Author of the article: Anastasia Ivanova Last modified: January 2021 17909

For individuals, the Civil Code provides for the possibility of an oral agreement. Enterprises and organizations are required by law to enter into contracts exclusively in writing. Gratuitous transactions between legal entities are a fairly common form of agreement. Let's look at specific examples of such transactions and the features of their conclusion.

Free transfer of property between legal entities

You can give something to each other from the bottom of your heart, without expecting anything in return. Or you can try to achieve some financial benefits for yourself in this way, for example, reduce the amount of tax. Individuals can transfer any property to each other without burdening themselves with additional registration if they do not wish to do so. But organizations must adhere to legally regulated procedures.

There are many nuances in the gratuitous transfer of property between legal entities that an entrepreneur must comply with in order to remain within the law. Let's consider which methods of transferring property can be classified as free of charge, how such a transfer is carried out and how to formalize it correctly, and also clarify the tax subtleties relating to this procedure.

When you don't have to pay tax

The Tax Code of the Russian Federation contains a list of gratuitous transactions that are not considered sales for the purposes of calculating and paying VAT (clause 2 of Article 146 of the Tax Code of the Russian Federation) or are exempt from tax (Article 149 of the Tax Code of the Russian Federation).

Let's look at some of them.

Transfer of property is not a sale

The gratuitous transfer by state and municipal institutions, authorities and local governments, as well as state unitary enterprises and municipal unitary enterprises of fixed assets is not considered a sale (clause 5, clause 2, article 146 of the Tax Code of the Russian Federation). Therefore, the transferring party does not need to calculate VAT.

The gratuitous transfer of funds is also not considered a sale, therefore, the transferring party is not subject to VAT (clause 1, clause 3, article 39 of the Tax Code of the Russian Federation, subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation).

The gratuitous transfer of valuables or other benefits for the implementation of the main activity specified in the charter of the enterprise and other than entrepreneurial activity to non-profit organizations will not be considered a sale (clause 3, clause 3, article 39 of the Tax Code of the Russian Federation). In this situation, the basis for calculating and paying tax is not formed, which means there are no obligations to calculate and pay VAT.

When transferring property, there is a VAT benefit

In cases where a gratuitous transfer transaction is subject to VAT, it is possible not to pay the tax. So, in Art. 149 of the Tax Code of the Russian Federation establishes transactions for which a benefit applies, that is, there is no need to calculate VAT.

For example, the distribution of advertising magazines, booklets, leaflets and other things is exempt from VAT if no more than 100 rubles were spent on the creation or purchase of a copy of this assortment, including VAT (clause 25, clause 3, article 149 of the Tax Code of the Russian Federation).

There is no need to pay VAT when transferring valuables free of charge for charitable purposes (clause 12, clause 3, article 149 of the Tax Code of the Russian Federation). The exception is the transfer of excisable goods.

Charity in the legislation is considered as an activity for the disinterested (free) transfer of material assets or other benefits to legal entities or individuals on a voluntary basis (Article 1 of the Federal Law of August 11, 1995 No. 135-FZ “On Charitable Activities and Charitable Organizations”).

But this benefit is only possible if the following conditions are met:

- the assistance provided must strictly correspond to the charitable purposes specified in the list of paragraph 1 of Art. 2 Federal Law No. 135-FZ;

- recipients of material assets, as well as gratuitous assistance in the form of other benefits, can only be non-profit organizations or individuals;

- the gratuitousness of the transfer of valuables must be documented.

According to the explanations of officials, such an operation is confirmed by the following documents (letters of the Ministry of Finance of Russia dated October 26, 2011 No. 03-07-07/66, Federal Tax Service of the Russian Federation for Moscow dated December 2, 2009 No. 16-15/126825):

- an agreement on the agreement of the parties to transfer free of charge;

- copies of documents confirming the acceptance of valuables for registration by the recipient of gratuitous assistance;

- acts or other documents confirming the intended use of the transferred values.

When a charitable transfer of material assets occurs, the transaction is considered taxable, but exempt from tax. The obligation to draw up an invoice for transactions exempt from VAT from January 1, 2014 on clause 3 of Art. 3 Federal Law dated December 28, 2013 No. 420-FZ). Therefore, when transferring valuables in the form of charitable assistance, an invoice may not be issued.

Gratuitous transfer or donation

An organization, while carrying out its activities, can accept from other organizations or transfer to them property belonging to the company, without expecting any reciprocal steps in return, that is, free of charge . This is expressly permitted by Art. 572 of the Civil Code of the Russian Federation.

Once the property has been donated, the organization receiving it does not in any way assume the following obligations.

- This or that form of payment for the received property.

- Counter provision of services, performance of work, reciprocal property barter.

A gift , in contrast to a gratuitous transfer, is the provision of property or money in an amount not exceeding 3 thousand rubles. and does not require documentation.

NOTE! From the point of view of the Tax Code, a transfer, even gratuitous, is a transfer of ownership of property from one legal entity to another, that is, the same implementation.

Free representation agreement

The transfer of powers from one legal entity to another for the purpose of performing specific actions on behalf and at the expense of the first is called an agreement of representation, according to paragraph 1 of Art. 971 Civil Code of the Russian Federation.

The Civil Code provides for the remuneration of such an agreement, unless the provisions of the document (or the law) provide otherwise. If the provisions of the law or clauses of the contract stipulate that in certain cases the principal must pay remuneration to the second party, then legal entities cannot enter into a gratuitous transaction.

When the condition on the payment of remuneration or its non-provision is not reflected in the document (and is not regulated by law), then the services of the attorney are paid according to market prices.

What can be donated?

Objects for gratuitous transfer may be:

- securities;

- intangible assets of the organization;

- goods;

- finished products;

- materials, raw materials;

- equipment, tools;

- real estate objects or the right to use them;

- vehicles;

- money in cash or non-cash form, as well as repayment of the financial obligations of the recipient.

IMPORTANT! If taking possession of the transferred property involves registration, for example, we are talking about a car or real estate, then the recipient party must register this property for themselves, and only then will a change of owner occur.

What can you give?

The list of gifts is practically unlimited by law: legal. and individuals can donate any property that belongs to them by right of ownership and is not prohibited for circulation.

If the donor is an enterprise and this is provided for by the terms of the Charter, the consent of the remaining owners will have to be obtained before the transaction. But usually it is not required.

If the donor is an individual, it is important that the person is fully capable and has documents confirming ownership.

Citizens who purchased property as a gift during marriage must obtain the consent of the spouses. If a share in real estate is given, the consent is certified by a notary.

Let us consider in detail the features of giving some gifts.

Vehicle

By vehicles we mean cars, agricultural machinery, motorcycles, etc. The DD is drawn up in writing, then the recipient undergoes a technical inspection, buys compulsory motor liability insurance and registers the car with the traffic police.

Registration does not equal ownership, and the PTS must indicate the recipient of the gift as the owner.

Note! The deed of gift for a car must reflect detailed information about the gift: year of manufacture, make, license plate, body type and number, technical specifications, engine number. It is also important to indicate the method of transferring the gift - handing over the keys.

Money

Money is given in rubles or foreign currency. If a legal entity is involved in the transaction, written form is required.

The donating enterprise does not need to pay VAT: according to the Tax Code of the Russian Federation, sales are recognized as the gratuitous transfer of goods, not banknotes.

The money DD must indicate the amount and currency.

Real estate

Real estate means land plots, residential and non-residential buildings, structures, apartments, shares in ownership.

An individual has the right to donate residential premises or commercial real estate to a legal entity.

Subsequently, the donee puts it on the company’s balance sheet. The DD should indicate detailed information: year of delivery, area, purpose, number of rooms, cadastral number, details of title documents.

Share in the authorized capital

Legal entities have authorized capital. If there are several owners in an organization, it is possible for one of them to donate a share in favor of a third party. Consent must be obtained if this is provided for in the Charter.

After the alienation of the share, the donor leaves the founders, and the donee takes his place. First you need to introduce a new owner into the structure, and then leave the donor.

Gift of fulfillment of obligations of the donee to a third party

The donor has the right to assume debt or property obligations imposed by a third party on the donee: payment of a loan, mortgage, repayment of debt on a receipt.

But the lender's consent will be required, because the deal affects his interests.

Limits on gifts and gratuitous transfers

It is impossible to transfer property for an unlimited amount free of charge, just as expensive gifts between business partners are illegal. The law allows gifts of no more than 3 thousand rubles; everything else donated must be formalized with an appropriate agreement and carried out in accounting.

Limits are lifted in certain situations specified by law:

- the property is transferred to a budgetary or public structure;

- donate to a religious organization;

- assets are received by a non-profit structure, a charitable foundation, etc.

FOR YOUR INFORMATION! The organization also has the right to make a gift to an individual, but only if he does not hold a government position, does not work in a bank or in social structures (medical, educational, etc.).

As for receiving something as a gift, an organization can be gifted, even for a large amount:

- an individual;

- government agency;

- municipal organization.

Results

The obligation to charge and pay VAT upon gratuitous transfer of property arises in cases where:

- the recipient of the valuables is a commercial organization (the transferring party will have to calculate VAT and pay it to the budget);

- a charitable transfer of valuables to a non-profit organization or individual is carried out; however, based on the benefits under paragraphs. 12 clause 3 art. 149 of the Tax Code of the Russian Federation, tax is allowed not to be paid if the transaction is properly executed taking into account all established requirements.

The gratuitous transfer of property will not be subject to VAT if:

- funds are transferred (clause 1, clause 3, article 39 of the Tax Code of the Russian Federation, clause 1, clause 1, article 146 of the Tax Code of the Russian Federation);

- the receiving party is a non-profit organization (for example, a state educational institution) and the values received as a gift are aimed at carrying out the main activities reflected in the charter of this institution (clause 3, clause 3, article 39 of the Tax Code of the Russian Federation);

- gratuitous transactions are not recognized as sales for the purposes of calculating VAT (clause 2 of article 146 of the Tax Code of the Russian Federation).

Attention! The materials on our website fully disclose general issues of inheritance. But it is impossible to cover every particular case in articles. In this regard, the service offers free online legal consultation. Ask your question through the site form and receive an answer within 5 minutes!

Host party accounting

The company that accepted the property as a gift thereby increased its assets. The cost of the income thus obtained should be reflected in the main indicators, taking into account depreciation (clause 47 of the Methodological Recommendations).

To correctly determine the value of donated assets, you need to take its market equivalent, current on the date of registration of funds (clause 10 of Accounting Rules No. 6/01), plus additional costs associated with the introduction of ownership, if the company incurred them (for example, for transportation, registration, etc.)

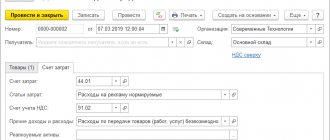

From a posting point of view, accounting will look like this:

- debit 08, account 98 “Gratuitous receipts” - the amount of the value of assets is entered;

- debit 08, account 60 “Related expenses” - expenses associated with the transfer of assets are entered.

Accounting and taxation of gratuitously received property

Voitov V.R.

Published in the issue: Accountant Consultant No. 10 / 2004

Gratuitous

The transfer

of property

from one commercial organization to another, which is essentially an operation under a gift agreement, is expressly prohibited by civil law (Article 575 of the Civil Code of the Russian Federation).

However, part one of the Civil Code of the Russian Federation does not exclude the possibility of concluding a contract of

charge .

In practice, such transfer occurs, especially in relationships within a group of interrelated organizations, between commercial organizations and state and local government bodies, as well as between non-profit organizations. In this regard, the problem of proper organization of accounting

and

tax accounting

of the relevant transactions arises.