Payment of transport tax is a mandatory procedure for any owner, regardless of who owns the car, an organization or an individual. Although the amount of tax itself is used differently in each case, this also applies to the code used in the payment document to transfer the tax amount. If organizations use code 18210604011021000110 for this procedure, then individuals must pay tax according to BCC 18210604012021000110.

To calculate the amount of tax, several criteria applied by tax authorities are used. These include the type and type of transport, as well as the capacity and duration of the period during which taxable transport is registered with an individual.

Decoding KBK 18210604012021000110

As with any budget classification code, KBK 18210604012021000110 encodes information about the purpose of the payment, its recipient and the status of the budget, and decoding involves decoding the data.

Let's divide KBK 18210604012021000110 into conditional blocks, in accordance with the serial number of the digits that make them up, each of which will help determine what tax in 2021 a citizen of the Russian Federation will be able to transfer under this code to the state budget, and what name of payment will need to be indicated in the receipt.

The result of decoding the budget classification code 18210604012021000110 will be included in the table.

| Digit p/p | What is encoded | Decoding |

| from first to third | payment receiver | <182> - Federal Tax Service |

| fourth | cash receipt group | <1> - income |

| from fifth to sixth | tax code | <06> - property tax |

| from seventh to eleventh | state budget item code | <04012> - transport of an individual |

| twelfth to thirteenth | budget ownership | <02> - budget of a constituent entity of the Russian Federation |

| from fourteenth to seventeenth | reason for payment | <1000> - main payment to the Federal Tax Service |

| from eighteenth to twentieth | state budget income category | <110> - tax |

Based on the information received after decoding KBK 18210604012021000110, we conclude which tax is encoded in this digital series: the specified KBK is applied when individuals transfer transport tax.

Transport tax for legal entities is paid according to the appropriate BCC.

Let's consider which budget classification code will need to be indicated when paying fines and penalties for taxes transferred late.

KBK table on insurance premiums for 2021

The Ministry of Finance, by its order No. 230n dated December 7, 2016, amended the budget classification codes for 2021. The same changes apply in 2020. The changes concern the following sections:

1. Corporate income tax - changes apply to enterprises working with foreign partners and receiving income from them.

2. Simplified tax system – changes affected organizations using the taxation object “income minus expenses”. The minimum tax and advance payments will be made to a separate BCC.

3. Insurance premiums - starting from 2021, administration has passed to the Federal Tax Service, with the exception of insurance premiums for industrial accidents and occupational diseases. This caused a change in the KBK codes.

From January 1, 2021, changes have been made to the list of budget classification codes. In particular, the changes concern individual entrepreneurs, namely: KBK 18210202140061200160 “Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation ...” was excluded from the list, while KBK 18210202140061100160 was renamed and is now called “Insurance contributions for compulsory pension insurance in a fixed amount, credited to the budget of the Pension Fund of the Russian Federation for the payment of an insurance pension.” In this case, accrued and paid amounts previously reflected under the excluded BCC 18210202140061200160 should be reflected on BCC 18210202140061100160.

The changes are related to the publication of Order No. 245n of the Ministry of Finance of Russia dated November 30, 2018 “On amendments to the Procedure for the formation and application of budget classification codes of the Russian Federation, their structure and principles of assignment, approved by Order of the Ministry of Finance of the Russian Federation dated June 8, 2021 No. 132n.”

A table summarizing the budget classification codes for insurance premiums is presented below.

| Purpose | KBK 2021 | |

Pension contributions | ||

| for insurance pension – for periods up to December 31, 2021 | 18210202010061000160 | |

| – for the periods 2021 - 2021 | 18210202010061010160 | |

| for funded pension | 18210202020061000160 | |

| for additional payment to pensions for flight crew members of civil aviation aircraft: – for periods until December 31, 2021 | 18210202080061000160 | |

| – for the periods 2021 - 2021 | 18210202080061010160 | |

| for additional payment to pensions for employees of coal industry organizations: – for periods before December 31, 2021 | 18210202120061000160 | |

| – for the periods 2021 - 2021 | 18210202120061010160 | |

| in a fixed amount for an insurance pension (from income not exceeding the limit): – for periods before December 31, 2016 | 18210202140061100160 | |

| – for the periods 2021 - 2021 | 18210202140061110160 | |

| in a fixed amount for an insurance pension (from income above the limit): – for periods until December 31, 2021 | 18210202140061200160 - excluded, you must pay at kbk 18210202140061100160 | |

| – for the periods 2021 - 2021 | 18210202140061210160 | |

| for the insurance part of the labor pension at an additional rate for employees on list 1: – for periods until December 31, 2021 | 18210202131061000160 | |

| – for the periods 2021 - 2021 | 18210202131061010160, if the tariff does not depend on the special assessment; 18210202131061020160, if the tariff depends on the special estimate | |

| for the insurance part of the labor pension at an additional rate for employees on list 2: – for periods until December 31, 2021 | 18210202132061000160 | |

| – for the periods 2021 - 2021 | 18210202132061010160, if the tariff does not depend on the special assessment; 18210202132061020160, if the tariff depends on the special estimate | |

Contributions to compulsory social insurance | ||

| for insurance against industrial accidents and occupational diseases | 39310202050071000160 | |

| in case of temporary disability and in connection with maternity: – for periods until December 31, 2021 | 18210202090071000160 | |

| – for the periods 2021 - 2021 | 18210202090071010160 | |

Contributions for compulsory health insurance | ||

| in FFOMS: – for the periods from 2012 to 2021 inclusive | 18210202101081011160 | |

| – for the periods 2021 - 2021 | 18210202101081013160 | |

| in the Federal Compulsory Medical Insurance Fund in a fixed amount: – for the periods from 2012 to 2016 inclusive | 18210202103081011160 | |

| – for the periods 2021 - 2021 | 18210202103081013160 | |

KBK 18210604012022100110 - penalty

Without having a directory at hand, the payer will be able, after receiving the results of decoding KBK 18210604012021000110, to accurately calculate which code should be indicated when transferring penalties for late payment of taxes, which is very convenient.

To do this, we will need to make changes to the block of numbers from the fourteenth to the seventeenth of the digital code 18210604012021000110, and by applying the rule, we will obtain information about which BCC we will need.

The rule is that for transferring penalties block 14-17 looks like <2100>, and for a fine - <3000>, no matter what tax we are considering. That is why we pay penalties for transport tax for individuals under BCC 18210604012022100110.

Using the same algorithm, you can determine which BCC for tax in 2020 will be needed to pay the fine.

KBK in 2021

Another feature of the BCC is that their meanings differ for organizations and citizens, and the methods of paying tax also differ from each other.

KBK for legal entities

As for organizations, they must fill out payment orders for payment

advance payments, in which the correct BCC is required. The codes have not changed since 2021.

However, it is worth noting that in comparison with 2014, the BCC for 2017 has changed significantly, so it is necessary to use the latest codes to avoid errors when entering tax.

And even if it is necessary to pay land tax for previous periods (when the old BCCs were still in effect), when transferring funds you will still need to be guided by the currently valid codes.

In addition, for penalties and fines imposed for payment as part of the payment in question, separate codes are provided, which are also divided depending on the territory where the land is located.

In relation to legal entities, the budget classification codes for paying off land tax penalties are as follows:

- For owners of land plots located within the boundaries of the Moscow Region within the cities of Moscow, St. Petersburg and Sevastopol - 18210606031032100110.

- For owners of plots within urban districts - 18210606032042100110.

- Similar to the above principle, the codes differ in urban districts with divisions within the city (18210606032112100110), in intracity areas (18210606032122100110), within the boundaries of inter-settlement territories (1821060633052100110) and rural settlements (182106 06033102100110), as well as urban settlements (18210606033132100110).

Features of KBK when paying transport tax

Transport tax is paid by all vehicle owners: legal entities, organizations and individuals. Its size depends on the amount of horsepower included in the engine power of the vehicle. This is a regional tax, so it must be paid to the budget of the region where the car is registered. But the tax return must be filed at the place of registration of the taxpayer.

Which KBK should an individual write?

Having received a notification of the transport fee from the Federal Tax Service, it must be paid using the specified details, while the KBK code in field 104 of the payment order has the following combination: 182 1 0600 110.

How do legal entities pay this tax?

For each vehicle registered to an organization, you must pay a tax, which can be calculated by multiplying the tax rate by the value of the tax base.

ATTENTION! In some cases, various coefficients are added to the formula (regional, for the cost of the car, etc.)

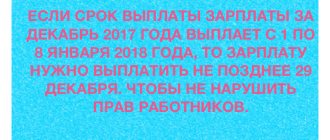

Legal entities are required to independently calculate the amount of transport tax, as well as report on its payment before February 1. Whether an advance payment is needed or the tax must be transferred all at once is decided by the regional tax authority.

Differences in payment of transport tax for organizations

For organizations, payment must be made in advance, unless otherwise specified at the regional level. The advance is paid every quarter after reporting for the previous one. The amount of tax that must be paid after February 1 is calculated by subtracting all advance payments made from the total amount of transport tax.

The KBK code for transport tax for legal entities has not changed since last year. If you are late in paying the tax, you will also have to pay a late fee. Arrears or non-payment of tax entail an inevitable fine.

Pension contributions under harmful, difficult and dangerous working conditions

The BCC for payments is set for the entire list as a whole.

Additional pension contributions at tariff 1 (clause 1, part 1, article 30 of the law of December 28, 2013 No. 400-FZ)

| Additional tariff that does not depend on the results of the special assessment | Additional tariff depending on the results of the special assessment | |

| Contributions | 182 1 0210 160 | 182 1 0220 160 |

| Penalty | 182 1 0210 160 | 182 1 0200 160 |

| Fines | 182 1 0210 160 | 182 1 0200 160 |

Additional pension contributions at tariff 2 (clause 2-18, part 1, article 30 of the law of December 28, 2013 No. 400-FZ)

| Additional tariff that does not depend on the results of the special assessment | Additional tariff depending on the results of the special assessment | |

| Contributions | 182 1 0210 160 | 182 1 0220 160 |

| Penalty | 182 1 0210 160 | 182 1 0200 160 |

| Fines | 182 1 0210 160 | 182 1 0200 160 |

Contributions to the Health Insurance Fund and Social Insurance Fund for employees

The cloud service Kontur.Accounting helps generate payment orders with current BCCs for paying taxes. Get free access for 14 days

The KBK 2021 and 2021 for transferring funds to the Federal Compulsory Medical Insurance Fund and the Social Insurance Fund from employee salaries have not changed, and the codes for maternity contributions remain the same, so we use the same codes as before. Let's remind them.

| Contributions for temporary disability and maternity | |

| Contributions | 182 1 0210 160 |

| Penalty | 182 1 0210 160 |

| Fines | 182 1 0210 160 |

| Contributions to the Social Insurance Fund for injuries and occupational diseases | |

| Contributions | 393 1 0200 160 |

| Penalty | 393 1 0200 160 |

| Fines | 393 1 0200 160 |

| Contributions to the FFOMS for compulsory health insurance | |

| Contributions | 182 1 0213 160 |

| Penalty | 182 1 0213 160 |

| Fines | 182 1 0213 160 |

Features of tax calculation

Several amounts are used for the amount of tax charged on transport. It all starts with multiplying the annual rate by the capacity of the vehicle, the resulting figure is subsequently multiplied by the number of months in which the vehicle was in the possession of the individual. The resulting amount is subsequently divided by 12.

But not all types of transport actually apply only this formula for calculating the tax. For cars belonging to the “prestigious” category and foreign cars whose cost exceeds 3,000,000 rubles, an additional slightly different calculation method is used. To obtain the tax amount, you must multiply the amount obtained from the formula by an additional increasing factor. For each year of production of a car, the Ministry of Finance has approved a certain coefficient.

Therefore, before starting to calculate the tax amount, you should find out the exact coefficient used for a given car. The list is present in the letter from the Ministry of Finance, submitted in June 2014.

Pension contributions under normal working conditions

A common code has been adopted for insurance contributions at regular and reduced rates of pension contributions. The BCC for payments for employees for an individual entrepreneur or for a legal entity is the same. We indicate the following codes when filling out a payment order to credit pension insurance contributions for periods starting from 2021:

182-1-02-02010-06-1010-160 - contributions;- 182-1-02-02010-06-2110-160 - penalties;

- 182-1-02-02010-06-2210-160 - interest on payment;

- 182-1-02-02010-06-3010-160 - fines.