Citizens can give and transfer any property to each other, without any restrictions. What about the situation when transferring property between legal entities - can organizations transfer things to each other in any case, how to document this, how to do it in accounting?

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please use the online consultant form on the right or call. It's fast and free!

These and other questions will be answered in this article.

The concept of gratuitous transfer of property to legal entities

The gratuitous transfer of property assumes that one legal entity transfers it to another legal entity, while the transferring party will not receive any counter-performance - neither in money nor in any other form (provision of goods, performance of work, etc.).

Difference between gratuitous transfer and donation

A gratuitous transfer can be carried out either forever or for a certain period of time it can be transferred for gratuitous use (loan). After the end of the period agreed upon by the parties, what was transferred under the contract must be returned to the party that transferred it.

A donation is a final transaction; a gift cannot be transferred temporarily.

In addition, the law prohibits donations between commercial organizations. Commercial organizations include those organizations that are created to make a profit. Such organizations only have the right to transfer things to each other for free use (loan), but not to give it as a gift.

Good to know! This ban was introduced in order to protect creditors from the unjustified withdrawal of assets belonging to the organization in the event of bankruptcy, as well as the founders from the actions of an unscrupulous manager.

However, for-profit organizations can give or receive gifts to non-profit organizations (those whose main purpose is not making a profit).

Let's celebrate! Non-profit organizations can either give things that belong to them or receive them as a gift from any person, including commercial organizations.

What can you give?

Commercial organizations can give or receive gifts from the same organizations, the value of which does not exceed three thousand rubles.

Non-profit organizations can give or receive as a gift any things the circulation of which is not prohibited by law.

As a rule, it is transferred (donated):

- real estate;

- vehicles;

- equipment;

- raw materials;

- goods;

- cash;

- securities.

What property cannot be given as a gift?

You cannot give something that is prohibited by law for circulation or is restricted in circulation. It could be:

- narcotic drugs, toxic substances;

- weapons (certain types), ammunition;

- some items of cultural value.

Also, you cannot donate those things that have been seized.

Financial assistance from the founder. How to choose the least risky basis for receiving money

15.04.2009

Estimated reading time: 12 min.

If there is an acute shortage of funds and difficulties in obtaining a bank loan, the company can be helped out by its own founder (participant), if his financial condition allows it. The lawyer of the company receiving such support is faced with the question of how to formalize the transfer of money. There are several ways: gratuitous transfer (targeted financing), interest-free loan, additional contribution to the authorized capital, contribution to the property of a limited liability company.

The effectiveness of any of these methods depends not only on the ease of registration, but also on possible civil risks and tax consequences. And those, in turn, are associated with the peculiarities of each specific situation - who is the participant providing financial assistance (individual or legal entity), what is his share of participation in the authorized capital of the receiving company, in what organizational and legal form is the company receiving assistance created ( limited liability company or joint stock company). An analysis of all possible aspects will help you choose a specific basis for transferring funds.

Free transfer of funds

The easiest way to provide financial assistance in terms of registration is the usual gratuitous transfer of funds by its participants into the ownership of the company. It is safe to use only when the participant helping the company is an individual.

Registration procedure

In practice, the gratuitous assistance of the founder is most often formalized in a targeted financing agreement. Although this type of contract is not named in the Civil Code, it is permissible by virtue of paragraph 2 of Article 421 of the Civil Code. Financial assistance is also practiced on the basis of a joint decision of the management bodies of the parent and subsidiary companies, after which the parent company transfers money to the account of the subsidiary. However, in arbitration practice there is still no clear opinion on whether the financial assistance of the founder is a gift prohibited between commercial organizations. Therefore, in this option there is a civil risk of the transaction being declared invalid if the participant transferring money to the company is also a legal entity.

Tax consequences

Funds received free of charge are not subject to income tax if the share of participation of the transferring party in the authorized capital of the receiving company is more than 50 percent (subclause 11, clause 1, article 251 of the Tax Code of the Russian Federation). This rule applies regardless of the status of the participant who provided gratuitous assistance (legal entity or individual). If the share of participation of the company providing funds in the authorized capital of the receiving party is less than or equal to 50 percent, then the gratuitous assistance is subject to income tax in full (clause 8 of Article 250 of the Tax Code of the Russian Federation). Receipt of funds in the form of financial assistance is not subject to VAT (subclause 1, clause 3, article 39, clause 1, article 146 of the Tax Code of the Russian Federation).

Increase the authorized capital

When the company receiving financial assistance is a limited liability company, the receipt of funds from a participant can be arranged by increasing the contribution to the authorized capital (Clause 2, Article 17 of the Federal Law of 02/08/98 No. 14-FZ “On Limited Liability Companies” ). True, there is a limit on the deposit amount. If at the end of the financial year the value of the company’s net assets is less than the increased authorized capital, then it will have to be reduced (clause 3 of Article 20 of Law No. 14-FZ). Otherwise, the tax inspectorate has the right to demand the liquidation of the company (for example, the resolution of the Federal Arbitration Court of the Volga-Vyatka District dated January 23, 2009 in case No. A43-6947/2008-19-203). Therefore, if the amount of expected financial assistance is greater than the size of net assets, it is better to choose another basis for transferring funds. In a joint stock company, financial assistance from a shareholder in the form of an increase in the authorized capital is also possible. But only by placing additional shares (Article 28 of the Federal Law of December 26, 1995 No. 208-FZ “On Joint-Stock Companies”). Due to the fact that the registration of receiving funds from a shareholder is complicated by the issue process, for a joint-stock company, increasing the authorized capital is not the best option for transferring money.

Registration procedure

The procedure for increasing the authorized capital of a limited liability company is established in Article 19 of Law No. 14-FZ. It depends on how many members of the company will make additional contributions - all (then clause 1 of Article 19 of Law No. 14-FZ applies) or only some of them (then clause 2 of Article 19 of Law No. 14-FZ applies).

If all participants agree to finance the company, the procedure begins with convening a general meeting. It is necessary to make a decision on increasing the authorized capital by making an additional contribution. Within two months from the date of such a decision (unless another period is established by the company’s charter), the participants transfer funds to the company’s account.

No later than one month from the end of the deadline for making additional contributions, another general meeting of participants will be required. It must decide to approve the results of making additional contributions from participants (Clause 1, Article 19 of Law No. 14-FZ). Within a month after this decision is made, it is necessary to submit documents for state registration of changes in the charter (on the size of the authorized capital and an increase in the nominal value of the share of the participant who made an additional contribution).

If financial receipts are not expected from all participants, then the procedure for making additional contributions is slightly simplified. Participants wishing to make these contributions submit appropriate applications to the society. Then a general meeting is convened, which decides to increase the authorized capital and make appropriate changes to the charter. It also sets a deadline for making additional deposits. Documents for state registration of changes in the charter are submitted within a month after the transfer of additional contributions to the company by all participants who submitted the application, but no later than six months from the date of the decision of the general meeting to increase the authorized capital.

If there is a delay in making a decision on approving the results of making an additional contribution and on making changes to the charter, the increase in the authorized capital is considered invalid. The same consequences have the delay in submitting documents for state registration of changes to the charter (clauses 1 and 2 of Article 19 of Law No. 14-FZ). In this situation, the company is obliged to return additional deposits to participants (Clause 3, Article 19 of Law No. 14-FZ). But in fact, the company can dispose of the funds received almost immediately after receiving them; there are no prohibitions on this. Even if, due to a violation of the registration procedure, the increase in the authorized capital is declared invalid, the transfer of funds can be reclassified as targeted financing or a loan. To do this, you just need to sign the appropriate agreement.

Tax consequences

The option to increase the authorized capital has virtually no tax risks for the receiving company. Receipt of funds as an additional deposit is not subject to VAT (subclause 4, clause 3, article 39, subclause 1, clause 2, article 146 of the Tax Code of the Russian Federation) and is not taken into account as income when taxing profits (subclause 3, clause 1, art. 251 Tax Code of the Russian Federation).

Contribution to the property of a limited liability company

An alternative option for financial assistance to the company from its participants is making contributions to property. This is only possible in limited liability companies (Article 27 of Law No. 14-FZ), since there is no similar provision in the Law “On Joint-Stock Companies”. The company can use the received contribution for any purpose; there are no restrictions in the legislation. The company does not have any counter-obligations towards the participant who made the contribution. This method is applicable only if the company has one participant or when all participants agree to provide financial assistance. Article 27 of Law No. 14-FZ does not provide for the possibility of making contributions to property by individual members of the company.

Registration procedure

To make a contribution to the property, a decision of the general meeting of company participants is required (Clause 1, Article 27 of Law No. 14-FZ). And if the company has only one participant, his decision is sufficient (Article 39 of Law No. 14-FZ). But since such a contribution does not affect the size of the authorized capital and shares of participants (clause 4 of Article 27 of Law No. 14-FZ), there is no need to make changes to the charter and register them with the tax authorities. Therefore, this option is simpler in terms of timing and registration method than increasing the authorized capital. But only in the case where the company’s charter already stipulates the obligation of participants to make additional contributions. Otherwise, you must first introduce such a provision into the charter (which requires convening a general meeting of participants), register this change, and only then convene a new meeting of participants to decide on making contributions to the property.

Tax consequences

As noted earlier, the receipt of funds is not recognized as an object of VAT taxation. Therefore, the receiving company has no reason to pay tax. For profit tax purposes, a contribution to the company’s property is considered as property received free of charge (Clause 2 of Article 248 of the Tax Code of the Russian Federation). Consequently, income does not arise only if the share of the participant making the contribution in the authorized capital of the receiving company is more than 50 percent (clause 8 of Article 250 of the Tax Code of the Russian Federation). Contributions of other participants are subject to income tax. Therefore, taxation can be completely avoided only in a situation where the contribution is made by the only participant in the company.

Interest-free loan

Financial assistance in the form of interest-free loans is often practiced between companies and their participants. Loans are possible in any situation, regardless of the legal status of the lender and the organizational and legal form of the borrowing company. With this option, unlike the previous ones, the company receives money on a repayable basis, but due to the absence of the obligation to pay interest, this is still tangible support. Taking into account the mutually beneficial relationship between the borrower company and its participating lender, you can immediately set a long loan repayment period or increase it by separate agreement of the parties if the financial condition of the borrower does not improve by the end of the initial period.

Debt forgiveness

It happens that the option of an interest-free loan is used when the return of money is not expected - in fact, only to “cover up” the gratuitous transfer of funds. At the end of the loan term, the parent company forgives the debt. But this option can also be regarded by the court as a prohibited gift between commercial organizations if the lender is a legal entity. Taking advantage of this, the lender may demand the return of the loan amount, citing the invalidity of the debt forgiveness agreement (for example, if after some time the relationship between the parent and subsidiary company deteriorates).

The relationship between the creditor and the debtor for debt forgiveness is qualified as a gift if the court has established the intention of the creditor to release the debtor from the obligation to pay the debt as a gift. Then debt forgiveness is subject to the prohibition established in subparagraph 4 of paragraph 1 of Article 575 of the Civil Code. And the absence of the creditor’s intention to reward the debtor can be evidenced, in particular, by the relationship between debt forgiveness and the creditor’s receipt of property benefits under any obligation between the same persons (clause 3 of the information letter of the Supreme Arbitration Court of the Russian Federation dated December 21, 2005 No. 104).

It can be assumed that by forgiving the debt of a subsidiary, the parent company receives a property benefit due to its personal interest in the economic situation of the subsidiary. However, there is no arbitration practice that would confirm this conclusion. Courts do not recognize debt forgiveness as a gift if the lender has forgiven only part of the debt in exchange for voluntary payment of the remaining part (decision of the Federal Arbitration Court of the North-Western District dated 10/09/08 in case No. A21-3512/2007) or when the debt is forgiven to pay off another debt (resolution of the Federal Arbitration Court of the West Siberian District dated January 22, 2009 No. F04-248/2009(19774-A46-13). Courts, as a rule, recognize unconditional forgiveness of a debt in full amount as void (resolution of the Federal Arbitration Court of the Moscow District dated November 25, 2008 in case No. KG-A40/10973-08).

Tax consequences

Operations for the provision of loans are not subject to VAT (subclause 15, clause 2, article 149 of the Tax Code of the Russian Federation). Therefore, neither the company providing the loan nor the company receiving it pays VAT on this transaction.

The borrower does not include the amount of the loan received in the tax base for income tax, and the lender also does not pay this tax on the amount of the repaid debt (subclause 10, clause 1, article 251 of the Tax Code of the Russian Federation).

In connection with taxation, the borrower is most interested in the question: should he pay income tax due to the fact that the loan is interest-free? The concept of economic benefit in the form of interest savings exists only for personal income tax (that is, for individual borrowers). The income tax does not have such a taxable object, so there is no need to pay tax. Officially, the Federal Tax Service of Russia recognizes this position (letter dated January 13, 2005 No. 02-1-08/ [email protected] ). However, in practice, territorial inspectorates sometimes try to charge borrowers additional income tax on unpaid interest, considering the loan a “free service received.” However, the courts recognize this practice as illegal (resolution of the Presidium of the Supreme Arbitration Court dated August 3, 2004 No. 3009/04, resolution of the Federal Arbitration Court of the Moscow District dated June 19, 2007 in case No. KA-A40/5440-07).

In the case of debt forgiveness, the borrowing company includes the loan amount that it does not need to repay in the income tax base as property received free of charge. But if the share of the lending company in the authorized capital of the borrower exceeds 50 percent, then the amount of the forgiven debt is not taxed on the basis of subparagraph 11 of paragraph 1 of Article 251 of the Tax Code. The Ministry of Finance of Russia adheres to the same opinion (letters dated 03/03/09 No. 03-03-06/1/106, dated 03/06/09 No. 03-03-06/1/112), which means that the likelihood of a dispute with the inspectorate on this issue is minimal .

It is easier to register a contribution to the authorized capital if the LLC has one participant

When there is only one participant in a company, he makes a decision on increasing the authorized capital, the amount of the contribution, the procedure and deadline for making it (Clause 1, Article 19, Article 39 of Law No. 14-FZ). No later than a month from the date of expiration of the deadline for making an additional contribution, the participant transfers funds to the company’s account, and then decides to amend the charter. Changes are registered based on the above decisions of the sole participant and a document confirming the contribution.

Possible claims by tax authorities against the company member who transferred the money. What you can object to the inspection Free assistance

The inspection may equate the transfer of funds to the sale of goods subject to VAT. The fact is that “goods” for tax purposes are any property that is sold or intended for sale (clause 3 of Article 38 of the Tax Code of the Russian Federation). And by “property” we mean types of objects of civil rights related to property in accordance with the Civil Code (clause 2 of Article 38 of the Tax Code of the Russian Federation), including money (Article 128 of the Civil Code of the Russian Federation). At the same time, “sale of goods” is considered to be the transfer of ownership of goods both on a compensated and gratuitous basis (clause 1 of Article 39 of the Tax Code of the Russian Federation).

What to object

This point of view is not consistent with the Tax Code. The transfer of funds, if it is not related to payment for goods, work, services or property rights, is not in itself considered a sale by virtue of subparagraph 1 of paragraph 3 of Article 39 of the Tax Code.

Contribution to LLC property

Tax authorities also sometimes equate this operation with the gratuitous transfer of goods and require VAT to be paid.

What to object

According to subparagraph 4 of paragraph 3 of Article 39 of the Tax Code, the transfer of property that is of an investment nature is not recognized as a sale (and therefore not subject to VAT). The list of possible investment transactions in this article is open. Investments are understood, in particular, as funds invested in business or other activities in order to make a profit or achieve another beneficial effect (Article 1 of the Federal Law of February 25, 1999 No. 39-FZ “On investment activities in the Russian Federation carried out in form of capital investments"). A contribution to the property of a business company increases the size of its net assets. And this indicator affects the distribution of the company’s profit between participants (Article 29 of Law No. 14-FZ). Therefore, the participant’s contribution to the company’s property is ultimately aimed at making a profit, and therefore is of an investment nature and is not subject to VAT. The courts are of the same opinion (resolution of the Federal Arbitration Court of the Central District dated February 20, 2007 in case No. A-62-3799/2006).

The most effective ways to apply for gratuitous assistance for specific situations Gratuitous transfer (targeted financing)

Ideal for the case when financial assistance is provided by a participant who is an individual and his share of participation in the company is more than 50 percent. There is no risk of invalidity of the transaction (the prohibition on donation does not apply), there are no tax consequences.

Contribution to LLC property

Suitable when the LLC charter already provides for the founder’s obligation to contribute to the property and provided that the company has only one participant. A simple method of registration (no need to make changes to the charter) and no tax consequences.

Capital contribution

Can be applied in other cases of receipt of financial assistance by a limited liability company. A complex method of registration, but the risks of the transaction being declared invalid are minimal and there are no tax consequences.

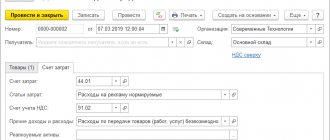

Accounting for gratuitous transfers in accounting

The gratuitous acceptance of the property of a legal entity must necessarily be reflected in the accounting documentation.

The transferred item is accepted as a fixed asset at its original cost. The initial cost is defined as the market value on the day of acceptance for accounting, including the amounts spent on delivery of the asset, its registration, bringing it into a condition suitable for use, and other costs.

The following entries must be made:

- enter the value of assets in debit 08, account 98 “Gratuitous receipts”;

- expenses spent on their acceptance, according to debit 08, account 60 “Related expenses”.

Reorganization in the form of spin-off

Reorganization in the form of separation (Article 57 of the Civil Code; clause 8 of Article 50 of the Tax Code of the Russian Federation) is the most universal method of transferring property that does not have organizational and legal restrictions (applicable to both JSC, LLC, and partnerships).

During the spin-off, a second legal entity is formed, which is not the legal successor of the reorganized organization in terms of its tax obligations, except in cases where the tax authority proves that the sole purpose of the spin-off was to evade repayment of debt to the budget (clause 8 of Article 50 of the Tax Code).

Tax consequences

Income tax

A spin-off involves the “spinning off” of an old company into a new company. The property is transferred under a transfer deed and its value is not an expense for the old legal entity and is not income for the new company. That is, there are no income tax consequences.

VAT

The transfer of property within the framework of the allocation is not a sale; the company on the OSN does not have the obligation to charge VAT.

If the legal successor switches to UTII or the simplified tax system, then he is obliged to restore the VAT previously accepted for deduction by the reorganized organization in proportion to the residual (book) value. Clause 3.1 of Article 170 of the Tax Code of the Russian Federation This obligation has been in effect since 2020.

Who can become a participant in the spun-off company?

During the procedure of separation from an LLC, the participants of the new legal entity may become:

- reorganized company;

- participants of the reorganized company in the same composition and in the same proportions;

- part of the participants of the reorganized company (in other proportions) or other third parties.

The main condition is that this third party independently pays for the authorized capital, at least in the minimum amount of 10 thousand rubles.

In the case of a joint stock company, only the first two options are possible during the spin-off. Either the new company becomes a 100% subsidiary of the reorganized company, or the same shareholders in the same proportions become participants in the spun-off company.

In addition, mixed reorganizations in the form of spin-off are allowed, when it is possible to spin off an LLC from a JSC or vice versa.

Risks

The separation must be carried out in strict accordance with the principle of fair distribution of rights and obligations between the old and new legal entity. It means that:

- The assets of the spun-off company must be balanced by liabilities. In other words, it is impossible to transfer fixed assets without transferring the debt on the loans with which these fixed assets were acquired. If the old company has a large amount of accounts payable, then it is fair to transfer to the spun-off company part of such debt associated with the transferred property;

- the spin-off must meet the criteria of the business purpose concept (transfer of part of the assets to organize a new line of activity, business restructuring with the aim of creating several independent business units on the basis of former divisions, etc.).

When separating, the transfer of property and/or obligations to the new organization occurs under a transfer deed.

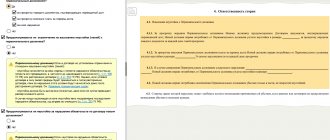

Drawing up a contract for the gratuitous transfer of property

How is the deal going?

An agreement on the gratuitous transfer of property between organizations must be drawn up in writing.

- If a thing is transferred between a commercial and non-profit organization, then the concluded agreement may be called a gift agreement or a gratuitous transfer agreement. In this case, the item is transferred irrevocably; the other party receives nothing in return for what was transferred. The party receiving it becomes the owner of the transferred item.

- If the parties to the transaction are commercial legal entities or commercial organizations, or the parties have agreed on the return of the transferred property, then in this case a gratuitous use (loan) agreement is concluded. In such an agreement, the parties stipulate that the thing is transferred to the other party for a time. The period for which the thing is transferred can either be stipulated in the contract indicating a specific date, or it can be stated that what is transferred under the contract is returned at the request of the transferring party. Upon expiration of the period established by the parties, or at the request of the transferring party, the item transferred under the contract must be returned. The previously transferred item must be returned in the same condition in which it was transferred, taking into account wear and depreciation. The owner of the transferred thing remains the party that transferred it.

Good to know! The agreement is concluded by managers or other persons who are vested with appropriate authority. If this is provided for in the text of the agreement, then it is sealed by the parties. An act of acceptance and transfer of property, which is an integral part of it, is drawn up along with the agreement.

In some cases, the transfer requires the consent of the founders, the management body of the organization or the owner of the property. Such consent may also be required for the acceptance of property. Whether such consent is required in a particular case must be determined by studying the constituent documents of the organizations participating in the transaction.

If such consent is not obtained, then the transaction may subsequently be declared invalid, the transferred item may be taken away, and even a fee may be charged for the entire period of use of the item.

Lawyers advise! If real estate is transferred, the party receiving it is obliged to register the transfer of the corresponding right to it with the Rosreestr authorities. The transfer of vehicles and other property is also subject to state registration, if registration of the transfer of rights is provided for by law.

Required documents

To draw up a transfer agreement you need:

- details of legal entities;

- statutory documents;

- data of managers, documents confirming their powers;

- documents confirming the powers of authorized representatives (if the agreement is not signed by the manager);

- documents confirming the right to the transferred item;

- consent of authorized persons (bodies) to the transfer and (or) acceptance of property (if necessary);

- details of legal entities.

Indirect share of participation

Subclause 11, clause 1, Article 251 of the Tax Code of the Russian Federation makes it possible to make a contribution to property not only from a direct participant, but also from a person who has an indirect share of participation through an intermediate company. For a contribution to be exempt from taxation, the share of indirect participation must also be at least 50%.

To calculate the share of indirect participation, it is necessary to multiply the shares of direct participation in each organization along the ownership chain. For example:

In this case, the share of indirect participation of the Participant in Organization No. 3 will be 63%. Accordingly, he can directly, bypassing the intermediate Organization, transfer funds, other property or property rights. When it comes to real estate, this saves time on registration activities and compliance with corporate procedures.

The rules for determining the share of indirect participation are spelled out in detail in clause 3 of Art. 105.2 of the Tax Code of the Russian Federation.

"Daughter's Gift"

At the same time, according to paragraphs. 11 clause 1 art. 251 of the Tax Code, not only the parent company can contribute to the property. The opposite situation is possible - the “daughter” transfers the property to the “mother” (the so-called “Daughter’s gift”). And even “grandmother” - taking into account the rules on indirect participation.

Agreement on gratuitous transfer of property - sample

To summarize what has been said, we can come to the conclusion that the gratuitous transfer of property between legal entities has two main forms: donation, i.e. the thing is transferred free of charge and irrevocably, and transfer for temporary free use (loan).

Good to know! If the parties to the transaction are commercial organizations, then donation between them is prohibited by law in order to protect their creditors, founders, and property owners.

If there is a need for a gratuitous transfer of property between commercial organizations, then it is necessary to conclude a loan agreement, in which it is indicated that the thing is transferred to the other party for temporary possession and use. The loan may have a perpetual nature. The ownership of the transferred item remains with the transferring party.

In all other cases, the parties are independently free to choose the type of agreement - donation or loan.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now: +7 (Moscow) +7 (812) 309-53-42 (St. Petersburg) It's fast and free!

Selection with appendix

Within the framework of one reorganization, the law allows you to combine two procedures at once (Article 57 of the Civil Code of the Russian Federation): separation and merger, which can significantly save time and costs for reorganization. First there is separation, then attachment. The intermediate company resulting from the spin-off is virtual in nature, as it is used solely to transfer assets and liabilities to the acquiring company. The period of existence of this legal entity is not defined by law, but we can say that it tends to zero.

Documents are drawn up first for the separation of the company. According to the transfer deed, part of the assets and liabilities of the reorganized company is transferred to it, which are then added to the balance sheet of another legal entity (“Company 2” in the diagram above).

Of course, real life cannot always be “shoved” into the framework of the above-described methods of transferring property. There are a great many options for property consolidation; most often they are a combination of tax-free and low-tax methods of property redistribution, the set of which is always unique.

A database of other business tools and comprehensive developments of the taxCOACH Center - at the seminar “STAY ALIVE-2021” in Yekaterinburg, December 10-12.

What about taxes?

Because a gift is an income, in some cases it is subject to appropriate tax. The difference depends not only on the amount of the transferred asset, but also on the tax system followed by the recipient legal entity. In the general system, the legal entity-donor pays VAT (the gift is carried out as a sale), and the recipient pays tax on non-operating income (Article 250 of the Tax Code of the Russian Federation).

VAT is not paid if:

- assets were received under international treaties of the Russian Federation;

- the transferred funds are intended for the safety of nuclear power plants;

- the property was donated by the founder-owner of 50% or more of the authorized capital;

- donate to a non-profit educational institution;

- funds are donated to charity;

- money is given in any form.

IMPORTANT INFORMATION! Some cases of donation provide for preferential VAT.

How to transfer company assets to an individual with minimal tax burden

Attention

Russian Federation) on the territory of the Russian Federation in cash or in kind or the right to dispose of which he has acquired, as well as income in the form of material benefits determined in accordance with Article 212 of the Tax Code of the Russian Federation, are subject to taxation under the personal income tax (hereinafter - personal income tax) . Income is recognized as an economic benefit in monetary or in-kind form, taken into account if it is possible to assess it and to the extent that such benefit can be assessed (Art.

41 of the Tax Code of the Russian Federation). According to paragraph 1 of Art. 211 of the Tax Code of the Russian Federation, when a taxpayer - an individual receives income from organizations and individual entrepreneurs in kind in the form of goods (work, services), other property, the tax base is determined as the cost of these goods (work, services) and other property, calculated on the basis of their prices , determined in a manner similar to that provided for in Article 105.3 of the Tax Code of the Russian Federation, i.e.

The founder takes “his” property

On the one hand (letters from the Ministry of Finance dated 08.11.11 No. 03-04-06/3–301, dated 05.04.11 No. 03-11-06/2/45 and the Federal Tax Service for Moscow dated 14.07.08 No. 28–10/ 066946), all income of an individual received as a result of the liquidation of a company is subject to personal income tax in the general manner at a rate of 13 percent.

In this case, the provision of paragraph 2 of subparagraph 1 of paragraph 1 of Article 220 of the Tax Code of the Russian Federation does not apply, which makes it possible to reduce the income received by expenses incurred when selling a share in the authorized capital, since the sale of a share does not occur upon liquidation of the company. On the other hand, the Federal Tax Service of Russia believes that the amount taxable to personal income tax at a rate of 13 percent of income is determined based on the market value of the property minus the costs of acquiring shares in the authorized capital of the LLC (letter dated January 27, 2010 No. 3-5-04/), which is much more profitable for individuals. True, this letter is the only one and quite old.

Free and paid transactions

Agreements that provide for the receipt of benefits are considered gratuitous. In other words, having provided any service or value, a legal entity does not receive remuneration in cash equivalent in return.

Free contracts include:

- charitable donation;

- donations;

- free use;

- other agreements, the provisions of which provide for gratuitousness.

Compensatory transactions involve receiving benefits. Initially, all agreements are recognized by law as compensated, but at the request of the parties they can become free of charge. Examples of such transactions will be discussed below.

Compensatory contracts include:

- purchase and sale;

- cession;

- rent;

- loan;

- contract and subcontract.

The list is far from complete, but it allows you to understand the difference between paid and gratuitous transactions.

Expert commentary

Leonov Victor

Lawyer

The main condition of a remunerative contract is the determination of the amount of remuneration that will be paid to a legal entity in exchange for the service provided.

It is possible to conclude a gratuitous transaction without consequences between subsidiaries and parent companies. In other cases, gratuitous contracts carry certain obligations. When concluding a contract for the provision of services, the service user is required to pay an additional tax. When calculating income tax, it is taken into account which taxation system is used by the legal entity.