To change the composition of the parties to the main obligation, an agreement on the transfer of debt is concluded. That is, the duties themselves do not cease to operate. The debtor changes. But subject to the conditions for the form, content and procedure for concluding an agreement on the transfer of debt.

The following example and recommendations will help you draw up a document correctly, taking into account the nuances of the main contract. Additional questions can be asked to the site’s duty lawyer. Other ways to settle existing debt can be found in the “Agreements” section (about debt restructuring, payment terms, etc.).

:

Debt transfer agreement

Classification

According to the subject composition, contracts can be divided into bilateral, trilateral, quadrilateral, etc. Naturally, the most common is the first variety. But trilateral agreements are not uncommon these days.

Legislative requirements for the form of such an agreement, as a type of standard agreement, are established in paragraph 4 of Art. 391, art. 389 part 1 of the Civil Code of the Russian Federation.

Of course, in some cases it may be difficult for three parties to reach a compromise at once. But in a number of situations, transferring debt obligations from one company to another is the most optimal solution for everyone.

Moreover, it is important to keep in mind that the transfer of debt is regulated by Article 391 of the Civil Code of the Russian Federation, and the change of creditor is regulated by Article 382.

Responsibility of the parties

This section provides for liability in the form of penalties for violations by the parties of their obligations. Thus, a penalty is established for the following violations committed by the original debtor:

- for late payment of the process fee;

- for failure to provide or for untimely provision of documents confirming the transferred debt.

When establishing a penalty, it is necessary to agree on its size and the period for which the penalty is paid.

A penalty is also established in case of violation of the terms of the contract by a new debtor, for example:

- in case of failure to notify the creditor of the procedure;

- when evading state registration of an agreement.

When establishing a penalty, the ratio of the penalty and losses is determined. As a general rule, damages are recovered in the part that is not covered by the penalty.

Creditor's consent

Debt from one debtor to another cannot be transferred without the consent of the creditor. This is clearly stated in existing legislation. The creditor risks increasing his risk of non-payment of the debt, so he has the right to know who will owe him at any given time.

When concluding such documents, banking organizations in most cases agree to all the conditions announced by the debtor. After all, their reputation and possible legal costs are at stake. The debtor's rights cannot be ignored.

Preamble

This section indicates the parties to the transaction, which are:

- original and new debtors;

- creditor, but only by expressing his consent;

- creditor and new debtor.

We will consider the option when the parties to the agreement are individuals (former and new debtors). Since the creditor is interested in the debtor fulfilling the obligation properly, the identity of the new counterparty is important to him. It is necessary to have the written consent of the creditor or his signature on the document. Otherwise, the transaction will not entail any legal consequences, and the obligation will remain with the original debtor.

When obtaining the creditor's consent to transfer the debt, it is necessary to avoid general language. He must agree to transfer the debt to a specific person or limited group of persons. If a creditor is involved in concluding a transaction, then it is necessary to indicate the name of the creditor and the person who has the right to express consent to the procedure on behalf of the creditor.

Elements of an agreement

The transaction is made only if all three parties agree to its provisions. The paper consists of several parts. This:

- Document details. The date of signing, number, and full name are indicated.

- Ascertaining part. List of parties.

- Subject of the agreement. The general aspects of the contract are revealed point by point.

- Rights and obligations of the parties to the agreement.

- Responsibility.

- Duration of the agreement.

- Dispute resolution.

- Legal addresses and signatures of each of the three parties.

Each part is explained in detail, all possible scenarios for the development of events are described. If necessary, each party engages competent lawyers to insure the fulfillment of its own interests. When listing the parties, the full name of the representative of each party is indicated. It is also necessary to indicate documentation according to which each employee has the right to sign such agreements.

Dispute Resolution

In this section, the parties must determine the procedure for resolving potential disagreements, establishing the deadlines for submitting and considering claims and the procedure for performing these actions. This chapter should also determine the jurisdiction of disputes that arise.

It must be taken into account that in the contract the original and new debtors determine the jurisdiction of only their internal disputes. For disputes arising between a new debtor and a creditor, the general rules on jurisdiction established by law or the rules that were agreed upon by the parties at the conclusion of the transaction apply.

Rights and obligations

The attached sample paper lists:

- The old debtor is obligated to transfer all documentation that evidences the existence of the debt to the new debtor.

- The deadline for the new debtor to pay the specified amount.

- The rights of the new debtor regarding making claims to the creditor under the terms of the agreement.

Subject of the agreement

The subject is the principal debt and penalty transferred to the new debtor. In order for the subject matter condition to be agreed upon, the parties must indicate in the document the basis for the obligation, its content and scope.

The procedure can be carried out both in relation to an obligation arising from a contract and in relation to a non-contractual obligation. Thus, the parties indicate the basis for their occurrence.

Next, it is necessary to determine the volume and content of the transferred obligation. Replacement of debt in both monetary and non-monetary obligations is acceptable.

The transfer is carried out not only in relation to the principal debt, but also in relation to penalties or interest for the use of other people's funds. Moreover, an isolated transfer of the obligation to pay penalties or interest is allowed. In this case, the contract must indicate the extent to which the obligation is transferred. If only the main obligation is intended to be transferred, it is advisable to indicate in the agreement that the obligation to pay the accrued amounts of property sanctions remains with the original debtor.

Shelf life

The tripartite agreement on the transfer of debt is drawn up in at least three copies. They remain in the custody of each party. This will allow the interests of each party to be respected and the existence of the document to be proven in possible legal proceedings.

The storage time of this paper will depend on the date on which the debt obligation was repaid, that is, when the agreement ceased to be relevant. And from this number it is necessary to count three years. For example, if payments were made over 5 years and the debt was completely closed, then the document can be destroyed after 8 years. Naturally, this process must be accompanied by the creation of a commission and the drawing up of a destruction act. The minimum storage time is 5 years.

Termination of an agreement

The document entails the transfer of obligation from the original debtor to the new one, i.e., the execution of the contract in this part is carried out at the time of its conclusion. In the event of termination of this agreement, the obligation loses its basis, and, accordingly, it is necessary to restore the property status of the parties. The consequence of termination of the contract is the reverse transfer of the debt.

Practice has shown that reverse transfer of debt is possible only if it is provided for in a document or on the basis of a court decision. The reverse process also requires the consent of the lender.

Termination of the contract is possible after its execution. The consequence of such termination will be the obligation to compensate the counterparty for losses.

Termination of obligations may be associated with either judicial termination or unilateral refusal. Unilateral refusal is possible if at least one of the participants in the legal relationship is an economic entity (commercial organization or individual entrepreneur).

If a transaction is concluded between an entrepreneur and a person who does not carry out entrepreneurial activities, only the latter has the right to refuse unilaterally.

What the notice should include

Expert opinion

Smirnov Alexander Stanislavovich

Lawyer with 12 years of experience. Specialization: civil law. Member of the Bar Association.

First, you need to refer to Article 382 of the Civil Code of the Russian Federation, which outlines how to notify the debtor and then generate documents for the transfer of rights.

According to the law, the creditor transfers the debts owed to him to any legal entity after concluding an assignment agreement.

For this type of transaction, there is no need to obtain the consent of the person who is evading fulfillment of his obligations - this is described in the second paragraph of Article 382 of the Civil Code of Russia. However, the law does not oblige the debt holder to inform him of this fact.

However, it is necessary to warn the debtor - without notification, the one who borrowed the money will not be able to pay off with the new transferee. It follows that the recipient can be notified by both the newly arrived creditor and the previous one.

It should be noted that there is no template established by law, so the notice can be drawn up in free form. In this case, it is necessary that the document contain the following information:

- name or organization name of the borrower;

- contacts and position of the authorized employee;

- notification of the fact of assignment indicating all the details of the document;

- data of the previous creditor;

- data relating to the new lender;

- the date on which the transfer of rights took place;

- a certain list of additional documents (usually a copy of the assignment agreement is sent).

The notice must be signed by the person responsible for it and the employee on whose behalf it is sent.

Below is a notification of the debtor about the assignment of the right of claim, an example sample.

In civil circulation, the debtor’s notification of the assignment of the right of claim is considered a mandatory document. The requirement to inform the debtor that he has a new creditor is expressly enshrined in Chapter 24 of the Civil Code.

There is no need to ask the debtor’s consent for such a transfer (read carefully the law in relation to legal relations and the text of the agreement, it may contain an obligation to obtain consent). And the notification is sent for the purpose of letting the debtor know who to perform the execution (transfer money, ship goods, etc.).

The information below will be devoted not only to the preparation of a notice, but also to the general rules of assignment (agreement on the assignment of the right of claim). For resolution of specific situations or individual advice, contact the site’s duty lawyer.

Notification of the debtor about the assignment of the right of claim

In what cases is

Individuals may enter into an assignment agreement in the following cases:

- during divorce proceedings;

- when changing the recipient of alimony;

- for the purpose of selling bad debts.

When dividing the property of the spouses, the obligations of third parties on a private loan may be assigned to the parent with whom the children remain. If alimony is paid for children, then a change in their legal guardian may be the basis for the assignment of the right to claim alimony debt to the new guardian, for example, if a child is transferred from a single mother to the care of a grandmother, then the mother may assign the right to claim alimony debt in favor of the grandmother.

Also, private individuals who have borrowed money on a receipt and are unable to collect the debt can sell the right of collection to third parties in order to reduce their losses.

Debt transfer

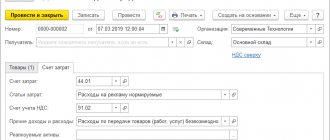

In the last issue of the magazine, in the article “Non-monetary forms of payment”, barter agreements, settlements with bills of exchange and offsets of mutual debts were considered. The author showed that in all these cases, the organization has an obligation to transfer to the counterparty the amount of VAT claimed in cash by a separate payment order. Concluding a debt transfer agreement will relieve the company of this obligation.

What are the requirements for drawing up a debt transfer agreement under current legislation? How are transactions reflected in the accounting and tax records of the parties? All this is discussed in this article. The essence of the agreement

As a rule, a debt transfer agreement is concluded in order to “close” previously arising (existing at a certain point in time) debts, when none of the participants transfers funds to the other. To explain the meaning of the debt transfer agreement, let’s imagine a simple situation. Enterprise "Alpha" is a debtor to organization "Beta", and is a debtor "Alpha". In this case, the type of existing obligations does not matter. In other words, it does not matter by virtue of which agreement the accounts payable and receivable arose in the accounting of the Alpha enterprise (under an agreement for the supply of goods, the purchase and sale of real estate, a contract, the provision of paid services, a loan agreement, etc.). The presence of debt itself is important.