Accounting statements of small businesses - what applies to them?

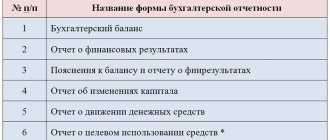

The composition of this reporting for legal entities is established by order of the Ministry of Finance of the Russian Federation “On Forms of Accounting Reports” dated July 2, 2010 No. 66n. The financial statements of a small enterprise in 2021, as before, include simplified forms of the following documents:

- balance sheet;

- financial report results;

- report on the intended use of funds (for companies that received such funds).

As for other forms (cash flow statement, statement of changes in capital), small companies are exempt from submitting them.

Personal income tax

Every quarter, companies, including those using the simplified tax system, submit a 6-NDFL certificate to the inspectorate. Thus, they inform the Federal Tax Service about the income of their employees. The certificate is submitted by the end of the month following the reporting quarter. Taking into account weekends and holidays, this year the reporting schedule is as follows: for the first quarter - until May 2, for six months - until July 31, for 9 months - until October 31.

In addition, once a year it is necessary to submit a 2-NDFL certificate. For 2016, it must be submitted before April 3 of this year.

The choice of personal income tax report form depends on the number of employees. If there are more than 25, then both certificates must be submitted electronically; if there are fewer, then at the discretion of the company.

Accounting of small businesses for 2021 (special points)

The accounting records of a small enterprise for 2021 must be created taking into account certain rules, namely:

- in any of the three reports, indicators are entered in an aggregated form - without detailed division into items;

- in documents it is necessary to present only the most essential and significant information, without which it is impossible to analyze the financial position of the entity and the efficiency of its functioning.

Using simplified types of reports is not an obligation, but a right of small businesses, and therefore they can choose: to work according to a simplified procedure or to generate the financial statements of a small business for 2021 in full.

Filling Features

What is the difference between filling out a balance sheet under the simplified tax system for 2021 and filling out a regular form? Of course, the amount of information processed and the form itself. If you carefully examine the form of this document, you will immediately see that the number of lines and sections in such a document is much less than the usual form. The simplified balance sheet form for 2021 is presented here.

The header itself is no different from the normal balance header; it requires the following information:

- Full name of the institution, its details;

- Its organizational and legal form;

- Reporting period;

- The currency in which the balance sheet is compiled, as well as the units of measurement;

- Field of activity;

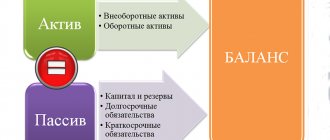

But then there are striking differences: the balance sheet itself does not have sections, but simply contains lines. There are 5 lines in the asset, but 6 in the liability. That's all. This is where the balance ends.

So the active part of the balance sheet for simplified people for 2021 contains the information:

- On the book value of non-current assets;

- About the value at the time of reporting of intangible assets, including financial ones;

- About the cost of inventories that are left in warehouses;

- About cash, as well as its equivalents, which are in the cash register and on the company’s current accounts;

- About financial current assets.

If we talk about liabilities, then here is information about the amount of equity capital, long-term and short-term borrowed funds, as well as other obligations of both long-term and long-term nature.

As for other features of filling out, they are no different from the features of filling out a regular form.

Filling features:

- The currency in which the valuation of all assets and liabilities is expressed must be presented in rubles. You cannot use other currencies as a measurement;

- Indicators are expressed exclusively in either thousands or millions. However, you cannot use fractional values, for example, 3.65 or 5.64. It is necessary to round everything according to the rules of mathematics - up or down. For example, if in one of the columns the value is only 350 rubles, then the total will be equal to 0, or rather the “-” sign will be indicated. Such rounding should not lead to significant differences in the balance sheet, but if necessary, you can clarify the information in the explanatory note to the balance sheet.

- Regarding the reporting period, the balance sheet for 2021 is also submitted for the year. In this case, the data is indicated for all three years, from 2015 to 2021. Sample of filling out a simplified balance sheet for 2017.

I would also like to note important information: as soon as an enterprise loses its small status, it must switch to filling out the full balance sheet form - Form 1. The use of Form 5 is strictly prohibited.

Accounting statements of small businesses 2017 – time and place of presentation

The 2017 financial statements of a small enterprise are submitted to the following government agencies:

- to the federal tax service inspectorate at the place of registration of the business entity;

- to regional statistical bodies.

It must be remembered that you need to submit reports for 2021 once - no later than March 31, 2021. In terms of submission deadlines, there are no clarifications for small enterprises, and therefore they submit in the same period as large/medium-sized enterprises. Since March 31 falls on a non-working Saturday, the deadline for submitting accounting reports in 2021 is April 2.

Simplified form: who is eligible

Let's start with the fact that only some business structures have the right to create a simplified balance sheet for 2021. These categories of subjects include only representatives of small businesses. Small business is a segment of entrepreneurship that is entitled to certain benefits from the state, as well as a simplified taxation system. But to obtain such status, the subject must meet certain criteria.

Companies are considered small enterprises if they meet:

- The number of employees permitted by law;

- The amount of income for the year that is prescribed in the Tax Code;

- The maximum share in the authorized capital of those companies that are not classified as small and medium-sized.

It is these three criteria that allow an organization to either be classified as a small business or not. At the same time, small business itself is divided into such areas as microenterprises and small entrepreneurship. And the table shows the gradation of such companies and the limit of indicators considered for them.

| Type of business | Criteria for classification as small enterprises 2021 | ||

| Number of employees, people | Authorized share in the capital of non-small and non-medium enterprises, % | Amount of income, million rubles. | |

| Microenterprise | 15 | 49 | 120 |

| Small business | 100 | 49 | 800 |

Please note that an enterprise has the right to submit a balance sheet in a simplified form for 2021 even if it does not meet the criteria for a small business in the current reporting period. This is due to the provisions of the law that allow companies to operate as small businesses for three years after the fact of such non-compliance.

Accounting statements of small businesses 2017

A simplified form for preparing financial statements is used, regulated by Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n. It is necessary to note the following main features of filling out reports:

- small enterprise accounting forms for 2017 must be encoded 0710001 (for the balance sheet), 0710002 (for the report on financial results), 0710006 (for the report on the use of funds);

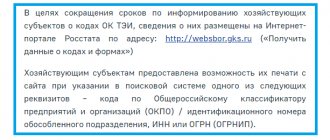

- business entities can supplement the forms required for submission if this is necessary for the purpose of more complete disclosure of information, for example, create explanatory notes. The format of their presentation (text or table) is chosen by companies independently;

- No changes can be made to the approved form of financial statements of small businesses-2017. If the form is not sufficient for disclosing information due to its abbreviated version, it is necessary to use the usual type of reporting;

- If there are discrepancies between the forms and the established templates, government agencies have the right to return the completed reports for revision.

Developed and approved reporting forms for small businesses are designed to facilitate the procedure for generating and submitting documents. If they are filled out correctly, the reporting procedure is greatly simplified, but it is always necessary to check whether the business entity meets the criteria for being classified as small or not. We talked about the criteria for classifying enterprises as SMP in 2021 here. How to fill out a simplified balance, read our article.

Line codes and their decoding

The balance sheet reporting form contains a “Code” column, which is filled out based on the data of Order No. 66n. It is necessary to indicate the code of the indicator that has the largest share of the group of articles. Reporting form 0710001 is divided into lines:

- Tangible non-current assets (code 1150). They consist of the residual value of fixed assets, unfinished construction work, design and survey developments, and undocumented acquisition of fixed assets.

- Intangible, financial and other non-current assets (code 1170). Information about funds that do not have a material expression and are used for a long time is indicated. This includes licensed computer programs, innovative technologies, and securities.

- Inventories (code 1210). Represented by raw materials, materials, semi-finished products, finished products and goods.

- Cash (code 1250). This type of asset consists of cash in the cash registers of organizations, amounts in bank accounts and deposits.

- Financial and other current assets (code 1230). This balance sheet indicator is formed by the enterprise’s receivables, prepayments to counterparties for future work and VAT on the purchase of goods, unrecorded tax overpayments, detected shortages, financial investments for a period of no more than a year and other assets that are not reflected in other balance sheet lines.

- Asset balance (code 1600). This is the total value of the enterprise's working and non-current assets.

- Capital and reserves (code 1300). Represented by authorized, reserve and additional capital, and the amount of authorized capital must be equal to the value contained in the constituent documents. If, during the operation of the enterprise, retained profit or loss has arisen, these amounts must also be reflected in line 1300.

- Long-term borrowed funds (code 1410). This includes credit and borrowed funds whose repayment period exceeds 1 year.

- Other long-term liabilities (code 1450). Other obligations not specified in line 1410 are reflected. This may include, for example, accounts payable to counterparties that arose more than a year ago.

- Short-term borrowed funds (code 1510). Credit and borrowing resources with interest due, which must be repaid within a year, are to be reflected here.

- Accounts payable (code 1520). The amount of short-term debt to counterparties is indicated.

- Other current liabilities (code 1550). An example would be a situation where a business entity receives targeted funds and undertakes, in turn, to ensure the readiness of the financing object within 12 months.

- Liability balance (code 1700). Reflects a set of long-term and short-term sources of obtaining financial resources.

Results

Thus, LLCs using the simplified tax system must submit a balance sheet to the Federal Tax Service and Rosstat at the end of the year. The balance sheet is compiled by simplifiers in accordance with generally established principles and rules. But, since many simplifiers are small businesses, they can submit financial statements not in a general form, but in a simplified one. The main essence of this simplification is that balance sheet indicators are combined into certain groups, and not detailed as in a regular report. However, if desired, an organization can submit a report using a standard form.

Currently, the Ministry of Finance has prepared a draft law to abolish the need to submit financial statements to statistical authorities, since the reporting forms used to submit reports to these two authorities are identical. This would improve the level of reporting discipline and government bodies would not duplicate each other. But for now this is just a project.

Simplified organizations have the right to simplify their balance sheet. More details below.

Simplified balance sheet liability

This section of the report, consisting of 6 lines, is filled out in the following order:

All credit balances on accounts 80 (minus the debit balance of account 81), 82, 83 and 84 are entered here. If a loss is reflected on account 84 (i.e. there is a debit balance), then it is taken into account in the same way as the data reflected on account 81. If the overall result is negative, it will be shown in parentheses.

The figure in this line should reflect the balance of the company's debt on long-term loans and borrowings (account 67). In this case, accrued interest, the maturity of which as of the reporting date is less than 12 months, is excluded.

Filled out for the amount of long-term liabilities listed in the loan balances in accounts 60, 62, 68, 69, 70, 71, 73, 75 and 76.

This line includes the balance of account 66, as well as the balance of accrued interest that was not taken into account when filling out information on long-term loans and borrowings.

This shows the sum of credit balances in accounts 60, 62, 68, 69, 70, 71, 73, 75 and 76 for all short-term liabilities.

A line that may be missing or not filled in if all the necessary information about obligations is reflected in the 5 previous lines.

NOTE! After filling out the liability and asset lines of the balance sheet, you need to compare the results obtained. The sum of all asset lines must be equal to the result of adding the liability lines.

Zero reporting. Penalties for failure to submit balance

Suspension of the activities of an enterprise for a while does not mean that it does not have to submit reports. Such LLCs still need to submit a zero balance sheet to the Federal Tax Service and Rosstat. Otherwise, the debtor will be subject to sanctions and it may even go as far as blocking the bank account.

However, a zero balance is not acceptable in principle. It cannot be like this, even if the company’s activities are stopped. At a minimum, it will need to reflect the authorized capital. It must be shown in lines 1300 and 1250. In the remaining lines, the organization will have to put dashes.

The fine for failure to submit reports in 2021 is 200 rubles for organizations. for each unsubmitted form. This norm is enshrined in paragraph 1 of Art. 126 of the Tax Code of the Russian Federation. Also, a fine will be imposed on the head of the organization and will amount to 300 – 500 rubles (Clause 1 of Article 15.6 of the Code of Administrative Offenses of the Russian Federation). These fines relate to failure to submit reports to the tax authorities. And failure to submit a balance to the statistical authorities also entails prosecution on the basis of Art. 19.7 Code of Administrative Offenses of the Russian Federation. At the same time, for organizations the fine will be 3–5 thousand rubles, and for a manager – 300–500 rubles.