Home / News and changes

Back

Published: 02/13/2019

Reading time: 5 min

0

290

Regardless of how much income an individual entrepreneur receives from his activities, he must pay mandatory insurance premiums for himself every year. Even if the entrepreneur’s business is not profitable, or the activity has been suspended (without the official closure of the individual entrepreneur), paying taxes cannot be avoided.

- What fixed fees must be paid?

- Contribution amounts

- Procedure and deadlines for payment of contributions Table

Also, the need to pay contributions is not affected by the fact whether the entrepreneur has hired employees or works independently.

What fees do individual entrepreneurs need to pay in 2019?

Individual entrepreneurs are required to pay insurance premiums on payments and remunerations accrued in favor of individuals within the framework of labor relations and civil contracts for the performance of work and provision of services (Clause 1 of Article 419 of the Tax Code of the Russian Federation). But individual entrepreneurs must also transfer mandatory insurance premiums “for themselves” (Article 430 of the Tax Code of the Russian Federation):

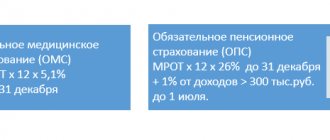

- for pension insurance;

- for health insurance.

In 2021, individual entrepreneurs are required to pay insurance premiums “for themselves” in any case. That is, regardless of whether they are actually conducting business activities or are simply registered as individual entrepreneurs and are not engaged in business. This follows Article 430 of the Tax Code of the Russian Federation.

There are also insurance premiums in case of temporary disability and in connection with maternity. Individual entrepreneurs, as a general rule, do not pay this type of insurance premiums (clause 6 of Article 430 of the Tax Code of the Russian Federation). However, payment of these contributions can be made on a voluntary basis. This is provided for in Article 4.5 of the Federal Law of December 29, 2006 No. 255-FZ. Why pay these contributions voluntarily? This is done so that in the event of, for example, illness, the individual entrepreneur can receive an appropriate sickness benefit at the expense of the Social Insurance Fund.

Individual entrepreneurs do not pay insurance premiums for injuries at all. Payment of this type of insurance premiums by individual entrepreneurs is not provided even on a voluntary basis.

Mandatory fixed contributions for individual entrepreneurs in 2021

Individual entrepreneur contributions for 2021 are in no way tied to the minimum wage. They are established by law dated November 27, 2017 No. 335-FZ:

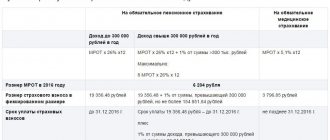

· to the Pension Fund of the Russian Federation - 29,354 rubles. + 1% on individual entrepreneur income over 300,000 rubles. (the total payment is limited to a limit of RUB 234,832);

· In the Federal Compulsory Medical Insurance Fund - 6,884 rubles.

The table below shows the amounts of all contribution payments, as well as the due dates for their payment:

| Where to pay | Size (amount) | Payment due date |

| For pension insurance in the Federal Tax Service (fixed amount) | RUB 29,354 | 31/12/2019 |

| For medical insurance in the Federal Tax Service (fixed amount) | RUB 6,884 | 31/12/2019 |

| For pension insurance in the Pension Fund of the Russian Federation with income exceeding 300,000 rubles for 2021 | 1% of the amount of income exceeding 300,000 rubles. At the same time, the amount of all payments of individual entrepreneurs for themselves is limited to the amount of 234,832 rubles. | 01/07/2020 |

How do contributions differ from taxes?

For an entrepreneur, all payments to the budget are perceived equally. This is money that must be transferred on time in order to avoid problems with the tax office. Taxes, fees, and contributions are taken into account when calculating the total fiscal burden of a business, but their legal nature is different.

Taxes are gratuitous payments that are spent at the discretion of the state. And contributions go to the personal account of each insured person and are directed towards his pension and health insurance.

The greater the amount of contributions in the insurance account, the higher the pension will be (taking into account the current rules for its calculation and payment). As for compulsory health insurance, it is carried out on equal terms for everyone.

Deadlines for paying contributions “for yourself”

The deadline for payment of fixed individual entrepreneur contributions is no later than December 31 of the current year. That is, contributions for 2021 must be paid no later than December 31, 2021.

As for additional contributions from excess income in the amount of 300,000 rubles, then according to clause 2 of Art. 432 of the Tax Code of the Russian Federation, such contributions are paid before July 1 of the year following the reporting year. That is, contributions for 2021 must be paid no later than July 1, 2021.

Next, we will consider some features of calculating and paying insurance premiums for individual entrepreneurs “for themselves” in 2021.

Calculate your liabilities with a chart guide

Calculate your obligations to pay insurance premiums in 2019-2020 yourself using the diagram:

ConsultantPlus experts spoke about what constitutes income for individual entrepreneurs under different taxation systems. Proceed to the explanations by getting trial access to the system for free.

If you still have difficulties calculating contributions, look for your situation in the table in the next section.

How much should an individual entrepreneur pay for an incomplete year?

If an individual entrepreneur did not register from the beginning of the year or completed his activities in 2021, then he must not pay the full amount of insurance premiums. In this case, contributions are calculated in proportion to the number of months during which he was registered as an individual entrepreneur.

Let's give an example of calculating an individual entrepreneur's contributions for himself in 2021, if the individual entrepreneur was opened in 2021.

Let's assume that the individual entrepreneur registered on January 15, 2021. For a full 11 months (from February to December 2021), the individual entrepreneur will have to pay:

- to the Pension Fund RUB 26,907.83. (RUB 29,354: 12 months x 11 months);

- in the Federal Compulsory Medical Insurance Fund 6,310.33 rubles. (RUB 6,884: 12 months x 11 months)

For part of January 2021, you need to calculate in proportion to the number of days during which the individual entrepreneur was an entrepreneur. There are a total of 31 days in January 2021, and the individual entrepreneur was registered on the 15th, that is, he was an entrepreneur for 17 days in the month (31 days - 14 days). Therefore, the amount for January will be:

- to the Pension Fund of Russia 1,341.45 rubles. (29,354: 12 x 17/31);

- in FFOMS 314.59 rub. (RUB 6,884: 12 x 17/31).

We count the amount in kopecks and round to the nearest kopeck according to the rounding rules. Total amount of contributions:

- to the Pension Fund RUB 28,249.28. (RUB 26,907.83 + RUB 1,341.45);

- in FFOMS 6,624.92 rubles. (RUB 6,310.33 + RUB 314.59).

In a similar way, you can calculate the contributions of an individual entrepreneur if he ceased operating as an individual entrepreneur in 2021.

If an entrepreneur decides to cease operations and deregister with the tax authority in 2021, he must pay the fees within 15 days from the date of deregistration.

Opened an individual entrepreneur - you can’t do without insurance payments

Let's start the conversation about fixed insurance premiums (FIP) for individual entrepreneurs with an example.

After graduating from college, Rustam Rafikovich Zainetdinov could not find a job in his specialty for a long time and, out of despair, decided to become an individual entrepreneur. I collected the necessary documents and submitted them to the tax office.

Soon he was offered a position as a mechanic at a plant with a decent salary and benefits package. He was so captivated by his new job that until the end of the year he did not remember that, according to his documents, he was an individual entrepreneur.

Therefore, the demands for payment of insurance premiums received by mail came as a complete surprise to him. Why did the debt arise if he was not actually engaged in business?

If the failed entrepreneur had studied Art. 430 of the Tax Code of the Russian Federation, he would not so frivolously forget about registering an individual entrepreneur and took into account that as long as he is registered in the Unified State Register of Individual Entrepreneurs (as an active entrepreneur), he will still have to pay contributions.

Find out how to register as an individual entrepreneur yourself, where to get a sample of filling out a registration application and what to do next after registration.

When an individual entrepreneur may not pay taxes, find out from this article.

Find out how much entrepreneurs will have to pay next year.

Insurance premiums for individual entrepreneurs in 2021 if income exceeds 300,000 rubles

If for 2021 the income of an individual entrepreneur exceeds 300 thousand rubles, then in addition to the contributions indicated above, the individual entrepreneur must pay pension insurance contributions in the amount of 1% of the amount of income exceeding 300,000 rubles. Moreover, the maximum amount of such contributions in 2021 is 234,832 rubles. = 8 x 29,354 rub.

Amount of additional contributions to the Pension Fund = Amount of income – 300,000 x 1%

Additional contribution to compulsory pension insurance – 1% on income exceeding RUB 300,000. (Letter of the Federal Tax Service dated April 18, 2018 N BS-2-11/) for the year. The following are considered income:

- under the simplified tax system - all accounted income without taking into account your expenses. The object of taxation – “income” or “income minus expenses” does not matter;

- for UTII - imputed income (clause 4, clause 9, article 430 of the Tax Code of the Russian Federation). To calculate it, add up the indicators of the lines of 100 sections. 2 UTII declarations for all four quarters of the year;

- when paying personal income tax - income reduced by professional deductions.

An example of calculating individual entrepreneur contributions from 1% income

From January 1 to December 31, 2021, the individual entrepreneur conducted business activities on the simplified tax system. The entrepreneur's income amounted to 16 million rubles. Since the entrepreneur worked out the entire billing period, he paid fixed amounts for 2019 no later than December 31, 2021. No later than December 31, 2021, the individual entrepreneur listed:

- for pension insurance OPS - 29,354 rubles;

- for medical insurance - compulsory medical insurance - 6,884 rubles.

The calculation based on income is 157,000 rubles. ((RUB 16 million – RUB 300,000)) x 1%. This amount does not exceed 234,832 rubles. The individual entrepreneur paid 157,000 rubles. to the Pension Fund no later than July 1, 2021.

Results

The minimum wage does not participate in the calculation of fixed payments for individual entrepreneurs in 2019-2020. Specific amounts of contributions are indicated in the Tax Code of the Russian Federation. For 2020 - RUB 32,448. for OPS and 8,426 rubles. on compulsory medical insurance. And for individual entrepreneurs employed in industries affected by coronavirus, the amount of contributions to compulsory pension insurance has been reduced to 20,318 rubles.

If income exceeds 300,000 rubles, an additional payment is made to the Pension Fund (1% of the amount of excess income over the specified limit).

Gaining or losing individual entrepreneur status within a year reduces the amount of insurance premiums in proportion to the length of the individual’s period of stay in this status.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Taxes

The main news in the field of taxation is the increase in VAT from January 1, 2021. The maximum value added tax rate will increase from 18% to 20%. The increase in VAT will affect even those entrepreneurs who do not pay it because they work under special regimes.

Most individual entrepreneurs are built into a chain of counterparties working on a common system, so the increased VAT rate will be reflected in the price of purchased goods and services. Many experts believe that real price increases will exceed 2%, and ultimately this will negatively affect consumer demand.

As for tax rates under special regimes, the situation here is more even. For payers of the simplified tax system and unified agricultural tax, nothing has changed. A slight increase in tax payments is expected on UTII due to the annual increase in the K1 coefficient, in this case from 1.868 to 1.915.

The cost of an individual entrepreneur’s patent may also increase in certain regions, but here everything depends on the decisions of municipal authorities. If they exercise their right to change the potential annual income for certain activities, the patent will cost more.

But the real innovation in the taxation of individual entrepreneurs can be called a new type of tax - on professional income. This tax is designed specifically for the so-called self-employed who are engaged in small businesses without registering with the Federal Tax Service.

Starting from 2021, individual entrepreneurs who operate in Moscow, the Moscow and Kaluga regions, and the Republic of Tatarstan can also become NAP payers.

The tax rate on professional income depends on the category of clients or buyers. If these are ordinary individuals, then the tax will be only 4% of the income received, and if they are individual entrepreneurs or organizations, then 6%. NAP payers do not pay insurance premiums for themselves.

To work under this new regime in one of the above regions, a number of restrictions must be observed:

- have no employees;

- receive an annual income of no more than 2.4 million rubles;

- not engage in resale of goods, as well as trade in excisable and marked goods.

All other conditions for NAP payers can be found out from the primary source.

In what cases can the payment of fixed payments be suspended?

Current legislation provides for periods when an entrepreneur does not pay insurance premiums (clause 7 of Article 430 of the Tax Code of the Russian Federation, Federal Law No. 400-FZ dated December 28, 2013 “On Insurance Pensions”), namely for the period:

- completion of military service upon conscription;

- care of one of the parents for each child until he reaches the age of one and a half years;

- care provided by an able-bodied person for a group I disabled person, a disabled child or a person who has reached the age of 80;

- residence of spouses of military personnel performing military service under a contract, together with their spouses, in areas where they could not work;

- residence abroad of spouses of employees sent, in particular, to diplomatic missions and consular offices of the Russian Federation, international organizations, the list of which is approved by the Government of the Russian Federation.

Reporting

Changes in forms and forms are generally accepted at the beginning of a new reporting period. However, officials do not always have time to register documents with the Ministry of Justice on time, so sometimes new forms are approved in the midst of the reporting campaign. This happened once with a declaration under the simplified tax system for 2015, when two different forms were in effect in one period.

That is, it is quite possible that by the end of this year some other new reporting forms will be adopted, but for now we only know about these:

- New declaration 3-NDFL for individual entrepreneurs on the general taxation system (order of the Federal Tax Service dated October 3, 2021 N ММВ-7-11 / [email protected] ).

- The new declaration form for UTII was approved by order of the Federal Tax Service dated June 26, 2021 N ММВ-7-3/ [email protected] The first time you must report using this form in the period from January 1 to January 20, 2019.

- The new form for calculating insurance premiums for employers has not yet been adopted, but its draft has already been posted for discussion.

In addition, a bill on canceling the declaration under the simplified tax system for the object “Income” has been posted on the official portal. Officials believe that if all income of a simplified person goes through an online cash register, there is no need to submit reports.

How to pay contributions through Sberbank online personal account

If an entrepreneur opens a current account with Sberbank, he is provided with Sberbank Business Online Internet banking. Using it, you can easily pay the fee without leaving your home. Let's look at the process step by step.

Step 1: Login

You must log into the Internet system using the link: https://sbi.sberbank.ru:9443/ic/dcb/ To log in, use your TIN as a login and a personal password. Next, you will need to confirm the login operation by entering the code from SMS.

Step 2. Create a payment order

You must select the item “Payments and transfers” and then “Payment to the budget”. A document creation form will appear on the screen in which you will need to enter data.

In the “Payment Amount” column you need to enter the amount of the contribution that needs to be transferred. The entrepreneur is given a fixed amount for the year, which can be paid at once or in installments. The main thing is that it is listed in full by the end of the year.

In the VAT section, you must indicate “VAT not subject to.”

Then you need to enter the details of the recipient of the contributions. They can be obtained from the tax office website https://service.nalog.ru/addrno.do, or received from the Federal Tax Service. For convenience, the details can be saved as a template, and further payments can be made using it.

The “Payment for a third party” field allows you to make a transfer for a third party.

In the field “Payer status 101” you need to enter 09, which means individual entrepreneur.

The required KBK code is entered in the “KBK 104” field.

In the “OKTMO 105” field, you must enter the OKTMO code assigned to the entrepreneur.

In the field “Base of payment 106” the TP is entered if the payment is made for the same year.

In the “Tax period indicator” field for contributions, indicate “Year” and its 4-digit number.

We set the document number and UIN to “0”, and select “Do not specify” for the payment date.

Attention: the purpose of the payment must verbally describe what the payment is for. For example: “Insurance contributions for compulsory pension insurance of individual entrepreneurs in a fixed part for 2021.” In fact, filling out this field is not so important, since the payment is posted, first of all, to the KBK.

The order of payment must be selected “5”.

The generated payment slip can be saved as a template for future use.

Step 3: Check for errors

The system itself will check that the fields are filled in correctly. She will not let you save the payment if there are errors in it. If an error is displayed in the checkpoint, then since the entrepreneur does not have this code, you must enter “0”.

Step 4. Sign the document

After the payment is generated, it must be signed using the code from the SMS. After this, the payment will be completed.

How to be sure to deal with taxes and reporting?

It is most effective to contact a company that professionally provides tax and accounting reporting services. You can order consultations, generation of a specific report or full support. We invite you to visit us!

Why do they trust us?

- Many years of experience. It helps us know in advance all the pitfalls of taxation and reporting, as well as avoid many common mistakes.

- Multidisciplinary. We employ not only accountants, but also lawyers.

- Services from a team of specialists. You do not depend on one person and receive multi-level verification of work.

Call us at the phone number listed on the website or fill out the feedback form so that the company’s employees can advise you on the exact cost and tell you how to start cooperation.

Individual entrepreneur registration

All options for registering an individual entrepreneur come down to two methods - independently and with the help of a specialist. Each method has its pros and cons:

| Way | Price | pros | Minuses |

| Independently through Gosuslugi | 0 ₽ | Cheap. No need to go to the tax office. | You must have an enhanced electronic qualified signature (No. 234-FZ dated July 29, 2018). An error in the application may result in refusal. |

| Independently through the Federal Tax Service | In the city of registration: 800 ₽ – fee In another city: 800 ₽ – fee 1200 ₽ – notary 500 ₽ – courier | You do everything yourself. If you are in the city of registration, it is enough to visit the tax office 2 or 4 times. | You must not make mistakes in filling out documents. You are wasting time and wasting money on taxis. If you are not in the city of registration, you need to visit a notary and courier service. |

| Through Delta Finance - economy | 800 ₽ – duty 1750 ₽ – tariff | The lawyer prepares the documents, you submit them to the tax office. We are giving away a month of accounting services free of charge. | Waste time visiting the Federal Tax Service and money on a taxi. |

| Through Delta Finance - turnkey | 800 ₽ – duty 3250 ₽ – tariff | The lawyer prepares and submits documents to the tax office, takes the Unified State Register of Individual Entrepreneurs (USRIP) entry sheet, advises on the choice of taxation system and submits an application to switch to the chosen regime. We are giving away a month of accounting services free of charge. | 1000-2000 ₽ more expensive than the “do it yourself” option. |

Along with the turnkey individual entrepreneur registration service, you can order the preparation of documents for opening a current account in a recommended bank.