Reflecting transactions with penalty amounts in the accounting of government institutions has its own characteristics depending on their type and traditionally raises many questions among accountants.

No time to read? Cheat sheet on the contents of the article:

- What is the difference between the concepts of “forfeit”, “fine” and “penalty”

- What legislation regulates the payment of penalties?

- 3 ways to collect penalties

- What transactions should be used to charge penalties to state-owned, budgetary and autonomous institutions?

- What indicators are reflected in the reporting forms?

We charge penalties in 2021 for a budgetary institution

Having considered the issue, we came to the following conclusion: Any penalties, fines and other sanctions transferred to budgets (extra-budgetary funds) can be taken into account by public sector organizations on account 0 303 05 000 “Settlements for other payments to the budget” with attribution to account 0 401 20 200 “Expenses of an economic entity.”

The amount of money reimbursed by the guilty person should be considered as compensation for the institution’s costs, to be reflected in account 0 209 34 000 “Calculations for compensation of costs.” Rationale for the conclusion: In accordance with paragraphs. 4 paragraphs 1 art. 23 of the Tax Code (hereinafter referred to as the Tax Code of the Russian Federation), taxpayers are required to submit tax returns (calculations) to the tax authority at their place of registration. According to Part 1 of Art. 119 of the Tax Code of the Russian Federation, failure to submit a declaration (calculation of insurance premiums) to the tax authority at the place of registration within the prescribed period entails a fine in the prescribed amount. In accordance with paragraph 1 of Art. 75 of the Tax Code of the Russian Federation, penalties are recognized as the amount of money established by this article, which the taxpayer must pay in the event of payment of due amounts of taxes or fees later than the deadlines established by the legislation on taxes and fees. Thus, the obligation to pay penalties and fines arises specifically from the taxpayer - the budgetary institution. Reflection in the accounting of transactions for the acceptance of such obligations, as well as their fulfillment, cannot be linked to the reimbursement of any funds from individuals or legal entities. In accordance with the Instructions approved by Order of the Ministry of Finance of Russia dated 01.07.2021 N 65n (hereinafter referred to as Instructions N 65n), expenses for payment of fines and penalties (including for late payment of taxes (contributions)) are reflected in CVR 853 “Payment of other payments” in connection with Article 290 “Other expenses” of KOSGU. From 01/01/2021, this article of KOSGU is detailed by subarticles of KOSGU 291-296. Thus, the costs of paying penalties, fines for violation of the legislation on taxes and fees, legislation on insurance premiums are included in subsection 292 of KOSGU * (1). Calculations for the transfer of penalties and fines to the budget can be taken into account by public sector organizations on account 0 303 05 000 “Settlements for other payments to the budget” * (2). Expenses associated with the payment of penalties and fines accounted for on account 0 303 05 000 are not included in the cost of products (works, services), but are charged to the financial result of the institution - to account 0 401 20 200 “Expenses of an economic entity” (paragraph 8 p 131 Instructions for the application of the chart of accounts for accounting of budgetary institutions, approved by Order of the Ministry of Finance of Russia dated December 16, 2021 N 174n, hereinafter referred to as Instruction N 174n). As a rule, judicial practice is based on the fact that payment of taxes and related penalties is the legal obligation of the organization and, accordingly, such expenses cannot be considered as direct actual damage. Therefore, making a decision to collect penalties from the guilty employees against the institution in the manner of holding them materially liable is inappropriate. However, this does not exclude the possibility of voluntary reimbursement by guilty persons of the institution’s expenses incurred in connection with the imposition of such penalties on the institution. We believe that in the situation under consideration, the amount of money reimbursed by the guilty person should be considered as compensation for the costs of the institution. Such revenues, according to Instructions No. 65n, must be reflected in accounting using subarticle 134 “Income from compensation of costs” of KOSGU. This KOSGU code corresponds to account 0 209 34 000 “Calculations for compensation of costs” (clauses 108, 109 of Instruction No. 174n). As a general rule, budgetary institutions reflect the accrual of any income on the debit of account 209 00 and the credit of account 401 10 only using the financial security code “2” - income-generating activity (letter of the Ministry of Finance of Russia dated November 9, 2021 N 02-06-10/65506). This accounting procedure does not prevent the organization from making an independent decision: - on the allocation of funds for expenses related to the implementation of government tasks; — on the transfer of received funds to budget revenues. Thus, in the situation under consideration, the following correspondence accounts can be reflected in the accounting of a budgetary institution: 1. Debit 4,401 20,292 Credit 4,303 05,730 - penalties and fines were accrued based on the request of the tax authority; 2. Debit 4,303 05,830 Credit 4,201 11,610 Increase in off-balance sheet account 18 (KVR 853, KOSGU 292) - penalties and fines paid; 3. Debit 2,209 34,560 Credit 2,401 10,134 - accrued income from compensation of expenses of the institution; 4. Debit 2,201 11,510 Credit 2,209 34,660 Increase in off-balance sheet account 17 (AnKVD 130, KOSGU 134) - funds voluntarily contributed by the guilty person were credited to the personal account.

How to calculate and reflect in accounting a penalty under a government contract

For a customer - a budgetary institution, penalties must be reflected in income-generating activities, regardless of the source of financing under the contract (subsidy, targeted funds, subvention, etc.). Accounting records in the event of receipt of collection amounts from the supplier will have the following form (clause 72, clause 93 of Instruction No. 174n, Instruction No. 175n):

What is a penalty under contract 44-FZ

Thus, a penalty under 44-FZ is understood as the amount of penalties established by contractual relations, which participants in procurement procedures are required to transfer to each other in case of violation of the essential terms of a government contract. At the same time, according to Art. 332 of the Civil Code of the Russian Federation, the party that violated its obligations and is found guilty pays a fine in an amount proportional to the cost of goods, work or services, even if this provision was not specified in the contract.

The transfer of funds for the penalty reflected on the personal account with code 21 to the personal account with code 20 is reflected in accounting with the execution of an accounting certificate f. These operations when filling out reports on the institution’s implementation of its financial and economic activity plan f. The explanations given in the letter regarding budgetary institutions, in the author’s opinion, can be extended to autonomous institutions. Let us consider, using examples, the procedure for reflecting in accounting transactions for the acceptance and fulfillment of obligations assumed under a civil contract, the source of financial support of which is a subsidy for another purpose, as well as transactions for presenting claims for the payment of penalties, fines and the fulfillment of these requirements.

Accrual of penalties for transactions with a budgetary institution in 2021

If penalty payments are assessed by the company independently, then they must be reflected on the date of calculation and payment to the budget. When accruing based on the results of an audit, they should be reflected on the date the audit decision came into force. Accounting for settlements with the budget for taxes is organized, in accordance with the chart of accounts, on account 68. If penalties are accrued on contributions, accounting entries are reflected on account 69. For the convenience of monitoring the accrual and payment of penalties for tax payments, their analytical accounting should be organized in the context relevant taxes. For example, when calculating penalties for VAT, transactions must be reflected in the subaccount of account 68, opened to record the accrual of this tax.

We recommend reading: At what age should a child apply for maternity capital?

But this standard does not determine the procedure for displaying tax sanctions, including penalties. Some explanations from representatives of the Ministry of Finance of the Russian Federation boil down to the fact that penalties should be displayed on account 0.303.05.000, relating to settlements with the budget for other payments. This is explained by the fact that penalties cannot be considered taxes or other mandatory fees; they should be classified as other payments paid to the budget. In order to maintain separate accounting in relation to tax sanctions and other payments due for payment to the budget, it is rational to open a sub-account to account 0.303.05.000. Postings for accrual of penalties for taxes in budget accounting are made as follows: Dt 0.401.20.290 Kt 0.303.05.730 subaccount “Penies” Whatever method is chosen by the organization, it must be fixed in the accounting policy of the enterprise. As a rule, the choice of method is determined by the qualifications and experience of the accountant.

Accounting entries in government institutions penalties

The emergence of obligations to pay a penalty, its accrual, as well as the determination of the procedure for fulfilling the monetary obligation of an institution under a state contract can be made on the basis of an act of acceptance of goods, work, services or other document provided for by business customs, in which information about the fulfillment of the obligation by the contractor must be indicated , on the accepted results of contract execution, including the amount of penalties, fines Letter from the Ministry of Finance of the Russian Federation dated In this case, it is necessary to indicate the reason for making changes in text form and attach a document confirming the decision made in the form of an electronic copy created by scanning Letter from the Federal Treasury from Procedure for settlements with executor In this section we will consider the procedure for settlement of institutions with executors within the framework of concluded contacts of civil contracts.

Calculation of penalties in a government posting institution

My profile Favorites Billing Personal blog. OFD Opinions User Agreement Rules for the use of materials. Source: Journal » Institutions of physical culture and sports: accounting and taxation » State municipal contracts, as well as civil contracts, provide for conditions on the liability of the supplier of the contractor, the contractor for non-fulfillment or improper fulfillment of obligations and on the payment of penalties in favor of the institutions.

We recommend reading: Benefits for children of war in Barnaul

In accordance with the Chart of Accounts (Order of the Ministry of Finance dated October 31, 2000 No. 94n), the amounts of tax penalties due are reflected in the debit of account 99 “Profits and losses” in correspondence with the account for accounting settlements with the budget for taxes.

Calculation of penalties under a contract in a budgetary institution

According to paragraph 6 of Rules No. 1063, for each day of delay, the supplier (performer, contractor) is charged a penalty in the amount of at least 1/300 of the key rate of the contract price. The rate is taken on the date of payment of penalties (as in the case of the customer). And the contract price should be reduced by an amount proportional to the volume of obligations that the counterparty actually fulfilled. The amount of sanctions for the supplier is determined according to the Rules approved by Decree of the Government of the Russian Federation of November 25, 2021 No. 1063 (Rules No. 1063). To calculate the amount, formulas from Rules No. 1063 are used. In this case, it is necessary to take into account Decree of the Government of the Russian Federation of December 8, 2021 No. 1340 (hereinafter referred to as Resolution No. 1340). It says that for relations regulated by acts of the Government of the Russian Federation in which the refinancing rate of the Central Bank of the Russian Federation is used, from January 1, 2021 it is necessary to apply not it, but the key rate, unless otherwise provided by federal law.

For a long time, the refinancing rate remained at 8.25 percent per annum (Instruction of the Central Bank of the Russian Federation dated September 13, 2021 No. 2873-U). However, starting from 2021, it has been equated to a key one. As a result, the refinancing rate has lost its former meaning and is now only a formal value that appears in many legislative acts. Let's find out how the accrual of penalties will change in connection with these innovations. The contract system is based on the provisions of the Civil Code of the Russian Federation. This is stated in Part 1 of Article 2 of Federal Law No. 44-FZ of April 5, 2021 (hereinafter referred to as Law No. 44-FZ). Thus, a contract is understood as a civil agreement, which can be concluded, among other things, by a budgetary institution in accordance with parts 1, 4 and 5 of Article 15 of Law No. 44-FZ. And one of the mandatory conditions of contractual relations is the liability of counterparties for non-fulfillment or improper fulfillment of obligations (Part 4, Article 34 of Law No. 44-FZ).

Accrual of penalties for postings in budget accounting

If the penalty to be paid is clearly disproportionate to the consequences of the violation of the obligation, then the debtor has the right through the court to demand its reduction. How to apply a penalty for late payment A penalty is an amount of money, determined by agreement or law, that the debtor is obliged to pay to the creditor in the event of non-fulfillment or improper fulfillment of its obligations. For example, in the event of a delay in payment for goods received, p. The penalty due to the organization for the buyer’s delay in payment under the contract is recognized as other income and is taken into account in the amount recognized by the debtor in the reporting period in which the debtor agreed with it.

How will the accrual of penalties for late utility payments change in 2021?

For an individual - that is, for the majority of consumers of utility services - the amount of the penalty will depend on exactly how many days the payment was not made. Previously, it was like this: penalties were accrued if you did not pay by the 10th day of the month following the month of accrual. Now the following scheme applies:

We recommend reading: Standard service life of structural elements

As is known, in addition to penalties, resource supply organizations have the right to limit or completely stop the supply of electricity, heat, water and gas. Of course, before cutting off a consumer from an energy resource, there will be several warnings.

Penalties: postings

The most common budget payments that an employing company faces are contributions to pension, health and social insurance. The deadline for their transfers is until the 15th day of the month following the billing month. Thus, this is a monthly payment, which due to various circumstances may be overdue. Penalties due to such delay are accrued based on the company's filing of quarterly reports. It contains data on accrued and paid amounts, therefore, the payee has the opportunity to compare the transfer dates and, if they are violated, the company is charged with penalties. Usually, if we are talking about a delay of 1-2 days, for example, due to inconsistencies in the work of the accounting department and the length of the banking day, then the amount of penalties will be quite insignificant.

Paying tax under the simplified tax system involves an advance system, that is, a company or individual entrepreneur is required to make settlements with the budget based on their own data, and quarterly, before April 25, July 25 and October 25. The final calculation for the year is made on the reporting deadline: for companies it is March 31, for individual entrepreneurs it is April 30. There is an opinion that such a situation makes it possible not to pay advances at all under the simplified tax system. But that's not true. They must be transferred within a strictly specified time frame, and delay, in turn, will lead to the accrual of penalties. Another question is that these sanctions will be imposed only after filing the annual declaration, that is, after the tax office learns about the amounts of accrued quarterly advance payments.

Calculation of Penalties Budgetary Institution 2021

PBU 9/99, Order of the Ministry of Finance dated October 31, 2021 No. 94n): Debit account 76 “Settlements with various debtors and creditors”, subaccount “Settlements on claims” - Credit account 91 “Other income and expenses” Administrative fine: accounting entries Thus, the accrued fine for violating traffic rules will correspond to the following accounting entry: Debit account 91 – Credit account 76 A similar entry will reflect the accrual of a fine by the labor inspectorate and other similar authorities. Consequently, payment of an administrative fine will be reflected as follows: Debit of account 76 – Credit of accounts 50 “Cash”, 51 “Cash accounts”, etc. A separate sub-account “Administrative fines” can be opened for account 76.

Having considered the issue, we came to the following conclusion: Any penalties, fines and other sanctions transferred to budgets (extra-budgetary funds) can be taken into account by public sector organizations on account 0 303 05 000 “Settlements for other payments to the budget” with attribution to account 0 401 20 200 “Expenses of an economic entity.” The amount of money reimbursed by the guilty person should be considered as compensation for the institution’s costs, to be reflected in account 0 209 34 000 “Calculations for compensation of costs.”

From what sources are penalties and fines paid by a budgetary institution?

Accrued debt for compensation of institution costs 2,209 30,560 2,401 10,130 20,000 Repaid debt for compensation of institution costs 2,201 11,510 2,209 30,660 20,000 [1] Instructions for the use of the Unified Chart of Accounts for public authorities (state bodies ), local government bodies, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions, approved. By Order of the Ministry of Finance of the Russian Federation dated December 1, 2010 No. 157n. [2] Instructions for the use of the Chart of Accounts for accounting of budgetary institutions, approved. By Order of the Ministry of Finance of the Russian Federation dated December 16, 2010 No. 174n. [3] Approved by Order of the Ministry of Finance of the Russian Federation dated July 1, 2013 No. 65n.

Repayment of obligations 4,302 xx 830 4,201 11,610 225 233 Settlements for obligations to the supplier to pay legal expenses (due to the fact that the institution pays these expenses on the basis of a court decision) are reflected according to the type of expenses code 831 in connection with Article 290 of KOSGU ( payment of state duty, compensation for losses) in accordance with the Instructions on the procedure for applying the budget classification of the Russian Federation[3]. These expenses do not form the cost of work (services) provided by the institution and are immediately written off as actual costs. Transactions are reflected in account 0 302 91 000 “Calculations for other expenses” (clauses 127 – 129 of Instruction No. 174n) in the amount of 9,767 rubles. (6,567 rub. + 3,200 rub.) as follows: Contents of transaction Debit Credit Amount, rub.

How to assess an administrative fine on transactions of a budgetary institution in 2021

Having considered the issue, we came to the following conclusion: Any penalties, fines and other sanctions transferred to budgets (extra-budgetary funds) can be taken into account by public sector organizations on account 0 303 05 000 “Settlements for other payments to the budget” with attribution to account 0 401 20 200 “Expenses of an economic entity.”

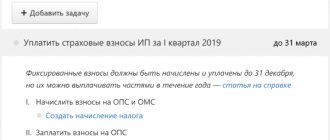

The tax authority imposed penalties on the budgetary institution for late payment of taxes (contributions, fees) and fines for failure to comply with deadlines for submitting tax returns (calculation of insurance premiums). Payment of the specified penalties and fines was carried out under subsection 292 of KOSGU at the expense of a subsidy for the state task. The violation of deadlines was due to the fault of the accounting employee, and he agrees to voluntarily reimburse the expenses incurred. How to reflect in accounting transactions for the payment of penalties and fines and their compensation by the guilty party?

Budget accounting entries with examples of basic transactions

Accounting in budgetary organizations has a number of features that differ from the accounting procedure in industrial and commercial enterprises. These include the availability of approved cost estimates and control of their execution, and the use of budget classification, which is the basis for organizing accounting in the institution.

Let’s imagine that a budgetary institution “Hospital” and LLC “Magnit” entered into an agreement for the supply of materials in the amount of 64,000 rubles, VAT 9,762 rubles. The contract provides for an advance payment of 20% of the cost of the goods, which was paid by the Hospital (RUB 12,800). The remaining part (RUB 51,200) was transferred to Slavutich LLC upon delivery of the goods.

Payment order for penalties in 2021 - 2021

So, the first difference is KBK (field 104). For tax penalties, there is always a budget classification code, in the 14th–17th digits of which the income subtype code is indicated - 2100. This code is associated with a significant change in filling out payment orders: from 2021, we no longer fill out field 110 “Payment Type” .

However, these changes did not affect accident insurance contributions, and penalties for them, as well as these contributions themselves, are still paid to social insurance. When paying both contributions and penalties to the Social Insurance Fund in fields 106 “Basis of payment”, 107 “Tax period”, 108 “Document number” and 109 “Date of document”, enter 0 (clauses 5, 6 of Appendix 4 to the order of the Ministry of Finance of Russia dated November 12, 2021 No. 107n). And if penalties are paid at the request of the fund and according to the inspection report, their details are given in the purpose of payment.

For the calculation and payment of transport tax

Correspondence of invoices: A budgetary institution purchased a vehicle and registered it with the traffic police on June 16, 2014. According to the technical documentation, the vehicle engine power is 132.39 kW. How to reflect the accrual and payment of transport tax for 2014 in the accounting of a budgetary institution? The reporting period is a quarter.

Correspondence of accounts: An autonomous institution has a passenger car with a capacity of 110 hp. With. In June, the institution replaced the engine of the said car with a new one with a capacity of 140 hp. With. The new engine was registered with the traffic police on 06/09/2011. How to reflect the accrual of transport tax for 2011 in the accounting of an autonomous institution? During the tax period, advance payments for transport tax are not made.

What are the fines for non-payment of personal income tax in 2021?

If tax inspectors reveal violations, the employer will have to pay 40% of the debt. But violators are often not afraid of this. Therefore, the issue of not only increasing penalties, but also other countermeasures is being resolved by law.

After committing an offense, the employer will need to pay a fine. It is calculated depending on certain circumstances. It is important to know the situations when additional funds cannot be withheld, as well as the powers of tax authorities in calculating such payments.

Penalties for late payment under a budget posting agreement

Penalties for taxes, fees and contributions are the amount of monetary punishment that the tax inspectorate imposes for late payments to the state budget. We will tell you in this material how to reflect these amounts in tax and accounting records.

Funds received by a budgetary institution in the form of penalties under contracts, which are the income of the budgetary institution, are subject to reflection on a personal account intended for accounting for transactions with funds of budgetary institutions, opened by the institution with the Federal Treasury (hereinafter referred to as the personal account with code 20), and are used by this budgetary institution in accordance with the plan of financial and economic activities. In accounting, complete the following entries: D. 506 10 XXX - K. 502 11 XXX - obligations have been accepted in the amount of the concluded contract for the supply of goods; D.

Postings for penalties for electricity in 2021 budgetary organization

Until 2021, control over the calculation of insurance premiums was carried out directly by extra-budgetary funds, and starting from January 1, 2021, these powers were transferred to the tax authorities. Now the transfer of contributions, as well as reporting on them, must be sent to the Federal Tax Service at the place of registration of the company. However, this in no way affects the accounting and postings that are compiled in the organization, and, therefore, the correspondence and rules for calculating contributions remain the same.

In accordance with the Instructions on the procedure for applying the budget classification of the Russian Federation, approved by Order of the Ministry of Finance of Russia dated December 21, 2021 N 180n, the costs of paying insurance contributions to the Pension Fund of the Russian Federation are included in subarticle 213 “Accruals for wage payments” of the KOSGU, the cost of paying penalties for late payment of insurance premiums are reflected by the budgetary institution under Article 290 “Other expenses” of KOSGU.

Write-off of penalty amounts

A decrease in the amount of accrued income when a penalty is written off on the grounds provided by the Government of the Russian Federation in accordance with the Instructions is reflected:

D-t (KDB) X

. 401.10 (174)

Kit (KDB) X

.

209.40. (560) or

(KDB)

X*

. 205.41. (560)

Where X is the source of financial support depending on the type of institution (1 – state-owned, 2 – budgetary, autonomous).

Account 401.10.174 “Lost income” was included in the Accounting Instructions by Order of the Ministry of Finance of the Russian Federation dated November 16, 2016 No. 209n (came into force on December 5, 2016).

How are penalties for non-payment of utility bills calculated and how to avoid them?

- From the 31st to the 90th day of non-payment of receipts, the fine will be 1/300 of the refinancing rate of the Central Bank of the Russian Federation (per day).

- From 91 days onwards, the penalty amount will increase to 1/130 of the refinancing rate of the Central Bank of the Russian Federation (per day).

We recommend reading: By what percentage were pensions increased in 2021 2021 2021

Another method, which is not officially established and does not always lead to the cancellation of penalties, is a personal appeal to the management company with a request to defer payments. Unfortunately, not all management companies do this for the sake of the residents.

Payment of penalties for non-fulfillment of contracts

Based on paragraphs 2 and 3 of Article 160.1 of the Budget Code of the Russian Federation, amounts of penalties, penalties, and fines accrued and received into budget revenue under a government contract (based on acts) are taken into account by administrators subordinate to the chief revenue administrator in accordance with the relevant legal act.

Budgetary institutions enter into civil contracts for their own needs. And the creditor in the obligations arising from civil contracts concluded by them as a result of placing an order becomes the budgetary institutions themselves. When paying for civil contracts, such an institution has the right to be guided by the provisions of Article 410 of the Civil Code of the Russian Federation, which provides for the possibility of terminating an obligation by offsetting a counterclaim of a similar nature that has become due.

New procedure for calculating penalties in 2021 using examples

It should be noted that this procedure for calculating penalties applies to arrears arising after October 1, 2021 (Clause 9, Article 13 of Federal Law No. 401-FZ of November 30, 2021). For debt that was formed earlier (before October 1, 2021), a different, “old” rule is provided. Penalties for companies are calculated based on 1/300 of the refinancing rate for each day of delay, regardless of its duration (Letter of the Ministry of Finance of Russia dated September 21, 2021 No. 03-02-07/1/60904).

If tax inspectors made a mistake in calculating penalties, then you should not remain silent. File a complaint. After all, tax inspectors do not have the right to charge penalties at a rate of 1/150 for debts that arose before October 1, 2021. The Federal Tax Service agrees with this (Decision on complaint dated 10/05/2021 No. SA-4-9/ [email protected] ).

Reflection in accounting of payment and accrual of penalties for insurance premiums

The procedure for reflecting the amounts of tax sanctions (penalties, fines) in budget accounting is not established by Instruction No. 162n. In private explanations, employees of the Russian Ministry of Finance (department of budget policy and methodology) indicate that tax sanctions (fines, fines) should be reflected in account 0.303.05.000 “Calculations for other payments to the budget.”* This is due to the fact that they are not taxes (fees), but refer to other payments credited to the budget.

Tax legislation separates the concepts of “penalty” and “fine”. A penalty is an amount of money that an institution must transfer to the budget in case of untimely fulfillment of the obligation to pay tax (clause 1 of Article 75 of the Tax Code of the Russian Federation). A fine is a tax sanction that is collected from an institution for a tax offense (Article 114 of the Tax Code of the Russian Federation).

How to calculate penalties on contributions in 2021 postings

Where to pay Insurance premiums, including penalties, are paid to the territorial tax office using the established details before the 15th day (inclusive) of the month following the reporting month. The exception is those months when the 15th of the calendar falls on a weekend, then the deadline will be the next working day.

We will talk about such a budget instrument as penalties for taxes and fees. Let's consider the concept of this term, let's name its main difference from a fine. The formula for calculating the amount of penalties for their independent calculation and current changes that came into force on October 1, 2021 will also be considered. Let's look at examples of calculating penalties for taxes and contributions, methods for accounting for penalties, as well as the nuances of tax accounting for penalties related to corporate income tax in 2021. In the article we will also talk about accounting entries when calculating penalties for taxes, and provide examples of calculations. The concept of a penalty, what is the difference from a fine Before starting a discussion of the entries and nuances of accounting and tax accounting for penalties, it is important to understand their semantic meaning.

Postings when accruing penalties under the contract

Contributions for penalties under an employment contract are generally always accrued (letter of the Ministry of Labor of Russia dated April 27, 2021 No. 17-4-OOG-701). Although in judicial practice there are also opposing positions (for example, Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 10, 2021 No. 11031/13). But strictly speaking, according to the letter of the law, contributions must be calculated and, in order to avoid legal disputes, it is recommended.

In both of these cases, personal income tax must be paid no later than the next day after the calculations are made (clause 6 of Article 226 of the Tax Code of the Russian Federation). Contributions, if any, are made, as usual, by the 15th day of the month following the date in which the payments were made.

Tax penalties: accounting entries

When calculating penalties in accounting, the entries may be different if we are not talking about a violation of tax laws, but about non-fulfillment of the terms of business agreements concluded between counterparties.

If an organization or individual entrepreneur does not pay its taxes on time, in addition to the overdue amount of debt, such taxpayers will have to pay penalties. A penalty is an amount of money that must be paid in excess of the amount of overdue taxes (Clause 1, Article 75 of the Tax Code of the Russian Federation). But it happens that the payment of penalties is also provided for in business contracts (for example, a purchase and sale agreement). We will tell you in our consultation what kind of entries are formed in accounting when calculating penalties.

We record income from penalties for violations of contract terms

Thus, the accrual of fines and penalties to the executor of the contract (agreement) for untimely and (or) improper fulfillment of its obligations in accordance with the terms of the concluded contract (agreement) is mandatory. Failure to perform such actions on the part of the customer is qualified by inspectors as a violation of the procurement of goods, works, and services.

Paragraph 36 of the FSBU “Conceptual Framework” establishes that for the purposes of accounting, the formation and public disclosure of accounting (financial) reporting indicators, an asset is property, including cash and non-cash funds, owned by the accounting entity and (or) in its use, controlled by it as a result of the facts of economic life that have occurred, from which useful potential or economic benefits are expected to flow. Receipts of cash or their equivalents to the accounting entity or in the course of the accounting entity exercising budgetary powers when executing the budget to the budget of the budget system of the Russian Federation, arising when using the asset independently or jointly with other assets, are recognized for accounting purposes as future economic benefits contained in the asset (p 38 FSBU “Conceptual basis”).

Which postings should be used to reflect penalties?

According to the current tax legislation, penalties are understood as payments that an institution must pay as security in the event of a delay in payment of its obligations (Clause 1, Article 72 of the Tax Code of the Russian Federation). Such a penalty is accrued if the organization has violated the deadline for paying a tax (including advance) payment, contribution, fee (clause 1 of Article 75 of the Tax Code of the Russian Federation).

Collections can also be carried out using account 91. However, when accounting through account 91 “Other income and expenses”, the enterprise will have tax obligations, since such expenses are not accepted for taxation (clauses 4, 7 of PBU 18/02).

KVR 851, 852 and 853: what it is and how to use it without violations

Institutions of all types, including budgetary ones, reflect codes of types of expenses (CVR) in 15-17 categories of account numbers, taking into account the exceptions provided for in the instructions for the use of institutional charts of accounts. In addition, the CVR is used to pay for expenses, so an error in applying the CVR can lead to the classification of the expense as non-targeted, as well as to distortion of the indicators of the reporting forms. In this article we will focus on how to apply without errors the elements of the CVR of subgroup 850 “Payment of taxes, fees and other payments”: CVR 851 “Payment of property tax of organizations and land tax”, 852 “Payment of other taxes, fees” and 853 “Payment other payments."

— payments to owners of animals and (or) livestock products seized by decisions of the highest executive bodies of state power of the constituent entities of the Russian Federation during the elimination of outbreaks of particularly dangerous animal diseases;

We charge penalties in 2021 for a budgetary institution

Svetlana, according to Instructions No. 65n, expenses associated with the payment of penalties for late payment for services provided are reflected in article 290 “Other expenses” of KOSGU. To account for settlements with suppliers for the amount of penalties, account 302.91 “Settlements for other expenses” is used. Moreover, in a situation where penalties under agreements (contracts) are accrued as the execution of judicial acts of the Russian Federation, settlement agreements, CVR 831 “Execution of judicial acts of the Russian Federation and settlement agreements on compensation for harm caused” is used to pay them. In case of voluntary payment of penalties under agreements (contracts) with suppliers, KVR 853 “Payment of other payments” is applied. It is advisable to write off such expenses immediately to the debit of account 401.20 “Other expenses”.

It is advisable to pay penalties and fines to budgetary institutions using funds from income-generating activities (KVD 2). However, current legislation does not directly prohibit the payment of economic sanctions using budget subsidies. At the same time, it should be understood that when such expenses are accrued and paid from subsidies, during control measures they can be classified, at a minimum, as ineffective.

We take into account penalties and fines in tax accounting and prepare entries

The instructions for using the chart of accounts establish that on account 99 it is necessary to take into account the “amounts of tax penalties due.” And penalties, according to the Tax Code of the Russian Federation, do not refer to tax sanctions (Chapter 15), but to methods of ensuring the fulfillment of obligations to pay taxes, fees, and insurance premiums (Chapter 11).

There are penalties that the buyer receives from the seller , for example, for untimely delivery of goods. Such fines and penalties are in no way related to the sale of products and services, and they definitely should not be included in the VAT tax base. This is confirmed by the letter of the Ministry of Finance of the Russian Federation dated 06/08/2015 No. 03-07-11/33051.

Accepted budgetary obligations - accounting entries

The full code of the budget accounting account is 26 digits. In practice, the first 17 digits are usually not reflected in accounting registers, since they are defined in the BCC list and therefore are the same for all transactions involving the expenditure of budgetary funds by institutions in a specific area of budgetary financing.

Accounting for accepted obligations in accounting registers: structure of accounts for postings

- includes a code of type 502, which reflects the fact that the institution has accepted its own financial obligations;

- includes code 12, which indicates that the financial liability relates to the current financial year.

Penalty is a term that has approximately the same meaning as interest on loans in a banking institution. But compared to any bank, penalties have a government background, expressed in their calculation using the refinancing rate. The amount of the penalty is 1/300 of the refinancing rate for each day, starting from the day following the last day of voluntary payment.

State institutions. From paragraph 13 of Art. 34 of Federal Law No. 44-FZ it follows that the contract must necessarily stipulate the terms and conditions of payment for goods, work or services, the procedure and terms for the customer to accept the goods delivered, the work performed (its results) or the service provided in terms of their compliance quantity, completeness, volume requirements established by the contract, as well as the procedure and timing for processing the results of this acceptance.

We recommend reading: Landlord describes property worth more than debt

The tax authority imposed penalties on the budgetary institution for late payment of taxes (contributions, fees) and fines for failure to comply with deadlines for submitting tax returns (calculation of insurance premiums)

When paying taxes, insurance premiums, and preparing reports, risks may arise that lead to the imposition of penalties and interest. How to reflect these transactions in accounting and generate accounting entries for calculating penalties for income taxes, VAT, personal income tax and insurance premiums will be discussed below.

The basis for transactions are documents confirming that the security remains with the institution:

- notification of clarification of client operations (f. 0531852) sent to OFC

- accounting certificate (f.0503833)

- crediting cash from the cash register: D-t (KRB) 1. 304.05 (ХХХ)

K-t (KIF) 1. 210.03.

(610) / 17.30 (610) or - crediting non-cash payments from the supplier (contractor): D-t (KRB) 1. 304.05 (ХХХ)*

K-t (KDB) 1. 209.40.

(560) or

(KDB) 1. 205.41.

(560) In “1C”: document “Cash Receipt”. - transfer of funds to budget revenue to your personal administrator account: D-t (KDB) 1. 210.02 (140) K-t (KRB) 1. 304.05 (ХХХ)* In “1C”: document “Application for cash expenses” or “ Cash receipts."

Where XXX depends on the codes by which payment is made under the contract.

Reflection of indicators in reporting forms

When choosing this calculation method, a government institution must take into account several factors:

- It is advisable to include in the contract a condition that the fulfillment of obligations to transfer the penalty to budget revenue is assigned to the state customer;

- transfer the penalty yourself to budget revenue (the name of the counterparty for whom the penalty is transferred should be indicated in the payment document);

- make changes to the indicators of the budget obligation taken into account by the FC body.

It should be noted that the Budget Code of the Russian Federation does not provide for the execution of the budget by income by offsetting expenditure obligations (Article 218 of the Budget Code of the Russian Federation).

The letter also states that if a budgetary institution has the right to present a penalty to the executor of an agreement concluded for the supply of goods, performance of work, provision of services for the needs of the institution (including within the framework of subsidies received for the implementation of a state (municipal) task), named funds are recognized as the institution’s own income and are subject to reflection within the framework of other income-generating activities (according to activity type code 2).

– at the expense of funds received when carrying out other income-generating activities from individuals, legal entities, including within the framework of the main types of activities provided for by its constituent document.

The emergence of an obligation to pay a penalty

Article 309 of the Civil Code of the Russian Federation provides that obligations must be fulfilled properly in accordance with the conditions and requirements of the law, other legal acts, and in the absence of such conditions and requirements - in accordance with business customs or other usually imposed requirements.

For such contracts, penalties are calculated in the amount of 1/130 of the refinancing rate for each day of delay (Clause 2 of Article 26 of the Electric Power Industry Law No. 35-FZ). Therefore, if the customer violates the terms of the contract, the supplier will impose a penalty.

We recommend reading: Child Benefit for Low-Income Families in 2021 Krasnoyarsk

Penalties are accrued under the contract (transaction entries will be presented below) if the parties are late in fulfilling their obligations under the contract, as well as in the event of improper fulfillment of contractual obligations (Parts 5, 6, Article 34 44-FZ). Thus, a penalty under 44-FZ is understood as the amount of penalties established by contractual relations

Which CVR and KOSGU should be used to apply interest for electricity?

Article 290 of KOSGU is detailed, and its use to reflect the expenses of an institution without the corresponding subarticles 291 - 296 of KOSGU is not allowed. According to Instructions No. 65n, Article 290 of KOSGU includes the following sub-articles: Sub-article of KOSGU Included expenses Including detail 291 “Taxes, duties and fees” Expenses for payment to budgets of all levels: – taxes (included in expenses); – state duties and fees; – various types of payments – VAT

Federal Law No. 402-FZ dated December 6, 2021 establishes a list of documents that should regulate the accounting procedure. According to its provisions, federal and industry standards are mandatory for application (Parts 1, 2 of Article 21 of this Law).

Budget accounting of fines for violation of the terms of the contract, posting 2021

An organization or individual entrepreneur on the OSN ─ the injured party ─ must include fines and penalties received from the counterparty as part of non-operating income in the event that they are recognized as a debtor or there is a court decision imposing a penalty that has entered into force (clause 3 of Art.

In some cases, it is possible that a previously accrued penalty must be written off by the customer institution. For example, as part of the anti-crisis measures taken by the Government of the Russian Federation, the obligation of institutions, under certain conditions, to write off the debt of suppliers (contractors) for penalties, penalties and fines was provided.