Every accountant has probably encountered such a problem that they need to delete an erroneous document in the previous period. But the period has already closed, the reporting has been submitted.

For such cases, 1C 8.3 (as well as 1C 8.2) provides for a reversal operation. It lies in the fact that in the current period all the same movements of the previous document are repeated in all accounting registers (accounting, tax, etc.), but with the opposite sign.

I will demonstrate how to reverse a document in 1C using an example.

Methodological and historical aspects

Reversal is a way of adjusting data in accounting (from the Italian stornare - withdraw, turn back). The term reverse (reverse) is actively used, which can be called a synonym for the word minus. Incorrectly entered entries* (they entered an extra document, made a mistake with correspondence, indicated an inflated amount) are subject to zeroing, for this purpose such entries are reflected in accounting with a negative sign.

*The term reverse is not always used in case of errors. Sometimes, if during a period accounting is carried out at planned prices, and then they are adjusted to actual prices, it becomes necessary to reduce the amount. In this case, the term “reverse” is also applicable.

Previously, when accounting was kept manually, in the turnover or accounting books, when errors were discovered, the incorrect amount was not crossed out, but was additionally written down in red ink. If red ink was not at hand, then such amounts were written down and circled in a rectangular frame. When calculating the totals, the amounts written in red should have been subtracted, or, in professional terms, the amount should have been reversed. It looked something like this:

Example 1: Account turnover, the amount of 1000 is correct, instead of the amount of 4000 they indicated 4400 (Operation 2).

Option 1

Fig. 1 Account turnover

Option 2

Fig.2 Turnover according to accounting account-2

The color reversal method was first described in 1889 by Alexander Aleksandrovich Beretti, and in Russian accounting a stable phrase has emerged - “red reversal”.

Theoretically, you can reset an erroneous entry by swapping debit and credit, creating a so-called reverse reversal. This approach creates the correct final balance, but the amount of turnover on the accounts will be overestimated, which will lead to some unreliability of the accounting information. By changing our example, you can clearly see this:

Option 3

Fig.3 Turnover according to accounting account-3

Sometimes the method of correcting errors by reverse posting is called “black reversal,” although this term cannot be called official. Moreover, there are options for action here too. It is possible, as in option number three (if the accounts are correctly corresponded), to indicate only the delta between the correct and deposited amount and not create additional correct postings (Operation 3).

Option 4

Fig.4 Turnover according to accounting account-4

The reverse reversal method is usually used in credit institutions or Western accounting systems. In Russian accounting, by default, reversal is most often understood as “red reversal”. Legislatively, for example, in the accounting law, the term reversal does not appear. The procedure for correcting errors is described in PBU 22/2010, but there is no term for reversal there either. At the same time, in other acts of legislation, mainly related to budgetary or autonomous organizations, the text directly refers to the red reversal method as a method for correcting errors. Based on the practice that has developed in our country of reversing erroneous documents, we will further understand the term “reversal” as “red reversal”.

Automation and reversal

When accounting was transferred to the area of automated processes, that is, when accounting was done on a PC, they began to generate postings with a minus sign (the correspondence of accounts did not change), and in the turnover, for better visualization, they left the red color for negative values. On some reporting forms you may see an instruction to show negative numbers in parentheses. When calculating the totals, we know that we must subtract them.

Note that if, as a result of an error, an underestimated amount was indicated, and the correspondence of accounts is correct, then an option is possible when the reversal method is not applied, but an additional entry is simply created for the difference in the amount.

Let us pay attention to an important nuance that determines the specifics of automated accounting in 1C. When posting a document in the program, transactions are generated in accordance with the chart of accounts. They are called that - accounting entries, which will ultimately show the amounts of assets and liabilities on the balance sheet. But the financial service also needs to fill out tax returns, reports to funds and other registers that are not methodologically tied to the chart of accounts and can be formed according to completely different principles. A stable term “tax accounting” has appeared, data for which should be generated in accordance with the Tax Code (accounting data is generated in accordance with PBU - Accounting Regulations). In 1C, in settings and postings you can often see the abbreviations BU (accounting) and NU (tax accounting). In addition, there are additional intermediate registers. For example, data for the purchase and sales ledger is generated in similar registers. Therefore, the reversal of documents should affect not only transactions related to accounting and tax accounting - the registers must also be filled out correctly.

Downward adjustment of current year sales

We need to reduce the sales shipped in the previous quarter. VAT reporting has already been submitted for it.

1.1. Adjustment of sales with correction in the sales book

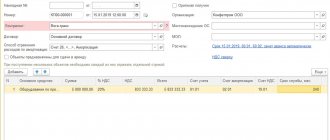

When you first enter Implementation Adjustments, 1C creates it with the default operation type Correction of primary documents. Let's reduce the price one line at a time:

Document Adjustment of implementation in 1C UPP

After carrying out we receive the postings:

Correction of implementation in 1C UPP - postings

Don't forget to create an invoice. It looks like this:

Then the document data should not be added to the Formation of a purchase or sales ledger. Therefore, after posting documents to VAT registers, you can see the result in the Sales Book. Check the box Generate additional. sheets for the adjusted period and look at the resulting additional sheet:

So,

An adjustment with the operation type Correction in primary documents reverses the amounts for the basis document and creates a new entry in the shipment period.

How to change an information register entry in 1C 8.3

As mentioned above, the Operation document is intended not only for adjusting documents, but also for adjusting registers.

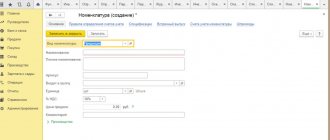

Let's look at a small example. Let's say June 24, 2016. the fixed asset was taken into account. The initial information was filled in, in which an error was made - the useful life was incorrectly indicated as 68 months instead of 60:

The DtKt button shows the movement of the document, including in the information registers: Asset depreciation parameters (accounting), Asset depreciation parameters (tax accounting):

To adjust the information register, we use the already familiar document Operations – Operations entered manually. The difference is that we select the Operation type:

We indicate the organization and click on the “More” button:

We select the necessary information registers for adjustment:

We create adjusting entries for the fixed asset:

In order to verify the correctness of the information on a fixed asset after changes to the information register entry in 1C 8.3, we will generate a universal report, indicating the information register OS depreciation parameters (accounting) and OS depreciation parameters (tax accounting):

We recommend watching our free seminar “Error in using 1C 8.3, for which you can be fired,” which discusses in detail errors when correcting documents in 1C.

For more details on how you can reverse a document in 1C, see our video tutorial:

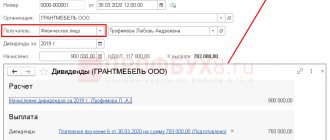

An example of adjusting salary data when deducting by reversing

Employee K. was paid a salary of 22,700 rubles for October 2021. The amount of personal income tax withheld was 2,951 rubles, the amount of insurance premiums was 6,855 rubles. When accruing, the accountant made an arithmetic error in calculating the allowance. The correct amount of accrued wages was 22,300 rubles. The deduction was made in the statement for November.

| Operation | Wiring | Amount (in rubles) |

| Operations for October 2016 | ||

| Payroll | Dt 20 Kt 70 | 22 700 |

| Calculation of insurance premiums | Dt 20 Kt 69 | 6 855 |

| Personal income tax accrual | Dt 70 Kt 68 | 2 951 |

| Issuing the amount to the employee | Dt 70 Kt 51 | 19 749 |

| Operations for November 2016 | ||

| Reversal of accrued amount | Dt 20 Kt 70 | 22 700 |

| Reversal of contributions | Dt 20 Kt 69 | 6 855 |

| Reversal of personal income tax | Dt 70 Kt 68 | 2 951 |

| Reversal of the issued amount | Dt 70 Kt 51 | 19 749 |

| Payroll calculation | Dt 20 Kt 70 | 22 300 |

| Calculation of contributions | Dt 20 Kt 69 | 2 899 |

| Personal income tax accrual | Dt 70 Kt 68 | 6 735 |

| Issuing the amount to the employee | Dt 70 Kt 51 | 19 401 |

Reversal method. Correcting Accounting Errors: Examples of Using Reversals

One of the mistakes is when an incorrect entry may be made when reflecting accounts. Cashier M. of the enterprise gave employee S. an accountable amount of 5,200 rubles for business needs. At the time of the transaction, the cashier applied the amount to the payroll account. The error was discovered in the current period when summing up monthly results. In the accounting of an enterprise, the accountant makes entries:

- Adjustment of postings using the reversal method: Dt 70 Kt 50 in the amount of 5,200 rubles;

- The amount given to the employee is reflected: Dt 71 Kt 50 in the amount of 5,200 rubles.

Conclusion: the red reversal adjustment did not affect the results of the month. Another common mistake is recording the transaction amount in a larger amount.

Cashier N. carries out payroll calculations in the branch using a cashier authorized to issue amounts in the branch. The amount of the payroll for the payment of wages for March amounted to 87,250 rubles. Cashier N. indicated to the cash register and issued the amount of 97,250 rubles. The error was discovered when the settlement with employees was completed and the statement was submitted to the cashier. The following entries are made in the company's accounting:

- Reversing an incorrect transaction amount: Dt 70 Kt 50 in the amount of 97,250 rubles;

- Entering the correct entry: Dt 70 Kt 50 in the amount of 87,250 rubles.

Conclusion: the error, which arose due to the carelessness of the cashier and the distributor, was eliminated this month.

Using the reversal method in payroll

Reversal of excessively accrued wages is carried out only in the cases specified in Art. 137 Labor Code of the Russian Federation. Withholding is possible if an accountant commits a counting error or recognizes for employees a failure to comply with labor standards established by a labor dispute commission or a judicial body. Overpayments resulting from incorrect information provided by the employee are withheld based on a court decision. Counting errors occur most often in accounting.

The definition of a counting error is not established by law. It is assumed that a counting error is understood as an inaccuracy due to inaccurate calculation, incorrect rounding of amounts, or the accountant performing erroneous arithmetic operations. In other cases, overpaid amounts are not withheld, but can be paid by the employee voluntarily. To withhold an overpayment in the event of a counting error, it is also necessary to have the consent of the employees. The employer must decide to withhold the excess accrued amount within a month.