The UTII regime will cease to apply at the beginning of 2021, so now is the time to think about what to use instead. One of the areas of small business that operated on imputation was cargo transportation. Let's figure out which tax systems companies and entrepreneurs should consider as an alternative.

Prepare a UTII declaration for only 149 rubles

UTII and motor transport services: conditions of application

Subp.

5 p. 2 art. 346.26 of the Tax Code of the Russian Federation allows the use of imputation when providing motor transport services for the transportation of passengers and goods in cases where the number of vehicles available to the taxpayer intended for transportation does not exceed 20 units. Vehicles may be in his possession, use, possession or disposal. Is it possible to apply UTII for cargo transportation if some of the cars are rented from individuals, find out here.

You will find explanations from the Federal Tax Service on how to calculate the maximum number of vehicles for UTII here.

An organization providing cargo and passenger transportation must register and pay tax at its location, an entrepreneur - at its place of residence (Clause 2 of Article 246.28 of the Tax Code of the Russian Federation). The same principle applies when transportation services are provided in another city or region.

ConsultantPlus experts explained what nuances to consider when registering as a UTII payer for the transportation of passengers or cargo. If you don't already have access to the system, get a free trial online.

The use of the UTII regime is possible only if it is permitted by regional legislation. Thus, first of all, it is necessary to familiarize yourself with the laws of the region in order to find out whether a specific type of activity falls under UTII in a given area or not.

Attention! Starting from 2021, UTII is planned to be abolished throughout the Russian Federation. A number of regions have already abandoned the special regime. Read more about the cancellation of UTII here.

Other modes

In addition to the tax systems considered, there is a main one. However, it involves the payment of taxes, the rates of which are higher than under special regimes, and in most cases is unprofitable for cargo transportation.

Entrepreneurs additionally have the right to apply the NAP - a regime based on the payment of tax on professional income. There is no need to pay insurance premiums. However, this mode involves a lot of restrictions. For our example, the following are important:

- the income of an individual entrepreneur must fit within the limit of 2.4 million rubles per year;

- It is prohibited to hire workers.

So this mode cannot be applied to this example. Although, if an individual entrepreneur transports goods independently and has a small income, he may well consider NAP as a suitable system after the abolition of UTII from 2021. In this case, he will pay a tax at a rate of 6% on income received from organizations and individual entrepreneurs, and 4% from citizens.

Calculation of UTII: transport services (2020)

Let's consider the procedure for calculating the single tax on imputed income when providing services for the transportation of passengers and goods in 2021.

Read about the general procedure for calculating the tax base for the single tax on imputed income in this article.

1. At the first stage, the tax base is determined according to the formula given in Art. 346.29 Tax Code of the Russian Federation:

NB = BD × K1 × K2 × (FP1 + FP2 + FP3),

where: NB - tax base;

BD - basic profitability per month;

K1 is a deflator coefficient, the value of which is established annually by order of the Ministry of Economic Development;

K2 - correction factor, its value is established by local or municipal authorities;

Read more about coefficients K1 and K2 in the materials of the section “UTII Coefficients (K1, K2)”.

FP1, FP2, FP3 - values of the physical indicator in the 1st, 2nd and 3rd months of the quarter.

2. At the next stage, it is necessary to calculate the amount of single tax for the quarter using the formula:

UTII = NB × C,

where: NB - tax base;

C is the tax rate, according to Art. 346.31 of the Tax Code of the Russian Federation, for most regions it is equal to 15%, and the cities of Moscow, St. Petersburg and Sevastopol can now set it in the range from 7.5 to 15%.

It should be noted that when several types of activities are simultaneously conducted that fall under UTII, the above calculation of the single tax will be carried out for each type of activity (clause 2 of Article 346.29 of the Tax Code of the Russian Federation). The total amount of UTII for the tax period is derived by adding the results obtained.

3. At the last stage, the amount of tax to be paid to the budget is determined. To do this, the calculated tax amount must be reduced by the established percentage points. 2, 2.1 Art. 346.32 Tax deductions of the Russian Federation. These are:

- insurance contributions for social insurance (for compulsory health insurance, compulsory medical insurance, in case of temporary disability and in connection with maternity, against industrial accidents and occupational diseases);

This article talks about reducing UTII by the amount of mandatory insurance contributions..

- payment of temporary disability benefits to employees;

- payments under voluntary insurance contracts for employees in the event of their temporary disability (except for industrial accidents and occupational diseases).

These deductions can be applied by impostors who use the labor of hired workers. However, these deductions reduce the amount of tax by no more than 50% (paragraph 2, clause 2.1, article 346.32 of the Tax Code of the Russian Federation).

If an individual entrepreneur does not make payments to employees due to their absence, he has the right to reduce the tax by the amount of all fixed payments for compulsory health insurance and compulsory medical insurance (paragraph 3, clause 2.1, article 346.32 of the Tax Code of the Russian Federation). For individual entrepreneurs, such a reduction has no restrictions on the amount, i.e., the imputed tax can be reduced to zero.

Check whether you have correctly determined the amount of tax for transport services with the help of advice from ConsultantPlus. Get trial access to the system and proceed to the calculation example for free.

Attention! To simplify your tax calculation, use our UTII calculator. The calculator itself is here. And here you will read about how to use it correctly.

A real example of calculating taxes payable

To determine the optimal system for taxation of cargo transportation, we will calculate the tax base and possible amounts of taxes payable using a specific example.

Initial data:

- The legal form of the carrier is individual entrepreneur.

- Municipal entity - Rostov-on-Don.

- Activities: cargo transportation.

- Number of transport units – 12.

- Salaried employees – 3 people.

- Revenue income for 4 quarters. – 875,000 rub.

- Insurance premiums for employees were paid in Q4. 2021 – RUB 37,500

- When working for UTII, fixed contributions were paid in the 4th quarter. 2016 – 7,800 rub.

Table of calculations of tax payments paid for the reporting period:

| Tax amount | simplified tax system | UTII | PSN | |

| "Income" | "Income - expenses" | |||

| Tax rate taking into account the characteristics of the municipality | 6 % | 10% (Law No. 843-ZS of May 10, 2012) | 15%, DB = 6,000 per 1 car; K1 = 1.798, K2 = 1 | 6%, potential income for 12 cars = 3,832,000 Basis - Law No. 843-ZS of May 10, 2012. |

| Tax calculation | 875,000 x 6% = 52,500 – 26,250 (50% of the accrued tax amount) = 26,250 | (875,000 – 37,500) x 10% = 83,750 | 6,000 x 12 x 1.798 x 1 x 15% = 19,418.4 x 3 months. = 58,255.20 – 29,127.60 (50% of the accrued tax amount) = 29,127.60 – 7,800 = 21,327.60 | The calculation was made for 3 months, based on the patent validity period of 1 year. For 12 cars 57,480 = 3,832,000 x 6% / 12 x 3 |

| Total according to the applicable tax regime payable, in rubles. | 26 250 | 83 750 | 21 327,60 | 57 480 |

Calculation of UTII: basic profitability for transport services

In Art. 346.29 of the Tax Code of the Russian Federation defines basic profitability and provides its values for all types of activities falling under UTII.

So, basic profitability is a conditional income in rubles that can be obtained in 1 month from 1 physical indicator. The physical indicator, in turn, characterizes a specific type of activity in various comparable conditions. Both of these indicators are used to calculate UTII.

Thus, when calculating UTII for transport services for the transportation of passengers, the basic profitability is 1,500 rubles. for one seat. The seat in this case will be a physical indicator.

How to determine the number of seats for calculating UTII, read the ready-made solution ConsultantPlus.

When providing cargo transportation services, the basic profitability is 6,000 rubles. from each vehicle - a physical indicator for this type of activity.

If the imputed person provides services for repair, maintenance and washing of vehicles, then when calculating the tax, he needs to use the value of the basic profitability equal to 12,000 rubles. per person, for everyone involved in this activity, including the individual entrepreneur himself.

Find the full base yield table here.

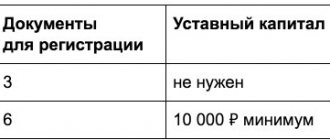

Features of acquiring a patent

To participate in the patent taxation system, a patent must be purchased at the place of registration of the business. It is purchased for a period of 1 month to 1 year. Conditions that an individual entrepreneur must meet to be able to purchase a patent:

- the number of employees in the PSN part is up to 15 people;

- total revenue for the period of activity on the patent – up to 60 million rubles;

- the area of the premises occupied by the business is no more than 50 m2.

Features of PSN:

- inability to reduce the cost of payment;

- the need to keep records of KUDiR separately for each area;

- Each area of activity requires a separate patent.

UTII regime for vehicle repair, maintenance and washing

Subp. 3 p. 2 art. 346.26 of the Tax Code of the Russian Federation classifies the provision of services for repair, maintenance and washing of motor vehicles as falling under UTII. These services for the purposes of applying UTII in accordance with paragraph. 9 tbsp. 346.27 of the Tax Code of the Russian Federation include:

- Services provided for a fee to individuals and legal entities - code 45.2 according to OKVED 2 OK 029-2014 (NACE rev. 2), approved. by order of Rosstandart dated January 31, 2014 No. 14-st).

- Services, also provided for a fee, for technical inspection of vehicles for the purpose of their admission to participation in road traffic (mandatory state technical inspection) - code 71.20.5 according to OKVED 2.

It is impossible to apply UTII in accordance with paragraph. 9 tbsp. 346.27 of the Tax Code of the Russian Federation when providing services:

- for refueling vehicles;

- warranty repairs and maintenance;

- storage of vehicles in paid and impounded parking lots.

But the Ministry of Finance and the courts are still arguing about the possibility of using UTII when renting out a vehicle with a crew. In what cases judges and officials allow the use of a special regime, find out from the Tax Guide. To do this, get trial access to ConsultantPlus for free.

Does the entrepreneur pay?

The obligation to pay transport duty lies with all owners of cars and other vehicles. Who the owner is - a legal entity or an individual - does not matter (paragraph 1, article 357 of the Tax Code of the Russian Federation). Individual entrepreneurs also pay a fee to the treasury for the use of a vehicle. These obligations are not affected by the tax system:

- regular;

- patent;

- simplified tax system;

- UTII.

Important! If the vehicle was transferred for use by power of attorney before July 29, 2002, then the taxpayer is considered to be the person indicated in the document. It is the company that is obliged to pay the tax duty for owning a vehicle.

For 2021, taxpayers are considered to be the owners of vehicles on which tax must be paid. Such objects include:

- cars, motorcycles, buses;

- water transport (yachts, boats, etc.);

- air (helicopters, airplanes).

You can be exempt from tax if the individual entrepreneur’s vehicle does not fall under the criteria for the object of taxation (clause 2 of article 358 of the Tax Code of the Russian Federation). There is no need to pay for:

- Certain types of water transport (weak boats, fishing vessels, vessels for passenger and cargo transportation, etc.).

- Passenger cars equipped for disabled people.

- Agricultural transport.

- Air ambulances.

A complete list of objects is presented in the Tax Code (clause 2 of Article 358 of the Tax Code of the Russian Federation).

Results

So, in 2021 UTII applies to services for the transportation of passengers and cargo, as well as technical inspection services. When switching to a special regime for motor transport services, you need to take into account local legislation and the number of vehicles, as well as know the value of the physical indicator for the corresponding type of activity.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

conclusions

Given the specified initial data, including the region of operation, UTII becomes the most optimal regime for entrepreneurs. Additionally, when calculating the imputed tax, fixed payments are taken as reducing amounts, paid by the individual entrepreneur “for himself” at the established rates.

Allows you to reduce the tax burden on the company and the use of the simplified tax system “income”. In case of in-depth miscalculations, the use of a patent and the simplified tax system “income-expenses” turns out to be unprofitable.

In terms of creating records and reflecting business transactions, entrepreneurs enjoy an advantage, since by law they are exempt from the need to conduct accounting.

Legal entity companies can use a simplified accounting methodology with the submission of mandatory reports according to a shortened list. As for the above calculations, they are valid not only for individual entrepreneurs, but also for organizations.

Simplified system

The use of the simplified tax system is justified in the absence of agreements with clients paying VAT.

Positive aspects of using the simplified tax system:

- Possibility to apply one of two simplified accounting schemes - “income” or “income minus expenses”. The change of type is carried out from the beginning of the new tax period. Which form is better to choose and how much you need to pay to the budget is determined in the course of practical activities.

- The minimum number of required accounting forms.

- Possibility of tax reduction if assessed contributions to the Pension Fund are paid.

Negative aspects of using the simplified tax system:

- There are restrictions on revenue and staffing levels.

- Application of another type of taxation is possible only from the beginning of a new tax year.

For transport services within the framework of the simplified tax system, the “income” taxation scheme is often used. If the expense part is minimal, the use of this type of accounting is justified. An entrepreneur can determine exactly how much taxes must be paid and has the right not to pay the expenditure side of taxation. With a minimum tax, the system allows you to have a reduced staff of service personnel.

Does the individual entrepreneur pay transport tax?

Often, in their business activities, businessmen use their own transport. In this case, who is obliged to pay the TN state – an entrepreneur or a citizen? To understand the issue, you need to carefully study the registration documents for the object. Since when registering a car, the certificate indicates an individual and not an individual entrepreneur, an ordinary person also becomes a taxpayer. Consequently, the entrepreneur pays property taxes, including transport and land taxes, on behalf of the citizen, without indicating the legal status of the individual entrepreneur.

Conclusion - we looked at how transport tax is paid by legal entities in accordance with legal requirements. To remain a bona fide taxpayer, an organization must independently calculate and pay the car tax according to the rates and deadlines accepted in the region. In case of violations of regulations, administrative and tax penalties may be applied to the enterprise.