Assignment of debt between legal entities is a common practice. The subject of turnover and individual transactions, as a rule, is accounts receivable - a good asset both for investment or speculative transactions, and for obtaining financing. Often the right to claim a debt is an illiquid or non-core asset that simply needs to be sold so that it does not stand on the balance sheet and does not lead to unnecessary costs.

On the other hand, the purchase and sale of receivables is a profitable business for many if you know how to analyze the subject of the transaction and make money from collecting or reselling debts. The assignment of the right to claim debt between legal entities is also practiced for other purposes - from the implementation of various investment and business models, business acquisitions, etc. to one-time transactions for the sake of solving private problems.

What are the differences between a transfer agreement and an assignment of the right to claim a debt?

Every obligation has two parties - the creditor and the debtor. These concepts may be formal. For example, a debtor may be considered a citizen or legal entity whose obligation to pay the agreed amount has not yet occurred under the terms of an agreement or transaction. Even such debt, actually confirmed only by a future obligation, can be assigned to third parties.

In civil law, there are two options for transferring obligations to third parties - transfer of debt and assignment of the right of claim. In the first case, the debtor changes in the obligation, while under the assignment agreement (assignment) the creditor is replaced. Let us explain the difference between these legal terms using the example of a loan:

- under the lending agreement, the borrower-organization incurred a debt to the bank;

- due to the reorganization or liquidation of a legal entity, the banking institution may agree to replace the debtor, i.e. there will be a transfer of debt to another enterprise;

- The bank, which has the right of claim against the borrower, can assign (sell) it to other persons, which is formalized in an agreement.

The difference between a transfer and an assignment lies in the procedure for giving consent to such an agreement. When assigning, the debtor's consent is not required unless this is expressly stated in the original agreement. In the case of a debt transfer, the creditor is not only notified of such a transaction, but must also give written consent.

There will also be differences in the procedure for drawing up contracts. When transferring a debt, the bank will indicate its consent in the form of a separate document, or will be included by the participant in a tripartite agreement. When assigning, the bank will always be a party to the assignment agreement, while the borrower does not take part in its signing.

The company is bankrupt

The borrower's debt can be reduced by selling liabilities in the event of bankruptcy. Typically, in such situations, the borrower has a long deferment, and the lender needs the money urgently.

If the transaction took place before the enterprise was officially declared bankrupt, it will lose legal force.

In such circumstances, an official explanatory note is drawn up, which will indicate the impossibility of collecting the debt.

How to register the assignment correctly?

The type of debt assignment agreement is identical to the primary agreement.

If the original agreement was drawn up in writing by hand, then the new paper should have the same form.

If the assignment is used in real estate transactions, the agreement is registered in Rosreestr.

Under other circumstances, the contract will not be valid. A certain package of documentation must be submitted to the Federal Reserve System, including a copy of the share participation agreement registered with Rosreestr, as well as the assignment itself with all the conditions.

The developer is required to have on hand a document confirming the legal registration of a legal entity, papers of incorporation, a certificate from the Unified State Register of Legal Entities, as well as documentation indicating that this person has the authority to submit papers to the reserve system.

The assignment of debt between legal entities provides the creditor with the right to recover a certain amount of money from the borrower or force him to fulfill his obligations under a court decision. Stand up for your rights and study law!

You can watch more about the assignment of rights in this video:

Application and terms of the assignment agreement

The right of claim can be assigned under an assignment agreement. The procedure and conditions for making such transactions are regulated by Articles 388-390 of the Civil Code of the Russian Federation. Here are the mandatory requirements the law provides for the preparation of a debt assignment agreement:

- if the original transaction was in simple or notarial form, the assignment agreement must be made in the same format;

- if the main obligation has been registered, the assignment agreement will also have to be registered;

- the debtor will receive notice of the assignment, but will not be able to object unless the transaction is contrary to law or the terms of the original contract.

Find out more Collection of penalties for failure to fulfill the terms of the contract

It is understood that the issue of assignment of debt is of a compensatory nature. The creditor (assignor) will not receive the entire amount due under the transaction or claim to the obligated person. Another person (assignee) receiving the right to claim will bear the risk of non-repayment of the debt. For this reason, the assignment is usually of a compensatory nature, i.e. the creditor will receive less than he could claim or collect later. Due to this difference, the assignee will receive income if he is able to return the money upon the request received.

In a number of cases, the law provides direct prohibitions or restrictions on assignment:

- it is impossible to assign a debt without the consent of the obligated person if his identity is important for proper performance;

- a joint and several (share) creditor has the right to assign his claims only with the consent of the remaining participants in the transaction on his part;

- a future obligation may be the subject of an assignment if it can be accurately and unambiguously identified from the terms of the transaction, the text of the agreement or other forms.

When concluding an assignment agreement, the assignor will be responsible for the invalidity of the obligation. If the assignment is subsequently revoked for these reasons, the assignee will be able to recover not only the entire amount of the assignment, but also his losses .

After the transfer of the right of claim, the previous procedure for the execution or repayment of the debt remains. Otherwise, it can only be provided for by a tripartite agreement in which the debtor took part. It is impossible to change the procedure and method of execution, or the deadline for payment of the debt, unless the obligated person gives consent to this.

Cases from practice

As a rule, transactions are concluded in two forms:

- Classic, that is, with the execution of an agreement.

- Modern, that is, transactions at electronic auctions.

The second option is very common in business. There are special online platforms where you can buy or sell any debts. The first option is used mainly for one-time transactions. Lenders work in this format, often selling debts and having their own connections for this. Before concluding a contract, a new lender must check:

- Does debt really exist?

- Can the first creditor claim debts and sell them.

- Is there another contract for the same obligation?

- Will the debtor be able to challenge the transaction?

- There are no reasons to invalidate the agreement.

Tripartite agreement on the assignment of the right to claim a debt

In most cases, there will be only two parties to the assignment, i.e. original creditor and assignee. The obligation to notify the debtor about the transfer of rights may be assigned to any of them (this is indicated in the agreement). The law also allows for the execution of tripartite agreements, which may be due to the following reasons:

- if such a condition is expressly stated in the original agreement or other document;

- if such a decision was made by the assignor and assignee, and the debtor agrees to be a party to the transaction;

- if the terms of repayment of the obligation change, the timing of debt payments, or other provisions of the original contract are shifted.

A tripartite agreement is drawn up according to the same rules as a bilateral document. However, three participants will have to agree on all the terms of the contract at once. If at least one party to the assignment refuses to sign the document, it will not enter into force.

To simplify the process of agreeing on the terms of the assignment, instead of a tripartite agreement, it is better to use the following algorithm of actions:

- the creditor and the assignee enter into a standard agreement with two participants and send a notice to the debtor company;

- after the transfer of the right of claim, at the initiative of the obligated entity or assignee, a bilateral agreement can be drawn up to change the terms of the obligation;

- the original lender will no longer be involved in subsequent transactions, which will simplify the approval process.

Find out more The procedure and methods for collecting receivables

Under a tripartite contract, it is also more difficult to comply with the requirement for notarization or registration (if required by law). You can use the services of a representative who will act in the interests of the parties at a notary office, Rosreestr, and other departments. You can clarify the nuances of concluding tripartite agreements on the assignment or transfer of debt during a consultation with our lawyers. We will prepare a conclusion on the legality of actions, help draw up documents, and explain the rules of the law.

Real estate lawyers will answer your questions:

Details

Real estate lawyers in St. Petersburg

Search, verification Registration Disputes in court

Assistance from experienced real estate lawyers. Registration of real estate, verification of the transaction, protection of your interests in court. Free legal consultations.

Verification of purchase and sale transactions

An independent real estate lawyer will fully insure the transaction

Disputes with developers

Defense of shareholders in court, disputes with developers, verification of transactions.

Who benefits from a debt assignment agreement?

For the debtor, a change in creditor practically does not change the procedure for repaying the debt or fulfilling obligations. The notification and other documents about the completed transaction will indicate a new account for payments, bank details, and contact information for correspondence. It is not difficult to change previously completed payment slips or invoices for the delivery of goods, so the interests of the debtor will not be violated.

For the original creditor, the assignment provides the following benefits:

- you can quickly receive the money owed, and the difference in amounts will be covered by the turnover of funds and goods;

- you will not have to make claims, go to court with a statement of claim, or seek forced collection through the FSSP;

- You can save on bank interest if the amount of debt was planned to repay the loan.

The only disadvantage of the assignment for the assignor is the loss of part of the money. However, having received fulfillment of the obligation ahead of schedule, even if not in full, you can use the funds to purchase goods or other current purposes. With a competent approach, this will allow you to reimburse all expenses for the paid nature of the assignment transaction.

For the assignee, obtaining the right to claim the debt may also be beneficial:

- if the transferred obligation is properly confirmed, you can make a significant profit due to the difference (discount);

- if the debtor is a company with a long history and positive reputation, the risk of non-repayment will be minimal;

- if the right of claim was secured by a pledge, the assignee will always be able to foreclose on such property.

The basis for the assignment of rights will only be the mutual consent of the original creditor and the assignee. It is impossible to force a person to enter into such an agreement or to force a transaction in any other way. Therefore, you can calculate in advance all the benefits and disadvantages of the assignment, check the solvency and reliability of the debtor, and then make an informed decision.

Find out more Procedure for re-issuing licenses

If you need the help of a lawyer when drawing up a contract and agreeing on the terms of the transaction, you can call the numbers listed on the website or fill out the feedback form (it is at the bottom of the article). You can also get help from the author of this article and all other materials on the site. To do this, follow the link in the widget.

Rating

Helpful information

When signing, special attention should be paid to the following criteria:

- The reality of the subject, confirmed by objective information and primary documents.

- Mandatory presence of a link to the original source, which gives the right to formalize the assignment of debt.

- Consent of the new lender or borrower. It can be confirmed in the main contract with a signature or seal, and can also be provided in a covering letter.

An assignment agreement that is not drawn up properly or in violation of the requirements may lead to its cancellation or an undesirable result.

Responsibility and consequences

The law does not prohibit the use of the principle of gratuitousness in an assignment transaction. When concluding an agreement only between citizens, this can be used without any consequences. However, for legal entities the possibility of making gratuitous transactions is practically excluded. If such a fact is revealed by the Federal Tax Service, an extraordinary or scheduled inspection will be ordered against the parties. This can result in large fines and other liability for deliberate understatement of profits and non-payment of taxes.

The following consequences may also occur:

- if the transferred obligation was initially invalid, all losses and lost profits can be recovered from the assignor;

- if the original document indicated a prohibition on assignment, or required the obligatory consent of the debtor, violation of these rules will entail the cancellation of the transaction with the return of all funds received;

- if participants make a profit under an assignment transaction, they are required to pay taxes (in accordance with the chosen taxation scheme).

The debtor's liability for breach of obligations will not change. You can collect from him not only the principal amount of the debt, but also penalties, penalties, and fines. The exact amount of sanctions will be specified in the original agreement or in a tripartite agreement. The assignee who has received the right to claim under the assignment will be able to hold the debtor accountable. Read about how penalties are collected under contracts in our material at the link.

Tax nuances

Everything that the assignor receives as a result of the sale of the debt (in excess of the amount of expenses for processing the loan and further transfer of claims) is income, and therefore it is included in the tax base. You will need to pay VAT on this profit. The same applies to the assignee, who will receive a profit as a result of the debtor fulfilling his obligations. Failure to pay taxes is fraught with administrative and even criminal penalties.

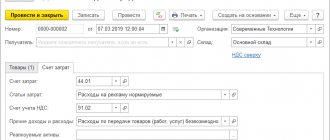

As for the posting in accounting, for the assignor it will be:

- Cost – Dt 90.2. Kt 41;

- Profit on the transaction – Dt 90.9. Kt 99;

- Fact of assignment – Dt 76. Kt 91.1;

- Debt write-off – Dt 91.2. Kt 62;

- Income (payment) – Dt 51. Kt 76.

The assignee needs other entries to correctly prepare accounting records:

- Purchase of debt – Dt 58 Kt 60 (76);

- Payment to the assignor – Dt 60 (76) Kt 51;

- Receiving payment from the borrower - Dt 51 Kt 60 (76);

- Reflection of income - Dt 60 (76) Kt 91.1;

- Cost – Dt 91.1 Kt 58;

- Profit as a result of the transaction – Dt 91.1 Kt 99.

Definition of the term

Assignment of the right of claim means the transfer of the right to collect a debt from one person to another. That is, this concept means a change of creditor, without changing the parameters of the debt itself. The procedure is carried out on the basis of an assignment agreement. This is an official document confirming the assignment.

Reference! Both legal entities and individuals can act as parties to the process.

Most often, the assignment is used by banking organizations that want to get rid of problem debt (such debts negatively affect the bank’s rating and, accordingly, its activities and raising funds).

The procedure is also used if:

- The borrower wants to buy back his own debt.

- The enterprise that is the creditor is being reorganized or liquidated.

- The lender urgently needs money and cannot wait until the borrower repays the debt in full.

Thus, the main purpose of the procedure is to solve urgent financial problems. An assignment agreement makes it possible to quickly return part of the lost money and use it for the development of the enterprise.

Benefit from the deal

Such procedures are carried out because they are beneficial to their participants. First of all, we are talking about creditors.

For them, an assignment agreement is an opportunity to get rid of bad debts, the return of which in court is impractical. This is especially true for the debts of enterprises going through bankruptcy proceedings.

The assignment is also beneficial to collection agencies and other companies that make money by buying out debt at a low price and then collecting it. In this case, the lender can get rid of problems, the borrower can change the terms of repayment (by agreeing with a new lender), and the intermediary can make money on the difference between the purchase price and the total amount of debt.

Tax consequences

It should be noted that the transfer of debt is fraught with certain tax consequences. So, for example, if this process is carried out on a fee basis, VAT is collected from the transaction amount.

However, if the transaction involves a debt arising from the provision of any service or sale of goods, this tax is not used.