Cash settlement limits between legal entities and individuals in 2021 fall within the sphere of influence of the Central Bank of Russia. Establishing restrictions on the volume of funds passing in the form of settlements between counterparties through the cash desk is necessary to ensure the transparency of purchase and sale transactions. Turnovers in bank accounts of legal entities are easy for regulatory authorities to check, and cash payments are classified as difficult to track. The transfer of large transactions to the non-cash sphere allows for maximum control over the legality of the activities of enterprises.

What is the cash payment limit for legal entities in 2021?

Cash payments between legal entities in 2021 are limited by a limit. This is the maximum amount of money in which cash payments can be made between legal entities and individual entrepreneurs. What you cannot spend cash proceeds on, see the article >>>

In 2021, the limit for legal entities within one contract is 100 thousand rubles. If the amount specified in the agreement exceeds the settlement limit, the balance must be transferred to the counterparty's account by bank transfer.

The question arises: is it legal for an organization to make payments on the same day with the same counterparty under several contracts, the total amount of which exceeds the established limit? Yes, it is legal if the individual amount for each agreement does not exceed 100 thousand rubles.

Please note that when concluding an agreement with an individual, the organization has the right not to comply with the limit.

For individual entrepreneurs, the limit is also 100 thousand rubles. If a company has entered into an agreement with an individual entrepreneur, then for both of them there is a cash payment limit of 100,000 rubles. Cash payments between individual entrepreneurs and individual entrepreneurs are also limited to this amount.

There are no restrictions on cash payments with individuals. Please note that from October 1, simplified customers will have to switch to mandatory card payments. The algorithm of actions is here >>>

Articles about small business cash transactions:

What are the consequences of violating the cash payment limit?

If the limit established by the Central Bank for accepting cash in the context of individual transactions between individual entrepreneurs and enterprises is exceeded, Article 15.1 of the Code of Administrative Offenses of the Russian Federation provides for the application of penalties:

- for institutions, the financial penalty is a fine in the range of 40-50 thousand rubles;

- 4-5 thousand rubles will be collected from the official.

A violation is also the deliberate splitting of a large contract with one supplier or contractor for similar products into several agreements that fit within the limit for cash payment. The identity of commercial products and the coincidence of terms, methods of payment and delivery are grounds for declaring illegal the fact of dividing a transaction into different contracts.

Punishment is imposed taking into account the statute of limitations when brought to forms of administrative liability - before the expiration of a period of two months counted from the date of the commission of the unlawful act (Part 1 of Article 4.5 of the Code of Administrative Offenses of the Russian Federation). The date of detection of non-compliance with standards is not taken into account. The exception is ongoing violations. If the company has exhausted the limit on cash payments under the agreement and continues to deposit or accept money through the cash register as part of this transaction, the statute of limitations is counted from the day the offense was discovered.

Responsibility lies with both parties - payers and recipients of cash. Article 23.5 of the Code of Administrative Offenses involves the consideration of cases of violations during cash payments by tax inspectors.

When making cash payments to legal entities and individual entrepreneurs, it is necessary to check each contribution for its legality by correlating the accumulated amount of payments under the agreement with the limit established by the Central Bank of Russia. An additional criterion for assessing the legality of a transaction is whether the category of spending money from the cash desk corresponds to the source of origin of cash resources. Otherwise, there is a high probability of violations of cash discipline, which will entail the imposition of fines on the enterprise and responsible officials.

Limit of cash payments when issuing money on account

The organization has the right to issue any amount to its employee on account. And the employee has the right to spend this amount without taking into account the limit. For example, for travel expenses.

If an organization issues an accountable amount to pay for goods, work or services under contracts concluded by the organization itself, the cash payment should not exceed 100 thousand rubles.

The same approach applies to the situation when an employee makes payments on behalf of the organization by proxy.

Application of instructions from the Central Bank for cash payments

For companies and entrepreneurs, the Bank of Russia has determined the conditions for cash payments (Instructions No. 3210-u). The operation of the cash register, organized by management, is mandatory. Enterprises are recommended to comply with the established limits on the cash balance at the end of the working day (clause 2 of the Central Bank Instructions).

If the rules are violated, the company may lose the ability to leave cash in the cash register. To maintain cash documentation, only documents in the form established by the State Statistics Committee of the Russian Federation (Resolution No. 88) are used.

Rules for conducting cash transactions

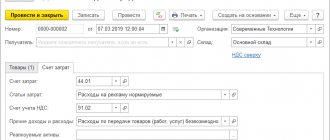

It is required to process cash transactions using receipt and debit orders. Such documentation is maintained by an accountant or cashier of the enterprise. It is also permissible for the manager to issue orders if he is engaged in settlement transactions (clause 4.2 of the Instructions).

The enterprise clearly defines the circle of employees allowed to make cash payments (manager, accountant or cashier). They record all completed cash transactions and make sure to enter the necessary information into the cash book.

Changes in the design of cash documents

In paper format, PKO and RKO are drawn up by hand or using special software, the signature of the responsible person is affixed personally.

Cash documents in electronic form are processed on a computer using coding to prevent unauthorized intervention. This will prevent them from being distorted or losing important information. An electronic signature is placed (Federal Law No. 63). Corrections in cash documents are not allowed.

The manager is responsible for ensuring maximum data protection to ensure reliable safety of documentation in any format.

Is there a limit on cash settlements when paying dividends?

Founding organization. Joint stock companies do not have the right to issue dividends in cash from the cash register.

As for LLCs, they can pay dividends in cash, but not from trading proceeds.

The company pays dividends based on the minutes of the founders' meeting. Since the cash settlement limit applies only to settlements between counterparties within the framework of an agreement concluded between them, we can conclude that this rule does not apply to the payment of dividends.

However, as practice shows, during on-site tax audits, tax inspectors may think differently and fine the company for issuing dividends from the cash register in excess of 100 thousand rubles.

Therefore, it is safer to pay dividends either in non-cash form or within the limit.

The founder is an individual. If the founder is an individual, dividends can be paid to him from the cash register without restrictions on the amount.

For what purposes can legal entities spend cash proceeds?

All of the above operations can be carried out only from funds received by the organization’s cash desk as a result of the sale of goods, performance of work or provision of services.

For what purposes can legal entities spend cash received at the cash desk from their current account?

The organization does not have the right to spend trade proceeds generated in the organization’s cash desk for these purposes.

For what purposes can legal entities spend money from the cash register without restrictions?

All other purposes for spending cash are limited by a limit.

Innovations in cash payments between organizations

The limit for settlement under one contract remained unchanged and is equal to 100 thousand rubles. Legal entities and individual entrepreneurs have the right to make cash payments in domestic currency in the specified amounts, as well as in foreign or an equivalent amount at the Central Bank exchange rate at the time of the transaction.

Established restrictions

Clause 6 of Bank of Russia Directive No. 3073 lists the conditions under which the above restrictions are observed. They apply:

- in relations between participants in monetary settlements within the framework of a civil contract throughout its validity;

- When cash is issued by a bank or other credit institution in accordance with agreements on the return of balances, they are transferred to a special account with the Central Bank.

When the cash payment limit does not apply

Limits do not apply when using cash used for the following purposes:

- for the issuance of salaries and other payments from the salary fund, including social benefits;

- for consumer purposes of an individual entrepreneur not related to his economic activities;

- for reporting to company employees.

Changes have been made to allow unlimited use of the cash balance for individual entrepreneurs and small business representatives who are legal entities.

Calculation of the maximum amount of cash balance in the cash register

Today, calculating the cash balance limit at the enterprise's cash desk is not mandatory for small businesses. Nevertheless, in order to ensure the safety of property and for the operational management of cash flows, organizations are recommended to calculate the cash balance limit in the cash register, approve it with the appropriate order and scrupulously implement it.

The maximum amount of cash balance in the cash register is established by order of the manager and is strictly observed

Fines for non-compliance with cash discipline

If the limit for cash payments between legal entities is exceeded, liability falls on both the seller and the buyer.

The fine provided for by the administrative code of the Russian Federation for this offense will cost the company in the amount of 40 to 50 thousand rubles.

For the manager - from 4 to 5 thousand rubles.

For what purposes can/cannot cash proceeds be spent in 2018?

Memo: What you can/cannot spend cash on

Establishing a payment limit for an LLC and its structural division

Organizations and enterprises have the right to make cash transactions between separate divisions. The transfer of money is carried out by issuing a cash receipt order according to the procedure established by the enterprise. It is also observed when receiving cash from structural divisions.

There are no limits established between the parent company and its divisions, but nothing is said about the absence of restrictions. If we are guided by clause 3 of Article 55 of the Civil Code of the Russian Federation, we can draw a logical conclusion: divisions are not legal entities, which means that restrictions do not apply to them.

The unified form KO-3 is intended for registration of cash documents in the parent organization and structural divisions

Limits on cash payments between legal entities, as well as between individual entrepreneurs

The maximum amount of cash payments is RUB 100,000. under one contract.

This cash payment limit applies to payments between firms, organizations and individual entrepreneurs, as well as only between individual entrepreneurs. It will continue to operate under the same contract even after the contract expires. For example, a tenant company’s lease agreement has expired, it has vacated the premises, but it has a debt to the landlord. So, even after the expiration of this agreement, the company will be able to repay the debt in cash only within 100,000 rubles.

In addition, the limit is 100,000 rubles. It does not need to be used for issuing funds to employees on account, paying wages and other social benefits, as well as for spending money on personal (consumer) needs by entrepreneurs.

Settlements with legal entities under agreement

Cash payments are made between legal entities on the basis of the provisions of Article 128 of the Civil Code of the Russian Federation; these relations are the object of rights. During such interactions, cash can move freely between legal entities.

In certain cases, certain restrictions may apply. The CBR Instructions state that “cash” can only be used in accordance with established rules. By decision of the company, only funds can be spent for settlements with partners, in particular, for mutual settlements with product suppliers.

For settlements with legal entities, a limit of 100 thousand rubles has been established. This limit is taken into account for each transaction under a separate agreement.

Non-receipt of funds

One of the most common violations in practice is the failure to post money to the cash register - a violation of clause 4.6 of Directive No. 3210-U.

One of the evidence of this violation may be a test purchase act issued by the tax authorities when checking the use of cash register systems. In such a situation, non-receipt may result in the fact that when issuing a cash receipt to the buyer, there is no relevant information about the transaction in the organization’s documents (see Resolution of the 9th AAS dated October 22, 2015 No. 09AP-41654/15). The argument that the procurement act is one of the operational-search activities is rejected by the arbitration courts on the basis of clause 19 of the resolution of the Plenum of the RF Armed Forces “On some issues...” dated October 24, 2006 No. 18, which refers to the admissibility of the procurement act as evidence .

The resolution of the Supreme Court of the Russian Federation dated February 17, 2015 No. 301-AD14-6145 in case No. A29-1732/2014 states that the failure to reflect cash proceeds received on the same day in the cash book in itself indicates that cash was not received at the cash register.

The absence of a cash book also forms part of the non-receipt of funds (Resolution of the 11th AAS dated March 24, 2016 No. 11AP-400/16). Most often, this violation is recorded in separate divisions, which are also required to maintain cash books, despite the absence of a direct rule indicating this (see also resolution of the 14th AAS dated January 18, 2016 No. 14AP-9902/15).

Legislation

The Civil Code of the Russian Federation calls paper money a separate legal object (Article 128), they have free circulation on the territory of Russia, and restrictions can only be introduced by introducing instructions, laws and other acts.

Cash transactions are transactions carried out by transferring paper bills. Banks are not involved in this process, but the process is recorded using a cash register.

Such payments are made in accordance with the Directive of the Bank of Russia No. 3210-U dated 2014. Government authorities require all businesses to have a cash register and use it in accordance with established rules.

To maintain cash register records, a responsible person is appointed, who must familiarize himself with the above document, since violation will entail penalties. Keeping cash register records is regulated by Federal Law No. 54 of 2003.

Thus, when making payments to individuals, all entrepreneurs and organizations are required to issue one of the following documents:

- strict reporting form (SSR);

- cash receipt.

The amount of the check is not limited if it is issued to an individual.

If the client does not ask for a check, this does not deprive the legal entity of the obligation to issue it.

When setting the limit, the Bank of Russia took into account the currency in which settlements were made. In general, the regulator does not restrict the movement of foreign currency and allows settlements to be made in it. In practice this rarely happens.

Failure to comply with the limit does not affect the recognition of expenses

So, we found out that cash payments in excess of the limit are an administrative offense and are punishable by a fine.

At the same time, the question often arises: can violation of cash payment restrictions lead to withdrawal of expenses? After all, tax authorities use all the tricks to do this.

If this happens, you can go to court. The court will support you if the transactions performed are real, the expenses are justified and the documents supporting them are in order (see, for example, the Determination of the Volga District Court of April 28, 2021 No. F06-23175/2015 in case No. A65-14760/2014).

If the transaction is real and the costs are justified, violations of cash limits should not be reflected in tax liabilities.

Is the amount of payment for individuals regulated?

It is worth noting that if one of the parties to a monetary relationship is an individual, i.e., an ordinary citizen, both parties to the transaction may not comply with the settlement limit. However, the Ministry of Finance of the Russian Federation has more than once started talking about setting limits for individuals in order to control the expensive acquisitions of citizens. It is planned to set a limit on cash within 300 thousand rubles. The initiators of this innovation propose to amend Article 861 of the Civil Code of the Russian Federation, namely, a penalty in the form of a fine equal to the difference between the limit and the excess amount of revenue from the sale of goods or services.

Scope of one agreement

An important clarification regarding the cash limit is that it cannot be exceeded within the framework of one contract.

A contract is a document of agreement between persons (legal and/or natural) about certain actions intended to establish, terminate or change certain rights and obligations of the parties.

The amount of transactions for each such document cannot exceed 100,000 rubles, and the specifics of its conclusion are not taken into account.

- Type of contract . It doesn’t matter what the agreement is about - a loan, supply of goods, payment for services - the declared value for payment in cash cannot be more than the limited value.

- Terms of the contract . Even if the contract involves a long settlement, the specified amount cannot be exceeded.

- Frequency of payments . Installment plans or other cash payments, divided according to the agreement into several parts, each of which is less than the limit, will not be legal if their amount exceeds 100,000 rubles.

- Additional obligations . If the contract has an additional agreement or obligations arising from it, for example, penalties, fines, penalties, compensation, they cannot be paid in cash if payment has already been made under this agreement for a limited amount.

- Decor . One document or exchange of papers between the parties does not matter, the total obligations cannot exceed one hundred thousand in cash.

- Method of calculation . Will an authorized person bring the money, will it be issued at the cash desk - more than 100,000 rubles. “in one hand” is not issued.

How should payments be made to individual entrepreneurs?

If cash payments are made between a legal entity and an individual entrepreneur, compliance with the limit is mandatory . This is how the movement of the cash supply is controlled and abuses in the form of concealment of income are not allowed. Indeed, in business, the exchange of money can mean the completion of mutually beneficial transactions in which both parties receive a certain profit. The easiest way to do this is with cash, but it is almost impossible with non-cash payments.

The unified form KO-1 is used to formalize the operation of depositing individual entrepreneur’s money into the cash register

Regulations on cash payments

Unified requirements for cash payments are established by the instructions of the Bank of Russia dated October 7, 2013 No. 3073-U.

The standard provides for a number of restrictions and conditions that must be met in order to spend cash at the organization's cash desk. The key requirement relates to the expenditure of proceeds received as payment for products sold, work performed and services rendered. In 2021, it is prohibited to spend cash proceeds for any purpose, except for the following:

- wages and social benefits to employees;

- personal needs of a businessman (IP);

- payment for goods, works, services, except for securities;

- refund of payment for goods, work, services;

- the issuance of money will be accountable;

- operations of bank payment agents, subagents;

- insurance compensation under insurance contracts with individuals.

For example, in order to issue a loan to a third party, you will first have to hand over the cash proceeds to the bank. Then submit an application to the bank to receive cash. Capitalize the money in the cash register, and only then transfer the funds as a loan to a third party.

Release from restrictions

As mentioned above, business entities are exempt from restrictions on cash transactions in a number of cases.

- Payment of wages.

- Insurance and social charges.

- Issuance of funds on account.

- For personal needs of the owner of a company or individual entrepreneur.

In addition, the Central Bank in its Guidelines names additional cases that exclude cash limits:

- transactions involving the Central Bank;

- customs, tax duties;

- loan payments.

With such a seemingly democratic attitude, the CBR Instructions contain innovations that are much more beneficial for banks, but not at all for entrepreneurs.

To use cash in cases not specified in the special list, it cannot be taken from the company’s cash desk. In the new year, you first need to deposit the required amount to the bank, and only after that withdraw the necessary cash.

Thus, the state gets the opportunity to control the flow of funds, and the Central Bank receives interest for completed transactions. As for the entrepreneur, he does not win anything, but only acquires unnecessary problems and incurs additional expenses.

How to properly set a cash balance limit?

The cash balance in the cash register cannot be anything - this is a strictly regulated amount. At the same time, legislators give the entrepreneur the right to independently determine its size. The owner of a business entity or authorized manager must:

- calculate the permissible limit;

- approve the calculation results with the chief accountant and director of the enterprise;

- sign the appropriate order for its introduction;

- attach the calculation results to the order.

It is recommended to prepare the calculation on the company’s letterhead, although this is not necessary. The order can be drawn up in any form - the document must refer to the normative act regulating the requirement to introduce a cash limit for the enterprise, indicate the amount of the non-carrying balance, set the validity period of the introduced limit and attach an approved calculation to it. The responsible person is the chief accountant or general director of the enterprise.

The validity period of the assigned cash balance limit is determined by the entrepreneur himself. It depends on several factors: the characteristics of the type of activity, the amount of turnover and the amount of cash profit of the company.

Business entities that have only recently completed registration carry out calculations using approximate initial data, and later recalculate and adjust them taking into account the average profit received. At the same time, enterprises have the right not to adjust calculations as long as the order is valid, even if the initial indicators have changed dramatically.

The maximum permissible amount is calculated in two ways, and the choice of a specific method depends on the specifics of the organization of the company’s work. The calculation takes into account:

- profit received in cash from goods or services sold during the billing period;

- the total amount of money that is spent on various needs (salaries, household expenses), if the company makes payments exclusively by bank transfer.

In this case, the business owner has the right to choose the appropriate calculation method at his own discretion. If an organization has branches and covers several business processes, the maximum possible balance is calculated for each of them separately. Formulas for calculation are given in the Appendix to the Directive of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U.

Subscribe to our channel in Yandex Zen - Online Cashier! Be the first to receive the hottest news and life hacks!