one for receipt of services (VAT rate - 20%), and the second for transfer to the Pension Fund (which is not subject to VAT, indicate the VAT rate - Without VAT). The completed form of the “Third Party Services” document is shown in Figure 9.Figure 9 – Document “Third Party Services”

After posting the document “Services of third-party organizations”, entries will be generated that will reflect Gross expenses in tax accounting, a tax credit, and the cost of services will also be included in the composition of administrative costs (Figure 10).

Figure 10 – Postings of the document “Third Party Services”

- In the third step, it is necessary to reflect the transfer of payment for services received. To do this, you should create and fill out a “Bank Statement” document. The document should reflect in one line the transfer of payment for the received - “20%”, select “Counterparty”, “Agreement”, indicate the amount that should be transferred for the service received. The second line should indicate the contribution to the pension fund, indicate the “VAT rate” – “Without VAT”, select “Counterparty”, “Agreement”, and also indicate the amount transferred to the Pension Fund. The completed form of the document is shown in Figure 11 - Document “Bank Statement”. Figure 11 – Document “Bank Statement”

After the “Bank Statement” is completed, a posting will be generated that will reflect the transfer of payment to the counterparty for the service received (Figure 12).Figure 12 – Postings of the “Bank Statement” document

- In the last, fourth step, it is necessary to reflect the closure of the VAT tax credit. To do this, based on the “Third Party Services” document, for which the first event occurred, you must enter two “Acquisition Ledger Entry” documents. One document (VAT rate – “20%”) for communication services and a second document (VAT rate – “Without VAT”) for transfer to the Pension Fund. If you try to enter on the basis of “Third Party Services” in the “Acquisition Ledger Entry” document, the details will be filled in automatically based on the data that was specified in the “Third Party Services” document. Please note that it is not correct to show the amount transferred to the Pension Fund in the VAT database, because this amount is included in the declaration. Therefore, you should correct the “Amount without VAT” for payment of services in one document, and in the second document indicate the “VAT rate” - “Without VAT” and manually fill in the “Amount without VAT” for transfers to the Pension Fund. The documents are shown in Figure 13 and 14 respectively. Figure 13 – Document “Acquisition Book Entry” payment for services Figure 14 – Document “Acquisition Book Entry” transfer to the Pension Fund

After posting the document “Acquisition Book Entry”, a posting will be generated for only one document – payment for services. Wiring shown in Figure 15.Figure 15 – Postings of the document “Acquisition book entry”

Other

VAT: the buyer reimburses the seller for transportation costs

Commentary to the Letter of the Ministry of Finance of Russia dated August 15, 2012 N 03-07-11/299 “On the application of VAT deductions and issuing invoices for transport costs reimbursed by the buyer of goods to their seller”

Perhaps, in the vast majority of cases, goods, products or other valuables purchased by the buyer from the seller must be physically moved from one place to another, for example, transported from the supplier's warehouse to the buyer's warehouse. Moreover, often we are not talking about delivery of purchased goods to a neighboring street or within the same city, but about transportation to other localities or even to another country. How to correctly calculate VAT in one of the special cases arising during the transportation of goods is described in the commented Letter of the Ministry of Finance of Russia dated August 15, 2012 N 03-07-11/299.

Transport costs when selling goods or finished products

The following options for accounting for delivery costs are possible:

- If the delivery price is included in the price of the product.

This option most often occurs when the goods under the contract are delivered by the supplier to the buyer’s warehouse and the delivery price is not highlighted separately in the primary documents.

Transport costs in these circumstances are selling costs. The entry for the corresponding transaction in accounting will be as follows: Dt 44 Kt 60, 76.

Such expenses should be written off to cost in full at the end of the month. The entry will be as follows: Dt 90, subaccount “Sales expenses” Kt44.

- The delivery price is shown separately from the cost of the product.

If the delivery price is highlighted in the contract for the purchase of goods, this means that the supplier intends to receive payment for delivery separately. In this case, there is revenue for transport services. Costs associated with delivery must be reflected in the following entry: Dt 23 Kt 02, 10, 70, 69.

Subsequent write-off of expenses: Dt 90, subaccount “Cost of transport services” Kt 23.

How to take into account delivery costs under the simplified tax system

Source: Glavbukh magazine

If you purchase any valuables and pay for their delivery, the seller most often writes out separate documents for the delivery price. Or it distinguishes its value separately from the value of the values themselves. Accordingly, you need to reflect these expenses in accounting.

How exactly to do this? Should the shipping cost be included in the initial cost of the valuables or should it be written off separately? Are there any differences between accounting and tax accounting for transportation expenses? We have discussed all these points in this material.

How can a buyer reflect delivery costs under the simplified tax system?

In tax accounting under the simplified tax system, write off the cost of delivery of purchased goods and materials as a separate type of expense as such costs arise and are paid. There is no need to wait for the purchased valuables to be written off (clause 2 of Article 346.16 and clause 2 of Article 346.17 of the Tax Code of the Russian Federation). But taking into account the costs of transporting fixed assets to the simplified tax system, don’t rush!

The fact is that fixed assets are accepted for tax accounting at the cost that is formed according to the accounting rules (clause 3 of Article 346.16 of the Tax Code of the Russian Federation). And in accounting, delivery costs must be included in the initial cost of fixed assets (clause

8 PBU 6/01 “Accounting for fixed assets”).

It turns out that in tax accounting, the delivery of expensive property is written off not as an independent expense, but as an integral part of the cost of the fixed asset - quarterly, in equal shares during the calendar year, after putting the object into operation (clause 3 of Article 346.

16 of the Tax Code of the Russian Federation). Please note: entrepreneurs do not keep accounting records. But if a businessman bought a fixed asset, then he must formulate its value in tax accounting according to exactly the same accounting rules. That is, include transportation costs incurred in the cost of the object.

Thus, in tax accounting you will not have a separate cost item for the delivery of fixed assets - they will be included in the cost of the property. Transport costs will appear in tax accounting only for goods and materials.

So, for the delivery of purchased valuables, you can pay the supplier himself or a specialized carrier specially hired for this purpose. Your cost item in such cases will be payment for transport services provided to you (subclauses 5 and 23, clause 1, article 346.16 of the Tax Code of the Russian Federation).

And if you deliver valuables using your own transport, you will have several types of expenses. At a minimum, costs for fuel and payments to drivers. Take them into account in the generally established order according to the relevant elements. For example, reflect fuel costs as material costs (subclause 5, clause 1, art.

346.16 Tax Code of the Russian Federation). Payment to drivers - as labor costs (subclause 6, clause 1, article 346.16 of the Tax Code of the Russian Federation).

What are the rules for writing off transportation costs in accounting?

Purchase of fixed assets. Delivery costs under the simplified tax system in accounting are included in their initial cost of fixed assets.

As a general rule, a similar procedure in accounting is applied for all other purchased assets - goods, materials, etc. (clause 6 of PBU 5/01 “Accounting for inventories”, clause 8 of PBU 6/01).

But exceptions are possible if you specify the appropriate methods in your accounting policies

Purchase of materials. So, if we are talking about materials, the costs of their delivery can be taken into account in a separate subaccount of account 10 “Materials” (clause 83 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, hereinafter referred to as Instructions No. 119n).

From a separate subaccount, transport costs, if their share does not exceed 5% of the cost of materials, you can write off in full to increase the cost of the valuables themselves. And if the specific gravity is no more than 10% of the cost of materials, immediately assign the entire amount to account 20 “Main production”.

If the costs of delivering materials are significant, then you will have to write off the amounts to the account to which you wrote off the materials. At the same time, in order to determine the amount of write-off, the cost of written-off assets must be multiplied by the percentage of transportation and procurement costs (TZR). It is calculated using the formula (p.

86 - 88 Instructions No. 119n):

| Average percentage of TRP per month | = | TZR at the beginning of the reporting month | + | TZR for the reporting month | / | Cost of materials at the beginning of the reporting month | + | Cost of materials received for the reporting month excluding internal movement | X | 100% |

As you can see, the order is not so simple. Therefore, see if it makes sense for you to allocate transport costs separately? It is quite possible that it is more convenient to include them immediately in the initial cost of the property when registering it.

Then delivery costs under the simplified tax system will be automatically written off as part of the original cost.

The selected accounting option (with or without the allocation of transport costs in a separate subaccount of account 10), we repeat, you need to register in the accounting policy for accounting purposes.

Example 1. LLC Lazur, which uses the simplified tax system with the object of taxation of income minus expenses, acquired a fixed asset in May 2014 worth 45,000 rubles. The delivery of the object was carried out in-house. Delivery costs (gasoline costs, driver's salary and insurance premiums) amounted to 2,200 rubles.

The accountant reflected the purchase of fixed assets as follows:

DEBIT 08 CREDIT 60 - 45,000 rub. — the costs of acquiring fixed assets are reflected;

DEBIT 08 CREDIT 10 (70, 69) - 2200 rub. — delivery costs are included in the cost of the fixed asset;

DEBIT 01 CREDIT 08 - 47,200 rub. (RUB 45,000 + RUB 2,200) - the fixed asset is accepted for accounting.

The fixed asset must also be accepted for tax accounting at a cost of 47,200 rubles. And write it off as expenses after paying for the facility and putting it into operation in equal quarterly installments until the end of the current year.

In addition, in the same month, the company purchased materials in the amount of 25,000 rubles. The costs of their delivery by a third-party company (TZR), paid in the month of purchase, amounted to 3,000 rubles. The Company accounts for TZR in a separate subaccount of account 10 “Materials”.

There are no remaining unwritten materials and unaccounted amounts of inventories from previous months. In May, materials worth RUB 18,200 were written off from the purchased batch. The accountant calculated the average percentage of inventory write-offs per month. The indicator was 12% (3,000 rubles: 25,000 rubles × 100%).

The following entries were made:

DEBIT 10 subaccount “Cost of materials” CREDIT 60 - 25,000 rub. — materials purchased;

DEBIT 10 subaccount “Transportation and procurement expenses” CREDIT 76 - 3000 rub. — the amount of delivery of materials is reflected;

DEBIT 20 CREDIT 10 subaccount “Cost of materials” - 18,200 rubles. — materials are written off for production;

DEBIT 20 CREDIT 10 subaccount “Transportation and procurement expenses” - 2184 rubles. (RUB 18,200 × 12%) - TZR attributable to consumed goods was written off.

In tax accounting under the simplified tax system, the accountant reflected the delivery amount in May in full (3,000 rubles), since delivery services were received and paid for.

Purchase of goods. If you are engaged in trade and purchase goods, you can use the accounting option provided for in paragraph 13 of PBU 5/01.

And reflect the costs of delivering goods either immediately at the original cost in account 41 “Goods”, or in a separate subaccount of account 44 “Sales expenses”.

The chosen option, again, is prescribed in the accounting policy for accounting purposes.

If account 44 is used, transportation costs from it at the end of each month must be written off to the debit of account 90 subaccount “Commercial expenses” (or subaccount “Sales expenses”). You can write off the amounts in full, or you can only write off the portion attributable to the goods sold. That is, then transportation costs must be distributed between sold and unsold goods.

How exactly to calculate the amount of transportation expenses to be written off in this case is not established by regulations. Usually, the accounting policy establishes the methodology set out for tax purposes for income tax payers in Article 320 of the Tax Code of the Russian Federation.

According to this formula, by trade organizations the transport costs to be distributed are determined according to the formula set out below.

| Delivery costs to be written off for the reporting month | = | Transportation expenses not written off last month (account debit balance 44 at the beginning of the month) | + | Delivery costs for the reporting month | – | Transportation costs attributable to the balance of goods at the end of the reporting month |

In this case, to calculate the last indicator, use the following algorithm:

| Transportation costs attributable to the balance of goods at the end of the reporting month | = | Cost of remaining goods at the end of the reporting month | X | Average percentage to determine the amount of transportation costs related to the balance of goods |

| Average percentage to determine the amount of transportation costs related to the balance of goods | = | Transportation costs at the beginning of the reporting month | + | Transportation costs for the reporting month | / | Purchase cost of goods sold during the reporting month | + | Cost of purchasing the balance of goods at the end of the reporting month | X | 100% |

Example 2. At the beginning of the month, Quartz LLC had no balance of goods and no unwritten off transportation costs. During the month, the organization purchased goods, the total cost of which was 250,000 rubles. Of these, 175,000 rubles were sold. The total balance of unsold goods is 75,000 rubles. (RUB 250,000 – RUB 175,000).

Business expenses for the month amounted to 45,000 rubles. Of this, RUB 8,500 is for transportation of goods. The amount has been paid in full to the carrier. According to its accounting policy, the company writes off commercial expenses partially, distributing transportation costs between sold and unsold goods.

Next, I calculated the amount of transportation costs attributable to the balance of unsold goods. The indicator is 2550 rubles. (RUB 75,000 × 3.4%). Then - the amount of business expenses that can be written off at the end of the month.

It is 42,450 rubles. (RUB 45,000 – RUB 2,550).

The following entries were made:

DEBIT 41 CREDIT 60 - 250,000 rub. — goods purchased;

DEBIT 44 CREDIT 60 (10, 70, 69...) - 45,000 rub. — expenses associated with the sale of goods, including their delivery, are reflected;

DEBIT 90 subaccount “Cost of sales” CREDIT 41 - 175,000 rub. — the cost of goods sold is written off;

DEBIT 90 subaccount “Business expenses” CREDIT 44 - 42,450 rub. — commercial expenses attributable to goods sold are written off.

In tax accounting, the accountant took into account delivery costs under the simplified tax system in full (8,500 rubles) at the time of payment.

What documents are needed to justify transportation costs?

To confirm the reality of the purchase, it is not enough to receive only a delivery note from the supplier.

You must also have a delivery note available, which will confirm that the purchased valuables have been delivered to you (the buyer). In addition, the same document will justify transportation costs.

And if you are transporting the goods yourself, you need to issue a waybill. You can learn more about the forms of required transport documents from the table.

Which transport document will confirm the delivery of valuables?

| Type of transport used | Required supporting document (clause 2 of article 785 of the Civil Code of the Russian Federation) |

| Automotive |

TZR when purchasing materials

PBU 5/01 determines that TZR are included in the actual cost of materials (clauses 6, 11). Paragraph 83 of the guidelines allows the use of three methods of recording TKR in terms of purchases. The company is instructed to choose one of the methods below and include it in the accounting policy of the enterprise.

- The 15th account “Procurement and acquisition of materials” is used for reflection.

In addition to the mentioned 15th account, with this method and when applying accounting prices, the 16th account “Deviation in the cost of material assets” is also used. Reference prices can be taken from the following categories:

- negotiated prices (they should not take into account associated costs for procurement and delivery);

- prices in force in previous periods;

- planned prices;

- average prices valid for a certain group of inventories.

In order to show what records are made when materials are received and written off, we will draw up the following table:

| The essence of the recording | Dt | CT |

| We record the cost of materials received based on the primary documents received from the partner (at purchase prices) | 15 | 60, 71, 76 |

| We record the technical requirements based on the primary documents received from the supplier (clause 85 of the guidelines) | 15 | 60, 71, 76 |

| We receive materials using discount prices | 10 | 15 |

| We write off the amount formed as a positive difference between the actual price and the accounting price | 16 | 15 |

| If a negative difference is formed, the entry will be reversed | 15 | 16 |

| We record the write-off of materials for production using the accounting price | 20, 23 | 10 |

| We record the difference between the actual and accounting value of the inventories transferred to the buyer, if this difference is positive. Otherwise, the same posting is reversed. | 20, 23 | 16 |

When forming the above table, in addition to those already described, the following accounts were used:

- 10th - “Materials”;

- 20th - “Main production”;

- 23rd - “Auxiliary production”;

- 60th - “Settlements with suppliers and contractors”;

- 71st - “Settlements with accountable persons”;

- 76th - “Settlements with various debtors and creditors.”

Paragraph 87 of the guidelines provides formulas used to calculate the percentage of write-offs of price deviations. The calculation procedure is as follows:

K = (Off0 + Off1) / (M0 + M1) × 100,

Where

K is the size of the deviation as a percentage;

Deviation0 - the size of the deviation at the beginning of the month (remainder);

Off1 - the size of the deviation accumulated during the month;

M0 - volume of materials at the beginning of the month in accounting prices;

M1 - volume of materials received during the month at accounting prices.

Off2 = K × M2,

Where

Off2 - the size of deviations that can be written off as expenses;

M2 is the volume of materials at accounting prices, which is written off as expenses.

- For reflection, a special sub-account is used on the 10th account “Materials”.

For such circumstances, we present the following tabular form for the records:

| The essence of the recording | Dt | CT |

| We reflect the cost of materials at purchase prices based on primary documents from the partner | 10 | 60, 71, 76 |

| We reflect the technical requirements on the basis of primary documents from the partner (clause 85 of the guidelines) | 10, sub-account “TZR” | 60, 71, 76 |

| We write off materials for production | 20, 23 | 10 |

| We write off inventory items in proportion to the cost of materials generated at the end of the month | 20, 23 | 10, sub-account “TZR” |

The above formulas can also be applied in this case. In this case, the selected calculation method should be approved in the accounting policy.

- TZR are directly included in the actual cost of materials.

This method is available only to those companies whose list of materials used is small and there are groups of materials that occupy a predominant volume in their total quantity. In other words, if the TRP falls on such inventories, then such expenses will be included in the cost of a unit of material.

Also look for information on materials accounting in the article “Accounting entries for materials accounting.”

How to take into account transport costs in tax accounting, see ConsultantPlus. Get free trial access to the system and go to the Ready-made solution.

Concept and types of services

Services are a type of activity that does not have a material expression, the results of which are sold and consumed in the process of economic activity of the enterprise (Clause 5 of Article 38 of the Tax Code of the Russian Federation).

Services exist in a wide variety, in particular:

- informational;

- audit;

- transport;

- storage;

- consulting;

- real estate agents;

- communications;

- training, etc.

In accounting, all services are included in costs based on primary accounting documents.

The main primary documents confirming the execution of services are:

- Agreement.

- Certificate of completion of work or other document confirming acceptance of services.

IMPORTANT! The Ministry of Finance believes that if the agreement does not provide for a clause on drawing up an act, then it needs to be drawn up only in cases provided for by law (letter dated November 13, 2009 No. 03-03-06/1/750). The Civil Code obliges to draw up an act confirming the acceptance of work only in the case of a construction contract (Article 720 of the Civil Code of the Russian Federation).

The procedure for concluding and terms of the contract for the provision of services are regulated by Ch. 37–41, 47–49, 51, 52 Civil Code of the Russian Federation. The main actors in the contract are the contractor and the customer of the services. Let's look at the accounting procedures for each of them.

Accounting for services from the contractor

The contractor's accounting directly depends on the type of activity and taxation regime. Most often, companies providing services in order to reduce the tax burden choose special regimes: UTII or simplified tax system. Along with them, OSNO can also be used.

- Income accounting.

Revenue from services provided is income from ordinary activities. The procedure for its accounting is regulated by clause 5 of PBU 9/99.

Postings from the contractor when selling services will be as follows:

- Dt 62 Kt 90.1 - reflects the sale of services.

- Dt 90.3 Kt 68 - VAT charged.

- Dt 90.2 Kt 20 (23, 25, 26, 43) - the cost of services provided is written off.

- Dt 50 (51) Kt 62 - services paid for by the customer.

- Cost accounting.

Cost accounting for companies engaged in the provision of services has its own specifics, since it depends on the specific type of activity. If a company is engaged in the provision of services that do not require material investments (for example, information, auditing or the like), then all costs are collected in the debit of account 20 “Production expenses” (clause 5 of PBU 10/99).

Consider, for example, training services. The main costs are salaries of employees, calculation of taxes and contributions, depreciation, etc. That is, to provide these services, the organization does not spend material assets on the production of any objects. At the end of the month, its costs are written off to the cost of sales by posting Dt 90.2 Kt 20.

If the company provides services and at the same time produces some material assets, then cost accounting is organized using accounts 20 “Production expenses”, 26 “General expenses” to account for management costs, and, if necessary, the 25th account “General production expenses” is used. expenses". Produced objects are accounted for on account 43 “Finished products”.

Example

Modern LLC provides outdoor advertising services. Assorted LLC ordered a banner for the store. The amount under the contract was 38,335 rubles. (including VAT RUB 5,847.71).

Postings in the accounting of Modern LLC:

- Dt 51 Kt 62 — 38,335 rub. — payment was received from Assorti LLC.

- Dt 62 Kt 90.1 — 38,335 rub. — sales of services are reflected.

- Dt 90.3 Kt 68 - 5,847.71 rub. — VAT is allocated.

Materials in the amount of 17,342 rubles were spent on the production of the banner. (excluding VAT). The remuneration of employees amounted to 8,500 rubles, contributions from the payroll - 2,805 rubles.

Postings:

- Dt 20 Kt 10 - 17,432 rub. — materials for making the banner were written off;

- Dt 20 Kt 70 - 8,500 rub. — wages accrued to employees;

- Dt 20 Kt 69 - 2,805 rub. — contributions from the payroll are calculated.

According to the accounting policy, Modern LLC keeps records of finished products at actual cost.

- Dt 43 Kt 20 - 28,737 rub. (17,432 + 8,500 + 2,805) - the banner was made at the actual cost.

- Dt 90.2 Kt 43 - 28,737 rub. — the cost of services is written off.

Do you want to know what risks the contractor may have when concluding a contract for the provision of paid services? Sign up for a free trial access to the ConsultantPlus system and proceed to the Guide to Contractual Work.

Accounting for services from the customer

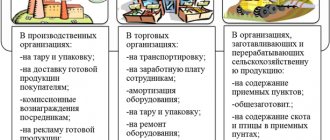

Services are expenses of the customer enterprise and are most often included in expense accounts 20 (23, 25, 26, 44).

Let's continue the example

The accountant of Assorti LLC will make the following entries in the accounting:

- Dt 60 Kt 51 - 38,335 rub. - paid for advertising.

- Dt 44 Kt 60 — 32,487.29 rub. — advertising costs are taken into account.

- Dt 19 Kt 60 — 5,847.71 rub. — input VAT is taken into account.

However, some services may increase the cost of purchased goods or fixed assets (clause 6 of PBU 5/01, clause 8 of PBU /01), for example, transport or information services. In this case, they are reflected as follows:

- Dt 08 (10, 41) Kt 60 - the cost of fixed assets (inventory, goods and materials) has been increased by the amount of transport or other services to be included in the price.

For the procedure for forming the cost of fixed assets and inventory items, see the articles:

- “01 account in accounting (nuances)”;

- “What transactions reflect transportation costs?”

Do you want to know what risks a customer may have when concluding a contract for paid services? Sign up for a free trial access to the ConsultantPlus system and proceed to the Guide to Contractual Work.

TZR when purchasing goods

When purchasing goods, appropriate transportation costs can also be taken into account in different ways, which depend on what kind of activity the company is engaged in.

Thus, trading companies are allowed to choose an accounting method from the following list:

- TZR are included in the cost of goods (clause 6 of PBU 5/01): Dt 41, subaccount “TZR” Kt 60.

If account 15 “Procurement and acquisition of material assets” is used to record goods, then the entry will be as follows: Dt 15 Kt 60.

- TZR are included in the costs of selling goods (clause 13 of PBU 5/01), with the following costs:

- are scattered between those goods that are sold and those that remain in the warehouse (in the description of account 44, chart of accounts approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n),

- written off to cost in full: Dt 44 Kt 60.

At the end of the month, sales-related expenses can be written off to cost. The entry will be as follows: Dt 90, subaccount “Sale expenses” Kt 44.

The chosen accounting method must be included in the accounting policy of the enterprise.

In the above entries, in addition to those already mentioned, the following accounts are given:

- 02nd - “Depreciation”,

- 41st - “Goods”,

- 44th - “Sales expenses”,

- 70th - “Settlements with personnel regarding wages”,

- 69th - “Calculations for social insurance and security”,

- 90th - “Sales”.

If a partial write-off is used, then the accounting policy will need to include a method that the company will use when dividing inventory between goods sold and those that remained stored in the warehouse. The regulations do not provide guidance on which method to choose in different circumstances. That is, companies are free to choose it themselves.

However, you can get your bearings using the formula given in Art. 320 Tax Code of the Russian Federation:

K = (TP0 + TR1) / (T1 + T2) × 100,

Where

K is the average percentage of goods and materials that fell on inventory balances at the end of the month;

TP0 - transport costs, which correspond to unsold inventory balances at the beginning of the month;

TP1 - transport costs incurred in the current month;

T1 - the cost of goods that have already been purchased and sold in the current month;

T2 - the cost of goods that were purchased but not sold at the end of the month.

TP2 = K × T2,

Where

TP2 - transport costs that fell on unsold inventory balances at the end of the month;

T2 - the cost of goods that have already been purchased but not sold at the end of the month.

Non-trading organizations have the right to take into account transportation costs as sales expenses. This definition is contained in paragraph 227 of the guidelines for accounting for inventories, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n. Non-trading organizations should be considered those companies that, in addition to trading operations, carry out other types of economic activities.

Companies included in this category have the right to choose whether to spread costs between the cost of goods already sold and inventory balances. However, there are also some recommendations in this regard, contained in paragraph 228 of the guidelines. It is proposed to distribute expenses if:

- TZR exceed 10% of sales revenue,

- TZR is uneven throughout the year.

In addition, TZR are also taken into account in the actual cost of acquired fixed assets, as read in the article “Rules for keeping records of investments in non-current assets.”

Primary documents for accounting services

In tax accounting, services are also included in costs and reduce taxable profit, subject to economic justification and the availability of primary accounting documents (Article 252 of the Tax Code of the Russian Federation). The exception is standardized expenses, when only part of the costs according to the rate specified in tax legislation is included in the base when calculating profits.

As noted above, most often, to confirm the fact that the service has been provided, a certificate of completion of work is drawn up. The form of the act is not contained in the album of unified forms (with the exception of the KS-2 form); it is developed and agreed upon by the parties to the agreement independently, taking into account the conditions of each specific transaction. In this case, the form must contain the mandatory details listed in Art. 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ:

- Name and date of the document.

- The name of the company that prepared the document.

- The name of the work performed, indicating the cost and quantitative characteristics.

- Signatures of the parties indicating the positions and names of the signatories.

For a sample of filling out the acceptance certificate for completed work, see the material “Acceptance certificate for completed work - sample.”

The fact of provision of construction services is confirmed by an act in the KS-2 form.

The algorithm for filling out this document is given in the article “Acceptance certificate for completed construction work - sample”.

When providing transport services by a carrier company, in addition to the work completion certificate, there must be transport documents. Such documents, in particular, include invoices.

IMPORTANT! Since 2013, unified forms are not mandatory for use; organizations have the right to develop them independently.

The procedure for accounting for transportation costs is described in detail in the publication “Transportation costs are charged to the buyer’s account - posting.”

Results

Accounting for services is based on accounting standards. The accounting methodology is specific and depends on the specific type of activity of the performing company. Revenue from the provision of services is included in income from ordinary activities. Expenses are recorded as costs from normal activities in cost accounts. In the production of material assets necessary for the performance of services, finished product release account 43 is used.

For the customer, the cost of services is recognized as an expense and is charged either to cost accounts or to an increase in the purchase price of assets for which these services are related.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

To what account should the services of a third party be attributed?

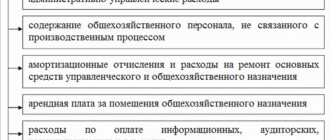

Quote:Account 26 “General expenses” is intended to summarize information on expenses for management needs not directly related to the production process. In particular, the following expenses may be reflected in this account: administrative and management expenses; maintenance of general business personnel not related to the production process; depreciation charges and expenses for repairs of fixed assets for management and general economic purposes; rent for general business premises; expenses for payment of information, auditing, consulting, etc. services; other administrative expenses similar in purpose. General business expenses are reflected in account 26 “General business expenses” from the credit of accounts for accounting for inventories, settlements with employees for wages, settlements with other organizations (individuals), etc. Expenses recorded in account 26 “General business expenses” are written off, in particular, to the debit of accounts 20 “Main production”, 23 “Auxiliary production” (if auxiliary production produced products and work and provided services to the outside), 29 “Service production and farms” (if servicing production and farms performed work and services to the outside). These expenses can be written off as semi-fixed expenses to the debit of account 90 “Sales”. Organizations whose activities are not related to the production process (commission agents, agents, brokers, dealers, etc., except for organizations engaged in trading activities), use account 26 “General business expenses” to summarize information on the costs of conducting this activity. These organizations write off the amounts accumulated on account 26 “General business expenses” to the debit of account 90 “Sales”. Analytical accounting for account 26 “General business expenses” is carried out for each item of the relevant estimates, place of origin of costs, etc.