Accounting 2

You can study this section only if you have a sample balance sheet in front of you.

It is located in Appendix No. 1. Prepare it for work, if you have not already done so, and place it in front of you. Look at the balance. As you can see, the assets and liabilities of the enterprise are displayed on the balance sheet on different halves: left and right.

This is done to ensure that the organization’s property and debts do not accidentally mix. Property should be in assets, debts - in liabilities. It cannot be otherwise.

On the left half of the balance sheet, the accountant records the value of all assets that the company has.

On the right half of the balance sheet, the accountant records the value of all liabilities that the company has.

However, if an accountant begins to list in the balance sheet all the assets and liabilities of the enterprise, then instead of a two-page report, you will have to send a thick book to the tax office.

For this reason, a long time ago, accountants divided all the assets and liabilities of an enterprise into several groups and called these groups balance sheet items .

Each item was given its own name and a separate line was allocated for it in the balance sheet. All balance sheet items look like special shelves on which the accountant lays out all assets and liabilities.

For example, on the shelf called CASH we will place the money that is stored in the company’s cash register, and that which is in the bank account, and all the other money that the company has. Find this article in the sample.

Please note: the balance sheet may contain items with the same names. For example, in assets we have two lines FINANCIAL INVESTMENTS. Find them in your balance sheet.

This is not a repetition or an error. The fact is that financial investments are divided into two types: those that will return to us no earlier than in a year (non-current assets), and those that will return to us within a year (current assets). You will learn to understand such similar balance sheet items gradually during the learning process. There are no difficulties here. In the meantime, let's continue our acquaintance with the structure of the balance sheet.

You have probably already noticed the leftmost column of the balance sheet, which is called “Explanations”. This column appeared in the balance sheet recently. Why is it needed?

The fact is that in addition to the balance sheet, the company also draws up other reporting documents that are designed to reveal in more detail the content of all balance sheet items. One of them is called “Explanations to the Balance Sheet” . Each explanation in this document is assigned a unique number. The accountant writes this number opposite the balance sheet item that the document “explains.”

Line 1230 of the simplified balance sheet explanation

Thus, all debt to the company is included in reporting Form No. 1.

Liquidity of debts as an asset

Accounts receivable is a financial current asset with which a company can quickly pay off its obligations to others.

The speed with which an asset can be used to pay bills indicates liquidity. The faster an asset can be converted into cash, the higher its liquidity.

But in practice, the presence of a large share of debtors, especially with reserves on account 63, indicates the company’s problems. Debts are unpaid bills issued to customers and clients. They used the products or services, but did not pay any money.

Or, on the contrary, the advance was paid to the contractor, but the work was not completed. The company must constantly monitor the level of such arrears, as there is a high risk of fraud and financial losses.

Arrears arise for the following reasons:

- Imprudence in choosing clients when concluding a transaction.

- Insolvency of buyers.

- Difficulties in selling products.

- Lack of daily work with debtors.

- Rapid growth in sales volume.

The optimal indicator of the level of receivables is when the balance of the accounts included in line 1230 of the balance sheet and the company’s funds coincide with obligations to creditors. To track fluctuations in existing debts, you can conduct financial analysis using a special ratio.

Measuring Accounts Receivable

Accounts receivable on the balance sheet tend to increase or decrease, which can be either positive or negative. To measure the proper level of the indicator, the turnover ratio is used in finance.

It is advisable, for convenience in accounting, to open analytical accounting on account 76 on subaccounts.

All these account balances are added up, then the balance on the passive account is subtracted from them. 63 “Provisions for doubtful debts”.

Just remember that the balance on all accounts must be expanded.

What are notes to the balance sheet?

This is detailed information about some of the assets and liabilities of an organization as shown on its balance sheet, as well as the income and expenses reported on its Income Statement. The accountant discloses in the explanations the information that he considers important for users, which, in his opinion, is necessary for users to assess the financial position of the organization (clause 6 of PBU 4/99). For example, you can describe in the notes to the balance sheet the fixed assets available to the organization:

- data on the initial cost and accrued depreciation at the beginning and end of the period;

- data on the cost of received and retired fixed assets;

- data on the method of calculating depreciation in accounting.

Explanation of balance: sample

Here is a sample explanation in tabular form in a situation where an accountant wants to disclose information about the organization’s fixed assets:

Explanations to the Balance Sheet

Romashka LLC for 2021

1. Fixed assets

1.1. Depreciation for all fixed assets is calculated using the straight-line method. There is no revaluation of fixed assets.

1.2. Data on the availability and movement of fixed assets for 2021 (in rubles)

String structure

The balance sheet is filled out as of the reporting date.

Information is entered into it based on the balances shown in the accounting cards. When calculating the balance of accounts receivable, which should be shown on the balance sheet, you need to focus on the debit balances of the set of accounts.

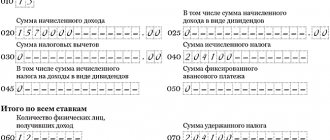

As a result, this is what line 1230 of the balance sheet consists of:

- in the final amount of debt, it is necessary to take into account the size of completed tasks for unfinished work reflected in account 46;

- balance of settlements with suppliers on account 60;

- the status of the debt of debtors, whose roles are buyers or customers of works/services - account 62;

- the final total for the debit of account 68, if there are overpayments of taxes and fees;

- to designate the receivable for insurance premiums, take account balance 69;

- also, line 1230 may contain information about overpaid funds to personnel (salaries overpayments are reflected in account 70, accountable funds to be returned are recorded in account 71, other transactions - account 73);

- if the debtor of the company is the founder, it is necessary to sum up the debit balance of account 75;

- The calculation must take into account the balance of account 76, which accumulates information on all groups of debtors not included in the previous categories.

Remaining debts to legal entities

As mentioned above, all these types of debt are distributed across different accounts of the balance sheet.

In cases where we are talking about debt balances to legal entities, we mean funds that are reflected in two accounts No. 60 and 62.

Innovations in accounting and reporting

One of the most controversial issues of the beginning of 2011 in the accounting professional community was what forms to use to submit financial statements for the first quarter of the current year. Some argue that, in fact, only annual reporting for 2011 will be compiled using new forms. Others insist on using new forms starting with interim reporting for 2011. We asked Igor Robertovich Sukharev, head of the accounting and reporting methodology department of the Russian Ministry of Finance, to clarify the situation on this issue, as well as to talk about upcoming innovations in the field of accounting.

Igor Robertovich, please tell me what forms of accounting reporting should be used when preparing an organization’s reporting for the first quarter of 2011?

Interim financial statements must be submitted using the same forms as annual statements.

Accounting reporting forms are used from the moment specified in Order of the Ministry of Finance of Russia No. 66n 1. This document stipulates that the order comes into force starting from the annual financial statements for 2011. Everyone is interested in the question of what forms to submit interim financial statements in 2011. The meaning of the phrase “from the annual financial statements for 2011” is as follows. The order approved several dozen different forms included in the annual financial statements. However, interim reporting contains only the balance sheet and profit and loss account from this entire set. Therefore, such an order cannot come into force earlier than the annual reporting. In this regard, it is more correct to raise the question not about the moment of entry into force of the order (it is already determined), but about the applicability of individual appendices to the order (more precisely, only one of the appendices) to interim reporting. Here it is necessary to take into account the requirements of PBU 4/99 2. This document does not contain direct rules on the formats of interim reporting, but from the rules that are in the document, I believe it directly follows that the format of interim reporting must correspond to the format of annual reporting. In this regard, interim reporting must be prepared using the same forms as annual reporting.

Composition of the explanation

The main difference from the previous form is the introduction of a column (the first one) “Explanations”, in which, according to the note to the form, the number of the corresponding explanation to the balance sheet and profit and loss statement is indicated.

It should indicate the number of explanations that relate to a particular line of the balance sheet. Let's assume that information about the availability and movement of fixed assets is grouped in table 2.1. Then in the balance sheet before the line “Fixed assets” you need to put “2.1”.

Explanations (formerly - explanatory notes) to the balance sheet and profit and loss statement (hereinafter - Explanations) can be presented in tabular and (or) text form. The organization can choose the recommended version of the form or develop its own form, but with the obligatory condition that the Explanations disclose all essential information for interested users.

If an organization chooses a tabular form of explanations, Appendix No. 3 to Order No. 66n is taken as a basis, which resembles the currently valid “fifth” form.

The purpose of the explanations is to decipher the lines of the balance sheet and income statement so that users of the statements are left with no questions about how this or that figure was derived. Previously, such transcripts were provided in form No. 5; now there is no special form for them.

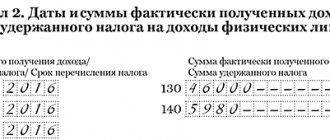

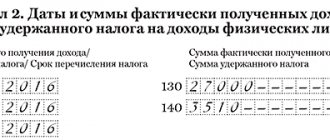

The accountant has the right to format the explanations in the way that is convenient for him. If the chief accountant chooses a tabular format, he can use the sample compiled by the authors of Order No. 66n. The sample is a series of tables where data is grouped for various accounts: fixed assets, intangible assets, inventories, accounts receivable, etc. For example, the table for “receivables” consists of the columns “At the beginning of the year”, “Changes for the period” and “ At the end of the period." The columns separately indicate the amounts of short-term and long-term debts, amounts accounted for under contracts and included in the reserve, etc.

Those who prefer a text format of explanations must show in words and numbers what transactions were completed during the year. In essence, this will be a series of separate fragments of text, each of which is dedicated to its own account: fixed assets, intangible assets, inventories, debt, etc.

Regardless of the chosen format, it is important that each piece of explanation (be it a table or part of the text) has its own number. It must be indicated before the corresponding line of the balance sheet or income statement so that the user can easily find the necessary explanations.

However, there are still differences in the Explanations; we will present them.

1. In the Explanatory Forms, in addition to the indicators at the beginning and end of the reporting period and changes for the period, for the comparability of indicators, row-by-line data is also provided for the previous year.

2. Information on the availability and flow of R&D by objects (groups of objects) is combined in one section “Intangible assets and R&D expenses”.

3. The “Fixed Assets” section of the Explanations includes a new subsection “Unfinished Capital Investments” indicating the costs incurred, write-off of costs and acceptance of capital investments for accounting as fixed assets.

4. From the reference information, the indicators “Changes in the value of fixed assets as a result of completion, retrofitting, reconstruction and partial liquidation” are displayed in a separate subsection, indicating specific objects of fixed assets that have undergone modernization.

5. In the “Financial investments” section it is necessary to indicate additional information: changes in financial investments for the period (disposal, interest accrual, etc.), their other use.

6. The explanations have been supplemented by the “Inventories” section, where information on groups of inventories should be disclosed: balances at the beginning and end of the year, changes for the period (received, disposed of, reserve for impairment, pledged, etc.).

7. In the “Accounts receivable and payable” section, information will need to be disclosed in terms of changes for the period (receipt, interest due, repayment, restoration of reserves, transfer from long-term to short-term, etc.) and separately highlight overdue receivables and payables.

Short-term receivables - concept, types

Debt of legal entities and individuals (suppliers, customers, borrowers or employees) to an organization, the repayment of which must occur within 12 months, is short-term receivables .

The following types of receivables can be distinguished (hereinafter referred to as receivables):

- normal - when goods (work, services) have already been shipped to the counterparty, but have not yet been paid because the payment deadline has not yet arrived;

- overdue - when payment for previously shipped goods (work, services) has not been received within the agreed time frame.

An overdue loan can subsequently be considered doubtful or hopeless for collection, if it is also not secured by a pledge, surety, or a bank guarantee.

Short-term accounts receivable - line on the balance sheet

To correctly fill out line 1230 “Accounts receivable” of Form 1, you must consider the following:

1. Additional lines should be entered into the balance sheet form to divide the account balance into short-term and long-term.

2. The amounts of the listed advances are indicated separately from the amount of payment for the sale of goods (works, services) provided that it is significant (letter of the Ministry of Finance of Russia dated January 27, 2012 No. 07-02-18/01).

3. The amounts of listed advances for goods (work, services) are indicated minus VAT, subject to deduction (letter of the Ministry of Finance of Russia dated January 09, 2013 No. 07-02-18/01).

Receivables expressed in foreign currency and conventional units are recalculated into rubles at the official exchange rate of the Central Bank of the Russian Federation on the last day of the reporting period (with the exception of listed advances).

4. If settlement accounts (60, 62, 68, 69, 70, 71, 73, 75, 76.) have debit and credit balances, then offsetting between them is not allowed.

5. The amount of debt for which the reserve for doubtful debts was created is indicated minus this reserve.

Explanations to the balance sheet

The balance sheet is a document whose preparation should be taken very seriously . It presents data on a specific enterprise for the tax service, government statistics bodies, and structural divisions of the organization for analytics and management.

In addition to the formation of this document, it is necessary to draw up explanations for it.

Line 1230 of the balance sheet: what does it consist of?

Line 1230 of the organization’s balance sheet as of the reporting date reflects, after certain adjustments, the amount of the debit balance of the following accounts (Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n):

- 46 “Completed stages of work in progress”;

- 60 “Settlements with suppliers and contractors”;

- 62 “Settlements with buyers and customers”;

- 68 “Calculations for taxes and fees”;

- 69 “Calculations for social insurance and security”;

- 70 “Settlements with personnel for wages”;

- 71 “Settlements with accountable persons”;

- 73 “Settlements with personnel for other operations”;

- 75 “Settlements with founders”;

- 76 “Settlements with various debtors and creditors.”

What is it and who makes it

The document explaining the financial statements contains information about certain assets and liabilities of the company, which are reflected in the balance sheet, along with income and expenses, that is, financial results.

The accounting employee in the specified documentation explains the information that is most important for auditors. Thanks to this information, they are able to assess the financial condition of the enterprise . The explanation usually states:

- original cost and accrued depreciation at the beginning and end of the reporting period;

- price indicator of incoming and outgoing property;

- How is depreciation calculated in accounting?

Drawing up explanations for the balance sheet is the responsibility of every enterprise , unless it is small. Small organizations do not need to issue these explanations when their balance sheet is not subject to audits.

Results

Explanations for the balance sheet are allowed to be drawn up in any form. They may contain tables, graphs and charts. The detail of information in them can be very varied - it all depends on the company’s intention to disclose any important indicators in a certain way. The main thing is that the information contained in the explanations is reliable and useful for users.

Sources:

- Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n

- Federal Law of December 6, 2011 N 402-FZ “On Accounting”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.