Payment of vacation pay to employees is a social guarantee norm, which is provided for in Art.

114 Labor Code of the Russian Federation. This employee’s income cannot be considered as wages, since no work activity is carried out during the rest period. Dear readers! To solve your specific problem, call the hotline or visit the website. It's free.

8 (800) 350-31-84

The differences in payments for the period of time worked and for the period of annual rest are quite significant and different points for calculating personal income tax are provided for them:

- Salary - personal income tax is withheld on the last day of the month of accrual or the date of dismissal of the employee (clause 2 of article 223 of the Tax Code of the Russian Federation).

- Vacation pay - personal income tax is withheld on the day of the expense transaction (1 clause 1 of article 223 of the Tax Code of the Russian Federation).

Thus, the need to reflect a separate vacation pay code in the 2-NDFL certificate is required for clear control by the tax authorities of compliance with the deadlines and amounts of tax transfers.

Why should vacation time be taken into account separately from basic earnings?

Vacation payments to an employee are one of the forms of social guarantees provided for in Art.

114 Labor Code of the Russian Federation. But they cannot be considered as wages, since during vacation the employee de facto does not work. The difference between payments for time worked and for annual rest is significant, since they provide for different points for calculating the taxable base for personal income tax:

- earnings for days worked - the last day of the month of its accrual or the day of termination of the working relationship (clause 2 of Article 223 of the Tax Code of the Russian Federation);

- vacation pay - the day of the expense transaction for their payment (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation).

That is, the tax agent is obliged to calculate and withhold personal income tax at the time of payment of vacation pay, and he has the right to transfer the withheld amount to the budget until the last day of the month in which the payment was made.

This judgment was officially confirmed by the Russian Ministry of Finance in its letter dated January 17, 2017 No. 03-04-06/1618.

Thus, a separate reflection of the vacation pay code in the 2-NDFL certificate is required so that tax authorities can monitor compliance with the deadlines and amounts of tax transfers.

Recommendation from ConsultantPlus: We recommend filling out the 2-NDFL certificate in the following order: general part; section 1; Application; section 3; section 2. Line-by-line algorithm for filling out 2-NDFL, see K+.

Trial full access to the K+ system can be obtained for free.

When does compensation arise for unused vacation upon dismissal?

As we have already said, as a general rule, such a thing as compensation for vacation is a consequence of the dismissal of an employee. Such a payment is included in the amount of the final settlement with the employee on his last working day (Article 140 of the Labor Code of the Russian Federation). At the same time, personal income tax is withheld. You can pay it to the budget the next business day or immediately.

The article is relevant for the following regions of the Russian Federation:

Republic of Adygea (Maikop), Republic of Altai (Gorno-Altaisk), Republic of Bashkortostan (Ufa), Republic of Buryatia (Ulan-Ude), Republic of Dagestan (Makhachkala), Republic of Ingushetia (Magas), Kabardino-Balkarian Republic (Nalchik), Republic of Kalmykia (Elista), Karachay-Cherkess Republic (Cherkessk), Republic of Karelia (Petrozavodsk), Republic of Komi (Syktyvkar), Republic of Crimea (Simferopol), Republic of Mari El (Yoshkar-Ola), Republic of Mordovia (Saransk), Republic of Sakha (Yakutia) ( Yakutsk), Republic of North Ossetia-Alania (Vladikavkaz), Republic of Tatarstan (Kazan), Republic of Tyva (Kyzyl), Udmurt Republic (Izhevsk), Republic of Khakassia (Abakan), Chechen Republic (Grozny), (Chuvash Republic (Cheboksary), Altai region (Barnaul), Transbaikal region (Chita), Kamchatka region (Petropavlovsk-Kamchatsky), Krasnodar region (Krasnodar), Krasnoyarsk region (Krasnoyarsk), Perm region (Perm), Primorsky region (Vladivostok), Stavropol region (Stavropol), Khabarovsk region (Khabarovsk), Amur region (Blagoveshchensk), Arkhangelsk region (Arkhangelsk), Astrakhan region (Astrakhan), Belgorod region (Belgorod), Bryansk region (Bryansk), Vladimir region (Vladimir), Volgograd region (Volgograd), Vologda region (Vologda) ), Voronezh region (Voronezh), Ivanovo region (Ivanovo), Irkutsk region (Irkutsk), Kaliningrad region (Kaliningrad), Kaluga region (Kaluga), Kemerovo region (Kemerovo), Kirov region (Kirov), Kostroma region (Kostroma), Kurgan region (Kurgan), Kursk region (Kursk), Leningrad region (St. Petersburg), Lipetsk region (Lipetsk), Magadan region (Magadan), Moscow region (Moscow), Murmansk region (Murmansk), Nizhny Novgorod region (Nizhny Novgorod) , Novgorod region (Veliky Novgorod), Novosibirsk region (Novosibirsk), Omsk region (Omsk), Orenburg region (Orenburg), Oryol region (Oryol), Penza region (Penza), Pskov region (Pskov), Rostov region (Rostov-on -Don), Ryazan region (Ryazan), Samara region (Samara), Saratov region (Saratov), Sakhalin region (Yuzhno-Sakhalinsk), Sverdlovsk region (Ekaterinburg), Smolensk region (Smolensk), Tambov region (Tambov), Tver region (Tver), Tomsk region (Tomsk), Tula region (Tula), Tyumen region (Tyumen), Ulyanovsk region (Ulyanovsk), Chelyabinsk region (Chelyabinsk), Yaroslavl region (Yaroslavl), Moscow, St. Petersburg, Sevastopol, Jewish Autonomous region (Birobidzhan), Nenets Autonomous Okrug (Naryan-Mar), Khanty-Mansiysk Autonomous Okrug - Yugra (Khanty-Mansiysk), Chukotka Autonomous Okrug (Anadyr), Yamalo-Nenets Autonomous Okrug (Salekhard).

The current personal income tax code in 2021 for vacation pay and for its compensation

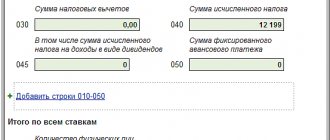

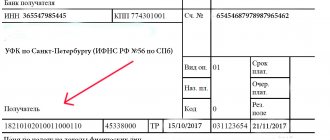

Clause 2 Art. 230 of the Tax Code of the Russian Federation defines the employer’s obligation to provide tax authorities with 2-NDFL certificates every year. They must be compiled reflecting payments received from the enterprise by month of accrual, codes of types of income and separate divisions, as well as indicating tax deductions that the recipient of payments uses.

Do not forget that from 2021 the form of calculation of 6-NDFL is changing, and the 2-NDFL certificate, as a separate document, has been cancelled. We also remind you that the deadline for submitting 2-NDFL certificates to the Federal Tax Service has been reduced by 1 month. You now need to report on the form no later than March 1st. In 2021 it is a working Monday. This means there will be no transfers. In addition, the report must be submitted electronically if you have more than 10 employees. See here for details.

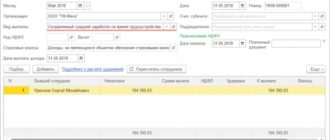

Possible payment codes that are practiced when filling out personal income tax registers are mentioned in Appendix No. 1 to the order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11 / [email protected] For vacation pay, the code is highlighted separately - 2012 “Vacation pay amounts,” he continues valid this year as well; changes in the code book did not affect it.

Payments of compensation to an employee for unused vacation days due to dismissal are also worthy of special mention. Since for them, starting with reporting for 2021, a new code 2013 “Amount of compensation for unused vacation” was introduced.

And for severance pay exceeding three times the average salary, code 2014 is provided.

Since January 2021, other income and deduction codes have been introduced for filling out the 2-NDFL certificate.

See here for details.

For a complete list of income codes in the 2-NDFL certificate, see the article “List of income codes in the 2-NDFL certificate (2012, 4800, etc.)”

All meanings

Summarizing the above, below is a table with a breakdown of income codes that may appear on income certificates in 2017.

| Code | Income type |

| 1010 | Dividends |

| 1011 | Interest, including discount, received on a debt obligation of any type, with the exception of: · interest on mortgage-backed bonds issued before January 1, 2007; · interest received on bank deposits; · income received upon repayment of a bill. |

| 1110 | Interest on mortgage-backed bonds issued before January 1, 2007 |

| 1120 | Income of the founders of the trust management of mortgage coverage received on the basis of the acquisition of mortgage participation certificates issued by the mortgage coverage manager before January 1, 2007. |

| 1200 | Other insurance payments under insurance contracts |

| 1201 | Insurance payments under insurance contracts in the form of payment for the cost of health resort vouchers |

| 1202 | Income in the form of excess amounts of insurance payments over the amounts of insurance premiums multiplied by the average annual refinancing rate of the Bank of Russia for each year, under a voluntary life insurance agreement, except for voluntary pension insurance agreements (subclause 2, clause 1, article 213 of the Tax Code of the Russian Federation) |

| 1203 | Income in the form of insurance payments under voluntary property insurance contracts (including civil liability insurance) exceeding the market value of the insured property or the cost of its repair, taking into account the paid insurance premiums (Clause 4 of Article 213 of the Tax Code of the Russian Federation) |

| 1211 | Insurance premiums under insurance contracts that are paid for individuals from their own funds by: · employers; · organizations (entrepreneurs) that are not employers. |

| 1212 | Income in the form of cash (redemption) amounts paid under insurance contracts (except for voluntary pension insurance contracts), in case of early termination of insurance contracts in terms of excess of the amounts of insurance premiums paid by the taxpayer |

| 1213 | Income in the form of cash (redemption) amounts paid upon termination of a voluntary pension insurance contract, reduced by the amount of insurance premiums paid by the taxpayer, in respect of which the social tax deduction provided for in subparagraph 4 of paragraph 1 of Article 219 of the Tax Code of the Russian Federation was not provided |

| 1215 | Income in the form of cash (redemption) amounts paid upon termination of a non-state pension agreement |

| 1219 | Amounts of insurance contributions in respect of which the payer was provided with a social tax deduction provided for in subparagraph 4 of paragraph 1 of Article 219 of the Tax Code of the Russian Federation (upon termination of the voluntary pension insurance agreement) |

| 1220 | Amounts of insurance contributions in respect of which the payer was provided with a social tax deduction provided for in subparagraph 4 of paragraph 1 of Article 219 of the Tax Code of the Russian Federation (upon termination of the non-state pension agreement) |

| 1240 | Pensions paid under non-state pension agreements concluded by: · organizations and other employers with Russian non-state pension funds; · citizens with Russian non-state pension funds in favor of other persons. |

| 1300 | Income received from the use of copyright or other related rights |

| 1301 | Income received from the alienation of copyright or other related rights |

| 1400 | Income received from the rental or other use of property (except for similar income from the rental of any vehicles and communications equipment, computer networks) |

| 1530 | Income received from transactions with securities traded on the organized securities market |

| 1531 | Income from transactions with securities not traded on the organized securities market |

| 1532 | Income from transactions with derivative financial instruments that are traded on an organized market and the underlying asset of which is securities, stock indices or other derivative financial instruments, the underlying asset of which is securities or stock indices |

| 1533 | Income from transactions with derivative financial instruments not traded on an organized market |

| 1535 | Income from transactions with derivative financial instruments that are traded on an organized market and the underlying asset of which is not securities, stock indices or other derivative financial instruments, the underlying asset of which is securities or stock indices |

| 1536 | Income received from transactions with securities not traded on the organized securities market, which at the time of their acquisition met the requirements for traded securities |

| 1537 | Income in the form of interest on a loan received from a set of repo transactions |

| 1538 | Income in the form of interest received in the tax period under a set of loan agreements |

| 1539 | Income from operations related to the opening of a short position that is the object of repo operations |

| 1540 | Income received from the sale of shares in the authorized capital of the organization |

| 1541 | Income received as a result of the exchange of securities transferred under the first part of the repo |

| 1542 | Income in the form of the actual value of a share in the authorized capital, paid when a participant leaves the organization |

| 1544 | Income received from transactions with securities traded on the organized securities market, accounted for in an individual investment account |

| 1545 | Income from transactions with securities not traded on the organized securities market, accounted for in an individual investment account |

| 1546 | Income from transactions with derivative financial instruments that are traded on an organized market and the underlying asset of which is securities, stock indices or other derivative financial instruments, the underlying asset of which is securities or stock indices accounted for in an individual investment account |

| 1547 | Income from transactions with derivative financial instruments not traded on the organized securities market, accounted for in an individual investment account |

| 1548 | Income from transactions with derivative financial instruments that are traded on an organized market and the underlying asset of which is not securities, stock indices or other financial instruments of futures transactions, the underlying asset of which is securities or stock indices accounted for in an individual investment account |

| 1549 | Income received from transactions with securities not traded on the organized securities market, which at the time of their acquisition met the requirements for traded securities accounted for in an individual investment account |

| 1550 | Income received from the assignment of rights of claim under an agreement for participation in shared construction (an investment agreement for shared construction or under another agreement related to shared construction) |

| 1551 | Income in the form of interest on a loan received from a set of repo transactions accounted for in an individual investment account |

| 1552 | Income in the form of interest received in the tax period on a set of loan agreements accounted for in an individual investment account |

| 1553 | Income from operations related to the opening of a short position that is the object of repo transactions accounted for in an individual investment account |

| 1554 | Income received as a result of the exchange of securities transferred under the first part of the repo, accounted for in an individual investment account |

| 2000 | Remuneration for performing labor or other duties; salary, monetary allowance not subject to paragraph 29 of Article 217 of the Tax Code of the Russian Federation, and other taxable payments to military personnel and equivalent categories of individuals. In addition to payments under civil contracts |

| 2001 | Directors' remuneration and other similar payments received by members of the organization's governing body (board of directors or other similar body) |

| 2002 | Amounts of bonuses paid for production results and other similar indicators provided for by the laws of the Russian Federation, employment agreements (contracts) and (or) collective agreements (paid not at the expense of the organization’s profits, not at the expense of special-purpose funds or targeted revenues) |

| 2003 | Amounts of remuneration paid from the organization’s profits, special-purpose funds or targeted revenues |

| 2010 | Payments under civil contracts (except for royalties) |

| 2012 | Vacation pay |

| 2201 | Author's fees for the creation of literary works, including for theatre, cinema, stage and circus |

| 2202 | Royalties for the creation of artistic and graphic works, photographs for printing, works of architecture and design |

| 2203 | Author's fees for the creation of works of sculpture, monumental and decorative painting, decorative and applied art, easel painting, theatrical and film set art and graphics, made in various techniques |

| 2204 | Royalties for the creation of audiovisual works (video, television and cinema) |

| 2205 | Author's fees for the creation of musical works: · musical and stage works (operas, ballets, musical comedies); · symphonic, choral, chamber works; · works for brass band; · original music for film, television and video films and theatrical productions. |

| 2206 | Copyright royalties (rewards) for the creation of other musical works, including those prepared for publication |

| 2207 | Author's fees (rewards) for the performance of works of literature and art |

| 2208 | Copyrights (rewards) for the creation of scientific works and developments |

| 2209 | Royalties for discoveries, inventions, industrial designs |

| 2210 | Remuneration to the heirs (legal successors) of the authors of works of science, literature, art, as well as discoveries, inventions and industrial designs |

| 2300 | Temporary disability benefits |

| 2400 | Income from: · leasing or other use of any vehicles (including sea, river, aircraft and cars) for transportation; · fines and other sanctions for idle time (delay) of vehicles at loading (unloading) points; · leasing or other use of pipelines, power lines (power lines), fiber-optic lines, wireless communications, and other means of communication, including computer networks. |

| 2510 | Payment by organizations or individual entrepreneurs for goods (work, services) or property rights, including utilities, food, recreation, training for an individual |

| 2520 | Income in kind, in the form of full or partial payment for goods, work performed, services provided in the interests of an individual |

| 2530 | Payment in kind |

| 2610 | Material benefit received from savings on interest for the taxpayer’s use of borrowed (credit) funds received from organizations or individual entrepreneurs |

| 2630 | Material benefit received from the acquisition of goods (work, services) under civil contracts from individuals, organizations and individual entrepreneurs who are interdependent in relation to the taxpayer |

| 2640 | Material benefit received from the acquisition of securities |

| 2641 | Material benefit received from the acquisition of derivative financial instruments |

| 2710 | Financial assistance (except for financial assistance specified in codes 2760, 2761 and 2762) |

| 2720 | Cost of gifts |

| 2730 | The cost of prizes in cash and in kind received at competitions and competitions that are held on the basis of decisions of the Government of the Russian Federation and other government bodies (local government) |

| 2740 | The cost of winnings and prizes received at competitions, games and other events for the purpose of advertising goods, works and services |

| 2750 | The value of prizes in cash and in kind received at competitions and competitions. Provided that these events are not carried out according to decisions of the Government of the Russian Federation and other government bodies (local government) and not for the purpose of advertising goods (works and services) |

| 2760 | Financial assistance provided by employers to their employees, as well as to their former employees who resigned due to retirement due to disability or age |

| 2761 | Financial assistance provided to disabled people by public organizations of disabled people |

| 2762 | Amounts of one-time financial assistance provided by employers to employees (parents, adoptive parents, guardians) upon the birth (adoption) of a child |

| 2770 | Reimbursement (payment) by employers for the cost of purchased medications prescribed by the attending physician to the following persons: · their employees; · spouses of employees; · parents and children of employees; · your former employees (retirees); · disabled people. |

| 2780 | Reimbursement of the cost of medications purchased by the taxpayer (payment for the taxpayer) prescribed by the attending physician, in other cases not falling under paragraph 28 of Article 217 of the Tax Code of the Russian Federation |

| 2790 | The amount of assistance (in cash and in kind), as well as the value of gifts received by: · veterans of the Great Patriotic War; · disabled people of the Great Patriotic War; · widows of military personnel who died during the war with Finland, the Great Patriotic War, and the war with Japan; · widows of deceased disabled people of the Great Patriotic War and former prisoners of Nazi concentration camps, prisons and ghettos; · former minor prisoners of concentration camps, ghettos and other places of forced detention created by the Nazis and their allies during the Second World War. |

| 2800 | Interest (discount) received upon payment of a bill presented for payment |

| 2900 | Income received from transactions with foreign currency |

| 3010 | Income in the form of winnings received in the bookmaker's office and betting |

| 3020 | Interest on bank deposits |

| 3022 | Income in the form of fees for the use of funds of members of a consumer credit cooperative (shareholders) Interest on the use by an agricultural credit consumer cooperative of funds raised in the form of loans from members of an agricultural credit consumer cooperative or associated members of an agricultural credit consumer cooperative (from January 1, 2011) |

| 4800 | Other income (scholarships, compensation for delayed salaries, etc.) |

Also see “New income and deduction codes for 2-NDFL certificates from December 26, 2021.”

Read also

21.12.2016

What accrual period for vacation pay income code should be in the 2-NDFL certificate?

Another question that concerns an accountant in the “Salaries and Personnel” section is how to correctly calculate personal income tax for a time period, taking into account the employee’s tax deductions.

As you know, vacation is paid according to the average earnings for the entire vacation period at once. If in a situation where the vacation period falls within the framework of one month, everything is clear, then what to do with “rolling” vacations, the end date of which does not fall in the month when they were paid?

The answer to this question has been repeatedly given by both tax authorities and the Ministry of Finance, including in the letters that we mentioned earlier: regardless of the start and end dates of the vacation, the period for receiving income will be the month in which the vacation pay was actually paid.

Read about reducing the tax base for individuals here.

Results

In the 2-NDFL certificate, payments to vacationers must be separated from wages and accounted for under a separate income code. This will allow you to comply with the requirements of tax legislation regarding the procedure for tax accounting and filling out reports.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.