We recommend downloading the 3-NDFL form in 2021 using the links provided just below in this article.

[sc:docObr id=»https://grazhdaninu.com/wp-content/uploads/2017/07/3NDFL-2019.pdf» mytext=»form 3-NDFL in case of renting out housing»]

In addition, individuals will be able to understand, using a clear example, on which pages of the declaration and according to what rules it is necessary to enter the information required to provide a tax deduction.

- Link to a blank tax return form.

- Link to a sample of the completed 3-NDFL form.

- Link to the program for filling out 3-NDFL for 2021.

Rental income tax: when is it paid?

Individuals (not entrepreneurs) renting out apartments to individual tenants are required to file a declaration and pay personal income tax. Only in a situation where the employer is an enterprise, the lessor is released from the obligation to declare income, since the company becomes a tax agent and withholds and then transfers personal income tax to the budget. If for some reason the company did not do this, the tenant must draw up a declaration and pay the tax himself.

Form 3-NDFL should be submitted to the Federal Tax Service at the end of the year in which the income was received. The deadline for its submission is April 30 of the next year (with adjustments for weekends that fall out, for example, in 2021 the last day for accepting declarations will be May 3).

Please note that in 2021 a new form 3-NDFL is in effect.

3-NDFL reflects information on income received and calculates the tax:

- at a rate of 13% for residents of the Russian Federation;

- at a rate of 30% if the lessor is not a tax resident, i.e. lives in the country for less than 183 days a year.

The calculated tax must be paid by July 15 (in 2018 - by July 16, since July 15 is a day off). When renting out an apartment, the 3-NDFL declaration is submitted to the Federal Tax Service at the place of registration of the lessor; the address of the rental property does not play a role.

An example of filling in the case of renting property

Many individuals are the owners of not one property, but several, and in connection with this, some of them decide to rent out. However, in order to avoid problems with the law in this case, they are required to fill out a declaration and transfer part of the earned material resources to the state budget. How to correctly fill out the title page has already been discussed above, but as for the design of the remaining sheets, we suggest going into more detail on this.

Sections No. 1 and No. 2

The second page of the 3-NDFL form, filled out by the taxpayer who rents out real estate, will be section number one. In the line marked 010, it is necessary to write one, thereby attesting to the fact that the individual is donating money to the state budget, and does not want to reimburse the funds from there.

Then in line with code 020 you need to enter twenty digits of the budget classification code, and in line 030 - the code assigned to the territory of the municipality in which the individual is registered. Both codes are taken from the certificate in form 2-NDFL from the taxpayer’s place of work. And the last parameter is the amount that needs to be reimbursed to the state.

In order to calculate the amount that needs to be paid additionally to the budget, you need to take the total amount of profit received from renting out the property for the tax year and find thirteen percent of it.

As for section number two, you only need to fill out a few lines:

- 001 and 002 - on profits received by individuals from renting out housing, the tax rate is set at thirteen percent. In this regard, the number thirteen is indicated in line 001. And in line 002, which requires displaying the type of income, you should put the number three, thereby showing that the profit has nothing to do with dividends or foreign companies.

- 010 and 030 - in both of these lines the taxpayer needs to enter the same amount that he received for the entire tax year from the rental of real estate. To do this, you will need to add up all the money that the tenant paid for each month from the very beginning of the tax period indicated on the title page of the declaration.

- 060 – Here you will need to write the size of the tax base. In this case, this is the same amount that is indicated in lines 010 and 030. However, if the taxpayer submits form 3-NDFL both to additionally pay funds to the budget and to receive a tax deduction, we advise you to consult with a tax agent about filling out this line.

- 070 and 080 - in line 070 you will need to write the amount of payment that the taxpayer is obliged to return to the state. In order to correctly find the size of this amount, you should divide the profit earned during the year for leasing property by 100%, and then multiply the result by 13%. In the line with code 080, zero is written, since the individual has not yet paid taxes from this source of payments.

- 130 – this line duplicates the amount entered in the line with code 070. Or, in other words, the found thirteen percent of the total income of an individual is indicated.

Sheet A

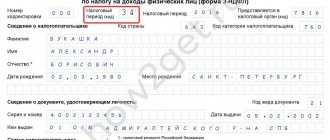

And the last page of the 3-NDFL form, which tax inspectors require, is sheet A. First of all, this page displays the digits of the taxpayer identification number, then the serial number of the sheet, which in this example is indicated as 004, and then the surname and initials of the lessor .

After this, the tax rate is written (as noted earlier, it is 13%) and the profit type code (this is code 04, since we are talking about money earned through rent).

Line 060 contains the full last name, first name and patronymic of the tenant, and lines 070 and 080 indicate the amount he paid for the tax period to the individual filing the declaration. A little lower, in line 090, the amount that needs to be paid to the state is again entered, and in line 100 a zero is entered.

We recommend using the 3-NDFL form in Excel, since this format allows for fairly convenient viewing of the form and allows you to quickly navigate to the desired page of the document.

3-NDFL when renting out non-residential premises to an individual

3-NDFL when receiving income from the rental of non-residential premises, for example, an office or warehouse, is filled out if the individual does not have an individual entrepreneur and does not turn the rental of real estate into a business.

If this is his entrepreneurial activity, then OKVED provides a group of codes “68” for such a business, and the citizen needs to open an individual entrepreneur:

- fill out application P21001;

- pay a fee of 800 rubles;

- make a copy of your passport.

As a result of submitting these forms, the Federal Tax Service will make an entry about the new entrepreneur in the Unified State Register of Individual Entrepreneurs and issue him a OGRN certificate.

Now the person needs to choose a special regime and, depending on it, file or not file a declaration. For example, in the patent system you do not need to submit reports, but you do need to keep a simple log of income and expenses.

The need to register an individual entrepreneur is also due to the fact that contractors renting offices or warehouses need to conduct paperwork with you and take into account rental costs in their financial result, and without an individual entrepreneur you will not be able to exchange documents with them.

Deadlines for submitting a report to the tax service

For the convenience of landlords and the tax service, a deadline has been set by which it is necessary to submit a declaration to the Federal Tax Service of the Russian Federation. This date is set for mid-spring, namely April 30. If you do not have time to file 3-NDFL, then sanctions will be applied to the person .

In this case, the violator will be fined 5% of the unpaid tax amount, but not more than 30% of the specified amount in the tax document and not less than one thousand rubles (Article 119 of the Tax Code of the Russian Federation). And before July 15, a person is obliged to pay taxes to the state budget, otherwise the sanctions described above will be applied to him again.

What other documents need to be attached?

The 3-NDFL declaration is ready, but you still need to confirm the numbers indicated in the report. To do this, you need to attach documents, most of which are not originals, but copies. It is mandatory to provide :

- 2-NDFL (original);

- lease agreement (copy);

- documents confirming receipt of income in the reporting year;

- papers confirming tax deductions (if any).

Many people are confused by the third item on the list. After all, people who rent out an apartment for the first time do not know what can be provided as a document proving income.

In most cases, landlords attach to the 3-NDFL declaration a receipt for receiving money from the renting person, of course, a copy.

Now you know how to fill out the 3-NDFL declaration when renting out an apartment. It is enough to work with this document once and everything will be clear. It is important to take your time when filling out and double-check several times, because if the paper is filled out incorrectly, the tax office will call you and demand that you fill out the declaration correctly. And this is not only a waste of personal time, but also of nerves. Do not forget to attach documents confirming the figures to the 3-NDFL.

Pay personal income tax 13% as an individual

This is the most common method. If you have an apartment and decide to rent it out, first enter into a rental agreement with the tenants. Agreements for a period of less than a year do not need to be certified by a notary and registered with Rosreestr - the signature of both parties will be sufficient. In the contract, state the amount of the rent and indicate who will pay for utilities. Keep in mind that if payments for utilities are included in the rent, then you will also have to pay tax on them.

The security deposit, or deposit, is considered an advance and therefore does not need to be reported on your tax return. The deposit is included in income only if it is included in the payment amount for the last month of rent or the terms of the contract are violated - for example, damage to the property is caused.

Practical Guide “To Financial Freedom in 21 Days!” This book is a step-by-step plan for self-study of finance, designed for 3 weeks, with simple tasks for every day, for independent work.