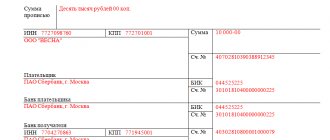

Payment

A company can make tax advances either quarterly or monthly. The specific order depends on:

Accounting 2 You can study this section only if you have

Accounting statements of small businesses - what applies to them? The composition of this reporting is for

We recommend downloading the 3-NDFL form in 2021 using the links that are given just

At the end of June, UTII payers submit a declaration and pay tax. However, in 2021

Concept and types of services Services are a type of activity that does not have material expression, the results of which

If there are no employees in the peasant farm, the calculation of insurance premiums is not submitted by the head of the peasant farm.

Home — Articles Returning goods is fraught with accounting difficulties. And everyone tries to avoid them.

Let's consider the features of calculating insurance premiums under civil law contracts (hereinafter referred to as GPC)

Almost everyone has at least once gone to the clinic to get a sick leave certificate, so that they can then take it