Concept and types of services

Services are a type of activity that does not have a material expression, the results of which are sold and consumed in the process of economic activity of the enterprise (Clause 5 of Article 38 of the Tax Code of the Russian Federation).

Services exist in a wide variety, in particular:

- informational;

- audit;

- transport;

- storage;

- consulting;

- real estate agents;

- communications;

- training, etc.

In accounting, all services are included in costs based on primary accounting documents.

The main primary documents confirming the execution of services are:

- Agreement.

- Certificate of completion of work or other document confirming acceptance of services.

IMPORTANT! The Ministry of Finance believes that if the agreement does not provide for a clause on drawing up an act, then it needs to be drawn up only in cases provided for by law (letter dated November 13, 2009 No. 03-03-06/1/750). The Civil Code obliges to draw up an act confirming the acceptance of work only in the case of a construction contract (Article 720 of the Civil Code of the Russian Federation).

The procedure for concluding and terms of the contract for the provision of services are regulated by Ch. 37–41, 47–49, 51, 52 Civil Code of the Russian Federation. The main actors in the contract are the contractor and the customer of the services. Let's look at the accounting procedures for each of them.

What is it for?

The quality of construction work is characterized by several criteria - the quality of the activities performed and the materials used in the construction process, as well as the availability and correctness of the submitted documentation. This is due to the fact that after the delivery of the object, its “life” does not end. In the future, the structure will have to be maintained, cosmetic work carried out, major repairs carried out, and so on. The availability of executive documentation makes this process easier and faster. For example, without drawings it is almost impossible to lay new or reconstruct old utility networks.

Consequently, the process of operating the facility depends on the quality of execution of the as-built documentation. Studying such papers gives a clear idea of the technical condition of the structure, as well as the people who are responsible for the work.

Accounting for services from the contractor

The contractor's accounting directly depends on the type of activity and taxation regime. Most often, companies providing services in order to reduce the tax burden choose special regimes: UTII or simplified tax system. Along with them, OSNO can also be used.

Revenue from services provided is income from ordinary activities. The procedure for its accounting is regulated by clause 5 of PBU 9/99.

Postings from the contractor when selling services will be as follows:

- Dt 62 Kt 90.1 - reflects the sale of services.

- Dt 90.3 Kt 68 - VAT charged.

- Dt 90.2 Kt 20 (23, 25, 26, 43) - the cost of services provided is written off.

- Dt 50 (51) Kt 62 - services paid for by the customer.

- Cost accounting.

Cost accounting for companies engaged in the provision of services has its own specifics, since it depends on the specific type of activity. If a company is engaged in the provision of services that do not require material investments (for example, information, auditing or the like), then all costs are collected in the debit of account 20 “Production expenses” (clause 5 of PBU 10/99).

Consider, for example, training services. The main costs are salaries of employees, calculation of taxes and contributions, depreciation, etc. That is, to provide these services, the organization does not spend material assets on the production of any objects. At the end of the month, its costs are written off to the cost of sales by posting Dt 90.2 Kt 20.

If the company provides services and at the same time produces some material assets, then cost accounting is organized using accounts 20 “Production expenses”, 26 “General expenses” to account for management costs, and, if necessary, the 25th account “General production expenses” is used. expenses". Produced objects are accounted for on account 43 “Finished products”.

Example

Modern LLC provides outdoor advertising services. Assorted LLC ordered a banner for the store. The amount under the contract was 38,335 rubles. (including VAT RUB 5,847.71).

Postings in the accounting of Modern LLC:

- Dt 51 Kt 62 — 38,335 rub. — payment was received from Assorti LLC.

- Dt 62 Kt 90.1 — 38,335 rub. — sales of services are reflected.

- Dt 90.3 Kt 68 - 5,847.71 rub. — VAT is allocated.

Materials in the amount of 17,342 rubles were spent on the production of the banner. (excluding VAT). The remuneration of employees amounted to 8,500 rubles, contributions from the payroll - 2,805 rubles.

- Dt 20 Kt 10 - 17,432 rub. — materials for making the banner were written off;

- Dt 20 Kt 70 - 8,500 rub. — wages accrued to employees;

- Dt 20 Kt 69 - 2,805 rub. — contributions from the payroll are calculated.

According to the accounting policy, Modern LLC keeps records of finished products at actual cost.

- Dt 43 Kt 20 - 28,737 rub. (17,432 + 8,500 + 2,805) - the banner was made at the actual cost.

- Dt 90.2 Kt 43 - 28,737 rub. — the cost of services is written off.

Do you want to know what risks the contractor may have when concluding a contract for the provision of paid services? Sign up for a free trial access to the ConsultantPlus system and proceed to the Guide to Contractual Work.

Forms KS-17 and KS-18

KS-17 and KS-18 in construction are acts on the suspension of various processes. Thus, the KS-17 act is a document that is drawn up in cases of suspension of construction and installation work. In this case, the suspension may be associated either with the conservation of the facility or with a complete cessation of construction.

Form KS-18 is drawn up to suspend design and survey work. It is used for work of this type that has already been started, but for some reason was not included in the plan.

In addition, the suspension of design and survey work may be caused by the inexpediency of further design of the construction of the facility. In such cases, a KS-18 act must also be drawn up.

It should be noted that all of the above KS forms, not only KS-17 and KS-18, are drawn up in the required number of copies. The minimum quantity is 2 copies: one for the customer’s organization, the other for the contracting company. However, it is often necessary to compile and provide a larger number of copies for all persons legally interested in the construction of the facility.

Thus, from everything written above it follows that drawing up KS forms of various types is an important process that affects the successful delivery and financing of any construction project.

Accounting for services from the customer

Services are expenses of the customer enterprise and are most often included in expense accounts 20 (23, 25, 26, 44).

Let's continue the example

The accountant of Assorti LLC will make the following entries in the accounting:

- Dt 60 Kt 51 - 38,335 rub. - paid for advertising.

- Dt 44 Kt 60 — 32,487.29 rub. — advertising costs are taken into account.

- Dt 19 Kt 60 — 5,847.71 rub. — input VAT is taken into account.

However, some services may increase the cost of purchased goods or fixed assets (clause 6 of PBU 5/01, clause 8 of PBU /01), for example, transport or information services. In this case, they are reflected as follows:

- Dt 08 (10, 41) Kt 60 - the cost of fixed assets (inventory, goods and materials) has been increased by the amount of transport or other services to be included in the price.

For the procedure for forming the cost of fixed assets and inventory items, see the articles:

Do you want to know what risks a customer may have when concluding a contract for paid services? Sign up for a free trial access to the ConsultantPlus system and proceed to the Guide to Contractual Work.

Primary documents for accounting services

In tax accounting, services are also included in costs and reduce taxable profit, subject to economic justification and the availability of primary accounting documents (Article 252 of the Tax Code of the Russian Federation). The exception is standardized expenses, when only part of the costs according to the rate specified in tax legislation is included in the base when calculating profits.

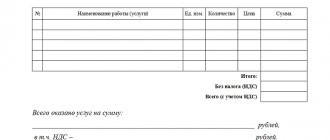

As noted above, most often, to confirm the fact that the service has been provided, a certificate of completion of work is drawn up. The form of the act is not contained in the album of unified forms (with the exception of the KS-2 form); it is developed and agreed upon by the parties to the agreement independently, taking into account the conditions of each specific transaction. In this case, the form must contain the mandatory details listed in Art. 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ:

- Name and date of the document.

- The name of the company that prepared the document.

- The name of the work performed, indicating the cost and quantitative characteristics.

- Signatures of the parties indicating the positions and names of the signatories.

Taxation in construction

The basic principle that construction companies must adhere to when organizing their tax accounting is the economic justification of expenses and their documentary justification. This is the main relationship between accounting and tax accounting in construction in 2021.

Taxation and accounting in construction should be organized in such a way that the information forming the tax base for taxes makes it possible to understand:

- ways for a construction company to determine its income and expenses;

- algorithms for the formation of tax bases for all types of taxes and fees paid by a construction company;

- reserve formation schemes;

- mechanisms for temporary distribution of expenses and transfer of part of them to subsequent periods;

- other tax parameters (amount of tax liabilities as of the reporting date, etc.).

The nuances of tax accounting and filling out tax returns will help you understand the articles posted on our website:

- “What is the procedure for filling out an income tax return (example)?”;

- “How is separate accounting for VAT carried out (principles and methods)?”

Results

Accounting for services is based on accounting standards. The accounting methodology is specific and depends on the specific type of activity of the performing company. Revenue from the provision of services is included in income from ordinary activities. Expenses are recorded as costs from normal activities in cost accounts. In the production of material assets necessary for the performance of services, finished product release account 43 is used.

For the customer, the cost of services is recognized as an expense and is charged either to cost accounts or to an increase in the purchase price of assets for which these services are related.

Accounting in organizations providing repair and finishing services

The core activity of repairmen and finishing workers requires, like any other, mandatory bookkeeping. The task can be solved with the involvement of a third-party contractor (outsourcer) or by forming its own staff of accountants. Everyone chooses the best option independently.

As for record keeping itself, it has a number of features determined by the specifics of business activity. Let's look at a few key points.

Settlements with customers

Mutual settlements with customers of repair services and finishing works can be carried out in cash or non-cash. In both cases, documentation of financial and business transactions in accordance with regulatory requirements is mandatory. If cash is used for mutual settlements, a business entity cannot do without cash register equipment. The latter must comply with the standards and requirements established by the current tax legislation. When paying in cash, special attention should be paid to the preparation of cash receipts. They must indicate the full details of the executing company.

Standard strict reporting forms are also accepted for accounting purposes. These include work orders and receipts. BSO used by the executing company are accounted for at the actual cost of acquisition and are reflected in a subaccount to account 10. The cost of the forms is written off as general business expenses.

There is another important point in accounting for mutual settlements with the customer. Amounts received by the contractor from the client are reflected in account 62 or 64 (settlements with customers, settlements on advances received).

Cost accounting

Each type of construction, repair, and finishing work has its own cost. And it is necessarily reflected in the accounting. To account for cost correctly, it is necessary to determine the cost accounting object. Most often, companies that provide repair and construction services under household contracts use the custom method. It provides for cost accounting separately for each contract (repair object). Costs are taken into account on an accrual basis. The custom method is convenient for companies performing the bulk of the work or entire repairs on site.

Organizations that provide highly specialized services (for example, installation of a water supply system, electrical wiring, installation of a hidden climate control system, etc.) often account for costs using the accumulative or “boiler” method. The latter provides for accounting for a specific period of time. The “boiler” method allows you to take into account costs by the places they arise and the types of work performed. The cost of the latter is determined by calculation. When performing the calculation, the actual costs of performing the work, work in progress, and the contractual cost of the work are taken into account.

In addition to determining the object of cost accounting, the distribution of overhead costs is of great importance in determining the cost of repair and finishing services. The method of such distribution is chosen by the organization and is reflected in the accounting policies.

Accounting for work implementation

Accounting for the implementation of repair and finishing works is carried out in accordance with the requirements established by the current PBU. The moment of implementation is determined by one of two methods. The first involves accounting for income for individual work performed. The second is for the object as a whole. The method is determined at the stage of concluding a contract. The procedure for the delivery and acceptance of work is also mandatory in this document.

Any contractor can determine income for the facility as a whole. But it is advisable to use this scheme for those who perform short-term work. The method involves determining income as the difference between the cost of services specified in the contract and the costs of performing the work.

Determining the financial result by type of work is rational to use if the maintenance of the facility is divided into stages. The cost of such stages is indicated in the contract. Income is taken into account by the contractor on an accrual basis.

Complete list of documents

The list of executive documentation is extensive, so here are the main documents:

- Executive geodetic diagrams of constructed objects, elements or components of structures.

- Acts of acceptance of the geodetic basis.

- General work log.

- Executive profiles of underground structures and utility networks and their diagrams.

- Logs of operational and incoming control, as well as special logs of completed work.

- Inspection reports (for works of a hidden nature).

- Designer supervision journal (if available).

- Acts of intermediate acceptance of finished structures and engineering systems.

- Test reports, as well as subsequent testing of devices, equipment and systems.

- Working drawings for the construction of the structure. They must contain inscriptions of compliance made by the persons responsible for the work (taking into account the specifics).

- As-built diagrams of buildings and objects on the ground (refer to architectural documents).

- Other papers indicating the implementation of decisions on the project, carried out by the decisions of construction participants, taking into account the specifics.

As-built documentation is drawn up taking into account SNiP (Russia, Republic of Kazakhstan, Republic of Belarus), GOST, reference manuals and existing programs. It is transferred during the process of acceptance of work and transfer of the structure for further operation.

Materials accounting

This accounting sector, like the previous ones, has its own characteristics. It should be noted that the contractor can provide repair and construction services using its own materials and the customer’s materials. In the latter case, upon receipt of materials from the customer, the contractor’s accounting department makes the appropriate entry to off-balance sheet account 003, which reflects the materials accepted for processing. Moreover, separate records reflect the materials received and subsequently consumed. If these are not completely consumed, the contractor can return them or reduce the cost of work performed by the amount of the balance of goods and materials received from the customer. In both cases, financial and economic transactions are reflected in accounting accordingly.

If the work is performed using contractor materials, their cost is included in the estimate. Materials are paid for by the customer in the manner established by the contract for the provision of services. Payment can be full or partial. In the second case, final payment for materials is made upon acceptance of the completed work. The cost of materials specified in the contract is fixed. The contractor has no right to change it unilaterally.

Warranty repair accounting

Any specialized company that values its reputation gives customers guarantees of the quality of the work performed. The service agreement specifies the procedure for eliminating deficiencies discovered during the warranty period.

There are two ways to solve the problems. Firstly, the contractor can eliminate the identified deficiencies at his own expense. Secondly, he has the right to proportionally reduce the cost of work performed.

If a specific warranty period is not provided for in the contract for the provision of repair services and finishing work, under civil law the customer has the right to demand that the contractor eliminate defects if less than 2 years have passed since the delivery and acceptance of the object.

OKUD form

0322001 Investor Fold LLC, Moscow, st. Zamorenova, 34. tel. 253-45-67 according to OKPO 495678192 (organization, address, telephone, fax) Customer(General contractor)

Fold LLC, Moscow, st. Zamorenova, 34. tel. 253-45-67 according to OKPO 495678192 (organization, address, telephone, fax) Contractor (Subcontractor) Stroyinvest LLC, Moscow, st. Novikova, 34. tel. 194-34-23 according to OKPO (organization, address, telephone, fax) Construction Moscow, st. Zamorenova, 34. tel. 253-45-67 (name, address) An object office building at Moscow, st. Zamorenova, 34 (Name)Features of accounting and taxation for a contractor

A work contract is an agreement under which one party (contractor) undertakes to perform certain work on the instructions of the other party (customer) and deliver the result to the customer, and the customer undertakes to accept the result of the work.

The Civil Code of the Russian Federation determines the list of works performed under a contract, which includes:

a) making a thing;

b) processing (processing) of a thing;

c) performing other work and transferring its result to the customer. Under a contract concluded for the manufacture of a thing, the contractor transfers the rights to it to the customer.

Accounting Regulations PBU 2/2008 “Accounting for Construction Contracts” ((hereinafter referred to as PBU 2/2008), approved by Order of the Ministry of Finance of the Russian Federation No. 116n dated October 24, 2008, regulates the specifics of the procedure for formation in accounting and disclosure in financial statements information on income, expenses and financial results of organizations (with the exception of credit organizations and state (municipal) institutions) that are legal entities under the laws of the Russian Federation and act as contractors or subcontractors in construction contracts, the duration of which is more than one reporting period years or the start and end dates of which fall on different reporting years.

Contract agreements subject to PBU 2/2008 include the following agreements:

- construction contract;

- provision of services in the field of architecture;

- engineering and technical design in construction;

- other services inextricably linked with the facility under construction;

- to carry out work on the restoration of buildings, structures, ships;

- for the liquidation (dismantling) of buildings, structures, ships, including associated environmental restoration.

The contractor can choose one of the accounting methods.

The first method is when costs are added up for accounting objects in the period from the beginning of the execution of a construction contract until the time of its completion (final payment for the completed construction project and its transfer to the developer).

The second method is when the costs of individual completed structural elements or stages of work, if the financial result is determined from them before the construction project is delivered to the customer, are taken into account as part of work in progress at the contractual cost.

The costs of construction work are grouped according to expense items: materials; labor costs; operating costs of construction machinery and mechanisms; overheads.

Account 20 “Main production” is used to account for the costs of construction and installation work. The debit of account 20 reflects the direct expenses of the organization in correspondence with the credit of the corresponding accounts:

10 “Materials” - for the cost of materials, structures and products used in the production of work;

23 “Auxiliary production” - for the cost of services provided by the organization’s own auxiliary production;

25 “General production expenses” - for the cost of expenses for the maintenance and operation of construction machinery and mechanisms;

70 “Settlements with personnel for wages” - for amounts of wages for workers engaged in construction and installation work;

60 “Settlements with suppliers and contractors” - for the cost of services related to the performance of work, etc.

Indirect (overhead) expenses associated with the management and maintenance of construction production are written off to account 20 from the credit of account 26 Account 26 - General expenses (Active) "General expenses" or to account 90-2 Account 90-2 - Cost of sales (Active) passive) depending on the chosen accounting policy.

Losses from defects during work, as well as costs to eliminate defects discovered during the period of warranty operation of the facility, are written off from account 28 Account 28 - Defects in production (Active-passive) “Defects in production”.

When maintaining account 20, corresponding sub-accounts are opened for it, and, as a rule, the cost of work performed by subcontractors is taken into account in a separate sub-account of account 20. When handing over the work, as the scope of work is completed, the contractor's accounting of the contract considers the costs of the contract throughout term of the contract. At the time of acceptance of work performed by the customer, accumulated costs are written off from account 20 “Main production” to the debit of account 90 Account 90 - Sales (Active-passive) “Sales” .a At the same time, on the credit of account 90 Account 90 - Sales (Active-passive) “Sales” » reflects the contractual cost of the work performed.

All actual expenses incurred related to the production of contract work performed by him in accordance with the construction contract form the contractor’s costs. Costs are generated by accounting objects, starting from the period of validity of the construction contract and until the time of its completion, i.e., until the final payment for the completed construction project and its delivery to the developer. In this case, the costs are taken into account by the contractor on an accrual basis as work in progress, and interim payments are taken into account as advances received until the full completion of work under the contract at the construction site.

The contractor's costs reflect the costs of creating reserves to cover anticipated costs and losses associated with the organization and performance of contract work. Unforeseen expenses and losses may arise at the stage of work, as well as after its completion and delivery to the developer. If these expenses can be reliably estimated, reserves are created to cover anticipated expenses.

The contracting construction organization carries out tax deductions for VAT in the general manner. Tax deductions for construction work performed by a contractor are made on the basis of inventories used in the execution of the work.

The amount of VAT presented by the supplier of inventories is accepted for deduction after the receipt of materials in the presence of an invoice. Thus, account 10 Account 10 - Materials (Active) “Materials” is used, and on account 19 “Value added tax on acquired values” VAT is allocated.

Procedure

The procedure for maintaining and content of writs of execution when performing restoration or construction work, as well as major repairs, was developed taking into account the Civil Code of the Russian Federation, as well as other norms, acts and the requirements of technical regulations in force in the Russian Federation. The preparation of such documentation is the task of the person who performs the construction work.

When issuing a permit for commissioning, the presence of correctly completed as-built documentation is accepted as evidence that the finished object complies with the current rules and regulations, as well as the drawn up project.

The as-built documentation must be kept by the customer or developer until the state supervisory authority carries out a control check. During the period of such work, the papers are submitted by the customer or developer to GASN. After studying, the construction supervision authority issues a conclusion on how much the constructed (reconstructed, repaired) building complies with the current requirements of technical regulations and other legal acts. In addition, the executive documents are transferred to the customer and the construction company for permanent storage.

See also: Construction permit form, sample document

The procedure for maintaining executive documentation is determined by the following numbers:

- RD-11-02-2006. It reflects the requirements for the procedure for maintaining and the composition of executive documents during the construction, overhaul or reconstruction of capital construction structures. It also reflects the requirements for inspection reports of structures, completed activities or areas of engineering and technical support.

- RD-45.156-2000. This document reflects the requirements for the composition and procedure for maintaining papers in relation to completed linear structures of intrazonal and main waves.

- RD-11-05-2007 - regulates the procedure for registering (maintaining) a special and (or) general journal, which takes into account the work performed during the reconstruction, construction or overhaul of objects.

- GOST R 51872-2002 - rules for performing as-built geodetic documentation.

Executive documentation is prepared on paper or in electronic form. It is important that documentation is accepted by state construction supervision structures only in paper form.

Accounting for third party services

Services of third-party organizations are a type of activity that does not have a material expression; the result of the service is sold and consumed immediately in the process of the organization’s economic activities (clause 5 of Article 38 of the Tax Code of the Russian Federation). If there is a material component, then this is work (clause 4 of Article 38 of the Tax Code of the Russian Federation):

In accounting, an organization can write off all direct expenses only for services (Letter of the Ministry of Finance of Russia dated February 22, 2007 N 03-03-06/1/114).

The primary accounting documents confirming the receipt of services from third-party organizations are:

- Service agreement;

- Certificate of services rendered, signed by the customer and the contractor;

- Invoice received.

Services provided by third parties may include:

- Communication services (discussed in example 1);

- Pre-sale preparation services (discussed in example 2);

- Cash register maintenance services (discussed in example 3);

- Housing and communal services;

- Storage services;

- Consulting services;

- Transport services;

- Training services;

- Auditing services;

- Legal services;

- Real estate services and so on.

Standard accounting entries for services received from third parties:

| Debit Account | Credit Account | Wiring Description | A document base |

| 26 | 60 (or 76.05) | Reflection of the cost of the service received (excluding VAT) | Certificate of services rendered, Invoice received |

| 19.04 | 60 (or 76.05) | The amount of VAT on the cost of the service received is reflected | |

| 68.02 | 19.04 | VAT amount accepted for deduction | |

| 60 (or 76.05) | 51 | Payment to the counterparty for services rendered | Bank statement |

| 90.02 | 26 | Write-off of the cost of services received to cost of sales |

Standard accounting entries when receiving services free of charge:

Get 267 video lessons on 1C for free:

- Free video tutorial on 1C Accounting 8.3 and 8.2;

- Tutorial on the new version of 1C ZUP 3.0;

- Good course on 1C Trade Management 11.

| Debit Account | Credit Account | Wiring Description | A document base |

| 91 | 60 (or 76.05) | The cost of the service received free of charge is reflected | Agreement for the provision of services free of charge |

| 60 (or 76.05) | 91 | Income from services received free of charge is reflected |

A sample contract for the provision of services free of charge can be downloaded here ˃˃˃

Short term construction work

In accounting, reflect the proceeds from the implementation of contract work that is short-term in nature by posting:

Debit 62 Credit 90-1 – revenue from the implementation of work is reflected (based on the acceptance certificate).

The cost of work is written off from the credit of account 20 “Main production”:

Debit 90-2 Credit 20 – the cost of work performed is taken into account as expenses.

For more information on the formation of the cost of contract work, see How to reflect the contractor's expenses under a construction contract in accounting.

If the contractor is a VAT payer, simultaneously with the recognition of revenue in accounting, reflect the accrual of this tax (subparagraph 1, paragraph 1, Article 146, subparagraph 1, paragraph 1, Article 167 of the Tax Code of the Russian Federation):

Debit 90-3 Credit 68 subaccount “Calculations for VAT” - VAT is charged on the cost of contract work.

The customer can pay the contractor for the work in advance - in advance.

Reflect the received advance payment on a separate sub-account opened to account 62:

Debit 51 Credit 62 subaccount “Settlements for advances received” - an advance was received from the customer.

After the prepaid work is completed (the parties sign the acceptance certificate), make the following entries in the accounting:

Debit 62 Credit 90-1 – revenue from the implementation of work is reflected (based on the acceptance certificate);

Debit 90-2 Credit 20 – the cost of work performed is taken into account as expenses;

Debit 62 subaccount “Settlements on advances received” Credit 62 – the advance (part of the advance) received from the customer is credited.

This accounting procedure is based on the provisions of paragraph 3 of PBU 9/99 and the Instructions for the chart of accounts.

If the contractor is a VAT payer, then upon receiving an advance payment he is obliged to charge VAT on this amount and issue an invoice to the customer within five calendar days (clauses 1 and 3 of Article 168 of the Tax Code of the Russian Federation):

Debit 76 subaccount “Calculations for VAT on advances received” Credit 68 subaccount “Calculations for VAT” - VAT is charged on the advance received for the completion of upcoming work.

When performing work on account of the advance received, as well as when terminating the contract and returning the advance to the customer, the contractor shall deduct the VAT previously accrued on the advance (clauses 8 and 5 of Article 171 of the Tax Code of the Russian Federation):

Debit 68 subaccount “Calculations for VAT” Credit 76 subaccount “Calculations for VAT on advances received” – VAT previously accrued on the advance received is accepted for deduction.

Situation: how can a contractor reflect in accounting and taxation the proceeds from the implementation of work under a construction contract if the customer refuses to sign the acceptance certificate? The work is short-term in nature. The Contractor applies the general taxation system and uses the accrual method when calculating income tax.

The basis for reflecting in the contractor’s accounting the proceeds from the implementation of work under a construction contract is a document (act) confirming the acceptance and transfer of work, signed by the contractor and the customer (subclause “d”, clause 12 and clause 13 of PBU 9/99 , part 1 of article 9 of the Law of December 6, 2011 No. 402-FZ, paragraph 4 of article 753 of the Civil Code of the Russian Federation).

Upon completion of the work, the contractor must inform the customer that he is ready to deliver the result of the work (stage of work). A standard sample of such a message is not approved by law, so the contractor has the right to draw it up in any form. Having received such a message, the customer is obliged to immediately begin accepting the work performed (Clause 1 of Article 753 of the Civil Code of the Russian Federation).

If the customer refuses to sign the act, the contractor must make an appropriate note about this in the act and sign it unilaterally (clause 4 of article 753 of the Civil Code of the Russian Federation). According to civil law, such an act is considered valid, which means it can serve as the basis for reflecting proceeds from sales in accounting and tax accounting (clauses 12, 13 PBU 9/99, clause 3 of Article 271, clause 1 of Article 39 of the Tax Code RF).

The moment of determining the tax base for VAT (in the absence of prepayment) is the day of transfer of the results of the work performed (subclause 1, clause 1, article 167 of the Tax Code of the Russian Federation). The fact of such transfer is confirmed by an acceptance certificate (including one signed unilaterally with a note indicating the other party’s refusal to sign) (Clause 4 of Article 753 of the Civil Code of the Russian Federation). Therefore, at the time of signing the act, VAT must be charged on the cost of the work performed. This rule applies if the debt is repaid voluntarily.

If the debt is collected in court, do this. The day the work was completed will be the date of entry into force of the court decision, according to which the court recognized that the contractor had fulfilled all the terms of the contract. Therefore, accrue VAT on this date, and not on the date of signing the act unilaterally (clause 1 of Article 167 of the Tax Code of the Russian Federation). Such clarifications are contained in letters of the Ministry of Finance of Russia dated May 18, 2015 No. 03-07-RZ/28436, dated February 2, 2015 No. 03-07-10/3962, dated December 31, 2014 No. 03-03-06/ 1/68990.

Postings for services received from third parties

Let us consider in more detail how to attribute the services of third-party organizations in transactions using the example of receiving various types of services.

Example 1. Receipt of communication services

Expenses for communication services are reflected in accounting in accordance with paragraph 18 of PBU 10/99 “Expenses of the Organization”; in tax accounting they are reflected in accordance with subparagraph 25 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation.

Let’s say the supplier Svyaz LLC provides communication services to Vesna LLC. According to the contract, the cost of communication services per month is 14,750 rubles, incl. VAT 18% - 2,250 rub. Costs for services are included in the organization's expenses.

The accountant of Vesna LLC reflected the receipt of communication services from the supplier with the following entries:

| Debit Account | Credit Account | Transaction amount, rub. | Wiring Description | A document base |

| 26 | 60.01 | 12 500 | The cost of communication services in the current month is taken into account | Certificate of services rendered, Invoice received |

| 19.04 | 60.01 | 2 250 | VAT amount included | |

| 68.02 | 19.04 | 2 250 | The VAT amount is accepted for deduction | |

| 60.01 | 51 | 14 750 | Payment to the counterparty for services rendered | Bank statement |

Example 2. Purchasing pre-sales services

Expenses for pre-sale preparation are reflected in accounting in accordance with paragraph 6 of Article 226 of the Methodological Instructions, and in tax accounting are reflected in accordance with Article 265 of the Tax Code of the Russian Federation.

Let’s assume that Vesna LLC transferred its goods in the amount of 250 pieces to the counterparty for polishing. The cost of the pre-sale preparation service under the contract is 61,950 rubles, incl. VAT 18% - RUB 9,450. According to the accounting policy, service costs are classified as indirect costs.

The accountant of Vesna LLC reflected the services provided for pre-sale preparation of goods with the following entries:

| Debit Account | Credit Account | Transaction amount, rub. | Wiring Description | A document base |

| 44.01 | 60.01 | 52 500 | The cost of services provided is taken into account | Certificate of services rendered, Invoice received |

| 19.04 | 60.01 | 9 450 | VAT amount included | |

| 68.02 | 19.04 | 9 450 | The VAT amount is accepted for deduction | |

| 90.07.1 | 44.01 | 52 500 | Distribution costs are written off as financial results | Help-calculation of write-off of indirect expenses |

Example 3. Receipt of cash register maintenance services

For example, Vesna LLC purchased a cash register machine (CCM) worth RUB 10,207, incl. VAT 18% - RUB 1,557. For commissioning work, 1,062 rubles were paid, incl. VAT 18% - 162 rubles. An agreement was concluded with the KKM Technical Service Center for monthly KKM maintenance, the cost of the service is 295 rubles, incl. VAT 18% - 45 rub.

Under the conditions of the example, maintenance costs are included in the organization's expenses. The accountant of Vesna LLC reflected cash register servicing services with the following entries:

| Debit Account | Credit Account | Transaction amount, rub. | Wiring Description | A document base |

| 44.01 | 60 | 250 | The amount of expenses for KKM maintenance is taken into account | Certificate of services rendered, Invoice received |

| 19.04 | 60 | 45 | VAT amount included | |

| 68.02 | 19.04 | 45 | The VAT amount is accepted for deduction |